Plaid: Stitching Together the Future of Finance 🪡

Plaid's origins from a PFM app to a data connectivity platform, a timeline of key events, an overview of its product stack, two major strengths, and

Hey Fintechers and Fintech newbies 👋🏽

This is an extra special edition that I wrote on This Week in Fintech, and sponsored by a fintech that I have a particular fondness for because of its area of operation, the way it's expanded over the past 11ish years, and its focus on data connectivity, a foundational component in the fintech ecosystem…Plaid.

Plaid built an Open Banking connectivity platform long before Open Banking was made official in the UK/EU in 2016 through PSD2 and over a decade before the recent finalisation of the 1033 rule from the 2010 Dodd-Frank Act in the US.

In this deep dive, I start in those early days of Plaid's journey from its founding to its rapid evolution, key products that continue to define it, its impressive product velocity and the opportunities that lie ahead as it shapes the future of financial connectivity.

Here’s what to expect:

Plaid’s original offering

A timeline of key events from 2013-Present Day

The Visa acquisition offer (an offer they DID refuse *Godfather voice*)

Future Fintech’s ‘Plaid Moment’

Their latest product launches

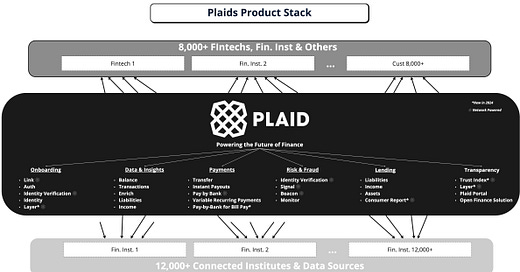

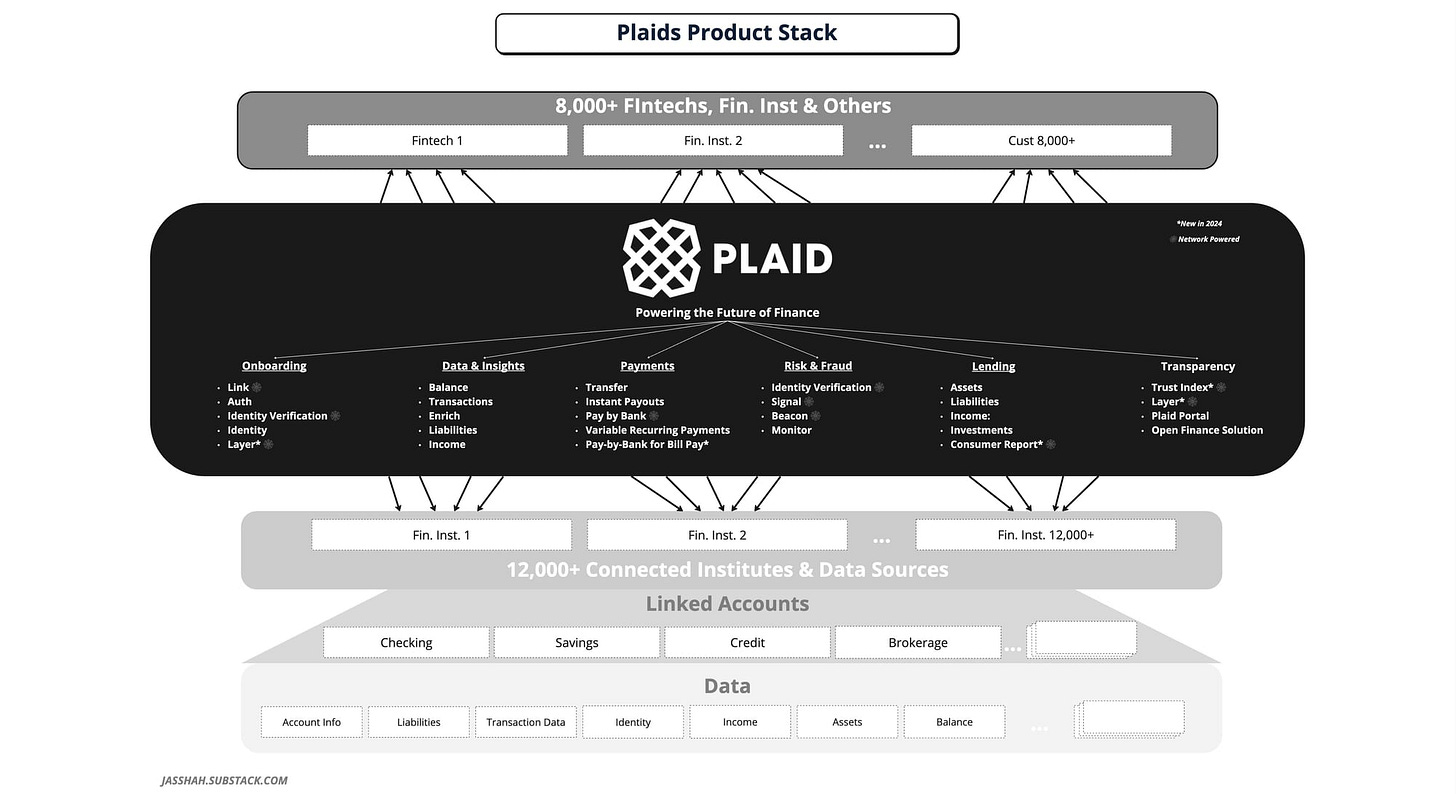

Overview of their broad product stack

Latest Plaid Numbers

Plaid’s two biggest strengths: Product Depth & the Plaid Network

Logical opportunities and some speculative ones

💡 This newsletter has been kindly sponsored by Plaid. Plaid provided some up-to-date numbers and product releases but this has been written independently, because frankly, I wasn't sure if the Plaid team would approve all my gifs and puns 😂.The Early Strands of Plaid 🪡

Plaid didn’t start out as a financial data connectivity for the masses.

Former Bain associates and Plaid founders Zach Perret and William Hockey initially planned to launch a consumer finance app to help people better understand and analyse their finances.

The inspiration came in 2012 after observing that customers were frustrated with financial products, they weren't getting the financial tools they needed, and there was a broader mistrust of banks at the time to look out for consumers' interests. This was post the 2008 financial crash and around the time of the Occupy Wall St movement, where frustration and lack of trust in traditional financial institutes reached a boiling point across the West.

Some of the things they were looking to build were certainly ahead of its time and long before the PFM boom of 2018 such as tools that could help consumers analyse their spending, recommending places where you could spend less money, and more broadly, helping consumers better understand spending habits and where they can improve.

The footprint of their early Personal Finance Management product can be seen in a snapshot of the original website where they talked about changing the way people use data.

However, they quickly realised that the challenge of creating customer-centric financial management products was much deeper than creating a front-end application.

“We started to realise we were struggling so much of the time because we couldn’t connect anything to financial services,”

William Hockey, Plaid’s then Co-founder & CTO and now founder of Column, said in an interview in 2013.

“The fundamental building blocks that make it really easy to build an application, we just couldn’t find.”

The bigger problem that needed solving was accessing reliable, standardised data from financial institutions. At the time, there was no universal way for developers to connect to bank accounts, retrieve transaction data, or perform authentication seamlessly. Each FI had its own data structures, security protocols, and login methods, which made it nearly impossible to scale a finance app that required connectivity to multiple banks, as the majority of the effort was spent on building those connections rather than creating a customer-centric and feature-rich consumer-facing app that solved genuine problems.

Note: The EU Open Banking framework designed to provide standardised access, security protocols and authentication was in its infancy at this time.

This realisation led to their pivot (cue the classic ‘Ross from Friends shouting “pivot”’ gif): instead of building a consumer-facing app, they would focus on creating the “plumbing” laying the foundation for the next generation of fintech applications.

In 2013, the Plaid we know and love today was born.

Their bold decisions did not stop there though. They realised that such a Big, Hairy, Audacious Goal (BHAG) would benefit from a prebuilt use case, so they joined the 2013 Disrupt NY Hackathon, and with the help of friend Michael Kelly, they built Rambler, a web app that let users view their credit and debit card transactions on a map and used the Foursquare API for locations and the Plaid API to access user spending data.

👀 FUN GAME: To show the size of the achievement of Rambler taking 1st prize at TechDisrupt, I've attached an image of the main hall above. Zach, William and Michael are in the above picture, kinda like a 'Where's Waldo' but for fintech. You have 30 seconds. See if you can find them (HINT: Use the image at the top right as a guide)They took first prize at the event, $5,000, and earned even more valuable press for the Plaid API in the process.

By 2014, Plaid had begun attracting early adopters, including notable fintech startups like Venmo and Acorns. Venmo, with its innovative peer-to-peer payment system, leveraged Plaid’s API to provide users with seamless bank account linking, enabling instant transfers between friends. Acorns, a micro-investing app, used Plaid to automate the process of rounding up purchases to the nearest dollar and investing the spare change.

These early clients underscored Plaid’s role as a critical enabler for fintech innovation.

The timing was also ideal, as the U.S. fintech sector was poised for massive growth, and many startups were looking to launch products that relied on secure, standardised financial data. Plaid's offering not only saved them countless hours of development but also enabled a consistent and reliable user experience, which was crucial in building trust in nascent financial technologies.

The Fabric of Fintech: Plaid’s Timeline of Connectivity ⏳

From those early hackathon days and early client wins to today, they've gone through quite the journey, growing the breadth of their financial data connectivity offering as well as the depth of those early features and experiencing a major acquisition attempt in the process.

2012-2013: Consumer Finance app and pivot to developer API

Founding & Early Vision: Zach and William launch Plaid with the goal of creating a consumer finance app to help users understand their spending.

Initial API Launch: Realising the challenges of connecting to multiple banks, they pivot to offering a data connectivity API for developers. This new direction aims to simplify access to financial data. This API provided functionalities like account verification and transaction data retrieval, laying the foundation for fintech applications.

2013-2014: Initial Client Traction

Early Clients: Plaid gains traction with clients like Venmo and Robinhood, who rely on Plaid’s API for account verification and funding connections, allowing users to link their bank accounts easily.

2015-2018: Scaling and Expansion of Product Suite

Series A Funding: Plaid raises $12.5 million from Spark Capital to accelerate its API development and expand its reach among U.S. fintechs.

Personal Finance: Launched a suite of data solutions to enable personal finance use cases, including transaction data, investment accounts and liabilities like loans and credit cards, so that PFMs can get comprehensive financial overviews for users.

Series C Funding: Raises $250 million in Series C funding led by Kleiner Perkins, valuing Plaid at $2.65 billion. This round includes major investors like Andreessen Horowitz and Index Ventures.

International Expansion: Began extending services beyond the U.S., starting with Canada, to support a growing global client base.

Plaid Link: Introduced in 2015 as a secure and user-friendly way for first-time fintech users to connect their financial accounts, setting a new industry standard

Auth Product: Plaid launched 'Auth,' facilitating instant account verification for ACH payments, reducing reliance on traditional micro-deposit methods.

Series B Funding: Secures $44 million in Series B funding in 2017, led by Goldman Sachs Investment Partners and also included Citi & Amex.

2019-2020: Strategic Acquisitions and Product Innovation

Acquisition of Quovo: Quovo, a data platform specialising in investment and brokerage accounts, was acquired to enhance Plaid's wealth management offerings.

Payment Initiation Services: Launched services enabling direct bank payments, positioning Plaid in the payments sector and offering alternatives to traditional card networks.

European Market Entry: Expanded into the UK and Europe, adapting products to comply with PSD2 regulations and supporting open banking initiatives.

2020-2021: Visa Acquisition Attempt

Visa Acquisition Attempt: In January 2020, Visa announced its intention to acquire Plaid for $5.3 billion, aiming to integrate Plaid's data connectivity solutions into Visa's stack. The U.S. Department of Justice filed an antitrust lawsuit to block the acquisition, citing concerns over reduced competition in the online debit market. In January 2021, Visa and Plaid mutually agreed to terminate the merger agreement, allowing Plaid to continue operating independently.

Series D Funding: Plaid raises $425 million in a Series D round led by Altimeter Capital, Silver Lake, and Ribbit Capital, along with long-standing investors like Index and NEA, elevating Plaid's valuation to $13.4 billion.

Big Bank Backers: JP Morgan Chase also participated in this round, marking a sea change from traditional finance and joining Citi, GS, and AMEX, placing a long-term bet on Plaid's transformative impact on FS.

Accelerated Adoption of Digital Finance: Plaid benefitted from the massive growth of fintech adoption as a result of COVID, which it noted grew from 58% to 88% in 2021 – a 52% increase year-over-year. This accelerated Plaid's roadmaps, as well as those of legacy players like banks and encouraged hyper-frenzied investment rounds in fintech companies, most of which were built on Plaid.

Open Finance Solutions: To help move the industry forward, Plaid released Plaid Exchange (now Core Exchange), a free toolkit to help banks and credit unions build safe, reliable and interoperable data connectivity for open banking services.

2021-2022: Advancements in Payments, Fraud Prevention, and Credit

Push Into Payments - Plaid announced a payment partner ecosystem with nearly 50 payment companies to integrate bank-based payments. In addition, it launched Plaid Transfer, an all-in-one bank payment solution and Signal, a machine-learning transaction risk engine to analyse the likelihood of ACH returns.

Fraud Prevention: First foray into fraud prevention with the acquisition of Cognito, an identity verification and compliance platform.

Identity Verification: Shortly after the Cognito acquisition, Plaid launched Identity Verification to streamline user onboarding and enhance security for digital financial services, enabling organisations to verify user identities swiftly, often in under 30 seconds, utilising liveness authentication and other advanced methods to combat fraud.

Monitor: Monitor was also launched, a tool that automatically scans customers against regularly updated government AML and politically exposed persons (PEP) lists.

Income and Employment Verification: Launched products to digitally verify income and employment status, assisting in lending decisions and financial planning applications.

2023: Deepening Fraud and IDV products, Plaid Check, and enterprise growth

Anti-Fraud Network: Plaid introduced Beacon, a collaborative anti-fraud network enabling financial institutions and fintech companies to share critical fraud intelligence via API aimed at enhancing fraud detection and prevention across the industry.

Expanded Credit Solutions: Plaid formed Plaid Check, a subsidiary consumer reporting agency (CRA) focused on building products for customers who want ready-made credit risk insights from consumer-permissioned cash flow data.

Verify Once, Verify Everywhere: In June 2023, it expanded its IDV offering by introducing a "verify once, verify everywhere" experience. This enhancement allows consumers to fast-track verifications across Plaid-powered apps and services, reducing friction during the onboarding process while maintaining compliance with KYC regulations.

Growth in Enterprise Clients: Plaid reported that its enterprise customer base had grown to over 1,000, with enterprise growth starting to outpace the rest of its business. This expansion reflects Plaid's success in diversifying its client portfolio beyond traditional fintech startups, adding the likes of H&R Block, Rocket Mortgage and Citi to its extensive client list.

You can see from the timeline that the broader mission of providing connectivity to the whole of financial services has gone much further than just transaction data, and the evolution from that initial consumer finance app idea to the present day has been rapid. Beyond transaction insights and connectivity to banks, it’s also enabling payment initiation (aka Pay by Bank), building fraud detection tools, providing income and employment verification products, and much more.

Fast forward to today, Plaid operates in 20 countries, powers 1000s apps, provides hundreds of millions of connections, and has helped power over half a trillion dollars in bank payments…

But before diving into its 2024 releases, here is a very short note on the Visa offer.

The Visa Offer 💳

There’s often talk of various companies ‘Instagram’ moment, i.e. being acquired at the time by a bigger company for what seems like an exorbitant amount and then going on to far exceed that purchase price over the next few years, making it seem like a bargain.

That could have been the case if the Visa acquisition offer went through in 2021.

However, the $5.3 billion acquisition didn’t end up going through, so the ‘Instagram moment’ didn’t materialise. Instead, Plaid went on to raise a Series D at a valuation of $13.4 billion, increased the depth and breadth of their offering, and continued to provide the rails on which thousands of organisations build valuable products.

In the future, fintechs that go through an acquisition process that ultimately falls through, then go from strength to strength and nearly triple its acquisition value within a year should be known as ‘having its Plaid Moment’.

The other reason for referencing the Visa offer again (other than squeezing in a quick Godfather gif) is to link back to the deck Visa put together and, specifically, this diagram. A great overview of Plaid’s key position in the ecosystem at the time.

New Threads for 2024 🧵

Now to 2024. The themes of its big releases this year are clear. Improving the conversion and experience of onboarding, deepening its credit offering, broadening its payment capabilities, and tackling fraud in various forms. Here are the products that signalled those themes:

Onboarding

Layer: In June, Plaid released 'Layer,' unifying critical onboarding steps like identity verification and bank account linking into a seamless experience, providing almost instantaneous onboarding for users already part of the Plaid network. Layer can reduce sign-up time by up to 90% and increase conversion by 25%. Consumer lenders Possible Finance and Empower are among the early adopters.

Payments

Pay-by-Bank for Bill Pay: Allows users to make bill payments directly from their bank accounts, providing businesses and consumers with a secure, seamless, low-cost alternative to card-based transactions with up to 40% lower processing costs than traditional cards. For the 1 in 3 US adults already part of the Plaid network with a connected account, it offers a true, fast and secure alternative to cards and is already in use by early customers in telecommunications, property management, insurance, automotive and more.

Credit

Consumer Report: Launched its first cash flow underwriting solution that provides lenders with cash flow data and insights for smarter decisioning. With access to a borrower’s inflows, outflows, Plaid provides additional insights into gross and net income, as well as, predicted next pay check dates. In addition, Consumer Report also provides lenders with deeper insights and attributes that help to predict credit risk based on an applicant’s connection history across the Plaid network that allow lenders to better understand applicant creditworthiness on a more granular level.

Fraud

Comprehensive Fraud Prevention Suite: In October, Plaid launched an enhanced fraud management suite that includes Fraud Calibration, Refine Risk Models, and the Plaid Trust Index. Fraud Calibration enables clients to mark sessions as fraud or non-fraud with a single click, refining algorithms and reducing false positives to minimise user friction. Refine Risk Models adds 11 machine learning scores to explain flagged sessions, allowing for fine-tuned adjustments without sifting through complex code. The Plaid Trust Index aggregates verification data into one trust score, offering a streamlined, holistic view of user reliability for quicker, more confident decision-making in fraud prevention.

Plaid’s Broad Tapestry of Products 🧶

Plaid’s product suite isn’t just expansive; it’s meticulously crafted to solve specific, complex needs across the financial landscape. From powering secure payments and verifying identities to providing comprehensive financial insights, Plaid’s offerings are the essential threads weaving together the fintech ecosystem, and I’ve mapped out those key threads as follows.

1. Enable Accurate Financial Insights

👉🏽 Enable better personal financial management with up-to-date balance information, transaction categorisation, and insights, empowering users to make informed financial decisions, manage budgets effectively, and enabling personalised financial insights and assessments.

Real-time financial data: Real-time account balance checks, ensuring up-to-date financial insights.

Transactions: Aggregated and categorised transaction data to better support budgeting and spending analysis.

Enrich: Enhances transaction data with categorisation, enabling personalised spending insights and budgeting tools.

Liabilities: Shows outstanding obligations, giving a balanced view of a user's credit risk.

Income: Verifies income details, supporting loan assessments and financial planning.

🧠 Example: PFM apps use Balance, Transactions, and Enrich to provide users with real-time budgeting insights and financial health tracking, incorporating Income and Liabilities for a full financial picture.

2. Facilitate Secure and Reliable Payments

👉🏽 Enable fast, secure, and direct bank payments that offer a reliable alternative to traditional card-based transactions.

Transfer: Supports ACH transfers for secure bank-to-bank payments, combining account authorisation, risk assessment and processing via a single API. It also supports FedNow and RTP for instant payouts from investment accounts, loan disbursements, insurance claims and more.

Pay by Bank: Supports a range of use cases from account funding, bill pay and e-commerce that allows consumers to pay directly from their bank accounts, reducing fees and improving payment security. Works with Plaid's payment partner ecosystem.

Signal: A payment transaction risk engine that helps companies better predict the likelihood of ACH transaction returns using machine learning. This allows companies to deliver faster and even near-instant payment experiences without increasing risk.

🧠 Example: Billers and merchants integrate Pay by Bank to reduce fees on direct bank payments and use Instant Payouts to ensure fast disbursements to merchant accounts, streamlining cash flow.

3. Simplify User Onboarding and Verification

👉🏽 Make onboarding quick, seamless, and secure by offering tools that verify user identities, link accounts, and reduce user friction in financial applications.

Layer: Combines identity verification and account linking steps in a single flow, reducing user drop-off and improving the onboarding experience.

Identity Verification: Verifies user identities either by bank account verification or via our identity verification and liveness ID document verification, liveness checks, risk analysis, and anti-money laundering watchlist screening.

Plaid Link: Allows users to securely link bank accounts to applications with ease.

Auth: Enables fast, reliable account verification for ACH payments.

🧠 Example: A digital bank uses Plaid Link and Auth for seamless account linking and Layer to streamline onboarding steps, reducing drop-offs and enhancing the user experience.

4. Enhance Fraud Detection and Risk Management

👉🏽 Detect and prevent fraud while managing risk, leveraging real-time data and industry-wide intelligence to safeguard users and minimise financial losses.

Identity Verification: Confirms user identity for compliance with KYC and security needs.

Signal: Predicts the likelihood of transaction returns using machine learning to help businesses manage payment risk.

Beacon: Anti-fraud network to enhance fraud detection industry-wide through shared fraud intelligence, bank account insights from the Plaid network, and data breach reports.

Monitor: Scans customers against regularly updated government AML and politically exposed persons (PEP).

🧠 Example: Companies use Beacon to access shared fraud intelligence, helping detect and prevent fraud effectively among new and existing users.

5. Improve Lending and Credit Decision-Making

👉🏽 Support informed lending decisions with comprehensive insights into users’ financial standing, income, and liabilities, ensuring accurate credit assessments.

Consumer Report: Enables low-friction cash flow underwriting for lenders, with the ability to see user inflows, outflows, income streams and a user’s held assets to give lenders a clear view of a borrower’s financial health.

Liabilities: Shows outstanding obligations, giving a balanced view of a user's credit risk.

🧠 Example: Lenders use Consumer Report to assess loan applicants comprehensively, enabling faster, data-driven lending decisions.

6. Enhance Consumer Trust and Transparency

👉🏽 Build user trust by simplifying account verification and linking, providing clear insights into data usage, and ensuring a secure and transparent experience.

Plaid Trust Index: Combines verification data for a comprehensive trustworthiness score.

Open Finance Solution: A suite of free tools to help banks and fintechs deliver safe, secure Open Banking experiences and meet requirements, including API access, permissions management and app directory capabilities.

Layer: Creates a unified verification flow, building user confidence and improving transparency in data sharing.

Plaid Portal: Consumer dashboard that allows users to see and manage connections made through Plaid. An important product giving consumers ultimate control over their data, which could also be crucial as part of any future Digital Identity products.

🧠 Example: Plaid Portal allows users to review and manage their linked financial accounts, enhancing transparency and control over their data. Open Finance Solution allows banks and other companies to build similar portal experiences within their own services.

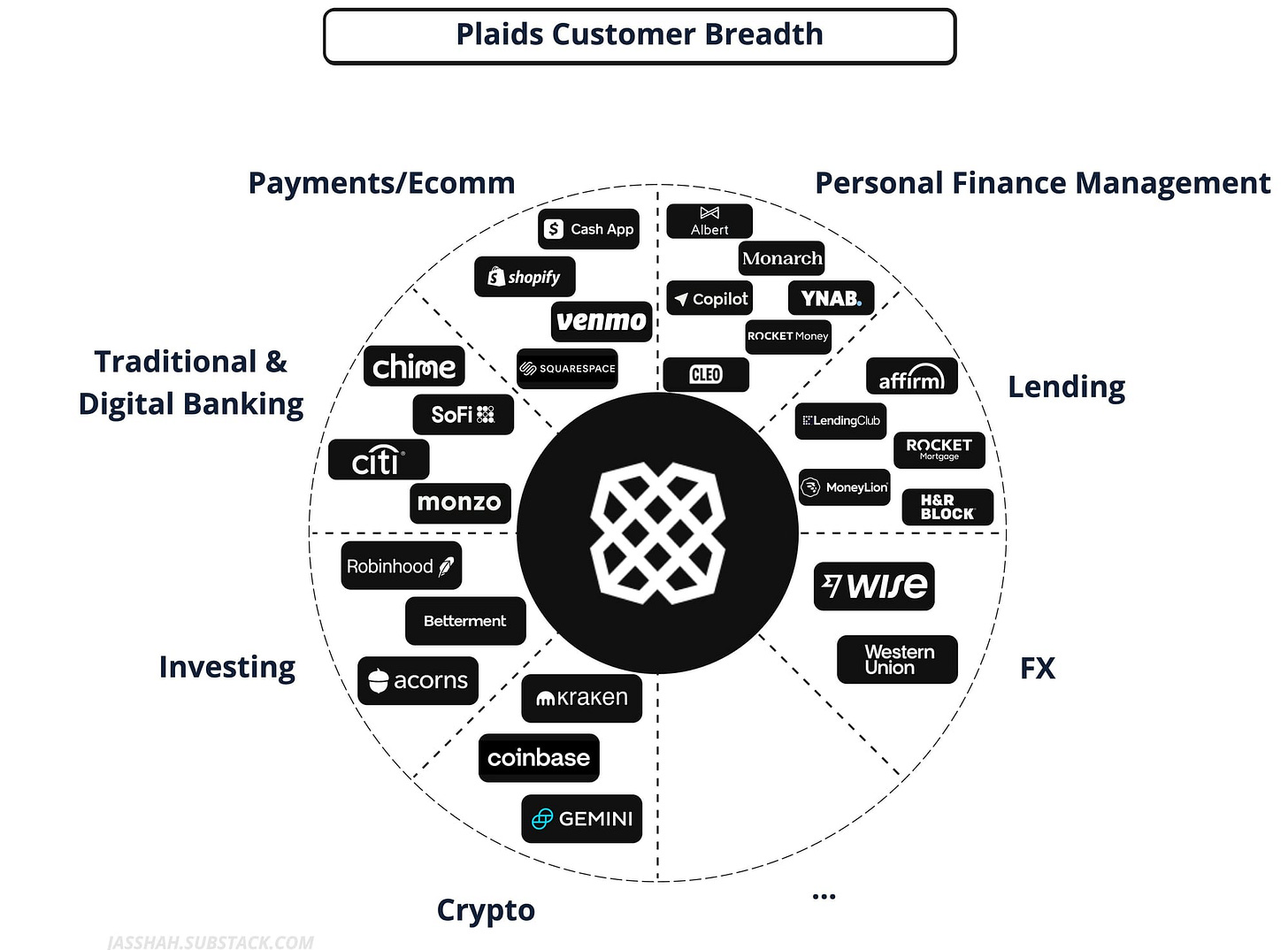

Plaid’s Customer Breadth

Plaid's diverse client base reflects the expansive reach of its financial data solutions across multiple industries, demonstrating its versatility and widespread applicability.

Starting with fintech, Plaid quickly became the backbone of major financial apps, supporting clients like Robinhood, Betterment, and Acorns in the investment space and CashApp, PayPal, and Venmo in payments. As digital banking surged, prominent names such as Chime, Monzo, and SoFi leveraged Plaid's tools to streamline onboarding and secure bank connections for users.

Plaid's influence extends further into eCommerce and consumer payments with platforms like Shopify and Squarespace, which rely on its services to offer seamless payments and user verification. In lending, companies such as Rocket, LendingTree, and Affirm use Plaid to access borrowers' financial profiles, improving credit assessments and loan processing. Crypto players, including Coinbase and Kraken, also rely on Plaid for secure user verification, account funding, and bank linking.

Then, coming full circle to where it all started, Personal Finance Management they continue to support apps like Rocket Money, Cleo, YNAB, and Monarch Money, which use Plaid to offer budgeting and financial insights.

As Open Banking continues to evolve, Plaid's extensive client base positions it to seize new opportunities across multiple sectors, especially as Open and Embedded Finance gain momentum. While Plaid's penetration with major players in core industries is substantial, there remains ample potential to deepen its influence within these sectors and broaden its reach across new ones.

Numbers paint a strong picture 🖼

Plaid's reach and impact across the financial landscape are significant. With hundreds of millions of account connections, Plaid enables more than one in three U.S. consumers with a bank account to connect through its platform. Covering over 12,000 financial institutions—including major fintech players like Chime and Robinhood—Plaid facilitates 500,000+ new connections daily across the US, Canada, and the EU, helping drive innovation and growth for thousands of fintech partners.

In payments, Plaid has powered over $500 billion in bank transactions, with Signal protecting $50 billion annually from unauthorised activity. Its fraud prevention efforts have saved customers tens of millions of dollars by verifying millions of identities each month, ensuring secure and trustworthy transactions.

Plaid's Layer product has transformed onboarding efficiency, enabling users to sign up for financial apps in seconds. It can reduce onboarding time by up to 90% and has been shown to boost conversion rates as much as 25%—a substantial improvement to the industry gold standard rate of 2% increases.

Together, these metrics showcase Plaid's pivotal role in making financial services safer, faster, and more accessible—providing the perfect backdrop for its unique strengths.

Plaid’s Major Strengths 🏋🏽♀️

Plaid has many strengths, but in my opinion, two in particular have been instrumental in driving its powerful scalability, leading to those impressive numbers over the past few years.

1. Product Breadth & Depth

I've referenced product depth throughout, and for a good reason—it's one of Plaid's biggest strengths. Plaid isn't just about technical connectivity rails; if it were, major fintechs such as the ones in the 'client wheel' would likely have bypassed it and built direct connections themselves.

Both enterprise clients and startups are looking for more than a one-off problem-solver. They need a partner who can help tackle multiple challenges as they scale. With Plaid's expansive breadth of products, clients can address a range of needs—from fraud prevention and credit underwriting to streamlined payments—without turning elsewhere.

In addition to its breadth, the depth of its products across onboarding, credit, payments, and fraud puts Plaid in a position to deliver increasing value to its broad customer base. More than half of Plaid customers already use multiple products,, making it a trusted partner as they and their customers continue to expand in the financial landscape.

2. Network, Network, Network

Its biggest strength is the power of its network and its use of the 'Network Effect' in its products.

The network effect is when a product or service becomes more valuable as more people use it. It creates a positive feedback loop: as more users join, the product improves, which attracts even more users, enhancing the experience for everyone involved. LinkedIn is a great, well-known example of a product that benefits from the network effect. As more professionals join LinkedIn, it becomes a richer network for job seekers, recruiters, and companies alike.

As Plaid's network grows, so does its ability to generate unique insights, leverage past interactions, and enhance the accuracy and security of each experience. The network effect is baked into several of Plaid's products, which means that as more customers join the ecosystem, the products become richer and more accurate.

Plaid's network effect also boosts payment security.

Signal uses insights from millions of transactions to help businesses predict the likelihood of ACH returns, refining its accuracy with every new data point. Similarly, Beacon draws from Plaid's extensive network to identify and prevent fraud, using collective insights to recognise patterns across accounts. Other products across its credit and onboarding portfolio rely on this shared intelligence, drawing from Plaid's network to build tools like the Trust Index and fraud scores, which help companies assess risk more accurately.

Layer also benefits from what Plaid calls "remembered experiences," where a user's past verifications make future onboarding almost instantaneous across Plaid-powered apps. This not only makes the experience more seamless for the user but also ensures trusted accounts across the board.

Plaid's baking of the network effect into its products gives it a perpetuating advantage, which means that as they onboard more customers and the network grows, it improves the impact and effectiveness of its existing insights, onboarding, payments, fraud, credit, and trust products. This, in turn, makes the overall offering richer and easier to attract customers, and the cycle continues.

Opportunity Knocks 🚪

Despite the growth of its product stack, there are still many opportunities. Some are pretty clear based on the 2024 releases, and some require a little more creative thinking.

Lending/Credit: Plaid's ongoing development in credit shows a clear opportunity to deepen its role in lending. As cash flow data heats up, Plaid could support more accurate credit assessments and streamlined loan applications and help reshape the credit landscape for years to come.

Anti-fraud (network-powered insights): With its extensive network and fraud tools like Beacon and Signal, Plaid is well-positioned to leverage collective insights, giving clients a stronger defense against emerging fraud threats through holistic risk assessment. Similar to the services Early Warning Systems provides to large banks, Plaid could become the next anti-fraud network for the fintech ecosystem.

Pay by Bank: The successful rollout of Pay-by-Bank for bill pay suggests an opportunity for Plaid to expand direct bank payments through its broad network of payment processor partners, offering businesses and consumers a lower-cost, more secure alternative to card-based transactions across even more industries, especially in the U.S. market where check digitisation is becoming the new normal. This shift is gaining momentum as more businesses recognise the benefits of faster settlement, reduced fees, and enhanced security associated with direct bank payments. Plaid is well-positioned to capitalise on this trend, supporting various industries—from telecommunications and property management to insurance and automotive—and expanding access to a more efficient, digital-first payment experience.

Future Looking Opportunities

Backend tools: As Pay-by-bank grows in popularity, more organisations will look to better understand bank payments' performance, conversion rates, and the performance of different FIs more broadly. Backend management tools that pull together performance and activity across Pay-by-Bank, Layer, Credit Reports, and other tools will also become more valuable as Plaid's product depth increases.

Embedded X: Embedded Finance is regularly touted as a $7.2 trillion opportunity by 2030. Plaid's new lending products and clear expansion into the lending ecosystem make it a viable tech partner for EF propositions where fintech lenders are embedding into other financial products such as bank accounts and accounting platforms. But beyond riding the existing wave, it also has the potential to work with more non-financial enterprise institutes on their embedded solutions and further expand their industry segments. Working with Car Dealerships, for example, to power the risk engine using its insights and credit features for an embedded finance and insurance offering for car buyers and leasers. Or embedding Pay-by-Bank for gig economy workers like those in Uber and DoorDash, which routes a portion of each payout directly into a savings or retirement account, creating automated payroll-linked savings to cover those uncertain periods. Embedded Payments, Finance, insurance, etc, offer a huge opportunity to further expand Plaid's breadth of clients and depth of product offering.

Open Finance to Open Data: As Open Banking evolves into Open Finance—and ultimately Open Data—the scope of accessible accounts will extend beyond basic financial products, reaching into areas like mortgages, insurance, and even healthcare. This shift creates a huge opportunity for Plaid to broaden its connectivity across more account types, unlocking richer, more varied data for both existing and new clients. With its infrastructure already built to support diverse data sources, Plaid is well-positioned to provide insights that could reshape how people manage everything from property investments to health expenses, making it a valuable partner for organisations ready to leverage these emerging data streams.

Owning & Scaling Digital Financial Identity: One area that is fundamental to the success of the inevitable shift from Open Banking -> Open Finance -> Open Data is Digital Identity.

Plaid is already in a prime position to play a leading role in digital identity. As more interactions and transactions require robust identity verification, Plaid's existing ID Verification and Layer capabilities provide a solid foundation for expanding into this space. An enhanced version of Plaid Portal could also give users a tool to have complete control over their digital identity, including where it's been used and where it should be revoked.

By leveraging its existing network of connected financial institutions and embedding "remembered experiences" for identity verification, Plaid could become a trusted digital identity provider in finance and sectors like healthcare, real estate, and government services. This move would enable Plaid to support single sign-on experiences, streamlined verification across platforms, and even secure data portability for users, positioning it as a frontrunner in the rapidly growing digital identity market.

I can see a not-too-distant future where 'Sign up with PlaidID' is an option across a range of products & services. This would give customers faster access to consumer finance, SMB finance, mortgage eligibility decisions, and the best pension options while also giving the provider an instant KYC with a ported identity.

It not only supports shift from Open Banking to Open Finance, but is also the crucial hurdle for any successful Embedded Finance, Insurance, Investments, Savings, giving the decision makers instant access to the high quality data required, and instantaneously answering the crucial fundamental KYC question of "Are you who you say you are?".

Banks in the Nordics and the UK are already playing in this space, but none have the depth of products, technological capabilities, and, most importantly, the network to dominate it as Plaid does.

Plaid's early beginnings are not too dissimilar from other successful fintech products like PayPal & Stripe.

Motivated founders trying to solve fundamental problems and then pivoting after discovering that the biggest challenges and potential opportunities lie further up the chain.

Similar to those behemoths, they've not just created a solution for a singular problem but traversed the problem tree to solve all sorts of financial data connectivity challenges, building out solutions for Fraud, Payments, and Lending along the way, which are areas they will continue to innovate in.

As their products become richer, they unlock new opportunities to capitalise on regions like the UK and EU as they bring out formal Open Finance and Open Data roadmaps. They are also able to leverage their position to provide the data infrastructure and foundations for Embedded Finance propositions and many other innovations to continue to power the world of digital finance.

Digital identity is fundamental to more seamless embedded experiences, the growth of Open Finance, and many other experiences as customers move more of their lives online. With its existing stack of Onboarding, Fraud, and Transparency products, it already has the foundations to build the future of financial identity and make a truly, portable, reusable, and secure Digital Identity a thing of the present rather than the distant future.

One factor that will undoubtedly be central to their continued success and power new products and improve existing ones, is their use of the network effect.

With every new connection, Plaid is strengthening the foundation for a more integrated and accessible financial ecosystem, and I, for one, am very excited to see how and where they use their network superpower to innovate next... 👀

That's it from me. Hope you enjoyed this deep dive

Jas. 👋🏽

P.S. If you’re interested in sponsoring an edition or working with me on something else product innovation and strategy related, reply to this or send me an email with details to jas@bitsul.co.uk 😊

Excellent content, Jas! Greetings from Brazil! 🙌