Fintech R&R☕️ - To Embed, or not to Embed. That is the question.

A brief primer on Embedded Services and Finance, the pros (and the cons) and some HUGE overlooked embedded opportunities on the horizon

Hey Fintechers and Fintech newbies 👋🏽 Thanks for joining me in the 2nd edition of Fintech R&R

Before we dive into the topic, I want to address this week's title.

I have a degree in Computer Science. I was not a fan of English Literature at School. And I'm not a Shakespeare nut. The height of my Shakespeare expertise is Baz Lurhmans Romeo + Juliet.

But for some strange reason, whenever I picture someone toiling with a dilemma I always think of "To Be or Not To Be", which I'm told is from Hamlet.

And in this case, the dilemma I'm talking about is what many are touting as a $7 trillion (yes, $7,000,000,000,000 that is not a typo) opportunity by 2030…Embedded Finance.

The dilemma is whether, as a Fintech, you enable or facilitate that embedded finance service for other organisations. And it can be a dilemma. Because it's easy to look at that $7 trillion figure and salivate at the opportunity. But one thing that needs to be talked about and taken into consideration is the opportunity cost.

Embedding finance into an offering is rarely straightforward, and several factors must be considered before diving in to take a piece of that enormous pie.

So I'll outline those factors, list some prerequisites for Fintechs and others when considering embedded finance and call out some of the substantial real-life embedded finance opportunities coming down the road. All from my unique viewpoint (as I'm currently working with a finance provider with a successful embedded solution).

Summary

Wider Embedded services environment with examples

What the 🤬 is Embedded Finance?

The Opportunity and Beneficiaries (including customer value)

Opportunity often comes at a cost

MASSIVELY overlooked/undervalued Embedded Finance use cases to watch

But before jumping straight into the deep end and covering reasons, let's take a short step back and explain the hottest phrase of the Fintech zeitgeist and the wider context of embedded services.

The Wider Embedded Services environment

A generic definition I’ve come up with for embedded services is

‘A product or service that is attached to another product or service for the purpose of providing net gain to both the customer and enterprise”.

This can take different forms. For example:

A Partner Offering – Booking a flight return with BA and being suggested a discount car booking via Sixt for the same date range

Package Offering – Opening a Tide Business account and having the companies house setup and included in the monthly cost

Or an almost invisible, fully digitally embedded solution…

The most common example of a reasonably invisible embedded solution that most of you reading this will have used but not thought too much about is this little fella:

reCaptcha, aka the 'I'm not a robot checkbox', is the security solution from Google that provides website operators with spam and bot protection software. And it's the perfect demonstration of an embedded solution used by millions daily, reducing customer friction and headaches for anyone running a website whilst being barely noticeable as an external embedded solution.

The biggest reason I think reCaptcha is an excellent embedded solution is that it's solving a challenging problem for website hosts–preventing spam, data scraping, bots and specific malicious attacks– using technology that, to the customer, looks like a simple and honest consent button.

But when customers click that simple checkbox, they are, for the purpose of checking whether they are human or not, consenting to have several data points captured and analysed, including a snapshot of browser history, IP address, mouse & keyboard behaviour, and OS info. This data is then fed into an algorithm to decide whether you're customer is an actual human.

And reCaptcha is an example of a good embedded solution because it:

Uses available or obtainable data to make a decision and enhance a customer journey rather than bothering customers with cumbersome forms and data entry

Provides value for all parties. The embedder, embeddee and the customer

It embeds fairly seamlessly and with minimal friction

The only pointer I have for reCaptcha is that it’s almost too seamless, with most customers not realising these browser and behaviour checks are even happening. So don’t feel bad if you didn’t know this because the vast majority don’t. Or didn’t until now…

And that's why when building products, friction can be beneficial if used effectively.

I’ll admit, security solutions aren’t exactly great at captcha-ing imaginations 😉 when it comes to exploring the embedded world. But there are other embedded verticals, including:

Embedded Security & Authentication

Embedded Productivity

Embedded Communication

Embedded Healthcare & Fitness

And of course Embedded Finance

What the 🤬 is Embedded Finance?

There are many definitions out there for embedded finance. And that's why the folks over at Bain provided a clear description before diving into the subject in their whitepaper. Because some play fast and loose with the 'embedded' part. But a straightforward definition that trickles down from the earlier embedded services is as follows:

‘A financial product or service that is attached to another product or service for the purpose of providing net gain to both the customer and enterprise”.

That's why Klarna, the BNPL provider, is an easy example. Because it's a consumer-facing financial product that people have heard of, and it's attached to several other products and services (mainly e-commerce sites) with the purpose of 1. Helping enterprises increase basket conversion - people checking out at e-commerce sites - and 2. Giving customers the option to finance purchases if they don't have funds readily available.

I want to talk too much about Buy-Now-Pay-Later here because it deserves a deep dive, which I'll do in due course.

But Klarna (other BNPL options are available) providing Embedded Lending is just one example in a spectrum of Embedded Finance options. And in my opinion, it's the least valuable one from a customer value perspective.

The big 3 embedded finance areas are:

Lending: POS Lending, Mortgages, Personal Loans, Business loans, Business Asset finance, Revenue finance. Example: Klarna provides POS lending for e-commerce purchases

Payments: Card payments, bank-to-bank payments, Mobile payments, Invoices. Example: Stripe provides an easy-to-use card payments gateway for digital and physical stores

Insurance: Car, Home, Travel, Business, Personal, Employment. Example: Jove embedding business insurance options into job search platforms and other products

But there are other areas of finance with lots of scope to embed, like:

Cards: Physical cards, Virtual cards, Prepaid cards

Investment: Funds, Stocks and Share trading, Property & Commodity investments

Savings: Cash, Fixed-term, Pensions, Round-up

Crypto: Storing, converting to and from digital currency

Power to the people: A note about BaaS 💪🏽

Banking-as-a-Service - technology providers that facilitate the end-to-end execution of financial products and services - is a popular fintech area increasingly associated with embedded finance. Although BaaS providers themselves are more like embedded finance enablers - providing the embedders with the technology to build solutions to then embed into products and propositions - it's probably not long before these providers look to deliver their solutions directly to large organisations like e-commerce, retailers etc. become the embedders themselves.

Marqeta, one of the more well-known industry BaaS providers, recently acquired Power, a credit card service provider. This means they're able to provide their clients with more capabilities allowing them to build and manage full-stack credit card programs from market research and card design to day-to-day card and risk management. But it also means they could provide this tech and service to established and up-and-coming e-commerce organisations to launch and manage their own branded credit cards, moving from embedded finance enabler to embedded finance provider.

For example, by partnering with Marqeta + Power, Aldi could ideate and launch a branded rewards focussed credit card and manage everything through the tech and services Marqeta provides. I specifically picked this value supermarket chain due to its rise in popularity of late and its lack of credit card offerings.

Note: I know there was an opportunity to create an ever more pun-tastic header for this section, so here are the titles that I left on the cutting room floor

More Power to you - The popular phrase

With great Power comes great responsibility - Spiderman reference

No one BaaS can have all that Power - A play on the famous Kanye West song

If I missed any obvious ones, please comment or DM me. And feel free to steal these for yourself for any relevant articles :-)

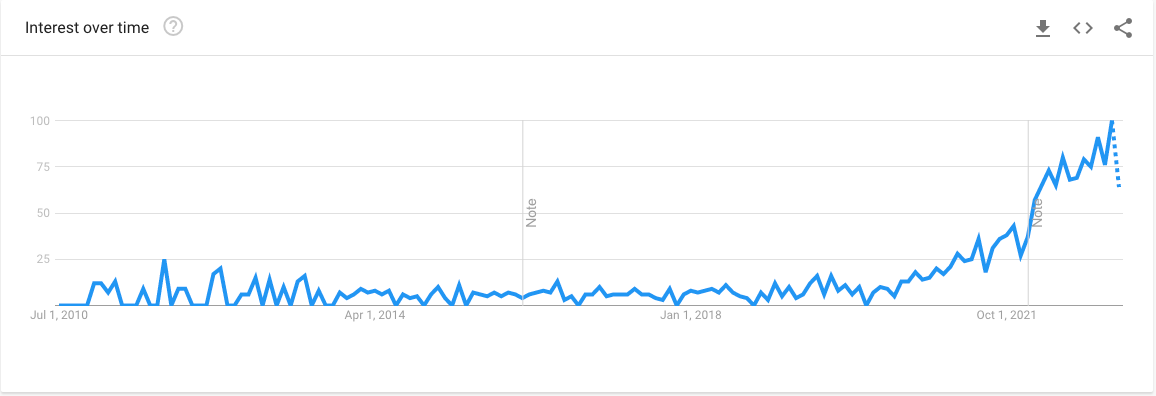

What I've described is just a taste of embedded finance opportunities and shows the sheer breadth of where embedded finance can go. So it's no wonder we've reached peak discussion around embedded finance, as this google search trend analysis shows.

So it's clear that the term is widespread, and there's a breadth of types of finance and use cases, but before calling out the key opportunity costs, I have to highlight the main benefits and beneficiaries.

What is the opportunity, and who are the main beneficiaries?

This is a tongue in cheek intro but this is image that jumps to mind when I think about the $7 trillion opportunity

🏦 Traditional finance services: There's no doubt that conventional banking institutes like high-street banks, insurers, mortgage providers and fund managers will benefit. Because although it's Fintechs who are creating the majority of the embedded technology, the backend of many of them still rely on well-established insurance & account providers, lenders and investment funds. AND traditional finance companies are also embedding finance into their products to enhance and expand their offering, benefiting in two ways.

📱 Fintechs: The leading creators of embedded finance technologies and the value that comes with it. In return for providing embedded technology, they either get, commercial value based on usage, increased customer numbers & long-term growth, acquired by a larger organisation OR all of the above.

🛒 eCommerce: One of the most significant users of embedded finance as it covers all buying and selling of goods on the internet from big retail outlets like Amazon, Shopify and Etsy to online automotive & travel industries and beyond. ECommerce providers use embedded finance to give value and a richer customer experience and increase retention, revenue and activation.

👩🏽🤝👨🏼 Customers: The end customer should be the ultimate beneficiary of embedded finance. With more embedded finance options, customers should see less friction in purchasing goods and services, richer brand-aligned offerings and better customer journeys.

The pros(e) for Embedded finance

I touched on this earlier with the reCaptcha example. But outlining the overall benefits of embedded services goes a long way in increasing the understanding of why it exists and further clarifying the value of embedded products.

And there are some clear and obvious benefits to embedded a product into another offering effectively creating a mutually beneficial embedded proposition. And I’m outling these using my Product lens 🤓

Decrease Customer Friction

This can often be the customer value, but as it's one of the key benefits of embedded finance to the customer, it deserves its own section. Embedded finance propositions that reduce customer friction by using data to check eligibility, give an instant assessment of options and generally decrease the time, effort and sometimes cost is a huge win for customers

Increase Customer Value

This is the value given to the customer in addition to the product/service they've already signed up for or purchased. It could be a beneficial relevant financial product that is given at a discount if bought with a specific product (like a flight and embedded holiday insurance). But it's also likely to be removing the friction itself

Increase customers/users and revenue (for embedder)

This is one of the most significant benefits for the creator of the embedded finance tech (the embedder). Because when embedding technology, it's usually with an organisation or entity with a larger customer base than them (or a customer segment they are looking to target but want to do so in a cost-efficient manner). Dynamic embedded options, that is, options that are surfaced to the partner's customer base when they fulfil certain criteria, give the embedder access to customers at a lower acquisition cost. And more customers at a lower cost usually means higher revenues

Increase customer activation (for embeddees)

For the companies embedding finance into their offering (and let's just stick with eCommerce for simplicity), because they're enhancing their offering and hopefully reducing friction for customers, this should increase customer activation. For eCommerce for example, this means getting a customer to checkout once they have finished adding things to their basket and removing frictions, enhancing options and improving the journey should lead to greater activation

Name recognition, brand visibility, and brand trust (for embedders and embedees)

For embeddees, this can give smaller newer outlets some validation and increase trust with the brand if they accept Klarna as a payment option, for example. As they are an established and well-known brand, the outlet itself has a glow effect that is ported over from people who trust Klarna.

The more prevalent example of this is for embedders and technology providers. Because embedding technology into a larger, more well-established organisation and a bigger brand name amplify not only the customer base but recognition of the brand.

Time and effort saving (for embedders)

This is just the time and effort (cost and expertise) of an organisation creating the finance offering in the platform themselves. In technological terms, this is the 'build bespoke' or 'buy off the shelf' debate. Often 'off the shelf' is a time and effort-saving in the short to medium term.

The Cost of the Opportunity

Now. I've waxed lyrical about the types, breadth and benefits of Embedded finance. You might think this is a bait and switch, and I'll now use the old interview trick to describe all embedded finance's negatives as positives.

I'm not going to do that.

There are downsides, mainly for Fintechs looking to create embedded offerings.

Running before you can walk

Let's take a Fintech providing loans with a direct-to-consumer offering, a solid customer base, a track record of providing finance, and are looking to offer embedded solutions to larger organisations. This type of organisation is well positioned to create an embedded offering and provide it to larger eCommerce or traditional financial institutes.

Conversely, a Fintech without a customer-facing proposition or with very few customers and, therefore, little validation of use cases and the technology will face an uphill battle trying to provide a technology solution in the space to larger organisations with no product validation. Not only does it make finding a partner tough, but it also makes the offering less robust therefore less scalable and more likely to crumble under the weight of a mass of customers.

Picking the wrong partner

This is something I've yet to see a lot of, but then again, many failed partnerships are invisible. Picking the right partner in any situation is essential. I'm not necessarily talking about life and relationships, but those are relatable examples. In those instances, compatibility is a vital component, and it's the same with embedded options. Embedding a solution in an organisation with largely differing customer personas and attributes, differing brand values, technological capability and organisational objectives screams of incompatibility. And incompatibility often leads to failure. Or at least a damp squib of a partnership.

The real terms cost. In time and effort

For organisations that already have a direct-to-consumer offering, providing an embedded option to amplify customer numbers, increase brand awareness and grow & scale the product might make sense. But before embarking on that initiative, there need to be some 'quick maths'. Are the time and effort expended to build an offering and embed it into an online store going to pay dividends going forwards? It's not always the case. Commercial agreements, especially those with larger organisations that are in a position of power in terms of negotiation, are skewed in that direction. So if an organisation before an organisation deploys time and resources in pursuit of a fruitful embedded proposition, they'll need to assess whether it's commercially viable or not. And it isn't always.

And finally, the opportunity cost

As a Fintech, what is the cost of embedding, and what opportunity am I missing out on? If none of the previous points are of concern, the product works and is validated, there are some clear compatible partners, and the commercials and costs make sense, then it's a no-brainer, right?

This takes us to the fourth movie reference of this newsletter involving Newton's Third law.

"Every action has an opposite and equal reaction."

But Matthew McConaughey said it best in one of my favourite films. Interstellar.

And what opportunity are you leaving behind by focusing on embedding technology into other providers' platforms?

The biggest one is the direct-to-customer offering.

Although acquiring customers directly is more expensive (higher acquisition cost than tapping into an already established and curated customer base), it CAN be more profitable in the long run. And it also averts the risk of losing the bulk of your customer base if the eCommerce site or other partner decides that they want to build the financial offering themselves to keep all profits. Or use another partner. Now the big fish is gone, and you're left wondering whether you would have been better off building more nets and sticking to catching little fish (did I mention you get golden nuggets of analogies and puns and movie references?).

What questions should you clarify as a fintech company thinking about embedded finance right now?

Here are just some of the questions that I'd get answers to before jumping into an embedded partnership:

Is the product offering clear?

Has the product been validated with a stable customer base?

Does the organisation have the operational capability of an influx of customers?

Are there clear customer personas?

Do the personas of the other organisation (embeddee) align with ours?

Does the combined end-to-end customer journey provide a net benefit to the customer?

Is the customer benefit measurable?

Does the partner organisation have a large enough customer base to make this worthwhile?

How can the partnership be tested and validated via beta testing?

Do the commercials make the time and effort worth it?

…I have a big checklist but I’m not going to copy and paste the whole thing here.

BIG Embedded Finance opportunity areas

I'm not all doom and gloom. And there are already many great EF firms out there giving great value. And loads of great use cases that, in my opinion, are perfect embedded finance accelerators that tick all 6 of those benefits I listed earlier:

🧑🏼💼 SME Finance at the point of raising invoices via Accountant, Accounting software and/or connected finance provider

Bounce-back loans and Covid bounce-back loans have come to an end. Corporation tax is going up to 25%. Inflation is still high. Brexit is still causing supply chain issues.

And big organisations still pay Small and Medium-sized businesses (SMEs) late.

This means that when SMEs raise an invoice, they might not be paid for 60 days or more, causing cashflow problems that could send a business under. But with the correct accounting data, invoice data, company information and embedded finance provider, SMEs can obtain cost-effective invoice finance at the point of raising the invoice.

🚘 Car Finance & Insurance at point of sale of online car purchases

Although car finance is prevalent especially for new cars at large manufacturers, insurance is usually provided or obtained separately so embedded insurance would reduce some of that friction and give clarity over the total or total monthly cost.

And the secondary market is another area altogether. Allowing dealerships to embed car finance into their offering rather than using marketplace websites benefits local dealers and experts.

🏚 Airbnb Hosts x Property Finance providers

I had a speculative idea, but one that would be valuable for Airbnb hosts. Providing refurbishment or home improvement finance for underperforming listings on Airbnb.

The made-up scenario is a listing in a popular area on the Airbnb platform but at a lower rate than other similar properties in the area and underperforming in terms of booking quantity. A property finance provider provides finance through the Airbnb platform, which the lister then pays back through listing it on the platform and paying interest through rentals over a set period. It improves the quality of listings on the platform and allows the lister to improve their home. Win-win.

🛍 Finance for e-commerce merchants

This one already has traction, but it'll be one of the bigger pieces of the embedded finance pie in the coming years. It's revenue-based finance from companies like Pipe and Uncapped. This means extracting cash based on historical sales and future projected sales from eCommerce sites.

In practice, it means online merchants and stores that use platforms like Shopify, Amazon, and Etsy can be given timely and means-based finance options using their historical sales and credit ratings as projections for the likelihood of defaulting on the finance agreements. Providing this means-based finance means good stores stay afloat and on the platform.

There's no doubt that Embedding finance is a massive opportunity for Fintechs, eCommerce and many others in the next decade. But it's not all sweet-smelling roses and infinite money trees. There are hurdles. There are pitfalls. But the opportunity is huge, so be prepared. Map out customer journeys. Identify high-value partners. Think outside the box. And remember.

Everything is Fintech. Or at least it could be…