Fintech R&R☕️ - Enter the Fintech Metrics

A dive into the rabbit hole of metrics and a preamble on Frank & Chase

Hey Fintechers and Fintech newbies 👋🏽

Welcome to another Fintech R&R. Firstly, thanks to those who left feedback via the form at the end in previous posts. I’m going to incorporate some of your ideas into future editions! And secondly, thanks to you early adopters reading this. Squeezing this into my Wednesday and Thursday evenings every fortnight is tough but your support makes it a bit easier 🙂. Now let's dive in.

A bit of controversial news triggered the thinking about this week’s subject. Chase’s acquisition of Frank.

For those who don’t know about the acquisition, I’ll give some background in the first section, but the summary of this story is as follows. Back in 2021, JP Morgan Chase, the biggest bank in the US, acquired Frank, the fintech that makes student loan applications easier.

But Chase recently shut down the Frank website amid claims that the fintech had fraudulently over-reported the number of customer accounts they had during their due diligence process. This was discovered almost by accident when they launched an email marketing campaign and had around 70% of those emails bounce back. A common reason for email bounce back is emails not existing, and Chase subsequently filed a lawsuit against Frank’s former CEO and Founder.

When I heard this news, I thought about following the white rabbit down one of two holes:

🔵Blue Pill: Big organisation acquisitions and the due diligence process involved

🔴Red Pill: Metrics in Fintech products, the good, the bad, and the misunderstood

Naturally, I leaned towards the latter because it fits more closely with the work I do with Fintechs. It’s also a fascinating and underexposed area and because due diligence feels more like Agent Smith than Neo. So here we go…

Summary of what’s to come

Background of Chase and Frank

Why are metrics important & product development lifecycle

North Star Metrics and Metrics Hierarchies

North Star examples in Fintech

Clarifying some contentious Fintech Metrics

Talking Frank-ly about Chase’s acquisition

Since 2020 Chase has been pretty clear about their intention to acquire valuable organisations to broaden their offering and ‘compete with Fintechs’. And in a letter to JPMs shareholders in 2021, Chase’s CEO, Jamie Dimon, listed fintech as one of the “enormous competitive threats” to banks.

“We have spoken about this for years, but this competition is now everywhere. Fintech’s ability to merge social media, use data smartly and integrate with other platforms rapidly (often without the disadvantages of being an actual bank) will help these companies win significant market share.” - Jamie Dimon

That’s why the acquisition of Frank came as no surprise, as Chase was already on the ‘if we can’t beat it, then we buy it’ train.

Acquisitions are part and parcel of banking life and have been for decades. RBS, Barclays, Lloyds and the organisation I worked for, Citigroup, have all grown in size and stature after acquiring other organisations and absorbing them into their umbrella. It’s part of the reason banking tech transformation projects are so hard (and expensive) because although it seems like a simple enough exercise to simplify and improve technology, it’s a normalisation of several different organisations and tech stacks that have been absorbed over time, not just a simple reformatting of the banks own tech.

But the advantages of acquisitions often outweigh the tech debt. As the bank will gain valuable technology, increase the deposits or assets under management, OR gain fast access to a target market or demographic.

And it’s that last one that JPM was Chase-ing with Frank (had to be done).

Frank was a portal that helped students enrol in online courses and simplify the process of applying for and negotiating financial aid for college (that’s Uni to us Brits). And Chase was looking to deepen its relationships with students by acquiring Frank and its customer base, which it would use to upsell its checking accounts (that’s current accounts for us Brits) to those students.

“What is real? How do you define real?”

Well, after paying an eye-watering $175 million for the Frank website, technology and around 4.25 million customer accounts, Chase alleged that the platform actually had less than 300,000 customers. 14x less than the Frank team had reported during the due diligence process. And considering they bought the platform mainly to access this student population, they have every right to be a little pissed off.

If I bought a Porsche at full market price and got the following, I’d be a bit annoyed too…

The lawsuit hasn’t concluded, but there’s clearly a discrepancy between 300,000 and 4.25 million customer accounts. And although, as mentioned, due diligence is one of the rabbit holes I could have gone down, to me, metrics, and specifically fintech product metrics, is a more intriguing subject. For example, could Chase and Frank be far off on their definition of a Customer Account? Is that even the most important metric to measure the value of Frank? Is the number of accounts the metric by which all fintechs should be measured and valued?

The answer to those questions is ‘no’, but it’s crucial to highlight why and give some insight into metrics in fintech more broadly.

Metrics and the Product Development lifecycle

Metrics are a critical part of any product, fintech or otherwise, and are usually owned by the Product team, whether a broad team spanning multiple product streams or a one-person product hero.

Having a clear metrics framework is essential to understand the general usage of the product through quantitative measures but also gives the ability to drill down into specific processes the customer might go through, unexpected habits of customers based on clicks, and highlight overlooked parts of the product.

The best analogy I can think of when describing metrics to someone is to compare the metrics put in place to track the health of a product, to the measures put in place to track the health and fitness of an individual.

Without metrics, like the info that comes from blood work (like organ function, Thyroid function, T-cell level), glucose tests, cholesterol, VO2 Max, you might feel like a healthy individual but not actually be one. Without the right metrics, you don’t objectively know.

And if you have specific goals, there are even more metrics. Like calorie intake, daily steps, hours of sleep, respiratory rate and more.

Product metrics are no different.

And as with health and fitness, the type and importance of different metrics changes over time and depending on objectives.

Discovery, Design, Build 🏗

I know what you’re thinking. What kind of product metrics exist before there is even a product?

Well, the main objective of discovery, design and build is to perform in-depth research, understand problems, and then design and build a solution to solve these problems. But an advantage of performing early-stage discovery and identifying key customer segments is that you can create a community of early adopters, give people a place to learn more about the prospective product with a landing page and sign-up list, and create advocacy by providing valuable content. These are definitely more marketing focussed metrics but still crucial indicators of interest and future product success.

Useful Metrics:

Landing page sign-ups

Newsletter sign-ups

Website visitors

Page Views

Email open rates

Launch 🚀

More obvious why and what metrics fit in here. Launch, whether that’s a beta to a subset of customers or a full public launch, is the first time a mass of customers will see the product where most are looking to achieve Product/Customer and Product/Market fit where they are successfully serving customer needs and solving problems AND then doing this across a more extended period with customer growth and low churn.

Useful Metrics:

Churn/Retention Curve - Keeping the rate at which customers leave the product low or a retention curve number over 40%

Testimonials/CSAT (Customer Satisfaction Scores)/NPS (Net Promoter Score) - Ensuring positive CSAT & NPS scores benchmarked by industry

Growth rate - The rate at which onboarded customers remain on the platform week-to-week and month to month

Direct customer Surveys - Using the Sean Ellis Product/Market Fit survey, ask customers how disappointed they’d be if the product no longer existed and ensure at least 40% of respondents answer ‘Very Disappointed.’

Growth 💪🏽

The product is out in the market, has many dedicated customers and shows sustained customer acquisition. Time to start increasing the customer segments, grow the customer base and track key product revenue markers.

Useful Metrics:

Onboarding Conversion - Increasing the rate at which customers who land on your site or ad convert to active customers through onboarding (above 10% is generally good)

CLTV (Customer Lifetime Value) - The revenue generated from a customer throughout the entirety of their relationship with the product. Simplified calculation: (Customer revenue * customer lifetime) - cost of acquisition and maintenance

MRR/ARR (Monthly/Annually Recurring Revenue) - A heavily simplified calculation is the Total Number of Customers * Average Monthly Billed amount. For a monthly subscription service is pretty easy to calculate

TTV (Time to value) - Time it takes for a customer to get to their first activation event. A neo-banking example would be the time between the customer opening an account to making their first deposit, with the aim being as close to 0 as possible

Scale 📈

This is different to growth. Many folks make the easy mistake of thinking growth and scale are the same. They are not. Scale is about growth but long-term sustainable growth of customers and the organisation. This means ensuring the cost of acquiring customers is reduced, the time and effort spent supporting customers is efficient & cost-effective, and internal operations can scale up with the product and organisational growth.

Useful Metrics

CAC (Customer Acquisition Cost) - The cost of acquiring a customer usually related to marketing expenses but can also include sales effort, professional services and overheads

Expansion Revenue - Additional revenue generated from existing customers

Virality - Exponential rate of adoption based on product sharing

Metrics at different stages of the product life cycle and the development of a metrics framework over time are great for new or early-stage startups. But the issue is that when most fintechs start out, they don’t have the time or resources to outline and implement a metrics framework. And when they eventually have time & resources (once the product has launched maybe and they have more people) it’s a much bigger task to implement a hierarchy.

So what’s a good starting point?

🌟North Star Metrics and Metrics Hierarchies 🎄

A good place to start if you’re an organisation with few or zero product metrics is by identifying the product’s North Star.

That’s the metric that results in revenue, shows customer value, evaluates progress and provides company-wide direction by aligning with the high-level objective.

For Frank, the student finance platform I dove into about 1000 words ago, a North Star example would be “Number of successful students applying and receiving student finance”. That makes the logical assumption that the main objective of Frank was to ensure more students were able to successfully and easily obtain student finance.

That’s the other thing that makes a North Star Metric a valuable one to start with. Because ideally, it reflects the objective of the product, which should therefore make it unique.

Although it’s easy to think of the North Star Metric as The One, as the name suggests it’s actually there to give direction to the wider team and should be part of a wider metrics hierarchy.

An ideal metrics hierarchy will have key metrics across features in each of the areas of the product which then feed into the North Star which sits at the top of the hierarchy like the star on a Christmas tree.

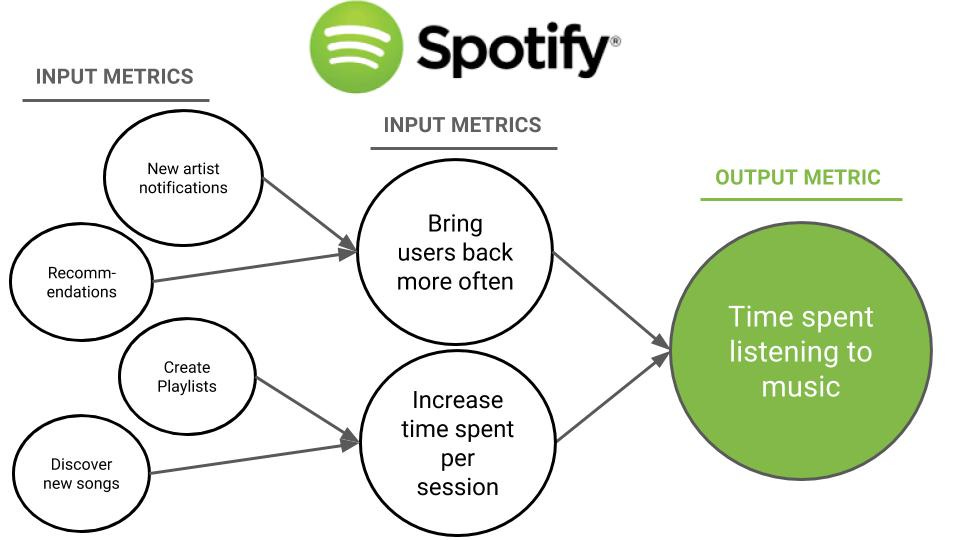

Here’s a great example of Spotify’s NSM and feeder metrics:

North Star examples in Fintech 🏦

I know you’re not here just to learn new acronyms like CAC, TTV, CLTV and enjoy Matrix puns. You want to see some other examples of North Star Metrics in different types of Fintechs right?

So here are some generic fintech examples but gives highlights brings NSM to life:

PFM apps -> Average Amount Saved Per customer

Challenger/Neo Banks -> Customer Deposit Amount or Daily Card Transactions

SME Finance Fintechs -> Number of SMEs Finance and SME Financed Amount

Buy Now Pay Later -> Basket Size Financed

I’ve got a broader list of North Star examples but if anyone reading this would like me to ‘guess their Product NSM’ then drop your examples in the comments.

I’m also curious how many people know what their organisation or product stream’s NSM is. I feel like I know the answer but would love to hear from you:

Glitches in Fintech metrics 🐈⬛

Before I close out this fortnight’s edition, I want to come full circle and talk about some of the contentious metrics in fintech, including ‘Customer Numbers’ and have a mini-rant about an overused metric and overvalued. Number of Clicks to onboard a customer.

Onboarding Clicks/Time

I’m unsure where the obsession with clicks has come from, especially with bank onboarding. It seems more like a vanity metric than anything. If all things are equal, quality of KYC checks, data gathering etc., then clicks or onboarding speed can make a difference. But if you onboard someone quickly and they cannot understand the product or organically perform key actions in the product, then one of the key points of onboarding has failed. And if they onboard quickly and the Time To Value is still huge, in a bank's case, the time it takes to make a deposit and/or transact, then speedy onboarding isn’t that valuable.

Number of Customers or Accounts

This is the one that ties back to Frank as that’s at the centre of this $175 million lawsuit.

Number of Customers might seem simple enough to define but it depends on how you look at it. For example, if you walk into a store and don’t buy anything are you a customer? What about browsing a site without creating an account? Or adding items to a basket and not checking out? When it comes to these kinds of metrics, the definition is everything.

I know in the Frank case, they are talking about the number of customers who signed up but didn’t take out any finance, i.e. They registered with their details. Regardless of whether Frank faked a number of accounts or not, which it seems like they did, the crucial metric to look is number of financed students.

But in many fintechs, simply registering doesn’t OR shouldn’t make you a customer. For banks, it’s once KYC checks have been performed and an account has been opened. Until then, you’re a registered or prospective customer. And we haven’t even gotten into ACTIVE v DORMANT accounts.

Daily Active Users/Monthly Active Users

This is another one where the definition can be skewed to pad the stats. The key word here is active. And how you define activity. If, using the Spotify example, a customer opens the app but performs none of the meaningful actions, searching for a song, or creating a playlist, then is that ‘activity’? No. It’s a prerequisite to activity, but logging alone is not an activity.

For PFM apps, if a customer reviews a few transactions across banks, THAT’S MEANINGFUL ACTIVITY.

For neobanks, if a customer checks their balance.

THAT’S MEANINGFUL ACTIVITY.

For BNPL, a customer runs an eligibility check on a basket of goods.

THAT’S MEANINGFUL ACTIVITY.

For SME finance providers, an SME runs a finance eligibility check.

THAT’S MEANINGFUL ACTIVITY.

Metrics are vital at all product lifecycle stages and key when scaling and raising investment. But they should be well-defined, align with product objectives, and ideally be part of a wider framework of supporting measures.

Most successful products identify and use critical metrics.

And there's a good reason why Metrics are everywhere. All around us. Even in this very newsletter.

(Nothing sinister just Delivered Rates, Open Rates, Click through rate)

P.S. Bravo if you spotted the circa 9 matrix references as there were a couple of subtle ones 💪🏽