Fintech R&R ☕️ 🧮 - Getting Personal with Finance Management Version 2.0

PFM JTBD, financial literacy, Positive Friction in UX, using emotion and accountability to reach financial goals and what to expect from the next phase of Digital Money Management tools

Hey Fintechers and Fintech newbies 👋🏽

There’s been a bit of trouble in fintech this week with payments institute PayrNet stopped from trading by the Bank of Lithuania, causing a knock-on effect to several fintechs. There’s still a bit more that’ll unravel here, so I’ll cover it in another later edition.

Instead, I’m diving into another timely and relevant subject triggered by two recent events.

The first was at a literal event, London Fintech Week, where I hosted a great panel discussion about Fintech for Good, which covered environmental impact, social impact, accessibility, financial inclusion, financial literacy, and, importantly, financial education.

I promise this is the last reference to my fintech event and panel discussion escapades for at least a couple of months! 🤣

The second was the Bank of England raising the base interest rate to 5.00%. The expectation is another 0.5% rise will follow by September in an effort to curb inflation. Inflation is the rise of costs of goods and services, which makes the pound in your pocket worth less (not completely worthless) and squeezes people’s finances assuming salaries don’t rise at the same rate as inflation. Judging by the various strikes happening across the country, it’s safe to say most wages are not growing in line with inflation.

Raising interest rates seems to be the only way to beat inflation. Making it more expensive for folks with mortgages or loans encourages people to save, which means they spend less on goods and services, which slows price rises.

Now, I’m not an economics major, just a lowly Computer Science grad, but to me, trying to stop people from becoming poorer by making a whole swathe of people with mortgages and loans poorer doesn’t quite add up. There must be additional levers to pull on. Economics Majors. Answers on a postcard.

Anyway, these two areas, financial education and the interest rate rise, led me to think deeper about this week’s topic.

Personal Finance Management

There’s a lot to cover here, from the taboo of talking about budgets with friends & family (which also stems from salary discussions), financial education, the Financial Management Jobs-to-be-Done, factors that will make managing finances more critical over the coming years and areas for improvement.

So this edition, as well as interesting news, puns + movie references, of course, includes the following:

Financial literacy stats and the rising need for a budget

The headline budgeting Job-to-be-Done

Granular features of finance management (managing income, understanding outgoings etc.)

Fintechs helping in this space

Trends in the next version of PFM apps

4 key features of the next generation of PFM

If you’re reading this and you haven’t subscribed yet, subscribe by hitting the button below. It’s free, packed full of stats, insights and relatable analogies. And it’s free. I said that already but always good to be transparent on pricing 😊

The Big Short(fall) in Personal Finance Management

It can be a taboo subject, but having a budget and proper financial plan is vital in ensuring people achieve their financial and life goals. Buying a house. Going on [x] number of holidays a year. Planning for retirement. Starting a family.

For some in lower-income households where the income-to-outgoings ratio is tighter, budgeting is necessary to ensure food, bills and housing costs are covered week-to-week and month-to-month.

There are also different budgeting methods which can cause more confusion.

In the interests of transparency and removing some taboos, I’m sharing a bit about how I budget.

I mostly budget in my head and use the ‘if I can’t see it, I can’t spend it method’. Once my primary income hits my account, I keep a certain balance in that current account for bills, mortgage and other fixed monthly costs, which has an overdraft facility. I have a fixed savings amount each month, which I sweep into a separate account, move a portion of funds to my Monzo account for groceries, and use a points-based Amex card for all other discretionary spending. I also have a buffer, an instant access savings account, which I use in case I overspend in certain months or to cover temporary jumps in bills which I keep topped up at around £1000. If I go over budget two months in a row, I adjust some of the savings Direct Debits, review spending in the other areas and add more funds in the accounts that need it.

It’s not fully regimented but what I’d call a ‘soft budget’ and similar to ‘envelope budgeting’.

Many follow the same loose method; others might use a tool or a more controlled spreadsheet to budget. Most of the core knowledge around budgeting initially came from my parents, like many others, and the knowledge has grown over time as I’ve added on additional accounts and Direct Debits for saving, investing and pensions (not something I was concerned with at 22).

This is largely scene setting but I’ve outlined this to highlight a few key things that will resonate with most:

1️⃣ Most people’s foundational budgeting & finance management knowledge has come from their parents

2️⃣ There’s no specific learning at primary/secondary education where we obtain baseline knowledge about finance management (economics is not part of most standard curriculum)

3️⃣ Budgets are lifestyle & goals based and, therefore, often bespoke

4️⃣ Budgets evolve as people’s circumstances change, i.e. Budget of a 22 yo graduate is different to the budget of 50 yo professional

All this means that some people know and understand the benefits and the budgeting process, but many others don’t. It’s not any individual’s fault if they don’t know how to budget. It’s the fault of the system that makes it fairly straightforward to create a bank account to store money and provide people with a card so they can spend that money, but not the resources and tools by which they can effectively manage their finances.

Anyway.

This isn’t based solely on anecdotal evidence. There’s an avalanche of research and statistics that demonstrate the benefits of planning and the issues that come with a lack of knowledge when it comes to personal finance management:

Stats from research by SovereignBoss and FinCap:

👉🏽 Only 58% Feel Comfortable Creating a Personal Budget

👉🏽 69% of Households Had Insufficient Emergency Funds

👉🏽 Only 30% of People Have a Long-Term Financial Plan

👉🏽 22% of UK adults have less than £100 in savings & investments

👉🏽 Only 52% of 7 to 17-year-olds say they receive a meaningful financial education in school, at home, or in other settings

👉🏽 After Just One Year, 83% of People Who Make Financial Objectives Are Happier With Their Finances

Regardless of the process of managing a budget or if there is a lack of active finance management, there are key ‘Jobs’ that all customers want to be solved.

PFM Jobs-to-be-Done 👨🏽💻

I spoke about Jobs-to-be-Done not long ago when I dove into SME problems (which is an excellent read if I do say so myself, so check that out 😊). But in short, JTBD is a framework for understanding customer needs widely used to spark ideas for innovation and the perfect way of highlighting customer solution areas around budgeting and finance management.

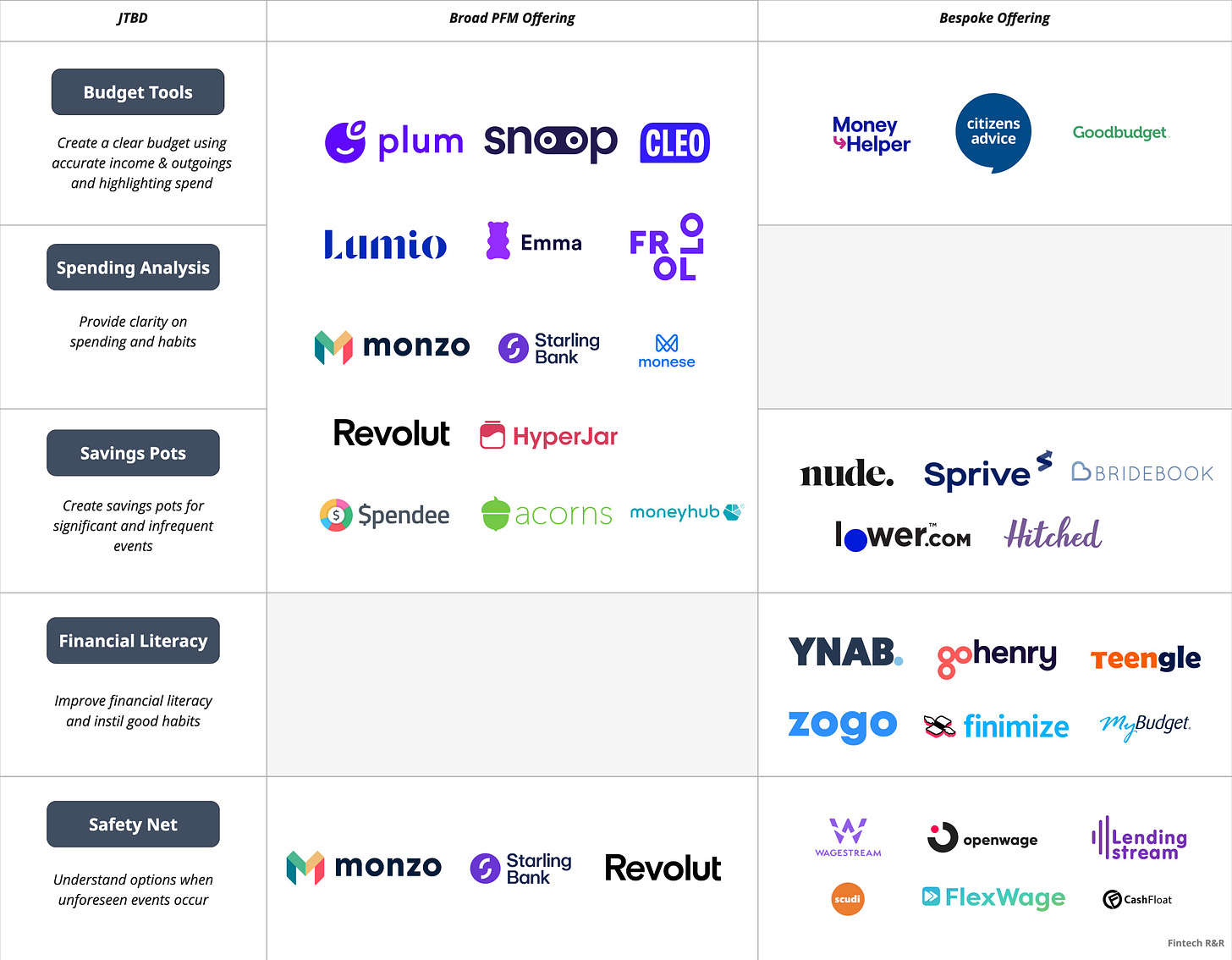

So here are the core JTBD for Personal Finance Management, details about the micro problems that need to be solved and the companies servicing these jobs for customers.

Create a clear budget using accurate income & outgoings and highlighting spend 🧮

The foundational JTBD for personal finance management. Clarity over money available after outgoings means having a clear view of income and outgoings and using a budget to manage any extra funds to put towards individuals’ goals.

Most Personal Finance Management (PFM) apps use a digital version of the tried and tested ‘Envelope Budgeting’ technique. The traditional method involves separating physical cash received as income into different envelopes to represent the various outgoings, and the amount of money stuffed in those envelopes represents the budget that each of those outgoings has.

The digital version is similar, and either use separate digital pots to allocate the budgeted limits in each area parallel to the physical separation of cash OR categories that represent the different outgoings, have limits for each of those outgoings and allocate transactions to a particular category based on where that spend occurred. E.g. If you spend £300 at Asda, it will auto allocate that spend into groceries and warn you if you’re close to your limit.

JTBD Features 📲

Aligning Income and Outgoing timings: Many have issues with the alignment of salary/income payment with the major household costs, bills and subscriptions. Suppose the gap between someone’s income and outgoings is too broad. In that case, it isn’t easy to budget properly, even if that money is allocated separately because that money is psychologically yours until it leaves your account. A gap in many current PFM apps is a service that aligns your major outgoings closer to your income which also makes available spend clearer and more accurate. Tethering this to time, e.g. aligning income and outgoings to the start of the month, is also a great way of bridging the digital money management gap and bringing it into reality as it creates a more relatable physical countdown until the next reset of the monthly budget.

Consolidating All Outgoings: Having a consolidated view of all outgoings leads to a more accurate budget and available spend. Open Banking has made this straightforward for many digital players to allow customers to add all relevant accounts to a single app and see all their outgoings in one place. Not all accounts are available through Open Banking, though with a number of savings and investment accounts not available through OB and smaller organisations a bit slower to make these available to customers.

Creating the budget: A key part of budgeting is the budget itself. Fortunately, again because of Open Banking, historical transactions are available, so digital PFM apps can see some income, major outgoings, and spend history and create an initial budget based on fixed income, outgoings and the customers’ medium & long-term goals.

Providers: Plum, Snoop, Cleo, Emma, Lumio, Starling, Monzo | MoneyHelper

Provide clarity on spending and habits 💳

This is the key lever to pull when aligning income and outgoings against medium-long term goals. Taking a deeper dive into spending on recurring subscriptions, entertainment, coffees, drinks with friends, dinners, clothing, and transport allows a proper diagnosis of the gap and areas that can be cut back or eradicated to create a more significant savings pot.

It’s usually done by pulling the Merchant Category Code (MCC) of every transaction made on your card, grouping them into categories, and seeing the actual merchant itself. For example, trips to Starbucks for coffee might be put into a ‘Shopping’ category, but you’d also see Starbucks as a merchant and track the number of times you bought coffee there in a peculiar period.

JTDB Features 📲

Displaying spending categories: Grouping spending into traditional budgeting categories like clothing, entertainment, transport etc. and sorting by largest spend to smallest brings into focus the areas where the biggest spending is occurring and highlights areas of overspend.

Frequency and timing of spend: Using transactions and timestamps to understand how often a specific spend occurs (the daily morning Starbucks, for example) is vital in understanding individuals' habits and highlighting when individuals are veering out of their norms.

Highlighting loyalty to specific brands: Merchants’ names are pulled whenever transactions occur. These are then surfaced as ‘Name’ on banking apps, highlighting brand loyalty and areas of improvement. For example, if an individual does their weekly shop at Waitrose and it ends up totalling £120 each week, then it could indicate a spending habit that can be improved (the average individual weekly shop is £45 per week), and the brand could be substituted for a similar, cheaper alternative.

Providers: Snoop | Frollo | Emma | Plum | MoneyHub | HyperJar

Create savings pots for significant and infrequent events 🍯

This is often a medium-long term spend, and events include a wedding, a big round-the-world trip, planning for a newborn, buying a house etc. These events aren’t frequent, usually require a minimum of 6-12 months of saving and have personal significance to the savers.

For people who haven’t traditionally put a finance plan together, a specific life event like a deposit on a house or getting married is usually a trigger to create one. Not just in the build-up but post-events.

We’ve all had that blowout holiday that went a little over budget, and then we come back and reign in spending for a couple of months.

This requires a separate pot to put regular savings, an estimated ‘completion date’, and a savings plan that builds on the previous two jobs.

JTBD Features 📲

Identification of important goals: The starting point of this job is knowing what the goal is. Creating the goal, giving it a title and uploading an image that has personal significance (if it’s a wedding, a picture of you and your partner), are all vital to creating a sustainable savings goal. Studies show that sentimental and emotion-driven savers can save around 67% more than their non-emotional counterparts. So using imagery and text to create emotional connections with savings goals can increase the likelihood of success.

Clarifying the approximate cost for that event: It’s challenging to create a savings plan if you don’t know the amount. Many digital PFMs have a placeholder to enter the savings amount, but the number is never validated. For example, many create a wedding goal and budget, but nearly half of couples go over their wedding budget. There’s some opportunity here to bake in some logic and use a bit of predictive AI to create more realistic targets for goals like buying a house and getting married. Based on the industry size and lack of prominent tech solutions, I think there’s a huge opportunity in the WedFinTech space 👀.

Creating a savings plan: Without a plan, that life goal is more a dream than a reality. Using the goal details (amount and time), it’s easier to work backwards and establish the daily, weekly and monthly saving amount needed to hit the savings amount by the specified deadline. Once those amounts are precise, they can be compared to similar weekly spending amounts (like coffee, for example), and clear and relevant trade-offs can be suggested. I.e. Reducing or substituting coffee visits equates to £20 per week.

Providers: Nude | Sprive | GetPark | Bridebook | Hitched | Lower

Improve financial literacy and instil good habits 🤓

Regarding personal finances, the job isn’t to leave everything to an app. It should also provide individuals with the knowledge to make informed decisions and instil good habits that they can use regardless of the tools by which they manage finances. A PFM app without any literacy and education tools is like learning to ride a bike and never taking the training wheels off. Individuals are then reliant on the tools and cannot port that knowledge if that app ceases to exist.

JTBD Features 📲

Financial learning programs: In-app programs to understand each person's level of financial management knowledge, gaps in their understanding and suggested learning modules with feedback and achievements.

Applying learnings to day-to-day finances: Applying skills and concepts to real-life scenarios by connecting a bank account, using actual money to test newly acquired knowledge and issuing rewards to affirm positive habits. I’m a big fan of Charles Duhigg’s The Power of Habit, which outlines the benefits of rewards to instil good habits.

Providers: YouNeedABudget | GoHenry | Teengle | Bloom | MyBudget.au | Finimize

Understand options when unforeseen events occur 🥊

While a rainy day fund is a financial staple, sometimes it just doesn’t cut it, and no matter how good the budget, there’s that inevitable punch in the mouth that can destabilise well-laid plans.

Everybody has a plan until they get punched in the mouth - Mike Tyson

Whether it’s a broken boiler, an expensive trip to the dentist, or an unexpectedly high energy bill, life will find a way of testing your financial management resolve. But it’s important to have options for customers when these inevitable punches occur.

JTBD Features 📲

Surfacing options to address the monthly shortfall: Showing finance options for months where the outgoings exceed income, including short-term lending and early wage access options.

Embedded eligible finance options into PFM tools: Providing a filtered set of options using customer data and allowing customers to apply for relevant opportunities where necessary.

Providers: Wagestream | Openwage | Scudi | FlexWage

Friction for Good

Before moving into some insights and opportunities in the PFM space, I want to briefly touch on three reasons why budgeting and finance management are becoming more important (the last one being the most important of all).

Rising interest rates and Inflation 💸

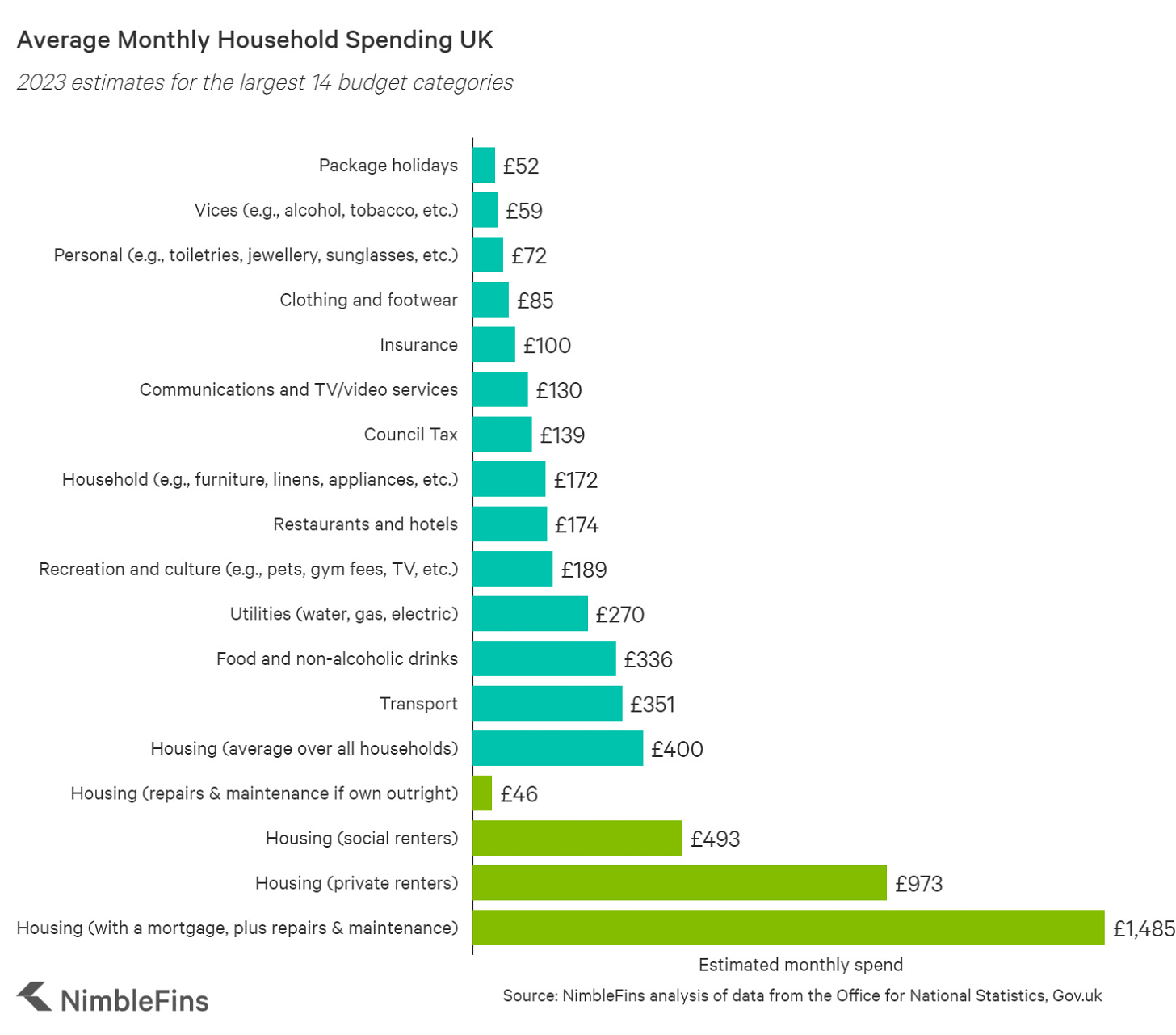

I’ve already touched on the inflation + interest rate squeeze folks are facing, and it will only increase the need for more stringent financial management. Increased interest rates affect renters as much as they do mortgage holders, and with even more energy price rises on the horizon, household spending will be squeezed even further.

Continued reduction in financial education 📚

There’s no indication that populations are becoming better financially educated. Quite the opposite. The research shows the problem is getting worse with millennials and Gen-Z less literate and comfortable with managing finances than their boomer predecessors.

In a study by the TIAA, Gen Z respondents averaged the lowest (43%) in answering finance-related questions correctly

Almost half (45%) of the UK adult population lack confidence when managing their money

Financial skills among the under-34s, on average 16.5% lower than the national average

Zero-Friction payments race 🏎

There’s been a ‘race to frictionless’ with consumer payments over the past two decades. Chip & PIN, Contactless, Card Tokenisation (ApplePay/GooglePay), Card-on-file, and 1-Click checkouts have all increased the number and speed of transactions over time and made it easier and more convenient to transact.

While in many areas reducing friction is a net positive, payments is an area where we could still do with a bit of friction.

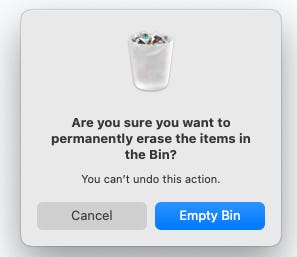

Friction can prevent a customer from making a bad purchasing decision.

It can drive behavioural change.

It can allow the customer to learn more about the product or service.

‘Positive Friction’ is where the customer journey is slowed down, but the experience remains positive.

I’d like to see fintechs introduce more friction in the payments journey from their side, but the frictionless race doesn’t see any signs of slowing down, with BNPL removing the ultimate friction, not even having the full balance in your account at POS to actually pay for goods.

These factors enforce the need for improved financial education (at the very least at a curriculum level) and better tools for managing finances.

Trending in PFM 📈

In this penultimate section are some of the overarching trends we should see entering the PFM space. At least I hope we do.

Smarter Budgeting and Planning tools

Currently, most of the digital tools available solve the problem but are largely static. What does that mean? If you’d set a budget of £100 a week for food in 2021 and prices started to rise with inflation, that budget wouldn’t shift. You’d have to manually shift it as you started reaching the upper limits. And as interest rates go up, the housing bands would also remain static.

Investment banks, pension funds and asset managers use interest rate and inflation curves (projections of interest rates and inflation) to manage finances on a macro level. It’s a matter of time before it’s used on a micro level and uses predictive models to adjust budgets and tighten or loosen the financial plan depending on those projections rather than adjusting them reactively.

Embedded Finfluencer content

According to a study from Lowell, 20% of 16- to 24-year-olds rely on social media for financial advice. It’s not surprising, given overall social media usage. Using TikTok or Instagram as a source of advice isn’t inherently bad, but using it as a sole source of knowledge without foundational literacy can be a dangerous combo. Curated and expert ‘Finfluencers’ have a part to play in using short-form content to educate people as part of a partnership with a PFM app and as part of a wider education initiative.

I’ve always said that I’d be first in line for a Martin Lewis Money Management App, and I think many others would too. He’s more ‘mainstream media but there are several reputable Finfluencers who fit the bill, like Mark Tilbury, Humphrey Yang, ThisGirlTalksMoney and Dave Ramsey

Video, as well as course-led finance education content, is the perfect blend for an ever-digital population.

AI. Because it’s AI

It seems like a bit of a cheat code to put AI in as one of the PFM 2.0 trends because it’s used as a trend for pretty much every tech platform but hear me out. There are some specific reasons why AI will slowly be used as the financial co-pilot for individuals as part of PFM apps. Predictive AI has already proven with stock selection models that it can understand markets, pull in large financial data sets and make informed predictions. It can do the same for individuals while using the interest rate and inflation projections to tweak a budget or create one from scratch, given key inputs.

It also has the benefit of being scalable, accessible when needed, and overcomes a challenge many in more complex situations face when dealing with money.

The concept of money shame.

The internalised feeling of being a person that is ‘bad with money’. For many, this barrier prevents them from speaking to financial experts and can cause a spiral.

AI can provide a similar level of basic expertise whilst lowering the barrier for people who struggle to talk about their finances.

Embedded PFM

I’m amazed this isn’t widespread.

PFM apps embedding their technology into other platforms and providing money management solutions for specific goals like planning for a wedding, buying a house (and auto allocating stamp duty, legal fees, moving costs) and other cases is a no-brainer.

From a brand partnership, customer acquisition and revenue share perspective, there is very little downside other than integration effort, and it offers an invaluable service to the partnering company and customer base.

I can see PFMs lending their APIs to mortgage brokers, wedding planners, estate agents and other ‘significant high-cost purchases’ soon, and I’m so convinced this is an ample and valuable space I might do it myself.

NB - Embedded PFM doesn’t register a single hit in Google’s word trend analysis, but maybe it will after this.

PFM 2.0: Personal Finance Strikes Back

People often give sequels a bad rap. But there are several notable sequels that were better than the originals.

The Godfather: Part 2

Back to the Future Part 2

Terminator 2: Judgement Day

The Dark Knight

The Empire Strikes Back

The Matrix Reloaded

Ok, maybe not that last one. But you get what I mean. Sequels can improve on the original.

And just as sequels benefitted from newer technology and audience feedback, PFM apps have an opportunity to shed their old skins, and use the newer technology & customer feedback to build a better version 2.0.

Four Features of PFM 2.0

Here are four things I expect in this next iteration of upgraded PFM apps

1️⃣ VRP to auto-allocate funds into high-interest accounts

Some apps have started using Variable Recurring Payments, or VRP for short, which in its most simplistic form is Open Banking’s recurring payment instruction mechanism and akin to Direct Debits (but with less hassle). VRP, in conjunction with Open Banking’s Account Information Service (AIS), can be used to identify and compare higher-interest savings accounts and use rules to sweep any remaining cash into high-interest accounts making your money work for you.

Key Benefit(s)

Removes the ‘chore’ from saving and puts some of the month-end admin of moving money into various accounts on autopilot, creating larger rainy day funds and also adjusting as circumstances change.

2️⃣ Actual financial advisors to talk to

Although we’re moving towards a fully digital world, we’re not there yet. There’s always a discussion about the ideal balance of human interaction to digital. With financial management, advice is a key and regulated element, so it has to come from qualified individuals. It means they’re a limited and valuable resource, so I want to see this in terms of interaction layers.

Layer 1: In-app feedback, notifications and dashboards providing the customer with regular insights

Layer 2: Generative AI support layer using customers’ data and knowledge base to answer any support questions and bespoke queries

Layer 3: Human customer support filtering any additional questions unanswered by generative AI

Layer 4: Financial advisor used scarcely and to provide expert and tailored advice for customers

Key Benefit(s)

A cost-effective way of creating a premium product & service, giving customers regulated financial advice when they get to the stage where they need it and using AI as a transition layer.

3️⃣ Custodian Services

Very few PFM apps have a dedicated account and team of budgeting and debt experts that manage money on your behalf, but I think we’ll see a rise in these in the next few years. They offer a much-needed service for many in dire straits, and for folks who want to create that extra friction to curb bad spending habits, it’s an ideal solution. And there are already custodian savings services, like Park Christmas Savings, that allow customers to give money to a custodian and get paid out when the time is right.

Key Benefit(s)

Money is in a separate account, managed by an external party which creates necessary friction and accountability.

4️⃣ Using Accountability to drive positive behaviours

There’s a lot of psychology around accountability. Numerous studies outline the benefits of working out in pairs and larger groups. Yes, gym buddies are beneficial to your fitness goals. It’s often described as the Köhler effect, a psychological phenomenon that occurs when a person works harder as a group member than when working alone. And according to an Ohio State University study, getting others involved in New Year’s Resolutions increases the likelihood of sticking to it, and it’s “easier to keep a promise to a friend than it is to ourselves”. PFM apps that bake in accountability functionality (like an alert that goes to a nominated friend if you order Deliveroo more than three times a week) can drive real positive behavioural change.

Key Benefit(s)

A lo-fi way of getting customers to stick to budgets and achieve their goals. It also has the added benefit of creating a wider community of customers.

Outro

PFM apps went through what felt like a boom period in 2018 & ’19, with a bit of a slowdown in growth over the pandemic years, but intentions have always been good, and they served key jobs for customers.

Now that Version 1 of ‘budget apps with some spending analysis’ has matured, it’s time for Version 2 to use new capabilities Open Banking provides, the learnings from customers, and the opportunities that Finfluencers, AI and Embedded technology bring.

All this should lead to better outcomes for customers, their wallets and a more financially literate society.

That’s the hope.

News

Nick Hungerford’s story and race to create a community for his daughter and other children dealing with grief - I read this and frankly couldn’t put anything else with it. Yes, it’s not strictly fintech news, but the Nutmeg founder’s race against the clock to set his daughter up with the tools to manage the loss of a parent is a gut-wrenching and emotional must-read. Please read it, then check out the charity Elizabeths Smile. ❤️

Perfect timing for this Jas - as my bank app decided today was the day to remind me how much I spent in our local Spar shop this month! They sell my favourite wine and crisps and are a 4 min walk away!

As much as that made for shocking reading, it has made me think.

I love Plum and Wealthify. I've used both for a few years.

I am also a petrol head and started totting up how much it is to run my beast of a 3.0l car! Changes afoot.

As usual a great read, and this one was particularly thought provoking for me.

😂 Yeah the notifications from most banking apps can be hit and miss precisely because they are very personal I.e For some, the local Spa is their only source of weekly shop and for some 👀 it’s bit of an ad hoc treat. Being able to tag these as ‘happy spends’ could be beneficial as they’re not thrusted in your face every time.

Plum is great!

I was going to drop a little discovery exercise at the end to ask about biggest merchant spend. I might add that to the LinkedIn post on Monday 😊