A Stablecoin Primer: Money for the Digital Age

A deep look at stablecoin, the history of money, how stablecoins remain stable, the different layers supporting this digital currency, how the different providers stack up to TradFi, and more

What are the different layers in the stablecoin stack?

What are some use cases for stablecoin beyond remittances?

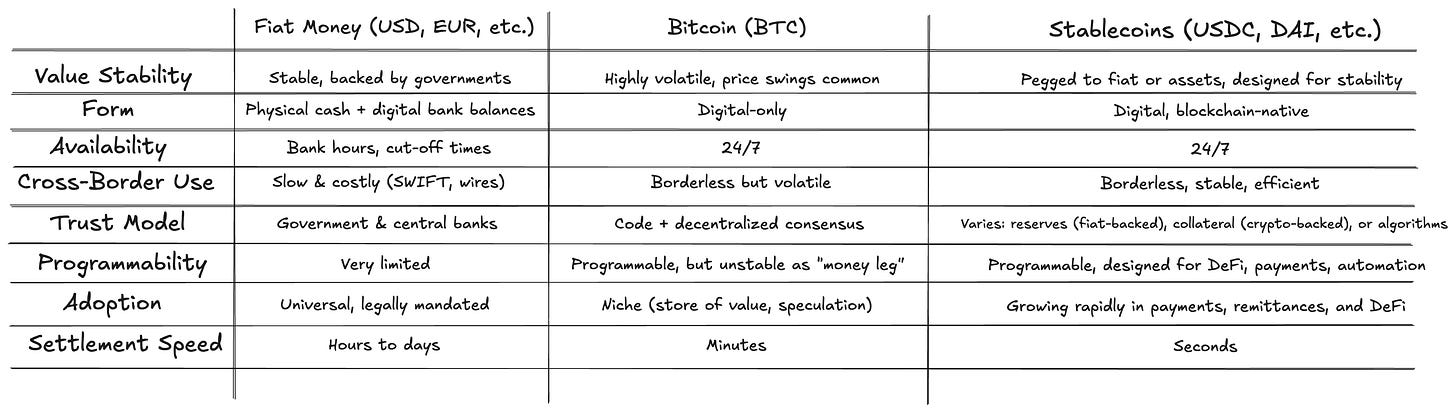

What’s the difference between stablecoin and Bitcoin?

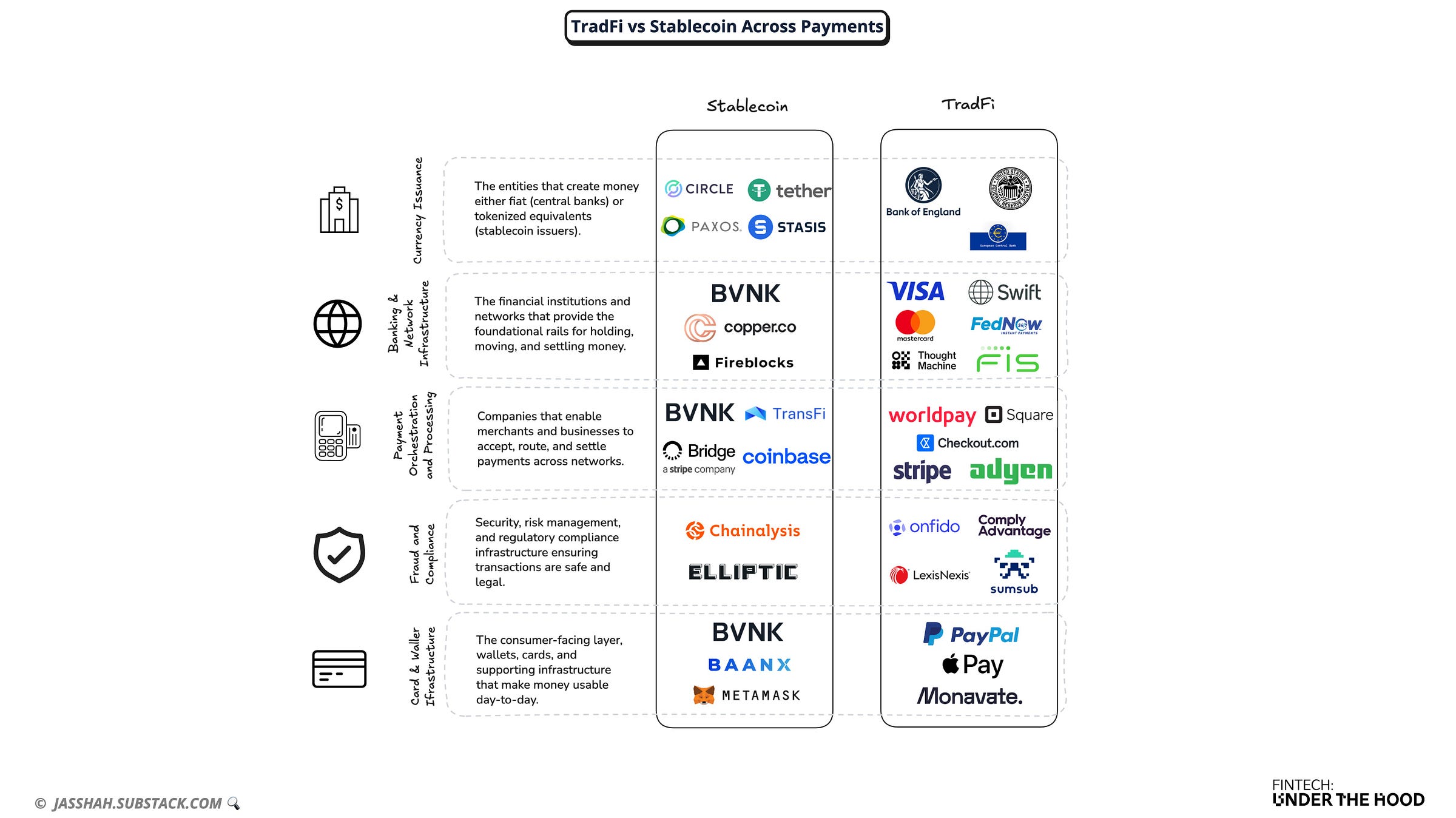

Who are the big stablecoin players and how do the compare to the existing TradFi players?

How are Credits from Sci-Fi and Digital Currency similar?

These questions and more will be answered in this week's edition.

Hey Fintechers and Fintech newbies 👋🏽

It feels like there's at least one major stablecoin announcement each week now, and it’s become the norm.

Just recently:

BVNK now covers all 50 US states - The full-stack stablecoin payments provider announced the expansion of its stablecoin services across the US, and is able to support customers in over 130 countries. In the last month it has also announced new customers: Xapo Bank, Flywire and Bitso.

Circle launched Arc - The USDC issuer launched a new Layer-1 blockchain designed for the new stablecoin-based financial infrastructure.

Stripe announced “Tempo” - Stripe is joining the Layer-1 crew after it announced it was building its own high-performance blockchain, “Tempo”

The stablecoin train has left the station and shows no sign of slowing down. In fact, we'll see an increase in stablecoin partnerships, new initiatives, and adoption news before the year ends.

Unlike the crypto boom of yesteryear, the last few years of stablecoin has seen a fundamental shift in the market from seeing digital currency as a bet, to going all in on it being the future of finance, with stablecoins being central to the new world.

And when I say ‘shift in the market’ I mean global ‘TradFi’ firms like Visa and Mastercard making stablecoins a big part of their strategy, fintech giants like PayPal and Stripe putting major stablecoin initiatives at the heart of their roadmaps (along with AI of course), and the advent of the GENIUS Act which I covered in the regulatory edition a few weeks ago.

One thing I have noticed with stablecoin and many other fintech topics is how quickly people slip into talking in acronyms and shorthand and forgetting that not everyone is deep in the space.

Layer 0. Layer 1. Layer 2. Blockchains. Tokens. On-chain.

The list of terms goes on.

So in this primer, I’m going to explain why the current shift in money was long overdue, explain the difference between blockchain, cryptocurrency, and stablecoin, give context to some of these sometimes alien terms, outline some of the use cases of stablecoin (beyond remittances), and give a clear explanation as to what some of the big stablecoin enablers do by comparing them to the traditional financial services, and bust some of the myths that have been flying around.

If you’re a stablecoin OG, this should be some fun revision for you with the addition of a couple of useful diagrams and some use cases you may not have thought of.

If you’re a stablecoin newbie, then by the end you should be able to explain what a stablecoin is confidently, know the names of some of the biggest companies enabling this movement and what they do, see the difference between Layer 0 and Layer 2, and have a better idea of the benefit of stablecoin vs TradFi.

Here’s what to expect:

History of Money and Key pivot points

Barter and Trading agreements ~9000 BCE to Present Day

What is Stablecoin?

How Stablecoins Remain Stable?

Fiat-Backed Stablecoin

Algo-Backed Stablecoin

Crypto-Backed Stablecoin

The Different Layers Supporting Stablecoin

Layer 0

Layer 1

Layer 2

Layer 3

TradFi vs Stablecoin

Two Use Cases for Stablecoin Beyond Remittance

Cross Border B2B Payments

Payroll & Gig Economy Payments

Interesting News🗞: HSBC faces outages

Now let's get into it 💪🏽

NOTE: You know the drill. Your mail client might crop the end of this so click here to see the full, unclipped, perfectly formatted edition,drop a like and comment at the end, and don't forget to subscribe below.History of money and key upgrade moments 📜

To better understand the current state of money and why the recent digital currency upgrade was inevitable, I find it helpful to take a short look back at the history of money, mark the other key ‘upgrade’ moments, and outline why they were needed at the time.

I did say short, so whilst I’m going back around 10,000 years, I’ve tried to compress thousands of years of evolution of money into a few short paragraphs with a punchy one-liner summarising the innovation in each era.

1. Barter & Trading Agreements (~9000 BCE – 3000 BCE)

The era: In humanity’s earliest economic systems, barter was the foundation of exchange. Farmers swapped grain for tools, hunters traded animal hides for pottery, and shepherds exchanged livestock for labour. Value was subjective, determined by negotiation in each transaction. While this system worked within small, tight-knit communities, it quickly revealed inefficiencies. The need for a “double coincidence of wants”, both parties having exactly what the other wanted, made scaling trade nearly impossible. Despite its limitations, barter represented the first step in formalising exchange and highlighted the human need for a universal measure of value.

Core innovation: Exchange without a universal medium.

2. Commodities as Money (~3000 BCE – 1000 BCE)

The era: As societies expanded, people began turning to commodities, goods with inherent utility or scarcity, to serve as proto-money. Cowrie shells in Africa and Asia, salt in Rome, tobacco in colonial Virginia, and cattle across agrarian cultures all functioned as units of exchange. These items were widely recognised, durable, and carried a sense of universal value. Their acceptance as money stemmed not from government decree but from shared cultural recognition of worth. Still, they were often bulky, hard to divide, and lacked standardisation, limiting their usefulness in larger economies.

Core innovation: Universal store of value beyond barter

3. Metals: Gold, Silver, Bronze (~1000 BCE – 600 CE)

The era: The discovery and use of precious metals fundamentally changed money. Gold, silver, and bronze coins solved many problems of commodity money: they were durable, portable, divisible, and rare. By the 7th century BCE, the Kingdom of Lydia (in modern-day Turkey) issued the first stamped coins, with a ruler’s seal guaranteeing weight and purity. This created a trusted, standardised medium of exchange that powered trade across empires and over long distances, including routes like the Silk Road. Metals not only made commerce efficient but also tied wealth to tangible, universally recognised assets.

Core innovation: Standardisation of money

4. Paper Cash & Early IOUs (~600 CE – 1700 CE)

The era: The Tang Dynasty in China pioneered the use of paper notes as early as the 7th century, replacing cumbersome metal coins with lightweight, portable representations of value. These notes were originally backed by stores of precious metals or commodities, functioning as IOUs redeemable on demand. The concept spread slowly, but by the 13th century, European traders encountered it through explorers like Marco Polo, who marvelled at China’s paper money system. Over time, paper became normalised, enabling larger economies and more complex financial systems by abstracting value from the physical metals themselves.

Core innovation: Portability and abstraction of value.

5. Fiat Money & Central Banking (~1700 CE – Present)

The era: As trade and economies grew, reliance on gold and silver became limiting. Governments and central banks transitioned toward fiat money — currency not backed by a physical commodity but by state authority and public trust. Fiat systems allowed greater flexibility in controlling supply, particularly during wars and economic crises. Central banks emerged as the stewards of this trust, managing inflation, issuing currency, and enforcing legal tender laws that required taxes to be paid in fiat. By the mid-20th century, fiat had fully replaced the gold standard, with the US severing ties to gold in 1971, cementing money’s reliance on governance rather than metal.

Core innovation: Sovereign-backed, flexible money supply.

6. Credit & Cards (1950s – 2000s)

The era: The post-war consumer boom demanded new ways to transact and borrow. In 1950, Diners Club introduced the first charge card, followed by the emergence of Visa and Mastercard networks in the 1960s. These systems enabled consumers to spend money they didn’t yet have, creating liquidity and convenience in everyday transactions. Plastic cards became ubiquitous, supported by a growing global infrastructure of point-of-sale systems and financial networks. Trust shifted from the physical possession of cash to the credibility of banks and card companies, who guaranteed payment on behalf of the consumer.

Core innovation: Extension of trust into credit.

7. Digital Payments & E-Money (1990s – 2010s)

The era: The rise of the internet and mobile phones ushered in a digital-native money era. PayPal, founded in 1998, offered secure online payments, while M-Pesa in Kenya (2007) allowed millions without bank accounts to send and receive money via mobile phones. In China, super-app ecosystems like Alipay and WeChat Pay integrated payments with messaging, shopping, and everyday services, making cash nearly obsolete in urban centres. These systems digitised money further, embedding it into technology platforms. However, they remained tied to banks and centralised intermediaries, with trust dependent on corporations and governments rather than technology itself.

Core innovation: Digitisation and global accessibility.

8. Cryptocurrency Era & Stablecoins (2009 – Present)

The era: Bitcoin’s invention in 2009 introduced decentralised, programmable money not controlled by governments or banks. It represented a radical new trust model: a blockchain-based ledger secured by cryptography and consensus. Yet Bitcoin and other cryptocurrencies suffered from high volatility, making them poor mediums of exchange. Stablecoins emerged to bridge that gap, combining the programmability and borderless nature of crypto with the stability of traditional currencies. Tether launched in 2014, followed by USDC in 2018, and decentralised variants like DAI. Today, stablecoins are at the frontier of payments and finance, moving trillions in transaction volume and beginning to rival traditional networks like Visa in scale.

Core innovation: Programmability and global interoperability.

Paper made money portable.

Fiat made it flexible.

Cards extended trust into credit.

And digital platforms brought global accessibility.

Stablecoins are the logical next step in the evolution of money.

Since the 1970s, we’ve seen the acceleration of global commerce through containerised shipping and multinational supply chains, the 1990s rise of the internet and instant digital communication, and the 2000s emergence of mobile-first economies, yet our money often moves with the friction of the last century. Bank wires can take days, cross-border transfers are costly and opaque, and payments rely on layers of intermediaries that introduce inefficiency.

And yet, since the advent of the card and the major network rails that power them, we haven’t had a real upgrade of money despite these major changes in the way we communicate, work, and live in an increasingly digital, borderless economy.

The biggest changes have largely been to the last few steps of payments with Tokenisation (enhancing cards) and with Real-Time Payment Rails (enhancing the payment rails), but not major upgrades to the system as we saw in previous eras.

Stablecoins present the biggest single disruption to the system of money since the invention of the charge card in the 50s.

N.B. Yes, the digital payments and e-money era innovations were big leaps forward in the way we interact with banking services, but the underlying infrastructure largely remained the same.

They preserve the stability of fiat while adding the programmability, speed, and borderless reach of digital assets and will likely be the next logical step in the centuries-long evolution of money.

What is Stablecoin? 🪙

A stablecoin is a type of cryptocurrency designed to maintain a stable value by being pegged to a reference asset, most commonly a fiat currency such as the US dollar or euro, or in some cases, commodities like gold. Unlike Bitcoin or Ethereum, whose prices fluctuate significantly, stablecoins are engineered to provide price stability, making them more practical for payments, remittances, and financial contracts.

At their core, stablecoins aim to combine the trust and familiarity of traditional money with the efficiency, speed, and programmability of blockchain technology. They function like digital-native dollars that can be sent globally, peer-to-peer, in seconds without relying on banks or traditional payment networks.

So while current money movement relies on messaging networks and rails that update a ledger sat within a banks infrastructure, and comes with settlement that can take days, stablecoins offer a money movement relies on decentralised blockchain technology where the blockchain is the ledger, and can be updated almost instantly, allowing users to move money in seconds and having it available to use in under a minute.

💡 For a digitally native merchant taking payments, the current process is authorising transactions, then waiting for them to be processed and settled at an issuing bank using a traditional centralised ledger and therefore those funds are inaccessible. Stablecoins offer a way of taking payments on internet-native infrastructure, instantly and having access to those funds as soon as the transaction is processed. That’s one legitimate use case that companies like Stripe are clearly bullish on.

It’s important to note that stablecoins are also cryptocurrencies.

This is a squares and rectangles situation as all squares are rectangles, but not all rectangles are squares.

Or similar to the Oreo analogy from my AI deep dive. All Oreos are cookies (or biscuits in the UK), but not all cookies are Oreos.

Cryptocurrency is simply a type of digital or virtual currency that uses cryptography for security and functions on a decentralised blockchain network, eliminating the need for a central bank or authority.

So all stablecoins are cryptocurrencies, but not all cryptocurrencies are stablecoins.

How Stablecoins Remain Stable ⚖️

The reason stablecoin has emerged as the next major upgrade to money vs a traditional cryptocurrency like Bitcoin is that, surprise surprise, it has a lot more stability and less volatility than Bitcoin, Ethereum and Solana, and therefore is a much more viable money upgrade in the current economy.

Stablecoins are cryptocurrencies pegged to a stable asset, commonly USD, but can be pegged to other FIAT currencies, commodities, or assets, and a few different mechanism designs exist, each with its own trust model and trade-offs:

Fiat-Backed Stablecoins (e.g., USDC, USDT):

These are backed 1:1 by fiat currency or cash-equivalent reserves (like US Treasuries) held in regulated institutions. Each digital token represents a claim on a dollar in reserve. Stability comes from the issuer’s ability to honour redemptions.

Pros: Simple, trusted if reserves are transparent.

Cons: Centralised, requires trust in the issuer and custodians.

Note: FIAT money is simply government-issued money with value derived from public trust and legal decree, not from a physical commodity like gold or silver.

Crypto-Backed Stablecoins (e.g., DAI):

Instead of fiat, these are backed by other cryptocurrencies locked into smart contracts as collateral. They typically require overcollateralisation (e.g., $150 in ETH to mint $100 in DAI) to protect against crypto volatility.

Pros: Decentralised, transparent, trustless settlement.

Cons: Capital-inefficient, exposed to extreme market volatility.

Algorithmic Stablecoins (e.g., UST, failed example):

These attempt to maintain stability through supply and demand algorithms, expanding or contracting circulation based on market price. In theory, they don’t require collateral; in practice, they’ve proven fragile. TerraUSD’s collapse in 2022 wiped out billions in value and damaged confidence in algorithmic models.

Pros: Scalable in theory, capital-efficient.

Cons: Fragile, highly risky, prone to “death spirals.”

Out of these three, fiat-backed stablecoins have emerged as the frontrunner probably because of their adjacency to the current financial system, bringing stability and familiarity, whilst retaining the benefits vs traditional money, including:

Speed & Settlement: Instant, 24/7 transactions across borders, without cut-off times.

Cost: Lower fees than card networks or remittances.

Programmability: Money that can interact directly with code, enabling automation, DeFi, and embedded finance.

Interoperability: A single digital dollar (or euro, or peso) that moves seamlessly across platforms, apps, and geographies.

Accessibility: Anyone with an internet connection can hold and transfer value, bypassing barriers of traditional banking.

At its simplest, a stablecoin is money reimagined for the internet age. A cryptocurrency that looks and feels like a dollar, euro, or other familiar currency, but moves with the speed, openness, and programmability of blockchain. It is digital cash with global reach, designed to settle in seconds, run 24/7, and plug directly into internet-native infrastructure.

The Cryptocurrency Layer Cake 🍰

Although cryptocurrency and blockchain are new(ish) technologies, the various infrastructure and application layers (probably because they have taken a technology-first approach and are designed for the digital age) bear a similar resemblance to the different layers that make up the internet.

The internet isn’t just one thing.

It’s a stack of layers working together.

At the bottom, you have physical cables and protocols that let computers talk to each other.

Above that, standardised rules like TCP/IP ensure networks interconnect.

Higher still, browsers and apps make the web usable for everyday people.

My fellow computer science nerds will already be aware of these layers as it forms part of most Com Sci foundation classesAnd just like the layers that make up the internet, there are core layers that underlie stablecoin.

The base blockchains are like the internet’s cables and protocols, scaling layers act like broadband and CDNs to make the system faster, and the applications are like the web apps, browsers and services we use every day.

NB. Regular readers will be familiar with my use of analogies, and I’ve included a great one to explain the different layers of stablecoin, but despite the Layer Cake reference, it will not be baking-related.

Layer 0 (Interoperability & Connectivity)

What it is: The “network of networks” that allows different blockchains to communicate. Examples include Polkadot, Cosmos, Avalanche subnets, and interoperability standards like IBC.

Why it matters: Stablecoins don’t live on just one chain. USDC, for instance, operates across Ethereum, Solana, Polygon, and Tron. Without Layer 0, liquidity fragments and users are stuck in silos.

Stablecoin connection: Enables a single digital dollar to move seamlessly across chains.

👉🏽 Layer 0 is the cleared and standardised ground that blockchains get built on, which ensures connectivity and interoperability of traffic between them.

The analogy will make more sense with each layer!

Layer 1 (Base Blockchains)

What it is: The foundational blockchains where stablecoins are issued and recorded (Ethereum, Solana, Avalanche, Tron).

Why it matters: Provides security, decentralisation, and settlement finality. Every stablecoin transaction is inscribed permanently on these ledgers.

Stablecoin connection: Fiat-backed coins like USDC and USDT live natively on multiple L1s. The reliability of the coin depends on the robustness of the underlying chain.

👉🏽 If L0s are the ground, L1s are the highways built on this ground, the fundamental infrastructure on which everything else runs. They allow the secure transportation of messages and money.

Layer 2 (Scaling & Efficiency Layers)

What it is: Built on top of L1s to reduce costs and increase throughput (Optimism, Arbitrum, Polygon, Lightning).

Why it matters: Stablecoins on L2s can move faster and cheaper than on congested base chains, essential for payments and retail adoption.

Stablecoin connection: Enables $10 payments to move globally for fractions of a cent and confirm in seconds.

👉🏽 If L1s are highways, L2s are the express lanes, moving the same traffic, but at higher speed and lower cost.

Layer 3 (Applications & User Interfaces)

What it is: The wallets, apps, and financial protocols where people actually use stablecoins. Examples include MetaMask, Coinbase Wallet, Stripe’s crypto payments, and DeFi platforms like Aave and Uniswap.

Why it matters: Without Layer 3, stablecoins are just tokens sitting idle. Apps transform them into usable money for payments, lending, savings, and commerce.

Stablecoin connection: Merchants can accept USDC instantly, individuals can send remittances, and developers can plug stablecoins into programmable finance.

👉🏽 If L1 is the highway and L2 is the express lane, L3 is the car you drive or the ride-hailing app you use to jump on the highway. It’s the part users actually touch.

Bringing the Layers Together

Layer 0 ensures networks connect - The Cleared and Standardised ground

Layer 1 provides trust and finality - The Highways

Layer 2 delivers speed and efficiency - The Express Lanes

Layer 3 makes it usable in everyday life - The Cars

If you can come up with a better analogy, I’d genuinely love to hear it so reply to this or drop it in the comments!

TradFi vs Stablecoin

One thing that I’ve found difficult to get my head around is what all the different companies in the stablecoin stack do.

Names like BVNK, Circle, Arc, Tether and Bridge are mentioned regularly, and although the Layer Cake outline helps position the different layers, getting across what companies do in these different layers can be a bit tough.

For me, the best way of showing what these companies do is by comparing them to companies doing similar things in the ‘traditional’ ecosystem , and getting across all the different value props along the payment chain from issuing money, to processing payments, and preventing fraud.

Multi-Role Stablecoin Players

As you can tell from the diagram, some stablecoin players are taking the approach that many fintechs have taken over the past decade, and that’s to build full-stack infrastructure across the different solution areas. Here are some of those multi-role players:

BVNK: Full-stack set up, including infrastructure-only platform, managed payments (APIs liquidity, licensing, compliance), payments orchestration and white-label embedded wallets

Fireblocks: White-label issuing, payment orchestration, wallet/security infrastructure.

Circle: Issuer (USDC), also offers APIs/white-label issuance solutions.

Bridge (Stripe): White-label issuing, card infrastructure.

PayPal: Issuer (PayPal USD), processor (merchant acquiring, cross-border), consumer wallets.

Visa: Traditional processor, card network, and going all-in on stablecoin settlement pilots, and processing.

Use Cases for Stablecoins (Beyond Remittances)

The ‘Why’ for stablecoin is always raised in the debate, and one of the most frequently cited applications of stablecoins is remittances, the cross-border payments that migrant workers send home to their families. This is a natural fit as traditional remittance channels like Western Union or MoneyGram are slow, expensive (fees often exceed 6–8% and can be higher depending on the corridor), and heavily dependent on cash agents and bank cut-off times. Stablecoins, by contrast, allow workers to send money instantly, 24/7, at a fraction of the cost, with the funds often arriving in under a minute.

It's compelling, especially given that global remittances topped $860 billion in 2023, and the potential for stablecoins to reduce fees and increase speed could have a direct, positive impact on millions of households worldwide.

But remittances are also the example everyone reaches for when they talk about stablecoins. To avoid repeating the obvious, I want to look beyond this well-trodden ground and mention a couple of other use cases that could be just as transformative for financial services.

Cross-Border B2B Payments & Trade Settlement

The Current Challenge:

Global B2B trade flows exceed $23 trillion annually, but the way businesses move money across borders is still anchored in the correspondent banking model. Payments flow through multiple intermediaries (local banks, correspondent banks, FX providers, clearinghouses), each adding fees and delays. Settlement can take 2–5 business days, with little transparency into where funds are at any given moment. Small and mid-sized businesses are especially disadvantaged, as they often pay higher FX spreads and face limited access to global banking networks.

How Stablecoins Solve This:

Stablecoins cut out layers of intermediaries by providing a shared, global settlement layer. A company in Singapore can pay a supplier in Germany directly in USDC, settling in seconds with finality. No correspondent banks, no daylight exposure, no wire cut-off times. Fees drop from 3–7% to fractions of a percent, and both payer and recipient see the transaction in real-time on-chain.

🧠 Example: A Singapore-based fintech settling US invoices in USDC with suppliers in Europe.

Payroll & Gig Economy Payouts

The Current Challenge:

The rise of remote work and the global gig economy means millions of workers now get paid by companies outside their home country. Traditional payroll systems and banks struggle with this shift:

Slow settlement: Cross-border payroll runs through multiple banks and intermediaries, often taking 3–7 days to land.

High fees: Workers lose 5–10% to wire fees, FX spreads, and local bank charges.

Limited access: Many freelancers and contractors in emerging markets lack reliable bank accounts, making it hard to receive international payments at all.

Cashflow strain: Contractors often wait weeks for invoices to be cleared, which can be financially stressful.

How Stablecoins Solve This:

Stablecoins allow companies to pay global talent instantly, 24/7, without relying on the correspondent banking system. A designer in Argentina or a developer in Nigeria can be paid in USDC within minutes, and either hold it as a dollar-equivalent store of value (hedging against local inflation) or convert it into local currency through crypto off-ramps.

Speed: Near-instant settlement vs multi-day wires.

Cost: Transaction fees drop from several percent to pennies.

Access: Anyone with a smartphone and wallet app can get paid, bypassing the need for a local bank.

Certainty: Funds arrive in full, visible on-chain, with no hidden deductions.

🧠 Example: Deel, Request Finance, and Remote offering stablecoin payroll giving companies a faster and cheaper way to manage payroll globally.

There are more examples I could list but I’m trying to keep this punchy.

The point is, remittance is just one major application of stablecoin. There are many others, and they become apparent when you consider cases where it’s essential to obtain money quickly, affordably, and across borders, whereas the current process is slow, expensive, and difficult to transport without incurring high fees.

That’s to solve existing problems. Then programmability unlocks an entirely new segment of innovation, but I’ll cover programmable payments in depth in a future edition.

Got any credits?

There are reasons why I’ve finally written about stablecoin.

Firstly, the adoption path is a bit clearer, especially on the payments side now that cards are actively used as the bridge between the eras. It remains to be seen whether cards will be the future (I suspect we’ll see the shoots of the future of payment methods before the decade is out).

Secondly, there’s the GENIUS Act, the bipartisan proposal in the US that would create a clear regulatory framework for payment stablecoins, requiring issuers to hold high-quality liquid reserves and operate under federal oversight signed into law on July 18 2025. Its very existence signals that regulators are beginning to take stablecoins seriously as part of the future financial system.

Finally, there are the big FS and Fintech firms, including Visa and Mastercard, PayPal, Goldman Sachs, and even JPMorgan (which were vehement sceptics, but it appears they and JD have come around).

These are all pretty strong signals that stablecoins are not a fad.

But look, it’s not all sunshine and roses. There are challenges in the current stablecoin world.

Fraud & Scams: Fraudsters exploit the speed and irreversibility of stablecoin transfers for theft, phishing, and rug-pulls.

Regulatory Uncertainty: Different jurisdictions (US, EU, Asia) are moving at different speeds, leaving issuers in limbo.

Reserve Transparency: Not all issuers provide real-time audits — questions about backing remain a trust risk.

Interoperability: Stablecoins are still fragmented across chains, leading to liquidity silos and reliance on fragile bridges.

Consumer Protections: Unlike bank deposits, most stablecoins aren’t insured — if you lose your keys, your money is gone.

Adoption Friction: On/off-ramps (moving from stablecoin to local fiat) remain clunky and expensive in many markets.

These are all fixable, of course, and as adoption and time increase, more of these will be solved, but it's still worth pointing out that it's not without its challenges. As is the current card and account-based payment ecosystem, which has challenges, notably with fraud, even 50 years later.

But there’s one very unscientific reason that digital currency (likely stablecoin) is the future…

And that’s because every representation of money in science fiction has heavy undertones of a digital currency, and sci-fi has been a pretty good decent predictor of future trends (think about the mobile phone like devices in Star Trek).

Think about it. Pretty much every major Sci-Fi movie uses credits, a generic form of digital currency.

👉🏽 Total Recall has Credits.

👉🏽 Judge Dredd has Creds.

👉🏽 Star Trek has Federation Credits

👉🏽 And famously Star Was has Galactic Credits

Why credits? They are interoperable, easy to transfer across borders, accessible, and understood everywhere, similar to the benefits of stablecoin.

I did say it was very unscientific although it’s a great way to get you thinking.

Based on the current shift in the technology era, it’s pretty logical that some form of digital currency will be the future of money.

But if you feel strongly that it won't be, then what will? Answers on a postcard please

That’s it from me.

Hope you enjoyed this primer edition, and as always, I’d love to hear your thoughts.

See you in a few weeks 👋🏽

J.

Note: This has inspired me to do a classic company and product deep dive on one of the full-stack companies mentioned so watch out for a deep dive on BVNK in the coming weeks!Interesting News🗞: HSBC online and mobile faces outage

HSBC’s online and mobile banking went down in the UK, leaving customers (including myself) unable to view accounts or make transactions. Many reported error codes like “err03” while others were simply told to “try again later.”

As more banks go branchless, uptime becomes even more important and outages will warrant more outrage. Stripe boasts a 99.999% uptime across the year for their merchants and this is a metric banks should be putting higher up their agendas.

Excellent article. Please revise to reflect that the US Genius Act was signed into law on July 18, 2025.

https://www.congress.gov/bill/119th-congress/senate-bill/1582/text

Great read and memorable references - 'credits' and analogy with a TCP/IP model for computer networks.