Fintech R&R ☕️🏠 - Fintech's £200 Billion Residential Proportunity and the future of homebuying

A review of the UK homebuying process, the fintechs already innovating, and the key pillars that will shape the future of property purchases

What’s the average UK house price, income and standard price-income ratio?

How many coffees would you have to drink to reach the equivalent deposit for the average UK home?

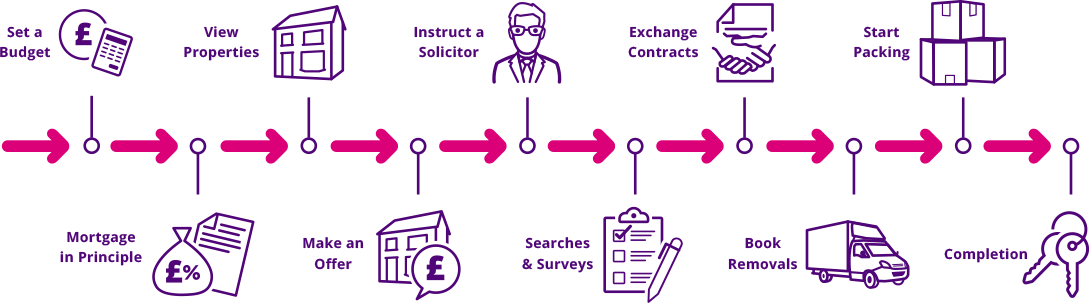

What does the typical homebuying process look like?

Why is storytelling a key part of product?

What do I think the future of homebuying will look like?

Where does Rightmove rank in terms of the most visited websites in the UK?

These questions and more will be answered in this week's edition of Fintech R&R

Hey Fintechers and Fintech newbies 👋🏽

In the last edition about Product Roadmaps, I highlighted the news about Coadjute and its £10m raise, which included investment from three of the biggest players in the UK residential housing market: Lloyds Bank, Nationwide, and Rightmove.

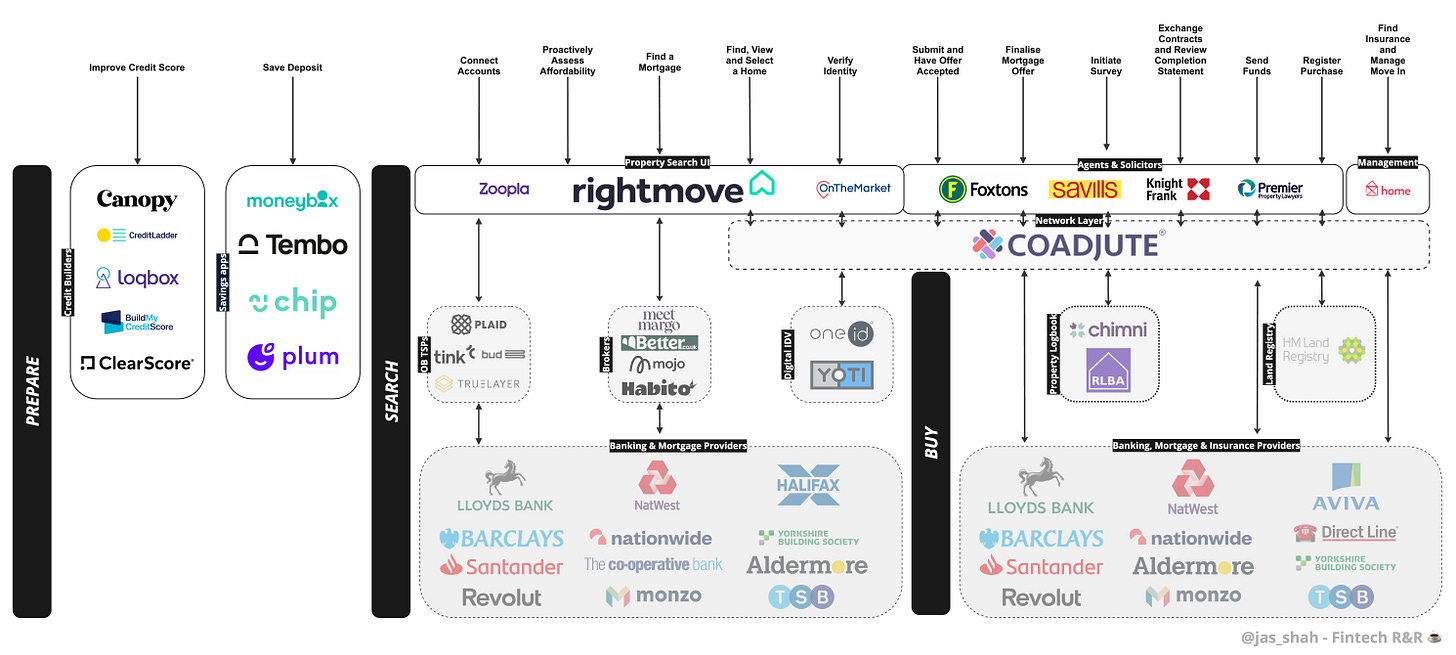

Coadjute (co-ad-jute), which means “to cooperate with” or “to help or mutually assist,” is a platform looking to transform the entire homebuying process by creating a network of verified estate agents, conveyancers, mortgage lenders, buyers, and sellers and a standardised way to share deeds, IDV, key property reports, and financial transactions.

This will come as a welcome change for anyone who has gone through the property purchase process and felt the pain of lengthy back-and-forth with conveyancers, solicitors, estate agents, banks, mortgage brokers, credit reference agencies, and others.

That includes myself. I have been through this pain.

So, I’m looking forward to this new digital future of property and what will unfold in the next 5-10 years.

Or sooner.

Because as I write this intro, yet another property-related announcement involving Coadjute and several FS firms was made.

On the 15th, UK Finance announced that eleven of its members, Barclays, Citi, HSBC, Lloyds Banking Group, Mastercard, NatWest, Nationwide, Santander, Standard Chartered, Virgin Money and VISA, would band together to work on a UK Regulated Liability Network (RLN) experimentation phase with the help of Coadjute as well as EY, Linklaters, R3, Quant, and DXC.

UK RLN is “envisaged as a common ‘platform for innovation’ across multiple forms of money”, and the experimentation phase will run until the end of summer 2024 looking at several use cases including the process of buying a home, mitigating conveyancing fraud, connecting customers digital money to digital assets and more.

The first thing I thought of was one of those TikTok/Instagram trends:

“Tell me you're building a standardised UK blockchain that’ll include property purchases and a digital pound, without telling me you’re building a standardised UK blockchain that’ll include property purchases and a digital pound.“

As I said, I’m excited and optimistic about the future.

However, I want to look at the present as several other organisations are doing really interesting things, and there are broader problems for customers in the property market long before making a purchase that can’t be solved by simply buying less expensive coffee and cutting pricey avocados off the shopping list.

So in this edition, I’m diving into…FinPropTech, some of the growing challenges, the big opportunities in the property space, and my outlook on the future of homebuying.

As well as interesting news, puns + movie references, this edition includes the following:

Scene setting for the UK property market

Typical homebuying journey through the years

The process from searching to completing on a home

Headwinds making it harder for future generations to buy

The value of storytelling in product

Interesting Fintechs innovating in the space including:

MeetMargo

CreditLadder

Sprive

Better.co.uk

The key tenets of the future homebuying process

Now let’s get into it 💪🏽

NOTE: Another slightly longer edition so your mail client might crop the end of it. Click here to see the full, unclipped edition, drop a like and comment at the end, and don't forget to subscribe Laying the Foundation 🧱

(The property puns begin 👆🏽)

Before outlining some of the core residential processes and the problems, I’ll first give some relevant context about the traditional residential housing journey in general and then highlight some statistical foundations on which some key current and growing problems can be defined.

So, let’s start with housing in general.

What we see as a typical journey has some very tight parallels with ‘The American Dream’, and that homeownership path often looks like this.

👉🏽 From birth to around 16: Live with your parents during infancy, early teens, and most of your childhood until mandatory education has been completed. A 16-year-old can legally move out of their parent's house with permission, but renting at 16 is legally and financially tricky, and many naturally stay with their parents until they are 18.

👉🏽 16-18: At 16, mandatory education finishes and options begin to branch. I will largely focus on a typical middle-class and above experience and try to include other pathways. So some go into further education – sixth form, college, apprenticeship, or other vocational education– OR enter the workforce.

👉🏽 18-21: A typical middle/upper class and an ever-growing working class option (a reminder that these are words from a working-class kid) is to go to university. Most choose to live on or near the university campus to get the full experience. According to a government study, over 63% of students choose to live away from home.

For many, this will be their first experience of obtaining residential accommodation. Take a second to think about that and try to recall the process if you went through it.

👉🏽 21-25 (ish): Students on a typical 3-year bachelor’s degree graduate and enter the workforce. Some will return to their hometowns and live with their parents while they work, and some move to a big city and get their second big experience of renting. As my parents lived in Shropshire and there wasn’t an abundance of techy jobs in the area at the time, I fell into the latter category. The type of place and exact location depends on lifestyle choices and long-term goals. Some will spend more money to live independently, in a bigger place, and some will share accommodation and live slightly further away from work to save more.

👉🏽 25-35 (ish): After renting for a while and likely having a desire to be ‘more settled’, which could mean settling with a partner or just not wanting to be at the mercy of a landlord who can kick you out after each tenancy, folks decide to buy. The decision to buy has likely been made a few years before to allow enough time to save money for a deposit. The house hunt, mortgage selection, and purchase process begins. This can take between 3 months to over a year (I know some folks who have spent more than a year trying to buy).

👉🏽 35-beyond: You’re now on the property ladder. Depending on circumstances and desire, some move frequently and sell their old property to upsize, especially those with growing families. Hence the phrase, moving up the property ladder. They may have children, and the cycle continues…All we’re missing is the white picket fence, and The American (and British) Dream is complete.

NB. At the 25-beyond phase, some choose, or have no choice but to rent. This is again based on circumstances and desire but increasingly due to circumstances rather than choice.

This is a very crude and punchy timeline of the journey but serves to outline the important and common milestones that I’m sure many reading this have gone through or have been fortunate to go through, I should say.

The actual homebuying process is a bit more complicated than just deciding to buy, finding a place and then going through with the purchase. Again, I’m focussing on buying rather than renting but some of these steps are relevant to both.

Building a deposit: Getting a deposit together, often starting at a minimum of 10% of the average property value (around £30,000 based on the average property value of £300,000) but more realistically around the 30% mark

Mortgage ‘Agreement in Principle’: Getting a mortgage agreement in principle from a mortgage provider based on income, outgoings, credit history and a few other factors. The provider then agrees on an indicative amount they’d be willing to lend

Setting a budget: Deposit + indicative lending amount is the ceiling of property purchasing power, but prudent buyers will also factor in other costs like solicitors fees, estate agent fees, stamp duty, etc, to come up with a realistic total budget

Picking desired areas: Using local knowledge and other online resources to find a desired area(s)

Searching for the ideal property: Using online tools and local estate agents to create criteria for the ideal property, e.g. No. of bedrooms, Garden, Proximity to trains, etc and view properties that fit the bill

Making an offer: Submitting an offer on a desired property through the estate agent often submitting multiple bids in an effort to get to a mutually accepted price

Instructing a solicitor: Once the offer has been accepted, the buyer appoints a solicitor to handle all the legal obligations of the homebuying process, including handling deed transfer, preparing the exchange of contracts, and managing the fund transfer process

Finalise ‘Mortgage Offer’: Now that an exact property has been chosen, a mortgage offer can be drawn up by the provider. This is often dependent on surveys, whether the property has a lease and some other property-specific factors

Surveys: The property is formally surveyed to understand the condition of the building, foundations and surrounding plot, as well as whether it’s in a flood-risk area. Lenders will often want a survey carried out as part of their lending assessment, and different risks affect the lending amount

Exchange contracts: All being well, contracts are exchanged and signed by each party. At this stage, the sale becomes legally binding, and pulling out of the sale would come at a considerable financial penalty. Once contracts have been exchanged, a completion date can be set. At this point, the buyer will instruct their lender to release funds and also look at building insurance to align with the completion date

Completion Statement: The solicitor will assemble a Completion Statement outlining the overall agreed price, deposit amount, mortgage advance, stamp duty, solicitors fees, and any other owed amounts. This happens shortly after the exchange of contracts and in good time for the buyer to review and ensure relevant funds are with the solicitor

Sending funds: Before the completion date, the lender will release the mortgage funds to the solicitor. Different banks have different fund release times once the mortgage offer is given. Santander processes applications and releases funds to solicitors in around five days, whereas HSBC can take around two weeks. The buyer has to move all remaining funds outlined in the completion statement into the solicitor's account. Some money would have moved during exchange, usually 5% of the purchase price, but the remaining deposit and fees are transferred. Traditionally, this was done by consolidating funds into a single account on the buyer's side and then initiating a CHAPS (Clearing House Automated Payment System) payment to the solicitor's account costing around £30. Nowadays, and depending on banks' individual limits, Faster Payments is used as it’s much more widespread and offers 24/7 transfer as long as the amount is less than £1 million pounds.

Moving in, registering ownership and receiving title deeds: After moving in the solicitor will register the new ownership with Land Registry and organise for the new title deeds to be sent over.

Sometimes, the order of the first three steps can swap around a little. After all, everyone's done a bit of property window shopping on Rightmove. Other than that, the above steps and their order are pretty consistent.

As mentioned, the process commonly takes a few months with most suggesting a six months end-to-end. So even using this lite step-by-step view of the homebuying process you can see the areas where a standardised data, document and finance sharing system speeds up the process, increases transparency and makes the entire process more efficient.

Especially step 6 onwards.

Reduction of back and forth with solicitors. Offers formally submitted and recorded on a ledger rather than voiced solely through estate agents. Transparency over surveys and a historical record of the property and its issues. Faster exchange to completion times and instant transfer of funds into a custodian account and then to the seller. All through a single gateway.

The possibilities could extend to the mortgage agreement in principle process, checking product eligibility and more.

So you can see why I’m excited about the next phase of the digitisation of the homebuying process, which is marked by the Coadjute fundraise and UK finance experimental phase.

But, and it’s a big but, while this is a fascinating period of innovation for homebuyers, the homebuying process is becoming something fewer people can go through. We hear snippets of it in the news, with rents increasing, cost-of-living rising, and inflation rising, but these are not the only things impacting people’s ability to step onto the first rung of the property ladder.

Here’s info highlighting prevailing issues impacting first-time buyers…

Headwinds of dread for first-time buyers

💨 Growing Student debt

I mentioned student accommodation as one of the first formal interactions many will have with the property market. The growing cost of accommodation, as well as the rising cost of higher education and increasing debt burden, will impact post-grads trying to get on the property ladder years after graduating.

Student debt is a factor considered in mortgage applications, and it also impacts individuals’ saving power.

NB. A steeper year-on-year increase can be seen from 2012 when the tuition fee cap tripled from £3,000 to £9,000

💨 House building

Something you hear regularly shouting at the dispatch box in parliament is that more houses need to be built. The government set a target for 300,000 new homes to be built each year, but real figures fall short of the target. As with many markets, price is determined by the supply and demand of goods or services, and if demand exceeds supply, prices will rise. This is an important factor causing a limit of supply and contributing to price rises that freeze many first-time buyers out.

💨 Cost of Renting

The cost of renting is a significant factor for many wanting to get onto the ladder. Savings experts say that rent should be around 30% of your income, but for many, that’s just not feasible. Recent data from the Office for National Statistics shows private rent costs are increasing faster than house prices. That means it’s becoming harder and harder for current renters trying to save up a deposit to get on the property ladder as rent inflation eats into their ability to save.

💨 Divorce rates

A factor that popped into my head while thinking about the supply-demand economics of housing. Since the introduction of the Divorce Reform Act 1969 we’ve seen a sharp increase in divorce rates that have remained in the hundreds of thousands each year. A divorce usually involves one party moving out of the ‘family home’ meaning where we traditionally had a couple live in a single dwelling, as more couples split up and separate, more accommodation is being taken up by divorcees leading to supply issues, driving prices up.

This one is speculative but the logic stacks up.

💨 Housing price to income ratio

This is the culmination of a few of the previous factors but is also the north-star many cite as the reason first-time buyers struggle to get onto the ladder.

Performing some quick maths using some of the numbers from the below chart we can see the size of the challenge.

Average house price in 2022: ~ £300,000

Average income in 2022: £32,278

Price-to-income ratio: 9.2

Multiple of income that banks typically lend: 4-5

Deposit shortfall buyers have to make up: 4x salary ~ £100,000

Even if we say The Bank of Mum and Dad gift half of the deposit, there’s still £50,000 that needs to come from a £32,000 salary. Even if the person manages to save £10,000 a year for five years, 30% of their salary, by that point the goalposts have shifted, prices have increased and it’ll require an extra £15k to get the same property. And so the deposit chase begins.

Just for comparison, because I’ve seen some folks on TV in reference to younger generations complaining about getting on the housing ladder say, “just drink less coffee and stop buying avocados”, saving £10,000 a year is the equivalent to:

🥑 8333 Avocados/per year

🥑 694 Avocados/per month

🥑 23 Avocados/per day

Or for an average £3.40 coffee

☕️ 2942 Coffees/per year

☕️ 245 Coffees/per month

☕️ 8 Coffees/per day

Now you see how ridiculous that statement is because cutting out avocados or coffee only makes a difference if you’re consuming them at frankly dangerous and ridiculous rates.

Context is everything

There is a lot of context here and there is a reason why.

Product folks don’t just write Jira tickets.

To varying degrees, depending on the stage of the company and the seniority of the product person, they also have to understand the domain, the wider market, perform customer research, understand micro and macro problems, and identify & shape solutions.

This involves telling a story about the problem space and product that can be used to build advocacy with customers and investors.

The best pitch decks don’t just have a bunch of stats and then the product.

They show the broader market, problems within that market, micro problems for customers, prevailing headwinds, and why the solution is needed.

Sometimes this storytelling is to convince stakeholders why x should be built over y, and sometimes it’s to give evidence-based reasoning to investors as to why the product should be built at all.

In this case, the storytelling is to build enough clarity over the process and prevailing problems to further highlight the areas where innovation is vital AND to provide a solid foundation I can reference in future property editions of Fintech R&R.

I could have just led with “the current price-to-income ratio is 9.2 which is why it’s tough for the average person to get on the property ladder”, but the adequate context of the historic ratios, house price trends, rent inflation, the typical process, and a reference to avocados, makes this 9.2 number a lot more relevant.

Cold hard facts can be great, but cold hard facts weaved into a relatable story further deepen people’s understanding of a problem and relevant solutions.

Dwelling on the problems

So with all the context, one thing that is clear is that we need more houses to reduce the income-price inflation.

However, we’re not able to click our fingers and make up for decades of property shortages in an instant.

That’ll take time.

In that time, there are still core problem areas to tackle, and there are already some really interesting solutions trying to solve them.

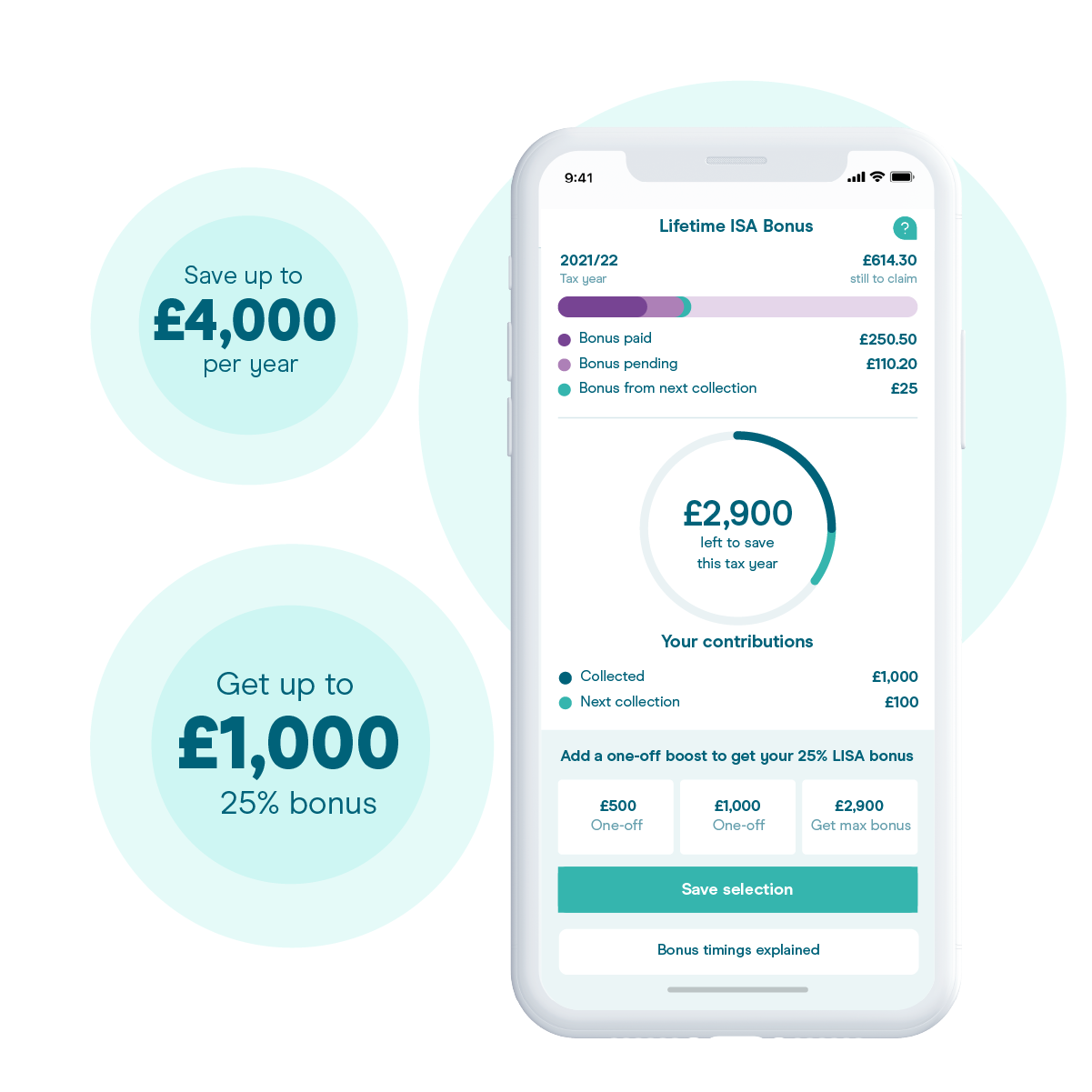

Build up a realistic deposit 💰

As is clear from the above, building up a deposit for the average person is a challenge. A sizable deposit can make a big difference in the price of the house you can buy and the rate you pay for the mortgage you inevitably need.

MoneyBox - A familiar name in the digital savings space that allows customers to put money into a Lifetime ISA, giving a 25% boost in savings for first-time buyers up to £4,000 (£1,000 bonus per year for free, giving £5k tax-free savings each year). They also have a gifting feature, giving friends and family the ability to gift savings via a payment link. There are other cool features like a time-machine view that projects future savings, a mortgage calculator and even an integrated mortgage search and application process. One of the best deposit savings apps on the market.

Proportunity - Proportunity supplements a 5% deposit (using the previous example of a deposit and house price, the total deposit would be 50k rather than 100k) and provides an equity loan to the buyer of up to 25% of the purchase price for 5 years. That allows the buyer to save a lower deposit amount and create a blended overall interest rate that can work out better than a 5% deposit alone. As it's an equity loan, if the price goes up in those 5 years, the total loan repayment goes up, but conversely, if it goes down, the repayment also goes down.

Lloyds Lend a Hand - While not a separate fintech product, this is still an interesting innovation getting over the big deposit hurdle by allowing family members to put money into a fixed-term savings account linked to the buyer's mortgage, which is a Lloyds 95-100% 3-year mortgage. There are obviously some caveats here, including the dependency on a family member willing to lock funds away for 3 years, having a family member with the funds to place into the account and having house prices rise so that at the end of the 3 year period when family members take their savings back there is equity in the property. Some big dependencies, but it is an interesting option.

Maximise Lending Eligibility 🪜

This comes in a few different forms and revolves around reducing the risk that banks see when lending to you and getting the best possible rate. Closely linked with growing a bigger deposit and reducing debts but also heavily linked to spending habits and credit building.

CreditLadder - CreditLadder was the first rent reporting platform to hit the UK market back in 2016. You register, connect your bank account through Open Banking, pay your rent as normal, and CL identifies rent payments and sends them to the credit reference agencies to contribute to your credit score. Their platform has reported over £1bn in rent for tenants.

Canopy Rent - Canopy’s Rent reporting platform CanopyGrow, gives renters the ability to submit rent payments to the UK’s three major Credit Reference agencies to improve credit scores. It also gives renters personalised insights on how to improve their score in preparation for future credit arrangements which, of course, includes mortgages.

Obtaining finance for a property purchase 🏦

Along with a healthy deposit and adequate credit history, it's the third part of the homebuying trident, as the vast majority of first-time buyers are not cash buyers. That means finding eligible finance options via digital channels in a timely fashion.

Habito - Habito revolutionised the mortgage application process in the UK with its innovative fintech platform. Users register, connect their bank accounts through Open Banking, and receive personalised mortgage recommendations. Expert advice is readily available throughout the process and they have since moved from a pure broker model to a broker & lended. Since its launch in 2015, Habito has empowered thousands of users to secure mortgages quickly and confidently and arranged £9 billion worth of mortgages.

Better.co.uk (formally Trussle) - Initially launched as Trussle in 2015 and known as another of the early digital-led mortgage brokers, with a core manifesto of better service, no hidden fees, help for those on low incomes and pricing transparency. It uses an online questionnaire to gather initial data as well as some supplemental data, including a soft credit file pull, to gather mortgage options that the applicant can then discuss with the broker. They pride themselves on a speedy end-to-end process with a 20-minute target time and have a host of different mortgage options as well as very useful calculators.

MeetMargo - Not yet fully publicly launched, MeetMargo is another digital mortgage brokerage app that offers access to the best deals from high-street banks and brokers, a digital document sourcing process (no more physical uploads needed), and a unique focus: additional mortgage advice and homeownership empowerment for women. They're starting with remortgages, but they will inevitably broaden into other mortgages post-full launch.

Other notable innovative solutions💡

Sprive - Sprive is the brainchild of Jinesh Vohra, who launched the platform after becoming frustrated with the mortgage repayment process. It uses Open Banking connections to pull in account data, input estimated property value and save funds to overpay on a mortgage to reduce overall lifetime cost and become mortgage-free faster.

Home.cc - Home.cc is looking to become the end-to-end home buying and moving solution combining mortgage applications and conveyancing to removals, broadband, and energy switching services. A great proposition for those looking for a concierge style mortgage and moving service.

The Future of Homebuying

These solutions are all unique and innovative. They solve core problems in the homebuying process, mitigating some of those headwinds identified earlier. And I still see a position for them in the future, as well as a lot more growth and innovation in the deposit savings area, given the challenge of raising one.

Yes, I do have an idea of what the future of homebuying will look like. This isn’t just a clickbaity title with no substance.

I think the future of homebuying will have the following defining attributes and make for a faster, fairer and much more efficient end-to-end operation.

This is a bit of blue sky thinking based in logic. I think the search process will be much more embedded with finances, proactive eligibility and affordability (leading to pre-qualification and creating 'preferred buyers'), and Coadjute as a network layer providing a single source of truth of data required to complete the purchase and a single point of identity verification.

Financial services brands will become much more fungible.

Buyers will use less interfaces, interacting with connected services rather than de-coupled ones.

And Rightmove is perfectly placed to be the go to entry point for the homebuying process...

Rightmove as the core UI for buyers 🏡

The ‘proper’ process for buying a property is to first understand your financial position, deposit amount and buying power. Then, you start looking at areas and the size of the property.

But in reality, people jump to sites like Rightmove to look for properties before they have a clear understanding of where their finances are at. As I mentioned earlier, I and many others will do a bit of property window shopping and afterwards look at finances to figure out if financial reality meets expectations.

With the rise of embedded partners, I think it’s inevitable, and it’s sort of already happening, that property search sites will become THE main UI for buyers. Going to a Property Search Engine, creating a filtered list of requirements and possible areas, connecting your bank account via Open Banking and seeing only those properties that are within financial reach is clearly the future. Then, once you view a home you like, you apply for a mortgage directly through Rightmove, which matches you with a range of deals based on the account data given. Much more efficient than the disconnected process we currently have.

There’s another data-informed reason Property Search sites like Rightmove will be the central UI of the homebuying process. At present, it’s the 23rd most visited website in the UK, beaten only by the likes of Google, YouTube, Instagram, Amazon, LinkedIn and the other usual suspects. No mortgage providers, brokers, insurers or financial services organisations come close. The closest mortgage provider is Lloyds Bank, at around #88. So, it’s already the highest-ranking property-related site. They just have to embed more services to keep it that way.

Property Logbook 📝

The industry has been pushing for a property logbook for years, and this will be one of the key tenets of the future process.

At present, every time a party wants to check the history of a property it purchased, the condition of the property and any significant events (like an extension, building fault, etc.), they have to go through an individual research process which is usually part of the survey after an offer is made. This is an inefficient process, and surveys are often the point where asking prices are renegotiated after finding issues with the history of the property, like discovering remedial work that needs to occur post-purchase. A Property Logbook containing a full list of past sales, all major building work, environmental issues that impact the building (like subsidence), and any other relevant information would bring a greater level of transparency to the process, reduce the post-survey back-and-forth and improve the experience for all parties.

There is an unofficial list of property Logbook providers at the Residential Logbook Association (RLBA) website but it is optional, not really standardised and not mainstream enough to be beneficial. I think this will change in the future and we’ll have standardised logbooks similar to the latest V5 Logbook introduced for cars by the government in 2004.

Digital Identity 🪪

An unsurprising core tenet of the future process. You can read more about this in a previous Digital Identity edition but in short, having a standardised, reusable digital identity that can be used as part of the solicitor onboarding process, mortgage application and any other areas where KYC is required will greatly speed up the buyers access to funds and improve the process for all parties. Not to mention reduce fraud.

Because this might surprise you, financial services organisations are not the only ones required to KYC/KYB their customers because of Money Laundering regulations. It’s also for estate agents and solicitors (and a whole host of other organisations). These are two additional points of KYC that can slow down the process and cause delays.

A reusable digital identity that has a single point of update with adequate checks and balances solves this problem and improves the end-to-end process.

Open Property Data 📀

I sometimes evangelise about Open Banking and Open Finance as if it’s the solution to 90% of our financial frictions. I think it could be that but having access to a range of data sources across industry is central to making it work.

Open Property Data is one such example, and it’s the Open Property Data Association (OPDA) pushing for a Property Data Trust Network and technology standards akin to those at the early stages of UK Open Banking in 2016.

They are building a community of firms covering all areas of the property transaction market including:

Proptech startups

CRM and CMS platforms

Connectivity and integration partners

Data providers

Data aggregators and insight platforms

Property wallets and logbooks

Estate agents

Mortgage intermediaries

Mortgage lenders

Valuers and surveyors

Conveyancers and law firms

This would be the ideal data sets and network of piping that, once plugged into a UI where customers search for property, can quickly and easily access the best local solicitors and see their fees based on the property selected, organise a survey, get a clear valuation of the property based on area trends and use that to apply for an appropriate mortgage.

We’re not too far away from this with the work the OPDA is doing, and Open Property Data will be a core part of improving the overall homebuying experience, speeding up time to completion, and providing transparency to the wider market and granular process.

Creative Accounting 🧮

I read an article that valued the UK proptech market at around £14bn with a 2030 forecast of around £71bn.

These are rookie numbers.

If embedded finance has an estimated $7 trillion market size, then Proptech (and the fin part) has to have at least £200 billion in market size by 2030. I still think that’s conservative.

Given the sheer size and cultural importance placed on owning a home and the market itself, I think that’s a fair estimation.

And when you think purely about the four tenets of the future, the companies that will be part of and power each of these tenets, as well as some of the other FinPropTechs solving additional niche challenges, it actually looks like a hugely underestimated number.

For now, I’ll stick with the measly £200bn.

Coadjute has pushed the first domino in the journey to the future of homebuying and there will be some further innovation in that space.

But as I’ve mentioned, it’s not only the homebuying process where there’ll be innovation.

Despite the great ones already highlighted, there’s still huge scope for innovation in the areas I’ve mentioned: building up a deposit, understanding buying power, having a clearer view of your credit score, improving it, and understanding the costs of the entire process.

There are many areas for innovation and solving real customer problems; as outlined in my story earlier, these problems are only getting worse.

That’s where FinPropTechs come in, and the opportunity for them, as you can see and maybe also felt, is huge.

Don’t forget, if you enjoyed this edition, drop a like below, fire over your questions and share with a friend! Back again in two weeks!

Fintech Spotlight 🔦

Cheating a little bit this week as I really do love what both CreditLadder and Canopy do and how they do it so re-read their descriptions and check out their respective products as they are both in my Fintech Spotlight this week.

Favourite bits of news

We need to talk about Kevin - I’ve been banging the ‘in-person Open Banking Payments’ drum for a couple of years now as I think that will be the spark to take consumer A2A payments mainstream. Whilst I’m in touch with a few companies who have solutions in the works, Kevin beat them to the punch. I’ll be watching customer adoption rates for this very closely as this will kick start in-person A2A payments.

There is a significant spending and savings problem for would-be home buyers.

Someone smart coined a term for people who have given up on their dream of owning a home – "Guppies".

It's helpful to see a new generation of savings, budgeting and other money management apps come to the market that is impacting apathy in younger generations, but still very few solutions that have made a lasting improvement to one's chances of buying a home (except maybe Klink - www.klink-app.com - although they're still starting up).

Great write up on the UK home buying process - which can serve as a reference point to many starting their home buying journey, considering it, and beyond.

I'm currently going through a re-mortgage and the amount of nuances to be aware of can be baffling at times. For instance, the best two year fixed rate on the market doesn't allow you to make overpayments without a substantial penalty, whereas the rate a tiny bit allows a lot more flexibility when it comes to overpayments! Also it's frustrating to find that in an interest rates environment where we expect rates to go down, tracker mortgages are more expensive than fixed rate mortgages, and offset mortgages are more expensive still. So essentially if you want more certainty you need to lock in a rate which you know will be far from the best within 6-12 months. That said, this has likely always been the case in the mortgage market.

One interesting article on this topic that I recently read spoke about the wealth disparity within the millennial cohort.

"Bee Boileau and David Sturrock at the Institute for Fiscal Studies found that more than a third of young UK homeowners received help from family. Even among those getting assistance there are huge disparities, with the most fortunate 10th each receiving £170,000, compared with the average gift of £25,000."

£170k is a huge amount of money in any part of the world. So to a large extent the UK property market has been sustained by paying forward future inheritance. Well worth reading the full piece here: https://on.ft.com/3U8qVuz