Fintech R&R ☕️ 🐣- Buy It Now, Regret It Later

A BNPL rant, reasons why Apple are entering the space and why they'll eat up the market in the next few years

Hey Fintechers and Fintech newbies 👋🏽

First, a little Easter weekend shoutout to all subscribers, readers, and folks who have shared with others and given me feedback on this new literary adventure. New ventures are always challenging, whether giving up a couple evenings a week to write a newsletter, bootstrapping a startup alongside a full-time job, or changing roles/industries. New ventures come with uncertainty, and nothing helps alleviate this uncertainty more than a bit of support, so thank you!

Something that didn’t require much support was the inspiration for this write-up. Usually, as soon as I’ve published one newsletter, I think up a few conceptual ideas for the next one and keep an eye on the news for any correlation.

Fortunately, there’s never a dull week, let alone a fortnight, when it comes to fintech news.

And Apple just announced the rollout of their native Pay Later offering in the US, which is their latest attempt to take an even bigger piece of the payments pie and take on Buy Now, Pay Later (BNPL) providers like Klarna and Affirm. This is just the excuse I needed to have a bit of a rant about BNPL, talk about what Apple is doing and why it’ll likely be a blow to existing BNPL companies and include some references to pies and Good Will Hunting. Because...Well…Apples.

So as well as my favourite tweet, interesting news, puns + movie references, and a bonus easter egg pun, this week includes the following:

What is BNPL?

How it works + Pros and Cons of BNPL (in 3 instalments)

Apples Pay Later and the threat to existing providers

Product Purism and adding customer value

Healthy & Timely Use cases for BNPL

What the BNPL

Buy now, pay later (BNPL) is the phrase of choice for the alternate payment method that allows customers to finance the cost of commerce purchases and spread that cost over 1-3 months. So, for example, rather than paying for, let’s say, a £1000 TV and giving up that cash up front, a BNPL service gives the option of splitting that payment into 4, where the customer will only pay for 25% at the Point of Sale (POS), £250 using our simple maths skills, and the remaining £750 spread over the subsequent 6 weeks, therefore, paying £250 each fortnight.

BNPL is just a type of POS Financing that’s gained significant popularity with consumers and businesses alike due to its benefits to both parties. Its success is also down to companies like Klarna, Affirm and AfterPay building friction reducing customer journeys, using marketing to bring awareness about the alternative payment method and using strategic partnerships with retailers to put the option at the front and centre of customers’ checkout experience.

NOTE: All BNPL is POS Financing, but not all POS Financing is BNPL and I’ll highlight the BNPL-specific characteristics shortly.

The continued growth of BNPL is why it’s estimated to contribute to 12% of total e-commerce spend on physical goods by 2025. These were numbers generated before the Apple Pay Later launch, so this percentage will be seen as a conservative estimate now.

In terms of tangible numbers to put things into perspective, Klarna is the biggest BNPL provider.

It has over 150 million active customers worldwide.

500,000 e-commerce stores offer Klarna as a payment option.

The biggest share of the BNPL pie, with 53% of e-commerce sites choosing Klarna over their competitors.

Whilst this isn’t a Klarna deep dive, these are impressive acquisition numbers especially. But the other reason to call out some of these remarkable numbers is to compare

All Squares are Rectangles. Not all Rectangles are squares

I touched on POS Financing and how BNPL is just one form of finance. That’s because other types of POS Finance have existed for a while, and BNPL is just a form of finance under this broader umbrella.

POS Finance for furniture, for example, has been around for decades and used to involve a few forms of ID, bank statement and a credit check before a payment plan was put in place to pay off the balance over 2, 3 or 4 years and given to you in paper form. An appropriate example as the Easter Bank Holiday here in the UK is when furniture stores like DFS shout “Interest-Free Credit! Interest-Free Credit” through the TV.

Although still a form of POS Finance, BNPL is a bit different in the way it works, not only in terms of the characteristics and customer base but also, as mentioned before, in the smoothness and low friction of its user journey, one of the key drivers in it’s accelerated adoption.

In simple terms, here’s how it works:

Customer adds goods to basket as normal and sees the BNPL/Pay In Instalments option at checkout (if the retailer has a BNPL provider)

Customer enters delivery information, and billing info as normal and then select the Pay Later/Pay in Instalments/Pay with BNPL provider option

Customer logs in or does a light onboarding providing their phone number and email, which are then verified and used to retrieve any existing account or create a new one

BNPL providers use this info, along with name, address etc, to run a soft credit check to confirm eligibility for the repayment options and assess repayment likelihood.

Customer then selects whether to pay in instalments or defer the full payment

Once selected, the customer will have to enter card details or select a previously used card for repayment and will see a summary of their order and payment schedule

Customer completes the order by checking out

For ‘pay in instalments' the customer pays a percentage of the basket instantly with the remaining payments scheduled in intervals, e.g. £250 upfront using the TV example

BNPL provider pays the merchant/retailer the full basket amount minus any fees (usually 2-8% of the total basket). On a £1000 TV, the retailer would get around £950, but the fee varies depending on the provider

Customer then pays the BNPL provider as per the payment schedule using the connected payment method, with fees applied for any late payments

Key Characteristics of BNPL

Interest-Free - A key differentiating factor between other short-term lending facilities as BNPL tends to be interest-free for the customer

Low-Medium basket sizes - The amount the provider is able to lend is dependent on credit checks, but they can usually lend between £10-£2000

Soft Credit Checks - These checks are done to determine what your credit profile looks like and don’t impact your credit score, whereas a hard credit check, such as one that occurs if you apply for a credit card, will be recorded in your permanent credit file.

Short Installation Repayment time frame - Months, not years, with most payment schedules lasting 4-6 weeks

Low customer friction - BNPL solutions are digital-first, have simplified customer journeys and give low-friction access to credit for consumers.

Which consumers use it

Primarily Millennials (24-39), but the second biggest user group is Gen Z (under 24)

And what for?

The specific percentages vary, but the overwhelming use cases are for purchasing clothing and electronics (over 40% of purchases using BNPL is for clothing)

Pros

✅ Improving AOV and Conversion for e-commerce & physical retailers - I talked about metrics in an earlier newsletter. Regarding e-commerce, two key customer-facing metrics for e-commerce are Average Order Value, the amount the customer has in their basket, and Conversion, the percentage of customers who add items to their basket and fully ‘checkout’. And regardless of the 2-8% hit retailers face when goods are paid for using BNPL, the 20-30% increase in conversion means that both BNPL providers and e-commerce retailers see a net gain.

This is the most significant benefit of BNPL across consumers, providers and merchants, with most of the upside sitting with the latter two.

✅ Allows customers flexible payment terms for necessary goods - For consumers facing a financial squeeze who don’t have or can’t apply for a credit card, BNPL offers favourable and fast credit terms when purchasing high-value and necessary purchases like white goods (home appliances)

✅ Goods are paid for upfront (minus fees) - Because of how the model works, merchants get paid immediately for goods sold and don’t have to worry about chasing up repayments (left to the provider).

Cons

❌ Regulation - No formal regulation for BNPL in the UK, although there are plans for regulation being laid out. This means no regulation on the late fees providers can charge and no Section 75 protection (the protection that credit card holders receive in case of faulty goods or unsatisfactory service).

❌ Missed Payment Fees - The missed payment fees and the process are not transparent. It’s more translucent. This is probably because highlighting fees and the repercussions of missed payments is a point of friction in the journey, something that doesn’t help conversion. And although a missed payment does not directly feed into the consumer’s credit score, it’s visible to other lenders.

❌ Consumer Overspending - The reduced friction contributing to BNPL adoption also makes it easier for consumers to buy goods they can’t necessarily afford. And there’s research to support this overspending, with over 50% of BNPL consumers in this study saying they regret the purchase because it was too expensive

So where does Apple fit into this BNPL landscape?

Apple wants more of the fintech pie 🍏 🥧

Apple’s big entrance into the payments scene came back in 2014 when it launched Apple Pay. The digital wallet allowed Apple customers to add a tokenised (we’ll call it digital for now) version of the card to their device, allowing them to hold multiple payment cards and be used to pay for goods and services at stores.

NOTE: I won’t do a full Apple Fintech deep dive here or detail Apple Pay or Pay Later at a technical level, but that will come later down the line

It was back in 2014 that Apple Pay launched in the US, then the UK in 2015, with a subsequent gradual rollout to over 76 countries and some more still to go (the addition of several Middle-East, South American and East Asian countries in the past couple of years).

As of 2021, Apple Pay had 507 million users (including me), with around 50% of iPhone users using it and over 1,000,000 stores in the US alone accepting it as a payment method.

It’s estimated that Apple currently makes around $1 Billion from the fees it charges banks for transactions made through its digital wallet.

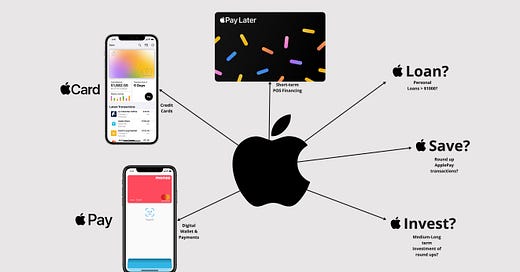

Although this isn’t a massive chunk of their revenue, it was always clear to me, at least, that Apple Pay was only the beginning of their entrance into the fintech arena.

Many others predicted the same thing when they acquired Credit Kudos, the Open Banking powered ‘challenger’ credit reference agency back in March 2022. I’ve spoken about the benefits of Open Banking when it comes to enriching complicated lending processes. Although they are using Experian for credit scoring and eligibility in its US rollout of Pay Later, they’ll likely use Credit Kudos’s experience and rules engine as part of the decision process when it comes to assessing affordability when it’s inevitably rolled out to the UK.

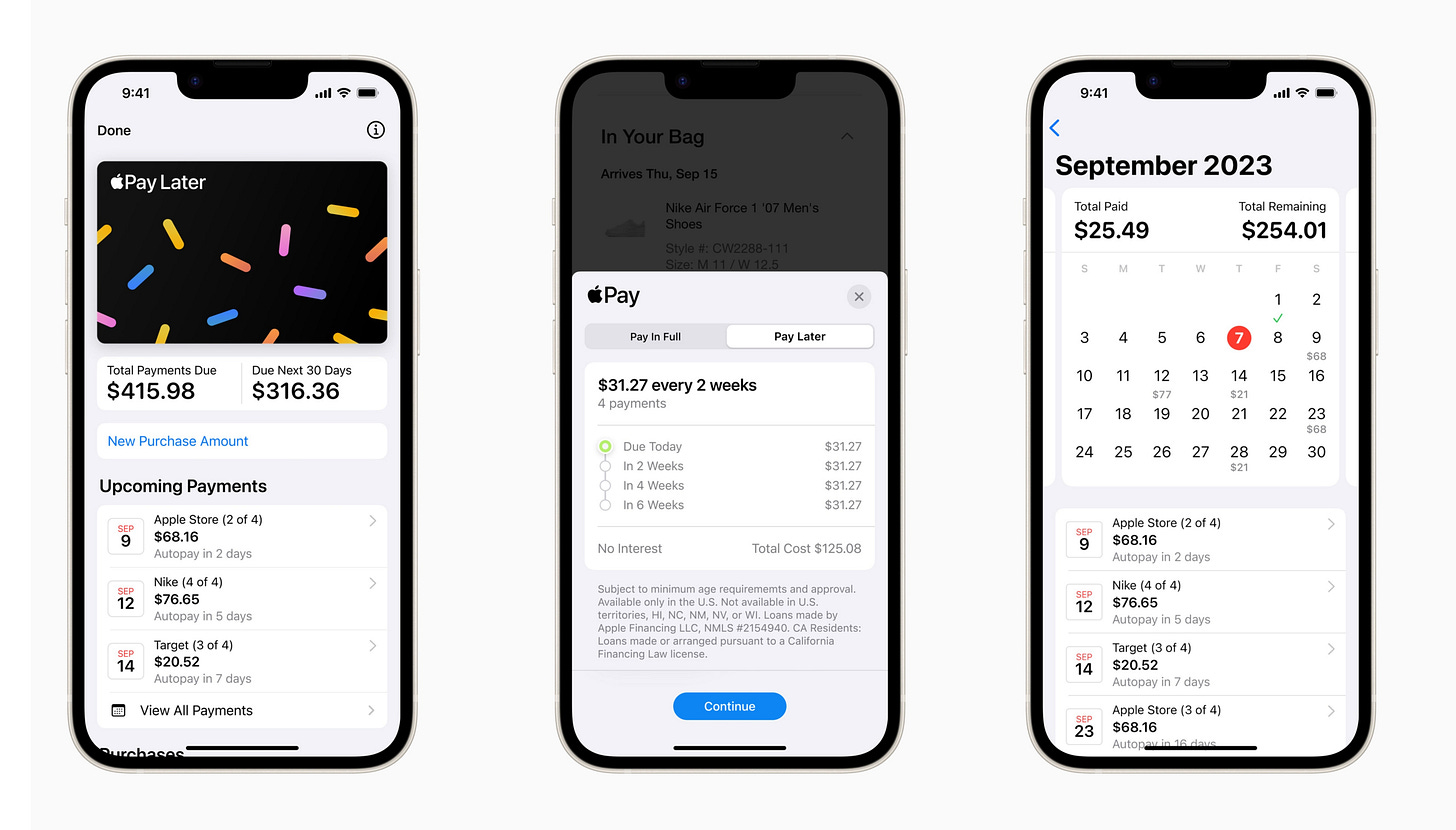

More details on how it’ll work here:

What is clear to me is although Apple says Pay Later is “Designed with users’ financial health in mind”, the primary beneficiary will be Apple, and although reducing friction in payments is something that can positively impact day-to-day consumers, I think their motivations are, as expected, financial. Despite the motivations, there’s no doubt in my mind that they’ll be successful in their endeavour.

Here are what I think are the three significant benefits to them and the reasons they’ll eat up the BNPL market in the next 5-10 years

1️⃣ Merchant Fees

Existing BNPL providers take between 2-8% from merchants in exchange for increasing AOV and conversion. It’d be surprising if Apple didn’t take something similar. Even 5% will be attractive to merchants as it’ll be a Win-Win situation regardless.

2️⃣ Even more interchange

I said earlier that Apple takes a cut of each transaction via Apple Pay. That percentage is 0.15%. And with Pay Later, customers are required to add a payment card, with the payment likely taken via Apple Pay. Every Pay Later arrangement will also mean 0.15% straight back into Apple’s pockets. So when I said Win-Win for merchants and Apple. I meant Win-Win-Win Because Apple win twice.

3️⃣ Data. More Data.

Apple will get more of an ever-valuable resource when customers agree to have credit checks run on them. It means they’ll have a better idea of any debts the customer is in, an indication of their financial behaviours and an overall better picture of their financial position. Of course, what they’ll use that for remains to be seen. Still, the possibilities could be additional lending products, a native Financial well-being app, pre-qualification for Apple Credit, a future debit card, and more.

🥚Egg-sisting Retail connections

Apple Pay is already accepted at over 1,000,000 stores in the US alone and over 250,000 in the UK. No additional technical work will be required to enable Pay Later for stores already accepting Apple Pay. AND. Pay Later will work at physical POS terminals. A massive advantage over traditional BNPL players.

🙋🏽Ready-made user base

The reference to Klarna’s customer numbers before was to highlight the stark difference in customers. Klarna, the biggest BNPL provider in terms of numbers, has around 150 million customers. Apple Pay has 500 million. And there are 1.5 Billion active iPhone users worldwide. A ready-made customer base who are experienced and comfortable with digital payments.

🥑Demographic overlap

Gen-Z is a growing population. And the predictions are that almost half of Gen-Z are expected to use BNPL services by 2025. This a convenient statistic for Apple because guess which phone model is the most popular among 18-34-year-olds covering both Gen-Z and the core of Millenials. Yup. The iPhone. So not only does it have an already accessible customer base. It also has inroads with the customer segments targeted for growth in the next few years.

💸Even Lower Friction lending

BNPL providers have created low-friction lending journeys. But Apple’s journey has even less friction. And once set up, the payment option will be accessible with 2 clicks of the screen lock button.

Although other providers will still see some growth in the area and many of the customers of those existing providers will stay loyal, I think Apple will be the go-to BNPL provider of choice for the above reasons and will likely convert die-hard Affirm, Klarna and Paypal Credit fans.

A short rant on BNPL

Full disclosure. I do not use any BNPL service and don’t intend to. It’s not because I’m rich or have a vendetta against short-term lenders. It’s because my financial mindset is to not live beyond my means, and I’ve historically changed my lifestyle to suit my financial situation rather than changing my financial situation in the form of more credit, to suit my lifestyle.

I don’t have a problem with BNPL providers or new entrants like Apple looking to offer services to people who will benefit from it. But I do have a problem with two things. The perceived customer value of BNPL and the race to reduce friction.

Consumer Value

The value of BNPL to consumers is the ability to access flexible finance for goods and services regardless of if that individual has a traditionally bad credit history or not. So folks who cannot access credit cards or other lending facilities can still buy presents for friends and family, get the occasional wardrobe refresh or buy necessary household electronics.

While there aren’t statistics on whether purchases are necessary, the fact that the most prominent use case for BNPL is clothing purchases clearly indicates that it’s not an essential facility for all users. And while delinquency rates for BNPL are nearly double that of Credit Cards, companies can provide real value here in providing financial guidance and education and access to credit to those who need it the most.

Good Friction v Bad Friction

The race to reduce friction is a strange one.

Anyone who’s built a digital product knows that not all friction is bad, and the goal is not always to reduce friction.

For example, early-stage products with a niche user base might introduce friction into their onboarding journey to filter out customers who won’t see the product’s value, leaving them with customers who will see the value and likely lead to higher retention.

For retailers, yes, reducing friction in the checkout journey is beneficial, but reducing friction too much can lead to more fraudulent transactions.

The same applies to customers. And creating low-friction access to POS credit has its consequences, as we’ve seen with the increase in delinquencies (missed repayments). Sometimes friction can be good.

For example, putting the late fees front and centre of the payment plan. Or making sure the customer is asked if they have any other BNPL plans in place and the total size of the debt (because not all BNPL arrangements are logged with credit agencies).

These ‘good frictions’ might slightly impact conversion and AOV but would go some way to reducing delinquencies.

Some healthier use cases for BNPL

I always like to end on a positive note, so here are some proposed but realistic areas I think BNPL and Apple’s Pay Later add real value:

👉🏽 Help alleviate some inflation pain: Inflation has hit many people pretty hard. Energy has had one of the most significant inflation spikes in the UK. And although energy companies do take card payments, many of them don’t offer the ability to spread particularly high payments across the space of a few weeks

👉🏽 Elective Credit Submission: Although BNPL plans don’t contribute to credit scores, for people who are locked out of the system (because they can’t get a credit card to build a credit score), it could be used to selectively submit finance agreements that contribute to the official credit score. This would be BNPL companies rewarding good behaviour. Sezzle is one company already doing this.

👉🏽 Unforeseen Spend: Everyone talks about a rainy day fund for when the boiler breaks down, the car needs repairs or a big birthday bash. And while rainy day funds are designed for these cases, cleaning out an account to pay for a one-off spend doesn’t make much sense. Instead, using part of that lump sum as a downpayment and splitting the cost across 4-6 weeks has a more significant benefit to overall cash flow, and Pay Later makes this a lot easier.

Hopefully, I haven’t been too dour on BNPL or Apple. I think Apple could prove to be a net positive to consumer financial health as long as they look at providing customer value and monetary benefits. And there are companies like Sezzle who are already looking to be responsible short-term lenders while also providing additional value to customers.

Regulation is overdue and needs to come in to support & protect customers, provide a bit of accountability to providers and be a bit of a positive friction layer and providers have opportunities to use their services and expertise to educate and inform customers as well as provide them with lending facilities.

Interesting Fintech News

Acorns acquired GoHenry - I love what GoHenry does. Although I was hoping they could go it alone, I’m glad they’ve been acquired by a company with a pedigree in fintech. I just hope they don’t mess with the product too much.

Tandem Bank acquires money sharing app Loop - Tandem is looking to be UK's go-to “greener bank”. Green meaning environment but probably also cash-flush. Loop has had success in acquiring young professionals and students so it’s a great fit for Tandem, who know the climate-conscious customer base they’re inheriting.

Santander, Oxentia and Microsoft launch AI challenge - With money up for grabs, the challenge aims to find AI solutions that will positively impact society. Let’s see if they manage to do it or if Musk and Co don’t put the brakes on AI with their ironically Open Letter.

Favourite Tweet

Unfortunately I was unable embed a Tweet because Twitter have restricted the embedding of tweets for some strange reason. Instead, here’s a screenshot.