Fintech R&R ☕️🤖 - Everything’s gonna be AI right? | Part 1

An AI primer, examples of AI and not-AI, the different types of AI, Fintechs using it in earnest, logical uses in Financial Services and more

What’s the difference between AI & ML?

Which Fintechs are using AI in earnest?

What is the most widespread type of AI in financial services that you’ve probably never heard of?

What are the key differences between Machine Learning and an Expert System?

Why is Deep Learning the Double Stuffed Oreo to AI’s Cookie (don’t worry, it will make sense)?

Have we already had an AI Winter, and are we in the midst of an AI Heatwave?

These questions and more will be answered in this week's edition of Fintech R&R.

Hey Fintechers and Fintech newbies 👋🏽

It’s been a busy fortnight of fintech news, especially in the Pay by Bank space. This has caused many Open Banking naysayers to reverse their opinions from just a couple of years ago and now say, “Pay by Bank is the next big thing”. I’m not going to name and shame in this edition, though. It’s not my style.

So, in no particular order, we had:

The announcement from Visa that following the Tink acquisition, they’re expanding Open Banking services to the US. Although the funky video focuses on transaction-sharing use cases, of which there are many, there will no doubt be an Account-to-Account payment angle down the line

Plaids’ Spring Update’, where they demoed changes to their bank payment journey, making the process of accepting Pay by Bank as an option for consumers more attractive by improving the Onboarding process, Security of payment and Movement of money. The onboarding journey, the number of screens and redirects in particular, has always been a big friction, so this is a welcome change. NOTE: This is a US change, and the UK journey still follows the OBIE standard

Uber’s strategic partnership with Stripe came to life for consumers with the ride-sharing giant offering customers a 40% discount off two journeys once they connect their bank account to use as a payment option via Stripe’s Link platform

Lots of Pay by Bank news to be excited about.

If you’re a regular reader, you’ll be unsurprised by this exponentially increasing Pay by Bank news and mainstream adoption domino effect as that’s exactly what I outlined in my Future of Open Banking deep dive at the start of the year. I also wrote a specific Pay by Bank deep dive which included adoption acceleration tactics last year, and ‘bank payments growth’ was No.2 on my list in my 2024 predictions edition in Jan.

So I’m not covering it again in this edition.

Instead, I’m taking some inspiration from Stripes Apple Style Sessions conference, where they revealed, in their own words, “its largest ever set of new features, following a year in which the company processed over $1 trillion in payments.”

The ‘session’ launched a range of new changes, but the focus on AI features was clear. AI powered fraud detection facilities and smart checkout optimisation are just two of the new features for businesses and it is the sign of things to come.

AI features will eventually be in every new product launch, and investors everywhere have already indicated a preference for investing in AI-powered products over non-AI ones.

Ask any founder who is raising and writing a pitch deck right now.

Even though AI isn’t new (I studied an AI module as part of my Com Sci degree over 17 years ago and it has been around for decades before that), OpenAI, ChatGPT, DALL·E and Midjourney et al brought it into the forefront of consumer usage and changed everything.

But despite the numerous conferences, panels, face-to-face conversations and roundtables, some of which I’ve been part of, I’ve seen sprouts of a lack of understanding of what AI is, what it’s capable of and what the logical next steps of AI in Financial Services look like.

So, as you’ve guessed from the Bob Marley-inspired title, in this edition, I’m diving into…Artificial Intelligence and its growing uses in Financial Services.

NOTE: This is also a great excuse to include some of my all-time favourite AI movie references, so watch out for those!

As well as interesting news, puns + movie references, this edition includes the following:

A brief history of AI including Turing, WW2 and the creator of the term Artificial Intelligence

What is AI, and more importantly, what isn’t AI?

The different categories of AI mapped out in a hierarchy

Machine Learning

Deep Learning

GenAI

Expert Systems

Four really interesting implementations of AI in Fintech (spot which one is my favourite)

Ramp

Klarna

Sage

The Bank of London ⭐️

Fintech Spotlight 🔦 - Tuza: The merchant payment comparison platform

P.S. I’m in Dubai at the Dubai Fintech Summit on the 6th and 7th of May, so if you’re reading this at the event and want to chat, drop me a message. If you’re reading this after the 7th, it went really well. I had many great conversations, met folks I already knew and connected with some lovely new ones. 😉

P.P.S. It takes nearly a full working day (most of my Wednesday and Thursday evenings) to put this together, so if you want to use these insights, please use proper citing/tag me/reshare directly OR DM me if you want to use them. I've been informed of a couple of instances of non-subscribers using content from editions verbatim without referencing, so call it out if you see it.

Housekeeping done. Now let’s get into it 💪🏽

NOTE: You know the drill. Your mail client might crop the end of this so click here to see the full, unclipped edition, drop a like and comment at the end, and don't forget to subscribe The AI heatwave & the Rise of the Machines ☀️

Let's do a very quick history of AI before we get started.

As with any subject involving even a smidge of the history of computing, standard practice is to go all the way back to Alan Turing, known by many, including myself, as the father of modern-day computer science and created what most regard as the first real recognisable computer.

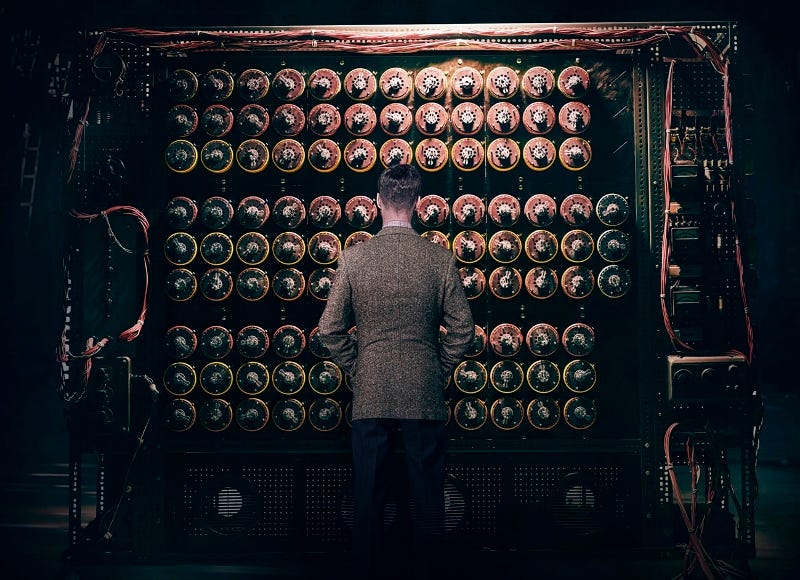

1️⃣ Alan Turing and the Enigma Machine (1930s-1940s): Alan Turing, a British mathematician, played a pivotal role during World War II by leading efforts to crack the Enigma code used by the German military. His work laid the foundation for modern computer science and AI. Alan and the team at Bletchley Park, a British intelligence facility, developed a machine called the Bombe to help break the code. The Bombe was a complex machine that used electro-mechanical rotors to simulate the Enigma Machine (the machine the Germans built to create the Enigma code) and systematically test potential settings until it found the correct one. The Bombe machine was created to systematically speed up the manual computation of the team of mathematicians and cryptographers to ensure codes could be broken in hours, not weeks, saving lives and contributing to the end of the war. The next iteration of Bombe, known as 'Colossus', is regarded as a closer prototype of the modern-day computer.

2️⃣ McCulloch-Pitts Neuron (1943): In 1943, Warren McCulloch and Walter Pitts introduced the McCulloch-Pitts neuron, a mathematical model of a simplified artificial neuron. This theoretical model inspired subsequent developments in artificial neural networks, a key component of many AI systems.

3️⃣ Dartmouth Conference (1956): The term "artificial intelligence" was coined at the Dartmouth Conference in 1956. Organised by John McCarthy, Marvin Minsky, Nathaniel Rochester, and Claude Shannon, the conference brought together leading researchers to discuss the potential of creating machines that could simulate human intelligence. John McCarthy is one of the "founding fathers" of Artificial Intelligence, was the first to coin the term at the Dartmouth Conference and later developed the LISP programming language, which has heavily influenced many of the programming languages used today (Java, Python, Ruby, R)

4️⃣ Early AI Programs (1950s-1960s): During the 1950s and 1960s, researchers developed early AI programs that demonstrated capabilities such as symbolic reasoning, problem-solving, and language translation. Examples include The Logic Theorist by Allen Newell and Herbert A. Simon and the General Problem Solver (GPS) by Newell and Simon.

5️⃣ Expert Systems (1970s-1980s): The 1970s and 1980s saw the rise of expert systems, AI programs designed to mimic the decision-making processes of human experts in specific domains. Expert systems were widely used in areas such as medicine, finance, and engineering.

6️⃣ AI Winter (1980s-1990s): Despite initial optimism, progress in AI slowed during the 1980s and 1990s, leading to a period known as the "AI winter." Funding for AI research declined, and many AI projects failed to deliver on their promises, leading to scepticism about the feasibility of AI. This included the likes of GE pulling back on their AI R&D centres and IBM

7️⃣ Resurgence of AI (2000s-Present): The 21st century has witnessed a resurgence of interest and investment in AI, fueled by advances in computing power, data availability, and algorithmic techniques such as machine learning and deep learning. Breakthroughs in areas such as computer vision, natural language processing, and robotics have led to the widespread adoption of AI technologies in various industries.

That’s a brief and high-level overview of AI from the cracking of Enigma to today. Most readers of this won’t even know about the AI Winter but will certainly feel the rays from the current AI Heatwave (trademark pending).

But what is AI in real, simplistic terms?

Some are scared to ask that question because a tech bro might make them feel embarrassed, or the sheer number of acronyms might simply be too overwhelming. Well, actually, ChatGPT, the most popular consumer-facing AI tool on the planet, is a great place to start, so I asked it a very specific question because, as we know, it’s about asking the right question…

What is AI (in less than 100 words)?

“AI, or artificial intelligence, refers to machines performing tasks that typically require human intelligence. It encompasses various technologies like machine learning, natural language processing, and computer vision. AI systems learn from data, recognize patterns, and make decisions or predictions. These systems can automate tasks, improve efficiency, and solve complex problems across industries such as healthcare, finance, and transportation. AI's potential ranges from virtual assistants like Siri to self-driving cars and advanced robotics. Its development raises ethical and societal concerns, yet it offers opportunities for innovation and transformation in how we work and live.”

A decent answer.

I prefer mine:

“AI is a machine’s ability to perform the cognitive functions we associate with human minds, such as perceiving, reasoning, learning, interacting with the environment, problem-solving, and even exercising creativity.”

Snappier right?

The key words there are perceiving, reasoning, learning and problem-solving, especially when we talk about it in the context of financial services.

I believe that explaining a concept can be clearer when you say what something isn’t rather than what it is, so I had a think about some examples of AI and not-AI to really bring the general point about AI home in different scenarios.

🙅🏽= Not AI

🤖 = AI

Cars

🙅🏽 The computer inside a car indicates that the fuel level is low to the driver.

🤖 A computer inside a car knows that the fuel level is low, calculates the time and distance to the next nearest set of refuelling points and gives the driver an updated route via a petrol station based on current fuel usage and need to fill up. Taking the data and applying reasoning and problem-solving to the situation.

Streaming Services

🙅🏽 Netflix suggests a film in the ‘action’ category because you’ve just watched an action movie.

🤖Netflix reviews your viewing history, understands specific patterns, favourite film stars and genres, and learns that you don’t like watching back-to-back action films. Because you like Ryan Gosling and you’ve just seen Drive, Netflix suggests Barbie in the ‘Watch Next’ list.

Continuous Glucose Monitor

🙅🏽A CGM used by diabetics to monitor blood glucose levels shows that insulin is required based on a low blood glucose level and prompts the user.

🤖A CGM indicates that blood glucose is on the decline. Based on historic insulin injections and analysis of insulin sensitivity, the CGM suggests a specific amount to inject or instructs an insulin pump to automatically inject the amount to keep the user in the optimal range (between 4-6 mmol/L). This learning is based on historic injections and perceiving the coming decline.

Accounting Software

🙅🏽Your business accounting platform reviews the invoices sent out, reviews suppliers and debtors and lets you know when you’re late paying a supplier or a debtor is late paying you.

🤖Your business accounting platform reviews the invoices sent out, suppliers, debtors, payments in and out, assesses the important and regularly suppliers, reminds you to pay them early, checks the historic payments days of all debtors and sends automatic chasers with penalties for those that regularly pay late.

These are just a few relatable examples I thought up, but it’s an interesting game to play. When someone says their product is ‘doing AI’ think about whether it’s “perceiving, reasoning, learning, interacting with the environment, problem-solving, and even exercising creativity” in a similar way to a human.

If it’s just sorting, aggregating some data and then visualising it, it’s likely not AI, just a regular old computational process.

The Weak and the Strong. The Shallow and the Deep 💪🏽

One essential point to note is that AI is a broad term. All of the examples above are AI, but AI is the overarching term, taking several different forms and subcategories.

So, let's start with the first simplistic division.

Narrow AI (Weak AI) and Artificial General Intelligence (Strong AI).

Artificial General Intelligence or AGI is an AI system that aims to replicate the broad cognitive abilities of human beings. AGI would possess the capacity to understand, learn, and apply knowledge across a wide range of domains, similar to human intelligence.

Examples of AGI are seen across Hollywood, from the cool Alex Garland thriller Ex-Machina to the all-time classic Blade Runner. In Blade Runner, police officers responsible for finding replicants (the AGIs) are subject to the Voight-Kampff test, designed to spot the lack of human emotion in replicants trying to pose as humans. This test is a fictionalised twist on the Turing test (previously known as the imitation game but renamed in honour of Alan Turing), which is the measure of a machine's ability to exhibit intelligent behaviour indistinguishable from that of a human.

As you can tell from the heavy sci-fi nature of the films I mentioned, this isn't an AI we are likely to see or experience any time soon. Most experts predict we won't see Artificial General Intelligence for a couple of hundred years, which is why AGI is featured across Hollywood and still in the Science-Fiction category.

Narrow AI, however, is something we are familiar with and see regularly.

Narrow AI, also known as weak AI, refers to artificial intelligence systems that are designed and trained for specific tasks or narrow domains, hence the name. The vast majority of things we consider AI fall into the narrow AI category, from Tesla's Autopilot and Netflix's recommendation algorithm to ChatGPT and Dall-E. The logical reason for not specifying Narrow AI each time it's mentioned or discussed on a panel is that it's clear that we're talking about Narrow or Weak and not Strong AI, so there's no need to specify. It's still good to know the difference.

So, we've covered the two broad types of AI. There's no value in discussing AGI now as its applications are currently non-existent, so let's look at some further subcategories of Narrow AI.

Machine Learning

Machine Learning is a subset of AI that focuses on algorithms that allow computers to learn from data, identify patterns, and make predictions and recommendations by processing data and experiences with minimal human intervention. It encompasses techniques like supervised learning (learning from labelled data), unsupervised learning (finding patterns in unlabeled data), and reinforcement learning (learning through trial and error).

The algorithms also adapt to new data and experiences to improve over time.

I've seen the confusing mashing together of Machine Learning & AI in a number of different scenarios but this is a squares and rectangles concept. All Machine Learning is AI, Not all AI is Machine Learning. In this scenario, AI is the rectangle and Machine Learning is the Square.

Or, to use a tastier analogy, all Oreos are cookies, but not all cookies are Oreos.

Example: Large-scale analysis of transactions, using that and merchant data to spot trends in fraud and identify likely points of fraud in the future.

Deep Learning

There is a deeper layer to Machine Learning, appropriately named Deep Learning. Deep Learning is more advanced than ML at processing a more comprehensive range of data resources (text, as well as unstructured data, including images), requires less human intervention, and can often produce more accurate results than traditional machine learning.

Deep Learning harnesses neural networks, modelled after the intricate interactions of neurons in the human brain. These networks process data by traversing multiple layers of neurons, progressively discerning intricate features within the data. For example, initial layers may detect basic shapes, while subsequent layers might identify nuanced objects like traffic lights or a crossing. Like traditional Machine Learning, Deep Learning iteratively refines itself, enhancing predictive accuracy. Once trained in recognising specific objects, it can swiftly identify them within new data, showcasing its ability to generalise learning across various contexts.

So if AI is the broad category of cookie, and ML is an Oreo, Deep Learning is a Double Stuffed Oreo. These are the kinds of obscure and creative analogies that AI currently struggles with.

Example: The obvious general one is self-driving cars. In FS, a good future-looking example is algorithmic trading. Lots of algorithms sit at the ML level, but we'll likely see more DL trading algorithms taking in additional factors and using human-like neural processing layers.

Large Language Models

Large Language Models (LLMs) are advanced AI systems designed to comprehend and process massive amounts of unstructured text. They leverage deep learning techniques, particularly utilising architectures like transformers, to process vast amounts of text data. These models learn intricate patterns and relationships within language through training on massive datasets, enabling them to generate coherent and contextually relevant responses to queries.

OpenAI's GPT (Generative Pre-trained Transformer) series is a prominent example of LLMs. GPT models have been trained on diverse internet text data, allowing them to perform tasks like text generation, translation, summarisation, and more. Through Deep Learning, GPT models grasp the nuances of language, producing responses that mimic human communication.

Example: ChatGPT

GenerativeAI

This is the one that most will be accurately familiar with.

The most basic description of GenAI is

"an AI model capable of generating human-like content in response to a prompt including audio, code, images, text, simulations, and videos ."

GenAI has led to a supernova effect in terms of mainstream usage of AI. OpenAI, creators of ChatGPT, Dall-E, and SORA, became the second fastest product (and fastest AI product) to reach 1 million customers in just 5 days when it launched in 2022. The fastest overall product to hit the same milestone was Threads. Remember Threads!?

The reason many are familiar with GenAI as a term is because it sits more on the consumer facing side, it has tangible & understandable outputs, and therefore has had a broader cultural impact.

As you've probably guessed, GenAI isn't a model that sits in isolation; it is mostly used in conjunction with other AI Deep Learning models.

ChatGPT is an excellent example of GenAI combined with a Large Language Model.

Example: ChatGPT, Dall-E, Sora (in conjunction with OpenAIs LLM)

Expert Systems

I’ve saved the best and least well-known (the term at least) till last.

An Expert System is an AI that emulates human expertise and decision-making in a specific domain. It consists of a knowledge base containing domain-specific information, rules, and heuristics and an inference engine that applies logical reasoning to interpret the knowledge and make decisions or provide recommendations.

How is an Expert System different from a Machine Learning model?

Expert systems rely on explicit knowledge encoded in rules and guidelines within the knowledge base, whereas ML and Deep Learning algorithms learn patterns and relationships from data WITHOUT explicit programming.

Expert systems provide transparent reasoning processes and explanations for their decisions, making them more interpretable compared to black-box ML and Deep Learning models.

ML and DL models can adapt and improve their performance over time through exposure to new data, whereas expert systems require domain experts to manually update their knowledge base.

Expert systems are typically designed for specific domains or tasks and excel in well-defined problem spaces. In contrast, ML and Deep Learning approaches can generalise across diverse datasets and perform a wide range of tasks.

You see why I left this till last.

Because although many think about LLMs, Machine Learning and GenAI when the subject of AI is raised, a lot of the practical systems that have been built over the past few decades (including some of the trading algorithms and decision-making tools I helped build early in my career) are examples of AI but in the Expert System category. Many AIs developed by Fintechs and Traditional FS are Expert Systems rather than the Machine or Deep Learning models that most assume.

This isn’t a slight on Fintechs and FS, by the way. It is logical and prudent to go from a standard system to an Expert System, then to Machine and deep Learning with GenAI rather than jump to GenAI with an LLM straight away.

The point is that, in the context of the ‘AI in FS’ discussion, we should be talking more about existing Expert Systems, how to build an Expert System in a way that makes it easier to evolve into an ML or DL model if relevant, and the pros and cons rather than purely talking about ML, DL, or GenAI because it brings some of those conversations back to the present and into practical next steps.

Example: Many existing use cases across FS and beyond, including Lending & Insurance Underwriting, Fraud detection & Translation monitoring, decision-making platforms in asset/investment/wealth management and more.

This visual I put together should make the AI hierarchy a bit clearer.

AI 🤖 -> Real-World 🏦

That gives a decent overview of the leading AI talking points and a good grounding for future editions where I'll no doubt reference the specific AI initiatives from fintechs and the exact category of AI in play. I've already touched on a few big fintechs using AI in earnest, like Plaid, Stripe and Tink, but to further bring AI into reality, I want to look at a few others across different use cases to see how it's spreading across the industry.

NB. With some, it's not clear what the AI blend is, so I may speculate a little or not include the AI types at play at all.

💵 Ramp: Using AI to analyse contracts, give sentiment on deals, provide advice on business performance and more

Ramp is using AI in several areas of their product and recently raised $150m to further embed AI into the spend and expense management platform.

They were one of the first fintechs to embrace AI early last year when they announced a range of AI-powered tools to help businesses called Ramp Intelligence. Including a software contract analyser that uses GPT-4 to analyse the contract and let the company know whether they are getting a good deal or not and can renegotiate the contract with vendors if not. And an advice centre where customers can ask questions about reducing costs like 'How can I cut operating costs?'. It'll then analyse the business's transactions and come up with suggestions.

There will be a theme of using ChatGPT with some training using the company's own private data, which basically equates to Deep Learning, LLM, company data, internal Expert Systems + GenAI.

🛍 Klarna: AI personal assistant to help with disputes, returns, payment issues and other queries

An AI assistant or chatbot is an easy example that most can relate to. Still, Klarna's AI assistant launched globally in Jan of this year, is one of the first to give tangle numbers to support its benefits to the business and customers alike. Baked into the Klarna app and again powered by OpenAI, it performs a range of tasks from "multilingual customer service to managing refunds and returns and fostering healthy financial habits."

The assistant itself is impressive, but more impressive are the numbers Klarna reported about the enhancement:

It is doing the equivalent work of 700 full-time agents

CSAT scores are on par with human agents

It is more accurate in errand resolution, leading to a 25% drop in repeat inquiries

Customers now resolve their errands in less than 2 mins compared to 11 mins previously

It's estimated to drive a $40 million USD in profit improvement to Klarna in 2024

In summary, it's faster, more efficient, leaves customers satisfied, and has saved the company money. These are the metrics that companies get drawn to when AI is mentioned, but the implementation is where many fall short. I suspect that going forward, the ones that think in depth about how and why to implement AI (and use existing LLMs and GenAI models like ChatGPT) will see similar returns.

🧮 Sage: AI-powered productivity assistant

When I used the accounting example earlier, I was thinking about Sage Copilot. The AI version of the accounting software I proposed is what Sage is building into their accounting platform, and coming from someone who has done a lot of SME research and led a product with accounting integration for two years, it's what SMEs are crying out for. Business owners don't want a list of transactions, a huge sales ledger and a list of invoices.

They jump into their accounting platform to perform specific mandatory tasks like raising invoices and understanding tax obligations AND to answer specific questions like:

"Who are my outstanding unpaid suppliers?"

"Who are the clients that take the longest to pay?"

and eventually…

"How much financing can I get from my outstanding eligible invoices?" 👀

🏦 Bank of London: An AI assistant for engineers and product folks to navigate complicated banking APIs

All of these examples are great, which is why I've picked them, but as a former engineer and full-time tech nerd who has spent hundreds of hours trailing through providers' API docs as part of various digital banking due diligence processes, I'm very excited about this one, more for the ripple effect across BaaS providers than anything.

This is The Bank of London's AI assistant which launched last week and sits across its developer API, an open sandbox environment that allows devs to test applications and integrations across different banking product sets. The AI assistant helps devs and others with all sorts of questions, from exactly where to start to connect, which APIs are relevant for transaction monitoring, which attributes are used to group merchants into categories and more (I tried all of these, and they gave logical outputs).

As I said, very cool.

Imagine wanting to build a neobank, having a list of requirements and an RFP, plugging those requirements directly into the AI assistant and having a clear sequence of the APIs required, prerequisites and everything else. It could even evolve to a point where it prompts you with feature ideas and lists out all the APIs required in the correct sequence with a written customer journey.

Anyone who has worked on a digital bank build knows that there are companies out there that claim to help you launch within six weeks, and also know that the claim is pretty far from what's possible. This goes some way to making the impossible possible.

It's also the first example of an AI assistant layer on top of a well-documented set of APIs, and I think it might be my current favourite implementation.

An AI assistant atop the Open Banking APIs would be very useful to first-time OB builders! 👀

These are just four examples of fintechs actively using AI in their products, but there are many more (please add other interesting implementations in the comments).

There are lots of great uses of AI. These are just the tip of the iceberg…

Now, this is going to feel like a sharp ending.

Like ending a film at the start of the third act.

It feels sharp because there’s more to cover here. In fact, there are probably more questions than answers after this edition, even though there were fairly detailed explanations and examples. Regular readers were probably expecting insights on:

The risks and costs of AI

The Now, Next and Later Roadmap of AI in FS

The different FS horizontals AI can be applied to

The logical next steps for AI adoption in customer service for banks and fintechs

How people will be impacted

What AI means for digital banking apps

Where regulation comes into things

…and maybe even my own GPT trained on all previous editions of the newsletter 👀

But as I was writing the last of the four examples, I realised it was getting a bit lengthy.

Any more, and it’ll veer into the ‘40min read’, I thought out loud.

There is also a lot to digest here even when it comes to thinking about what is and isn’t AI in your respective organisations or applying some of the benefits of Deep Learning and a GenAI model onto a key process or service in your product.

Here is a good point to pause, digest, re-read if necessary, and reflect.

Which is why I decided to add ‘Part 1’ to the title as I knew I’d have to split this into at least two parts. But actually having this be the part one with the grounding knowledge is the perfect foundation on which to make the second part even better.

Case in point.

The first Terminator movie was brilliant. It had some great scene setting, structured character development, motivations and explained some complex concepts in simple(ish) terms.

But how much bigger and better was T2 right?!

NOTE: There will be a Part 2 at some point over the next few months, not least because there are many more movie references to include, so stay tuned and see you again in two weeks for a non-AI edition. And don’t forget to add your favourite AI in Fintech example and example of AI in movies in the comments below as I might use them in the next edition 👋🏽

Fintech Spotlight 🔦

Lots of AI powered fintechs featured so I thought I’d change it up a bit this week with Tuza.

I stumbled across Tuza when it popped up in my Instagram feed.

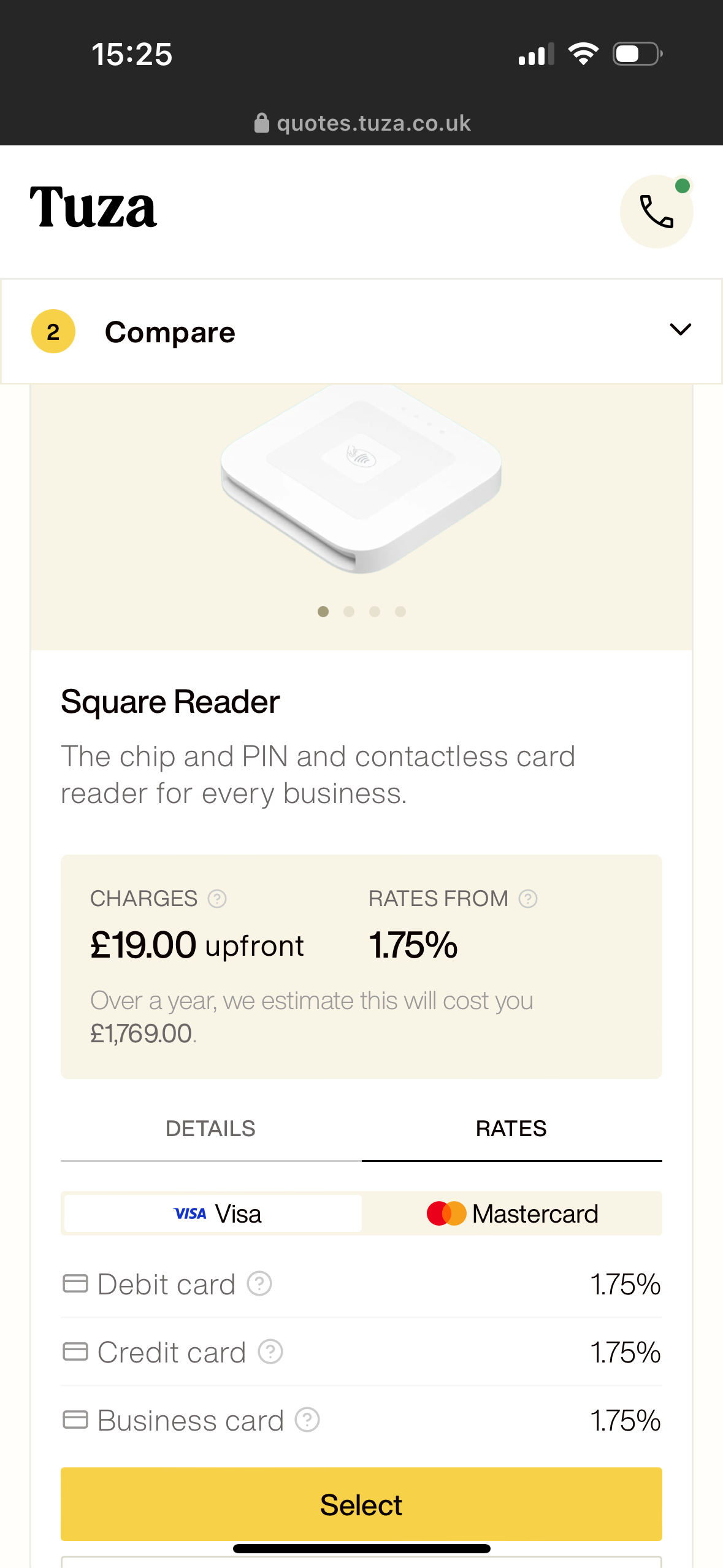

It’s the SaaS platform that allows businesses to compare a wide range of card payment software, hardware, and total processing costs. It’s not strictly fintech but has a huge role to play giving transparency to merchants around monthly and volume based costs of taking card payments.

Merchants input some basic contact info, enter their business name for credit checking purposes, estimated card volumes (or direct file uploads) and Tuza then generates a range of quotes from the likes of WorldPay, Square, and others with quotes split by network (Visa/Mastercard) which they claim can save an average of 20% on existing costs. Customers can then select a package to purchase and a date for hardware & software to be delivered and activated.

It’ll become even more interesting and competitive once in-person Pay by Bank options start to take off and there are more options on the platform for business to pick from. An overall net positive for merchants everywhere.

Their marketing efforts also look like very fun so check them out.

Favourite bits of news 🗞

Quite a bit of news covered already in this edition so I’ll redirect back to the Stripe Sessions launch mentioned at the top. Here’s the link to the full talk which I highly recommended watching in full if you have the time. You can also read the summary on their blog here.