Fintech R&R ☕️👮🏼♂️- Financial Services In the Line of Consumer Duty

The rules about to ripple through UK Financial Services, the basis for them and the long-term beneficial impact. And a reference to the Region-Beta Paradox

Hey Fintechers and Fintech newbies 👋🏽

Quick humble brag to lead into this week’s topic.

I recently had the privilege of attending an exclusive breakfast roundtable to discuss customer experience as part of a wider ‘Customer Experience in Financial Services' conference. In the room were digital leaders and decision-makers from HSBC, JP Morgan, Lloyds, NatWest, Metro Bank and several fintechs.

We were invited to discuss our views on customer experience (CX) and ‘User Struggle in Digital Banking’ in our respective financial products. I also spoke about my experiences building and launching digital banks, the challenges of my current fintech clients with CX, and some CX best practices when designing and developing fintech products.

Discussion points included:

Processes that can be put in place to analyse retention and customer churn

The balance between automation and human interaction in digital products

Challenges with reviewing customer feedback, including how to store and tag efficiently

The importance of optimising digital banking processes with CX guidelines

The tools involved in the CX processes such as analytics tools, feedback management & customer interviewing solutions

And, of course, there was a little sales pitch at the end of the 90 min discussion by one of the event sponsors. It’s fair game because there was a complimentary breakfast, and I was happy to be in a room with some great leaders who understood the value of customer experience in digital banking products.

A topic that came up multiple times during the open and honest discussion was Consumer Duty.

This is the Financial Conduct Authority’s new set of rules designed to “set higher and clearer standards of consumer protection across financial services and require firms to put their customers’ needs first.”

If you haven’t heard of it, don’t worry, I’ll cover the new rules, what they mean and who they apply to. SPOILER ALERT: IT APPLIES TO MOST FS AND FINTECHS

Most of the banks in the room didn’t seem too concerned about it, and one mentioned that they’d been working on ensuring they adhered to the new rules in preparation for the fast-approaching 31st July 2023 deadline. Only a few fintechs were in the room, and they didn’t have much to add to the Consumer Duty discussion.

Maybe it’s because fintechs and neobanks feel they’ve nailed customer-centric product development and customer feedback management.

Or because neobanks assume that big banks will feel any repercussions with their mass of customers first, and they have time to see the landscape and adapt.

Whatever the reasons, it’s important to talk in detail about these new rules, their positive outcomes and experiences for consumers, the huge impact to all financial services firms and why this is music to the ears of Fintech Product people everywhere.

So as well as interesting news, puns + movie references, this week includes the following:

Consumer Duty Origins

The Principle, Cross-Cutting rules and Four Consumer Outcomes

Timeline and Impacted firms

Regulators getting a bad rap

The huge changes in FS processes, tools and culture

Without further ado, let’s get into this slightly longer, deeper edition.

Psssss. Don’t forget to subscribe if you haven’t already and share this with a fintech friend.

Call of Consumer Duty

Origins

The new Consumer Duty started out as a few sounding out exercises by the FCA in 2018 after they published a paper on a duty of care for consumers and sought feedback on what form it would take. The recent Financial Services Act 2021 also included a provision requiring the FCA to conduct a public consultation about whether it should make general rules providing that organisations owe a duty of care to consumers.

In December 2021, there was the first formal consultation with organisations about duty of care to consumers where feedback was gathered. In Feb ‘22, the consultation closed, and in July ‘22, the FCA issued a policy statement, guidance and a deadline of 31st July 2023 for relevant FS companies to adhere to the new Consumer Duty.

The full Consumer Duty guidelines and policy are here, but as it’s 161 pages, I’ll do my best to pull out the key points so you don’t have to trawl through the whole thing.

An essential first step is outlining the objective of this Duty.

This is straightforward because the message is consistent throughout, including a line referenced earlier and pretty much the first line of the policy, which states,

“set higher expectations for the standard of care firms give consumers”.

Not only is this in the Consumer Duty policy but setting higher expectations and improving the standard of care of financial services customers is also core to the FCA’s five-year strategy outlined here.

Part of the overarching principle of improving care and value to consumers includes giving them communications they can understand, products and services that meet their needs and offer fair value, and they get the customer support they need, when they need it. I’ll go into more detail on some of these points later.

Some of the value the FCA hopes to provide with new Consumer Duty comes from the insights gained during consultations with various financial institutes and consumers. But much of the standard raising and consumer value objectives come from their own experience intervening when they saw firms presenting information in a way that exploits consumers’ behavioural biases, selling products or services that are not fit for purpose, or providing poor customer support.

Clear Vision + Better Behaviours + Higher Standards = Better Consumer Outcomes

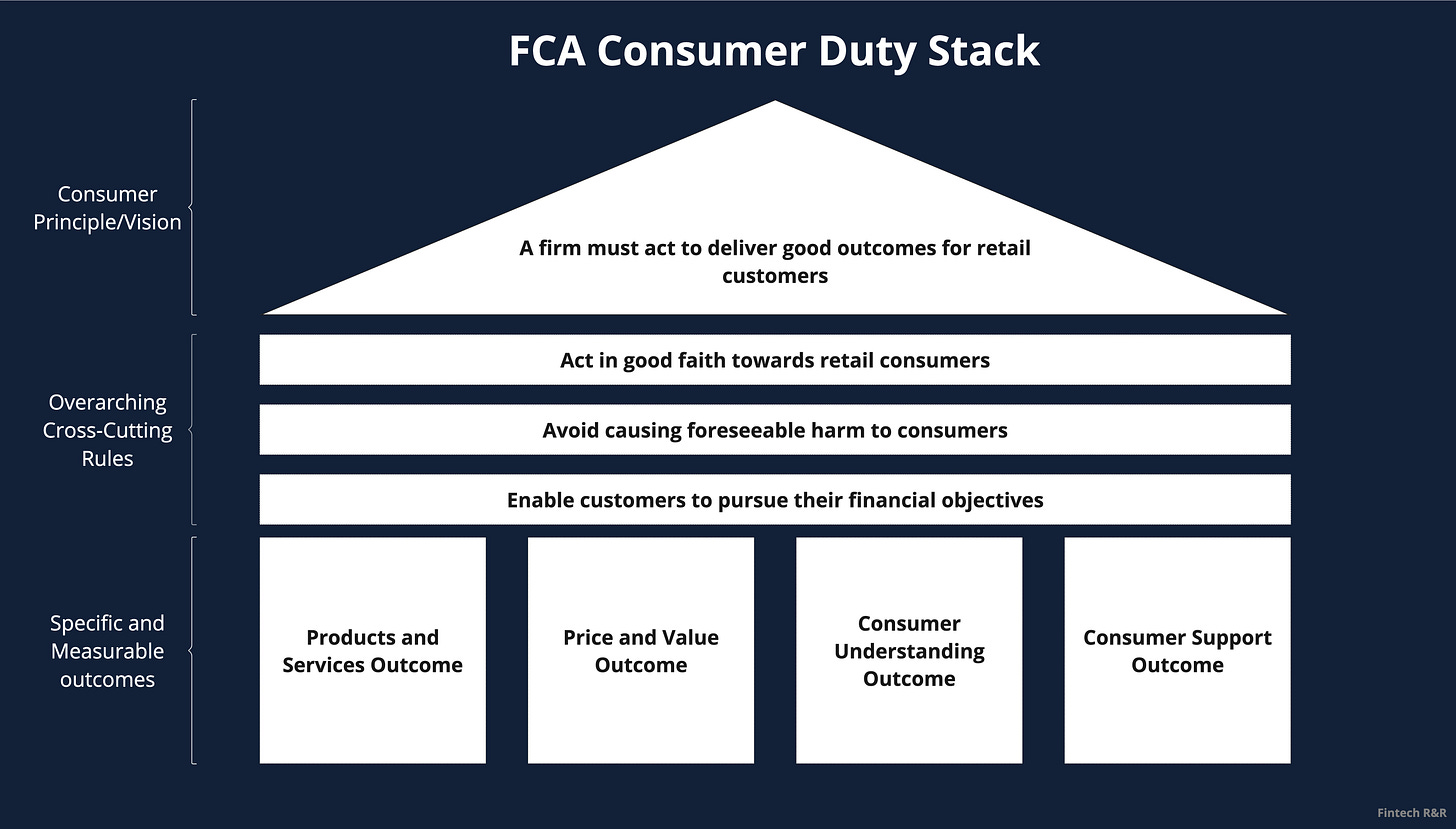

As with lots of policies and high-level strategies, the Consumer Duty starts off high level with a clear vision statement that everyone can comprehend and relate to, some rules that apply across all areas of operation, and clear expected outcomes that contain more detail about what is expected of organisations and the outcomes if those expectations are met.

Consumer Principle

The new Duty starts at a high level with a new Consumer Principle to be added to the FCA’s Principles for Business Handbook, Principle 12, which will replace Principles 6 (customers’ interests) and 7 (communications with clients). The new principle is:

“a firm must act to deliver good outcomes for retail customers”.

This is akin to a high-level vision statement for a product or initiative and sets the stall out of what's to come.

Cross-Cutting rules

The Cross-Cutting rules are the second layer down from the vision (Consumer Principle). As the name suggests, these are three overarching rules that apply across all areas of the firm’s conduct and outline how they should act to deliver good outcomes.

Here are the 3 Cross-cutting rules, along with examples of non-adherence to the rule:

1️⃣ Act in good faith towards retail consumers. This means conduct characterised by honesty, fair and open dealing, and acting consistently with the reasonable expectations of retail consumers.

Examples of Good Faith

In the Product/Service Design stage:

Designing features that avoid the exploitation of behavioural biases of consumers to create a demand for a product

Avoiding creating and using algorithms, ML, and AI that could lead to consumer harm. For example, using it to amply bias and create unnecessary divides and adverse outcomes for specific groups

Designing products and services where pricing is transparent and makes it easy for the consumer to understand the total cost

In terms of Customer Understanding:

Avoiding promoting products or services in a way that misleads customers about the benefits or risks, e.g. burying some of the key risks at the bottom of T&Cs consumers aren’t likely to read

Presents customers with clear, complete, undistorted information on sign-up pages, websites and other marketing materials

2️⃣ Avoid causing foreseeable harm to consumers through their actions and omissions. Firms, therefore, need to stay abreast of and respond to new and emerging sources of harm.

Examples of Avoiding Foreseeable Harm

In the Product/Service Design stage:

Designing products and services to meet the needs of customers within their target market, that the products and services are being distributed to that market, and continually checking they remain consistent with the needs, characteristics and objectives of the target market

Considering whether their charges represent fair value to different consumer groups

In terms of Customer Understanding and Support:

Communicating product or service terms clearly and highlighting key risks for consumers

Helping to ensure consumers get the necessary calls to action to avoid something that would negatively impact them

Consumers find it simple and easy to cancel a product or service that isn’t right for them

Making it easy for consumers to switch to another provider using a clear process

Consumers avoid becoming victims of scams relating to their financial products, for example, due to a firm’s well-designed or adequate systems to detect/prevent scams

Using appropriate friction in customer journeys to give customers a sufficient opportunity to understand and assess their options

3️⃣ Enable customers to pursue their financial objectives. The actions a firm might need to take to enable and support customers in pursuing their financial objectives are determined by the nature of the products or services and applied throughout the customer journey and life cycle of the product or service. This means knowing enough about the customer, their objectives, as well as any changes in circumstances to be able to maintain the right products and suggest more relevant ones if necessary.

Examples of Helping Customers Pursue Financial Objectives

In the Product/Service Design stage:

Designing products or services with clear and straightforward features so they can be understood by consumers in the target market

Not charging unreasonable exit fees which discourage customers from leaving products or services that are not right for them or getting better deals

In terms of Communications and Customer Support:

Using customer characteristics to tailor communications accordingly so that they are likely to be understood by customers

Includes avoiding unnecessary friction in the design of consumer journeys that prevents consumers from taking actions such as cancelling a product or amending terms

Having systems and processes in place to test and monitor the impact of communications on consumer understanding and using the outputs to improve their communications

Ensuring that the support channels work effectively and do not act as a barrier to customers utilising their products, cancelling or switching to another provider

Four Measurable Outcomes

The following outcomes represent the key elements of the firm-consumer relationship. Namely, how firms design, sell and manage products & services and the critical touch points in the customer journey.

These are the four lower-level strategic outcomes driven by the central Consumer Principle vision and supported by the overarching Cross-Cutting rules.

👉🏽 Products and Services Outcome: This requires all firms’ products and services to be fit for purpose, designed to meet customers’ needs, characteristics and objectives and targeted/distributed accordingly. A key part of this outcome is clearly defining the target customer demographic during new product and service development.

This is a monumental shift in many organisations’ product development principles and, in my view, a change for the good.

In the detailed overview of each outcome, the FCA has defined a set of questions firms are expected to answer, which gives a great understanding of what firms are expected to do.

Some of the key questions firms should be able to answer:

Has the firm specified the target market of its products and services to the level of granularity necessary?

How has the firm satisfied itself that its products and services are well-designed to meet the needs of consumers in the target market and perform as expected?

What testing has been conducted?

How has the firm identified if the product or service has features that could risk harm for groups to customers with characteristics of vulnerability?

What changes to the design of its products and services is it making as a result?

What data and management information is the firm using to monitor whether products and services continue to meet customers' needs and contribute to good consumer outcomes?

👉🏽 Price and Value Outcome. This centres on consumers receiving fair value, which ties into the Cross-Cutting rule of consumers being able to achieve financial objectives, but it means more than just price. It involves assessing products and services to ensure a reasonable correlation between the price paid and the customer's benefit.

Some of the key questions firms should be able to answer:

Is the firm satisfied that it is considering all the relevant factors and available data as part of its fair value assessments?

Can the firm demonstrate that its products and services are fair value for different groups of consumers, including those in vulnerable circumstances or with protected characteristics?

What insight has the firm gained for its value assessments by benchmarking the price and value of its products and services against similar ones in the market?

Have the price and value of its older products kept up with market developments?

If the firm charges different prices to separate groups of consumers for the same product or service, is the firm satisfied that the pricing is fair for each group?

👉🏽 Consumer Understanding Outcome. This requires that firms’ communications provide customers with the essential information needed to make informed choices regarding financial products and services. It is crucial to deliver information to customers promptly and in a manner that suits their specific needs and understanding. Achieving this goal necessitates clear, fair, and non-deceptive communication from firms.

Some of the key questions firms should be able to answer:

Is the firm satisfied that it is applying the same standards and testing capabilities to ensure communications are delivering good customer outcomes as they are to ensuring they generate sales and revenue?

What insights is the firm using to decide how best to keep customers engaged in their customer journey whilst also ensuring its customers have the right information at the right time to make decisions?

How is the firm testing the effectiveness of its communications?

How is it acting on the results?

👉🏽 Consumer Support Outcome. This outcome involves designing and delivering a support model that meets customers' needs. A good support model enables consumers to realise the benefits of the products and services they buy, pursue their financial objectives and ensure that they can act in their own interests.

Some of the key questions firms should be able to answer:

How has the firm satisfied itself that its customer support is effective at meeting customer needs regardless of the channel used?

Does the firm test outcomes across different channels?

What assessment has the firm made about whether its customer support is meeting customers' needs with characteristics of vulnerability?

What data, MI and customer feedback is being used to support this assessment?

How has the firm verified that it is at least as easy to switch or leave its products and services as it is to buy them in the first place?

How has the firm verified that the quality of any post-sale support is as good as the pre-sale support?

What data, MI and feedback is the firm using to monitor the impact its consumer support is having on customer outcomes?

How often is this data monitored, and what action is being taken as a result?

How effective is the firm’s monitoring and oversight of outsourced or third-party service providers, and is it confident that these services meet the consumer support standards?

Scope and Timeline

The new Consumer Duty will apply to regulated firms’ activities in relation to products and services sold to ‘retail clients’ and regulated firms in the e-money and payments sector. Retail clients include your ‘average’ financial services consumer and small-medium business but excludes large corporate institutes and government bodies. It also includes firms involved in manufacturing or supplying products and services to retail clients, even if they do not have a direct relationship with the end consumer. Finance Marketplace platforms, for example, and others who create or distribute financial products.

On a forward-looking basis, it'll apply to new and existing products and services, including closed book products and services. In relation to firms currently applying for authorisation or to vary their permissions, the FCA has clarified the need to demonstrate, from now on, the ability to meet the requirements of the new Consumer Duty.

Timing and next steps

The Duty will come into force via a two-phase implementation period:

On 31st July 2023 for new and existing products and services that are open to sale or renewal

On 31st July 2024 for closed products and services. Closed book products and services are still ‘live’ but no longer being actively sold or marketed to win new business. Things like long-standing insurance agreements, old mortgage products still in place with old customers but not actively sold etc.

What does this all mean?

That’s what you were thinking, right?

In summary, it means a whole range of organisations from traditional banks, lenders, and wealth management solutions to new fintechs, challenger banks, e-money institutes, digital wealth + investment firms and more have until the end of July to implement processes, train people and install tools to ensure they adhere to the Cross-Cutting rules and Consumer Outcomes outlined.

While the consequences are not crystal clear from the policy and guidance, it’s likely the FCA will initially take a ‘remedial’ approach by identifying the critical areas for companies to focus on, but eventually, just like the AML rules that were gradually implemented, there will be fines.

Here’s what they said in a recent press release:

“We will prioritise the most serious breaches and act swiftly and assertively where we find evidence of harm or risk of harm to consumers. In some cases, firms can expect us to take robust action, such as interventions or investigations, along with possible disciplinary sanctions”

It sounds like a bit of a ‘big brother’ approach by the regulator, but everything they’re doing is for the good of the consumer, and although they might not know it yet, for the good of big banks, fintechs and FS companies across the land.

Because there are some huge implications for FS and fintechs behind the scenes (which I’ll outline later), as well as the benefit to consumers and the overall raising of consumer standards.

Before I outline that, however, I have to give a quick shoutout.

Stop Dreading the Regulator

Regulators, financial regulators especially, always seem to get a bad rap.

From banks. From fintechs. From consumers. Even from governments.

Regulators are like football referees.

When bad things happen, and they don’t take the ‘right’ action, they’re criticised.

When they take action, at least one side hates them.

When they take too much action, everyone hates them.

But regulators are in place to ensure there is a fair and level playing field for all, and the rules are improved as the ‘game’ evolves. Their intent isn’t to get too involved or make a name for themselves. Quite the opposite.

Like referees, regulators get involved when they deem it necessary. In this case, it’s vital with a policy and set of guidelines proportional to the changes needed in consumer protection.

So kudos to the regulator.

Ch-ch-ch-ch-changes

While a few more prominent financial institutes will have already changed their internal systems and customer-facing journeys and procedures, only some have. And even the ones that have made changes will need to continually improve as this new set of principles matures.

As I said before, these changes are a good thing for all. As the saying goes, a rising tide lifts all boats. The changes and principles outlined will not only positively impact consumers but drive big changes inside traditional financial institutes as well as fintechs.

The following areas will see the most significant positive changes inside organisations. I’ve also outlined what I’d do to start driving change in these areas.

Product Development & Product Governance 🏗

The biggest area of improvement, specifically for larger and traditional financial institutes, is in the area of new product development and improvement. It’s clear from the new Consumer Duty that product development and customer-centric design are core to its principles (it’s clear from the Products & Services Outcome alone). Still, it’s not controversial to say neobanks and other fintechs have naturally adhered to many of the rules and outcomes the FCA have outlined, while the traditional FS firms have lagged behind a bit.

Like designing a proposition to meet customers’ needs and clearly defining the target customer demographic during new product development. This has come naturally and out of necessity for fintechs as they started out by developing products for specific niches, and had a clearer view of their target demographic and proposition before widening those demographic circles and increasing customer numbers. Fintechs have also had a ‘Lean Startup’ mentality with Build, Measure, Learn, Repeat a core process allowing them to gleam insights into the stickiness and relevance of features before wider, full product launch.

Larger financial institutes haven’t had widespread exposure to new product development practices, where agile customer discovery sessions and design sprints are foundational. To a degree, they haven’t needed to because they’ve had a mass of customers.

Long term, new product development practices will be essential to ensure adherence to the new Duty so that institutes can easily answer questions like:

Has the firm specified the target market of its products and services to the level of granularity necessary?

How has the firm satisfied itself that its products and services are well-designed to meet the needs of consumers in the target market and perform as expected?

What testing has been conducted?

What I’d do to help drive change💡 💡 💡

Driving process change, which is what this is, is challenging. The easiest place to start is not by forcing change on an existing product or team but by implementing it in a new project or product idea. Assuming that was possible, I’d:

Establish a clear Product brief including problem statement, objectives and outline the assumed demographic and success criteria

Perform a round of discovery (quantitative and qualitative research) on the target demographic to validate assumptions and gather any additional problem areas

Design a solution with wireframes and walk through the solution with a select few of the demographic

Make any solution changes based on feedback and build an MVP

Launch MVP with the select demographic, gather feedback and implement it back into the product

Take the learnings from the Discovery, Design, Build, Launch, Iterate process, document a clear process and look to implement in an existing team

Customer Journeys 🛣

This is referenced in many areas of the new Duty and will impact traditional FS and fintechs. From keeping customers engaged in the customer journey to ensuring customers have the right information at the right time to make decisions. Customer journey improvements are vital to adhering to the new rules and understanding customer behaviours and happiness.

One of the referenced improvement points for consumers is reducing ‘sludge practices’. These are the intentional friction points in journeys that prevent or discourage customers from switching providers or raising complaints. Using this specific point, improving the customer journey is not enough. The critical points in the journey also need to be mapped out with relevant analytics tracked to continually monitor the journey for different customer segments.

This means big changes for many financial services firms, especially those who need to clearly map out customer journeys.

What I’d do to help drive change 💡 💡 💡

A lot easier to drive change here with tooling and some supporting processes:

Map out the customer journeys in a process mapping tool

Define a metrics hierarchy for products and benchmarks for churn, conversion etc

Review and implement a relevant metric tracking tool like Mixpanel or Amplitude

Connect the metric tracking tool to the journeys to create a view of all journeys and metrics

Create a review and issue-raising process linked to specific points in the journey, such as the cancellation journey

Create higher standards and benchmarks for dropoff for areas of high potential ‘sludge’ like the cancellation process, product switching and complaints

Customer Support Model 🏋🏽♀️

Support is another area referenced frequently throughout the policy. While most FS firms have a responsibility to provide adequate support, the policy outlines additional requirements, including that the level of service is consistent regardless of channel, firms verify that the quality of any post-sale support is as good as the pre-sale support, and customer support is meeting customers’ needs with characteristics of vulnerability.

Although many implement customer support measures like NPS, Customer Satisfaction (CSAT), average response time and first response resolution rate, the additional rules and outcomes go above and beyond what many firms do today.

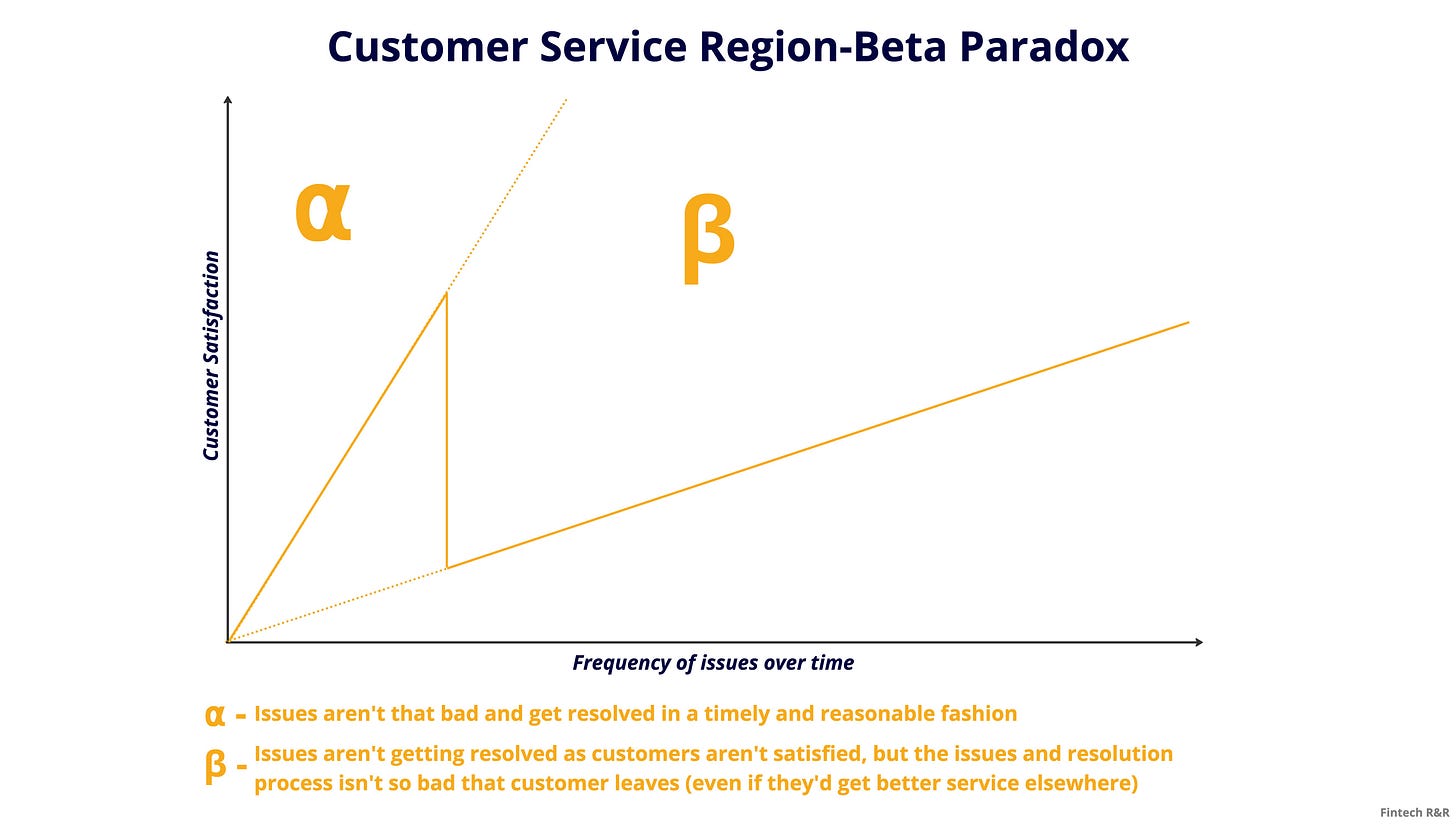

Traditional FS firms have, in relation to customer support and service, also been beneficiaries of a phenomenon called the Region-Beta Paradox.

The Region-Beta Paradox is a phenomenon whereby a person will remain in a state of mild discomfort and act only when the state changes to one of intense discomfort.

So we often endure things that are “not-so-bad,” but this stops us from flourishing into truly good situations. The paradox is that when situations are sort-of bad, we’d actually be better off if they were worse! Because then we’d do something about it.

This applies to customer support and service. Because if a product or customer service is bad, it’s often just bearable enough to stay with the provider. But we’d be better off if it was terrible, then we’d switch to a better provider.

There won’t be wholesale change here as many of the existing support processes are adequate. Still, lot’s more measures will be put in place to track customer happiness, segmentation of customer profiles and support approaches will have to be implemented. Many will have to up the level of their post-sales support.

What I’d do to help drive change💡 💡 💡

Implement metrics tracking processes and tools for customer support channels (including social media support channels)

Provide storage for customer feedback organised and accessible over time

Map out clear customer feedback loops at post-support and ongoing feedback level. The feedback gathered would inform support adequacy and product improvements

Review and refine all support communications’ scripts’ and procedures to ensure they’re fit for purpose and suitable for vulnerable consumers and a diversity of customer personas

Data & Customer Segmentation 💽

A key part of the Duty is that firms assess, test, understand and evidence the outcomes their customers receive. With this, it will be possible for firms to know they are meeting the requirements set out in the Consumer Duty.

A prerequisite is to have the data to assess, test and understand. Only then can they know if they’re meeting the Consumer Duty requirements.

The FCA lists the type of data firms should be monitoring to assess adherence to Consumer Duty, including:

Analysis of customer retention records

Products/pricing and fees and charges

Behavioural insights like customer interactions and drop-off rates

Training and competence records

Customer feedback

Number of complaints & their trends

Results of the regular testing

Staff feedback

Compliance reports

Many will discuss their data strategy and how they’ve nailed it, but I know most don’t. Even if they have all this data, it has to be easily accessible, understood and mapped out into respective outcome areas and across customer journeys then segmented by customer.

What I’d do to help drive change💡 💡 💡

Identify all key data points for each product as well as the required data points for consumer duty

Implement tracking via code or DB for any data points not captured

Establish a centralised access method for all these data points and key groupings (like product, customer segment, service type)

Create a regular data and performance reporting process for each of the product leads

Review the data and establish a baseline for each data point and across the different product sets

Establish a strategy for improving the data points that are below par and below baseline over time

Outro

Everything I’ve outlined is going to hopefully bring huge industry change, and the Duty has clear benefits for consumers if things go well like:

Clearer pricing and costs for customers taking out financial products

More transparent overall costs for things like overdrafts, interest on savings etc

A more robust and effective customer support process

Fewer frictions when switching current accounts, mortgages, personal and business finance providers

Better scam detection

Provide timely and transparent information that people can understand about products and services so consumers can make good financial decisions, rather than burying essential information in lengthy terms and conditions that few have the time to read

Improve customer support processes and reduce unnecessary ‘sludge’ in customer journeys

This is one of the most exciting and revolutionary policies ever created by financial regulators. It sounds a bit hyperbolic, but it’s true, especially concerning customer experience and product and service development. It will force wide-scale change in how products are built at 1000s of institutions and, in the long term, create better customer outcomes and hopefully be a lightning rod for internal change and product development principles.

It could also be the great equaliser between big traditional banking and finance organisations and the fintech revolution. You can quote me on that.

The clock is ticking for any digital organisation that hasn’t yet reviewed its requirements. But hopefully, they use this as an opportunity to drive massive internal change, not just as a checkbox exercise 👀 🚀

If any banks want a bit of advice, my DMs are open 😉

Favourite bits of news

How Ramp builds products - VP of Product at Business Fintech Ramp spoke to seasoned Product Expert

about how they build products. This is a must-read and something I’m considering doing (speaking to founders and product folks at prominent fintechs about their ideation, prioritisation, build and growth processes).Starling CEO Steps down - Anne Boden MBE steps down after 9 years at the helm and has managed to do something very few founders have done. Create a clear, loveable challenger banking proposition and get it to profitability.

Monzo turns a profit - Maybe I spoke too soon with that last comment. But as always, when Starling is mentioned, Monzo isn’t far behind. And vice versa. They’ve managed two consecutive months (Jan ’23 and Feb’ 23) of profitability off the back of lending interest income. Now they have to keep it up.