Fintech R&R ☕️ - The Future of Finance is...Open

Open Banking, the big opportunities still on the table and how OpenAI has the potential to transform Finance Management for the better

Hey Fintechers and Fintech newbies 👋🏽

It’s been a crazy and concerning few weeks in the world of Fintech and beyond.

Silicon Valley Bank and Signature Bank collapsed. Another, First Republic, got a $30bn cash liferaft put together by a group of 11 of the US’s biggest banks, and the ripples came across the Atlantic to Europe with Credit Suisse looking like they were in serious trouble until UBS, their bigger local rival, agreed to buy them for a measly $2bn.

There’s a lot of doom and gloom around, most of it warranted.

While there is a lot to unpack here, including regulatory oversight, the responsibility of risk within banking institutes, lessons learnt from previous banking collapses, the sensitivity of financial institutes to interest rates and the impact on Fintech startups, I don’t think the dust has settled yet, so I’m going to hold off covering this for now.

Instead, I want to talk about an area of Fintech that wasn’t around at the last major financial crash and an area that continues to provide value for the startup ecosystem and consumers alike.

Open Banking.

I’m not just talking about Personal Finance Management apps that aggregate transactions and show a single view of finances. These are great, but scratch the surface in terms of beneficial use cases and value as there are many more disruptive uses out there and that’s where a lot of the future value of Open Banking will come from in the coming years.

In addition to an Open Banking intro and some interesting significant use cases on the horizon, I also want to talk about success.

Because some prominent figures in Fintech, including the unofficial Queen of the neobank, Starling Bank CEO Anne Boden, effectively called Open Banking a failure when she spoke to MPs a couple of years ago.

This sparked 53 Fintech Founders to come out with a heated defence of the initiative.

Whilst I agree with the Fintech Founders, I also want to clarify why OB has been a success and why it also lays down the foundations for future innovation. Not just in the UK. But across the globe.

And it’d be remiss of me to write about Open Banking and Open Finance without covering another ‘Open’ subject that continues to gain popularity, was recently in the news with the launch of GPT4 and could be paired with OB to add considerable value to customers. OpenAI…

Here’s what’s included in this week’s edition:

What is Open Banking? (and a breakdown of the key terms)

The meaning of success for Open Banking

The biggest use cases still not cracked

OpenFinance + OpenAI = The end of financial advisors?

Interesting news

Favourite Tweet

What is Open Banking?

This will be a brief primer on OB. For a more detailed background and walkthrough, read this I wrote a while back.

As L’oreal ads used to say, “Here comes the science bit—Concentrate!”

Open Banking doesn’t exist without PSD2. The revised or Second Payment Services Directive (PSD2) is an EU regulation whose objectives include:

To contribute to a more integrated and efficient European payments market

Make payments safer

Increase the consumers’ protection

Foster innovation and competition while ensuring a level playing field for all players, including new ones.

The regulation was ‘entered into force’ (brought into existence in EU Law) in 2016, and EU Members had until 13th Jan 2018 to transpose it into national law.

Fortunately (or for a tiny set of my readership, unfortunately, 🤐), the UK was a part of the EU back in 2016, so took steps to prepare for this initiative. The Open Banking Implementation Entity (OBIE) was set up by the UK Competitions and Market Authority (CMA) tasked with adhering to the specific areas of PSD2, including Article 66 outlining Payment Information Services (PIS) -Giving the user the right to use third-party services that can initiate payments--and Article 67 outlining Account Information Services (AIS) --Giving the user the right to use third-party services that access and make use of the users account information.

What does this mean in plain English, I hear you ask?

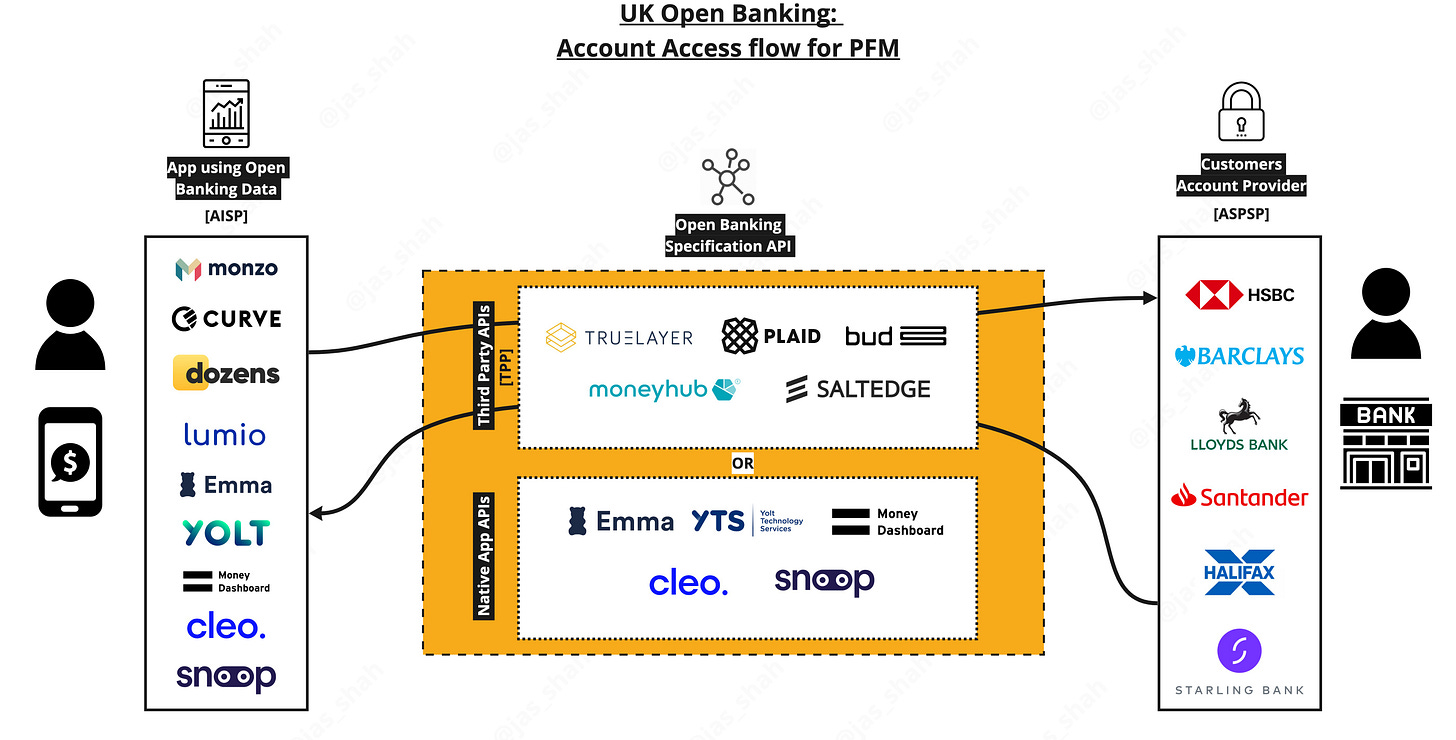

OBIE outlined technological standards and worked with the nine biggest banks in the UK (CMA9) to build access points and tech rails (APIs) to make it easier for customers to get access to their banking data like transactions, balance etc. and use third parties to initiate payments to and from bank accounts.

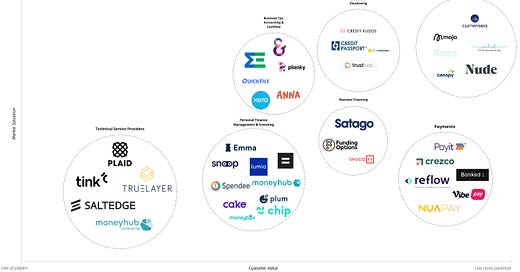

Third-Party Providers (TPPs) like Truelayer, Tink and Plaid then provided a simplified way to access these two key services, AIS and PIS, allowing Fintechs to build customer focussed propositions quickly.

NB: Many Fintechs chose not to use a TPP and connect to these bank APIs directly, realising that the short-term cost and effort of circumventing TPPs could pay off in the long run.

Since 2018 we’ve seen a gradual increase in the number of Fintechs building Open Banking based products (products that use the AIS and/or PIS service) and the number of customers using these products.

The initial popular use cases were based around budgeting and saving:

Consolidating transactions from multiple bank accounts and getting a clearer understanding of your finances, e.g. Lumio, Emma

Money management tools, including analysis of bills and subscriptions to identify areas where you can save money, e.g. Snoop

Creating better spending and savings habits and auto Saving/Investing, e.g. Plum, MoneyBox

Now the value and benefits of Open Banking are being realised across a much broader range of problem areas including:

Using bank data and a dedicated account to build a deposit towards your first home: Nude

Pulling business banking transactions into one place to provide a simple and cost effective accounting and invoicing solution for SMEs: Ember

Using rent payments to landlords to report good positive financial activity to credit agencies to improve overall credit score: CreditLadder

Using transaction data to give lenders the ability to perform fast and effective credit checks without impacting your ‘official’ credit score: CreditKudos

These are just some of the growing areas based on the existing OB tech features. And guess what. The underlying technology is improving. So the next few years will see more than just the ability to pull transaction data and initiate payments. And the range of accounts will also increase, moving from Open Banking (technology currently mandated to provide ‘openness’ of payment accounts, i.e. current accounts) to Open Finance (covering transactions and payments across all financial accounts, including savings, investments, mortgages, insurance).

So, how can a growing ecosystem of Fintechs using OB tech to provide value and solve real problems for over 7 million customers across the UK be called a failure?

Objective and Objective-based Success

I think most of us have been in the type of meeting where you’re discussing the pros and cons of an initiative, and there is always that question of ‘What does success look like?’. Usually, in those meetings, I’ve been that annoying interjector.

And even if you haven’t been in those meetings, most at one time or another have come across SMART goals. The goals often put at the start of the year to track performance should be Specific, Measurable, Achievable, Relevant and Time-Bound.

While the initial objectives of PSD2 and Open Banking weren’t full-blown SMART goals, there’s no doubt that it has succeeded in “Fostering innovation and competition while ensuring a level playing field for all players, including new ones”.

And although some folks might quibble with a couple of the other objectives, facilitating an ecosystem of 54+ founders, 100s of Fintechs with 1000s of employees, and over 7 million UK customers is objectively a success.

When I say objectively, not only am I talking about removing the influence of personal feelings or opinions, but I’m also referring to achieving an objective outlined from the outset.

To demonstrate the point between ‘objective-based’ and non-objective-based success, I want to draw out an example:

Bank A.

Set up in 2015. 5.8 Million Customers. £3.7 Billion Valuation

Bank B.

Set up in 2014. 2.7 Million Customers. £2.5 Billion Valuation

On the face of it, Bank A looks like a success and comparatively, Bank B is a failure, right? Bank B has fewer customers, a lower valuation and has been around for longer.

If the objective was to get more customers than Bank A, then technically, it has been a failure. But what if the objective is to take market share and customers away from other banks and gain a £1 Billion valuation? Then it has been a success.

If you haven't guessed it, Bank A is Monzo and Bank B is Starling.

Framing success in terms of objectives is much more effective (and accurate) than giving a subjective opinion.

And a more accurate statement on the progress of Open Banking is “Open Banking has been successful in building an on-ramp to customers' banking data and fostering innovation in the space. But more problems could be solved by the use of the technology and the technology itself has some improving to do.”

An Unexpected Journey

As mentioned, technology is improving. Whilst current account transactions and bank-to-bank payments is still the core Open Banking functionality, there are improvements in the technology itself and its application that will accelerate adoption over the next five years. Here are some of the key ones…

VRP and Cash Sweeping 🧹🧹🧹

Variable Recurring Payments or VRP, is a new feature of the Open Banking specifications that allows for the automatic movement of funds between two accounts held at different institutes. The difference between VRP and the core OB payments functionality is that the core payments functionality still requires authentication each time and is built mainly for one-off payments.

VRP allows for the creation of rules and regular movement of money between accounts an individual holds without needing authentication each time. This means that if you’re about to hit your overdraft and be charged a fee + interest in your HSBC current account for example, the required funds could be automatically moved from your Barclays Instant access savings account to cover the difference and avoid unnecessary charges and interest. You are essentially maintaining the best available average interest rate across all accounts.

That’s one example, but there are others, like the ability to have the ‘Round Up’ feature across all accounts, which means you round up to the nearest pound on every transaction and save the difference in a separate pot. Or merchant-based savings where every time you do a weekly grocery shop, it allocates 10% of that spend into a ‘Deliveroo pot’ as a reward for doing a responsible shop. Or allocating your monthly salary into different accounts like mortgage, pension, and savings as soon as it comes in.

The way organisations implement this is going to be the key factor in its success. Because although techies are adept at SQL and CASE statements, not all of the general public have computer science degrees, so the success of this will depend on how it’s designed and given to users (UX +UI).

Open Banking - > Open Finance 💸💸💸

The term Open Banking and the regulatory initiative in the UK and EU covered current accounts. Although some organisations chose to include some savings products proactively, this wasn’t mandatory, so the AIS (accounts and transaction data) and PIS (payments) functions don’t currently cover ALL financial accounts like pensions, mortgages, insurance etc. But once they do, and the OBIE puts forward the expansion to include a broader range of account types, it’ll lead to more all-encompassing solutions ESPECIALLY in the PFM space.

For example, when all account types are accessible via Open Finance, you can see your Current, Savings, Investment, Mortgage and Pension accounts in one view despite who you bank with. Then based on your goals and aspirations, you can decide whether it makes more financial sense to pay more into your mortgage, invest in the stock market, pay into a pension etc. Currently, most people get their ‘single view of all their finances’ by getting their data from various sources and typing it into a spreadsheet.

Payments 💳💳💳

This is one area of OB that has, let’s say, not been as successful as it should have been.

Debit and Credit cards have been the payment method of choice for consumers for the past five years. But card payments are costly for merchants (shops, department stores, and e-commerce stores). To accept card payments, merchants pay a monthly and per transaction fee, which can get up to 6% per sale, meaning up to 6% of the product or service you buy using your card goes towards facilitating the payment.

Because Open Banking payments are account-to-account, it removes much of those fees, making it a cheaper but no less secure option.

Although during Covid people got used to making mobile purchases using QR codes, those payment methods were still via cards (that included tokenised card payments via Apple/Google Pay).

There’s still a massive opportunity to provide low-cost and simplified payment solutions for merchants and customers. An excellent place to start would be local businesses that run on tight margins and could do with the extra cost saving Open Banking payments bring.

Open Finance - > Open Data 🌐🌐🌐

Open Banking to Open Finance is expanding services to include more financial data across different accounts. Open Finance to Open Data is a step towards using broader data to feed into some financial decision-making.

For example, pulling in some basic health records when applying for health insurance saves individuals time and effort and allows them to plug in their data to get the best rate. Or using car usage data like average speed, erraticness, brake speed etc., to assess how good a driver you are and use this to get better (or maybe worse) car insurance premiums. Some companies do this using a black box or connecting to specific vehicles.

But allowing individuals to own their data and use it to reduce costs will be a big step in data ownership. And it will likely piss off bad drivers. So win, win.

Open Banking as an on-ramp to Embedded Finance

I wrote about embedded finance and the $7,000,000,000,000 opportunity a few editions back (although I still haven’t managed to find the ultimate source for that lofty figure). Regardless, data is one of the prerequisites in embedding finance options and targeting the right, eligible customers.

This is the case whether talking about embedded finance into traditional banking institutes or embedding it into non-finance products like e-commerce.

For traditional banks: Whilst traditional banks already have a vast amount of customer and transaction information on account holders and can offer them external finance options, non-account holders could use these external finance options by giving the bank the requisite data using an open banking connection. So, if I hold a business bank account with Barclays, but Lloyds are offering preferential loan rates via a Fintech lender, then Open Banking could be used to share the prerequisite data and customer info required to facilitate the loan.

For e-commerce: In the embedded finance post, I discussed giving e-commerce stores on platforms like Shopify, Amazon, and Etsy means-based finance options using their historical sales and credit ratings. This is where OB data can be used. To do the means testing and filter out ineligible customers before taking them to the next step and confirming then disbursing finance.

I won’t go through all of the embedded options and outline the Open Banking factor here. Needless to say, it can provide significant value in getting the right data in a timely and secure fashion to make embedded finance propositions even more seamless.

Open Finance + OpenAI

Everyone is talking about OpenAI right now.

While it’s great that folks are using it to compose tweets, write LinkedIn posts, cheat on their essays, generate images of what Family Guy characters would look like in real life and so on, the real long-term use cases, as with most new tech, will become more apparent over time.

One use case just over the horizon that combines Open Finance and OpenAI is hyper-personalised finance management using data from Open Finance and a 1:1 dedicated intelligent ‘advisor’ from OpenAI.

Because with access to transactions and data across all accounts, the difficulty becomes solving problems for customers and helping them navigate through all this data. And what AI is good at is processing large data sets, spotting patterns, automating tedious tasks and providing a human-like intelligence layer between the consumer and their data.

So instead of starting the year with a budget hacked together using excel and its downloaded budget template, you’d connect your data to an app then ask it to set you a monthly budget.

If you want to ensure enough space in the budget for a holiday, then you’d be specific. “Budget for a week-long 5* resort holiday in the Maldives around May”. The app using OpenAI would then estimate the cost for that holiday and adjust the budget accordingly, taking all the time and hassle out of maintaining a usable budget. It would also be able to:

Figure out tax implications and create the data required for a self assessment tax return

Adjust pension contributions to make the most of any salary changes

Advise you on better, higher interest accounts for you to switch to

…and more….

Whilst we’re not there just yet *financial advisors everywhere just breathed a sigh of relief* it certainly won’t be more than a decade before we see fully digital advisory solutions and Open Finance become a more widely understood term.

But if you're reading this, you have a head start 💪🏽👋🏽

Interesting Fintech News

Hindenburg Research publishes investigative report on Jack Dorsey’s Block and CashApp platform - An appropriate name for a research company exposing dodgy customer metrics, negligent compliance and opaque sources of revenue. One to watch over the next few weeks…

Sibstar Launches UKs first Debit Card for people with dementia - These are the kind of Fintechs I really love. Created by founders where the frictions or problem area is directly connected to their day-to-day lives (in this case the founder’s mother has dementia and found it increasingly difficult to manage money while living with the disease) and creating a solution for people who really need it 👏🏽

ChatGPT launched a plugin store - Now they’ve launched a plugin store which means connections to external data and expertise from the likes of Expedia, Kayak, OpenTable and Shopify. So that budgeting and travel planning idea I talked about just got one step closer. 😬

Recent Tweet

Timely and relevant Tweet from Paul on SnooppApp (the PFM and subscription efficiency app) who are looking at a potential sale