Fintech R&R☕️ x Under the Hood 🛠 - Open Banking Payments and how to accelerate 'Pay by Bank' adoption

An Open Banking Payments Deep Dive, brief history of OB, major benefits of OB v Cards and big focus areas to drive mainstream pay by bank adoption

Hey Fintechers and Fintech newbies 👋🏽

I’ve always been an Open Banking advocate, especially for the UK’s Open Banking implementation. Over the past few years, I’ve helped shape a couple of OB-based propositions precisely because I believe in the value of the technology, and it still has great potential for consumers, SMEs, and fintech founders who want to build customer-centric products fast.

Companies see the value as well because OB-based companies are always in the news. Here are some recent examples:

CMC Markets partners with Truelayer to enable payments support onboarding

PFM app Emma enabling Rent Reporting to help renters improve their credit score

The next couple of years will see lots of evolution in the space, with Open Banking used to facilitate transferable digital identity, popular finance management apps gaining more widespread adoption and even more niche Open Banking solutions for customers.

I’m also hoping that at some point, credit ratings will be made available via the rails, whether that’s banks cached credit reports or credit data accessed directly from the big agencies because, for me, it’s still a bit of a gap in the “giving ownership of data back to customers” which was one of the core tenets of the original initiative.

There are many reasons to be optimistic, but one area where I’ve been underwhelmed is payments.

While the AIS (Account Information Service) functionality led to a boom in the number of account aggregators, personal finance management, and financial wellbeing apps in and around 2018, giving rise to the likes of Plum, Chip, Claro Money, Cleo, Snoop, and Emma, the PIS (Payment Initiation Service) functionality doesn’t seem to have created the same set of well mainstream fintechs.

There are of course, fintechs out there that have built products using the technology making it easier and cheaper for consumers and businesses to make and take payments but not as many as I would have expected.

There are reasons why I’m a little underwhelmed by the adoption of Open Banking Payments.

I feel like folks got used to the QR code-based payment initiation during the pandemic, which could have supercharged the growth of account-to-account payments using OB, but that didn’t really materialise.

Then I look at UPI in India, covered in the last edition, which has a lot of similarities with Open Banking Payments (OBP) as a technology but has seen far greater adoption and year-on-year growth, and I can’t help but feel a little disappointed.

OBP and UPI aren’t exactly the same though, which is why, before I give insights about where it’ll head and shout out some of the fintechs making waves in the space, I’m diving Under the Hood of Open Banking Payments.

This edition, as well as interesting news, puns + movie references includes the following:

Very Brief History of UK Open Banking

How it works Under the Hood

Benefits of using Open Banking Payments

Suggestions to accelerate adoption

Some interesting fintechs in the space

Open Banking from the beginning

Before jumping straight into the end-to-end process of OBP, here's a little context about the origins of Open Banking beginning with PSD2.

The revised or Second Payment Services Directive (PSD2) is an EU regulation whose objectives include:

To contribute to a more integrated and efficient European payments market

Make payments safer

Increase the consumers’ protection

Foster innovation and competition while ensuring a level playing field for all players, including new ones.

The regulation was ‘entered into force’ (which basically means brought into existence in EU Law) in 2016, and EU Members had until 13th Jan 2018 to transpose it into national law.

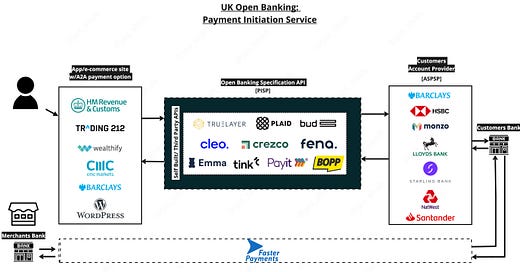

Payment Initiation Service

One of the biggest innovations detailed in the PSD2 regulations is the ‘access to account’ services defined in Articles 66 & 67 of the regulation. I’m no lawyer. And I don’t expect you to be either. But if you are, feel free to read the whole PSD2 doc here.

For the rest of us non ‘Suits’ types, Article 67 outlines Account Information Services (AIS) – Giving the user the right to use third-party services that access and make use of the user’s account information and Article 66 outlines Payment Information Services (PIS) – Giving the user the right to use third-party services that can initiate payments.

Simply put, it means banks HAVE to give secure access to Payment Services and Account Information so third parties can create tools that will ultimately benefit the customer. Got it?

So. This is where Open Banking comes in.

Even though Open Banking as a concept has been around for a while, the requirement for a secure way to give providers access to your financial information with the overarching goal of giving data and control back to consumers was given more urgency when PSD2 came into effect, and so the Open Banking term became much more mainstream. And in the UK, it’s the Open Banking Implementation Entity (OBIE) who were responsible for implementing these new initiatives and continues to oversee Open Banking initiatives, drive innovation & competition and hold banks to account (pardon the pun). You can find out more about them and what they do here.

So if you think PSD2 and its intent to make payments safe, increase consumer protection, and foster competition sounds like a positive EU regulation, you’d be right. See Brexiteers. Not all EU regulations are burdensome, inescapable nooses designed to take away consumer rights. 😉

Part of what the OBIE did in the run-up to the 2018 deadline was to create a set of API standards which allowed fintechs to build more niche customer-centric solutions that enabled customers to safely and securely access account data (leading to a rise in digital money management tools), provided Strong Customer Authentication to access accounts, and to initiate payments. Since then many fintechs have built their products using Open Banking APIs to connect securely to banks to pull account information and initiate payments.

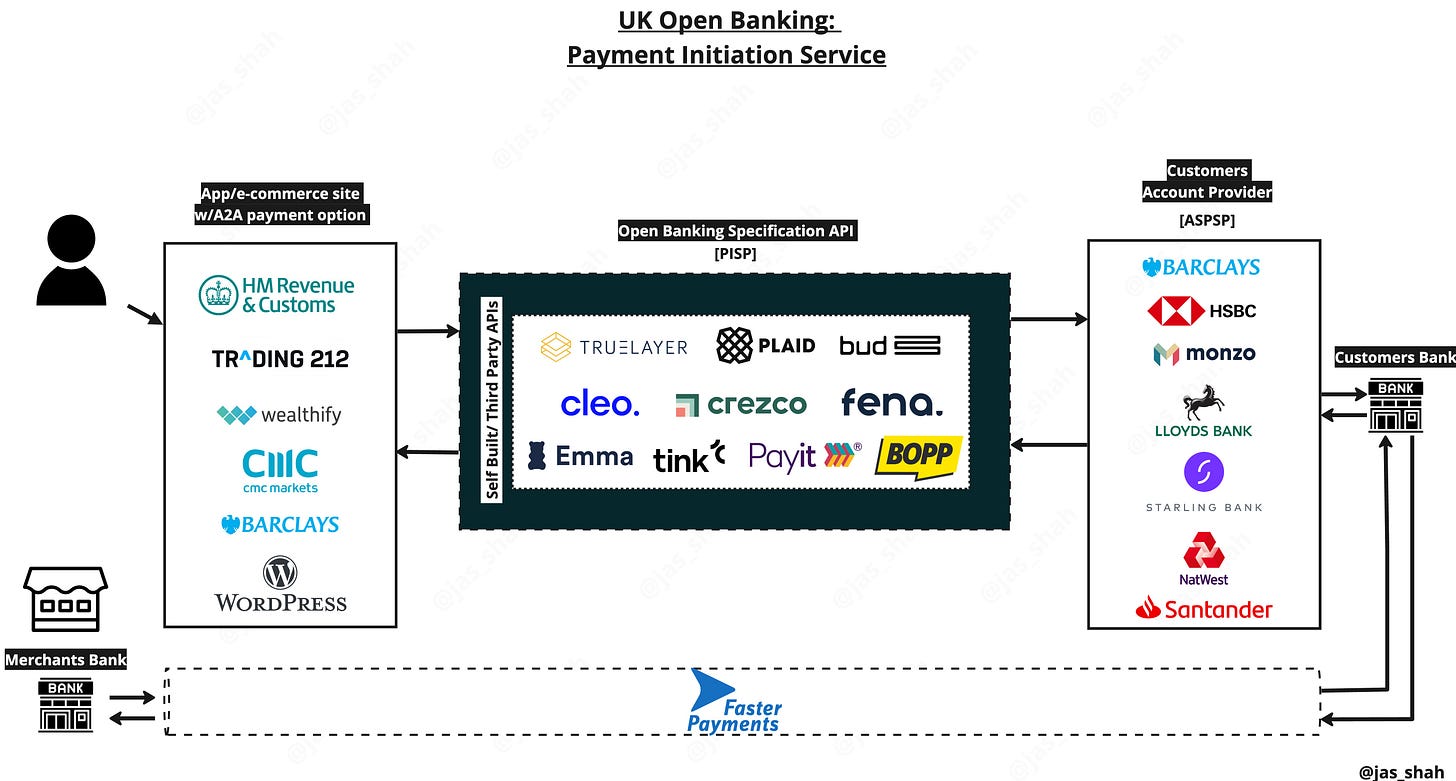

Open Banking Payments Flow

End-to-end flow of a one-time merchant payment using Open Banking

Step 1 - Payment Initiation

All payments start with some initiation. For this end-to-end explainer (and to make the diagram a bit simpler), we’ll stick with consumer-to-merchant payments, but the end-to-end process is mostly the same for consumer-to-consumer payments and business payments (things like invoices).

OB Payments are initiated by the customer selecting the ‘pay by bank’ option in an e-commerce journey, clicking a bespoke payment link, OR for in-store payments via a static or dynamic QR code.

Static QR codes: The ones you’ll see on a table or at a POS, usually fixed in a glass or plastic casing which takes the customer to a payment page where they enter payment details.

Dynamic QR codes: More common for in-store payments as the QR code is unique to each customer interaction and can therefore prepopulate the total amount and generate a transaction reference

NOTE: This journey is also identical for topping up funds in an investment account or paying off a specific bill amount, except that at this stage, the customer will be allowed to enter the amount and currency they want to pay, e.g. Add £200 to a Trading 212 account which will be reflected in the payment summary later rather than being shown the exact amount for goods + services.

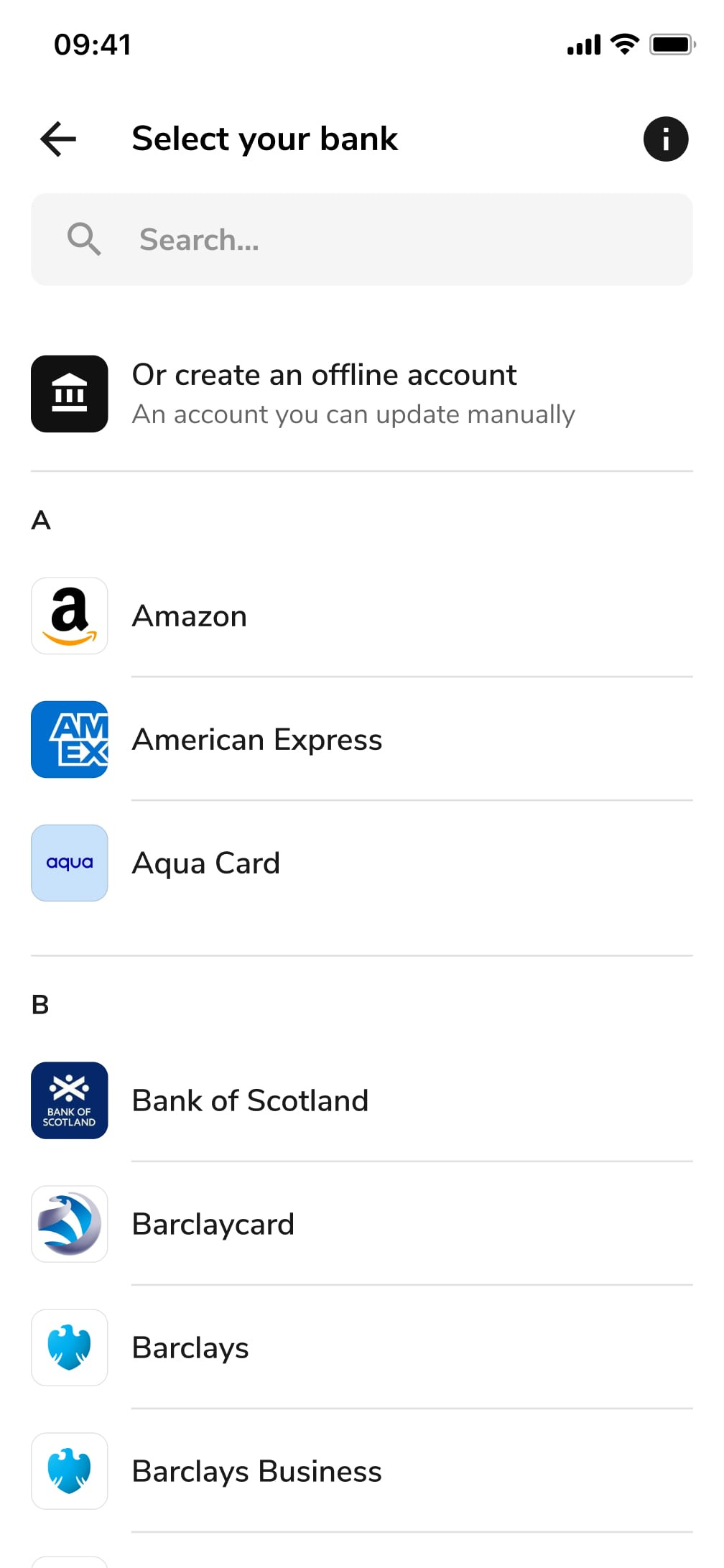

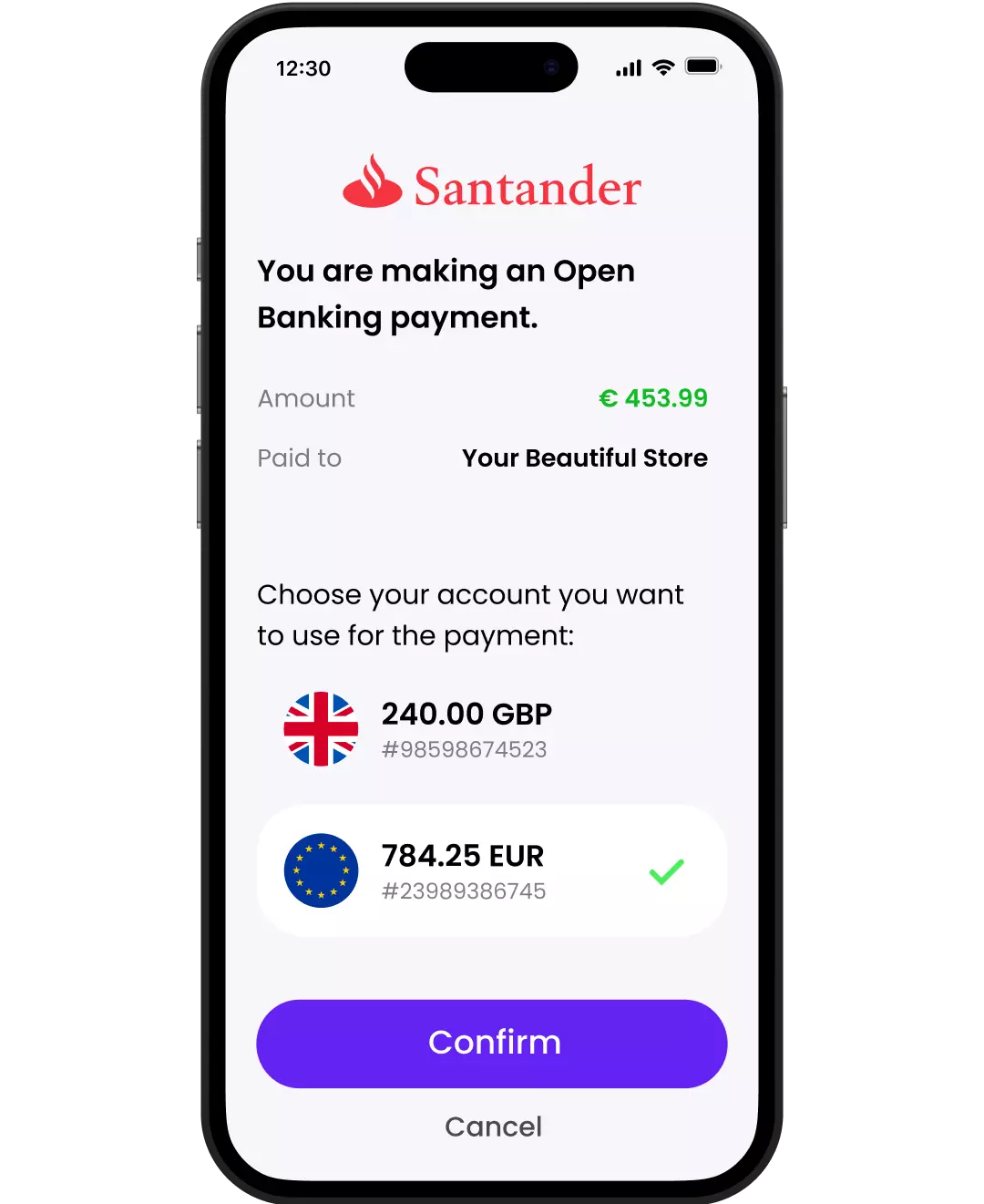

Step 2 - Account Selection

Once the customer has scanned the QR code or clicked Pay By Bank, they need to select an account where payment will be taken from.

There are a couple of ways the account gets selected as specified in the Open Banking guidelines. An uncommon method is that the customers enter their IBAN/Account Number + Sort Code up front, and this is used to send the payment request to the bank.

This is uncommon because merchants and PISPs have opted for low-text entry journeys to reduce friction and increase the likelihood of conversion.

The more common method, especially for new customers, is the PISP will provide a list of banks for the customer to choose from, the customer then chooses their preferred bank (no account has been selected yet), and they are taken to the payment summary screen.

Step 3 - Payment Summary

Before the customer is transferred to the selected bank, the PISP is obliged to provide a summary of the transaction, including:

Payment Amount and Currency

Payee Account Name.

Payment Reference (usually prepopulated by PISP).

Selected Bank

The customer can then review the payment request before proceeding and check that everything is in order.

Step 4 - Transfer to the banking app/web portal

The PISP Payment Summary will also provide a clear message with actions stating that they are securely transferring the customer to the selected bank. At this point, the customer either stops the journey or confirms that they understand they’ll be transferred to their chosen bank and clicks “Agree”/” Confirm”/” I Allow”/” Proceed”.

Step 5 - Banking Authentication

The payment request is sent via secure API to the selected banking provider, and on fully mobile journeys, the customer is redirected to the mobile banking app of choice, which triggers the Strong Customer Authentication (SCA) process from the customer.

I’ll touch on SCA later and the benefits of OBP v Cards, but this essentially prompts customers to authenticate themselves as the owner of their account independently and securely of the PISP and within the banking app itself, i.e. HSBC, RBS, Lloyds respective apps through Face ID/PIN on the device.

For web OBP, it simply triggers the banking web portal rather than the app, and authentication usually happens using the User ID, password and the bank’s mobile app authenticator.

Step 6 - Customer Selects account

Once the customer has authenticated themselves within their chosen banking app, they’re presented with the accounts from which payment can be taken. The customer selects the relevant account.

Step 7 - Customer proceeds with the payment

Final step and completion of payment. The customer reviews the payment details, including amount, currency, merchant and reference. If the customer trusts the merchant, it’s usually a quick process, and the customer hits “Proceed”/” Confirm”/” Pay”.

Step 8 - Bank performs checks

The payment request is sent using Faster Payments by default (UK’s instant payments system). Before sending the payment message, some banks will perform a Confirmation of Payee check, ensuring the merchant’s name aligns with the account and sort code given, and the bank verifies available funds.

Step 9 - Bank confirms the payment and sends payment via Faster Payments

The bank then sends the instruction via the Faster Payments network to the merchants' bank using the details given (account details, payment amount, reference, and sender details).

Step 10 - Merchant’s bank receives instructions and confirms the payment

The receiving bank (the merchant’s bank in this case) receives the instruction confirming that the details are valid (valid acc num etc.) and sends a confirmation back to the bank via the FPS network. The merchant should also get a notification that the payment has arrived.

Step 11 - Customers bank confirms successful payment and redirects the customer

The customer who, during steps 8,9 & 10, has been waiting patiently (for about a second on average) will be given a success screen from their bank and redirected to the PISPs page, where they’ll see a transaction complete/order complete page.

That’s the simplified ‘happy path’ end-to-end.

While this is the core ‘trunk’ of the OBP journey, it’s not without its additional branches, and there are some interesting ways the journey can be tweaked and made bespoke for different situations and payment types.

That’s the simplified ‘happy path’, end-to-end.

Tinker and Tailor Chaps 🕵🏼♀️

While this is the core ‘trunk’ of the OBP journey, it’s not without its additional branches and there are some interesting ways the journey can be tweaked and made bespoke for different situations and payment types.

CHAPS/Bacs instead of Faster Payments

The default bank-to-bank payment method is Faster Payments, but merchants can specify either Bacs or CHAPS as alternate payment methods. CHAPS can be used for higher value non-urgent transfers (over £1,000,000), and Bacs is traditionally used for direct debit payments. However, there aren’t many use cases to override Faster Payments as the default, as it’s considerably cheaper than CHAPs and Faster (as the name implies) than Bacs.

Tailored Amounts

At the start of the process, during payment initiation, it’s possible to give the customer the option to enter an amount. While most merchants will give a prepopulated amount based on goods and services purchased, there are cases where allowing the customer to enter an amount is more logical. For example, charity donations where there are options for amounts but also a text entry option where a bespoke amount can be entered. Or topping up funds in an investment account. For in-person charity donations, a static QR code mentioned in Step 1 could bring up the PISPs page and the customer can enter the bespoke amount and continue.

Future Dated Payments (FDP)

Not all payments via Open Banking rails have to be instant. Just before step 2 in the process, the customer can select a future date (if the PISP provides the functionality) for the payment to be made. In this case, the flow is the same, except money would only be transferred via Faster Payments on the date specified. This is ideal for bespoke bills or expenses that don’t need to be made immediately. Or things like Corporation Tax or VAT for businesses where the amounts vary, but meeting the deadline is important.

Benefits of Open Banking Payments vs Card Payments

Merchant costs ✅

It’s not clear to all consumers, but taking a card payment isn’t cheap for the merchant. There are transaction and processing fees to take into account, so the merchant may pay around 6% for each sale made via a card, excluding fixed monthly fees for things like the physical card acquiring hardware and initial setup. For tight-margin businesses, this is a significant piece of their profit margin.

Because there are fewer steps in the process as it’s an account-to-account payment, OBP works out cheaper for merchants. No network fees to pay, no physical hardware, no worries about PCI-DSS compliance and no monthly fee to a card-acquiring service.

Examples from PISPs state that businesses can save over 60% in transaction fees by using OBP.

It’s challenging to get the total costs as they vary from bank to bank. Some charge up to £5.00 per transaction and some charge as low as £0.30 to use the Faster Payments Service. In addition, there is the monthly and transaction cost of the third-party provider to act as the PISP using the likes of Truelayer, Tink and Plaid, as most won’t build the Payments APIs themselves.

But overall, it works out more cost-effective than card payments and a lot less than the average 6-7%.

Settlement Speed ✅

Merchants get paid faster using OBP and the underlying Faster Payments service vs traditional card payments. Payments settle instantly, and merchants, in the majority of transactions, are paid immediately. Card transactions take 1-3 days to settle, so it’s 1-3 days before merchants have those funds deposited into their business account and have access to that cash.

Security ✅

An estimated £376.5 million of e-commerce fraud took place on cards in 2020, accounting for 66 per cent of all card fraud and 83 per cent of total remote purchase fraud - UKFinance.org.uk

This is often down to compromised card details, where fraudsters use stolen card details to make purchases online.

With OBP, no card details are shared, and with Strong Customer Authentication, unless it’s explicitly stated, all one-off payments have to be approved by the customer using 2FA. The two common factors are Possession (of a mobile device that houses the banking app) and Inherence (Face-Id).

Payment details are also not held by the merchant making fraud due to data breaches impossible.

Open Banking Numbers 🧮

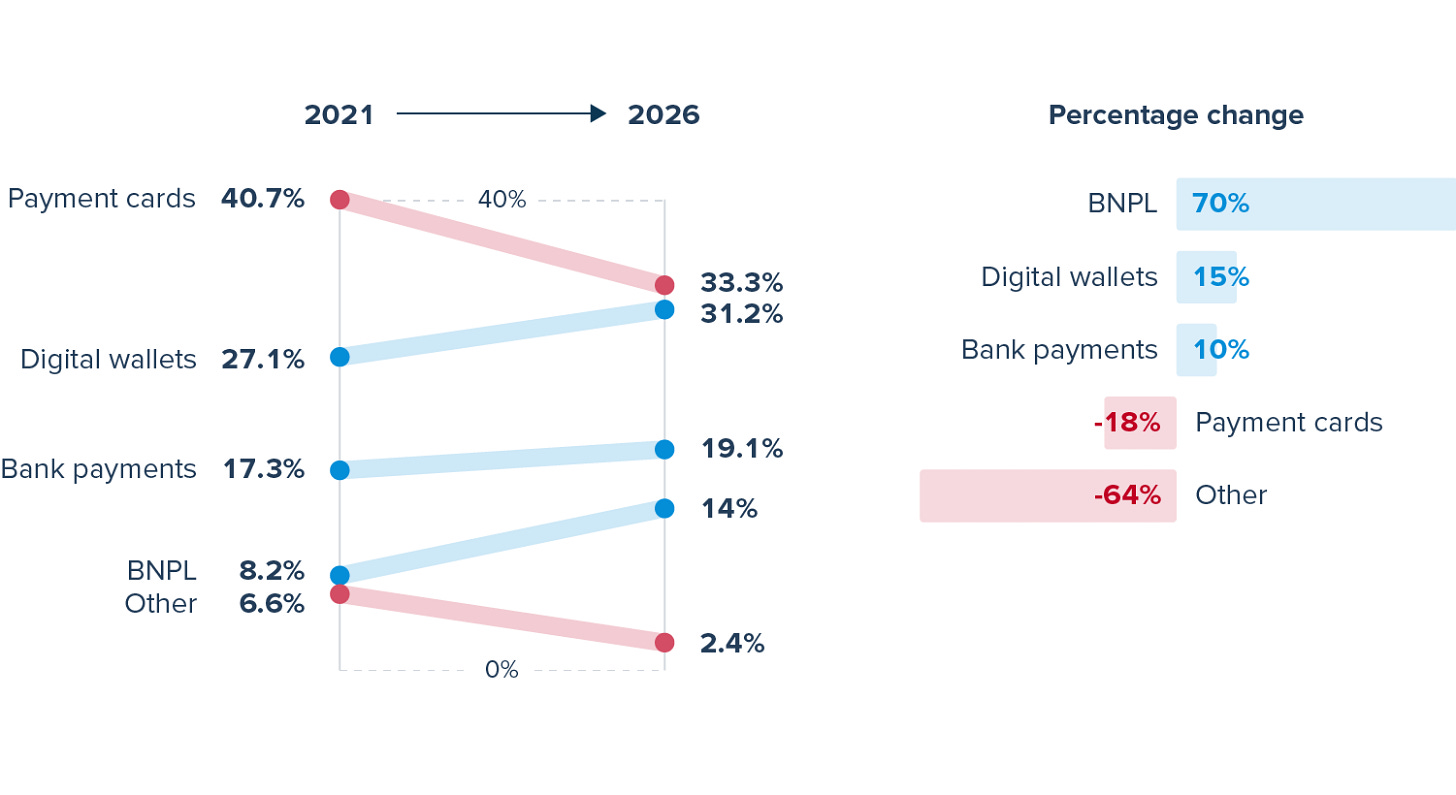

With the main benefit being the lower cost for the merchant, you’d think OBP would be making a huge dent in the payments space. While there has been steady growth, as I mentioned at the top, the Pay-by-Bank option hasn’t had the growth I was expecting or optimistically hoping for and here are some numbers to visualise it.

There were 2.1 billion debit card transactions in April, 5.1 per cent more than in April 2022. Open Banking Transactions hit over 9.5 million transactions in June.

According to research from Rapyd, OBP accounted for only 6% of consumer transactions compared to 75% via Debit Cards. This is research from 2021, though, and transaction volumes have since increased.

These numbers aren’t bad, but based on the value for merchants, the expectation is that adoption would be more significant, especially when you look at other similar implementations like UPI with skyrocketing growth.

I am still very optimistic about OBP in the UK and positive about the growth we see in successfully initiated and completed payments. I do have a few ideas for focus areas to accelerate OBP adoption further.

Open…For Business 💡

Here are some areas I think need more focus to accelerate adoption of OBP, take it mainstream and eat into the cashless payments.

No Brainer for New SMEs 🧠

For new SMEs taking payments online, OBP should be the first payment method on the page for the benefits already stated, especially for online-only organisations whose customer journey is through a web page or app. Truelayer’s plugin built for WooCommerce, a WordPress e-commerce solution, is a great example of a low-friction way to enable OBP for new businesses. Others need to develop plugins for new businesses to incorporate into their ‘new business setup process’ and get them accustomed to the flow so the benefits can be surfaced early and can be long-term advocates for the payment method.

How it accelerates adoption: Using the Stripe growth method of getting in the faces of organisations early in their journey can increase businesses’ familiarity with the payment method and its benefits and keep them as long-term customers who can then help build advocacy with customers.

Full Stack Merchant Solution for In-Person Payments 🥞

In-person payments are where cards still dominate, and it’s no surprise with contactless and ApplePay + GooglePay all contributing. While it’s an expensive proposition for merchants, as you can see from the prior card costs breakdown, companies like WorldPay, SumUp, and Square provide integrations into POS systems to make it easy for restaurants, popup stalls and others to select products, summarise the total purchase and take payment. Currently, no stand-out OBP-based solutions allow merchants to do this, generate a dynamic QR code, take payment and be notified of the successful deposit.

How it accelerates adoption: Provides a clear full-stack option for in-person payments via OBP, which also increases brand visibility and changes consumer habit (pay by dynamic QR code becomes normalised again).

Government Leading by Example 🇬🇧

HMRC already receives various payments using OBP, but more could be done to encourage its use. For example, it often sends out corporation tax and VAT reminders via post. These reminders could contain a QR code that has the payment reference and amount embedded, which recipients can scan and pay the required amount in less than 10 seconds.

It could also allow businesses to schedule their Corp Tax/VAT payment earlier using a Forward Dated Payment to avoid late fees.

For businesses with cashflow problems struggling to pay in a lump sum, Open Bankings Variable Recurring Payment– the functionality that allows customers to securely schedule multiple payments without the need for SCA each time– can be used to split large payments up into instalments without the need for a formal payment plan.

HMRC isn’t the only government agency where OBP would prove beneficial, and there are already talks to use it for other payment services and local authority payment needs like paying for a temporary parking permit. DVLA is another agency that “collects over £7 billion a year in Vehicle Excise Duty (VED).”. That’s the front and centre of the website. Imagine how much of that £7 billion collected is going on processor fees.

More government agencies should make it their payment method of choice as it increases awareness for consumers and businesses who aren’t aware of the method, and it’s a simple way to save taxpayers money 🤷

PS. If there are any folks from the government’s digital team looking for an independent consultant looking for someone with specific expertise to help with these initiatives, then I might know someone.

How it accelerates growth: Builds trust in Pay-by-bank as a checkout payment method as it’s associated with a long-standing entity, builds familiarity with the process and can act as a gateway into OBP for new consumers and businesses to the payment method.

More Marketing Efforts 💸

This is a contentious one.

I don’t necessarily mean marketing Open Banking Payments as a method directly to consumers, although the evidence from UPI in India is that it does work to help build trust and affinity with the method. I’m talking about companies like Truelayer (and maybe Tink and Plaid if Visa will let them 😉) to put real money behind campaigns to market their payment option to businesses. In the same way Visa, Mastercard and Amex spend 100s of millions of dollars yearly on sponsorship, partnership and marketing each year, companies should invest, maybe not the same amount but with the same conviction, to make paying by bank using OBP a more well-understood option. I also believe this applies to dedicated OBP apps.

Here’s a UK example I think we can point to that’s hopefully not too tenuous.

The Open Banking webpage has great data points on the usage of payments and account connections. One of the charts shows successful payments by ASPSP (customers’ bank).

In terms of banks, Barclays has by far and away the most number of successful PIS calls, and although they do have the largest number of customers with approx 48 million, the second most popular in terms of customers, HSBC, with approx 39 million doesn’t have proportionally the same number of successful PIS calls. Far fewer, in fact.

One factor in Barclays leading the way in PIS calls is they’ve gone through the effort of building a dedicated Barclays Pay by Bank app and campaign for its retail and business customers.

Dedicated marketing and an app under an established brand have clearly contributed to them executing proportionally more successful payments through OBP.

How it accelerates growth: Again a matter of trust but also awareness. Greater marketing efforts mean wider spread awareness and increased consumer trust with the method.

Interesting fintechs in the space 🔦

As I’ve said several times, I’m eternally optimistic and excited about the OBP space. Not least because some innovative fintechs are doing great things in the space and here are three of them:

Fena - The tagline. “Fast and fair payments”. Its solution is a full pay-by-bank offering for both in-person and e-commerce. I said earlier that there aren’t many full-stack solutions for businesses to take payments and use OBP. Fena is one of the rare fintechs that has a full business toolkit with order management software as well as a payments facility.

Crezco - A solution aimed at solving various payment problems for businesses using open banking. They allow businesses to make bulk payments and recurring payments, pay internationally and attach payment links to invoices to get paid faster. They also have accounting package integrations to reconcile invoice payments automatically.

Bopp - Multi-functional pay-by-bank solution aimed at business and individual consumers. The business offering is targeted at e-commerce, small businesses and charities giving them the ability to take payments using their technology using QR codes or their own app and manage payments using its bespoke payment management portal. The consumer-facing app gives consumers the ability to pay businesses as well as initiate payments to friends and family via payment link or QR code.

There are lots of reasons to be optimistic about the Open Banking Payments space.

Some really interesting fintechs are doing great things with the tech, and still lots of opportunities to make real changes in areas like government, small business and consumer behaviour.

OBP is gaining momentum, not just in the UK but globally, with shining examples in India, Brazil and China leading the way.

Providing the momentum continues, and with card payments predicted to decline, it feels like it’s only a matter of time before consumer payments via Open Banking is a direct competitor to the traditional plastic.

Interesting Fintech News

Bud launches AI core and assistant named….Jas - Open Banking + Jas related, so I had to include it. Open Banking technical provider Bud announced their generative AI core and a new AI assistant. I outlined some of the great potential of this for their clients, and this will spark the introduction of AI in a number of Bud’s client's propositions.

A rebrand of UPI to UP(A)I?- Shaktikanta Das, head of the Reserve Bank of India (RBI), is looking to introduce the technology, which will enable users to engage in conversation with AI-powered systems and make payments in a safe and secure environment. It’s not clear what the process looks like in principle, as it’s just a proposal, but it seems like a push to use commands to trigger payments (with some biometric verification prior to payment confirmation). Could be an interesting idea but still needs A LOT of work.

Interesting read, thanks Jas.

crystal & comprehensive as always, thanks & a lovely weekend