Fintech R&R ☕️📈- Fail to Prepare, Prepare to not Scale

The trials and tribulations of scaling a fintech, the product development lifecycle and why pirates are important to product roadmaps

Hey Fintechers and Fintech newbies 👋🏽

It’s been a busy few weeks for London Fintech Events.

Next week is London Fintech Week, and it’s shaping up to be great.

This week we had London Tech Week. Where Rishi, current UK PM, threw shots at Boris, and HSBC formally launched HSBC Innovation Banking (which included SVB UK), a banking proposition designed to support innovative businesses and their investors.

Sandwiched between London Fintech Week and London Tech Week is Fintech Fringe.

An inaugural event with support and insights from startups, banks, VCs and other experts into how to scale fintechs in the UK. At Fintech Fringe, I moderated a couple of fireside chats covering ‘Building Great Partnerships’ where I asked fintechs and banks about the origins of their respective partnerships, areas of contention in Fintech & Bank partnerships such as the Ways of Working and the skewed resourcing ratio as well as the reasons for partnering and the future of their relationships.

Partnerships are just one lever fintechs can use to grow and scale and are often not used in isolation.

The fireside chat got me thinking about some of the misnomers of scaling. Where it fits in the product development lifecycle. What it means to scale. How to do it and examples of fintechs who have done it successfully.

So in a fortnight where Monzo, the darling of the London fintech scene, finally achieved its first month of profitability, I'm covering….Scaling Fintech Products.

Because as has been demonstrated time and time again, ‘achieving scale’ is tough. Many have tried, and many have failed. There are several changes that fintechs need to make to scale, and that often disrupts, sometimes irreparably, the business and the product. Sometimes even the term ‘Scale’ is misinterpreted.

So as well as interesting news, puns + movie references, this week includes the following:

Scaling and where it fits in the Product development lifecycle

Scaling vs Growth

‘Achieving’ Scale

Different examples of fintech scaleups

Key Product scaling considerations

3 Scaling Levers

Scaling pitfalls

Before we get into this very timely topic don’t forget to subscribe & share 🙂

Interstellar Product Development

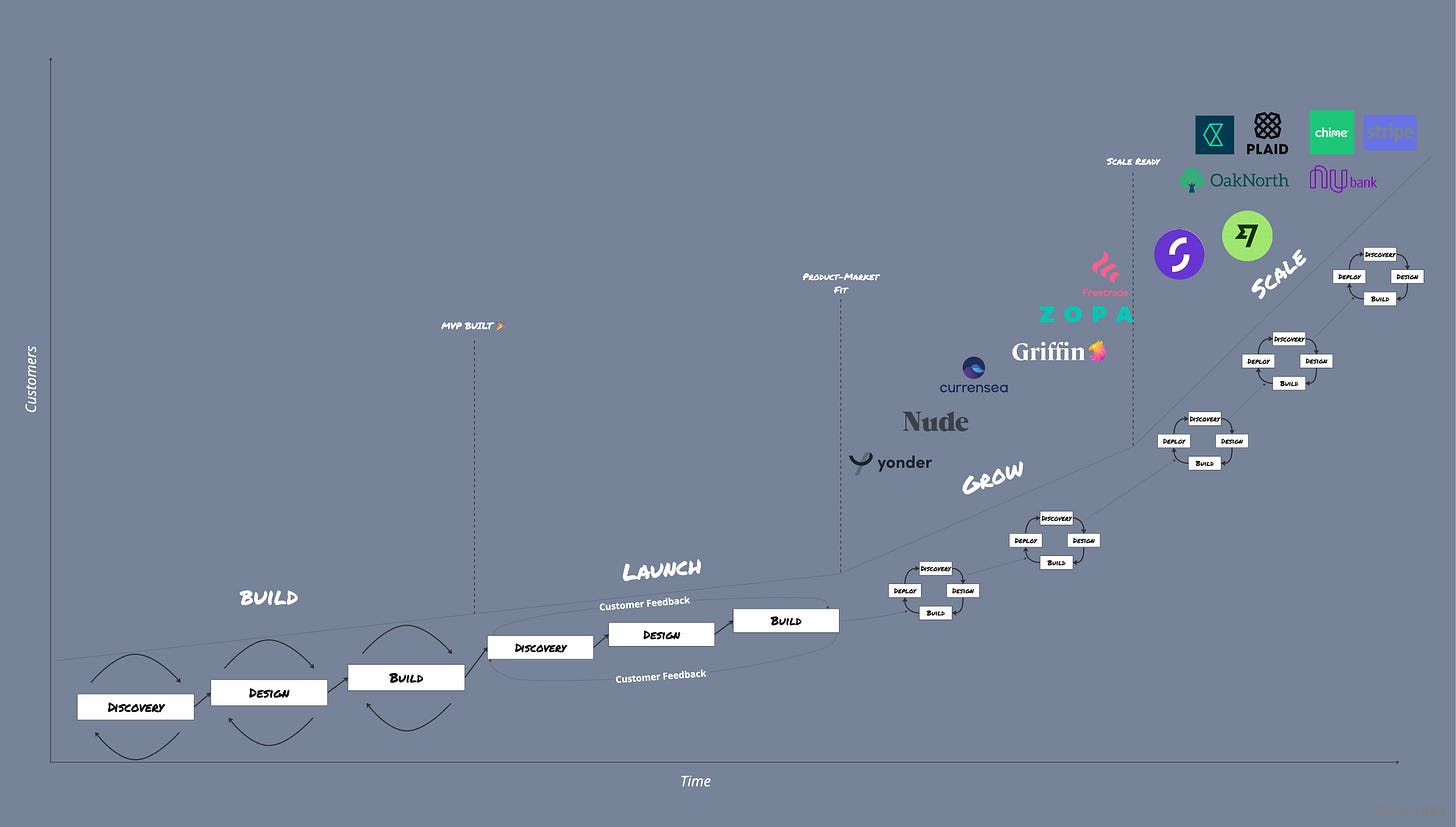

Much like a Christopher Nolan movie (Interstellar is one of my favourites) with its timeline jumps and non-linear structure, the product development lifecycle is also non-linear and an ever-iterating process.

Product Development Lifecycle

Product development is tightly aligned with the Software Development Lifecycle, but much like the SDLC, PDLC is not strictly linear.

A ‘traditional’ waterfall PDLC looks something like this and quite sequential.

Most products that get built follow a non-linear and more iterative development lifecycle.

A more modern PDLC looks more like this.

Even this is oversimplifying it to a degree, and the reality of most modern digital fintech developments is a bit more complicated, but I will visualise that later.

Both the traditional and more modern approaches have key stages that take an idea, turn it into a product and then go through growth and scale whilst iterating and improving the product over time.

Ideation 💡

Whether you already know what kind of product you want to build or are still figuring out exactly what the problem within the space is, obtaining external validation and performing a litmus test in terms of wants and needs for the product is vital. To determine if there is any bite for your idea or if you are barking up the wrong tree (forgive the dog analogy).

I sometimes call this part of the PDLC ‘Discovery Lite’. Not full-blown research but some initial questions with potential customers and a step into the market.

Discovery 🔎

Suppose the ideation phase is a lightning bolt moment or dipping the toe in the water of an idea or a problem area where a digital product could be the solution. In that case, the discovery phase is diving head first into the water and getting a full view of what’s below the surface in terms of the problem space and potential customers.

By the end of this phase, builders usually have the following:

clear problems identified

a clear and defined group that these problems affect

a market or area where these problems sit-in

identification of some solutions that already exist to solve these problems & areas where they can be improved OR

an assessment that there are currently no solutions to these or similar problems

Design 📐

Most of the previous discovery phase concerns the ‘what’, ‘why’, and ‘who’. What is it that we’re trying to solve here? What are the biggest problems in this space? Why do these problems exist? Why have they still not been solved? Who are these problems affecting the most? Who are the competitors in this space, if any?

Design is more concerned with answering the HOW of the previous questions. How do we solve these problems? How do we sequence solutions? How do we deliver value and help the affected people in the most effective way? How should the solution be structured to make the most impact? How do we phase the development of the product over time?

So by the end of the design phase, you should have the following:

User Personas to clearly define the initial users of the product

A clear set of features that will make up the MVP of the digital product

A Roadmap for future phases of development of the product

Technical architecture that will support the initial product and accommodate future development

User Journeys/Wireframes designed based on the users of the product

A Design Prototype that shows the core user journeys for the product and brings the idea to life

Build 🏗

We’re at the stage where there’s lots of solid research, feature ideas, a roadmap, some designs, user personas, user journeys, wireframes and, ideally, a design prototype. So time to get engineers to build the thing now, right? Well, not just yet. Although engineers and tech leads can start laying the foundations of the infrastructure, some structure and planning is needed before frantically tapping away and building the codebase.

Some of the things that should be done just before jumping into build or part of build prep:

Create feature specifications

Define major deliverables and create a build plan

Set up cloud and engineering infrastructure

Set up team, ways of working processes and tooling

Then finally, build.

The main objective in this phase of work is, of course, to build the product or version 1 (MVP). So this is where engineers will build the features and all foundational parts of the app as detailed in the specs written, the designs drawn up, as shown via the roadmap, and based on the architecture proposals previously put together. Design and product are also heavily involved here to support engineers in understanding each product feature better and sometimes tweak specifications (which product will investigate) and therefore changes to the design (which design will then make). Then the features can be built by engineers, tested and deployed. And repeat the process until the MVP is delivered. Simple.

Launch 🚀

Whilst a product can sometimes stand on its own merit and attract attention without launch and marketing activities – the ‘if we build it, they will come’ approach – these products are few and far between. And there are a surprising number of activities that are required to successfully launch a product. Including but not limited to the following:

Refining user personas and identifying the high-value early adopters

Performing internal testing

Establishing a metrics framework to measure success

Creating feedback mechanisms and loops

Marketing Campaign

The launch and launch campaign is ideally activated once beta users have given their feedback, and it has been incorporated back into the product and is now ready for the wider public. But it’s also common to do a mini-launch campaign just for the product's beta version to get signups. Overall, thinking about the product launch strategy is just as important as building it.

Growth & Scale 📈

Growth is growing customers and revenue, which is a direct result of the time, resources and money put into those efforts. Growth is quite linear. Some of the things that happen during the start and over the growth period are:

Monitoring, understanding and incorporation of feedback into the product

Widening of those initial customer personas in a controlled manner

New features that build on the MVP to create a richer offering

Reviewing metrics to ensure there is measurable and tangible customer growth

Scale is more exponential and usually involves making processes within the product and the organisation scalable, so they can get more customers and generate more revenue without inputting more capital, resources or technology. Or at least without that direct and tightly coupled relationship. Key initiatives as part of scale include:

Refinement of operation processes and automating where possible

Review Tech, Product and Design processes to maximise efficiencies and output as well as idea generation

Controlled growth of the products offering through new features or entirely new streams of the product

Identifying and executing key partnerships to increase customer base and brand awareness

A simplistic way to look at the product development lifecycle is that linear view and sequential approach.

But most fintechs follow a much more looped, parallel and overlapping approach which is much more aligned with iterative development.

This means Ideation, Discovery, Design and Build iteration until the MVP is launched, then periods of Growth and Scale in which there is continued Ideation, Discovery, Design, Build and Launch but at a feature level and incorporating feedback throughout.

I use this baseline process when working with early-stage founders and incubated teams within larger FS organisations looking to build products.

While I could write a book about each of the product development phases and cite fintech examples in each, there are many examples of fintechs that have been built and grown but fewer examples of fintechs that have managed to scale successfully.

I’ll list some of the companies in that scaling phase that are doing it well, but first, let’s dive into what scale is.

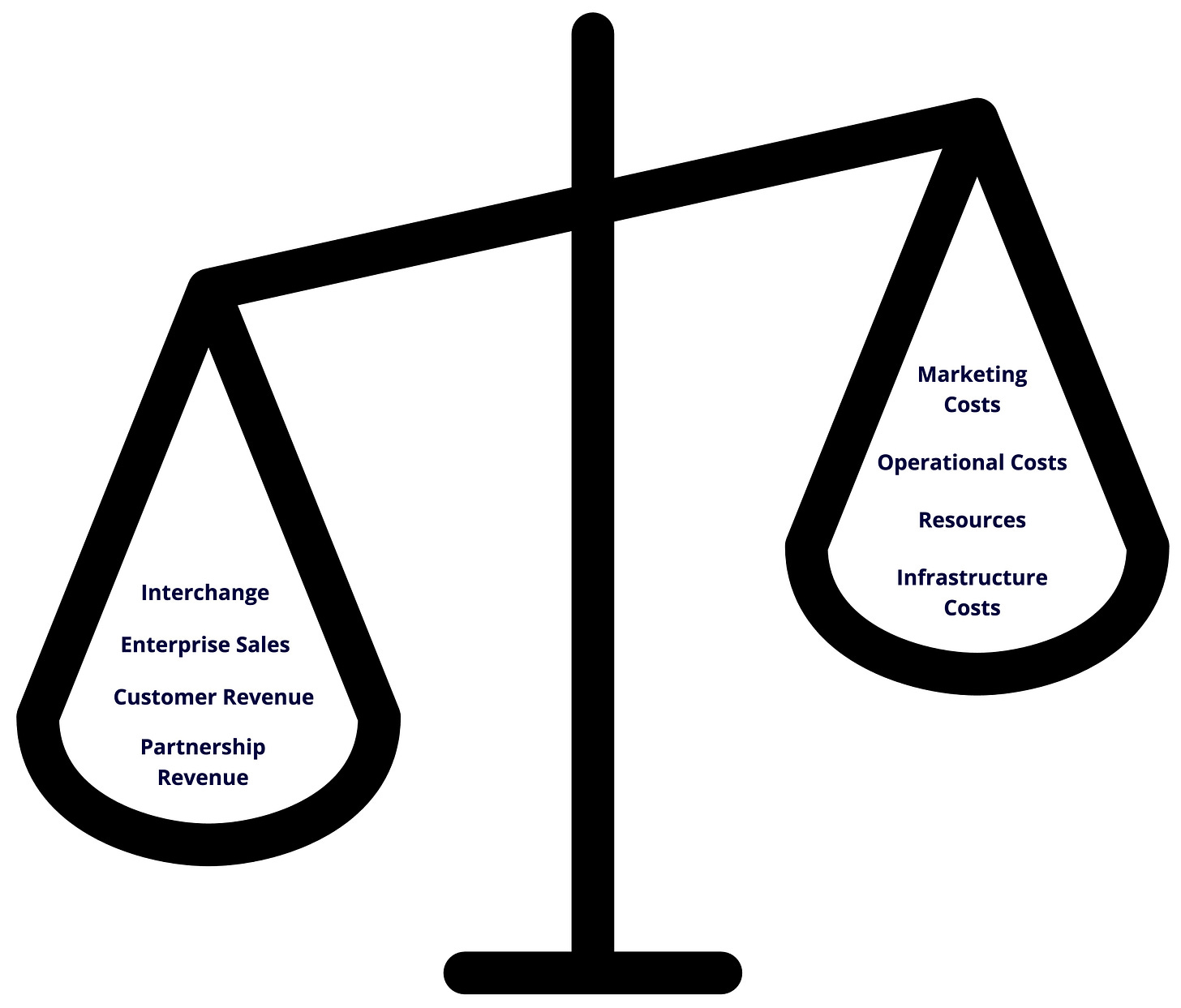

Tipping the balance of scale ⚖️

What is scaling?

In its most simplistic form, scaling is

“the ability of a product or service to accommodate increasing user demands and handle larger volumes of transactions or data without compromising its performance or reliability.”

It’s essential for fintechs as they aim to grow their user base, handle increased transaction volumes, and expand into new markets.

The reason it’s especially important for fintechs because most fintechs rely on deposits, transaction volume, and interest for revenue rather than monthly subscriptions. This means the more customers on the platform transacting, depositing funds, connecting accounts and taking out products, the more revenue for the organisation.

Product scaling isn’t just about gaining more customers and exponentially increasing the number of features of the platform, though.

It’s about supporting that exponential growth by scaling up various aspects of the product whilst reducing, or at least not increasing, the cost and effort incurred to acquire, maintain and retain those customers.

In addition to scaling the product offering itself to appeal to a broader customer base and therefore increase the number of customers on the platform, there are other key aspects of scaling:

Infrastructure Scaling: This focuses on the underlying technical infrastructure required to support the fintech product or service. It includes scaling servers, databases, and other components to handle increased user traffic and data storage requirements. This may involve implementing load balancing, caching mechanisms, database sharding, or adopting cloud-based solutions to enhance scalability.

Performance Scaling: Performance scaling ensures that the fintech product maintains its responsiveness and operates efficiently as user demands increase. This may involve optimising code, improving database queries, and employing caching techniques to reduce response times and enhance overall system performance.

Security and Compliance Scaling: Scaling in fintech also encompasses maintaining robust security measures and regulatory compliance as the product grows. This includes implementing strong authentication mechanisms, data encryption, fraud detection systems, and adhering to relevant financial regulations to ensure the security and privacy of user data.

User Experience Scaling: As the user base grows, it becomes crucial to maintain a consistent and seamless user experience. This involves designing the product with scalability in mind, ensuring that user interactions, account management, and transaction processing remain smooth and intuitive even with a large number of concurrent users. For more on CX check out my last newsletter

Operational Scaling: As a fintech product expands, operational scalability becomes critical. This involves scaling customer support, operational processes, and resources to handle increased user inquiries, transactions, and other operational requirements. The scaling and automation of operational processes to increase the customer load and reduce cost is the No.1 thing that gets overlooked in my experience.

This is a key difference between Growth and Scale. While growth is the steady increase of customers and revenue month on month and year on year, scale is growth PLUS the reduction of costs of acquisition and maintenance of customers and underlying efficiencies and improvements in the above key areas.

That’s why a celebration moment, especially for neobanks, is the elusive ‘reaching profitability’ that Monzo recently achieved for the first time. Because it indicates that the organisation has a growing customer base with low churn and solid revenue, and they are able to reduce acquisition and maintenance costs and handle sustained growth without sacrificing performance and reliability.

In other words, growth is expansion in terms of customers, revenue, and market share.

Scale is the means to support that growth sustainably.

Achievement Unlocked!

One thing that has always baffled me is the term ‘Company X has Achieved Scale’. While growth is often sustained once achieved for 6 straight months for example, scale is much more of a balancing act and less definitive.

Maybe it’s the language, but when someone says they’ve achieved scale, it sounds plain wrong.

Scaling, much like its namesake, is like a set of weighing scales that can always tip back in the other direction in certain situations if there is a recession, for example. That’s when scaling initiatives like geographical expansion, hiring and partnerships get put on hold, and companies reduce their workforce and generally pull back to balance out those scales.

Fintechs who scale too fast or too soon also experience this pullback, especially when growth is smaller than projected.

Different scaling examples

Examples of Fintechs that are beyond their growth phase

Note: I’m not going to include infrastructure or tech stack as a scaling lever in each of these examples because a microservice stack on cloud architecture is the one common reason that these fintechs are able to scale technology easily and at low cost as customers.

Neobank: Starling Bank

Starling has acquired around 3 million retail customers since its launch way back in 2015. More impressive than that is its Business banking offering.

It launched business banking services in 2018. In 2020, it announced it had acquired 100,000 customers. By Jan 2023, it had 520,000 small business accounts, representing 8.9% of the business banking market and a much larger share than the retail market. That’s a quintuple (5x) increase in business customers vs its first two years. 2022 was its first full year in profit, and it projects a 4x increase in profits in 2023.

Part of this fast acquisition of business customers is attributed to its accreditation as an approved Bounce Bank Loan provider. Its ability, through fast onboarding and intuitive UX, to get customers onto the platform and complete the loan application process quickly to get the cash disbursed fast was a key factor in its 5x increase in SMEs.

It’s also made effective use of strategic partnerships offering its customers services through providers like Wise and Raisin to retain and attract customers without expending the time and resources it’d take to build those services themselves.

Starling is still a UK-based bank and hasn’t announced plans for geographical expansion.

Payments: Stripe

Payments processing platform Stripe was founded in 2010 and designed to streamline e-commerce payments. It had a very aligned mission statement “to increase the GDP of the internet”.

Stripe’s growth can be attributed to a growth in the use of online payments as a whole but also its early focus on engineering and improving the customer experience of online payments aimed at smaller businesses and online retailers.

It was another company that benefited from strategic partnerships, with its growth linked to one of its early customers, Shopify. And in 2015, it landed Visa as an investor and strategic partner. It then ramped up its international expansion, especially in emerging markets, using Visa’s issuing and acquiring partners as a low-cost, low-friction way to enter.

Stripe now has a broader product offering for business from treasury services, virtual cards and business lending and expects to process $1tn in payments volume this year (more than double the 2020 figure)

Money Transfer: Wise

I wrote a deep dive into the history of Wise’s rise and its product evolution here.

Founded in Jan 2011 by founders Taavet Hinrikus (former Chairman) and Kristo Käärmann (current CEO), with the vision of making international money transfers for individuals faster and cheaper than traditional banks using P2P lending to get lower fee FX transfers.

By 2014, £1 billion in payments had flowed through their platform. After a slow and controlled increase of the supported currencies over time to target higher volume currency pairs, they acquired 16 million customers and saved them £1 billion in transfer fees.

In its last trading report, it estimated £100 billion in payments would be processed through the platform in 2023. 100x in nine years.

This wasn’t just down to direct customer acquisition. But as referenced in the Starling example, strategic partnerships. Offering Wise as a service to other fintechs and service providers meant they could acquire more customers through partner organisations without the high acquisition cost of going direct.

Wise also has a roadmap for growth and scale aligned with its new mission statement of “money without borders”, creating business transfer accounts, and adding cards and payroll features.

Key factors in Product Scaling

There are many levers to pull when scaling a product and areas that need to be looked at before even thinking about scale. And spoiler. It’s not just about partnerships, although that is an important lever.

From a product perspective, here are some of the areas to look at just PRIOR to scaling.

Product Roadmap and feature grouping

Wise’s roadmap is a great example of a high-level ‘Now, Next, Later’ roadmap grouped by product area and aligned with its mission. What it doesn’t show is which user behaviour metrics those features are linked to. This is important when building a roadmap for scale and where Pirate Metrics comes into it.

The Pirate Metrics Framework is a great way of tracking user behaviours across the product and a framework that most product-led businesses should have in place. Why is it called the Pirate Metrics Framework, you ask? Aarrr, the answer is before your very eyes….

Acquisition: Focuses on attracting potential customers through channels like online advertising and referral programs, tracking metrics like website traffic, app downloads, and account registrations.

Activation: Involves getting users to have their first positive experience by creating an account, verifying their identity, or making their first deposit.

Retention: Focuses on keeping users engaged with regular usage, measured by metrics like user activity, transaction frequency, logins, or customer churn rate.

Revenue: Involves generating revenue from services like transaction fees, interchange fees, interest income, or premium account subscriptions. Metrics include average revenue per user (ARPU), conversion rate, and overall revenue growth.

Referral: Focuses on turning satisfied customers into advocates who refer others to your product, tracked by metrics like customer referrals, referral conversion rate, and new customers acquired through referrals.

Grouping key feature ideas into one of the pirate metrics allows you to pick features based on solving some of the business needs.

For example, if there’s a steady stream of visitors to the website but a shallow conversion rate, focusing on building features that address Activation is logical. Or, if there’s high customer churn, then looking at Retention features should be the focus.

No product will be perfect, but addressing some of the issues around the existing product and creating a roadmap that improves & hopefully solves them going forward, as well as continuing to innovate, is crucial.

Otherwise, existing product issues will just be magnified during scaling.

Product Team Shape

Often overlooked is the structure of the product team itself. As an organisation and product grows, the product team grows with it. A product team might start out as a Head of Product, a couple of Product Managers and a few Business Analysts, but before an extended growth and scale phase, this needs upgrading. For example, early Monzo had a flat structure and multi-disciplinary Product Managers. Now, they have Group Product Managers who look after broader areas like Savings and Investments and leads who look after Onboarding, Accounts, and Payments in each of those groups.

As the product becomes broader, the team also has to broaden with a clear structure.

Product Operations

Another tricky area of product that usually needs a bit of attention prior to a big growth or scale phase. This involves looking at the ways of working between teams, reviewing prioritisation processes, assessing the suitability of tooling such as those used to review metrics and store documentation, and reviewing customer feedback processes. This all feeds into more efficient feedback, feature mapping and build process, all of which is critical to building products at scale.

Lever-ing Scale

1️⃣ Technology

An obvious one, but building scalable technology is a core lever. It’s why most modern fintechs build using APIs. Because when it comes to partnering, integrating with a different service provider, connecting a new analytics tool or upgrading a user interface, APIs offer low coupling and high cohesion.

Without APIs, Wise wouldn’t be able to offer its service to other fintechs in a highly secure and easily integrated way and would not have been able to scale its customer base as effectively.

Fintechs who don’t build using scalable, cloud-based solutions using microservice architecture (decoupled services that can be replicated across different networks and grow as the need grows) often find themselves in an uphill battle when looking to scale.

And because we’re talking about technology and fintech scaling, I have to drop the phrase ‘Embedded Finance,’ right? Tech is an EF enabler, and it’s the technology that will enable the most customer-centric and frictionless Embedded Finance journey.

2️⃣ Geographical expansion

This is usually a trickier lever to pull for certain fintechs. Not all products have that cross-border transferability. Neobanks, for example, usually start off with a particular country-specific customer niche and then slowly grow, developing their product over time. Another factor is the effort required to understand the regulatory nuance and cultural and consumer differences a new geography brings. This takes time and a lot of research to figure out and often needs product tweaks.

However, the benefits can outweigh the costs.

By reaching customers in different regions or countries, fintech products can attract a broader range of users and increase their market share, especially when entering markets with bigger populations than their own.

There can also be a competitive advantage gained by entering a new market that is technologically less mature than their own, as they can establish themselves as early movers or market leaders in new regions, capture market share and solidify their position in the industry.

3️⃣ Partnerships

This is the default scaling method of choice of late. And for many, it’s a no-brainer. Especially if you’re a smaller fintech looking for mass adoption and a bank looking for a technology solution. These are win-win-win partnerships (because the customer should also win in this situation).

But fintech x fintech partnerships can also be mutually beneficial, as Starling and Wise have proven. One gets the benefit of giving their customers access to a key service that would take time to build, and the other gets access to customers that fit the customer persona they would have spent money to try and acquire directly.

And fintechs partnering with non-FS organisations can also be a lever for scale. For instance, investment platforms like Acorns have partnered with major financial institutions and brands to offer their services as part of employee benefits packages, enabling them to reach many potential investors.

It’s not all plain sailing

Scaling ain’t easy.

I think I’ve made that clear throughout.

Sometimes it’s bad timing that can affect scaling. I think about Vine failing just before the era of Instagram and TikTok (that was also down to bad product planning, though). Sometimes it’s scaling too fast. A great example is fintech Fast, the one-click checkout company whose revenue couldn’t catch up with its burn rate. Irony alert.

There are some key things to watch out for when scaling.

Scale Readiness

Be Prepared.

It’s the scout’s motto. And applies to most situations, except for a skydive. Trust me. Challenging to be fully prepared to jump out of a plane at 13,000ft.

Scale readiness is essential. More than that, treating scale like a project and planning the same as if it was the MVP build phase. Performing a retrospective on the product and process so far, establishing key metrics, planning milestones, allocating resources and actually taking the time out to do all these things is extremely important.

Fail to plan, plan to fail.

Be ready to make hard decisions

A common theme in scaleups is having to make tough decisions. Whether that’s parting ways with someone from the founding team to get someone with more scaleup experience, reallocating the budget and pausing development on an exciting part of the product or outsourcing part of the engineering team. These are just some of the tough decisions that need to be made. Whilst scaling, indecision can be a killer. Letting deadlines for key features overrun. Keeping someone in a position that they are underqualified for because they have been in the company since the beginning. These instances of indecision can be costly.

Vision alignment

It’s easy to be in a phase of scale and lose sight of what you’re building and why you’re building it. Having a clear vision is vital for any product-led organisation.

It acts as a strategic framework for decision-making. It helps prioritise initiatives, investments, and resource allocation during scaling. With a clear product vision, fintechs can make informed decisions that align with their long-term goals, ensuring that scaling efforts are purposeful and effective.

Ultimately, a product vision acts as a compass, guiding the company’s decisions, strategies, and actions during scaling. It provides clarity, purpose, and a sense of direction, enabling the organisation to navigate the challenges and complexities that come with growth and scale.

As I said at the event earlier this week. Scaling is hard.

The common statistic is that 90% of startups fail. Which means less than 10% even make it to scaleup.

My number one tip.

Be fully prepared when scaling.

At the very least, understand if you’re not ready to scale and address those issues, whether it be resources, process, tooling or vision.

It’s a marathon. So train and prepare before the starter gun goes off.

Favourite bits of news

GooglePay UPI evolution - GooglePay in India has activated the use of Aadhaar Cards (India’s national ID card) for onboarding UPI as an alternative to a debit card. This means users will be able to, within a few minutes, set up a UPI account and use GooglePay to access their account and make payments. This is a complicated subject, but India’s Unified Payments Interface is something I’m going to dive into in detail soon

HSBC IB - Mentioned at the top, but HSBCs not so innovatively named new banking arm for innovative businesses and investors is live. The hope is that this provides support to new startups and first-time founders giving them access to funds and alternate banking services

Splendid, as always!