Open Banking in Saudi: The Catalyst for Accelerated Fintech Innovation 🇸🇦

History of Open Banking in KSA, Similarities and Differences to the UK, the big opportunities that it unlocks for the region, and how different stakeholders should use it.

How does the Saudi implementation of Open Banking differ from the UK’s?

Who are the key players in the KSA OB ecosystem?

What areas can Open Banking make real change for consumers and SMEs?

What should banks, fintechs, and VCs do to prepare for the innovation wave?

These questions and more will be answered in this week's edition.

Hey Fintechers and Fintech newbies 👋🏽

I’m back to the regular editions again, and this one is a bit of a follow-up to a popular deep dive I put together towards the end of last year.

So, if you haven't already read “Saudi Arabia’s Fintech Oasis” I recommend doing so first.

If you already have, or don’t have the time to read that all the way through, here are the very high-level clef notes:

Youthful and Digitally Savvy Population: With 70% of the population under 35, 99% internet penetration, and 90% smartphone usage, Saudi Arabia is primed for mobile-first fintech solutions targeting financial literacy, digital payments, and credit options.

Vision 2030 Driving Fintech Growth: The ambitious national strategy promotes financial inclusion, a cashless society (70% digital payments by 2030), and increased SME contributions to GDP (35% target), creating a fertile environment for innovation and investment.

Significant Gaps in Savings, Investing, and SME Finance: Challenges include a 55bn SAR household savings gap, low retail investment participation (20%), and a 117bn SAR SME financing gap, highlighting opportunities for micro-savings tools, Shariah-compliant investment platforms, and SME-focused financial solutions.

Emerging Consumer and SME Fintech Opportunities: Advanced PFM apps, wealth management tools, embedded finance platforms, and modular BaaS infrastructure represent white spaces with potential for growth and differentiation.

One of the areas I outlined but didn’t explore in too much depth was Open Banking.

Trust me when I say there is a lot going on with fintech in the Middle East as a whole, and specifically with Open Banking.

In Oman, the Central Bank of Oman recently approved the country’s regulatory framework for open banking after developing a draft framework in July 2024

In Qatar, the National Bank’s (QNB) Open Banking API is approaching its first birthday, and more innovation in the API is on the horizon.

The UAE’s Central Bank, the CBUAE, issued its Open Finance Framework last year and is rolling it out in a phased approach.

This is just the tip of the iceberg. There’s much more happening in the region. There is too much to cover in this edition alone, so rather than cram it all into here, this will be a bit of a sequel to Saudi Deep Dive and focus on…Open Banking in Saudi Arabia.

As well as interesting news, puns + movie references, this edition includes the following:

Timeline of the Saudi’s Open Banking Framework

2021: Strategic Announcement -> 2025 and beyond

The players in the KSA OB ecosystem

Regulator

Banks/ASPSPs

TSPs

AISPs/PISPs

RTP Rails

Differences between UK and KSA Strategies

OB Areas of Significant Innovation

Saving, Spending and Financial Literacy

Wealth & Investing

SME Enablement

The cultural significance and relevance of Majlis

Fintech Spotlight🔦: Vyne: The UK OB Payments company going to MENA

Interesting News: HSBC shuts down Wise ‘rival’ Zing

Let’s get into it 💪🏽

Sands of Time ⏳

Open Banking in Saudi Arabia is not just a regulatory development but a crucial part of the country’s ambition to modernise its financial sector in alignment with Vision 2030. By embracing Open Banking, the Saudi Central Bank (SAMA) aims to create a more transparent, innovative, and inclusive financial ecosystem, fostering collaboration between traditional banks and fintechs to serve both consumers and businesses better.

The best way of getting familiar with the framework in the region is to take a brief look at how it has come to be through its implementation journey, which has been a structured, phased rollout designed to address technical, operational, and regulatory complexities systematically.

2021: Strategic Announcement

SAMA announces plans to implement an Open Banking Framework as part of the Financial Sector Development Program, a key pillar of Vision 2030.

Initial consultations and collaborations begin between SAMA, banks, and emerging fintech companies to explore global best practices and adapt them to the local market.

2022 (January): Release of the Open Banking Framework

SAMA publishes the Open Banking Framework, which includes comprehensive regulatory, technical, and operational guidelines.

The framework defines the roles of banks, fintechs, and technical service providers, setting clear expectations for compliance and innovation.

2022-2023: Sandbox and Pilot Phase

SAMA launches a regulatory sandbox to enable real-world testing of Open Banking solutions.

Banks and fintechs participate in pilot programs focusing on Account Information Services (AIS) and Payment Initiation Services (PIS).

Use cases tested include personal finance management tools, SME cash flow optimisation, and secure payment solutions.

2023 (Q4): Launch of Phase 1 - Account Information Services

SAMA formally rolls out Phase 1 of Open Banking, prioritising Account Information Services.

Consumers can now access consolidated views of their financial information across multiple accounts, enabling better financial decision-making.

Early adopters among banks and fintechs begin offering innovative AIS-based products.

2024: Launch of Phase 2 - Payment Initiation Services

Phase 2 focuses on enabling Payment Initiation Services, allowing consumers to initiate payments directly from their bank accounts via third-party applications.

This phase opens up opportunities for more seamless payment experiences, reducing reliance on traditional payment gateways and enhancing transaction speed.

2025 and Beyond: Expansion and Open Finance

SAMA explores the broader implications of Open Banking by integrating it with Open Finance initiatives.

The framework expands to include additional financial products like insurance, investments, and pensions, fostering a more comprehensive financial ecosystem.

Continued innovation in API standards ensures scalability and cybersecurity enhancements.

Most Open Banking initiatives follow similar ‘Ideation, Strategy, Consultation, and Implementation’ beats, and KSA's implementation isn’t too dissimilar from the UK's in that regard.

Saudi Arabia’s process has few surprises, and even the players across the ecosystem have clear parallels.

Similar Game. Similar Players ♜

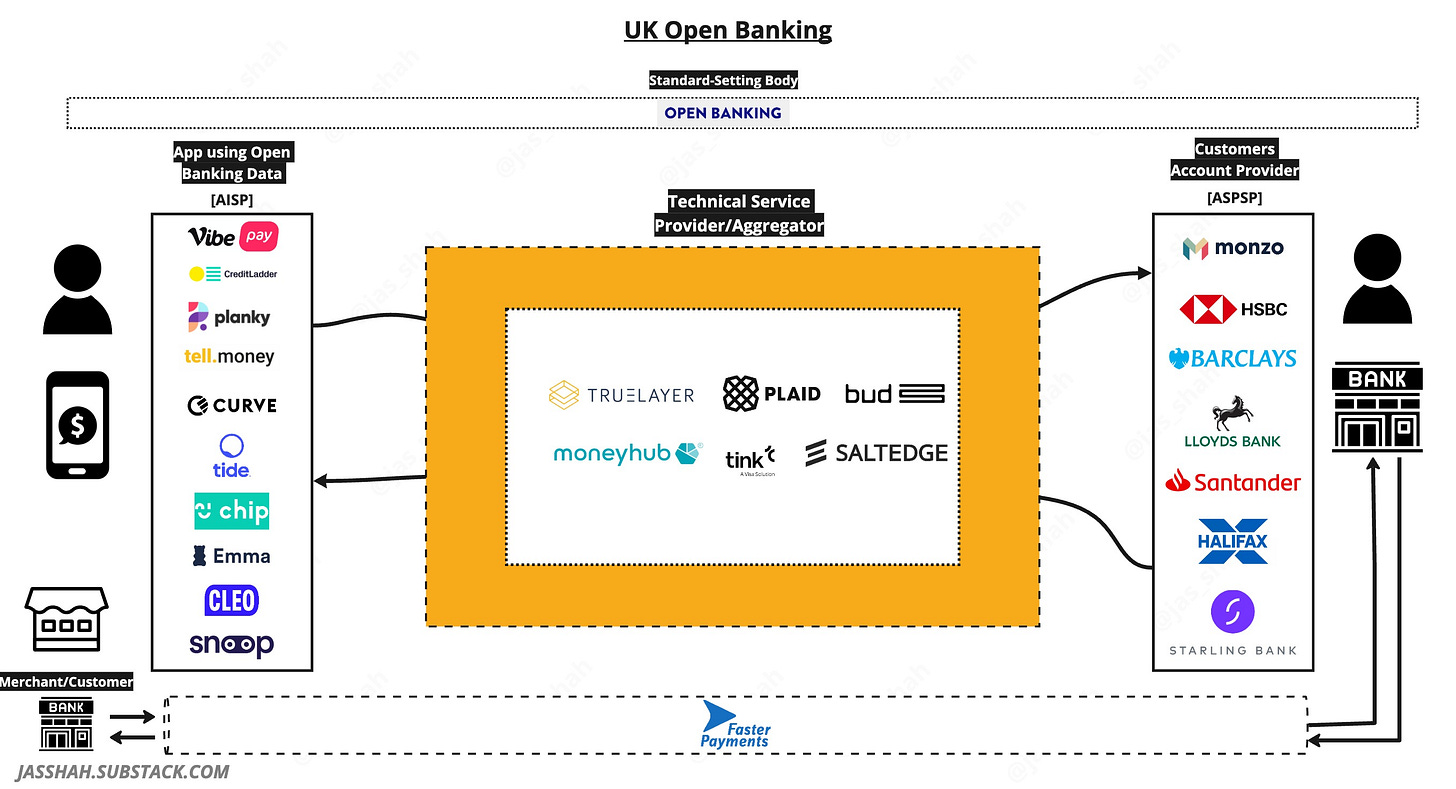

The UK’s Open Banking scene has a few key players, most of which I outlined in this modified overview from 2021.

Regulatory oversight of Open Banking and the implementation of the standards is set and monitored by the Open Banking Implementation Entity (OBIE), now known as Open Banking Ltd.

Banks or ASPSPs (Account Servicing Payment Service Providers) like HSBC, Barclays, and Natwest provide and maintain a payment account for a payer and, with appropriate consent through Open Banking, allow third parties to access account data and initiate payment requests.

Technical Services Providers like Tink, Truelayer, Plaid, and SaltEdge are regulated entities that have built connections to the major ASPSPs and provide a single point of integration to access an aggregated set of account and payment initiation services. They are sometimes called Third-Party Providers or Aggregaters.

AISPs and PISPs are the service providers who either display and give various insights on top of Account Information OR who allow Payment Initiation through their products. Sometimes both. For the most part, these are fintechs like Snoop, Cleo and others using account info to aggregate into a dashboard, create bespoke credit profiles, allow for bespoke accounting platforms, and fintechs like VibePay who use Open Banking to facilitate P2P payments or Crezco who facilitate B2B payments.

The Real-Time Payment Rail that powers the Account-to-Account payments initiated by a PISP in the UK travels via the Faster Payments network.

End users aside, these are the leading players, and the Saudi stack is essentially a carbon copy.

KSA Open Banking Players

Regulator

👉🏽 Saudi Central Bank (SAMA): This body leads the regulatory charge, ensuring compliance with Vision 2030's financial inclusion goals. It is slightly different from the separate body that was set up in the UK as it has a broader role akin to the FCA or SEC in the US, but part of its role is to perform similarly to the OBIE in its management and oversight.

Banks or ASPSPs

👉🏽 Riyad Bank, Al Rajhi Bank, Saudi National Bank (SNB), and Banque Saudi Fransi (BSF) are among the 11 local banks Collaborating with fintechs to offer Open Banking-enabled services.

Technical Service Providers

👉🏽 Tarabut Gateway: A regional Open Banking platform active in Saudi, Bahrain, and the UAE.

👉🏽 Lean Technologies: A Saudi-based fintech providing Open Banking APIs to streamline data sharing securely.

👉🏽 Spare: A Saudi founded Open Banking platform that allows businesses to access their clients' financial data

NOTE: Seen Tarbi has also been added to the permitted list by SAMA

Fintechs Leveraging Open Banking AKA AISPs and PISPs

👉🏽 STC Pay: Expanding its ecosystem with Open Banking for real-time account aggregation and payments.

👉🏽 Tamara: Incorporating Open Banking for creditworthiness and consumer-friendly BNPL solutions.

👉🏽 Wafeer: Using Open Banking to offer tailored savings recommendations.

👉🏽 Geidea: A payments company that utilises open banking for enhanced services.

👉🏽 Hakbah: A fintech startup, offers alternative savings and investments using Open Banking APIs to provide more personalised investment options.

Real-time payment rails

👉🏽 Sarie: Saudi’s ISO 20022 standard instant payment system that facilitates A2A payments initiated using the Payment Initiation Service. It’s also sophisticated enough to facilitate payments using aliases such as a mobile number or email address.

UK vs KSA Open Banking 🇬🇧 🇸🇦

Open Banking initiatives tend to have quite similar beats, and as you can see from the above, many of the same key players are involved, with many of them even named the same. Much of this stems from the UK implementation being seen as the gold standard.

Although on the face of it, it looks like a cookie cutter “Ctrl+C, Ctrl+P” implementation of the UK, Saudi does have some key differences.

The Approach: Hybrid vs Regulatory-Led

The UK’s implementation of Open Banking was regulatory-led and driven by the CMA's in response to the need for greater competition and innovation in the banking sector, stemming from the EU-mandated PSD2. The mandate came with strict timelines and a centralised governance model through the OBIE.

KSA’s approach is a little more hybrid. While the Central Bank has taken a strong regulatory role in setting frameworks and standards, there’s a noticeable emphasis on collaboration with market players. The rollout balances regulatory oversight with a market-led approach, encouraging financial institutions to innovate and co-create solutions. This flexibility has allowed KSA to prioritise strategic objectives, such as financial inclusion and Vision 2030, while gradually ramping up compliance.

The API: UK’s Mature API Standards vs KSA’s Localisation and Flexibility

The UK's Open Banking API standard, developed by the OBIE, is still considered the gold standard, with detailed specifications on endpoints, security protocols, and data structures.

In KSA, the API standards are mostly taken from the OBIE specifications but tailored to local needs. For example:

Localisation for Islamic finance: API standards in KSA account for Sharia-compliant financial products, such as profit-sharing accounts, which are not present in UK specifications.

Enhanced data privacy measures: Given the cultural and regulatory emphasis on privacy in KSA, API standards may have stricter guidelines for handling and sharing personal data.

Broader scope for inclusion: While the UK's APIs focus heavily on retail banking, KSA’s APIs extend support for SME banking and underserved segments, aligning with Vision 2030 goals.

SAMA has also left room for iterations and feedback, enabling continuous improvement based on real-world adoption.

If you're after technical specs, you won't go far wrong if you look at the ones still on the OBIE site, though…

The Rollout: Prioritising Use Cases and Phased Implementation

A major positive difference in KSA’s implementation is the clear focus on use cases. While the UK rollout initially focused on meeting regulatory requirements and achieving compliance among the nine largest banks, it lacked a strong consumer-centric narrative, which slowed early adoption. I covered that in depth at the start of last year with this write up:

KSA, on the other hand, has emphasised key use cases from the outset:

Financial inclusion: Open Banking is seen as a tool to bring more unbanked and underbanked individuals into the formal financial system.

SME empowerment: By enabling easier access to credit and financial tools for SMEs, KSA aims to bolster one of its key economic drivers.

Islamic finance: Open Banking solutions are tailored to meet the needs of Sharia-compliant products, ensuring relevance for the local market.

It has also adopted a phased implementation strategy, starting with Account Information Services and gradually expanding to Payment Initiation Services, which launched in September '24. This staged rollout allows the ecosystem to mature while ensuring consumer trust and system stability.

Beyond the Rails: How Open Banking Powers Opportunity and Growth for All 🛤

The opportunities for Open Banking in the region for these key groups are clear:

For Consumers:

Seamless account aggregation for better personal finance management.

Transparent and faster payment processes.

Access to tailored financial products.

For SMEs:

Simplified multi-bank connectivity for cash flow management.

Faster access to loans and credit through improved financial profiling.

Reduction in payment processing costs.

For Banks:

Opportunities to collaborate with fintechs instead of competing.

Enhanced customer retention via value-added services.

And For Fintechs & Digital Innovators:

Allows them to develop, test and launch innovative products more quickly by leveraging secure, standardised data access, which, also helps fintechs better understand user needs

By integrating data from multiple sources, fintechs can offer seamless, holistic solutions for users, such as integrated personal finance apps or unified payment platforms.

I said global Open Banking frameworks have similar beats and they have broadly similar beneficial impacts as well including:

🚀 Access to real-time financial data which allows lenders to assess creditworthiness with greater precision, reducing biases and enabling faster loan approvals

🚀 Consumers gaining a holistic view of their finances, enabling better budgeting, savings, and investment decisions (in theory)

🚀 Standardised APIs, which encourage fintechs and financial institutions to collaborate, driving the creation of cutting-edge products and services.

🚀 Payment Initiation Services simplifying transactions by enabling direct account-to-account payments, reducing costs and improving transaction speeds, meaning businesses benefit from lower processing fees and enhanced checkout experiences for their customers.

🚀 Secure access to financial data, which enables underserved populations to access tailored financial products, bridging gaps in traditional banking services.

🚀 Automation of processes such as onboarding, credit checks, and payments reduces operational costs for financial institutions.

Sidebar: This is my message to fintech innovators in a region that sees Open Banking rails go-live

It’s easy to develop broad ideas of where Open Banking can be applied to create regional solutions. But rather than aimlessly speculate on those solutions and areas, I’m using the previous primer to outline informed opportunity areas where Open Banking can drive real product innovation.

Saving, Spending, and Financial Literacy 🤓

In Saudi, financial habits are shaped by a strong preference for savings over debt, reflecting cultural values around fiscal responsibility. Although credit card usage is rising, Saudis typically reserve credit for larger, planned purchases rather than everyday spending, leading to a relatively low credit card penetration rate of 17%. Despite Vision 2030’s savings target, projections reveal a 55bn SAR gap between household disposable income and actual savings levels, underscoring the need for tools that encourage and simplify savings.

The push towards a cashless economy is also evident, with 57% of consumer transactions now cashless, fueled by e-commerce growth and widespread adoption of digital payments. Vision 2030’s cashless target opens the door for fintechs to develop digital tools that further reduce reliance on cash.

Financial literacy is also a concern with rates among the youth at around 38% which is lower than the UK, Germany and South Africa so there is a clear need to build effective and impactful education tools, especially for the youth.

OB-Powered Solutions:

🧠 Open Banking APIs can integrate with micro-savings apps, automated budgeting tools, and goal-oriented platforms to help individuals save more effectively. Financial literacy-focused features embedded in apps can educate young Saudis on how to build smarter financial habits.

🧠 Open Banking supports A2A payments, digital wallets and BNPL solutions, reducing reliance on cash and aligning with Vision 2030’s cashless targets. Personalised spending insights from Open Banking data encourage responsible financial behaviour.

🧠 Gamified OB-powered PFM apps with real-time feedback can teach budgeting, credit management, and investing, fostering financial literacy from a young age and improving overall financial literacy rates. Once users have accounts to access, standalone education apps for different age groups can be developed and connected directly to account data using Open Banking.

Wealth and Investing 💰

Saudi Arabia’s retail investment participation is only 20%, compared to global averages of 60% in some regions, signalling untapped potential.

Younger Saudis are interested in diversified assets such as stocks, ETFs, and Shariah-compliant products, but access to user-friendly, low-cost investment tools remains limited.

Many prospective investors lack the confidence and knowledge to engage with financial markets, further contributing to the low participation rate.

OB-Powered Solutions:

🧠 Open Banking payments tech such as VRP can be used to create ‘Invest as you spend’ products that sweep money into investment accounts as consumers purchase goods.

🧠 Open Banking data can power platforms that educate users about financial markets, increasing transparency and trust.

🧠 Tools focused on goal-based investing can attract younger investors seeking customisation and affordability. Open banking can help create sustainable goals based on income and spending, then sweep funds into an appropriate investment account

SME Enablement 🗄

SMEs account for 99% of businesses in Saudi Arabia but face a financing gap of 117 billion SAR, with high-interest rates and stringent credit requirements limiting access to funding.

Many SMEs are in the early stages of digital transformation and struggle with cash flow management, invoicing, and regulatory compliance.

SMEs currently contribute 28.7% to GDP, falling short of the Vision 2030 target of 35%, underscoring the need for innovative financial solutions to bridge this gap.

OB-Powered Solutions:

🧠 Open Banking facilitates digital lending platforms that leverage transaction data to assess creditworthiness and extend loans to underbanked SMEs, helping address financing gaps.

🧠 It speeds up the implementation of Embedded Finance solutions allowing easier integration with SME workflows providing access to capital without additional administrative burden.

🧠 Open Banking allows for a much more seamless real-time monitoring of cash flow, automated invoicing, and streamlined payment processing for SMEs. It also lowers the barrier to entry for fintechs wanting to create new solutions in the space.

🧠 Open Banking solutions can enhance financial services for high-growth sectors like e-commerce by enabling seamless payment solutions and supply chain financing.

The broader benefit of Open Banking in the kingdom across all opportunity areas is that fintechs and banks will be able to innovate faster and have a more complete picture of SMEs and Consumers, which should ultimately lead to better outcomes for all parties.

This use of technology to innovate faster also fulfils a ‘higher purpose’ in that it helps achieve the fintech goals set by the government and the ruler of the kingdom, Mohammed bin Salman (MBS), as part of Vision2030.

These include:

Increasing the SME sector’s GDP contribution to 35%

Raising household savings from 6% to 10%:

Building a cashless society with over 70% digital payments by 2030

And maybe the most ambitious target is to establish 525 fintech companies in the region by 2030. The current number is around 215, so we are essentially looking to double the current figure in five years, which is nearly 50 fintech companies per year.

I predict that at least a quarter of the 200 companies they aim to build over the next five years will be based on Open Banking, and frankly, using Open Banking is the best way to get close to that 525 fintech target.

Before ending this KSA Open Banking deep dive I want to reference a relevant cultural phenomenon I learnt about during my most recent time in the region, known as a Majlis.

Majlis (maj·lis) is a centuries-old tradition in the Arab world, symbolising a gathering space where people come together to share ideas, discuss challenges, and propose solutions. Traditionally, Majlis gatherings were primarily attended by men, but this is evolving as inclusivity grows. Discussions in a Majlis can range from politics and business to personal matters and community issues.

A Majlis can take place in a formal sitting room, but it’s also common to hold these gatherings in the serene deserts during the winter months, where the environment fosters deeper reflection and meaningful dialogue.

This tradition provides the perfect metaphor for ideation and problem-solving in today’s digital world. In this metaphorical Majlis, different groups should be ideating and exploring Open Banking innovation in the following ways:

In a Banking Majlis:

Banks could discuss how Open Banking can enhance customer retention by offering personalised financial products. And how they can implement a bank led open banking ecosystem to attract fintechs to build in an incubated and supported environment.

Collaboration opportunities with fintechs to improve services like account aggregation, payment initiation, and financial planning could be explored.

In a VC Majlis:

Investors might debate the most promising fintech opportunities enabled by Open Banking, such as embedded finance, BaaS platforms, or RegTech solutions.

Strategies for identifying and funding startups that leverage Open Banking data to create unique value propositions could be highlighted.

In a Fintech Majlis:

Fintech founders and teams could brainstorm innovative use cases, such as gamified PFM tools, Shariah-compliant investment platforms, or SME-focused cash flow solutions.

They could also discuss how to build scalable solutions that align with regulatory requirements and market demands.

In a UK-Based Open Banking Majlis (ok, you’re less likely to be having a Majlis and more likely to be discussing this at a pub or other after-work mixer):

Open Banking-powered fintechs from the UK could consider how to adapt their existing solutions for the Saudi market, leveraging insights from the local demographic and regulatory landscape.

They could explore partnerships with Saudi banks or regulators to create localised products that address specific consumer needs.

Saudi Arabia’s journey into Open Banking is a testament to the transformative potential of combining tradition with innovation. The Kingdom is not only adopting global fintech trends but shaping them to fit its unique cultural and economic landscape, and now you know a little more about where and how it can spark fintech innovation.

With a youthful, digitally savvy population, ambitious government initiatives, and a collaborative ecosystem, there are many exciting possibilities for fintech growth especially given the evolution of Open Banking in the region, and the lofty ambition of 525 fintechs by 2030.

Open Banking innovation in KSA a fast moving area that I’m paying close attention to and you should. 👀

That’s it from me

J.

Remember to like this edition and share it with a friend. Back again in two weeks 👋🏽

Fintech Spotlight 🔦: Vyne

Vyne is a UK-based fintech company specializing in Open Banking-powered payment solutions. It enables businesses to accept instant, account-to-account payments directly from customers, bypassing traditional card networks. By leveraging Open Banking technology, Vyne offers merchants lower transaction fees, faster settlement times, and reduced fraud risk.

For consumers, Vyne provides a seamless checkout experience, allowing them to make secure payments directly from their bank accounts without entering card details. Its platform supports a wide range of industries, including e-commerce, hospitality, and financial services, with a strong emphasis on improving both user experience and operational efficiency for businesses.

In 2024, Vyne was acquired by Middle Eastern Open Banking TSP Tarabut to rollout its services across the region.

I think this is one fintech to watch because there are a host of use cases now that PIS is live in the region including P2P payments, and business to business Pay by Bank.

Interesting News 🗞: HSBC shuts down Wise ‘rival’ Zing

You might think Zing is sound your money makes when it travels cross border, but no, it’s now the sound of a Wise rival shutting its doors after just over 1 year in the market.

I don’t want to go too hard on them, or to any great depth but this is the classic case of a bank copying a fintech and missing the mark. We’ve seen it with RBS’s ‘challenger bank’ Bo.

Too much spend early on.

Too many people on the project.

Changes in leadership.

No clear points of differentiation (in the product or the brand).

A familiar story with a familiar outcome.

I may do a post-mortem edition but for now, another bank’s fintech project bites the dust. 💀