Fintech R&R☕️🗞 - News Edition feat/Apple, Mercedes, and Money Dashboard

A deeper dive into Apple's UK Open Banking initiative, Mercedes Pay+ and other great use cases for 'Pay by car' and Money Dashboard closing its budgeting app

Hey Fintechers and Fintech newbies 👋🏽

In my jetlag-hazed state a couple of weeks ago, I forgot to mention that the next full edition of Fintech R&R will be next Friday 13th, rather than today.

It will be worth the wait and a US-inspired Under the Hood edition, covering the mysterious and sometimes spooky subject of Tokenisation. It's landing on Friday 13th, after all!

For new subscribers wanting to know what a Fintech R&R x Under the Hood edition looks like, you can check out the Card Payment Process or the Open Banking Payment Process edition.

However, I wanted to send an email with insights, and there has been some really interesting news in the past week, so I'll do a quick dive into headlines I've found particularly interesting.

Mercedes and Mastercard to partner for in car payments

Everyone talks about embedded finance, and with good reason. But no one really talks about embedding payments into different aspects of customer journeys. That could be because tap to pay and mobile wallet payments have already reduced much of the traditional friction with lower-value payments.

Mercedes are looking at more innovative ways to enable customer payments by embedding a fingerprint scanner in their in-car entertainment systems and partnering with Mastercard to make in-car payments seamless. Mercedes' payments initiative, Pay+ is initially launching with 'Fuel and Pay' in Germany, allowing Mercedes drivers with Mastercard Credit or Debit cards to drive into gas stations (the US influence is clearly rubbing off on me), fuel their vehicles and pay using the in-car fingerprint scanner without having to use their card or leave the vicinity of their car.

The Fuel and Pay service activates once the driver arrives at a connected service station and shuts their engine, presumably utilising the gas station's already active licence plate recognition software. The car's system then calculates the fuel left in the tank and estimates the maximum amount payable. Another assumption I'm making here is that at this point, there is likely a balance/proof of funds check to verify the customer can make the payment. The customer then fuels up, gets in their car, and reviews and completes payment using the fingerprint scanner on the MBUX display.

This uses the standard practice of 2-factor authentication (2FA) for payments, commonly 'Something you have', your mobile device, and 'Something you are' FaceID/Fingerprint. In the case of Pay+, the 'Something you have' is your vehicle, and the 'Something you are' is your fingerprint.

There's so much potential for Pay+ that involves the car as the 'Something you have' to greatly improve the customer journey and reduce the negative payment friction (because we still need the positive friction).

Here are some I thought up:

Toll roads - This should be next on the Pay+ roadmap, in my opinion. Drive straight through a toll, have your licence plate scanned, be notified of the payment and verify via fingerprint instantly, avoiding any surprise fees and a letter in the post.

Fully contactless fuelling - Although the German fuelling method is great, is not fully contactless as the driver still has to leave their vehicle and fuel up. The US, however, has many stations where there are gas station assistants who pump the gas petrol for you, and the payment can be confirmed via fingerprint, meaning fully contactless fuelling.

Congestion/low emission zones - London has just extended its congestion zone, causing a bit of an uproar. But for drivers who aren't registered for automated payments, they can drive up to a congestion zone where their plate is scanned, be notified in vehicle, either avoid the zone or pay as they enter, and authorise while in the vehicle.

Drive-thru food outlets - This is a long shot but could be beneficial for folks in a rush who don't want to shuffle around in their pockets for their phone or a card. Drive straight up to a Starbucks, McDonald's or KFC (because there are no healthy drive thru's), order using the first screen via audio or touchscreen, and have the payment sent to your vehicle and confirmed before moving to the next window where you can pick up your order.

Parking Spaces - Whether it's an underground garage or regulated on-street parking, the process of parking and paying can be a bit frustrating. Many still use the 'stick this on the windshield' method, but having parking garages you can park right up to and pay with your car + fingerprint can be a much more convenient way of securing your spot.

It's a really exciting space and a big win for Mercedes, especially when, frustratingly, their wins on the F1 track are becoming increasingly rare. Can you tell I'm Team Mercedes? 😬

Apple Banking on Open Connections

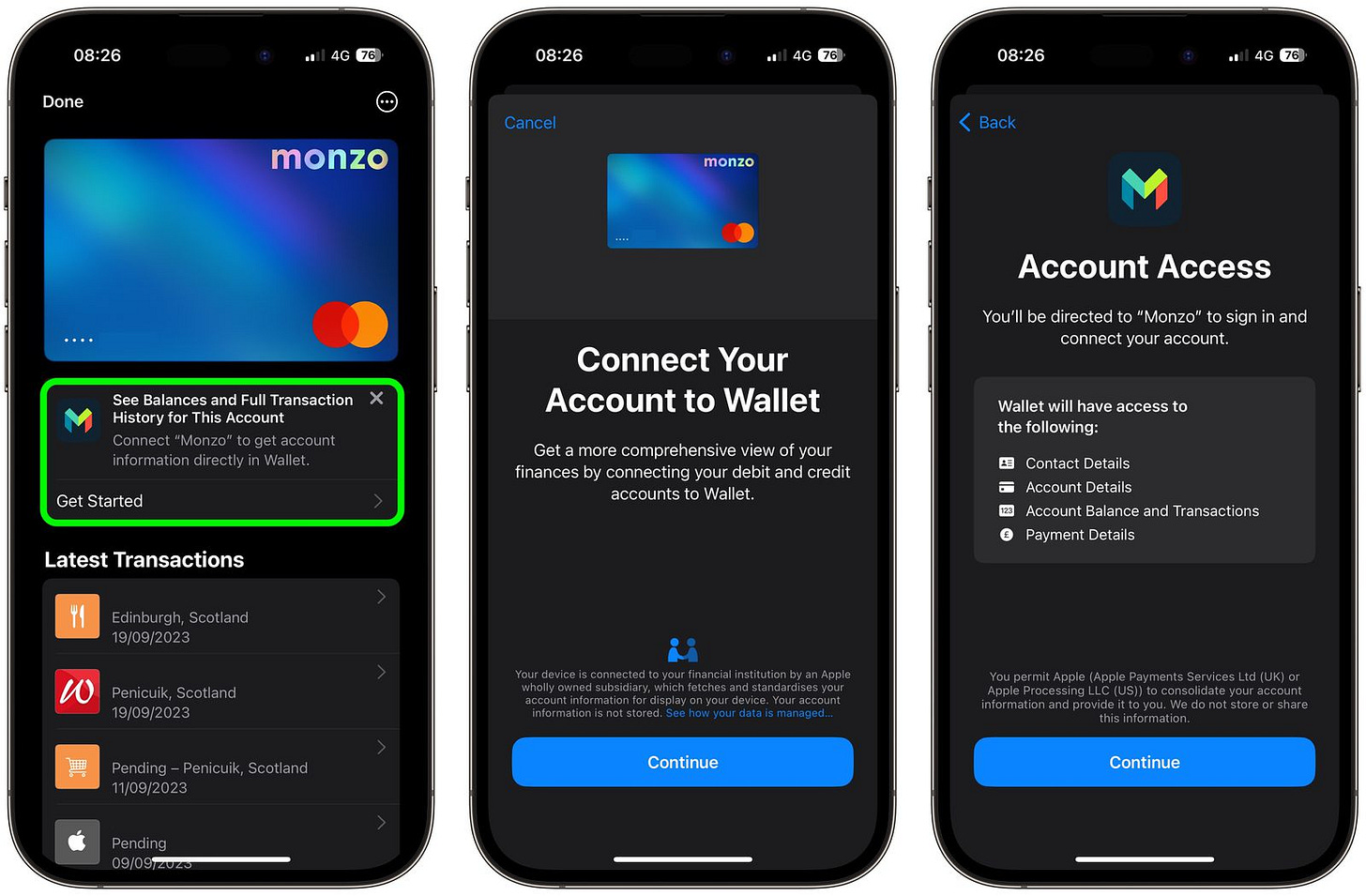

Apple just announced they are making cross-account balances available in the Apple Wallet to UK customers that go through the standard Open Banking authorisation flow. This will mean customers can see their balances in their wallets without jumping into their banking apps.

I'm not an Apple insider, and I don't have a backchannel to get extra knowledge, but based on their history, I think this is a feature they've created to take a step towards something bigger for them and specifically their bottom line.

I've always said Open Banking is an embedded finance on-ramp because of the ease with which it allows access of vital transaction data. Apple's foray into OB, as with everything else, is usually well thought out and has a longer-term plan attached. Balance visibility is a stealth feature designed to get customers to connect their accounts and allow for the processing of transaction data to surface lending opportunities. This is a logical assumption, and here's why.

In 2022, Apple acquired Credit Kudos, the Open Banking powered credit checker that gave organisations the ability to use transaction data to make lending decisions. When Apple announced in 2022 that they'd be stepping into the trendy BNPL space in the US, I assumed that newly acquired Credit Kudos would be powering the decision part of the BNPL agreements with individuals. I couldn't see any trace of Credit Kudos in the T&Cs of that Pay Later proposition, but what makes more sense is that it was acquired to power a UK lending opportunity. Because having customers connect their various bank accounts to show a balance and, later on, surface lending opportunities is a much lower hurdle than asking customers to connect their accounts for the possibility of a loan.

Asking customers to perform an action in return for tangible value is always better than asking customers to perform an action in return for the POTENTIAL of tangible value.

I bet a financial health app is also on the cards and part of their long-term strategy. Most Apple users, myself included, would welcome a financial health app with all the design and customer experience of an Apple product, bringing together communication, leisure, payments, health and financial wellbeing in a single device. Watch this space to see whether my predictions come true.

Money Dashboard formally shutting its budgeting apps

On the 3rd October, I recieved this email from the Money Dashboard team.

As mentioned here and repeatedly in previous editions, Open Banking is a great asset for customers and financial services as a whole when used correctly. The launch of the Account Information Service and the ability to pull transactions created a wave of digital money managment apps (aka PFM apps) when it launched in 2018. While the creation of these apps benefitted many customers, it's a really tricky area to crack in terms of the product and the business model which is why I think we're seeing a bit of an overdue consolidation.

From a product point of view, using transactions to build a picture of someone's finances works well, but being able to give them the tools, insights, and techniques in the app to manage this, get better at budgeting and generally improve finances is quite tricky. It's also tricky to do this while targeting a specific demographic but that's what's required to create a successful PFM, as has been proven by Plum, Cleo, Emma, and Snoop.

From a business model point of view, it's even trickier. While current PFM apps charge for their premium version, most still provide a free version that doesn't generate direct revenue. Some mitigate this by implementing a referral model that suggests alternate current and savings accounts for customers and provides a kickback for the PFM app for every successful conversion. This isn't a hugely sustainable model though, as each customer is only likely to change accounts once every few years, if at all (based on recent research, most millenials will keep had the same account for around 13 years). This makes the margins and business model very tight, especially when you factor in the costs of the TPP, like Truelayer or Tink, to provide the Open Banking connection and sometimes provide data cleansing services.

The last factor causing a strain on some PFM apps is the current account providers building a lot of the PFM functionality in their native apps. Folks like Monzo, Starling, and others have built their own Open Banking connections to pull in data from other accounts and provide budgeting, spend management and other personal finance management functionality. This, along with the tight margins, means any stagnation in customer growth can lead to a sticky time for apps such as Money Dashboard.

I can see a bit more of a challenging time in the digital money management space before settling down, with the apps that provide valuable insights, tools and techniques along with tailored UI and thoroughly researched and developed customer experience gaining popularity.

That's it for this short, sharp news review edition. Let me know if you liked it by replying to the mail or dropping a like at the bottom. Back to regular schedule programming on Friday the 13th….👻

I like it, maestro. the car pay seems to have aroused lots of different opinions lately, while the imminent one might be not that solid for some, the ones you've thought up above make more sense.