Zing...and they're gone ⚡️💨

The timeline of events, why HSBCs international payments project was a step in the right direction, the lessons they can learn, and some myths debunked

NOTE: I got a microphone for Christmas, and in an effort to "dogfood" my own work, i.e. apply my own advice from the accessibility edition I wrote last summer and into writing, this entire edition will be available via audio, voiced by myself, and can be heard by clicking the play button above (feel free to switch back to the visual edition for the images and if you get bored of my voice)Why was the Project codename "Marco Polo" perfect for Zing?

What lessons should HSBC take from Zing?

Which three myths are doing the rounds?

What are the pitfalls of a referral mechanism?

What has Roadrunner and Wile E Coyote got to do with Wise and Zing?

These questions and more will be answered in this week's edition.

Hey Fintechers and Fintech newbies 👋🏽

Forewarning. This is a bit of a ranty edition. In the intro to the last issue on SME lending, I touched on some of the bad takes about Zing, and I couldn't shake those annoyances.

For those of you unaware of what happened with Zing, it was the HSBC-backed but separately incorporated international money app with ambitions to compete with Wise, Revolut and Monzo, but it is now in the process of being shut down just a year after it's launch.

The aftermath of the closure message from Zing saw 'expert opinions' ranging from the diligent and thought out, to the slightly lazy and uninformed. I suspect this need to write something, anything, as quickly as possible is a symptom of some folks transforming from industry voices into Fintertainers.

It was mainly the "see, banks can't do innovation and this is proof of it'" undertone that several of the posts and comments had that frustrated me, as from my perspective, there's a multitude of reasons Zing did not succeed and it being an HSBC backed proposition was only part of it.

The rant won't be a full-on "why everyone is wrong about what happened with Zing"; rather, it will be a logical analysis of what happened, what could have been done better, and lessons for everyone to take away.

As well as interesting news, puns + movie references, this edition includes the following:

A brief history of Zing

2022-2023: Developing Marco Polo and Investment

2024: Official Launch, Partnerships and Product Releases

2025: Shutdown Announcement

What did they do well (let's start with the good)

They leveraged partners for the tech stack

They brought in external fintech folks

Branding, Naming and separation of the entity

4 of the major problems as I see them

Addressing some myths that are circulating

They could have just re-KYC’d existing HSBC customers

They spent 3 years planning without speaking to customers

They spent $150m (not technically true)

The majors lessons they can take away

Abundance isn’t an accelerator of innovation

Discovery is crucial to product development and acquisition

High-initial product costs can kill a product

Fintech Spotlight🔦: Call to Action

Interesting News: WigWag → Stitch Express

Now, let's get into it 💪🏽

Timeline 🛣

Let’s start with the timeline because that’s one thing there’ll be very little debate about.

2022-2023: Developing Marco Polo and Investment

January 2022: Work on Project Marco Polo, later branded as Zing, begins after research reveals that customer experience in international payments is “opaque” and lacking in customer service. James Allan, who at the time was HSBC’s Head of FX & Payments, Wealth & Personal Banking, is named CEO of Zing and leads the initiative.

Presumably, Marco Polo was picked as the codename because he was a renowned explorer and would have valued a fee-free FX card. A genius codename, IMHO.

2022: Allan makes several key hires to build the Zing team, bringing in expertise from fintech companies to shape the app’s development.

James brings in experienced fintech folks from former Monzo director of product marketing Neil McKeown, former Revolut-er, Dario De Angelis as a senior treasury manager, and former Wise engineer Eduardo Mercer, as well as others from inside HSBC and externally from Mox, Grab and others.

July 28th 2022: MP Payments, the separate HSBC-backed entity that Zing would be built from, is incorporated at Companies House with Nuno Matos and James Allan among the Directors

September 2022: HSBC invests $35 million into Monese, a UK-based fintech

2022-2023: HSBC funnels around $150 million (~£118 million) into Project Marco Polo (later named Zing) and the MP Payments entity to build the competitive international payments app.

They spend the next year building and readying the product for launch.

2024: Official Launch, Partnerships and Product Releases

January 3rd 2024: HSBC announces the official launch of Zing, an app designed to offer international payments and multi-currency wallets.

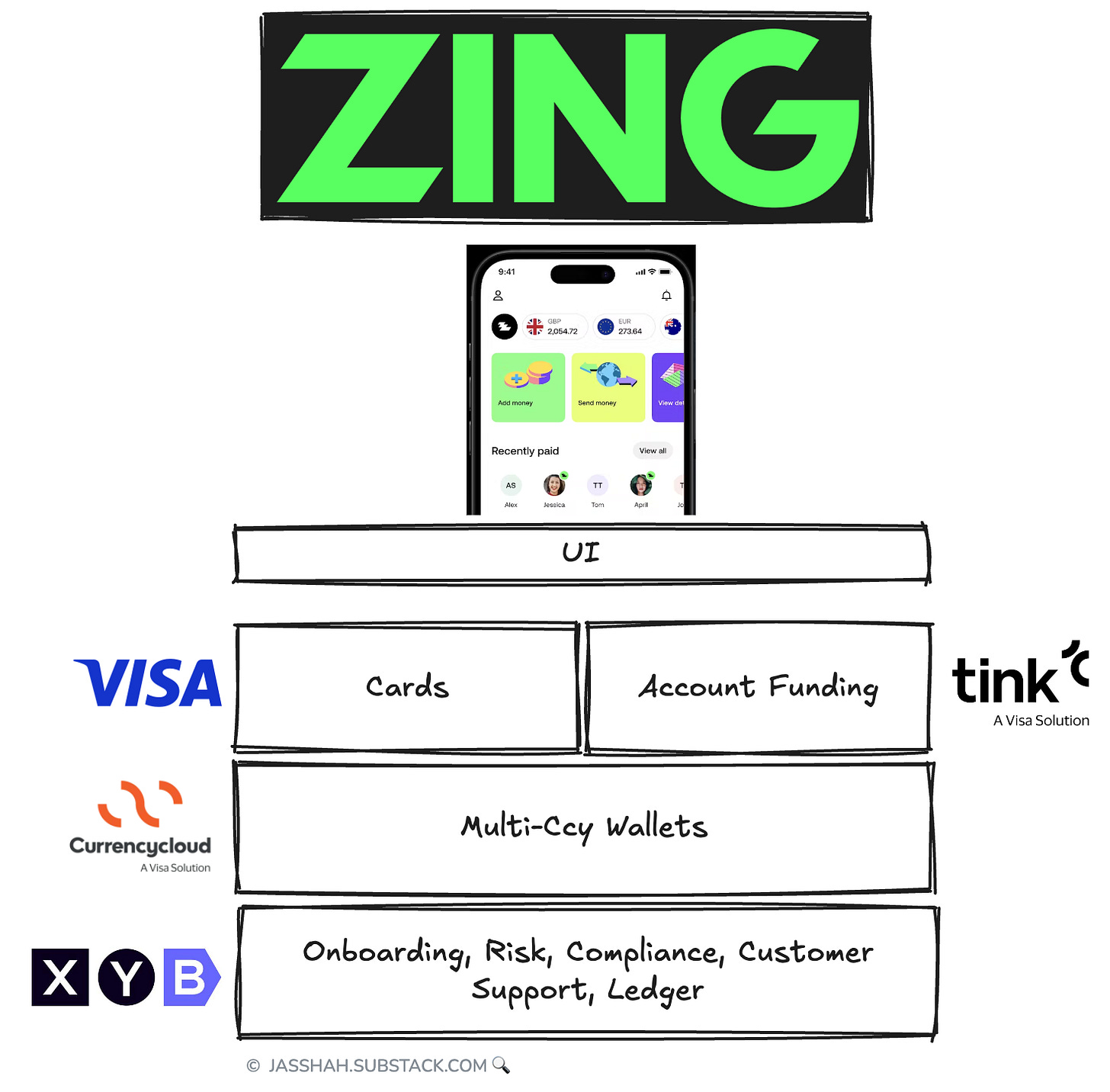

January 8th 2024: AltFi reveals publicly that the Zing was built using XYB, Monese’s self-developed banking platform, powering Zing’s onboarding, risk, compliance, and customer support

May 2024: Zing begins offering a £20 cash reward per successful referral, up to a £400 limit.

June 2024: Zing offers £500 fee-free currency exchange for a limited time, giving customers zero FX fees on conversions until April 2025.

July 2024: Visa announced that it collaborated with Zing to develop the product allowing Zing to have a single point of contact for multi-currency wallets (through CurrencyCloud), quick account top-ups (through Tink) as well as Visa cards

August 2024: Zing becomes Brentford FC’s official international payments and remittance partner, marking its first partnership in sports.

September 24: Georges Elhedery is officially announced HSBC’s new Group Chief Executive

October 2024: HSBC writes off its $35 million investment in Monese.

October 2024: Zing increases its referral offer to £30, with a £600 limit.

October 2024: Reports of a private announcement in an internal meeting that Zing would shut down, following its failure to meet customer acquisition targets.

October 2024: Nuno Matos, former CEO of HSBC’s Wealth and Personal Banking division, is credited as Zing’s key sponsor. He leaves HSBC after an internal battle for the CEO position, which marked the end of his involvement in the project.

November 2024: Zing launches automatic and one-tap top-ups for all members.

November 2024: Zing partners with Checkout.com to enhance alternative payment methods and streamline transaction processing.

2025: Shutdown Announcement

January 2025: HSBC makes a public announcement confirming the shutdown of Zing. Users are informed about the option to transfer to HSBC’s UK bank and use the existing fee-free currency service, Global Money.

The following quote from an HSBC spokesperson was quite telling:

“Following a strategic review of Zing within the HSBC Group and after careful consideration, we have made the decision to close Zing and integrate its underlying technology platform into HSBC. HSBC is focused on increasing leadership and market share in the areas where it has a clear competitive advantage, and where it has the greatest opportunities to grow and support our clients”.

So they announced the shutdown at the end of January and redirected customers to their internal Global Money product, requiring additional onboarding. The app will still function until April and will be fully shut down in May.

As mentioned at the top, reactions to the announcement varied, mostly negative, and some of which were fair, but very few highlighted the areas where they’d done things that we in the fintech community have been asking banks to do for a while.

What they did well ✅

I’m starting with the positives because I’m using what those in the cheesy corporate management world call the concept of a “s**t sandwich (if you’re listening to the audio version, I could not find the *bleep* button, so apologies).

You know what I mean.

The technique used by bad managers and the kind of thing David Brent/Micheal Scott would read and love.

A job rejection letter is the perfect example.

👍🏽 “We’re really glad you applied and yours was among some of the most impressive.”

👎🏽 “Unfortunately, you were unsuccessful this time as there were a couple of candidates who were a better fit.”

👍🏽” However, we’d love to stay in touch as if another role comes up, we’d like to consider you.”

I’m going to follow a similar structure with a flow that is more of an end-of-year performance review style.

What they did well (positives), what didn’t go so well (the big problems), and specific improvements for the future.

Positive #1: They didn’t build all the tech themselves

An accusation that’s regularly thrown at banks, and quite rightly, is that when they develop fintech products, they try to shoehorn in existing bank tech as part of the process. This ends up being to the detriment of the product and often extends development timelines.

One of the key positives of Zing was that HSBC didn’t try to reinvent the wheel by building every piece of technology from scratch. Instead, they wisely leveraged existing fintech infrastructure and partner platforms, such as CurrencyCloud for multi-currency wallets, Tink for Open Banking functionality, including account top-ups, and Monese’s XYB banking platform to power Zing’s onboarding, compliance, and customer support functions. This not only saved valuable development time but also ensured that they were using trusted, industry-leading technology.

NB. Yes, you can argue that XYB wasn’t exactly best of breed at the time, and it was a partially strategic decision to use the platform based on the investment in 2022, but at least it didn’t make the mistake of trying to crowbar in existing outdated bank tech.

Positive #2: They brought in external folks with real experience

Zing’s development benefited significantly from the experienced hires that James Allan brought on board. By recruiting individuals with a proven track record at successful fintechs like Monzo, Revolut, and Wise, Zing gained expertise in areas like product marketing, treasury management, and engineering. These external hires brought fresh perspectives and deep knowledge of what it takes to succeed in the highly competitive fintech space.

The senior leadership team was mostly made up of HSBC staff but they didn’t make the mistake of having an exclusively HSBC team.

Positive #3: Branding, naming, separation

It’s easy to look at things in hindsight, but there’s no doubt that the early decision to separate the Zing entity (MP Payments) from core HSBC plc was a good one. It’s a mistake that some banks’ fintech projects have made in the past. It meant a great separation and the ability to make decisions on the naming, which I also thought was good, and on the brand. Yes, it looked like it took some heavy influence from Wise. At the time, I even said it looked like they copied the brand and made some tweaks, but sometimes that’s not a bad thing. No one at the time was complaining about the lame name and poor branding, so that’s a win and, again, something that is levelled at other banks’ fintech projects (Bó being the perfect example).

No matter what you say, there are positives in what HSBC did with Zing, including the initial discovery on the market in late 2021 that found customer experience in international payments is “opaque” and lacking in customer service. There are definitely positives for the global bank to take away from this project, but not before looking at some of the negatives.

The Bad👎🏽

Problem #1: Customer Acquisition strategy wasn’t quite right

You don’t start out going after established products’ customers, even if that is your long-term aim, mainly because on day one, your product will always be inferior to one that has evolved over 10 years.

You start by building a core group of brand advocates that see the benefit of your product, use that core group to improve and iterate, and then, over time, try and compete with competitors if that is still the objective.

HSBC has around 14 million active customers across the UK. Based on growth figures, Wise likely has under 10 million UK (their total customer numbers are higher than that, but I’m unable to specify the specific UK component, so I’ve guestimated). There is clearly a subset of HSBC customers who don’t have a Wise account, and this should have been part of the early strategy. Look at the HSBC customers who aren’t transferring money to or from Wise’s IBAN range. Onboard these customers who might also spend abroad but are not getting the best rates.

Lock in this core group, then refine and improve the product, increase customer scope, and then go after Wise, Revolut and Monzo customers, if that’s still the objective.

Problem #2: There was no clear point of differentiation

A brief look at the Zing offering:

No outbound transfer fees

FX conversion fees from 0.2%, (once the monthly £500 allowance is used up) which do not change based on the amount or day of the week

Real-time, mid-market currency conversion rates

Free UK ATM cash withdrawal

One free withdrawal per month for international ATMs (further withdrawals cost £2 or equivalent)

No charge to receive a physical plastic card – and no charge for your first replacement if you lose or damage it!

All Zing members receive £500 of fee-free currency conversion each month until the end of 2024.

The £500 fee-free conversion each month was the only real point of differentiation (and maybe the consistent FX fee based on the time of the week, which fluctuates with Revolut).

In this day and age, and especially as the acquisition strategy wasn’t to go after non-Wise/Revolut/Monzo customers, offerings have to be a little more unique. Fee-free withdrawals, fee-free FX conversions, no charge for cards and ‘real-time’ rates are becoming the norm for many FX products, and the introductory offers were not compelling enough to draw in potentially new customers to a less established product.

For me, this comes down to not having enough knowledge of the core customer group. Deeper discovery during the development of the product such as interviews with prospective customers, mapping out their typical interactions with FX products and surveys on how and where they spend abroad. This would have uncovered some potentially valuable features and offers that would have further differentiated the product.

Here are some example points of differentiation I thought of based on some research I’d done previously:

Free Airport Rides: 3 Free airport rides per year (capped at £30 each) so long as your annual spend is £500.

Lounge access: Free lounge access for 6 months. You book a slot in the app and show your Zing card on arrival.

Cashback on Foreign Currency Spending: Offer cashback on overseas spending with the Zing card e.g., 1-2% of their international purchases back in the form of Zing credits or even a foreign currency of their choice. It encourages spending whilst also rewarding the customer, and it’s the same tactic that worked for Chase when it first launched.

Travel Insurance Bundled with the Card: Provide complimentary travel insurance for customers who meet certain spending thresholds or hold the card for a certain period. This could cover medical emergencies, flight delays, baggage loss, or trip cancellations, offering real value to international travellers.

Deeper research hints towards an area of differentiation, which may have been one of the above or something completely left field.

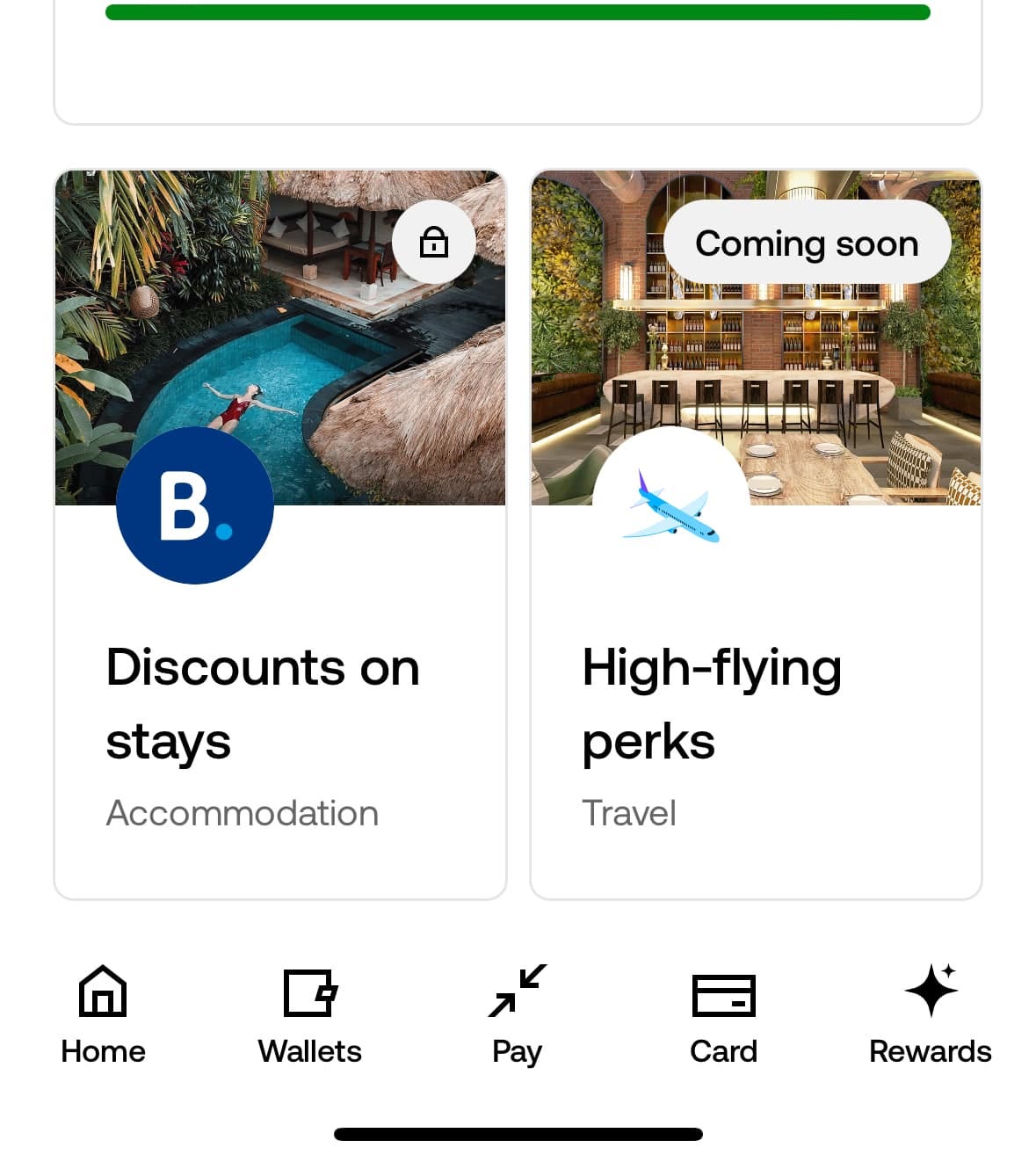

I also think that there was a plan to introduce more of this over time (see the image below), but it should have been a day 1 offering.

These two problems were big but could have been overcome over time. The following two, I believe, were the true killers of Zing.

Problem #3: Customer Acquisition and Servicing Costs were too high

This is the first of the two biggest reasons I believe Zing was canned.

Early-stage fintechs generally have high customer acquisition costs. If we think purely about the marketing costs, ad spend, and PR needed to get a new brand out there it’s usually quite costly in those early days but not unusual.

If you add the costs of servicing a card, performing KYC, core bank costs, etc, you’re likely to see costs per customer in excess of £130-£150 in the early days, with that tapering down over time as you refine operational costs and reduce marketing spend.

There were three areas that I suspect meant that the costs for Zing were A LOT higher than the average platform.

Visa Infinite Card: The Visa Infinite card is on the premium end of Visa’s card offering. It offers additional protections, travel assistance, rewards, offers & perks and much more. I suspect that the reason Infinite was chosen was to enable a richer rewards offering going forward, and it was a long-term decision, but it would have added significant costs to the program initially vs a standard Visa Debit or Prepaid.

No initial funding restrictions: The early days of a product can make or break the economics, and the fact that there were no minimum funding requirements before a physical card was sent out (physical card and package printing costs are not cheap) was a bit of a surprise. Of course, in the early days of a proposition, there is a tendency to be open and unrestrictive, but there are smarter ways to get a customer to fund the e-wallet and use a tokenized card before a costly physical card is sent out. It meant that anyone could download the app, and order a card but not fund or spend a penny, meaning the org was £100+ out of pocket on those zombie customers.

Expensive Referral Mechanisms: Referral programs are a great way to grow a customer base if used correctly but they can also be abused and create counter-productive outcomes, like attracting customers outside of your Ideal Customer Profile (ICP). Zing’s referral program was quite open, started in May, offering £20 per person referred up to £400 return, providing each customer made a £5 purchase. They later upped it to £30 per person up to £600 with the same funding requirements. It’s a great way to increase the customer base BUT very, very expensive, and depending on how you run the program, you don’t necessarily get the right customers. People also look to game the system as you can see all over Reddit threads.

Contrast that with Wise’s referral program, which is still going but has some economical restrictions to help scale.

These three things would have meant that the Annual Revenue Per User (ARPU) figure would have had to have been in the £200+ mark for it to even be at break even. More importantly, though, I don’t see this as a way to grow the core customer base effectively.

Problem #4: Politics

Not to sound sensationalist, but combination of the announcement of new CEO and the departure of Nuno, the person who has been identified as the key sponsor, was clearly the nail in the coffin for Zing.

This is a quote via the FT from a Zing employee who said that the closure is more a result of HSBC’s internal politics and management style than the app’s own performance.

“This isn’t a story about operational failings, it is a story about what happens to so many of these fintechs that are incubated in a big bank,” one former employee said. “They’re not given the chance to live the life that they could live if left unencumbered.”

They are right, and a large part of this is due to politics. The struggles of big bank politics is severely underestimated. In this case, had Nuno been announced as the HSBC CEO, Zing would likely still be around and may have had a chance of success, but with Georges coming in, the writing was on the wall.

He mentioned that part of the decision was down to cost-cutting, and maybe if the acquisition costs were lower, it would have stayed open.

Maybe.

But when you are coming in and looking to steady the ship, it’s quite an easy decision to kill your rival’s project in the name of cost cutting.

It happens all the time in football. You bring in your own backroom staff, have your own objectives and want to put your own stamp on things. It doesn’t look good if the previous manager’s signing continues to perform, and you’ll often see those players who don’t fit the system sidelined or are told they are surplus to requirements.

Big bank politics is still alive and kicking, and it’s this, along with the costs, that ultimately killed the initiative before it had a chance to prove itself or fall on its sword.

Mythbusters 🔍

Before I move onto the “what they can do better next time”, I’m addressing a couple of myths that have also been floating around. These myths might be a case of “don’t let the truth get in the way of a good headline”, but I’m quite a big fan of the truth so here goes.

Myth#1: Re-KYC for existing HSBC customers made no sense

This is the biggest one I saw floating around the posts and articles on some prominent publications, that it was a big mistake to make existing HSBC customers perform KYC again for the Zing app. The implication is that existing customers could just log onto the product as they’d already been KYC’d. However, because Zing was on a new technology stack, was a separate entity, and, crucially, was a new product (an international payments app with an attached card that HSBC didn’t have), this would not have been possible. Even if HSBC had an internal Digital Identity program (which, btw would have made this more likely), during the Zing onboarding process, it would have had a fork in the road for HSBC customers vs non-HSBC customers, making the journey complicated.

In short, they had no choice but to re-KYC existing customers to adhere to Money Laundering Regs, and their only other option would depend on some pre-existing portable digital identity framework to easily port and speed up KYC for existing customers.

Myth#2: They spent 2-3 years of planning before speaking to any customers

This is slightly incorrect. They did perform research before the project even began, so they spoke to customers before embarking on the project at the end of 2021. I’m not aware of any ongoing research or customer engagement activities that occurred during the development, but they certainly didn’t spend 3 years planning.

Myth#3: $150 million spent before seeing any revenue

This is not a full-blown myth, but it’s not entirely true. Yes, HSBC did inject $150 million into the separate MP Payments entity that built Zing, but it’s not clear if they spent the full $150m. The most recent evidence we have is the 2023 annual statement on companies house, which shows a $42m loss for 2023, meaning around $107m remaining. It’s not likely that they spent over $100m in 2024, so we can reasonably assume that they didn’t spend the full $150m. The odds are that they will wind the company down and pull that money back into the organisation. Likely one of the reasons Georges shut the venture down.

Things to improve 💪🏽

In typical end-of-year review fashion, there is a “things to improve” section, but as Zing is shutting down, this is more of a “things they should have done” or a “what HSBC should do with any future fintech ventures”.

Improvement #1: Use research to drive the Product & Customer Acquisition Strategy

Customer, Market, Competitor and Behavioural research is a fundamental part of building great products. From a product strategy perspective, using research to ensure the roadmap contained hero features from the beginning and additional hero features were added throughout the year would have made a huge difference to the product and helped with customer acquisition as well as differentiating the product from others.

With the customer acquisition strategy, it looked like the net was cast a little too wide. Using research to really narrow down their ICPs would have made work for the marketing teams lighter and ensured the first few months of customer growth were focused on a specific group of Zing advocates.

Gathering feedback through the app, speaking directly to these brand advocates and using these insights to refine the product would have ensured the product was more polished, then expanding to competitors’ customers would have been a more sustainable strategy.

Research is not a “one and done” exercise. Behaviours, trends and markets move all the time and ongoing research is crucial to building and growing successful products.

Improvement #2: Optimise Customer Acquisition, Servicing Costs, and Better Understanding Growth Levers

Zing’s high customer acquisition and servicing costs were significant challenges that contributed to its downfall. Offering premium features like the Visa Infinite card and not requiring initial funding for physical card issuance may have contributed to unnecessary costs, particularly for customers who did not use the platform. A smarter approach would have been to incentivise users to fund their accounts digitally before issuing a costly physical card. Additionally, Zing’s referral program, while effective in gaining customers, may have attracted users outside of its ideal customer profile, further inflating acquisition costs. A more targeted and cost-effective referral strategy, similar to Wise’s, could have helped mitigate these expenses.

Having a better understanding of the growth levers and when to pull them is also key. The referral lever could have been pulled once the core group of customers had been established using research, and then the tap slowly opened over time.

Improvement #3: Mitigate the Impact of Internal Politics

A huge factor in Zing’s closure was the internal politics at HSBC. The departure of Nuno Matos, Zing’s key sponsor, and the appointment of a new CEO, Georges Elhedery, shifted the bank’s strategic focus, leading to Zing’s termination.

As is often the case in large organisations, political dynamics can influence the fate of internal projects, regardless of their performance. To mitigate this, HSBC could have ensured greater alignment and buy-in from the top management earlier in the project’s lifecycle and ensured the project was sustained over a longer period of time.

Additionally, creating a more independent operational framework for Zing could have given the project a better chance to prove itself without being subject to shifting internal priorities. They did that with the setup of a separate entity but could have added more external experience to the senior leadership team and advisory board of the venture.

There are lots more improvements I could outline, but I’ll stick with these for now and allow you to add any more to the comments.

Was Zing destined to fail from the start? I’m going to go against the grain and say “No”.

From what I can see, they built the underlying tech using an approach most fintechs follow, had a solid name, and a sharp brand.

Their customer acquisition strategy and product could have been tweaked over time, as I’ve seen many fintechs do after their first year in the wild.

The way HSBC approached Zing was a monumental step in the right direction, not a step backwards.

I might sound a little crazy saying that, but looking objectively at the venture itself, it’s the assessment I’ve come to.

I don’t agree with the customer acquisition strategy but they weren’t really given time to change course (they were live for 10 months before the internal decision seemed to have been made)

I’d have liked to see more ongoing discovery and hero features from the beginning but I’ve seen other ventures start with products identical to competitors on day one, then evolve over time.

And I don’t agree with the huge $150m investment to get it off the ground. Because I don’t believe such abundance fosters innovation.

What I do think is that if they take the positives, learn lessons from the experience, and apply it to future ventures (with a little more of that product expertise in those early stages) then it was a gamble that will pay off in the long run, even if the venture itself didn’t fly.

That’s it from me!

Hope you enjoyed this slightly ranty edition.

Back to my regular upbeat insights in two weeks 😊

J.

Fintech Spotlight 🔦: Call-to-Action

No spotlight this week, but a reminder that if you’re a newly founded fintech solving interesting problems in the space, I’m always looking for ways to find interesting and relevant products to feature, so drop me a DM or connect with me on LinkedIn. I have a bunch of cool fintechs to put under the spotlight in future editions but I’m always on the lookout for more.

Interesting News🗞: WigWag -> Stitch Express

Online payments solution WigWag has been brought back under the Stitch umbrella as Stitch Express. Designed for platforms like Shopify, WooCommerce, and Squarespace, Stitch Express enables quick sign-ups and seamless payment methods tailored to South African consumers. Initially spun out from Stitch to better serve small to medium-sized merchants, WigWag gained valuable insights over the past year and has since developed a suite of solutions for e-commerce businesses. Stitch Express offers customisable checkout flows, high-converting payment methods, instant payment links, and automated refunds. Built on the Stitch platform, it ensures reliable support, user-friendly experiences, and continuous innovation to meet evolving payments needs.

DISCLAIMER: This write up and related diagram has been painstakingly put together by myself, Jas Shah. If you wish to use this content for a commercial project or intend to put any of this content behind a paywall, you must request permission first.

I listened to this one! Loved the bit when you had to swear and could not bleep it out! Haha

Excellent - and not as ranty as you think it is. 150mil is pretty eye-watering and I agree about your customer acquisition strategy using data they have and being smart about it. If only they'd got some smart, experienced product people involved from the off, eh?

Great post, Jas. Always a fascinating read.

I've got a slightly different view. The best things about HSBC are its brand and large customer base. Any proposition that doesn't leverage these two strengths is doomed. Instead of a launching a new business, HSBC should incorporate Wise-like functionality within its standard consumer banking product set and spend £150m marketing this.