Fintech R&R ☕️- SMEs Got 99 Problems. But Fintech Ain't One

A dive into the SME landscape, the problems they face, Jobs-to-be-Done and Fintech's positive impact on SMEs

Hey Fintechers and Fintech newbies 👋🏽

Welcome to another edition of Fintech R&R.

Full disclosure. I had every intention of talking about digital IDs in this edition because there was some exciting news around digital identity that caught my eye with some cool potential applications.

But as I walked down my small high street this weekend, I saw a sign up at one of the few non-chain restaurants in my area.

It read:

“It is with a heavy heart that we announce the closure of Ham this Sunday after more than 5 years in business.

The soaring costs of everything makes it very difficult to maintain our mission of being a neighbourhood restaurant providing amazing food at affordable prices.

This obviously comes at a time when our customers are squeezed by the same cost rises.

We are open as normal from now until Sunday so please come for a last hurrah.

Thanks, and goodbye for now.”

My first thought was, ‘SMEs are still criminally underserved’. And this isn’t a throwaway comment based on seeing a ‘closing’ sign at one of my favourite local restaurants. It’s something I’ve thought about for a while. And since I’ve been working with an SME lender & cashflow fintech and become further entrenched in the day-to-day problems of Small to Medium Enterprises, that belief has deepened.

That’s why I’ll be diving into SMEs this week. The landscape, the problems they face, some headwinds, areas where fintech is already adding value to SMEs and some areas where they still need support.

As well as interesting news (and puns + movie references of course), this week includes the following:

SMEs definition and an overview

The Super Squeeze facing SMEs

Jobs-to-be-done for SMEs

Real fintechs and the benefits they bring

Next steps for SME focused fintechs

And dont forget to subscribe you haven’t already to have future editions land directly in your inbox!

SME Landscape Overview 🗃

What is an SME or SMB?

Small-to-Medium Enterprise (SME), aka Small-to-Medium Business (SMB), is a term used to describe a business with a specific number of employees and annual revenue, which fits into one of three subcategories.

Medium Businesses: Annual Turnover of less than or equal to €50 million AND less than 250 employees

Small Businesses: Annual Turnover of less than or equal to €10 million AND less than 50 employees

Micro Businesses: Annual Turnover of less than or equal to €2 million AND less than 10 employees

That’s the case for businesses in the UK and across the EU.

The US is slightly different (surprise, surprise) with their small business government agency, the Small Business Administration, SBA for short, often use only one of the Turnover or Employee numbers as a factor. So, for example, a business can be automatically defined as small in specific industries if it has fewer than 500 employees.

As the expression goes, "Everything is bigger in the states".

SMEs come in many different forms and across several sectors. However, some of the most common SMEs include:

Retail businesses: Selling products directly to consumers, such as shops, boutiques, and online stores.

Construction businesses: Providing building and construction services, such as architects, builders, and contractors.

Manufacturing businesses: Manufacturing products, such as clothing, furniture, and electronics.

Creative businesses: Providing creative services, such as graphic design, web design, and photography.

Health and wellness businesses: Providing health and wellness services, such as fitness centres, yoga studios, and massage therapists.

Hospitality businesses: Providing food, drink, and accommodation services, such as restaurants, cafes, hotels, and bed and breakfasts.

Service-based businesses: Providing a range of professional services, such as consulting, marketing, accounting, IT services and legal services.

A solo law practice, a family-run car wash and a chicken shop would all be considered SMEs. 👀

The TV show that links these three businesses shouldn’t be too hard to figure out, but if you don’t know the answer, drop a comment or message me.

99.9 Problems 🧮

SMEs are not just far-reaching, covering all private sector industries. They also run deep.

Every politician that comes into power in the EU, US and UK says the same thing about SMEs when they have the opportunity.

“SMEs are the backbone of the economy.”

Biden recently called small businesses “the engines of our economy.”

Although a political cynic like myself might think it’s a statement to capture votes (which I think it is), it’s also because SMEs are the backbone/engine of the economy. And here are some numbers to prove it.

At the start of 2022:

There were 5.5 Million SMEs in the UK

1.4 Million of these SMEs had employees

SMEs had a combined total of 16.4 million employees

Had around £2.1 trillion of turnover (51% of total private sector turnover)...

…And SMEs accounted for 99.9% of the business population

That 99.9% weighting of SMEs to the overall business population is identical in the US and Europe.

So what’s with the Jay-Z-inspired header, and where are the problems? Surely the growth and turnover contribution from SMEs will continue? Well, as the closing sign on the restaurant indicated. No. It doesn’t look like it will.

Warning Signs ⚠️

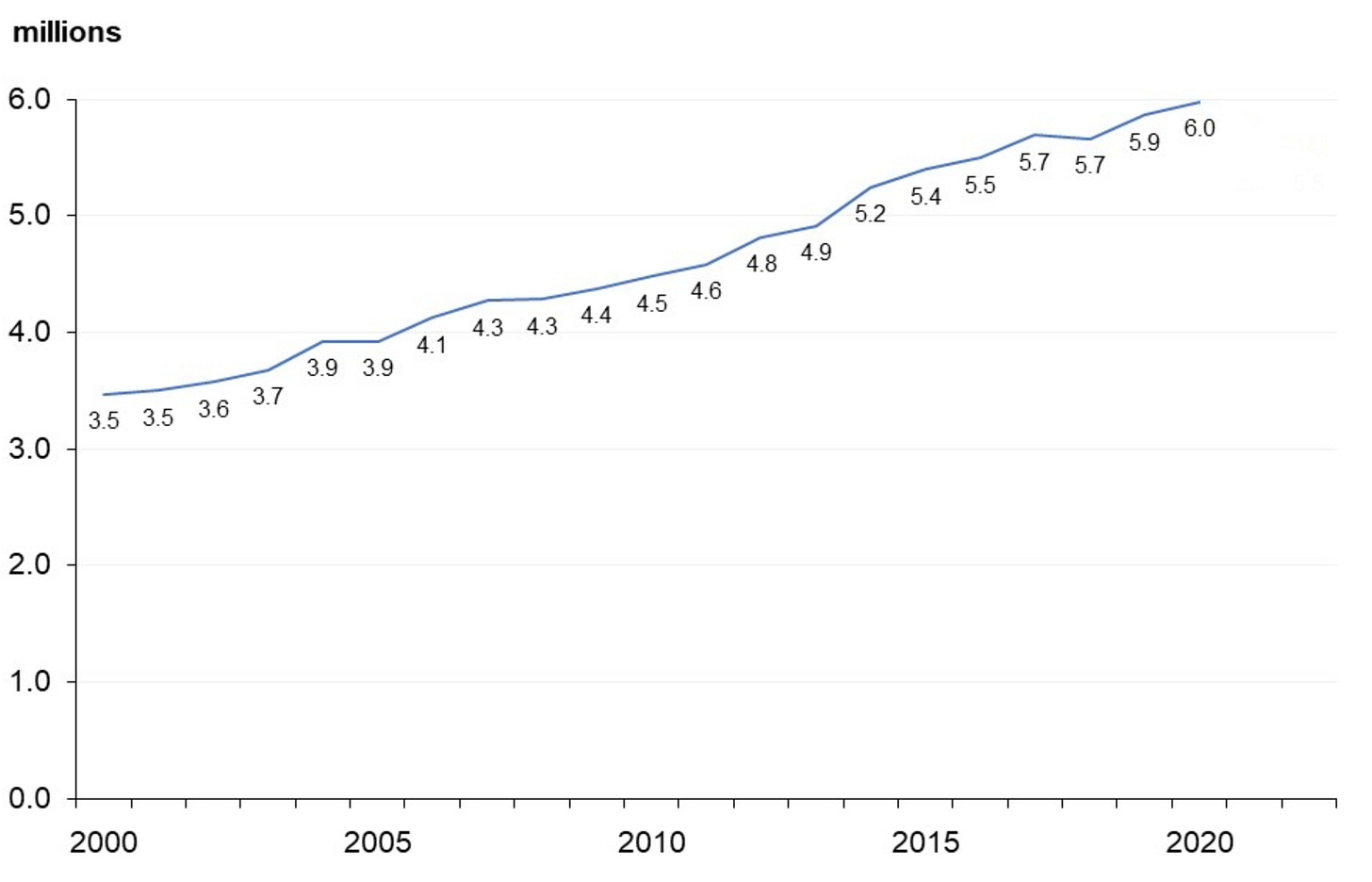

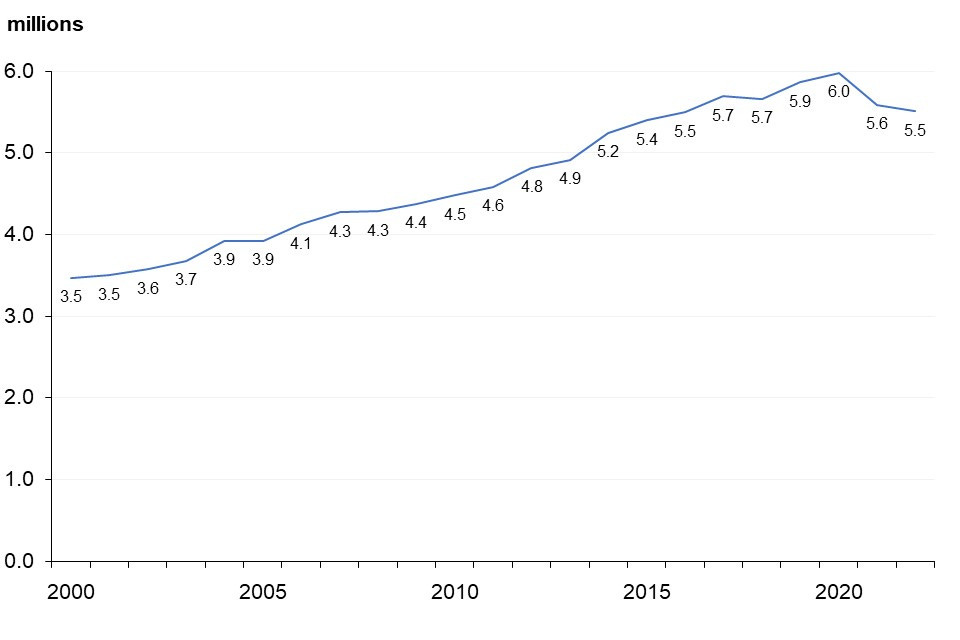

Some of the eagle-eyed readers might have noticed that the initial chart showing the number of SMEs in the UK stopped in 2020. But above, I’ve provided a figure from 2022 that indicates there are 5.5 Million SMEs. So why miss off years of data from the chart?

It’s because I wanted to highlight this.

Since the start of 2020, SMEs have been in decline. Of course, there is a major contributing factor. Covid and the lockdowns.

So now that ‘Covid is over’ as many say, we’d expect to see some increase or flattening of this number when the official govt estimates for 2023 get released in October.

But rather than promote growth, several factors seem like they’ll stifle and stagnate it, some of which are unique to the UK.

Brexit 💂💂💂

Over three-quarters of British companies reported that Brexit has made increasing sales and growing their business difficult. It’s not just increasing sales and growing, though. 4 in 5 firms named Brexit the biggest supplier chain disrupter causing issues in importing and exporting goods. It’s also contributed to labour and regulatory headaches for SMEs which isn’t going away anytime soon.

Inflation 📈📈📈

Costs associated with doing anything have gone up for consumers and SMEs. This means the cost of office space, energy, and costs of particular goods and services (construction materials, for example) increase. Consumer spending tends to decrease as consumers have less available cash so SME sales go down. And when it also leads to a rise in interest rates, it is more expensive to get finance and service existing deals. This is the economics module of my Business Studies A-level coming into play.

Corporation Tax Rise 📈📈📈

SMEs operating as limited companies (around 30% of that 5.5 Million) are liable to pay corporation tax on profits. The tax rate has been 19% for many years and has now increased, as of April 1st 2023 (no, it’s not a joke), to a flat 25% for companies with profits over £250,000. It means many companies will have more taxes to pay and less money to invest in growth.

R&D Tax Credits Reduction 📉📉📉

The Research & Development tax relief scheme is a government incentive designed to encourage and reward research and development activities conducted by companies, many of which are SMEs. It allowed companies to claim corporation tax relief where they spent money on research, development and specific innovation activities. Unfortunately, the amount of relief companies can claim has significantly decreased for SMEs, meaning even less money. Another April 1st present from the government.

On top of the residual impact that many still feel from Covid, the above factors contribute to what I’m calling an SME Super Squeeze. It makes it tougher for new businesses to succeed and squeezes the existing companies.

Although these factors cause massive headaches for SMEs, they broadly fit into the existing core set of problems SMEs face rather than new problem buckets.

Make Jobs. Not Problems

Before jumping into the core SME problems, I want to discuss a framework lauded and widely used in the Fintech Product community (myself included).

Jobs-to-be-Done.

No, this isn’t a handyman service for minor home improvements.

Jobs-to-be-Done, or JTBD, is a framework for understanding customer needs that’s widely used to spark ideas for innovation. In observing customers, doing research, understanding their motivations and identifying the ‘jobs’ they need help getting done rather than listing problems it leads to products that better serve those needs. It’s also a more customer-centric approach that, in my opinion, is better than the ‘build some features that we think customers will resonate with’ approach that some take. The other clear benefit of a JTBD approach is that it is much clearer and easier to market as it essentially reframes problems that customers face into Jobs statements that customers can more easily resonate with.

For example, this means that instead of the problem statement, ‘Men and Women between the age of 25-40 don’t know how or where to invest spare cash’, the job becomes ‘Educate millennials in the ways to make the most of surplus cash’. You can read more about Jobs-to-be-done here.

In the SME world, an all too common problem statement is, “Customers can’t get access to finance when they need it and are often unable to obtain affordable finance to grow or stabilise their business”. A simplified JTBD statement would be “Provide SMEs with fast, flexible and affordable finance to help support and grow their business”. Solutionising and developing features that help with this job is easier and marketing that solution is much more straightforward.

JTBD provides a great way to simplify products' value and identify the key areas customers need help with.

Here are some of the key Jobs-to-be-Done for SMEs with some simplified headers and the companies and products helping with these jobs

Understanding the basics

Giving potential SMEs information about the options and process of setting up their business

Essentially providing customers with all the information they need to make informed decisions about what type of company to set up, if any, and the steps they need to take, including where to register for tax etc.

Gov.uk | FSB | British Business Bank | Enterprise Nation

Obtain a banking solution

Giving SMEs the ability to receive payments, make payments, raise invoices, and obtain spending cards

One of the early and fundamental jobs for SMEs that allows them to receive vital payments for goods and services, raise invoices to receive payments, and allow them to use a card to pay for day-to-day expenses as well as growth levers.

HSBC | Tide | Starling | Wise | Revolut | Anna

Understanding Accounts

Helping SMEs understand accounts and adhere to tax and company liabilities

This is the next thing people think of when picturing a small business. Someone frantically gathering receipts and talking to their accountant. Nowadays, lots of the hard work has gone digital, but it involves categorising transactions to allocate spending and receipts, ring-fencing finances to pay taxes, and creating company statements for filing

Sage | Xero | QuickBooks | FreeAgent | Coconut | CountingUp

Getting Paid Faster

Getting SMEs paid faster for invoices sent and goods & services rendered

This involves automated invoice and debt payment chasing, which is used by 100,000s of businesses across the UK, predominantly chasing larger organisations for invoices yet to be paid. But it also includes debt collection facilities that SMEs don’t want to have to manage themselves.

Satago | Chaser | Credit Hound | DebtCol | InDebted

Getting Financed

Provide SMEs with fast, flexible and affordable finance to help support and grow their business

This takes quite a few forms from companies helping with invoice finance (extracted cash from invoices issued), asset-based finance, revenue-based finance (where finance is provided based on sales made), grant funding and loans. These solutions are all based on getting enough data from SMEs to make risk-based decisions and provide affordable finance.

Satago | Allica | OakNorth | Iwoca | Uncapped | Pipe | Grantify

These are some of the core JTBD, but there are more like providing insurance for SMEs where required, giving SMEs with employees easy-to-use expense management platforms and automated payroll systems and providing SMEs with automated HR tools.

One thing is clear.

Getting finance is critical for SMEs to both grow, innovate and survive. The key aspects to SMEs are:

Flexible financing options.

Speed of eligibility checks.

Speed of disbursement of funds.

Clarity over the process.

Cost of borrowing and clarity over any repayment required.

Fintechs have come in over the past decade and provided technology focussed solutions which, because of their approach, have led to lower-cost finance options and faster, more integrated decision making solving many of the jobs that traditional banks have been unable to provide for SMEs.

That doesn’t mean fintechs are the silver bullet for the SME Super Squeeze, but they have a big role to play in getting the right options to SMEs in a timely, efficient and cost-efficient manner.

Before discussing that role, I want to highlight some examples where fintechs have helped SMEs.

Fintech SME benefits IRL

Uncapped x Cord

Uncapped, the revenue-based finance provider, helped Cord, the messaging tool helping people find work, and raise finances without giving away any equity. Ben, the founder of Cord, called on Uncapped to get 39k from future revenue to hire for new engineering, sales, and customer success positions and continue to raise capital without giving away or diluting existing equity.

OakNorth x Simmons Bars

OakNorth, the SME bank and lender, had supported Simmons, the popular London bar chain, since 2018, when they had their first major investment. Simmons CFO cites OakNorths speed and efficiency of financing and help during Covid as the reason for using them and continuing to use them as their bank and lender.

Satago x Luna & Fennel

Satago, the cash flow management and invoice finance solution, provided Luna & Fennel, an independent pizza company that supplies Harrods, Selfridges and Whole Foods, with a £25k invoice finance facility to fuel the next phase of growth for the ambitious business.

DISCLOSURE: Satago is the SME lender I’ve been doing some work with

Next steps for SME-focused Fintechs

Although fintechs still have a long way to go to scale up and amass customers to benefit the ecosystem on a wider stage, there are a couple of areas where fintech will accelerate the assistance that SMEs facing the squeeze desperately need.

Embedded Finance 🔌

It feels like I should just have an embedded finance corner because it comes up pretty much every week. But, in this instance, it’ll help give organisations access to the right financing options at the right time. And in terms of customers having more awareness of finance options, Fintechs partnering with banks and embedding their options into traditional banking platforms gives fintechs access to a mass of SMEs and SMEs access to a variety of finance options.

Artificial intelligence and Machine Learning 🤖

Big talking points recently with machine learning being slightly more advanced in its application and benefits to fintech and, by default, the SMEs that use them. Machine learning is already used in many fintechs to tailor risk models and give bespoke decision-making to finance applicants, but the more prevalent this becomes in fintech, the faster it’ll be adopted by banks and therefore benefit SMEs.

And AI can speed up the onboarding process through AI-driven KYB and lower the cost of finance by also being implemented in the ongoing fraud detection part of the lending and decision process, replacing some manual effort.

Fintechs are providing SMEs with much-needed support and innovation to help them overcome their challenges and grow their businesses. By adopting fintech solutions, SMEs can improve their financial management, access finance more easily, and ultimately achieve their growth ambitions.

But ultimately, fintechs alone can’t make a big enough dent in the SME Super Squeeze in a short space of time. And one of the reasons my local restaurant didn’t survive is that it didn’t have the right help at the right time and access to options. So the best way to reduce this squeeze for SMEs is to have the innovative fintech providers with tech-first solutions join forces with the larger traditional banks who have the largest mass of SMEs to really make an impact and hopefully stop more small to medium-sized businesses from going under.

Favourite bits of Fintech Product news

Ryan Reynolds gets into fintech - Folks have been talking about digital currency like it’s a new phenomenon slowly entering our lives. But influence is the informal digital currency that has been around for years and Ryan is flouting his to become, well, less Ryan Reynolds and more Ashton Kutcher. Taking this stake in Canadian payments company Nuvei won’t be his last fintech ‘venture’.

Super raises $85 million- The savings super-app , raised $60 million in equity and $25 million in debt to supercharge it’s product and engineering team growth and develop more features. To follow on from my super app write-up from a couple of weeks ago, this proves that super app growth is alive and well.

Especially painful the life of young small business - as soon as minimum requirements to be financed by most of the lenders 2 - 3 years, and minimum sum 5-10k. So I agree that fintech and particularly embedded lending could help. Still a lot to do in educating the market and improve traditional bank willingness to partner with fintech