Fintech R&R☕️⚠️- Navigating the Transitions is How Fintechs Win

A Monzo news double header, the reality of what a fintech product journey looks like, and why the transitions between stages is where the true test lies for fintechs

Hey Fintechers and Fintech newbies 👋🏽

Has Monzo's rise to fintech stardom been all plain sailing?

Is Capital G the most interesting name for an investment fund ever?

What do Rocky Balboa and Monzo have in common?

What's more challenging, designing a fintech product or moving from post-launch into growth?

These questions and more will be answered in this week's edition of Fintech R&R

P.S. The last edition of the year in two weeks will have an interactive element which I'm sure you'll all enjoy and is a fun little thank you to those of you who’ve recently subscribed, those of who you quietly enjoy these editions, the folks that send me comments every week and everyone else in between!

So don’t forget to share this with your friends and colleagues before the next edition because you will want to compare scores. It also helps grow the newsletter and make the weekend and evening efforts worth it 😊

Now let’s get into it 💪🏽

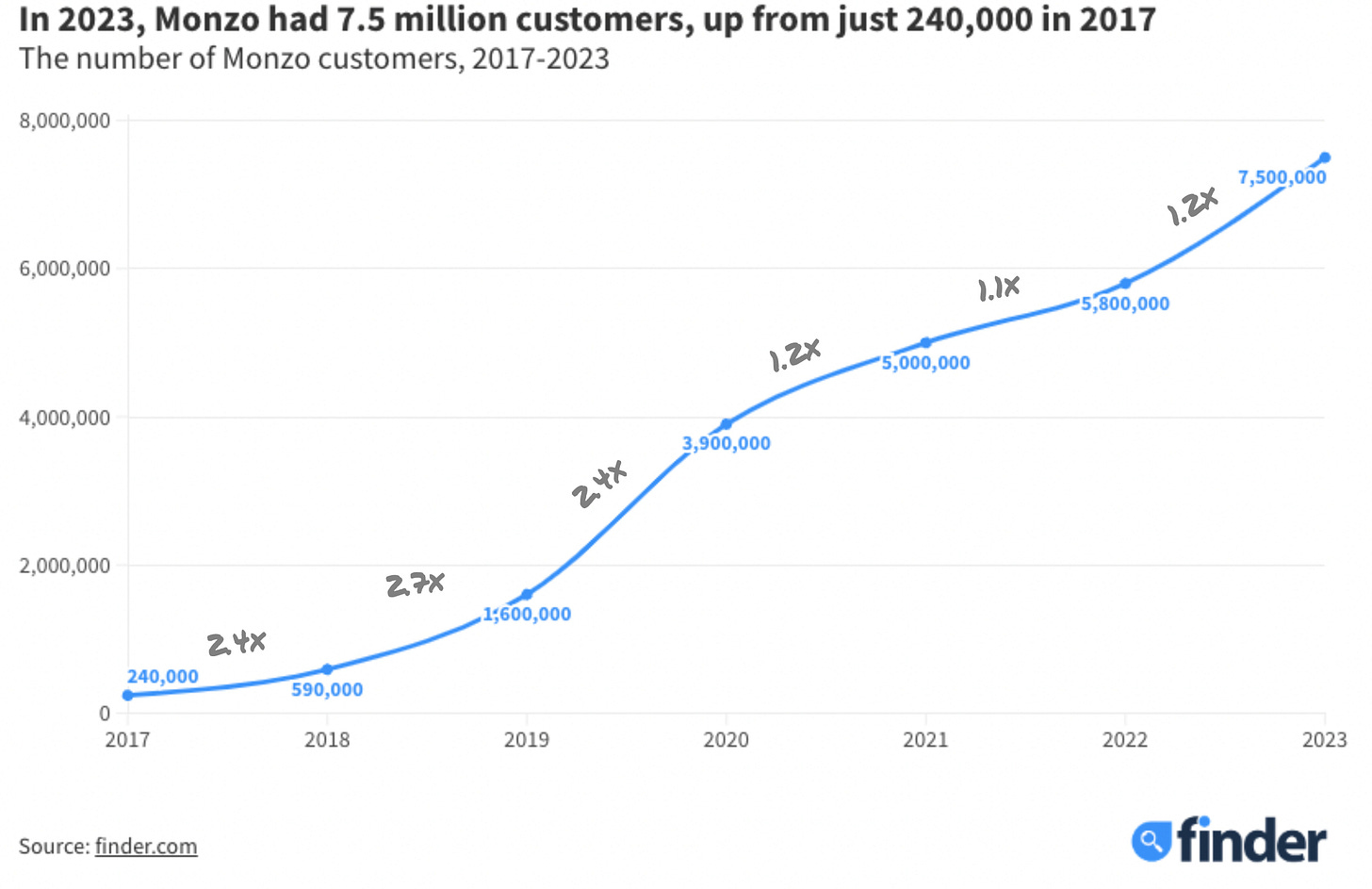

Rumours circulated recently of a potential investment by Capital G, Google's parent company investment vehicle, into Monzo Bank.

Let's get one of the above questions answered early. I think Capital G is one of the best, if not the best, names for an investment fund ever, so the creative team should take a bow. If anyone has a better example of a fun, on-brand name, then answers on a digital postcard AKA the comments section.

Back to the rumours.

This rumour that Capital G, a growth fund that has previously invested in the likes of Stripe & AirBnB, wants a piece of London fintech's poster child came out a couple of weeks ago. With 'rumours' like this, I always say there's no smoke without fire, especially when the specific investment range of "between £300-500m" is verified by multiple sources.

This investment, which sources say they are hoping to conclude before the end of the year, could signal a much-anticipated shifting of the tide of the recent fundraising slowdown and trimmed-down valuations.

The proposed investment and bumper £4 billion valuation wasn't the only significant Monzo news to drop in the past fortnight.

Co-founder and former Monzo CTO Jonas Templestein announced he was leaving after nine years at the beloved fintech and sent a letter to employees, which he also made public, talking about the journey and his optimism for Monzo's future. He is now the last of the five original founders to leave after Tom Blomfield, founder and former CEO, left in 2021. Tom also documented and published his thoughts about the journey in his blog, which is a brilliant read for any fintech enthusiast.

This double-header of Monzo news and a few conversations I've had recently about interim Product Leadership roles at fintechs led me to this week's topic, which is about the difficulty of navigating the transitions between stages.

I've spoken about the product development lifecycle before, particularly scaling, but what's apparent at a micro level (e.g. moving from MVP launch mode to growth) and at a macro level (e.g. a company like Monzo going MoM profitability to super scale) is that navigating the transitions is one the critical bits that successful organisations get right and unsuccessful ones get wrong.

Whether that's identifying and executing a changing of the guard with previous founders moving on and getting a 'seasoned' c-suite team in, refactoring the core flow of the product, doubling down on revenue-generating products and feature sets, or just moving from growth to scale, understanding the challenges and managing the transition is key because the path from A to B is not a straight line and is fraught with obstacles that require experienced navigators.

So as well as interesting news, puns, and movie references, in this penultimate edition of the year I’ll dive into the following:

Some of Monzo’s difficulties over the years

Interesting insights from Jonas's leaving letter (and some from Tom’s)

The difficult transitions fintech startups face

People as the most important thread to navigate difficult times

What’s the deal with Monzo?

Let's start with what the Capital G deal, or rumours of a deal, signal for Monzo.

This will be the formal kick-starter for their IPO. They've made no secret about their 'going public' endgame, and it'll make it easier to access capital in the long term after experiencing a tricky time to raise capital. It probably won't happen in 2024, though, so existing Monzo shareholders will have to wait a bit longer to cash out. As CEO TS Anil said to Reuters in May, Monzo is "some ways down the road" from reaching its ambition of going public.

Going public is one of Monzo's long-term plans and something that Capital G will certainly have in mind. It's nothing new, but it's good for context.

N.B. There has been talk of Monzo listing somewhere other than London. I'm sure other early adopters will also agree that Monzo listing on NYSE instead of LSE just wouldn't feel right.

The short-term plan for the investment is more likely to supercharge international expansion, especially in the U.S. Here's another TS Anil quote to cement the point:

"It's clear to me that the American customer needs a product like Monzo. That's a huge gap – it's a market that's very large with attractive economics," he said. "And it's one of the few markets in the world… where you don't need share to get scale."

The recent appointment of Conor Walsh, former Head of Global Product at CashApp, as US CEO to lead product, strategy and growth in the U.S. is another clear sign of intent.

This, along with Capital G's track record of growing fintechs in the U.S., completes the big signals that they'll be accelerating their growth plans and building on the tens of thousands of customers they've acquired after coming out of closed beta and going into full public launch last year.

There's no guarantee of Monzo's success in the U.S. (a bit of a tongue twister).

Because, for me, it's the spaces in between the different phases that determine success.

Managing those transitions between build & launch, launch & growth, growth & scale, scale & expansion, expansion & IPO or post-IPO & maturity is what separates the hundreds of thousands of companies you've never heard of from the very few 'Uber' successful ones.

It's in those spaces where uncertainty, challenge, and bumps in the road exist that can cause friction, internal frustration, delays, increased costs, runway burn, and ultimately lead to the downfall of a startup or project.

Some companies navigate this by doing everything in their power to avoid those big bumps in the road.

Some make sure they are equipped with the best team and structure to

manoeuvre themselves when they do hit those bumps.

The successful ones have a healthy mix of both.

What I can say for Monzo US's transition from post-launch into pre-growth is that they are equipping themselves to avoid any big bumps by hiring an experienced and dedicated U.S. operator in Conor Walsh, and by potentially having Capital G's experience and success growing and scaling fintechs in the U.S. on their side. They have also already done some manoeuvring with the withdrawal of their application for a full-banking licence when they got hints the application would likely not be approved, decided to continue operating under Sutton Bank's licence and refocus efforts on the U.K. in 2021.

There are many experiences Monzo OG has faced that, if absorbed, can be used by the U.S. team as experiences of maneuvering tricky bumps in the road between phases.

So before jumping into some of the common stumbling blocks while transitioning between specific phases, I'm going to talk about a few of the issues Monzo encountered in its journey and, where possible, use direct extracts from Jonans's recent letter and Tom's blog.

Some Bumps in Monzo’s Road to Success

Mondo Me 💳

Many Monzonauts (a term loosely used to define early adopters of the challenger and to describe early employees) will know that it started life as Mondo and then changed to Monzo in 2016. But the motivation for the change wasn't creative; it was to avoid a lawsuit. As Tom says about the name change:

"We had been threatened with a trademark lawsuit from a German fintech company which had a similar brand name (we were "Mondo" at the time) and considerably more funding than us. I fought this for several months (against the counsel of my board and investors), before accepting we had to change our name."

They eventually requested some ideas from the user community, of which only 6 out of 12,000 suggested 'Monzo', which was the name they settled on.

Isn't a big deal, right? But as he said himself, he fought it for several months, and it could have gone for longer, impacting card designs, website domains, in-app changes and more of the pre-launch efforts. Fortunately, he accepted the change, which is not easy to do as many founders who spent weeks thinking of a name, purchasing the domain and building a marketing campaign around it would have experienced.

Hiring for success 🫱🏽🫲🏼

Another fascinating insight from Tom's blog is some of the hiring pains experienced early on in the Monzo journey. In the summer of 2015, pre-alpha and beta launch, Monzo started the search for a Head of Marketing. After interviewing 10-15 candidates and hiring someone with decades of experience at a big tech firm, Tom says this about the process and the hire:

“Although the hiring process was slow and frustrating, we learned a lot…Looking back on my notes, all our conversations were about picking the right agency to run PR and another agency to run our paid social campaigns. She was used to running teams that were bigger than the entire headcount of the company at the time. I think she lasted less than 4 months.

“…At the same time, we interviewed and hired a young guy called Tristan as a community manager - he was in his early twenties, he’d graduated in Economics and spent the previous year in Egypt working with a local startup, where he’d picked up Arabic. He’d taught himself web development as a young teenager, and seemed to be extremely hands-on and impact-focussed…Tristan was perfect for us because he was representative of our customer base.”

“For the first 12 months, what we really wanted was someone to write blog posts, respond to social media and edit the copy for our app and website.”

“We made another Head of Marketing hire later in 2016 who also didn’t work out, and from that point onwards Tristan was put in charge of all marketing at Monzo.”

What does this long excerpt from Tom’s blog mean?

Hiring the wrong person can be one of those bumps in the road that eats into cost and time. Taking too long to hire the right person can eat into opportunity costs. Either way, it's one of those bumps that Monzo hit and fortunately manoeuvred, eventually landing on the right person, but had they not also hired Tristan, maybe they would have stuck with a less-than-ideal marketing head, and the overall marketing would not be what we know and love today.

Issues during the Pandemic 😷

When I call this a 'bump in the road', I'm talking from a Monzo customer growth perspective, as it's not an insignificant event in our personal lives. Some of the issues it faced during the early stages of the pandemic are summarised as part of Jonas's leaving letter.

“I want to especially recognise and thank Sujata and TS. When they joined in 2020, a funding round had just fallen apart due to the pandemic, we were losing a lot of money, hadn’t shipped a successful feature in a long while and were struggling with a series of incidents.”

This is a reflection of a few issues they were facing at the time.

While the funding round was a big setback that would have been difficult for anyone to manoeuvre, the struggles with feature shipping, revenue, and incidents could have been avoided or recovered faster. It seemed at the time like they were in that period in between growth & scale, and the funding round was tied to feature delivery improvements and that focus on lending features. They subsequently raised funds via multiple funding rounds and shipped lending products like Monzo Flex, loans, and overdrafts that have ultimately led to the revenue growth and month-on-month profit they've been looking for that can take them to the next stage in their journey.

Regulatory Hurdles 👮🏼♂️

In financial services and most other industries, regulations are in place to protect consumers, ensure market players are held to account, help guide innovation, and generally create a fair playing field.

But, when you're working to build a product to benefit consumers, regulations can sometimes feel like hurdles that need to be jumped over rather than guardrails in place to protect all participants.

Monzo has not been immune from regulatory concerns.

As Jonas mentions in his leaving letter about 2020, when CFO Sujata and TS Anil joined:

"Regulators were (rightfully!) concerned about our business model."

This was about the freezing of customer accounts linked to suspicions of money laundering. It’s a common process, but the complaints were from customers using Monzo legitimately and complaining that they were locked out of their accounts for weeks at a time.

In 2021, the FCA formally investigated the allegations from customers and took a closer look at Monzo's controls and processes in line with the money laundering regulations.

2021 also saw a separate breach levelled at them by the Competition and Markets Authority (CMA) after Monzo breached the Retail Banking Market Investigation Order between May 2021 and March 2022. The breach was due to Monzo not sending out transaction history to 13,000 offboarded customers as they were required to do so under the order, so customers use that history evidence if they choose to apply for a loan or mortgage elsewhere.

They subsequently sent out transaction history to the 13,000 affected customers and implemented checks and controls to ensure the issue did not occur again.

There's been little talk or publicity of regulatory concerns emanating from the FCA, MonzoHQ or anyone else for a while, which means there are none and 'no news is good news'.

Regardless. They managed to face, handle, and overcome some of those regulatory hurdles, coming out the other side with their reputation largely unaffected. That's no mean feat.

Although on the subject of regulation, what I will say is that any challenger who has managed to build in 4 years what it's taken a big bank 30 years and thousands of employees to build up over time has to be admired, especially if they get even close to the level fraud capture that the 'traditional' banks do.

Creating Smooth Transitions 🥊

What's the relevance of calling out some of the setbacks Monzo faced? This isn't a Monzo deep dive per se, but these are great examples of a fintech facing pretty hefty setbacks during the different stages of their business and, critically, in the transition between different stages.

They're a great example of an organisation that has done well to manage transitions and, in some cases, avoid pitfalls between critical phases of their development but, more importantly, manoeuvre themselves back on track when they face the inevitable bump in the road.

This is where one of my favourite motivational movie scenes comes in.

N.B. I sometimes play this before a long gym session or a big hike to get me in the mood. Volume up for this one!

Because it's not about how hard you hit (with how good your product is). It's about how hard you can get hit (with team changes, regulatory walls, development speed, and other unforeseen bumps in those transitions) and keep moving forward. 🥊

Hold back the tears for now and let’s carry on.

Here are examples of the transitions where, in my experience, some of the hits can hurt the hardest.

Discovery & Design into Build 📐→ 🏗

Some research has been done. Problem areas have been outlined. Customer segments identified. Journeys mocked up, and wireframes developed.

Now it's time to get building.

I've seen some severe mistakes happen at this transitional point of the product development lifecycle. At early-stage startups, it's less common because there's a smaller team of folks all working on these phases fairly fluidly, but issues still happen.

There are some things that don't necessarily fall neatly into design but definitely need to happen before the build starts and often get shoved into the build phase with the responsibility falling on engineers.

For example, if using partners, outlining the partner selection criteria, minimum functionality and thinking about how commercials and any integration will affect revenue and customer experience.

Or creating a build plan. This is something that will usually happen at the beginning of the build phase, but by that point, there might be engineers starting in the team waiting to get working and needing the right level of clarity on what they are building.

Standing up a roadmap (even if it's just for the alpha and beta versions of the product) and ensuring everyone, including marketing, engineering, product, and C-suite, knows what is being built, why and in what order.

You'd be surprised to see how many organisations don't even think about a roadmap until deep into the build.

But the biggest of all the issues I've seen is not including the engineering team in the discovery and design process. That period between Discovery & Design and the Build is where so many pivotal issues will be faced and where engineering, whether that's a CTO or broader team, is a vital part of working through issues, ensuring the best partner is selected, and there is a plan for the team moving into the build in earnest.

Setting up a company-wide roadmap, making sure engineering is part of the discovery and design phases and preparing a plan are all big mitigators against any issues faced before getting into the build.

Build & Launch into Growth 🚀 → 🌱

A version of the product is built and has been launched. It has customers using it earnestly, and some of the hypotheses around the problems it solves have been proven.

Why is this one of the tougher transition phases?

Now, the customer segment will be broadened, whether by looking at an adjacent demographic, looking at another geography, widening the problems the product is solving, or all of the above. This requires some research as well as experimentation.

Where should the product be grown?

What features have resonated, and what should be built next?

How should we get feedback on future changes?

What are the best ways to bake in revenue-generating features?

When should we introduce paid marketing?

There are lots of questions to answer while still shipping features, retaining that scrappy startup vibe, growing the team, and trying to build broader appeal.

All with the looming question of how to fund this growth…And at a stage where momentum is key!

This is where building a metrics framework into the product will prove invaluable when it comes to understanding the most used and underused parts of the product.

Some structured customer feedback loops help with informing what to build next.

Previous experimentation and cost tracking of marketing campaigns will help identify the best levers to pull for growth.

And the right people, like a community manager in touch with customers and a product-centric leadership team, will understand what to do next.

These will help mitigate and manoeuvre any tricky situations, including regulatory ones.

Some other critical transitions

Build into a Strategic Partnership: Moving from a build into a strategic partnership often involves aligning ways of working with the partner, working to tight deadlines, changing priorities and sometimes merging two teams into one. Planning and structure during the transition is key here.

Post IPO into Scale/Maturity: A youngish startup like Wise or Stripe going public, dealing with the extra scrutiny, a board, and potentially changing strategic direction in pursuit of profits. A strong management team and structure are critical here, especially one that is there pre-IPO and throughout that transition. Hence, TS Anil will probably take Monzo public, and Starling won't float until Anne's replacement is found.

I could go through more specific examples, but the point has been made.

The traditional product development phases a fintech goes through aren't easy, but there's a lot more certainty there. During discovery, you know what outcomes you're looking for, even though you may need to pivot. By the end of design, you expect some mockups, customer journeys, and maybe a brand book. Yes, there's nuance and pivots, but as mentioned, much of it is certain and trodden ground.

It's the transitions where much of the uncertainty lies, and navigating those is where the great fintechs are built and some weaker fintechs are broken.

Weaving a Strong Thread 🪡

I've already alluded to this in the previous sections, but some common threads make navigating those transitions and manoeuvring those pitfalls so much easier. Having a proper plan. Involving engineering at the earliest possible opportunity. Understanding regulatory constraints. Having great product expertise 👀.

But it's this that I want to close out with.

The right people (at the right time)

Sounds obvious. Of course, the right people, but with that key caveat of timing.

Look at Tom's first marketing hire. It didn't work out then, but if she was hired now with Monzo's current team breadth and less guerilla marketing, those P.R. relationships and team management skills might have been a better fit.

Having the right experienced people and having them at the right time can be a deciding factor in navigating an issue or hitting it and falling hard.

Another way of looking at this is keeping the right person at the right time or letting someone leave at a time that works for them and, in both cases, for the good of the organisation's long-term success. Here's what I mean.

Kristo Käärmann, Co-founder and CEO at Wise.

One of the original founders became CEO and continues to run the company post-IPO. Under his stewardship, they have gone from strength to strength, broadening their offering, rebranding and doing all the things you'd expect of a successful listed fintech. His position looks stable as he's successfully led the company through many phases (and transitions). He looks happy and willing to take Wise to the next level. Scale globally and sustainably.

Jason Gardner, Founder and Former CEO at Marqeta.

Jason founded Marqeta in 2010 and, after some initially slow growth, helped large companies process debit and credit transactions, reached a private valuation of $4.3 billion before going public. In 2022, he announced he was stepping down and not because of the economic environment or company performance.

In a Forbes article in 2022, he said running a public company is:

"..foundationally different from running a private company. You think it's going to be the same, and it's not even close. You go from being not transparent whatsoever to being radically transparent. And once you set a stage regarding where you're headed–whether it's guidance on a number of different factors–you need to execute. That execution is very different day-to-day than it is being a private company CEO."

"Put me on a plane and have me spend more time with customers so that I can really understand more about where they're headed. This is probably one of the most fun parts of my job."

It's not that Jason couldn't do the job because he did it for two years. He knew it wasn't for him, so he decided to step back into the 'zero to one' entrepreneurial work he loves.

The same could be said for Tom when he stepped away from Monzo and TS Anil stepped in. And maybe, to a degree, Anne's departure from the top of the Starling tree.

The C-suite roles are of course vital to get right to help navigate pitfalls but it’s also important to recognise when others at the organisation are ready for a new challenge or are burnt out from the constant grind from one stage to another. Refreshing key roles across the organisation and bringing in folks who have been through those transitions before is a great way of setting an organisation up for success and resilience through challenging times.

The Monzo team, past and present, have navigated through some tough transitions, hitting regulatory hurdles, working through funding failures, losing respected members of their team and dealing with some product stagnation from post-launch to growth & scale.

And bringing in Conor to manage the U.S. is an excellent example of bringing in the right person at the right time.

But there are still some big transitions to navigate.

👉🏽 Capital G funding round to IPO readiness.

👉🏽 U.S. Launch to Growth.

👉🏽 Growth to Scale.

👉🏽 Post-IPO to Stable Growth.

👉🏽 Growth to Global Expansion.

The key to navigating these transitions will be the great experience they already have and ensuring they continue bringing in the right people. And crucially, at the right time.

Interesting Fintech News

Curve Gives Cards the Finger campaign - I love what Curve does. The Lord of the Rings reference on their homepage (one card to rule them all) instantly gets me onside. And their new wearables partnership is no different. They've partnered with a few different wearable firms to bring payments to people's fingertips and done it with an edgy tube, digital screen, and online campaign.

Vinay Mendonca named CEO of HSBCs Embedded Finance venture - The current chief growth officer for HSBC's Global Trade and Receivables Finance (GTRF) will head up a team partnering with Tradeshift to "embed HSBC solutions into such venues so that customers can access financing when and where they need it.". SMEs have been underserved for a while, and this could be a way for HSBC to serve SMEs and take a slice of that embedded finance pie.

just lovely to see all those fuzzy feel & foggy areas along the trek so clearly delineated and navigated in a Friday post. Way to go, Monzo