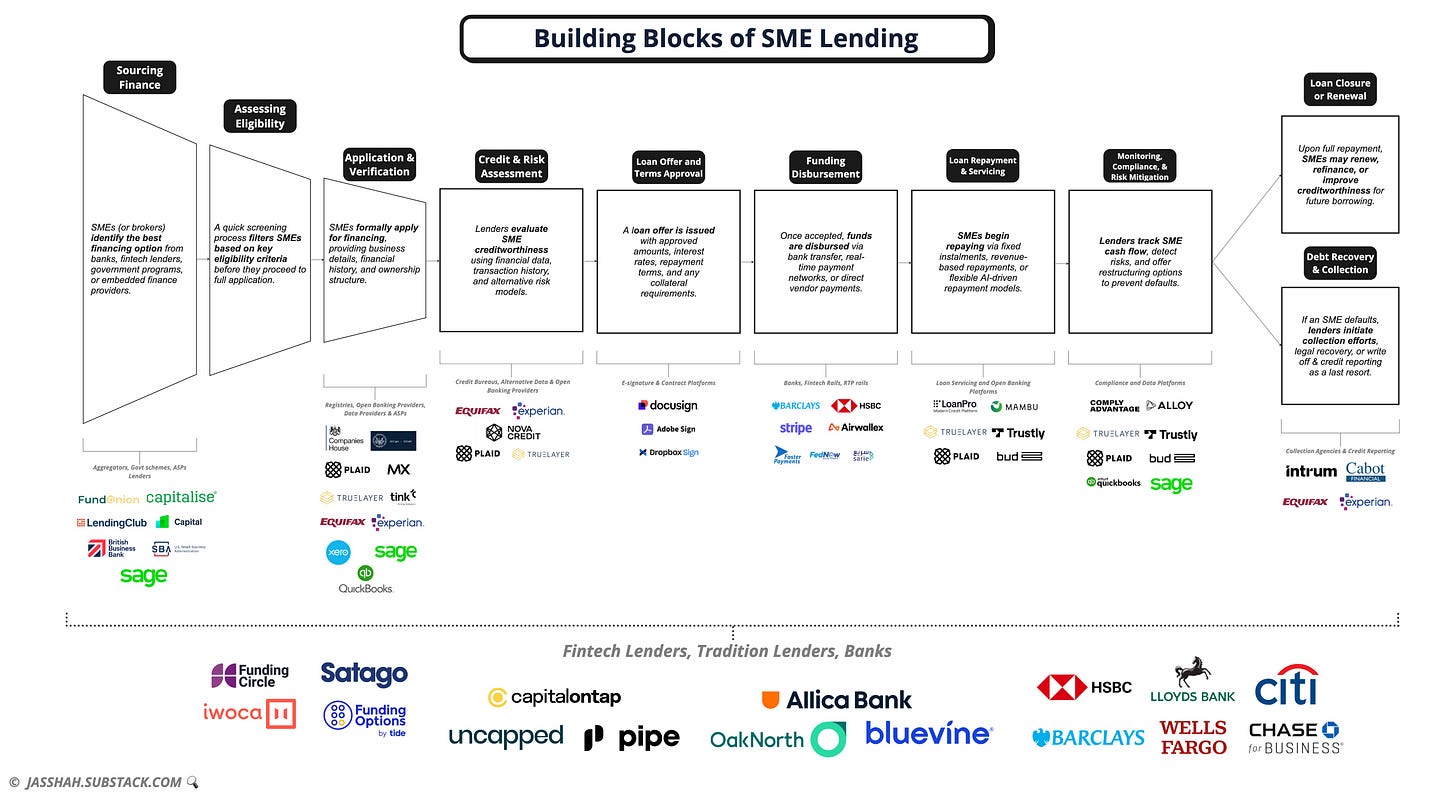

Under the Hood 🛠 - The Building Blocks of SME Lending

A deep dive into the typical SME Lending journey, the key players, challenges, and the three major technologies that will revolutionise the industry

How does the lending process typically work?

What has the Superman got to do with technology strategies?

What are the biggest disruptive technologies that will change lending forever?

Who are the key players across the lending journey?

These questions and more will be answered in this week's edition.

Hey Fintechers and Fintech newbies 👋🏽

It's been a busy few weeks in fintech, and I suspect the year will continue in this vein.

HSBC's Wise 'rival' Zing was shut down. They posted a message about the shutdown here (cue the barrage of people saying "I told you so. Banks are not good at fintech").

The issue wasn't that this was a bank-led incubated project and 'banks can't do fintech'. They were much more complex and nuanced than that.

Revolut launched a commercial property investment arm. Now that Nik is back in Canary Wharf, it looks like he's returning to his roots and turning Revolut into a retail + investment bank. It's not a bad move, considering his new HQ and previous industry connections.

Lastly, Monzo CEO TS Anil had an interesting discussion with Harry Stebbings on his 20VC podcast, covering topics such as their looming IPO, their launch in the US, and why Monzo won't get into the business of mortgages, preferring to be a facilitator.

Instead of looking into FX, commercial real estate or Monzo's disinterest in consumer mortgages (although I will touch on that in this edition), I'm diving into an area that, despite the perception of a lot of innovation, is still fraught with manual processes, relies on brokers, relationship management, and where fintech still has a lot of work to do…SME Lending.

I am going Under the Hood once more, walking through the typical SME Lending journey from sourcing, onboarding and application, all the way to recovery, pointing to the key players throughout the journey, and highlighting the areas where processes are somewhat manual.

I also outline the three key technologies that are primed to revolutionise SME Lending for the better.

As well as interesting news, puns + movie references, this edition includes the following:

A short intro to SME Lending

The SME Lending Journey: Step by Step

From Finance Sourcing to Closure

Why is Lending still such a challenge

The Open Banking Factor

The three technologies that will shape the next 5 years of SME Lending

Artificial Intelligence

Blockchain

Digital Identity

Fintech Spotlight🔦: Juice - E-commerce lending for modern SMEs

Interesting News🗞: Digital ID arrives in the UK

📢 PSA: If you want to meet and hear from some of the key players in Lending, and hear me speak to some of them on a panel in March, then make sure you’re signed up for FTT Lending happing in March in a historic London venue. Click the banner below OR the link at the end of the article to sign up. Look forward to seeing many of you there!

Now, let's get into it 💪🏽

The SME Lending Process: Step-by-Step

A quick caveat to start this one.

My other Under the Hood editions, outlining the ApplePay tokenization process, how a card payment works, and how India's Digital Identity process end-to-end, for example, have been very specific.

This will be slightly different as the SME Lending process has nuance in a number of steps, and the specifics of the process depend on the type of finance. So rather than create multiple nuanced journeys for each type, this outlines an SME lending journey that is abstracted a little and fits multiple types of finance.

This guide also assumes that the SME recognises the need or want of finance for a specific purpose, although this could also be added as a "Step 0.5", and there are some great cashflow analytics fintechs that work in this space.

NOTE: Much of this process is put together from my experience leading product for an SME lender, being directly involved in the end-to-end process, and occasionally speaking to SMEs about their pain points.

Now that the caveat is covered let's dive into the step-by-step process.

Step 1 - Sourcing Finance

In order to obtain finance, it must first be sourced. For SMEs this is a crucial step, as different lending sources have varying approval criteria, interest rates, and repayment terms.

Common Sources of SME Finance include:

Traditional Banks – Offer business loans, overdrafts, and credit lines but require strict documentation.

Fintech Lenders & Alternative Lenders – Provide faster approvals, digital front ends often leveraging Open Banking and alternative credit scoring.

Government-backed Loan Programs – Available in many countries to support SMEs with low-interest loans or guarantees (e.g., Kafalah in Saudi Arabia, SBA loans in the US).

Embedded Finance & Revenue-Based Lending – Some platforms offer lending within accounting software, e-commerce platforms, or POS systems based on real-time sales.

One underrated intermediary source of finance is through brokers. Much like Mortgage Brokers, SME Finance brokers play a crucial part in navigating the sea of options to find appropriate deals for SMEs, saving them time and money in the process. Research shows that up to 2 thirds of SMEs use brokers and the vast majority of them apply for subsequent finance through the very same broker.

🔍 Key Players: Banks, Fintech Lenders, Government Loan Programs, Alternative Finance Platforms, Embedded Finance Providers, Brokers.

Step 2 - Initial Eligibility Screening

Once an appropriate option has been found, directly or via a broker, many lenders have an eligibility screener. This is to ensure that SMEs are genuinely eligible for the type of finance being offered and is often a simplistic form that collects contact information and asks some screening questions such as:

How long has your business been trading for?

What type of business entity is it, e.g. LLC, Sole Trader, or Partnership?

How many directors are registered?

What is your business's annual turnover?

How many employees does your business have?

What are you intending to use the finance for? E.g. Equipment, Hiring, Marketing

These act as an initial filtration layer before any high-cost API connections or external vendors are used for deeper verification, such as connecting to companies' houses to review the status of the business and traverse the UBO structure. Harry Potter-style sorting hat that then points SMEs towards the finance option(s) they are eligible for, which leads into the formal application process.

This initial screener is a growing phenomenon as it’s not economically viable for the lender to have ineligible businesses go through the application step if they can be screened out at an earlier stage.

🔍 Key Players: Banks, Fintech Lenders, Government Loan Programs, Alternative Finance Platforms, Embedded Finance Providers, Brokers.

Step 3 - Application and Business Verification

This is where most assume the SME lending process starts, which is a fair assumption, but in reality, the application is a few steps down the lending funnel as you can see.

It’s where the SME formally applies for financing via a lender’s platform (bank, fintech, marketplace, or via a broker). The lender collects initial details about the business, such as:

Business registration details and ultimate beneficial ownership (UBO) structure.

Loan amount requested and purpose.

Financial statements, bank transaction history, and cash flow reports.

Credit history (business and, in some cases, personal credit of the founders).

This stage is essential to ensure that the applicant is a legitimate business and qualifies for credit assessment. Some of the required data may have been gathered at the previous step and merely supplemented with more specific data at this stage.

🔍 Key Players: SMEs, Banks, Fintech Lenders, Alternative Lending Platforms, Accounting Service Providers, Company Registry

Step 4 - Credit Scoring and Risk Assessment

Once the application is submitted, the lender evaluates the SMEs creditworthiness. Unlike consumer loans, SME lending often involves alternative data to supplement traditional credit scores.

Verification and Risk Assessment Checks:

Business age and stability (New startups may require additional guarantees)

Cash flow analysis (How consistently money flows in and out)

Debt-to-income ratio and existing liabilities

Industry risk (Some industries are riskier than others)

Transaction history via Open Banking (if available)

Credit history (Business and/or Personal)

Behavioural data (Previous lending behaviour, online reputation, etc.)

Lenders may use AI-powered underwriting models or traditional credit bureau reports to assess risk. In some cases, lenders integrate with Open Banking APIs to retrieve real-time financial data instead of relying on outdated financial statements.

🔍 Key Players: Credit Bureaus (Experian, Equifax, TransUnion), Alternative Data Providers, Open Banking Providers, AI-based Underwriting Platforms, Accounting Service Providers

Step 5 - Loan Offer and Terms Approval

Based on the credit assessment, the lender provides a loan offer with specific terms, including:

Loan amount approved (may be lower than requested)

Interest rate (fixed or variable)

Repayment period (short-term or long-term)

Fees (origination fees, early repayment penalties, etc.)

Collateral requirements (for secured loans)

If the SME accepts the loan offer, they sign an agreement digitally or in person.

🔍 Key Players: SME Lenders, Digital Contract & E-Signature Platforms (DocuSign, Adobe Sign)

Step 6 - Funding Disbursement

Once the loan is approved, the funds are disbursed to the SMEs bank account.This step varies depending on the lender:

Traditional Banks: Disbursement takes 2–5 business days, depending on the payment rail.

Fintech Lenders: Many fintech lenders offer same-day or instant payouts, especially for short-term credit products.

BNPL for SMEs: Some lenders directly pay vendors/suppliers instead of sending funds to the SME.

Funds are typically sent via:

Bank Transfers (ACH, SWIFT, SEPA)

Real-Time Payment Networks (Faster Payments in the UK, FedNow in the US, Sarie in KSA)

Digital Wallets (for fintech-based loans)

🔍 Key Players: Banks, Fintech Lenders, Embedded Finance Providers, Payment Rails (Visa Direct, Mastercard Send, Faster Payments, Sarie, FedNow)

Step 7 - Loan Repayment & Servicing

Now that the SME has received the funds, repayment begins based on the agreed-upon terms. Repayment models vary:

Fixed Installments: Monthly or weekly payments (common for term loans).

Revenue-Based Repayments: A percentage of daily or monthly sales (popular for merchant cash advances).

Bullet Payments: One lump-sum payment at the end (used for short-term bridge financing).

Dynamic Repayments: AI-driven models where payments fluctuate based on cash flow.

Automatic payment deductions are on the rise, with Open Banking enabling direct withdrawals from business bank accounts and ensuring a low-fi way of processing repayments.

Borrowers may also get real-time dashboards showing outstanding balances, payment schedules, and early repayment options.

🔍 Key Players: Open Banking Providers, Payment Processors, Loan Servicing Platforms

Step 8 - Monitoring, Compliance, and Risk Mitigation

Lenders don’t just wait for repayments—they monitor borrower behavior in real time to detect risks and prevent defaults.

👀 Monitoring Methods:

Automated alerts for missed or delayed payments

Cash flow tracking (via Open Banking)

Fraud prevention checks (ensuring funds are used appropriately)

Loan restructuring options for struggling businesses

Lenders may also sell loans to secondary markets (loan securitisation) or use insurance products to mitigate risk.

🔍 Key Players: Loan Management Platforms, RegTech Solutions, Credit Insurance Providers, Open Banking Provider

Step 9a - Loan Closure or Renewal

If all repayments are completed, the loan is officially closed. The SME can now:

👉🏽 Apply for another loan (some lenders offer auto-renewals)

👉🏽 Request early repayment discounts

👉🏽 Build business creditworthiness for future loans

Lenders analyse repayment behaviour to pre-approve SMEs for additional financing, which can be offered via embedded finance solutions directly within accounting or banking platforms.

🔍 Key Players: SME Lenders, Embedded Finance Providers, Credit Bureaus

Step 9b - Debt Recovery & Collection

This is another step that is often missed in the typical lending journey.

If an SME fails to repay, the lender begins the debt recovery process.

📉 Stages of Debt Recovery:

Soft Collection – Automated payment reminders via SMS, emails, or app notifications.

Restructuring & Negotiation – Some lenders offer repayment flexibility or refinancing options.

Hard Collection – If payments remain unpaid, lenders may escalate to debt collection agencies.

Legal Action & Asset Recovery – If secured, collateral may be repossessed; legal action may be pursued.

Loan Write-off & Credit Reporting – If uncollectible, the debt is written off and reported to credit bureaus.

Technology-driven debt collection is evolving, with AI-powered messaging and digital-first repayment portals making the process more borrower-friendly.

🔍 Key Players: Debt Collection Agencies, Credit Bureaus, Legal Recovery Firms, AI-powered Collection Platforms.

The Challenges

These are the basic building blocks of SME Lending journeys covering a direct loan, finance based on invoices, revenue based finance that uses sales data, all the way to a revolving credit facility on a card.

For most in the SME Lending space, this validates the steps, and for newbies, it provides insight into the process.

I want to draw attention to the challenges across the journey, which are relevant to both those experienced in SME lending and those relatively new to it.

Sourcing Finance and Screening 🚦

Too Many Options, Not Enough Clarity

SMEs struggle to navigate complex financing options—term loans, credit lines, BNPL for businesses, asset or invoice financing.

Many SMEs don’t understand the true cost of borrowing or the long-term financial impact of their choices.

The Drop-off Rate for Ineligible SMEs

Incomplete applications and unclear eligibility criteria mean many SMEs waste time applying for loans they won’t qualify for.

High rejection rates discourage businesses from seeking finance again.

Application and Business Verification 🏗️

The Document Collection Nightmare

SMEs often face paperwork overload, needing multiple financial statements, tax filings, and revenue projections.

Many drop off due to the complexity of submission requirements.

Fraud Prevention vs. Friction

Lenders must balance speed with fraud prevention, ensuring businesses aren’t shell companies or bad actors while still providing a smooth experience.

Credit Scoring and Risk Assessment 🎯

Traditional Credit Scores Don’t Always Work for SMEs

Many SMEs lack a strong credit history, making traditional credit scoring ineffective.

Understanding Cash Flow Risk

SMEs have irregular cash flows, making it difficult to predict repayment behaviour.

Revenue-based lending models help, but risk profiling remains a challenge.

High-Risk Industries Get Penalised

SMEs in volatile industries (hospitality, gig economy, early-stage startups) often face higher rates or outright rejection, even if their business is stable.

Loan Offer & Terms Approval 📜

The ‘Why Was I Approved for Less?’ Problem

Many SMEs request more than they qualify for, leading to confusion when they receive lower offers than expected.

Lenders need better transparency in explaining approval criteria.

High Costs & Hidden Fees

SMEs often overlook processing fees, origination fees, and early repayment penalties, leading to unexpected costs.

Collateral vs. Unsecured Lending Trade-offs

Some SMEs can secure better rates with collateral but don’t understand the trade-offs.

Others opt for unsecured loans but end up paying higher interest rates.

Loan Repayment & Servicing 🔄

Inconsistent Revenue & Payment Struggles

SMEs with seasonal or fluctuating revenue may struggle with fixed monthly payments.

Lenders must balance repayment flexibility with ensuring timely collections.

Manual Repayment Processes

Many SMEs miss payments because repayment isn’t automated, leading to late fees & penalties.

Lack of Financial Literacy

Some SMEs don’t fully understand how interest accrues, leading to unexpectedly high repayment costs.

Fintechs and banks are trying to tackle these problems with varying degrees of success.

Most fintechs take a digital first approach to the end-to-end process, including screening and application, which reduces manual document collections and speeds up time to disbursement.

And banks are partnering with fintechs to build embedded solutions for their business banking customers helping solve the problem of sourcing and speed up applications.

But SME Finance fintechs have a scaling problem, they simply don’t have the customer numbers (at the moment) to make real change for SMEs on a large scale.

And banks have a technology problem. Many lending journeys are tightly coupled and siloed which makes it difficult to innovate and iterate to fully digitise existing journeys. It's part of the reason embedded finance partnerships are so favourable.

I always suggest banks first look to decouple their existing processes (and new SME Lending fintechs develop a strategy with decoupled components, similar to the visual, rather than look to modernise the process as is. This decoupled strategy reminds me of this scene from the Justice League which might be my favourite movie reference yet!

Although both ends of the spectrum have their challenges (fintechs with a digitally native product but no mass of customers, and banks with the mass of customers but no digitally native product), there are technologies that will transform SME lending over the next five years, and one has already making an impact.

The Open Banking Factor

I had a brief exchange with someone in a fintech WhatsApp group recently where someone asked, “Are there any ACTUAL Open Banking success stories?”. It was a sincere, genuine, and fair question.

My paraphrased response was, “Open Banking is plugged into the backend of pretty much every fintech I’ve worked with over the past 7 years, making data access faster and easier. It’s enabled people to build products faster, make quicker decisions, and use more accurate, up-to-date data, so I’d say that it is a success, even if there are no consumer-facing OB fintech unicorns.”

Its impact on the SME Finance journey, alleviating some of those challenges, has also been a success and includes the following:

👉🏽 Faster and More Accurate Eligibility Checks - SMEs can instantly share real-time banking data, allowing lenders to assess cash flow, transaction history, and financial health without lengthy manual document uploads.

👉🏽 Alternative Credit Scoring for Thin-File SMEs - Businesses with little to no credit history can be assessed based on real transaction data instead of outdated traditional credit scoring models.

👉🏽 Faster Loan Disbursement - With instant access to financial data, Open Banking enables lenders to automate approvals and accelerate payouts, cutting disbursement times from days to hours (or even minutes).

👉🏽 Seamless Cash Flow Monitoring - Lenders can proactively track SME financial health via ongoing Open Banking data feeds, reducing default risk and enabling early intervention.

👉🏽 Automated Loan Repayments & Collection - Direct bank account connectivity allows for smoother, automated repayments, minimising late payments and manual processing errors.

Here’s what a fellow fintech nerd working at Plaid, Bruno Werneck de Almeida had to say about Open Banking for lending:

"Providing details about their income, spending, and bank account balances allows consumers and SMEs to present a more thorough picture of their financial situation when applying for loans, tenancy, and other use cases.

The credit decisioning stack will be fundamentally refactored over the next few years. Though there's a ton of work to be done the "why now" is clear: API access to consumer-permissioned cash flow data, digital decision engines, efficiency gains from GenAI, and open banking regs."

It’s not perfect.

But it is progress.

With the discussions around Open Banking shifting to Open Finance and Open Data, the hope is that the next phase of the roadmap includes dedicated initiatives and additions to the existing API that can:

Help facilitate transparency of finance options for SMEs

Allow for instant eligibility checks based on account data

…and enhance the rails to facilitate a richer, faster finance experience for SMEs.

These would take it closer to perfect.

The Tech Innovation Trifecta △

Open banking is one of the transformative technologies that has changed how SME lending works.

In addition to Open X, the following three will revolutionise how SMEs access, obtain and manage financing over the next five years…

1️⃣ Artificial Intelligence - Smarter, Faster, Fairer Lending

AI-driven underwriting is already changing the game. Traditional lending relies on static credit reports, but AI can analysereal-time transaction data, behavioural patterns, and industry trends to predict risk more accurately, all without bias towards or away from specific SMEs or industries.

How AI will transform SME lending:

🧠 Real-time risk assessments - AI can assess an SME’s creditworthiness in seconds, using dynamic data instead of outdated financial statements.

🧠 Automated loan approvals - AI-powered decision-making reduces manual intervention, cutting approval times from days to minutes.

🧠 Personalised loan offers - Instead of a one-size-fits-all approach, AI tailors financing based on an SME’s cash flow, industry, and risk profile.

🧠 Early warning systems - AI monitors SME financial health in real-time, flagging potential defaults before they happen and enabling proactive support.

💡AI makes SME lending faster, more inclusive, and more flexible, giving businesses access to funding they might have previously been locked out of.

It is already seeping into underwriting processes across the lending landscape, but the applications of AI across the journey from sourcing, document scanning, transparency over offers, monitoring repayments, and so much more will be transformative.

2️⃣ Blockchain - Trust, Transparency, and Faster Transactions

Blockchain can remove inefficiencies in SME lending by reducing fraud, ensuring transparency, and enabling seamless cross-border financing.

How Blockchain will transform SME lending:

🧠 Smart contracts – Self-executing agreements can automate loan disbursement, repayments, and collateral enforcement, reducing paperwork and processing times.

🧠 Tokenized assets for collateral – SMEs can use tokenized versions of physical or digital assets to secure financing without relying on traditional banks.

🧠 Cross-border SME lending – Blockchain eliminates inefficiencies in international trade finance and SME loans, allowing businesses to access credit globally.

🧠 Immutable transaction history – A blockchain-based credit history could help SMEs build trust with lenders, especially in markets where credit data is scarce.

💡 Blockchain brings efficiency, security, and global accessibility to SME finance, cutting out intermediaries and reducing reliance on slow, paper-heavy processes.

Blockchain tech to tokenize and log assets for collateral, make cross-border lending easier, and to create more liquidity in the SME finance is underrated. There’s still a lot of opportunity for innovation here especially for those looking to create blockchain infra to facilitate tokenization and a finance marketplace.

3️⃣ Digital Identity - Instant, Secure Business Verification

Verifying SMEs and their owners is one of the biggest bottlenecks in lending. Digital Identity solutions powered by biometrics, cryptographic verification, and decentralised identity systems are removing friction in the onboarding process.

How Digital Identity is transforming SME lending:

Instant KYC & KYB – Businesses can be verified in seconds instead of days, reducing onboarding friction for both lenders and SMEs.

Fraud prevention – Digital Identity ensures that businesses and their founders are legitimate, reducing loan fraud and unauthorised access.

Global SME verification – SMEs working across borders can access financing internationally without needing physical documents or local credit history.

Reusable identity credentials – SMEs can use a single, verifiable digital identity across multiple financial providers, streamlining loan applications.

💡 Digital Identity will make SME lending more secure, inclusive, and seamless, reducing fraud while eliminating bureaucracy.

Big UK banks like Natwest & Lloyds have already placed huge bets on Digital Identity and its role in smoothing the SME finance process. It’s a matter of time before it spreads to the rest of the banks, and I expect major fintech lenders and new players to incorporate Digital Identity as part of the lending journey as soon as practically possible.

The current SME Finance landscape is better than it was.

But the next 5 years will be unrecognisable from the last 5.

The killer SME Finance Fintech propositions developed over the next five years will be the ones that solve the outlined challenges, use AI, Blockchain, and Digital Identity as part of their core building principles, and proactively recognise when and why businesses need finance.

Fintechs have an opportunity to build greenfield platforms that use this tech from the beginning.

But based on the number of customers they have and the capital they have to deploy, it's really the banks that have the biggest opportunity to drive the transformation to benefit SMEs.

And in my eyes, they will either grab the opportunity soon…or fumble it. 🏈

That’s it from me

J.

Remember to like this edition and share it with a friend. Back again in two weeks 👋🏽

P.S. Sign up to FTT Lending in March where you can come ask me questions about this edition (or previous ones) in person. See you there!

Fintech Spotlight🔦: Juice

Of course, I’m highlighting lending fintech in this SME Lending edition. This week, it’s Juice.

Juice is a platform focused on funding e-commerce businesses. It has a cool, modern look and feel, a multi-layered name, and a clear message for potential customers about providing an alternative way of raising funds without giving away equity.

What I really like about them is that they aren’t just targeting businesses that need finance now. With their free business insights tools, they offer value to potentially ineligible customers to keep them in the journey, ensure there's less dropoff, and gather more data on them to provide more effective and timely lending decisions.

Their target demographic also looks quite interesting as, to me, it looks like they are going after the new and next generation of SMEs who are building digitally native e-commerce platforms likely run by Gen-Z. A smart bet.

Go check them out.

Interesting news

A Govt backed Digital ID is here…almost: A bit of news that went under the radar was the UK Secretary of State introducing a GOV.UK app and wallet which holds citizens’ driving licences, passports and benefits documents. The wallet, which launches in June of this year, will hold a digital version of a driving licence. It remains to be seen whether a govt Digital ID project will be successfully adopted by consumers (I will bet that adoption will be extremely slow), but this could be one step away from mandatory Digital ID in the UK. Good for SMEs, and bad for avid readers and lovers of 1984.

DISCLAIMER: This write up and related diagram has been painstakingly put together by myself, Jas Shah. If you wish to use this content for a commercial project or intend to put any of this content behind a paywall, you must request permission first.