Fintech R&R ☕️🚀- Open Banking Phase 3.0

A dive into UK Open Banking to date, what the next phase of UK Open Banking will bring, why other Open Banking implementations should read this, and much more...

What’s Zoolander got to do with Open Banking?

Why should emerging fintech powers keep an eye on the evolution of UK Open Banking?

Why do I think Open Banking is in its teenage years even though it’s just celebrated its 6th birthday?

What’s the importance of the OBIE/Open Banking Limited?

What key account and transaction data is shared as part of OB rails?

These questions and more will be answered in this week's edition of Fintech R&R

Hey Fintechers and Fintech newbies 👋🏽

The turn of the new year saw a flurry of Open Banking news, reviews, and predictions (including my own predictions in the last edition).

On the review front, I contributed to a Fintech Finance News article where I added my two cents on the ‘issue’ of adoption, ways to increase adoption in 2024, and some Open Banking use cases yet to be explored.

On the news front, it felt like PR departments spent December priming their January Open Banking press releases.

American Express & OVO announced a partnership that would give OVO customers the ability to pay their bills using an Open Banking transfer

GoCardless & JustGiving extended its existing similar partnership, making GoCardless its exclusive provider

MoneyHub partnered with Voxi to give its largely Gen-Z customer based 12 months free use of Moneyhub’s financial management app. A great move!

Open Banking provider Ozone raised £8.5m as part of its growth and expansion plans

Moneyhub announced it was the first TSP to add Smile Bank, Kroo Bank and Co-Op as available account connections, increasing its overall coverage

…and so much more in the last week alone!

All this news made me think of this from Zoolander…

Open Banking Is So Hot Right Now.

It feels like the sentiment among many who were previously extremely sceptical about the value of Open Banking in the UK, especially amongst those responsible for payment strategies, has shifted.

Cue, the quote from Anne Boden talking about its failure right before adding a ‘connect all your accounts using Open Banking’ feature’.

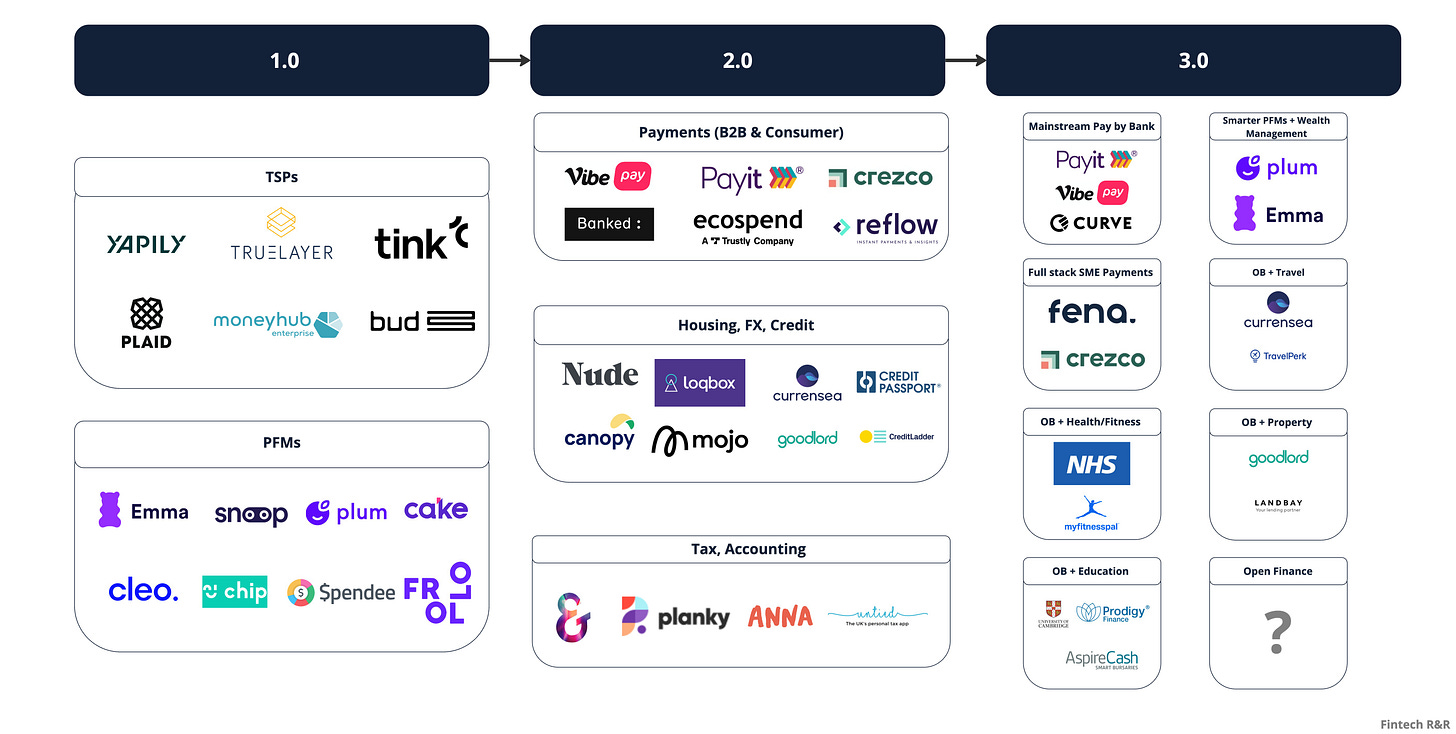

Many of the ‘Open Banking: 6 years in…’ articles, including the one I contributed to, looked at Open Banking from early 2018 to now and as a continuous evolutionary process, but thinking about it a bit deeper, it’s actually gone through a couple of different phases and I believe we are in phase 3 right now.

So, in a welcome return to normal editions of Fintech R&R, I’m explaining why I think we’re in the third phase of Open Banking, what that means, what the previous phases were and much more.

Now, these aren’t ‘official’ phases because they don’t directly correlate with the technical roadmap of Open Banking Ltd (formally OBIE), but they are aligned with the output of that roadmap, including resulting products, technologies and consumer benefits. Once I’ve outlined them, most people will see what I mean.

So, as well as interesting news, puns + more movie references, this edition includes the following:

A brief history of the origin of UK Open Banking

Phase 1.0: The Age of Aggregators and Boom of PFM apps (circa 2017-2019)

Aggregators, PFM apps, and the date OB shares

Phase 2.0: The Steady Rise of Payments, Broader Consumer Uses and Backend Automation (circa 2020-early 2023)

Steady payments growth, companies using OB in the backend, growth of broader use cases

Phase 3.0: Richer Apps, Pay by Bank growth, and entering the mainstream (circa 2023 - 2026?)

Partnerships, Pay by Bank growth and ways that OB will enter the mainstream

Why Open Banking is in its teenage phase and when will we see its teenage growth spurt?

What lessons can be learned by global Open Banking Implementations?

Now let’s get into it 💪🏽

NOTE: This is a slightly longer edition so to ensure you don’t see the clipped version that, hit this link to read the web version or hit the ‘View entire message’ at the bottom of the mail.

Prelude

Every time I do a brief Open Banking background, it feels like that scene from Spiderman: Into The Spiderverse, where a different version of Spiderman introduces themselves by saying, "Alright, let's do this one last time".

It's helpful context, though, so for one last time, and a little shorter than usual, here's a brief origin of UK Open Banking.

A Brief History of Open Banking 🕵🏼♀️

The history of Open Banking in the United Kingdom can be traced back to the implementation of the Payment Services Directive 1 (PSD1), a European Union directive that aimed to regulate payment services within the EEA. PSD1 came into force in 2009, laying the foundation for a more integrated and competitive payments market.

The formal push towards Open Banking in the UK gained momentum with the introduction of PSD2 (Payment Services Directive 2) in January 2018, which sought to enhance consumer protection, foster innovation, and promote competition within the financial services sector and across EU member states which included the UK at the time 🙄. PSD2 mandated that banks grant access to their customers' account information and payment initiation services to third-party providers, with the explicit consent of the account holders. This paved the way for the development of Open Banking as a means to enable secure and standardised access to financial data.

Part of the UK's implementation of PSD2 was the establishment of the Open Banking Implementation Entity (OBIE) as an independent entity by the Competition and Markets Authority (CMA) in 2016 to oversee the implementation of Open Banking and ensure that the prescribed standards and regulations were effectively put into practice.

OBIE was funded by the nine largest UK banks and was designed to ensure these very same banks opened up access to their customer data through standardised APIs and in addition to developing the OB standards themselves, OBIE was also responsible for:

Implementation oversight

Promotion of competition and innovation by proactively encouraging innovation by third-party providers

Educating consumers about its benefits and safeguards

And to operationally support the banks and third parties during the run-up to the 13th Jan 2018 deadline.

Although Open Banking existed informally prior to the 2018 launch deadline in the form of screen scrapers, experienced data aggregators and direct data sharing agreements, the run-up to 2018 allowed aggregators to build to a single standard, gathering much more data without the need for screen scraping individual data sharing agreements and meant third parties could build customer-centric products using banking data via standardised APIs that would have traditionally had a high-barrier to entry.

The creation of the Open Banking Framework standards led to a boom in aggregators, financial management & payment apps, credit checkers, digital identity providers, and a whole host of other products that use Open Banking data, many of which use Open Banking in the backend to power their proposition.

Phew. Shortest and most concise one yet! I'll just copy and paste the above for future OB editions.

Despite the recent growth in use cases and the UK's Open Banking Framework being held up as the gold standard by other regional OB initiatives, it still gets a bit of flack.

Some say growth and adoption have, needs to be faster, and we've lagged behind the likes of India and Brazil when you look at the numbers. Hard to disagree with that.

Some, like Anne Boden, for example, call it a flat-out failure.

I personally think that the truth is somewhere in between.

With more consumer education, slightly better branding on the payments side and a bit more stability with the governing body across the past 6 years, we might be a bit further ahead compared to where we currently are. It's all IFs and BUTs, though.

What we can do is look at its organic development to understand better where we're heading and allow other Open Banking initiatives, such as those in Saudi Arabia, Bahrain and elsewhere,

And from my perspective, I see the evolution until today as three key phases.

Entering Open Banking: Phase 3.0 📈

1.0 - The Age of Aggregators and Boom of PFM apps (circa 2017-2019) 📱

Although the burst of Open Banking startups came after the formal launch of PSD2 in 2018, the OBIE first published their API standards in March of 2017, which gave a sneak peek to all participants as to what was available to access, how banks would make data available, the structure of that data and more.

At this point, though, building consumer-facing apps was still a challenge as there was no data to test with, and the big nine UK banks weren't live.

But there was one big opportunity that a few spotted.

The Age of the Aggregator

Even with fully standardised and identical APIs, third parties building on top of OB standards would still have to ensure they could connect to all nine banks and hope that the data comes through in standardised form.

That's where Technical Service Providers (TSPs), often called aggregators, come in.

These aggregators, some formed in the run-up to 2018 and some 'legacy' players, saw a unique set of problems and set out to solve them.

Some of the problems they saw:

The standards will naturally extend beyond the nine biggest banks, which means that third parties will have to continually scour the market and ask customers to suggest additional connections. Cumbersome and vital for customer growth.

The Open Banking development roadmap will evolve, and third parties will have to continually monitor changes and ensure they understand and make appropriate changes to their technology to keep up with the standards. Costly and time-consuming.

The data coming through the APIs from the banks will come with varying degrees of cleanliness

Building a single point of access product that comes with Open Banking expertise and the facility to have some standardised data to use come through a single pipeline proved to be a valuable model.

Truelayer, Yapily, Bud, and MoneyHub all emerged during this period, providing a valuable technical integration to allow third parties to build products for customers and have become some of the most valuable and recognisable participants in the UK Open Banking Framework, or OBF, as I'll sometimes refer to it.

As more and more companies turned to OB as a means to service their internal data needs or to give value back to consumers, aggregators were used more and more, which led to their growth as a critical part of the ecosystem.

Boom of Personal Finance Management apps

One thing worth noting before elaborating on this section is the initial set of data and functionality made 'open' and available as part of the UK OBF.

The original PSD2 legislation had two articles in it which steered the data and functionality that member states had to make available. Article 67, which outlined Account Information Services (AIS) – Giving the user the right to use third-party services that access and make use of the user's account information, and Article 66, outlining Payment Information Services (PIS) – Giving the user the right to use third-party services that can initiate payments.

When it comes to the UK OBF, here's what that translated to and what banks had to make available.

Account Information

Surprise, surprise, information relating to a specific account that the customer has given explicit approval for, including:

Account Type and associate rates (e.g. Current, savings etc)

Account Holder Name (e.g. Mr J S S)

Account Currency (e.g. GBP)

Any standing orders associated with the account (e.g. Bills, Mortgage payments, Gym memberships)

The institute associated with the account (e.g. Lloyds Bank)

Account Balances

Transactions and Transaction Detailed (e.g. Amt, Date, Merchant, Balance Change, Payment Type, Currency)

List of all accounts at a particular institute (based on user consent)

Payment Initiation

Giving account holders the ability to securely initiate payments from their account without having to use their bank app directly and manually type in payment details.

Product Information

Effectively the Key Facts Illustration of the relevant accounts that organisations have and fall under Open Banking rules. This means Account Type, Rates and key account information that can be used by third parties for comparative purposes. This makes account comparisons a lot easier and was intended to promote greater competition.

…

This openness of individual account information, broader product information and the ability to initiate payments all via third-party apps should have led to an explosion of products in many areas, but there was a predominant boom in one area in particular.

Personal Finance Management Apps.

These are mobile applications that use a secure, user-authenticated Open Banking connection to share account and transaction data across the accounts the customer gives explicit consent to. The app then collates that data and presents it back to the customer in a way that aligns with a specific goal they have. Whether it's to save more in general, better understand spending in a specific category, get better at budgeting, or save for a specific life event.

I wrote a deeper dive into personal finance management and what the next generation of PFM apps will bring here, so check that out.

This isn't just anecdotal. Even now, in the OpenBanking directory and the OpenBankingTracker (both great resources btw), you'll see the Personal Finance category ranked highest in terms of the number of apps registered.

So the question is, with all the available data and the ability to initiate payments via the framework giving rise to 100s of different valuable use cases, why was there a big boom in PFMs alone?

My working theory that's been partially tested is that there are a number of factors that made it much 'easier' and popular to build a PFM app during the early days.

👉🏽 Many find it easier to build products that solve problems they themselves face. Finding tools to help with finance management is definitely one of those problems.

👉🏽 It's clear to see how Open Banking data makes building a PFM app cheaper and easier

👉🏽 Other than a spreadsheet, there was no stand-out finance management app so there was a clear opportunity in terms of competition

So, there seemed to be a perfect trifecta of a large market with an ever-growing openness to use digital products, a lack of competition in the space, and new technology that makes building the product much easier.

Both Aggregators and PFMs saw opportunities in the lead-up and after the formal launch of the UK OBF.

Aggregators have since gone from strength to strength, expanding their offering and growing customer bases, while PFMs have had more of a mixed bag.

Some have fallen by the wayside, MoneyDashboard most recently, citing challenges in finding a viable business model. Some have pivoted slightly, still using Open Banking but for slightly different use cases. And some, like Plum (who I use), Emma and Chip, have managed to build a great product, grow a dedicated community and find a value-based pricing model that seems to work.

2.0 - The Steady Rise of Payments, Broader Consumer Uses and Backend Automation (circa 2020-early 2023) 🏠 ✈️

In the run-up to 2020, there was a steady growth in the number of organisations using Open Banking, and there was a lot of positive news on the payments front.

In May 2019, NatWest became the first UK bank to use Open Banking to provide customers with an alternative way to pay for online purchases – without having to use their debit or credit card.

In September, American Express tapped Open Banking for account-to-account payments.

In November, GoCardless made the first live Variable Recurring Payment (VRP) transaction.

A pretty fruitful year for Open Banking Payments.

In its review of 2019, OBIE stated that one of its goals was to "Increase customer adoption of Open Banking".

While this was quite successful on the accounts front (think back to that set of account and product data I outlined earlier and the associated use cases), it was less successful on the payments side.

Although there was some news during the initial lockdown in 2020 that I thought would change things.

TrueLayer published in their $25 Series C round that:

"Between March and July alone, use of Payment Initiation, enabled by our Payments API, grew 832%, as consumers paid for goods and services online during lockdown."

Promising news, but looking back, this huge spike was 1. Relative to previous months, and 2. It was an anomaly as pretty much every service, site and resource saw a huge spike during that period when many were stuck at home.

Those growth rates obviously didn't carry through from this initial spike, and what we saw instead was slow and steady growth, which, for me, based on the number of people online, using apps and making payments, was a bit of a missed opportunity.

Going Beyond Transaction Categorisation

Payments are one aspect of this era.

The other is using the account data itself for more than transaction categorisation.

Many startups were entering the space, and existing ones that grew during this period used Open Banking to solve a variety of interesting problems.

These included:

Currensea* - The travel card and app that saves customers FX fees without the need to set up a separate bank account by using Open Banking to connect to existing accounts, customers use the Currensea low-fee card and payment is collected from the connected bank account as a transfer rather than a costly FX transaction.

Canopy - A company revolutionising the often painful process of renting for both Renters, Landlords, and Agents. They use OB to verify income and select specific rent payments used as part of what they call RentPassportTM, speeding up the background checking process renters and agents often go through and allowing renters to improve their credit scores.

Untied - The UK's personal tax app, giving every UK citizen with additional income the ability to do their self-assessment personal taxes in just a few minutes. They use transactions and account info gathered via Open Banking to understand individuals' tax positions and file directly with HMRC.

Ember - The digital accounting app for Sole Traders and Limited Companies that uses OB to pull underlying account transactions and provide tax optimisation, reporting, invoicing, and crucial account support in a single platform

*Full disclosure. I'm a Currensea investor

There are many more products in a range of different areas leveraging OB to benefit consumers.

Although these fintechs (Currensea aside) have yet to acquire hundreds of thousands of customers, they are using the technology to help solve valuable problems and, in the process, doing their bit to give broader education to consumers about Open Banking.

Automating existing backend processes almost invisibly

One of the most underrated areas Open Banking has significantly impacted is existing organisations reliant on account and transaction data to make decisions.

I've had first-hand experience across multiple engagements with fintechs over the past few years where I saw organisations either looking at the use of account and transaction data via OB to optimise an existing process or an organisation that was already using it looking to increase their usage to enrich their offering further.

Here are some examples where it's being used to support, optimise and enrich:

Eligibility checks for SME Finance - SME Lenders work on differing levels of product eligibility, meaning they have to ask customers a heap of questions about turnover, outgoings, payments to HMRC etc. A quick connect and transaction history check can answer these questions and tailor the product selection for SMEs saving both parties time and effort during onboarding

Mortgage eligibility - Some mortgage providers are starting to use Open Banking to pull in core account and transaction data to sweep two years of transactions, categorise spending, and understand salary, debts, credit card payments and other dependencies to speed up the backend mortgage eligibility process and . Some but not enough…

Credit Scoring - Some consumer and SME focussed organisations have added an OB-based credit score as part of their offering, in many cases enhancing their product offering and giving great value back to the customer in the form of a credit score that closely aligns with one from Experian, Equifax etc as well as some tips on how to improve

These are the invisible heroes of Open Banking, using TSPs, driving AIS connections, and leveraging technology to improve internal processes and customer experiences, increase time to value, and reduce costs.

3.0 - Richer Apps, Pay-by-Bank growth, and entering the mainstream (circa 2023 - 2026?) 💸

Current State

So. Where are we now?

I think we're in a bit of a transitional phase where a few things will happen, some of which we've seen and will continue to see, and some yet to materialise.

Third-Party Providers partnering with household names - This is one we're already seeing from the flurry of news I highlighted at the top of this edition. GoCardless and Natwest's PayIt are and will continue to be a vital part of the growing of consumer understanding of payments by partnering with more mainstream brands and making Pay by Bank a more prominent option at e-commerce checkout

More use cases and crossover - Another that we've seen some of and we'll continue to see. Use cases that involve:

Property - e.g. Mortgage applications, mortgage product comparison and rate switching, re-financing, renter verification, renter deposits

Education - e.g On campus payments, financial literacy, student debt management, microfinancing

Health & Fitness - e.g. Private healthcare costs, NHS Payment management

Travel - e.g. Insurance eligibility, travel planning/budgeting, cost-based options

Richer Apps - The introduction of VRP and cVRP, allowing users to split payments, sweep money from and to accounts and provide 'direct debit' like functionality, will create richer PFM experiences and have big implications in the SME space. Cashflow management is a hot topic right now, and being able to agree on a split payment structure with suppliers and using cVRP to to repay a supplier in instalments is a great way to smooth cashflow.

Future State

Then, there are some broader expectations of what will likely happen over this period.

Open Banking -> Open Finance

We're already seeing lenders use bank data to make decisions, but there's still a big step here to 'open up' accounts and products to include insurance, mortgage, savings, investment and pension products which are not under the current OBF. PFMs would certainly welcome it as it would mean a truly 360 view of finances, but it might be ambitious to see something rolled out before mid-2026.

Pay by Bank growth

It sounds like a copout to say 'growth', but I mean accelerate growth. Partnerships growth and key household names starting to offer a Pay by Bank option points to Pay by Bank growth, and I'd expect more of a push from full-stack SME payments POS solutions like Fena and B2B payments platform Crezco to also drive growth in the area. Pay by Bank is starting to enter the payment lexicon for consumers, and this is just the beginning.

Of course, there is the Pay by Bank vs Card payments, but I'll touch on that shortly.

Fully entering the mainstream

Ask 5 of your non-fintech friends if they've heard of Open Banking. Chances are, one of them will say yeah, but they don't really know what it is. Does that really matter? Yes and no.

No, it doesn't matter if they understand the implications of the consent they give and if they get value out of that product. But also, yes, because the more mainstream this becomes, the more likely we are to have non-fintech people who get a better understanding of the framework and its capability and use it to build something that solves a problem they themselves face! I'm sure this will happen in the next 2-3 years, and we'll see the number of friends who have heard of and understand Open Banking go up to 3/5. I’m an optimist.

Infancy -> Childhood ->Teenage years 👶🏼 🚌 👨🏻🎤

Looking at these phases analogously and having some creative fun with them, you can see them as three stages of human development. I have.

Phase 1.0 - Infancy, i.e. Getting to grips with the basics

Phase 2.0 - Childhood, i.e. Understanding more complicated concepts

Phase 3.0 - Teenage years, i.e. Maturing, full grasp of most concepts, settling into themselves and going through a growth spurt

There's another reason I'm using this analogy. Although teenage growth spurts have a large element of chaos and randomness, some elements, such as diet, exercise, and environment, can factor into when and how big the growth is.

Similarly, there are such dependencies that will seriously impact the growth of Open Banking in phase 3.0

Clarifying the future of the governing body

This is one I called out specifically in the '6 years on' article so here it is verbatim.

"There are some bureaucratic changes that need to happen such as establishing the structure, governance and funding of the Open Banking governing body itself to help speed up delivery of items on the Open Banking roadmap, which was supposed to happen in 2023. That's the first step."

India's UPI growth in such a short space of time has proven the importance of a steady and stable governing body. Clearing up the uncertainty around the regulatory body is a clear dependency.

Changing consumers habits

This is one of the hardest nuts to crack, and this is where Open Banking Payments takes heat. Card payments have been around for over 30 years. Contactless around 15. Wallet Payments (like ApplePay) maybe 8. BNPL about 5. These are loose estimates btw.

Adoption takes time, and it'll take more education and a more narrative around Open Banking payments to drive growth. This is where I'm looking at the likes of Natwest's PayIt and GoCardless to do some knowledge sharing and drive home the benefits of Pay by Bank as they grow.

That being said, I still think comparing Open Banking Payments with cards is a false dichotomy. As I said in the resolution edition a few weeks ago (and yes, I am quoting myself…again):

“Cards will still dominate payments where speed and convenience are customers' overwhelming priorities at supermarkets, tubes, trains, and certain retailers.

However, it's important to note that not all spending is speed-focused and transactional (although everything that shows up in your bank feed is called a transaction). Many, like the above, are transactional, where customers want to get their goods or services and leave, but there are many other areas where spending is more experiential.

Like at a restaurant where a payment can be parcelled up with a tip, a review and maybe a sign-up to the restaurant's newsletter. Or up-scale retailers where the in-person payment experience can include bespoke offers and loyalty programs sign up, all with a branded end-to-end payment experience and using a Pay by Bank flow.”

I expect Pay by Bank to be a richer payment experience and as retailers, restaurants and others get a better understand of what it can offer they’ll build bespoke journeys that delight customers as well as lower costs.

Improving on the existing functionality

This is another fairly obvious dependency for Open Banking's teenage growth spurt.

It's also something that Tom Burton, Director, External Affairs & Public Policy@GoCardless articulated in the same '6 years on' article.

"Instead of searching out new use cases for open banking, we think there's still a way to go to optimise for existing use cases. At a fundamental level, open banking payments would benefit from greater conversion rates, more consumer awareness, and a more consistent user experience across banks…In addition, we should be very focused on delivering commercial VRPs (cVRPs)… for early adopter segments like financial services initially. Nailing that down and proving cVRPs' value to customers will be an important stepping stone for expanding to other sectors."

There's also regular frustration at the refund process of Open Banking payments called 'Reverse Payments' as it's nowhere near as robust as a standard card refund.

Improving on the existing underlying functionality will make apps richer and stickier for consumers and lead to longer tail retention, usage and long-term growth.

History Lessons 📚

I was never a fan of history at school.

Maybe it's old age, but the further away I get from those prescriptive classes, the more I appreciate the value of understanding the past and its benefits in predicting the future.

That's why I did this write-up and why the reviews covering the 6 years since its launch are important. There's a lot to learn from the organic evolution of UK Open Banking and the guiding roadmap put in place, especially when you look at the resulting outcomes.

Many global Open Banking initiatives are being kicked off, and others are still in progress. Initiatives like the ones in Saudi Arabia, Bahrein and across other non-EU member states are looking to replicate some of the success that resulted from PSD2.

It's important because, depending on the direction KSA and other initiatives want to go, they can use the organic evolution of the UK framework as a lesson to shape their own.

If they're happy to let some organic growth happen (and it inevitably will), then fewer guardrails from the outset, a focus on the data being provided, and the structure of the APIs itself is the way to go. There are many ways of looking at it, so here are some pieces of advice for anyone looking to take learnings from OBF to apply to their own.

👉🏽 Establishing a clear, fair and long-term funding model for the governing body is vital to sustaining development

👉🏽 A technical roadmap is important, but so is a plan outlining the evolution of the governing body (the OBIE for example) to ensure a smooth transition and long-term stability

👉🏽 Publicising a technical roadmap is important for innovators, banks, end customers, investors, and pretty much everyone in the ecosystem. Ensure it's been thoroughly review, timelines (where relevant) are realistic, and it's in line with the overall strategy

👉🏽 Overarching strategy is another vital component. Is the strategy to build the technology and invite people to build on it? To connect up the entire financial ecosystem? Create a best-in-class technology framework that has the potential to be monetised globally. Whatever it is, it needs to be clear.

👉🏽 Don't underestimate the power of momentum

👉🏽 Create a financial product coverage plan early so innovators can plan for the expansion of other account types

👉🏽 Carrying out comprehensive research on consumer problems, existing financial services solutions, current technology restrictions, and their impact on those problems is probably the most important thing to do prior to creating a roadmap or strategy. This research helps identify the areas where Open Banking will create the most impact, help consumers, lead to the creation of high-growth products and solve key problems for customers without high technology fragmentation

👉🏽 Do some discovery and create verticals to discourage a boom in a specific area. What I mean by this is use the initial research to draw out problem areas and encourage fintech builders, innovators and entrepreneurs to build in a variety of areas rather than focusing on just one. This ensures less saturation of a specific area like PFM and a great way to do this is by allocating grant funding in different verticals to promote the building of a variety of app for a variety of used cases.

I have a few more but I'll park them for now.

Anyone who has read any of my other Open Banking write ups will largely know where I stand on the 'how has it gone' question.

It's gone well.

On the technical side, it's what other global implementations look at as the gold standard. And the structure of the framework overall was also a success. At least that first few years, anyway. It's been a tricky time of late with some deadlines missed, the governing body transition, and a bit of uncertainty. That happens in most projects, though.

Moving out of that fog of uncertainty and back into a regular routine of product launches, roadmap updates, and success stories is where we need to get to overall.

And for me, the first domino to fall has to be clarity over the structure of the governing body.

As soon as we get a steer on what's happening and when, we'll start to get the UK OBF back on track, which means that in the next two years, we will see Open Banking's big teenage growth spurt.📈

P.S. I will cover my contribution to the Future of Payments review in a separate edition

P.P.S. That was a longer edition so thanks for sticking with it and no news this week as I included quite a few bits of interesting news at the top and the word count is already high enough already!

Don’t forget, if you enjoyed this edition, drop a like below, fire over your questions and share with a friend! Back again in two weeks!