Checkout.com: Closing the Payments Acceptance Gap

A deep dive into Checkout.com's origins, timeline, current product stack, their recent releases, analysis of their mission statement, and what I think is the next stage of their product evolution

Hey Fintechers and Fintech newbies 👋🏽

In the last decade, the rise of e-commerce has transformed how businesses accept and manage payments but also introduced a wave of complexity.

Global e-commerce sales surpassed $6.3 trillion in 2024, with online payments accounting for over 75% of all retail transactions in some markets.

Customers have come to expect seamless checkout experiences with optimised, localised payment methods, one-click authentication, instant refunds, and real-time payouts.

For merchants, it’s a minefield.

Every failed transaction means lost revenue, every new market introduces unfamiliar regulations and payment preferences, and fraud tactics evolve just as fast as consumer behaviours, with global e-commerce fraud losses projected to top $48 billion in 2025.

The payments ecosystem has responded to this complexity with a wave of innovation spawning layers of gateways, acquirers, fraud tools, orchestration platforms, tokenization services, and now, increasingly, real-time payouts and alternative rails like stablecoins and Open Banking–powered bank transfers.

But while these solutions help, they also add complexity, and for many merchants, the challenge isn’t just taking payments and ensuring high acceptance rates, it’s stitching together a complicated stack that works across regions, rails, and risk profiles.

That’s where modern PSPs step in. Simplifying the chaos, helping everyone from lean startups to global enterprises move money, manage risk, and meet rising consumer expectations.

The forward-thinking Payment Service Providers have also ensured they have decoupled their technology to support a multi-PSP model, which many enterprise e-commerce brands have increasingly opted for to reduce single points of failure, optimise approval rates across geographies, or access specific local payment methods.

Few have done it with as much quiet precision as the subject of this fintech deep dive…Checkout.com.

In a classic deep dive edition, I’m outlining Checkout.com’s origins and timeline of growth, diving into their product stack, looking at some of the growth potential on the horizon as well as some of the cool new releases, and explaining the power of the network effect in fighting fraud and closing the acceptance rate gap, with a signature, fun, analogy.

Here’s what to expect:

Checkout.com’s origins and early pivot

A timeline from early founding and pivot and beyond

Impressive 2024 numbers

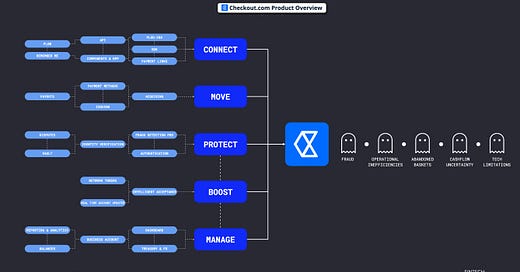

JTBD Overview of their products

Connect

Move

Protect

Boost

Manage

New Products

Face Authentication (IDV)

Business Accounts

Flow

Flow ‘Remember Me’

Mission Statement Breakdown

Living in a Multi-PSP-verse

The value of a multi-PSP model to enterprise merchants

Checkout.com’s Superpowers

Payments People

Stack Modularity

Data

The Network Effect (with a fun analogy)

A look into the future of Checkout.com

💡 This newsletter has been kindly sponsored by Checkout.com who provided some up-to-date numbers, product releases and answered some pressing questions I had, but as per usual, it's been written independently and with creative freedom.

P.S. This is a deep, deep dive, so click here to read the full version as your email client may clip the end, which you do not want to miss.“…Payments Chose Me”

Some of the greatest fintechs around have very interesting founding stories, and Checkout.com is no different.

Guillaume Pousaz, Checkout.com’s Swiss-born founder, didn’t start out wanting to revolutionise the payments industry.

He initially studied mathematical engineering at EPFL before switching to economics at HEC Lausanne with the ambition of getting into investment banking. He even had a job at Citibank London lined up.

🤔 There is an alternate universe where he does take the job at Citibank, and we’re working on the same floor in Canary Wharf.He didn't end up at Citibank though.

In 2006, he took a job at International Payment Consultants (IPC), a small firm that helped online merchants get set up with acquiring banks, advising merchants on payment gateway and acquiring bank selection, navigating card schemes, etc, and his payments journey began.

As he said himself to the Sunday Times in 2020:

“I didn’t choose payments – payments chose me.”

Regardless of the initial reasoning, the payments bug had bitten, and landing at a firm that was at the heart of the challenges merchants faced was the perfect crash course on all things payments for merchants.

A year later, after getting deep in the weeds of payments at IPC, Guillaume founded his first payments startup, NetMerchant. The company helped US businesses targeting European markets accept payments in EUR and GBP; a full transaction flow where the transaction was presented in either currency to the buyer and settled in the same currency back to the merchants’ US based bank accounts. Merchants avoided FX fees and shielded their customers from unnecessary charges, ultimately improving fees and acceptance rates.

The venture was short-lived, but it was pivotal. While the idea showed promise, it relied on third-party infrastructure and lacked the transparency and control needed to scale. The experience gave Guillaume a front-row view into the complexities of global payments and revealed just how broken the tools for moving money online really were.

With the same opportunity in mind, Guillaume acquired a small Mauritius-based payments company and began to build out a sales team in Singapore while the tech hub remained based in Mauritius. From there, he launched Opus Payments in 2009, targeting Hong Kong-based merchants who wanted to sell internationally. It offered settlement in US, EUR, GBP, CAD and AUD directly into Hong Kong bank accounts. The model was fundamentally the same as NetMerchant, but for new payment corridors. The idea was simple: help merchants in Asia accept payments from customers anywhere. This time, however, Opus Payments operated its own payment gateway. And when Opus landed a major account (Chinese electronics seller DealExtreme), the business became profitable and gave Guillaume breathing room to invest deeper into infrastructure.

Then, in 2012, came the crucial pivot point.

Seeing an opportunity with PSD1, he rebranded Opus as Checkout.com, moved the company’s HQ to London, and began building what the market was missing: a full-stack payments platform that gave merchants access to acquiring, processing, fraud tools, and settlement, all via a single API under a regulated entity.

Unlike Stripe, which took a developer-first, bottom-up approach, Checkout.com focused on building the infrastructure — acquirer, processor, gateway, risk engine, and more — from day one, creating a holistic solution for the complex flows of mid-market and enterprise businesses.

This infrastructure allowed them to deliver high acceptance rates, better service levels and a constant stream of new features optimised for enterprise merchants operating at global scale. They also developed a go-to-market model that matched, targeting enterprise merchants who wanted to thrive in the digital economy.

The "aha" moment wasn't a single stroke of genius, as I'm sure Guillaume himself would admit.

It was years of pain watching merchants duct-tape together PSPs, fraud vendors, and settlement solutions and realising the future of payments needed to be unified, compliant, and built for performance at scale.

The Checkout.com, as we know it, was born, quietly solving key problems for mid-market and enterprise customers looking to take payments, which they grew profitably for years before taking any external funding.

From the beginning, Guillaume knew that the only way to offer better infrastructure was to build it himself with his team. PSD1 was the springboard.

Today, his journey (and characteristics) sit alongside the founders of some of the most impactful fintechs of the last decade. Leaders like Nikolay Storonsky (Revolut), Tom Blomfield (Monzo), Zachary Perret (Plaid), and Sebastian Siemiatkowski (Klarna).

Deep product obsession. Quiet resilience. Relentless pursuit of better infrastructure.

Companies' origins are important, especially this one that demonstrates the evolution and strives to solve payment problems for enterprise customers. It gets to the heart of what the company is about, what they value and where their expertise lies. And since 2012, Checkout.com has been quietly building an impressive global payments business and expanding its product far beyond moving money…

Checkout.com - Timeline of Growth, Product, and Strategic Moves

2009: Founding and Initial Proposition

Opus Payments is founded in Singapore by Guillaume Pousaz.

Initially focused on helping Hong Kong-based merchants process cross-border e-commerce payments, especially for U.S. and European markets.

2012: Rebrand, Pivot and ‘Official’ start of Checkout.com

Rebrands to Checkout.com and relocates HQ to London.

Shifts product focus from a basic processor to building a full-stack API-based payments platform, with acquiring, processing, and fraud tools all under one roof. Starts applying for regulatory licenses in Europe.

2013–2017: Infrastructure and licensing groundwork

Checkout.com operates under the radar, securing FCA authorisation in the UK and building a unified acquiring platform with early attention to compliance, fraud management, and enterprise-grade APIs.

Begins onboarding large e-commerce clients like Deliveroo and Samsung.

Visa and MasterCard Licence

2018: Breaks into the European fintech spotlight

After years of building in silence, Checkout.com gains a reputation as a profitable, scalable PSP. Its product stack stands out for being acquirer-first, transparent, and customisable, particularly appealing to marketplaces and global retailers.

Signs deal with Netflix.

2019: First Major raise

Raises $230M Series A at a $2B valuation (Insight Partners, DST Global). One of Europe’s largest-ever Series A rounds.

Funds go into accelerating product features:

Payments API v2

Improved settlement and reconciliation tools

Enhanced merchant dashboard and reporting

Increased international acquiring support, especially in MENA and APAC

2020: Series B and growth via acquisitions

$150M Series B raise at $5.5B valuation

Checkout.com acquires French startup ProcessOut

Product growth includes:

Performance Optimisation Suite (routing logic, retries, failovers)

Begins building toward multi-rail payment support, including wallets and APMs

2021: Series C and MENA growth

Raises $450M Series C at $15B valuation

Checkout.com cements itself as the payments platform of choice for fintechs like Klarna, Revolut, and Coinbase. Middle East operations grow rapidly.

Product updates include:

Fraud Detection product (Frameshield)

Expanded real-time data insights

Onboarding APIs for platforms and marketplaces

First steps toward crypto integration

2022: Product momentum continues

$1B Series D at $40B valuation

Now Europe’s most valuable private fintech. Product momentum continues:

Launches Checkout.com Payouts: real-time, cross-border disbursements for platforms (head to head with Stripe Connect)

Expands into Web3-native payments, becoming one of the first PSPs to offer stablecoin rails with fraud and compliance layers built-in

Extends support for more alternative payment methods (APMs) across regions

2023: Operational refocus amid macro headwinds

Checkout.com narrows product investment toward high-conviction verticals: digital goods, marketplaces, and crypto-native businesses.

Behind the scenes:

Starts investing in AI/ML-based fraud models

Continues to enhance payout speed and FX optimisation tools

Experiments with platform extensibility and modular service rollout

2024: Global growth and strong numbers

Still processing billions monthly.

Despite talks of a valuation reset, Checkout.com remains a leader in regulated markets and global acquiring.

Prepares for next phase and ends the year with impressive numbers:

Enhancing platform for greater modularity

Developing new financial stack APIs beyond core payments

Deepening capabilities in MENA, North America and platform payments infrastructure

👉🏽 Achieved 40% overall net revenue growth

👉🏽 300+ new merchants joined the their network including Ticketmaster, Bumble, Trip.com, and Heineken

👉🏽 40+ of their customers now process over $1 billion

👉🏽 The Intelligent Acceptance product performed 26,000+ payment optimisations per minute to drive up merchants’ acceptance rate, resulting in $9 billion in additional revenue for merchants since launch

👉🏽 And they exited the year on a profitable run rate with profitability the target for 2025

2025: Present Day

That’s the fast-forward version of how Checkout.com went from a quiet infrastructure play to a global payments powerhouse, one that now sits at the intersection of enterprise finance, fintech innovation, and cross-border commerce.

They don’t just help Hong Kong merchants accept cards anymore.

They now process billions in payment volume, supporting a wide array of digital and alternative payment methods, from Mada in Saudi to Bizum in Europe with more than 2bn+ cards stored in their vault.

They don’t just serve one region.

They operate across the globe with domestic acquiring available in over 50 markets, offices in London, Dubai, Paris, Riyadh, New York, and Singapore, and regulated status in key financial hubs like the UK, UAE, and EU.

They don’t just do acquiring.

They now offer a full-stack platform that includes smart payment routing, real-time payouts, fraud detection, and a modular API stack that gives merchants complete control over how money moves in and out of their platforms.

They’re not just an option for enterprises. They’re the infrastructure behind them.

They power payments for some of the biggest names in fintech and commerce: eBay, DocuSign, Vinted, Uber Eats, Klarna, Wise, Sony, eToro, Alipay, Crypto.com, Farfetch, Careem, and many others that need reliability across multiple rails, regions, and regulatory regimes.

They’re not just keeping up, they’re betting on what’s next.

Whether it’s instant disbursements, wallet integrations, or modular services, Checkout.com is placing bets on the future of programmable money and embedded financial infrastructure.

It’s a far cry from their 2009 launch as Opus Payments, and it’s clear that what they’ve built isn’t just a payments processor.

It’s a full-blown operating system for money movement at a global scale!

Closing the Acceptance Gap 💳

As you can see from the timeline, their product has grown significantly since 2009 and evolved beyond just processing payments.

I frequently use the Jobs-to-be-Done framework to articulate solutions customers need and want, and it’s also a great way to get to the heart of an existing company’s product offering. Because it means, rather than just looking at the product offering, you see the product through the lens of the ‘job’ that it does for customers.

You can read more about Jobs-to-be-Done here.

In this instance, Checkout.com has made my job (get it) slightly easier as the core single-word adjectives they have for their five pillars start the JTBD-esque statement quite well.

1. Connect 🔌

🧠 Connect merchants to Checkout.com’s infrastructure quickly and flexibly so they can integrate, activate, and start accepting payments with minimal technical lift.

👉🏽 Connect is all about how businesses plug into the Checkout.com platform. From robust APIs for developers to plug-ins, SDKs, and payment links for faster go-lives. Whether a merchant is launching a global marketplace or spinning up a side hustle on Shopify, Connect gives them the means to go live fast and scale flexibly.

Plug-Ins: Pre-built integrations for platforms like Shopify, WooCommerce, Magento, and Salesforce.

Payment Links: No-code links and hosted pages to accept payments without a full integration.

Mobile SDK: Mobile SDKs for seamless, optimised checkout flows across iOS and Android.

API: Their core differentiator: a powerful, RESTful API built for performance and control.

HPPs: Hosted Payment Pages and modular checkout components for faster integration.

Flow: A pre-built, customisable payment user interface that you can embed directly into your website.

Why it matters: Faster, easier integration accelerates speed to market, especially critical when entering new geographies, adding new verticals, or launching time-sensitive initiatives.

2. Move 💸

🧠 Move money for merchants across borders, rails, and use cases, enabling faster acceptance, instant payouts, and global expansion from day one.

👉🏽 The core of Checkout.com’s platform. This pillar powers the end-to-end movement of money across borders, currencies, and rails. It includes everything a merchant needs to accept funds, issue payment instruments, and pay out at scale, whether it’s a checkout flow, a marketplace disbursement, or a wallet top-up.

Acquiring: Unified acquiring across regions, with granular control over transaction performance and as a licensed acquirer in multiple jurisdictions, it means they process payments end-to-end. No reliance on third-party banks.

Payment Methods: Over 150+ methods supported globally, including cards, wallets (Apple Pay, Google Pay), bank transfers (SEPA, FPX, Mada), and APMs.

Issuing: Physical and virtual card issuing to help platforms engage customers, manage business spend and control downstream flows.

Payouts: Real-time disbursements to cards, accounts, or wallets. Key for marketplaces, gig platforms, and fintechs.

3. Protect 🛡

🧠 Protect every transaction and interaction across the customer journey, ensuring merchants can grow revenue while reducing fraud, chargebacks, and compliance exposure.

👉🏽 Protect is Checkout.com’s fraud, identity, and compliance layer, designed to help merchants detect threats, reduce chargebacks, and stay compliant without bolting on third-party tools. It covers fraud detection, 3DS2 authentication, identity verification, dispute management, and secure data vaulting.

Fraud Detection Pro: Real-time rules-based and ML-powered fraud detection across channels.

Authentication: Full support for 3DS2 and secure customer authentication, localised per market.

Identity Verification: KYC tools and integrations for onboarding and fraud checks.

Disputes: Tools for managing chargebacks and payment disputes with clear resolution flows.

Vault: Tokenized card storage with PCI compliance, enabling secure recurring billing and card updates.

Why it matters: Fraud risk increases exponentially with scale and geography. Merchants need embedded, customisable defence mechanisms to protect revenue without harming conversion.

4. Boost 🚀

🧠 Boost payment performance across every transaction to maximise acceptance rates, retain customers, and recover revenue that would otherwise be lost.

👉🏽 Boost is Checkout.com’s performance engine. The set of tools designed to increase authorisation rates, reduce involuntary churn, and drive more revenue through every payment interaction. It includes machine-learning–based acceptance optimisation, network tokenization, and real-time card updater tools.

Intelligent Acceptance: ML-based routing and retry logic to maximise authorisation rates and merchant revenue.

Network Tokens: Support for Visa and Mastercard network tokens, improving success rates, security, and keeping up with network innovation.

Real-Time Account Updater: Automatic refresh of expired or replaced cards, keeping subscriptions flowing.

Why it matters: Incremental improvements in payment acceptance and retention directly drive top-line growth, especially for high-volume, subscription-based, or marketplace models.

5. Manage 💼

🧠 Manage payments, treasury, and settlement operations, giving finance and ops teams the real-time tools they need to optimise liquidity and minimise operational friction.

👉🏽 Manage is the command centre, the back-office interface for finance, ops, and payments teams to monitor flows, manage balances, and reconcile cash. It includes the Dashboard, real-time balance views, and treasury & FX tools to help large merchants manage multi-currency operations.

Dashboard: A central interface for monitoring transactions, performance, and fraud events. Effectively an operating system for back office teams.

Balances: Real-time visibility into account balances, settlements, and cash flow.

Treasury & FX: Tools for currency management, multi-currency settlement, and automated treasury controls, crucial for growing merchants and large enterprise orgs transacting across borders.

Business Account: A multi-currency account for merchants designed to hold, manage and deploy funds.

Reporting & Analytics: Customisable, granular reporting tools that give finance, operations, and payment teams full visibility into the metrics that matter.

Why it matters: As payments become more global, complex, and multi-currency, finance and operations teams need powerful tools to stay in control, optimise cash flow, and manage risk.

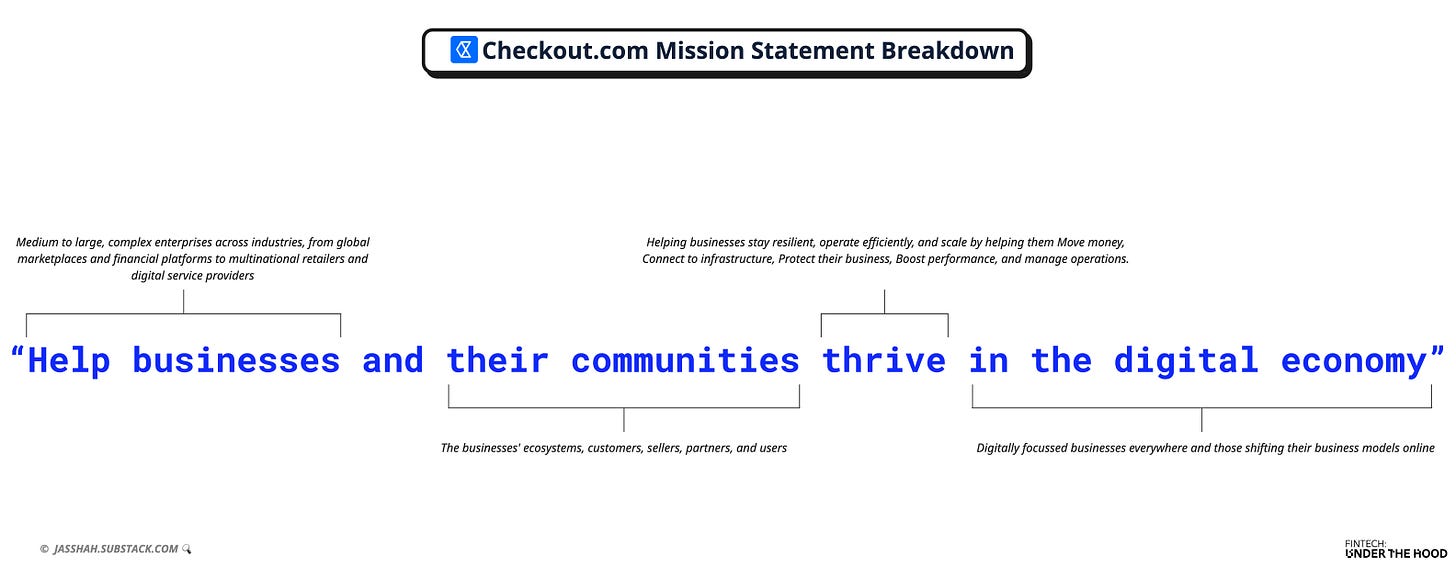

A Statement of Intent 📝

They’ve built a product stack to solve several key problems for customers, and the JTBD framework is a great way to see the granular jobs, but before diving into some of their cool new products, I want to zoom out a little and look at their mission statement, which is a better way of seeing the bigger picture of their what, why, and who.

It’s what I call a “Mission Map” (copyright pending).

You start with the mission statement, which for Checkout.com is:

“Help businesses and their communities thrive in the digital economy”

Then, you look at it through a structured lens. What does it say about:

Who the customer is

What market it operates in

Its broader ambition or purpose

Who is it for?

👉🏽 Business and their communities

Medium to large, complex enterprises across industries, from global marketplaces and financial platforms to multinational retailers and digital service providers. The phrase “businesses and their communities” is intentionally broad, signalling a focus on high-scale organisations and the ecosystems they power, including customers, sellers, partners, and users.

What market it operates in

👉🏽 The Digital Economy

Concentrating on digitally focussed businesses and communities everywhere but also at companies that are shifting their business models online. Again, this is intentionally broad. In the early days, this might have been “..in Hong Kong's digital economy”. The use of the broader term is a signal of their global reach.

Its broader ambition or purpose

👉🏽 Thrive

Again, this is not just “take payments” or “better understand risk”, it's the umbrella term used to describe their role in helping businesses stay resilient, operate efficiently, and enable them to grow by helping them Move money, Connect to infrastructure, Protect their businesses, Boost performance and Manage operations.

eBay Example: Let’s use their recent partnership with eBay as an example to embed into the mission statement

Help businesses (eBay) and their communities (their sellers and buyers) to thrive (display relevant payment options, provide frictionless global payments processing, allow sellers to keep a great share of payments, increase customer conversion, improve customer payment experience) in the digital economy (across eBay’s global digital marketplace)It’s a great way to zoom out and look at how the existing products fit into the broader mission as well as a great way to frame any new products, by asking the question, “how does this new feature or product help businesses and their communities thrive in the digital economy?”

Checkout my new toys 🧸

When it comes to helping businesses, Checkout.com is not letting up on product innovation.

Each of its new products also “Help businesses and their communities thrive in the digital economy”, strengthening and expanding the depth of its core pillars.

Here’s how.

Protect 🛡

Face Authentication: An AI-powered extension to its Identity Verification solution that enables businesses to securely verify and re-authenticate returning users in seconds using live video and facial matching, helping to remove friction from critical user flows such as password recovery, employee onboarding and secure platform access.

Big brands such as DocuSign, Uber Eats, and European fintech Swan are already benefiting from Checkout.com's IDV to provide a secure and low-friction user journey, and Face Authentication only adds to the depth of products in their 'Protect' pillar, helping those enterprise orgs keep larger volumes.

For PSPs, especially those supporting enterprise organisations, embedded IDV will be a key battleground in reducing fraud and increasing payment volume, which are key measures of success for any payments partner.

Manage 💼

Business Account: Checkout.com’s Business Account is a response to a long-standing pain point in global commerce. The lag between payment authorisation and usable funds. Launched quietly in 2024, it gives merchants access to same-day settlement, even before they receive the actual card scheme funds.

This matters more than it sounds. For many businesses, especially in high-volume or fast-moving verticals, delayed access to funds can constrain growth, increase financing costs, or slow supplier payments. With Business Account, Checkout.com acts as a treasury enablement layer, giving merchants visibility, control, and liquidity over incoming flows.

As you can imagine, an account to narrow the settlement lag is just the beginning and competitive yields on balance and full-blown expense management are inevitable value adds.

Connect 🔌

Flow: Launched last year at Thrive Barcelona (Checkout.com’s annual customer conference), Flow is the toolkit of configurable components designed to help merchants create localised, frictionless checkout experiences without rebuilding from scratch. It empowers businesses to dynamically present the most relevant payment methods based on user context (device, location, transaction type), all without custom front-end development. This not only speeds up implementation but directly improves conversion by surfacing the right payment rails at the right time.

As more merchants adopt a multi-rail approach enabling methods from cards and wallets, to bank transfers and APMs, and as the number of payment options continues to increase with stablecoin payments likely to become the norm, Flow becomes an ever more crucial part of Checkout.com’s pitch to businesses…launch faster, customise deeply, and convert better. A product that has been developed over years and uses learnings from processing billions of transactions.

"Flow makes building your payment page extremely simple, staying true to your brand while keeping your business safe. We have put years of experience towards designing a smoother checkout experience.” - Meron Colbeci, Chief Product Officer at Checkout.com

Remember Me: Remember Me is Checkout.com’s first step into consumer identity. It allows shoppers to store and re-use their payment credentials across the entire Checkout.com merchant network, creating a cross-merchant processing token for faster checkouts, improved conversion, and lower fraud risk.

What makes this cool is not just the ability to one-click checkout across merchants but actually its potential. Unlike browser autofill or merchant-bound vaulting, Remember Me is network-aware. It can work across brands, meaning the next time a user encounters Checkout.com’s checkout flow, even on a different site, they can pay with a single click. That unlocks a smoother user journey, better data fidelity, and lower cart abandonment.

In the future, Remember Me could evolve into a broader identity layer, enabling loyalty integration, fraud profiling, and secure user verification across platforms. For now, it’s a part of Checkout.com’s strategy that is thinking beyond payment processing and toward becoming part of the consumer’s digital wallet infrastructure.

Taken individually, each of these product launches is a meaningful step forward. But taken together, they show something more deliberate. Checkout.com isn’t building a monolithic payments processing stack. Instead, it’s building interoperable, modular tools that solve real problems for enterprise merchants without forcing lock-in or unnecessary integration debt.

This approach is becoming increasingly important in a world where many merchants, especially enterprises, are running multi-PSP models for redundancy, optimisation, or localisation.

Checkout.com’s new and existing products are standalone when they need to be, but integrated when it matters most making it easier for merchants to plug in just the pieces they need. It's a move that respects complexity while reducing it and a strategic response to how enterprise payment teams now architect their stacks.

Navigating the Multi-PSP-verse 🪐

For years, consolidation and a single payment service provider model was dominant in payments.

But that’s gradually changed.

Most enterprise merchants are embracing a multi-PSP strategy, layering in multiple payment service providers across markets, rails, and user flows, not because they have to but because it makes economic sense.

Why the shift?

At enterprise level, and increasingly at the smaller merchant level, payments are being looked at as a performance lever rather than a cost centre.

Approval rates, local methods, fraud, risk appetite, and settlement timing all directly impact revenue, retention and customer experience. And on top of that, when operating across regions, segments, and verticals, relying on a single provider introduces too much risk and not enough control.

The multi-PSP model offers:

Redundancy: Failover routing to avoid outages or provider-side downtime

Optimisation: Routing transactions to the provider with the highest approval rate by card issuer or regionCoverage: Using regionally strong PSPs for local payment methods or compliance (e.g. Mada in Saudi, iDEAL in the Netherlands)

Negotiation leverage: Splitting volume reduces vendor lock-in and can improve pricing

Risk diversification: Less exposure to operational or regulatory issues tied to a single PSP

Vendor A/B testing: Allows for the live testing of different PSPs on the same transaction set, meaning seeing in real-time which PSPs perform better in different jurisdictions and scenarios

The downsides of a multi-PSP model for merchants are minimal.

A few years ago, the biggest downside would have been implementation cost, but as many PSPs, including Checkout.com, have low-integration options, the cost is one of the least significant downsides.

There are some drawbacks, such as having multiple systems and separated payment data, as well as some additional complexity that some smaller organisations might face, but much of the complexity is mitigated by leveraging a provider with interoperable components and tools that work across PSPs.

For enterprise merchants…a multi-PSP model is now a no-brainer for organisations operating across regions and with a diverse customer base as it allows for the best-of-breed selection of payment providers and a configuration-based hierarchy of providers depending on the payment rail, risk appetite and region.

For PSPs…like Checkout.com and others, they are aware of this lean to a multi-PSP model and have leaned in themselves creating modular, interoperable stacks that can work alongside traditional/legacy PSPs, enabling and encouraging the multi-PSP model rather than discouraging it.

Checkout.com’s Superpowers 💪🏽

In this Multi-PSP-verse there are still huge opportunities to take the whole pie, even if that’s not the primary objective.

Checkout.com has several superpowers that’ll enable them to become even more attractive to enterprise clients and help grow their share across the landscape, whether that’s in a multi-PSP model growing their dominance as the main provider, or as a single PSP for a particular merchant. I’m going to focus on the four that I think will be the most important going forward.

People Power

They’ve built a team that reflects its ambition.

Ex-bankers, infrastructure operators, crypto engineers, treasury specialists, and platform builders from across Europe and MENA. And unlike growth-at-all-costs fintechs, it’s kept a tight culture rooted in performance and focus.

Their Payments Success Managers don’t just manage merchants, they optimise, advise, and engineer outcomes.

Think of them as mini-Guillaumes from back in the payments consulting days.

Experts in the payments domain and able to guide enterprise clients through challenges whilst improving acceptance rates and increasing merchant revenue.

This shifts Checkout.com’s role from service provider to strategic partner.

As payment complexity rises, merchants don’t just want APIs; they want intelligent humans who understand their revenue stack. Checkout.com gets that.

Modularity Mindset

This is an obvious one I’ve referenced throughout, and one of its quiet strengths is its embrace of modularity, which allows merchants to adopt only the parts of the stack they need. Authentication without acquiring. Payouts without frontend. Reporting without routing.

This is exactly what merchants need. Composable infrastructure that plays well with others. By avoiding the “lock-in everything” trap, they become the PSP you can integrate alongside others and, increasingly, the one you want to scale with once you do. It gets around the issues of large enterprises that are locked into lengthy contracts with vendors. If they already have a long-term payments partner, they come in offering their fraud or dashboard products, and when the merchant is ready to explore payments partners, Checkout.com is already in the building.

Data

This and the next one combined create Checkout.com’s unique moat, in my opinion.

Checkout.com sits at the heart of the most valuable and under-leveraged stream in fintech. Transaction-level data tied to real-world user behaviour. Every swipe, tap, decline, retry, or refund contributes to their growing data set that powers real-time fraud detection, smart retries, and ML-driven acceptance rate optimisation.

This isn’t just data for dashboards. It’s data that shapes infrastructure and powers new products.

Products like Intelligent Acceptance and its 87 million daily optimisations come from a data moat most PSPs can’t match. Fraud Detection Pro’s contextual rules are also powered by data across merchants and Flow, their configurable component toolkit, was made possible by using learnings from processing billions of transactions.

As they are the PSP for several enterprise merchants, they have access to large volumes of data, which means they have more insights to make decisions on conversion at a payment page or using data to prevent fraud, but in the future, they can use that data that assist enterprise merchants on where to launch next, what payment type to use for a new product based on similar products in the market, and even create a picture of ideal customers.

The Network Effect

The power of Checkout.com’s network effect works on a couple of different levels. Firstly, it’s built a network of merchants, transactions, fraud signals, and optimisation loops that improve the performance of its platform with every new integration.

For example, when a customer’s card fails on one merchant’s site, Checkout.com learns why, whether it’s a 3DS issue, an expired token, a regional compliance mismatch, or a bad issuer response. That insight can then inform real-time routing and retry strategies for every other merchant on the platform. If a fraud vector spikes in one country or sector, Checkout.com’s systems flag it and proactively harden defences elsewhere. It’s not a linear payoff; it’s compounding, and it gets better with each enterprise merchant that joins the network. More trusted ecosystem merchants, more data, more insights = better fraud detection and payment optimisations.

Secondly, with ‘Remember Me’, it looks like they are also building a trusted consumer network. Because the more customers who sign up to Remember Me at the checkout page, the more verified users are on the platform. That means Checkout.com can create profiles of customers, see where they’ve shopped, determine how trusted a customer is, and use that to apply a different level of scrutiny vs a non-verified customer.

As more customers and merchants use Checkout.com, the trust network becomes richer, which attracts more enterprise merchants (as now, a trusted customer network is an additional attractive prospect for enterprise merchants), and the cycle continues.

That’s the network effect in full flow.

The Merchant and Consumer network as a global immune system 🧬

To really understand the power of the network effect, it helps to think of Checkout.com’s network like a global immune system, one that gets stronger with every new merchant it protects.

Each merchant acts like a sentinel node in the body, constantly exposed to signals such as login attempts, card declines, suspicious behaviours, repeat users, and new devices. When a verified customer passes through safely, it's like a recognised “self” cell. The system logs it, builds confidence, and allows the transaction to flow with minimal friction.

But when an unfamiliar user enters the system, say, a new card-device pair, a strange routing behaviour, or a known fraud pattern seen elsewhere, the signal is picked up like a foreign body. Merchants on the network become the early detectors, and Checkout’s Protect and Boost layers act like antibodies, responding quickly, containing the threat, and adapting defences across the entire network.

The more merchants integrated, the more “immune coverage” Checkout.com has. Signals from one region help protect another. Edge cases become patterns. False positives drop. And most importantly, Checkout.com doesn’t just react to fraud; it learns from it and inoculates the network in real-time.

In a world where fraud mutates faster than rule-based systems can keep up, this kind of shared intelligence becomes a superpower. One merchant’s experience improves the outcomes for everyone else, and that’s the kind of network effect that truly compounds.

The Road Ahead 🛣

These superpowers not only help supercharge existing products to help businesses thrive but also are crucial to new products on the roadmap, including a new product pillar I think they’ll stand up.

Geographical Expansion 🌏

There’s already been some significant progress in Checkout.com’s geographical expansion plan in key regions over the past year:

Japan 🇯🇵: Became the first global PSP with direct Visa and Mastercard integration, and opened a Tokyo office.

Saudi Arabia 🇸🇦: Expanded domestic processing with Mada (local KSA scheme), serving leading global brands like Carrefour and Lego and local brands such as Salla and Mall of the Emirates.

Canada 🇨🇦 : Completed certification for direct acquiring, launching in Q1 2025 to strengthen its North American presence.

Brazil 🇧🇷 : Preparing for direct acquiring with Visa, Mastercard, and PIX, supported by a new São Paulo tech hub.

At Thrive Abu Dhabi in April, they announced plans to launch physical and virtual card issuing in the UAE, positioning themselves as the first global digital PSP to offer this capability in the region. The move will enable businesses to issue branded payment cards to users, unlocking new customer experiences across spending, rewards, and embedded finance.

Having worked in the region on a few different occasions and noticed this a lot more acutely in KSA, it’s clear the region would benefit from modern card-issuing platforms entering the region. Digital adoption is high, and the population is young and digitally savvy, but there are infrastructure challenges and a distinct lack of API first, modular payment processing with card issuing capabilities in the region.

I expect more geographical growth and the launch of key parts of its stack to new regions across the next few years.

AI 🤖

Naturally, given its position at the heart of high-volume decision and payment processing, AI has numerous applications across the stack. From speeding up fraud detection (think about the Immune system analogy but 1000x the number of antibodies), more personalised dynamic payment pages, faster A/B testing, and so much more. Its potential runs much deeper still.

Checkout.com is one of the acquirers Mastercard will be partnering with to enhance the tokenization capabilities with merchants to deliver safe and transparent agentic payments. They’ll also be one of the first to adopt Visa’s new Intelligent Commerce API.

Now, let's speculate for a second.

Remember those Payment Success Managers from earlier.

What if there were Payments Success AI-gents trained by those payments experts and built to order for individuals in various teams across enterprise merchants?

An AI-gent for the payments support team, the optimisation team, the SEO team, and even an AI-gent for CFOs that flags anomalies in treasury flows recommends FX positions or suggests payout schedule tweaks based on liquidity patterns.

These agents wouldn’t just answer questions; they’d act, driving revenue, reducing churn, and turning payments into an active lever for growth across the org.

And if Checkout.com continues investing in modularity and agentic APIs, it’s not unthinkable that merchants may one day have a fully autonomous PaymentOps layer running quietly in the background, built on their data, trained by their operators, and orchestrated through Checkout.com’s infrastructure.

It’s not here yet. But the pieces are starting to appear.

Grow as a 6th Pillar? 📈

This one is a bit of speculation, but I believe the next logical product pillar to add to Connect, Move, Protect, Boost, and Manage would be Grow, and it’s partly inspired by something Guillaume said at Thrive Abu Dhabi:

"We want to reinvent how people interact with financial services.”

This, of course, has quite broad applications, but the one area that it makes sense to build on is the recent launch of Business Account.

The logical next step for Business Account is to add competitive yields on balances, account performance, integrated expense management (with Checkout.com issued cards of course), and inevitably, offering financing.

Financial products like invoice financing that large enterprise organisations tend to use additional third-party providers for. Or revenue-based finance for enterprise and enterprise sellers that someone like eBay could use and offer to its marketplace sellers and is a key driver of growth.

Growth isn’t exclusively about financing.

It’s also about acquiring customers, keeping them for longer, increasing their average spend, all the while ensuring they have a positive and secure experience.

So, allow me to speculate once more. Every year Checkout.com releases its digital economy report with the latest just launched. The report contains a host of insights from 18,000 survey consumers, including insights on consumers' preferences by region, etc.

🧠 What if this was not only available via a report but also embedded into a tool that Checkout.com’s enterprise merchants can access?

Merchants looking to retain customers can use insights from the tool to give those customers bespoke loyalty and reward bonuses automatically as part of the checkout experience. Or suppose they are looking at new markets. In that case, they can use the tool to find the closest matches in terms of customer behaviour and identify the regions that closely align with already profitable markets, which will be markets ripe for expansion.

Remember Me, the one-click checkout and identity solution could also be huge here. The growth tool could use verified profiles from Remember Me to help merchants build a complete picture of their customers and their spending habits and use them to further power conversion, loyalty, and rewards programs.

There’s so much potential in this new prospective pillar for merchants, consumers, and everyone in between.

Focussing on the last mile…🏁

Enterprises spend millions – sometimes hundreds of millions – on getting people to the start line.

Ad budgets, SEO campaigns, influencer strategies, conversion-optimised landing pages, out-of-home marketing, and the list goes on.

Every pixel, every click, and every tracked behaviour is part of a high-stakes funnel designed to capture intent.

But the fact is, none of that matters if the payment fails.

And there’s actually a bit of double jeopardy because not only is there direct revenue loss due to the failed payment, but all the investment in customer acquisition is also a major cost not recouped.

The last mile of the customer journey, the checkout flow, the authentication prompt, the tokenized card pull, and the final authorisation, is where revenue is either realised or lost. And yet, it’s often the most overlooked part of the funnel.

Think of it like this.

👉🏽 You see a personalised ad for a product that you’d been thinking about purchasing for a while.

👉🏽 You receive a bespoke offer for a discount on that product, and you head to the store to buy it.

👉🏽 You pick up the product off the shelf and walk over to the checkout counter only to be told your offer isn’t valid, and they only take cash.

All that initial acquisition cost and effort is wasted, revenue is gone, and potentially, so is that customer forever.

🧠 That’s the real-world equivalent of the poor digital experiences that arise when that last mile isn’t considered as carefully as the first 99.

Whether through AI-powered retries, optimised fraud defence, tokenization, or identity-aware checkout flows, Checkout.com is helping enterprises close the loop on everything they’ve invested upstream.

For enterprise businesses, they improve conversion, retention and acquisition rates, lower fraud, and increase revenue in the pursuit of their ultimate aim…”Helping businesses and their communities thrive in the digital economy”.

And in the multi-PSP-verse and in a market where customer acquisition costs are rising, and margins are under pressure, the businesses that win are those who leverage experts in the field with world-class products and decades of experience in the space to treat the last mile of the customer journey with the same obsession as the first click.

Not just taking customers to the checkout page…but ensuring they get through it.

That's it from me. I hope you enjoyed this deep dive 👋🏽

Remember to hit the thumbs up below, drop a comment and share it with a friend or colleague (and if you’re at Money 2020 and want to meet up, drop me a message here, on the app or on LinkedIn).

Jas.

P.S. If you want to partner with me on a Fintech Product deep dive or are interested in working with me in any of the below areas, reply to this or send an email to jas@bitsul.co.uk 😊 :

👉🏽 Product Strategy/Development consulting

👉🏽 General Fintech advisory

👉🏽 Digital bank building and growth advice

👉🏽 VC/Family Office product due diligence

👉🏽 Mentorship or a ‘product therapist™️’ for your team

The undefeated champion at these long deep dives! I learned a lot from reading this one... Excellent diagrams too... Network Led Growth diagram gets the concept across really well