Fintech R&R ☕️-Superapps And Why Payments Are The Golden Glue

A primer, plus routes to growth in the West and Elon Musk's superapp ambitions

Hey Fintechers and Fintech newbies 👋🏽

Elon Musk is in the news again.

Media outlets often pounce on news involving the entrepreneur. Whether it’s for his controversial tweets, many startups, opinions on AI and sometimes hypocritical views on ‘truth seeking’.

And it’s been a busy news cycle for Musk.

Including the successful ‘launch’ of the biggest rocket ever and an hour long interview with the BBC about Twitter, which included a bit of a spat with the interviewer about hate speech and misinformation on the platform.

Some recent Musk news that I found particularly interesting and wasn’t covered in the lengthy interview was the merging of Twitter Inc. into X Corp, a holding company now wholly owned by ‘X Holdings Corp’ predicted to be the future holding corporation for all of his companies including SpaceX and Tesla.

Even though company restructuring can be interesting (not to me but each to their own), the more interesting area to me is the underlying meaning and motivation of the restructuring.

Commentators speculate that the merger of Twitter Inc. into X Corp is another signal of Musk’s desire to create a superapp (definition to follow later) or “everything app”, which will likely be named X.

Although Musk has publicly stated his intent to create a superapp, I think he’s already laid some groundwork for a ‘Social Media Superapp’ with subtle changes to Twitter’s features, which I’ll outline in more detail.

This made me think about superapps in general. From their customer value to their popularity in places like China, their infancy in the West, and the place for superapps in fintech.

So as well as my favourite tweet, interesting news, puns + movie references of course, this weeks short, sharp edition includes the following:

Elons obsession with X and his plans for a superapp

What is a superapp w/examples

Why superapps are less prevalent in the West

Payments as the glue for fragmented services

Practical examples that could lead to super app adoption

X marks the spot for Musk 🏴☠️

As you can probably tell, Elon has a bit of a fondness for the letter X. Something he’s stated publicly.

Some notable references across his companies and life include:

Tesla’s third car named Model X

Space exploration company SpaceX

Exa Dark and X AE A-XII (Officially X) the names of his youngest kids

Incorporating the OpenAI competitor X.AI back in March

X.com, his second company founded back in 1999

It’s the last example that was his earliest reference to X.

X.com was one of the early online bank accounts founded by Musk in 1999, which merged with Confinity, a payments platform that later became PayPal. During the merger, the domain name also became part of PayPal, which Musk finally repurchased in 2017.

The domain repurchase, the company restructure, and some comments from Musk before the purchase of Twitter caused some tech commentators to speculate about the potential of a superapp with a potential rename to X corp on the cards.

As I mentioned, I disagree with some of the speculation because some of the stones in a pathway towards a type of superapp have already been laid, not by the restructure.

However, context is everything. And the definition of a superapp seems to vary drastically from place to place, so I’ll first clarify what it is before diving into the steps X Corp Twitter is already taking towards one.

Everything. Everywhere. All at once 📱

A superapp –aka super app, superApp super-app– is an all-in-one mobile application that offers a wide range of services, such as messaging, social media, e-commerce, payment services, transportation, and food delivery, all within a single platform. It aims to provide users a seamless and convenient experience by integrating multiple services and features into one app.

The additional benefits of a superapp to the user are:

Cost-savings - Many superapps offer discounts, loyalty points and other incentives to use the platform for various services saving the customer money.

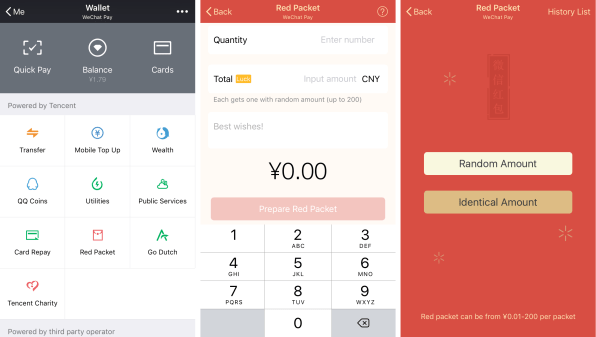

Frictionless and Time-saving payments - Many superapps have a Messaging + Payments combo offering lower friction peer-to-peer payments and saving time as the ‘paying friends’ experience is housed in one place.

Personalised Experience - As superapps house multiple services, the data gathered can generate personalised recommendations from places to eat to different retailers.

The benefits to the superapp creator are clear. Customers locked into the product, using it for longer and for a greater breadth of use cases.

It’s why superapps have an ever-growing customer base. Although you might be unsure whether you’ve used one or even heard of one, here are some of the most popular global examples, the giant WeChat, with around 1.3 Billion Monthly Active users. And see if you can spot the two trends…

WeChat - A Chinese superapp offering messaging, social media, e-commerce, payment services, transport, etc.

Alipay - A Chinese superapp that offers payment services, investment management, and other financial services.

Grab - A Southeast Asian superapp that offers ride-hailing, food delivery, payment services, and other on-demand services.

Gojek - An Indonesian superapp that offers ride-hailing, food delivery, payment services, and other on-demand services.

LINE - A Japanese superapp that offers messaging, social media, payment services, and other services.

Paytm - An Indian superapp that offers payment services, e-commerce, and other financial services.

Did you spot the two trends?

1. All offer payment services as part of their ‘super’ stack

2. They are all Asia-based companies

While the first trend is easy to explain, the second is trickier.

Payment Glue 💴

It’s evident that if you’re an app offering multiple services, offering a way to pay for those services within the app is almost mandatory. Otherwise, the user journey for, let's say, someone trying to book tickets to the cinema is incomplete, with customers leaving the journey to complete the transaction. If you’re offering a single app to search for relevant goods and services, then you have to provide a way of paying for those goods and services to reduce friction, close the loop and keep customers in that ecosystem.

Payment infrastructure is the glue that binds all these services together in a single app. Remember this for later…

East v West 🇨🇳 🇺🇸

This one is a bit trickier to explain as there are a few factors contributing to superapps prevalence in Asia vs anywhere else. But for me, the difference is down to culture and regulation.

Western markets tend to favour regulation to ensure fair competition, which means a broader range of offerings servicing the same problem and fragmentation of services serving niche problems and customer segments.

And in terms of culture, Asia is far more used to large conglomerates offering various services, so from a customer adoption point of view, superapps are similar. And that conglomerate approach has carried over into technology development.

There are other factors though. Such as the homogeneous nature of the Asia markets allowing for creation of more uniform services across the region. A large unbanked (no access to traditional financial services) population, meaning superapps with integrated digital wallets welcomed by swathes of the unbanked population. And different attitudes to privacy, centralised accessible data, and government-affiliated apps.

To summarise

• Superapps are all-in-one mobile apps offering a wide range of services.

• They benefit both customers and providers (but mostly providers).

• They’re currently most popular in Asia and with other notable examples in South America and Africa

• Payments are key in bringing together these various and sometimes disparate services

So what’s this got to do with Musk and Twitter…?

Twitter is everything🐦

As mentioned, I think the early signals of Twitter as a potential superapp are already here, and they include these key feature changes:

Increasing the Tweet character limit from 280 to 4,000

Once the USP of Twitter (restricted short-form tweets), now it looks like the character limit increase means, from a pure feature mechanics perspective, they can compete with the likes of Facebook and LinkedIn on the textual post front. Obviously, competing directly with those apps will mean importing connections as well as having multiple feed views (to separate work, life and any other additional niches like Fintech Twitter, Movie Twitter, etc.), but this early beta testing makes it technically possible to compete.

Increasing the Video upload length from 140 seconds to 60 minutes

In 2010, Twitter added the ability to view videos and photos within the platform. Since 2015 the video upload length has been restricted to 140 seconds, aligned with the 140-character limit they used to have on tweets. Now they are looking to extend that video upload time to 60 minutes. This opens up the possibility of people using Twitter for interviews, vlogs, and watching their favourite podcasts and content creators, eating into YouTube's video monopoly.

Introducing a Video Discovery Feed

‘Videos for you’ was introduced in 2022 to “make it easier for users to watch and discover videos on its platform” and essentially a video feed. It’s very similar to the scrollable TikTok feed. Although it doesn’t have the core thing that makes TikTok valuable (the audience and video editing functionality), the initial video feed is similar enough.

I don’t think Twitter is going to become a superapp anytime soon. At least not in the previous definition of the word. And certainly not within the next 5-10 years. Mainly because it’s not an app in Asia (or a similar market), and it’s missing a key ingredient. Payments.

But, I think it’s making steps towards a social media superapp by picking the most popular features from existing established apps and slowly incorporating them to become the ‘everything social media’ app.

Whether they continue down that road will be determined by the success of some of these copycat features on the platform, which will be measured by key feature metrics like:

Video Views to completion (for videos >2 mins 20)

Long-form videos uploaded

Time on Video Discovery Feed

‘Show More’ button clicks for tweets longer than 280 Characters

Either way, we’re a while away from a social media superapp, and the more likely superapp model in the West will revolve around retail financial services.

Payments as the glue 🩹

I’ve spoken about the lack of superapps in the West, and while they’re not prevalent, they do exist.

The most notable fintech superapp –yes, we’re finally back onto fintech–is Revolut.

Revolut's superapp platform allows users to open accounts, manage their finances, send and receive money, exchange currencies, invest in stocks and cryptocurrencies, and more.

The app also has budgeting tools, payment cards, and other features that make it the closest thing to a one-stop-shop for financial management hence the superapp title. With over 15 million registered users and a presence in multiple countries, Revolut has become a leading example of a fintech superapp, providing a seamless and integrated experience for its customers' financial needs.

However, it doesn’t yet offer the full suite of financial services most retail customers expect, as it’s still missing lending products like personal loans and mortgages.

I want to bring in an analogy to cover why I think payments are the key to superapp adoption in the West and to add another layer to the glue reference.

Kintsugi is a Japanese art form that involves repairing broken pottery with a special lacquer mixed with gold powder. Instead of disguising the cracks or breaks, kintsugi highlights them and uses the gold to accentuate and beautify them.

Using payments as the golden lacquer can pull together some of the previously fragmented digital services into a single place and accentuate and beatify those services.

It’s cheesy, but it works.

And payments pull together services and facilitate the growth of superapps in the West in two ways:

Fintechs and financial services with ready-made payments functionality adding peripheral services to their offering, e.g. Revolut adding rewards and lifestyle services to their existing app

Messaging, social media, travel organisations etc, adding seamless payments and other financial services functionality to their offerings, e.g. WhatsApp adding payments to their app in Brazil, making it easy to make P2P payments for things like travel, birthdays and shared dinners

The Western Transition

Embedded Finance and Open Banking, two topics I’ve covered in depth, are a couple of fintech tailwinds that’ll help facilitate payments and join services together.

But the biggest accelerator to superapp adoption is combining a smaller number of financial services with non-FS to solve existing problems and create a better customer experience.

Here are some services combinations and existing use cases they apply, at least in the UK, that would get the ball rolling and get people used to varieties of fragmented services with a payments element:

Messaging + Payments - Whatsapp Payments is already live in Brazil. And for me, the peer-2-peer payments problem hasn’t been solved. The journey is often full of friction and app switching, which breaks that end-to-end seamless experience. Anecdotally, I owe a friend money for a holiday she’s planned for our group. She specified the amount in a WhatsApp message, I went to pay it through my banking app, but I didn’t have her payment details. There was a break in the journey, so I didn’t pay her immediately, which is frustrating for her and me. P2P Payments within WhatsApp, the most used chat app in the UK, would tick that ‘Frictionless and time-saving’ box I spoke about early. And cover many use cases from splitting dinner payments, paying for gifts from a group, organisations birthdays or even just seamlessly lending a mate a fiver (which I realise doesn’t cover the cost of much these days).

Holiday planning/booking + budgeting - Very much adjacent to the previous example. But the holiday planning and budgeting process is still very much decoupled. Even though many in the UK still budget for holidays, that figure must be connected to the planning and booking process. Some people book the holiday and then figure out the required funds, but for most in the UK, it’s natural to have the budget drive the options for accommodation, travel, activities and food & drink. Because of the maturity of holiday planning sites like Expedia and Lastminute.com, it makes sense to embed a budgeting option that allows a connection to your bank account. But it would also be a more seamless experience if someone like Revolut added Flights + Hotels as part of their lifestyle offering. Reducing the friction of planning, budgeting and booking holidays.

Overall, I think we are closer to fully-fledged Financial Services superapps than behemoth apps combining a broad range of fragmented services. Largely because one of the biggest reasons for the prevalence of full superapps in other markets is culture. And culture takes a while to shift.

Fortunately there is another factor that drives superapp adoption.

Payments.

And it’s Payments that will be the glue for any superapp to be considered super.

Favourite bits of Fintech Product news

Lanistar Re-launching in the UK - I wrote a quick commentary on the latest news here. Still, as long as they’ve sorted the backend and regulatory issues, the testing they’ve managed in Brazil will help re-launch successfully this time.

Apple Launches Savings Account - The Goldman Sachs backend account (US only still) will provide 4.15% APR. It’s a matter of time before they launch in the UK, but it seems like they will build a full card, savings and lending product in the US before they do.

Lloyds Bank Launches PayMe for B2B payouts - This will provide businesses with an easy-to-use method of sending and receiving payments from clients, customers or suppliers a lot faster, giving support to a much-needed sector.

Favourite Tweet