Fintech R&R ☕️🇮🇳- India's Digital Payments Locomotive

How India's UPI emerged as the biggest digital payment platform, it's eyes on solving the $100B remittance challenge and India's potential as the Fintech hub of the future

Hey Fintechers and Fintech newbies 👋🏽

The US Federal Reserve’s instant payments platform, FedNow, went live last week with around 35 banks and credit unions. It’ll make instant payments much more widespread in the US using the Fed’s network, which includes the US’s circa 4000 community banks, offering instant payment and settlement. That could mean the end of that dreaded two-day wait for an important payment. You know the ones. Your friend sends you the £200 they owe you, and you check your balance every hour to see when it comes in so you can pay an important bill. It used to be a nightmare, especially over weekends. We’ve all been there. One of those “I’ve sent it, but it might not come through till Monday” payments.

FedNow isn’t the only instant payment platform on the block. Real-Time Payments (RTP) is a US instant payments system that has been around since 2017, so instant payments aren’t new in the US, and we’ve had FasterPayments (FPS) here in the UK since 2011. But the hope is that FedNow’s access to more banks and wider consumer reach means solving several time-based cashflow problems for consumers and businesses. Including fast access to wages, merchants paid faster and more control over personal finances.

NOTE: Instant payments (FedNow, RTP, FPS) is a topic for a future Under the Hood edition.

While the FedNow news is interesting, it isn't the most exciting recent news, just the loudest. It could be because when Americans, especially the government or Fed, announce something, we all sit up and pay attention. Maybe it's because they do things a bit bigger in the States. Perhaps it's just a bit of Western bias.

It is still the world's largest economy, so that's another reason that news from the States is usually widely reported. It is being chased down, though.

One of the chasers gaining traction and projected to overtake the US by 2075 is India, and it's Indias under the radar UPI announcements that piqued my interest this week.

Unified Payments Interface (UPI) is India's mobile-first instant payments system that allows customers to make interbank peer-to-peer and peer-to-merchant payments using a virtual payment address, transforming digital payments nationwide.

It's also expanded beyond its borders to the Middle East, Sri Lanka, parts of Asia and now France with its recent announcements.

Looking at its increasing usage numbers and growing international traction, I see the potential for a global player in the international payments sphere, and this is just one area of fintech India is making waves. There are also a lot of similarities and an interesting comparison to be made with Open Banking payments in the UK, which has largely been successful in account data and aggregation rather than account-to-account payments.

So this edition, as well as interesting news, puns, + movie references, of course, includes the following:

History of UPI

How it works

Benefits of UPI for Indian citizens, locally and internationally

The improvements needed for scale

UPI vs Open Banking

Why I’m bullish on Indian Fintech

The Evolution of India’s Digital Locomotive 🚞

UPI was officially launched on April 11, 2016, and was developed and launched by the National Payments Corporation of India (NPCI) to promote cashless transactions, enhance financial inclusion, and simplify the payment process. Since its launch, it has transformed how Indians conduct peer-to-peer and merchant transactions enabling seamless and instant money transfers between banks through mobile devices.

To explain the whole story, how it works, and how UPI came to be, we first need to head back to what now seems like a much simpler time, 2008…

A Brief History of UPI

2008: Creation of the NPCI

The origins of UPI began with the NPCI. The National Payments Corporation of India was founded in 2008 as an umbrella organisation for all retail payment systems in India, tasked with creating a robust and efficient payment & settlement infrastructure. The organisation was an initiative of the Reserve Bank of India (more on them later) and the Indian Banks' Association (IBA), run and owned by a consortium of banks.

It had two main objectives:

Consolidate and integrate the multiple retail payment systems in India

Build new payment systems that all citizens can use, regardless of location or income level

2010: IMPS Launch

In 2010 the NPCI introduced the Immediate Payment Service (IMPS), which allowed customers to transfer funds immediately through internet or mobile banking. IMPS was a significant step towards real-time money transfers in India and provided an instant, 24x7x365 interbank electronic fund transfer service, which was previously absent from the region. An important foundational step towards a society built around digital payments.

2012: RBIs Vision for Payment Systems

The Reserve Bank of India (RBI) is the equivalent of the Bank of England, FCA, and Royal Mint rolled into a single entity. It's India's central bank, it outlines regulation, spearheads overarching initiatives (like setting up the NPCI), and controls the printing of money, so it literally plays a central role.

In 2012, in its "Payment Systems Vision 2012-15" document, the RBI articulated its vision for efficient, accessible, and secure payment systems, urging the development of interoperable mobile payment systems.

NOTE: It now has a 2025 payments vision that is an interesting read and a handy acronym finder.

Front and centre of the document was its vision statement:

“To proactively encourage electronic payment systems for ushering in a less-cash society in India and to ensure payment and settlement systems in the country are safe, efficient, interoperable, authorised, accessible, inclusive and compliant with international standards.”

Several focus areas were highlighted in the full document, but the two relevant ones for our purposes were

Innovation and new product developments

Move towards a less-cash society

Although IMPS was a huge step forward, it required users to enter multiple details for each transaction. It was clear to many, especially those who put the document together, that there was a need for a more straightforward and user-friendly payment system that would enable transactions with just a few clicks.

2012-13: UPI Conceptualisation

The idea of UPI was conceived in 2012 when a group of bankers and industry experts came together to discuss the need for a payment system that would allow people to make seamless money transfers using a single identifier, such as a virtual payment address, eliminating the need for bank account details and Indian Financial System Code (IFSC). This group was headed by Nandan Nilekani, the former CEO of Infosys and the chairman of the Unique Identification Authority of India (UIDAI), which developed Aadhaar, the world's most extensive biometric identification system.

A deep dive into Aadhaar, India's citizen's ID card, and its uses in fintech is a topic for another day.

2016: UPI is born

Based on the RBI's reports and work done by Nandan to help develop the technology and get banks on board, UPI was developed by the NPCI, released in 2015 and launched to the public in 2016.

It provided a single, standardised platform for instant and seamless money transfers enabling easy transactions for urban and rural populations. It allows users to link their bank accounts to a UPI-enabled mobile application. This app acts as a virtual ID, allowing users to send and receive money directly from one bank account to another without needing account details such as account number and IFSC code (sort code).

How does it work? 🛠

For users, setup is straightforward.

First, users must ensure they have a smartphone and a bank account with a UPI-member bank (of which there are over 400 across the globe). They also need to ensure the mobile number they use is registered with that same bank.

The next step is to download a UPI-supported app. In terms of popularity, they are BHIM (built by the NCIP), GooglePay, Paytm, PhonePe anD MobiKwik.

For most of the apps, the process is then very similar.

Users first select a language (because UPI is international)

They then verify their mobile number via OTP (which is why the mobile number must be registered with the bank that will be used to power payments)

The app usually prompts them to create an app passcode (passcode required as a gateway to enter the app each time)

A list of available banks will appear, and the user will select the relevant bank they want to enable UPI Payments for

They will then set a UPI PIN (this is the unique PIN required to authorise payments). This involves entering specific details of the account (like the last four digits of the card associated with the card and the expiry). It'll trigger an OTP, which is then entered to verify that the individual is indeed the account holder, and the user will be prompted to create a UPI PIN for that account.

Once the UPI PIN is created, the app will create a UPI ID which differs depending on the app. For BHIM, it'll be a number followed by @UPI. E.g. 8182917292@upi. This is also known as the Virtual Payment Address (VPA), and it's used to send and request payments and abstracts from your bank account. The complete list of handles across all UPI apps is here.

That’s it.

Once set up, users can pay friends, family and others using their mobile number or VPA. They can request payments which recipients can approve in-app, and they can pay merchants using in-app QR code scanners or pay bills. All through the UPI layer, using the underlying IMPS for real-time interbank payment transfer circumventing the traditional Visa, MasterCard and Amex rails (detailed in the last edition of Fintech R&R).

Loosely speaking, this is how the tech works.

1️⃣ User Layer

This is the user interface (mobile or web app) and is where all the steps above occur, and payment initiation happens. It's also where the VPA is created and most user-side security occurs.

2️⃣ Middleware Layer

Here's where the majority of the heavy lifting happens. This is the layer between the User Layer and the Banking Backend layer. Here's where things like VPA validation happen (if you're sending money to an address, it's verified first), and the security and payment push/pull messaging occurs, routing messages to the relevant bank. We can say that NPCI +UPI is the middleware layer and does the mapping and routing of requests to and from the banking layer. Hence Middleware.

3️⃣ Banking Backend Layer

The banking layer will check balances, perform transaction compliance, authenticate the user request, action the request using the relevant payment rails, commonly IMPS, and send the confirmation back up the stack.

Key Additional Info

Fund transfer limits: Daily transfer of Rs.1 lakh (1,00,000 rupees or around £1,000). For merchants it’s around 5 lakhs. These vary bank to bank

User Requirements: Must have a phone registered with a UPI-Supported bank

Who can register: Indian citizens with bank accounts or Non-Resident Indians (NRIs) from Singapore, Australia, Canada, Hong Kong, Oman, Qatar, the US, Saudi Arabia, United Arab Emirates, and the United Kingdom. And soon, tourists to France will also be able to use UPI to make payments starting out with Eiffel Tower tickets and merchandise.

Payments is an acronym-heavy game. I count about 14 acronyms until this point, which must be some personal record. Unfortunately, I didn't have time to come up with a jazzy diagram to show the end-to-end process, which might have made it simpler to see the inner workings of the technology, but something else that I find really helps explain a technology is outlining its benefits.

The UP(I)SIDEs ✅

Abstraction & Security

A layer of abstraction between the user, recipient/merchant and the underlying bank account + card provides a clear benefit for the account holder, allowing them to share a VPA to send and receive payments rather than using their card or account details where funds are held. Having a smartphone also means additional security before getting into the app using phone security, verification during onboarding and transaction-level security. It ticks all boxes of multi-factor authentication.

💳 Something you have: The card details of your connected bank account during onboarding

👀 Something you are: Biometrics used by the smartphone that acts as the gatekeeper preventing bad actors from getting into the app

🔢 Something you know: The UPI PIN created when connecting each bank account and used for transaction security

Convenience

UPI gives apps like BHIM, Paytm, GooglePay and PhonePe the ability to house multiple bank account connections giving the convenience of managing payments to and from multiple banks in a single secure app (or across multiple apps if the customer wishes to have separate apps for differing purposes).

Transaction fees for customers and merchants

Because UPI uses interbank transfers via the IMPS rails, customers avoid any fees incurred on certain debit cards. Small merchants also benefit by avoiding Merchant Discount Rates on low-value transactions (<2,000 INR), meaning they keep more of the total value of goods or services sold.

Room for Improvement 🧠

This isn’t a utopian payment system and there are still a few areas of improvement needed to really make this an inclusive and dependable long-term payments solution for Indians, and potentially non-indians. Here are some areas where UPI needs to improve

The need for smartphones 📱

There is a glaring barrier to entry with UPI for nationals, and it's the need for a smartphone. Most folks with smartphones wouldn't think about this twice, but it won't surprise you to hear that adult smartphone penetration is not at 100% in India or anywhere else, for that matter. As of 2022, less than 50% of the population of India had smartphones compared to 68.4% of China (comparable in terms of population). This is an area where India needs to improve to ensure widespread inclusion, which is one of the fundamental tenets of its payments vision.

Treasury to make FX more competitive 💸

The growing use of UPI outside India and at non-local merchants means growth of cross-border transactions and factoring in FX. When the UPI is live in France, everytime a citizen buys a croissant from the Eiffel tower (has to be done), it still uses the underlying bank-to-bank transfer and Rupees are converted into local Euros. Traditional card networks like Visa, Mastercard and Amex have processes in place to deal with the nuance of fluctuating foreign exchange rates and they’ll ‘markup’ cross-border transactions. They also have treasury functions with banks that provide quotes for foreign exchange transitions and manage volatility across different currencies.

A dedicated treasury function and cross-border transaction markup are currently lacking but things that the NPCI will have to implement to make transacting abroad scalable.

Internet connection required 🤳🏽

Another prerequisite for onboarding and payments through UPI aside from the smartphone itself is network connectivity.

While 4G coverage in the region is good–the best operator Jio has 98.8% coverage across the country– that doesn't translate directly to speed. Until 5G is rolled out and all networks have high range and speed, it's still a small hurdle for UPI to cross. Although NPCI did launch UPI LITE in Sep 2022 to allow for low-value transactions to still occur without needing an internet connection or PIN, similar to the low-value transactions of Contactless payments in the UK.

A Sidebar on the term Rails 🛤

Before jumping into some usage numbers of UPI to bring things into perspective, I want to drop a quick word on the term rails and make a reference to my early days as a kid in the Midlands.

It's a term I and many others use, especially about payments. But why?

Payment rails are the technical infrastructure that transports money from one entity to another, whether a person or a business. Different rails can transport various cargo with differing levels of security, complexity and size.

As with physical train rails, payment rails also vary in how fast they can send cargo, how secure it is and how much load can be carried. The rails in Japan take bullet trains across the country at 200mph, for example, whereas the rails in the UK aren't capable of getting up to those speeds securely. The same limitations apply to payment rails, and in the case of FedNow and India's Immediate Payments System, they decided it's better and faster to build new rails for their use case rather than try and improve the old ones.

The term rails is also used when referencing other data transport via an API or other message transportation infrastructure.

While we're on the subject of India and Rails, I have to do a little shout-out to a song that was a mainstay of the later part of my childhood and one that played at pretty much every Indian wedding around the UK in the late 90s/Early 2000s. It's called Saddi Rail Gaddi Aayi, meaning Our Train Car has come. Imagine a conga-style line of people with arms on the shoulders of the person in front while bopping around with the train getting longer and longer as the song goes…Hopefully, that's a bit of nostalgia for some folks reading this 🙂

Statistics speak ek hazār (a thousand) words 📊

For folks who have heard very little about UPI and even for some who have heard about it, it might be opaque as to the impact and usage of it across the country and beyond. So here are some stats and graphs to bring the technology to light.

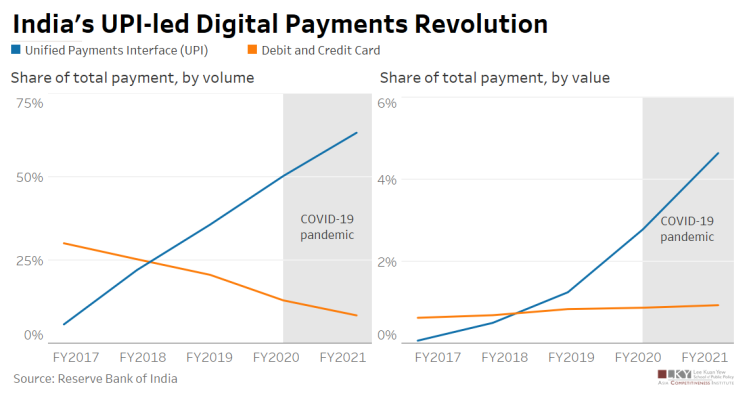

In Jun-23, UPI processed 9,335,000,000 transactions with a value of over 147 trillion rupees, and it has grown steadily since its launch with covid accelerating adoption.

Even more impressive when you compare that to the UK's Faster Payments growth.

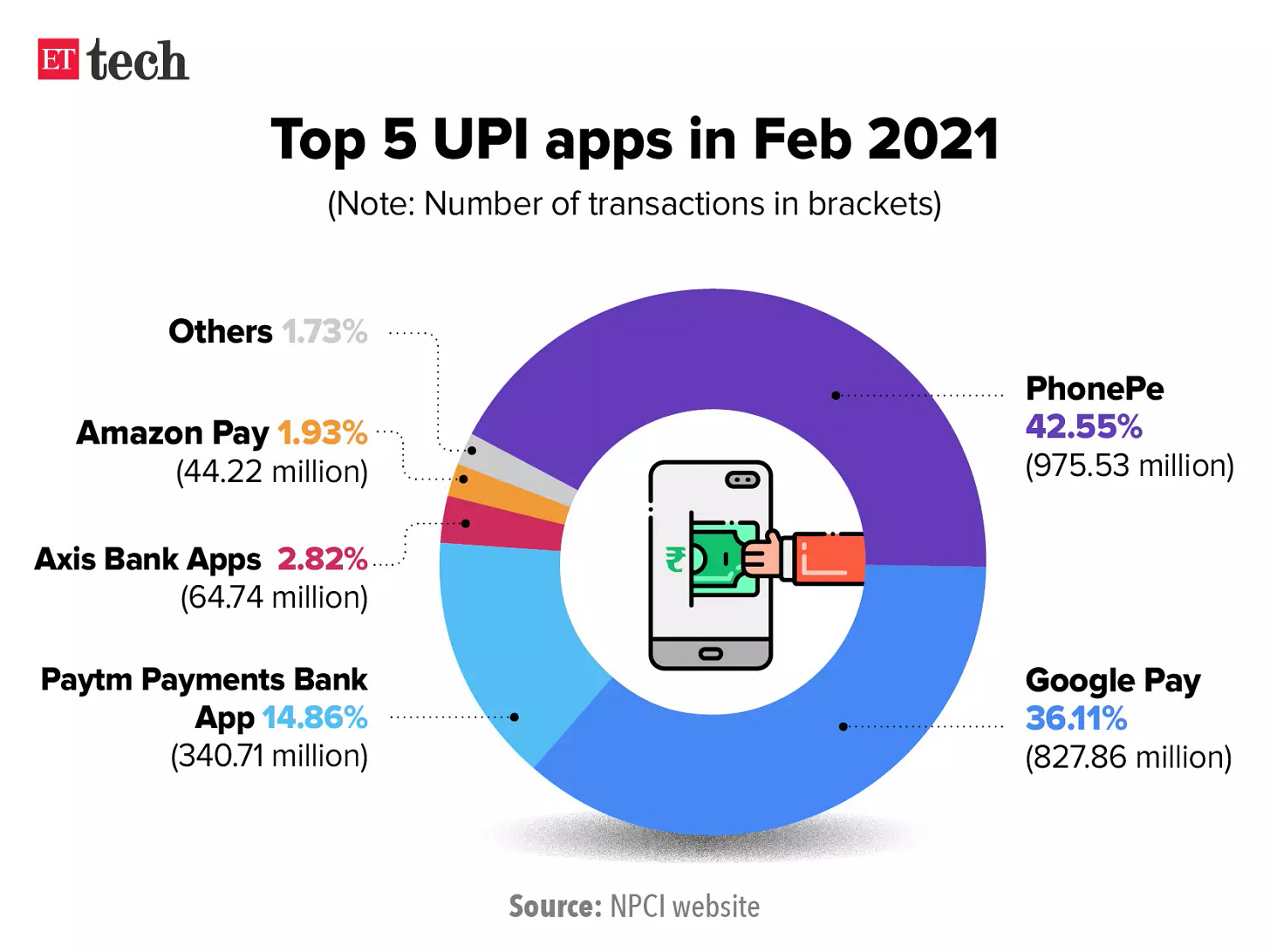

A handful of apps provide the gateway for users into UPI payments

UPI payments have significantly overtaken Debit and Credit Card transactions in volume and value

Although this is a 2020 chart, India still leads the world in Real-time payments

UPI v Open Banking 👥

There are many comparisons between UPI and Open Banking, the UK's open API for bank transaction data and interbank payment initiation.

Both came out of broader initiatives from governing bodies with ambitions of creating a more integrated payments landscape.

Both use underlying instant payment rails to power interbank transfers (Faster Payments v IMPS).

Both had live working products around the same time (2016-2017).

Both have overarching entities with a long-term roadmap and drive innovation on the platform OBIE/CMA9 v NPCI/RBI (there I go again, adding more acronyms).

And both use APIs to allow third parties to build interfaces for customers.

So why is it that in 2022 there were 68.2 million Open Banking payments made in the UK while at the same time, India had 74 billion? Adjusting for population, is India 50 times better than the UK at creating a high-adoption payments platform?

It's not that simple, and they are slightly different.

Open Banking payments were intended to be something other than a central payment interface. More like a layer for people to build tools on top of, but the downside is that no one app becomes the lightning-rod of consumer understanding that leads to the widespread adoption of Open Banking payments.

Another reason is that, unlike UPI, Open Banking wasn't ideated and driven by the Bank of England, and Open Banking doesn't have its own native app.

I do also think, to a lesser degree, OB (oh, yet another acronym) suffers from a bit of a marketing problem in that consumers and merchants aren't aware of the payment option as much as they are aware of Stripe, WorldPay or even Klarna. Anecdotally, many of my friends aren't aware of what an Open Banking payment is or how to make one.

I know this feels like I'm dropping teaser trailers for future editions than editions themselves, BUT there will be an edition dedicated to the Open Banking payments landscape and a deeper dive into the next steps 👀. I'd be doing it and UPI a disservice if I did that here.

Why I’m incredibly bullish (pun intended) on Indian Fintech 🐂

Yes, I made a 'cattle are sacred' reference in the title. It wasn't in poor taste, and it fits pretty well with the theme of the closing section, so I stuck by it.

If we look at UPI, there's much to be optimistic about.

Deals, Deals, Deals: Narendra Modi, the Indian PM, has clearly been reading Donald Trump's famous book, The Art of the Deal, because not only has he struck a deal with the French so merchants accept UPI as a payment method, he also struck a deal with Sri Lankan President Ranil Wickremesinghe last week to set up UPI in the country and create a land bridge from the island to mainland India as part of its economic recovery.

World Domination: In February, the Reserve Bank of India announced a plan for "a facility to enable all inbound travellers visiting India to make local payments using Unified Payments Interface (UPI) while they are in India.". As mentioned earlier, a treasury facility is needed to make this scalable, but promoting the technology to tourists is a great way to scale beyond the limits of its population and could uncover more use cases.

Pay w/Biometrics: The UPI technology, as it stands, is not too far away from Biometric payments. Biometrics are already captured as part of the Aadhaar Card (ID Card) onboarding, and it's a manageable leap to get payers to face a camera to scan their face to initiate a payment rather than getting them to scan a QR card.

Zooming out and looking at India as a whole, there's much to be excited about regarding innovation and solutions for problems. Part of UPIs development was to unify payments and increase digital adoption, but in doing so, it has also created a solution for remittances. For those who aren't aware, a remittance is where any citizen is living and working in another country and sends a portion of their earnings back home, usually to support families. Although remittances are commonplace across Asia and Africa, the biggest receiver of remittance payments from foreign countries is….you guessed it….India, which received $100 Billion in remittances in 2022. This is just one issue that occurs in countries like India, Mexico and China but not in Europe and the US.

There are many challenges and problems that await digital solutions that are unique to India. And I don't mean that in a disparaging way. It's because India isn't just one country with 1.4 billion people who share the same ideology, values and culture. It's cohesive but very diverse, with each state and even areas within those states completely different. You only have to look at the food and culture in the north (where my parents hail from) and compare them to that of the south with its fresh fish and lighter dosas compared with Punjab stuffed parathas and Samosas.

It has a larger Muslim population than Iran, Iraq, Saudi Arabia and the UAE combined at 195,000,000 people.

Language is also diverse. India has 22 official major languages. Not dialects. Languages.

And with all this diversity in culture, ways of working, and living comes unique challenges and, therefore, the opportunity to provide solutions.

That's why I think India will be one of the sources of innovative fintechs over the next 5-10 years and a great place for product professionals to hone their craft, help build great products and contribute to one of the significant focus areas in the RBIs vision. Innovation and New Product Developments.

Indian Fintech Zindabad (Long Live Indian Fintech) 💪🏽🇮🇳

Interesting Fintech News

FCA Implement Permanent Sandbox - They announced their permanent sandbox last week, and frankly, it's long overdue. Applicants to the sandbox can expect to be approved within 4 weeks of application, and they'll have access to over 200 datasets, 1000s of APIs and a community of other innovators. Hopefully, over time they'll add a curated list of fintech ecosystem partners that can help these innovators with things like marketing, operations, sales etc.

Bloom Money Raises £1M to digitise ROSCA - The UK fintech raised funds to digitise a traditionally cash-based community-focused savings group where members save collectively and keep each other accountable to reach financial goals via Bloom Circles. The app also has learning features to give new arrivals to the UK help and advice on things such as credit scores and the citizenship process.

i'm going for pratas, bon weekend mate