Agentic Commerce Is Here. Agentic Finance Is Next.

Why Agentic Commerce won't kill the checkout page, how agents work, what the Agentic Commerce stack will look like, and looking ahead to Agentic Finance

What is Agentic Commerce?

Why do I think it’s a no brainer for merchants?

What does the Agentic Commerce Stack look like?

What problems do Agents solve for consumers?

These questions and more will be answered in this week's edition.

Hey Fintechers and Fintech newbies 👋🏽

My first Money 20/20 last week was an absolute blast!

The energy and buzz you get from having multiple in-person conversations and seeing the best and brightest in financial services talk about the industry cannot be matched. I’ll definitely be back next year.

Thank you to all the readers who came up to me and said, “I love the newsletter!” or asked me questions about specific editions. It genuinely means a lot to hear feedback in person 🙂

Now, in terms of the takeaways from the flagship event, here are a few of my bulleted thoughts based on conversations, observations and a couple of the talks:

KYC/KYC/Fraud challenges are still high on the agenda, and a litmus test of that is the sheer amount of vendors with stands at the event.

Stablecoin and AI were the keywords of this year’s event. With Stablecoin, there is still a 12,000ft view of its application and benefits. Digging a bit deeper and looking at the Jobs-to-be-Done, emerging markets, cross-border payments is the big area it can disrupt for good (solving for those corridors where correspondent banking relationships are limited and cross-border payments are expensive). There is still work to do, though, and over time, I think the “it’s faster and cheaper” argument will erode as fraud and compliance are baked into rails, inevitably slowing down and making money movement slightly more expensive. I’ll give a deeper Stablecoin primer soon.

AI is everywhere, on all the stands, in pretty much every talk, and is what everyone raised in off-the-record conversations, afterparties etc. But when you scratch the surface, there is a canyon between companies talking about AI and using it practically. Only a few of the folks I spoke to could articulate exactly how they were using it. There’s still a long way for companies to go to see the true benefit of AI.

Agentic Commerce, one of the many AI in Fintech verticals, was another hot topic.

There were some interesting discussions about the value of Agentic Commerce to consumers and some ways it’ll come to fruition, but not much about the first steps consumers might take into the agentic commerce world, the key problems they solve for consumers in the checkout experience, and the critical factor of consumer control.

Ultimately, from a consumer behavioural perspective, buyers don’t want 100% of the agency taken away from them. They just want the 95% of admin removed so they can enjoy the fun parts of the experience and make the final decision. Control is key (more on that with The Matrix references).

I, like many, think Agentic Commerce will be a game-changer, not only transforming the commerce experience but sparking innovation that will lead to an even bigger disruptive and beneficial trend.

Agentic Finance.

Yup, you heard it here first. The challenges in SMBs obtaining finance are exactly what agents can help solve and where I believe the next major AI x Fintech disruption lies.

I’ll start with Agentic Commerce, though, and explain why it’ll transform the checkout page rather than kill it, along with puns and some very relevant Matrix references, here’s what to expect:

What is an Agent?

How does an Agent work?

Perception

Reasoning

Execution

Feedback

The challenges consumers face

Choice Overload

Lack of Personalisation

Decision Fatigue

The Klarna Effect and how Agents can help merchants

The Agentic Commerce Stack

Interesting News 🗞: Plaid Launches Plaid Protect

Now let’s get into it 💪🏽

P.S. This is a short , harp edition to get people primed, thinking, and hopefully start conversations of Agentic Finance and beyond.

What is an AI Agent? 🤖

An AI agent is an autonomous software entity that can perceive, decide, and act on behalf of a user OR organisation, often with minimal human intervention.

Unlike traditional automation, which follows static rules or prescription workflows, an agent is goal-oriented and adaptive. It can take inputs (like user preferences, real-time data, or external signals), reason about the best course of action, and then execute tasks across systems or platforms.

Think of it like this:

A search engine finds you options.

A recommendation engine suggests one.

But an agent goes a step further. It books the ticket, negotiates the price, applies your loyalty points, and sends a calendar invite without you needing to ask twice.

And Agents can be:

Reactive - Responding to user prompts

Proactive - Anticipating needs and acting ahead of time OR

Collaborative - Working with multiple agents or humans toward a shared objective.

How agents work

An AI agent operates through a continuous loop of perceiving, reasoning, and acting, and the best way to see the value and broad application of AI Agents across use cases is to map the logic steps they go through, starting with Perception or Input.

Perception 💽

Agents sense context through APIs, sensors, or data feeds, including things like:

User preferences, e.g. price guidelines, brand preferences, etc

Contextual signals, e.g. location, calendar, time of day, account balances

External data sources, e.g. product availability, price changes, interest rates, account data, payment methods

It also obtains the users' goal or infers it from past behaviour. Things like, “do my weekly shop for the cheapest price”, or “buy my favourite chinos twice a year”.

Reasoning 🧠

The agent uses AI, often a mix of machine learning, rules-based logic, and large language models, to:

Analyse options

Compare trade-offs

Predict outcomes

Make a decision that best aligns with the user’s goal

It may also ask clarifying questions or collaborate with other agents to complete a task.

Action/Execution 💪🏽

The agent takes action:

It might purchase a product, shift funds, send a notification, or trigger another system.

It does so via APIs, integrations, or its own internal capabilities.

Feedback & Learning 👂🏼

And finally, the bit that everyone forgets about, but one of the most crucial steps it observes outcomes after the action:

Did the user approve?

Was the goal met?

Should the decision logic be updated?

When you take a broader view and look at the process an AI agent goes through, you begin to see the applications of agents across several areas:

Personal finance: Agents that optimise your cash flow or move money across accounts based on live goals

SME operations: Agents that manage inventory, payments, and supplier coordination

Financial Management: Agents that manage a company’s finances and basically replace the concept of SaaS CFO-as-a-service

Consumer spending: Agents that understand your household budget and subscribe to essentials at the best terms

There are many, many more, some of which I’ll dive into in future editions, but this one is, of course, about Agentic Commerce.

It’s clear that an agent would add value to the ecommerce experience, but what problems could they ACTUALLY solve for consumers, and what do consumers care about?

The Challenges Agents Solve for Consumers

The e-commerce experience has definitely improved over the past decade, but just like in banking, where there’s a lot more choice, and everything is shifting to digital, that ends up creating different challenges for consumers.

1. Overload of Choice 🛍🛍🛍

One positive of the shift to digital is brands are able to show more options where previously they were limited to how much floor space they had.

This has led to pages like this where there are so many options that the company resorts to creating an infinite scroll feed, or there are 10s of pages of 100s of options in each.

It means customers have too many choices, and too many options mean less clarity and endless scrolling, comparing, and researching. This is bad for the merchant and also bad for payment processors who lose processing volumes.

🧠 AI Agents help overcome this choice overload and can present a limited set of relevant options that customers are more likely to execute on. This can increase conversion for merchants and TPV for payment processors and lead to a better overall experience for the customer.

N.B. I actually wrote about the paradox of choice and its relevance to fintech in this edition, so you learn more about that here…

2. Lack of Personalisation 🤷🏼🤷🏼🤷🏼

Another side effect of the e-commerce shift that many thought would be solved in the new digital age is the lack of personalisation. Platforms like Spotify promised AI-powered recommendations with high conversion, but as with many areas like music, travel, and retail, preferences recommendations aren’t just about surfacing options through a “You bought this, so you’ll probably like this similar item” method. These end up being generic and have low usage rates.

Because many of these offers are via email, they also feel irrelevant, and as they are not connected to shopping behaviours across stores (they are often limited to specific brands like ASOS, Shein, Zara, Lululemon, etc), they are often mistimed.

🧠 AI Agents can take personal data, shopping habits, and recently purchased items from SKU-level data and leverage user personas to create truly timely personalised recommendations during the e-commerce experience and via notifications/nudges in retail apps.

3. Decision Fatigue 🔴 🔵

This is the area that has seen the most fintech disruption but has seen the amount of choice at the point of execution also lead to more decision fatigue.

On one level, more choice is great as it leads to greater competition and competitive pricing for consumers, but a side effect of that is having so much at the point of execution, like having to dig out a discount code, typing in a shipping address, picking a payment method from the 10 available, and so on, leads to decision fatigue and drop off at the most crucial last mile of the journey.

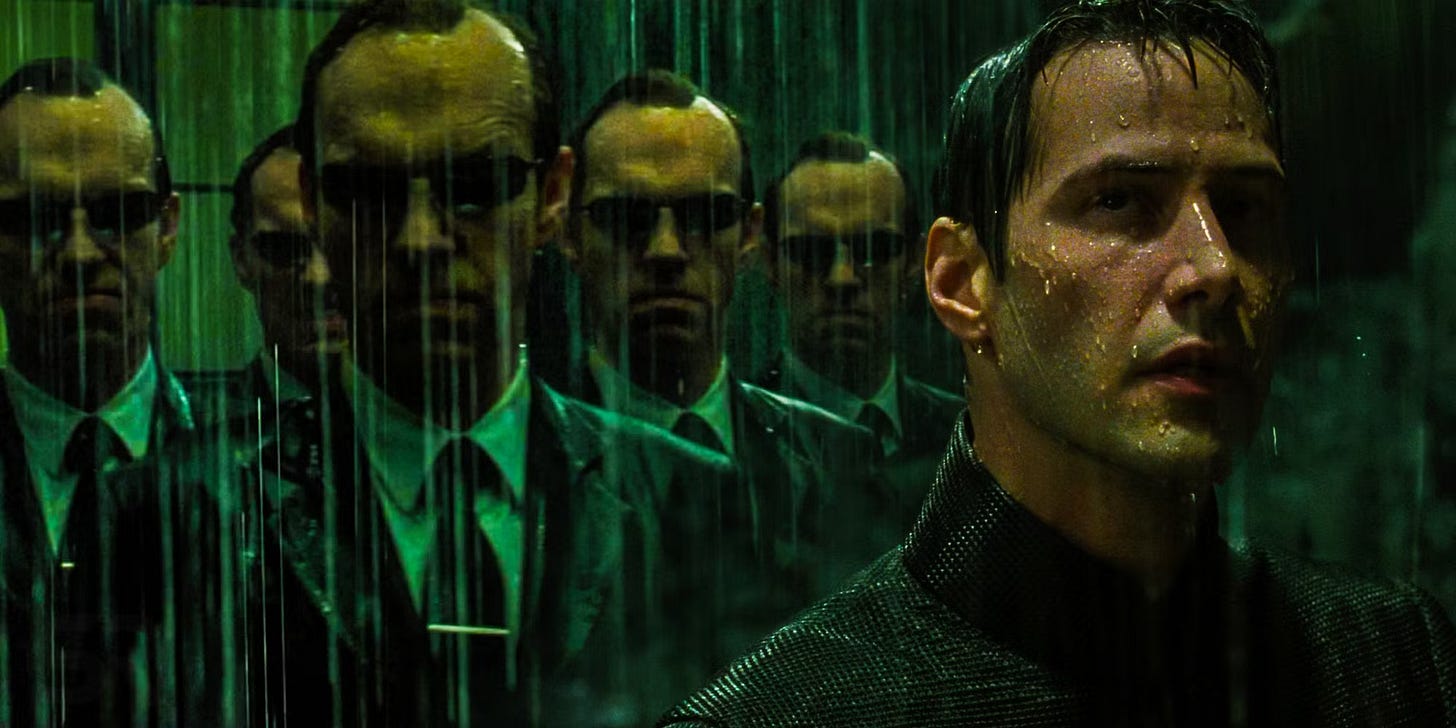

Think about the Red Pill and the Blue Pill choice in The Matrix.

Based on all the factors, it’s a simplistic decision (the reasoning is complex, but the ultimate decision is simple).

Red Pill or Blue Pill.

Now imagine a scenario where there are 5 different options, each with a slightly different pathway. The decision becomes far more complex, takes longer and has greater potential for abandonment. The same principle can be applied to the checkout page.

🧠 AI Agents can use historical consumer behaviour, identity information, and payment preferences, automatically apply discount codes, and autofill lengthy personal information forms so that the decision for the customer becomes binary. Complete the transaction or cancel the transaction.

The Klarna Effect 🛍

There’s a reason there’s a lot of buzz around Agentic Commerce. It’s not just because it solves some problems for consumers.

When I was on stage at London Tech Week on Tuesday (humble brag) talking about embedded opportunities in financial services, I spoke about the golden triangle of a successful embedded proposition.

That’s where the embedder of the product gets something (maybe access to a larger customer base), the embedee gets something (a digital journey or a boundary-pushing product to offer customers), and the customer gets something (a better product and/or experience).

It’s a Win-Win-Win scenario, and those are the embedded partnerships that tend to be successful as there is no imbalance of power and the customer benefits.

With Agentic Commerce, I see a similar 3xWin scenario that we saw when BNPL became mainstream where merchants were able to see tangible increases in basket sizes and conversion, customers were able to purchase items and spread the cost over longer periods of time and BNPL providers took a slice of the basket they’d help convert or increase.

In this case, merchants still get tangible increases in conversion, customers get more tailored, low admin experiences and products, and the companies that win will be those building or facilitating the building of AI Agents.

I do have a theory on they type of company that’ll be but first I want abstract and talk about the characteristics of the enablers of Agentic Commerce.

Characteristics of the Winners in the Agentic Commerce Game

Based on how agents work, it’s fairly logical to map the characteristics and features of those organisations that will be successful in the Agentic Commerce world, and there are three that are particularly important.

1. Identity

Why?

Understanding the consumer is foundational to building an effective agent. The agent needs to know who you are, what you value, and how you behave.

Organisations that already hold verified identity profiles and, crucially, understand the behavioural context (spending, location, life stage) have a significant head start. They can preload preferences, limits, and goals into an agent without requiring long onboarding journeys.

2. Historic & Real-Time Data

Why?

Agents learn and improve by observing past patterns. Players with deep, structured behavioural data (spend patterns, browsing habits, category affinities, etc.) can build agents that are more accurate, faster to personalise, and better at anticipating user needs.

Without this history and access to real-time data, the agent has to start from scratch, and users are unlikely to tolerate long learning curves.

3. Tokenization Processing & Payments Infrastructure

Why?

Agents need seamless, secure access to act on behalf of users, and that means being able to pay without friction. Players with tokenization processing capabilities and payment infrastructure can empower agents to transact safely and instantly without requiring repeated authentication.

Tokenization also allows for agent-led microtransactions, subscription adjustments, and rule-based spending, which are key features in agentic commerce.

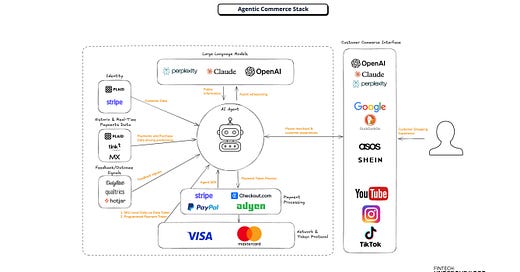

Based on these desirable characteristics, I believe it’ll mainly be payment processors like Stripe, PayPal, Adyen and Checkout.com that’ll lead the charge with Agentic Commerce with their access to customer identities through one-click checkout functionality, payment processing capability, usage of Visa and Mastercard’s Payment tokens (allowing for agentic, programmable payments) and access to enterprise data at scale.

I also think organisations like Plaid, who have network-powered identity, fraud, and data capabilities, with learnings from billions of data points, will be another dark horse in the Agentic development space as Identity and Data are two of their superpowers (I can see a world where a PP partners with Plaid to build agents for merchants).

From the payment processors, there has already been some progress.

Stripe has an agent SDK

Paypal has an agent toolkit

…and others are mobilising.

The Agentic Commerce Stack 🔍

Of course, I have a nice visual of what the Agentic Commerce stack will look like, which includes key players who fill roles in the building and running of AI Agents for commerce, and based on some of the companies already enabling this new world through vital infrastructure.

There’s a glaring inclusion in the diagram that others aren’t talking about, which is the customer as the ultimate decision maker on the right-hand side.

I’m highlighting this for two reasons.

1. It’s not clear what the regulatory ramifications of an agent, even with tokenized payment information, making a payment on a customer's behalf will be. I think this will mean the final authentication will still remain with the customer.

and

2. All the proposals of agents searching for goods and making payments on a customer's behalf ignore one key element.

Choice.

(yes, another matrix reference incoming)

One of the core threads running through The Matrix is that, even in a world of AI where you’re directed down a particular path, the choice is what makes us human and that power of choice should ultimately remain with humans, and in this case, the consumer.

Giving agents agency is one thing. Letting them make the ultimate decision is another matter altogether. Only the One can make the final choice 😉 (the One being the customer, of course).

💡 The Matrix references are very relevant to the discussion around AI because the entire movie is based in a lot of sound computer science principles and many of the references to Agents, Archtects, and constructs have been lifted from computer science text books. It's why it's one of my favourite movies and also because it made being a programmer cool at a time when kids were telling me writing code isn't cool.One other hypothesis I have is how it’ll impact the checkout page.

I believe the customer will still ultimately want to have the final say, even if that is just a simple click or Face ID, so Agentic Commerce won’t kill the checkout page. It’ll evolve it.

The future of commerce is agents working in the background to find the best deals, auto applying discounts, and filling out relevant payment information, but the origination will move from direct searches for brands to shopping via TikTok and purchasing directly through influencers content, finding goods through AI search engines, and automatic suggestions as soon as you land on company websites.

So no, the checkout page won’t be killed by Agentic Commerce. But it will move, probably to social media and AI search.

Agentic Commerce will be transformative, and even more so than Klarna was to basket conversion.

The even bigger Agentic opportunity is in finance. SMBs have so many hurdles in obtaining finance, and a Finance Agent that scours all finance options, pulls in identity & KYB data, takes in the director's preferences, then sources & presents those options to decision-makers would transform the SMB finance industry.

That’s what I’ll cover in a future edition.

In the meantime, keep your eyes out for more agentic releases. My eyes are on the mortgage industry next…If I were a mortgage broker right now, I’d be very, very afraid.

That’s it for this slightly leaner edition. I hope you enjoyed it, and yes it probably has raised more questions than answers. Questions like, “How can Agents be leveraged in the investing experience?”, and “Does an Agentic with access to my bank accounts means there is no need for a PFM app?”. I will answer some of these soon. 😊

See you in two weeks 👋🏽

J.

Interesting News 🗞- Plaid launches Plaid Protect

Plaid held it’s annual customer/developer conference recently “Plaid Effects” and there were some interesting products and demos, but right before the event it launched Plaid Protect, a real-time fraud intelligence system that helps detect and prevent fraud from the moment a user first interacts with your app or service.

Plaid is leveraging its unique position at the centre of account connections, identity and billions of data points to build a fraud tool for all customers with a dashboard and search function powered by natural language.

Protect is built on a powerful fraud model called Trust Index (Ti). It is an adaptive, ML-powered risk engine that generates real-time risk scores and attributes that evolve as user context changes—starting from the first interaction through to onboarding, account linking, and ongoing activity.

It’s clear that Ti will continue to evolve as the production model is labeled Ti1 implying multiple iterations. This is cool as it opens the possibility of customers testing different models before implementing them in production and seeing the difference in models in real time.

It’s also cool because I predicated more network powered innovation from one of my favourite fintechs last year in this extensive look at Plaid’s product and it’s strengths 😊

And finally, Protect and other network-powered fraud tools have key roles to play in the Agentic Commerce world, spotting fraud in real time, understanding the difference between human-led and agent-led execution, blocking ‘bad agents’ (like Agent Smith) from transacting, and much much more.

Everyone’s talking about retailers and marketplaces in agentic commerce, but the real advantage sits with fintechs and banks. They hold the richest, most complete dataset on consumer behavior — not just what people buy, but when, where, how often, how much, and in what financial context. They see income patterns, discretionary spend, subscriptions, credit behavior, recurring expenses, and life event triggers. This horizontal, real-world transaction data is far more valuable than the siloed vertical data a retailer like Amazon has. The players that can act on this data to power commerce agents — optimizing spend, predicting purchases, and personalizing offers in real time — will quietly control the future of agentic commerce.