☕️🦸🏻♂️ Hero & Hygiene features: The decade that shifted digital banking expectations

A look at the features that customers expect from their banks and some they don't. PLUS: Monzo's under-16 account and Revolut's UK Banking licence

Which piece of EU regulation transformed the UK digital banking scene?

What are Greenfield and Brownfield technology builds and which one is better for innovation (with a helpful housing analogy)?

What are customers minimum digital banking product expectations?

What’s the difference between a Hero and Hygiene feature?

What would be my MVP digital bank feature list?

These questions and more will be answered in this week's edition of Fintech R&R.

Hey Fintechers and Fintech newbies 👋🏽

Global events overshadowed fintech news over the past few weeks, with the worldwide IT outage impacting transport, retail, and banking, and the US Election bringing more twists and turns than a Christopher Nolan thriller.

There was still quite a bit that happened, and lots of it in the digital banking space, which is the topic of this edition.

Monument, the digital bank for the mass affluent, reached a major milestone of £3bn in deposits just three years after its launch in 2021.

Revolut turned nine and is looking at a $40B valuation from an employee stock sale. The neobank also released its 2023 results, which saw its revenue nearly double, net profit hit £344 million, and global customer base grow to 45 million.

As I’m writing this edition, they have secured their UK banking licence. More on that in the news section.

Then there’s the flurry of Monzo news.

They partnered with Championship team Coventry City, bringing their brand to football fans worldwide, which also prompting many City fans calling for Sky Blue cards

They launched a fun Out of Home (OOH) marketing campaign with Greggs creating a pop-up, limited-time sausage roll vending machine. It created nationwide buzz and presumably brought wider awareness to their free weekly Greggs treat as part of their Monzo Perks plan

A few weeks back they announced three fraud fighting features including ‘known locations’, ‘Trusted contacts’, and ‘Secret QR codes’. More detail on that in the last edition but the headline is, they continue to find new and innovative ways in the fight against fraud.

And their latest product development is a Monzo account for the under-16s. Monzo’s current offering is available from age 16. Their new account will cater to the 6-15 age group and will be available to kids whose parents or guardians have an account already. Lots of potential to further grow their customer base and get a younger audience familiar with and hooked on the Monzo product stack

NOTE: They introduced a Pension product as I was drafting this. Their velocity is immense

This digital banking news, Monzo’s impressive product velocity, and a recent webinar with Sopra Banking Software where I shared my insights on digital banking trends led to the thinking about today’s topic. The change in consumer expectations of digital banks.

In it I outline the hygiene features customers expect from the new batch of digital banks, what would still be considered a Hero feature (yes, I will explain the difference between Hero & Hygiene features), and go back to the start of the 10 year digital banking revolution.

📢 Let me know if you like these shorter intros and punchier reads by dropping a comment or replying to this email as a few of the following digital bank editions will follow the same format.As well as interesting news, puns + movie references, this edition includes the following:

The Origins of the Digital Banking revolution

Advantages new entrants had over traditional banks

Explanation of Hero & Hygiene features

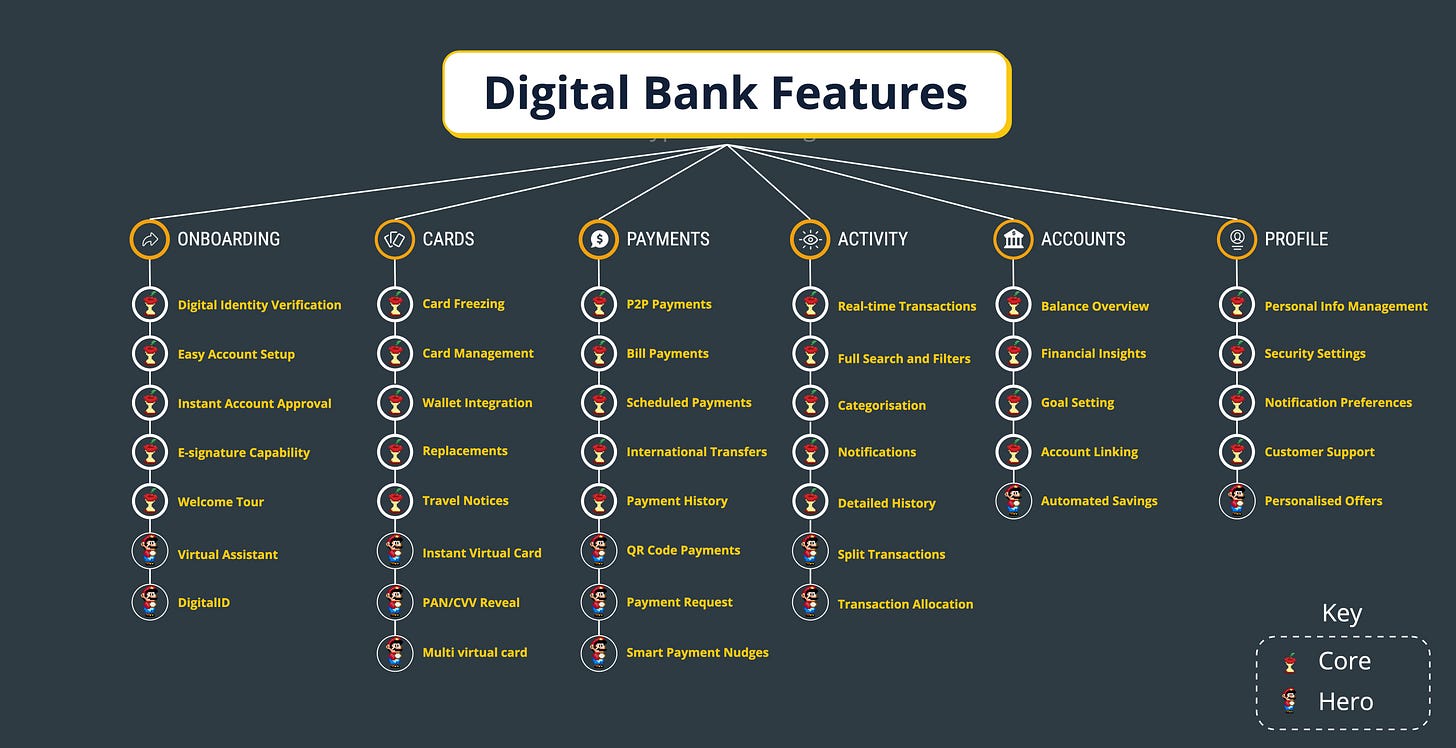

Digital Banking Hero & Hygiene features across key areas:

Onboarding

Activity & Insights

Cards

Payments

Account Management

Profile

Release Notes: Monzo’s Kids Account

Fintech Spotlight 🔦:Charlie: Financial management for the over 62s

Now let’s get into it 💪🏽

Origins of the Digital Banking Revolution 🥚

Before diving into features, I'll provide some concise but important context about the origins of the digital banking revolution.

It's the same background I gave on the Sopra Banking webinar before I covered some of the 'Digital Banking: 2024 and beyond trends', as it explains why digital banks have been able to innovate and move the needle of customer expectations over the past ten years.

ATMs (1960s): The journey to modern digital banking began with the advent of Automated Teller Machines (ATMs) in the late 1960s. ATMs revolutionised banking by providing customers with 24/7 access to cash and basic banking services, reducing the dependency on physical bank branches.

Internet Banking (1990s): The next major milestone was the introduction of Internet banking in the mid-1990s. Internet banking allowed customers to conduct a variety of banking transactions online, including viewing account balances, transferring money, and paying bills. This innovation marked the beginning of the shift from traditional branch banking to digital services.

First Payment Services Directive (2007): The development of digital banks was propelled by significant regulatory changes, particularly in Europe. The first Payment Services Directive (PSD1), implemented in 2007, aimed to create a single market for payments across the European Union. PSD1 facilitated greater competition and innovation in payment services by establishing a legal framework that allowed non-bank entities to provide payment services.

UK regulatory changes (2013): The 2012 Financial Services Act, which came into force on 1st April 2013, was far from an April Fools and was, in fact a significant piece of UK legislation that reformed the regulation of financial services. It established two new regulatory bodies: the Prudential Regulation Authority (PRA) and the Financial Conduct Authority (FCA), replacing the previous regulator, the Financial Services Authority (FSA).

The PRA, under the Bank of England, is responsible for the prudential regulation and supervision of banks, building societies, credit unions, insurers, and major investment firms. Its primary objective is to ensure the safety and soundness of these firms, thereby securing financial stability.

The FCA is tasked with ensuring that financial markets operate with integrity and that consumers are protected. It focuses on regulating the conduct of financial firms to promote competition and protect consumers.

These reforms included measures to make it easier for new banks to enter the market. This was achieved by simplifying the application process for banking licences and reducing the capital requirements for new entrants. The FCA's focus on promoting competition and innovation led to a more favourable environment for fintech startups and challenger banks. These new entities could leverage technology to offer more customer-centric services, thus increasing competition in the banking sector.

Smartphone growth and mobile internet access (2009-present): The rapid adoption of smartphones and the corresponding proliferation of widespread mobile internet access enabled consumers to access banking services anytime and anywhere. In 2009, smartphone penetration was around 20% in many western countries. By 2019, that figure had soared to over 80%, with rates exceeding 90% among adults in many developed markets. Social media apps also played their part in increasing consumer understanding as they were the most consistently downloaded smartphone apps providing an easy functionality transition between web apps and mobile apps.

The new regulatory framework, the timing of the growth of smartphone adoption, broader mobile internet access, and the long 20-year period in the 1990s and 2000s of stale internet banking products created the perfect conditions for disruption in space.

Challenger bank founders were the ones who capitalised soon after regulations changes in 2013, kicking off a revolution, and changing the way we bank forever.

An uneven playing field 🤾🏽

It wasn't purely the case that the conditions were perfect, and challenger bank founders organically found a way (evoking memories of this scene from Jurassic Park).

There were a range of reasons new challengers had a head start in disrupting the space faster than traditional banks.

👉🏽 Culture - Challengers took a customer-first approach to build a solution and, as such, learned about customers frustrations and were able to build solutions that solved problems and resonated with their way of banking. Banks had shifted away from the customer-centric approach after the introduction of internet banking created a bit of a wedge, and throughout this period, there was a focus on profit and programs to bring stability after the 2008 crash.

👉🏽 Regulation - Challengers in their early stages were able to build products without the big shadow of regulations. They were able to build great products under an EMI licence (another PSD1 initiative that created disruption) while they pursued banking licences. Banks were under several stringent regulations, making any new initiatives more time and resource-intensive

👉🏽 Size - Challengers were able to use their small size to their advantage, allowing for cross-company communication and alignment on strategy with a lean team and also able to learn and pivot in their pursuit of truly customer-centric products. Banks are behemoths. Most have >100,000 employees, and the old adage of a bank being a tanker and a challenger being a speedboat is apt. It makes everything a little bit slower, especially reacting to changing customer habits and hyper-adoption of new tech such as smartphones.

These are all significant factors, but the one that meant challengers were able to build innovative and effective products for customers at a faster rate than traditional banks is the one that is constantly overlooked in the Challenger vs Tradition bank debate.

The technology stack.

When someone says 'bank', you think of this singular obelisk like something out of 2001: A Space Odyssey, when in reality most banks, and much of their tech stack, is actually made up of many different organisations cobbled together over time.

So rather than a single homogenous monolith with cohesive pieces, think of a bunch of different lego blocks that have over the course of 60+ years been glued and taped together, some of them logically with the same colours put together representing verticals such as Lending, Mortgages, Insurance etc.

Take Barclays Bank for example. Barclays is made up of part of Lehman's failed Investment banking division + ING Direct UK + The Woolwich (an old British Building Society) + Banco Zaragozano (a Spanish bank) to name just a few. WIth all these acquisitions come some aspects of tech debt and duplicated lego pieces in key verticals tagged onto, in many cases, legacy platforms.

Building a mobile-first, fully digital bank on a brownfield tech stack is much more challenging than building a completely greenfield product.

Brownfield builds are like taking someone's requirements for a dream home and trying to create that dream home on the footprint of an existing one (and you can't knock the existing house down). It means digging out the basement, extending into the garden and building up into the attic. All while keeping the existing house running as usual.

Greenfield builds take those same dream home requirements and architect them on a clean plot of land.

Here is an example of a high-level overview of a challenger bank build I put together for a client a few years back:

Challengers, therefore, had a huge advantage over traditional banks when those perfect conditions for disruption arose, and the likes of Atom, Monzo, Starling and Revolut took advantage of their greenfield tech stacks to create customer-centric products and move the needle of banking experiences.

Hero vs Hygiene 🧹

Challengers shifted what customers expect from onboarding, account & profile management, payments, cards, and transactions. Also known as Hygiene features.

As challengers have been relabelled 'neobanks' and will, in the next few years, just be called banks, they are also the ones innovating with Hero features and further shifting the innovation dial.

The perfect example of that is Monzo's new fraud-fighting features.

Before I list out some of the Hygiene features expected in most of today's digital banks and examples of Hero features, I'll explain what Hero and Hygiene features actually mean.

The concept of Hero and Hygiene features has loose ties to marketing where there is a content marketing strategy known as The Hero, Hub, and Hygiene framework. The framework outlines the balance and weightings between three key content types.

Hero content…the big, bold, and attention-grabbing content designed to reach a wide audience. The aim is to generate a lot of buzz and attract new customers. Hero content is usually produced less frequently due to its high cost and resource demands.

Hub content…is regularly scheduled content designed to keep the existing audience engaged. This type of content aligns with the interests of the target audience and encourages regular visits and interactions.

Hygiene content…is always-on content designed to answer specific questions or solve problems for the audience. This type of content is optimised for search engines (SEO) to ensure it can be easily found by users looking for specific information. Hygiene content helps build trust and authority by providing valuable and relevant information.

There is some transposition between Hero & Hygiene content and Hero & Hygiene features.

Hero features are rare in products, are often quite bold and innovative, and customers tend to associate that feature with the organisation. Hero features tend to be non-standard and less than prevalent across similar propositions, and over time, as more organisations have that same feature, they become Hygiene features.

'Real-time transaction view' was a Hero feature of early challengers and was associated with Atom, Monzo, Starling et al., which, over time, have become a Hygiene feature across most digital banking products.

Monzo's new 'Known Locations' feature is another example of a Hero feature. One that, at the moment, only they have, but over time will become a Hygiene feature that customers expect from all digital banking products.

Hygiene features, as you've probably guessed, are less unique to specific company products, are more common than Hero features, and are things customers expect from products in that vertical. Examples from back in the Internet banking era are things like downloadable statements, real-time balances, and the latest transaction view.

Hero features are less common and are often innovative in the way they solve a problem for customers, and Hygiene features are more common and solve a breadth of problems for customers in a familiar fashion.

Or, putting it another way.

👉🏽 Hygiene features cause disappointment when they are not in the product.

👉🏽 Hero features delight when they are.

As I touched on earlier, over the past 10 years it has largely been the challengers, now neobanks, who shifted the dial, consistently churned out cutting edge Hero features that consumers had never seen before, that banks copied and over time became Hygiene features creating a new normal in customers expectations.

The Hero & Hygiene features of modern digital banks 🦸🏻♂️

So to actual Hygiene and Hero features across digital banking. The shift has been vast from a basic transaction feed, balance and some simple payment methods in the Internet Banking era, to the feature rich digital propositions of today, consumer digital banking products are now packed full of Core features and some Hero features in the following key areas.

NOTE: Although Hygiene is the vernacular, I’m not a fan of the word in this context so instead I’m labelling Hygiene features ‘Core’ as it fits better.

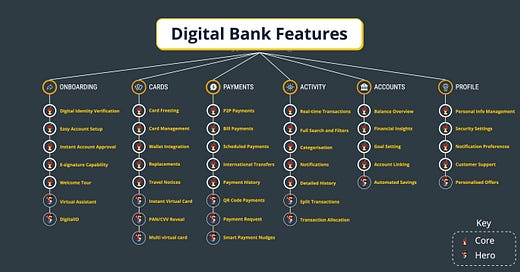

💡If you’re building a new digital bank, then this is a starting point of features you’ll have on your roadmap.Onboarding

Onboarding in a digital banking app refers to the initial process where a new customer sets up their account and gets familiar with the app's features.

🍏 Core

Digital Identity Verification: Automated KYC processes using document scanning and facial recognition

Easy Account Setup: Step-by-step guided account creation

Instant Account Approval: Quick verification and instant account activation

E-signature Capability: For signing up with minimum paperwork

Welcome Tour: Interactive introduction to app features for new users

🦸🏻♂️Hero

Onboarding virtual assistant: A chatbot or virtual assistant to answer any questions and provide assistance during onboarding

DigitalID based onboarding: Onboarding that uses stored DigitalId to onboard within a few clicks

Activity & Insights

Activity & Insights encompasses all actions and events related to a user’s account and provide users with a deeper understanding of their financial behavior and patterns.

🍏 Core

Real-time Transactions: Instant updates of account balance and transaction history

Full Transaction Search and Filters: Comprehensive search capabilities and filters for transaction history

Transaction Categorisation: Automatic categorisation of expenses and income

Transaction Notifications: Real-time push notifications for every transaction (where specified in notification settings)

Detailed Transaction History: Access to extensive transaction history with detailed information

Spending Insights: Visual representations of spending patterns and categories

🦸🏻♂️ Hero

Split Transactions: Feature to split transactions with friends or family

Transaction Allocation: Allocate a transaction to a different card

Cards

This section manages everything related to pre-paid, debit or credit cards issued by the bank.

🍏 Core

Card Freezing: Option to temporarily lock and unlock cards via the app

Card Management: Options to activate/deactivate physical cards, set spending limits, and manage PINs

Digital Wallet Integration: Easy addition of cards to Apple Pay, Google Pay, etc.

Card Replacement Requests: Order new cards directly from the app

Travel Notices: Notify the bank of upcoming travel to prevent card blocks

🦸🏻♂️ Hero

Instant Virtual Card Issuance: Ability to generate virtual cards instantly for online purchases

PAN/CVV Reveal: Secure display of card number (PAN) and CVV for card-not-present transactions

Multi virtual card issuance: Ability to issue multiple virtual cards for specific types of transaction e.g. Online shopping, gambling, deliveroo

Although there has been a lot of changes in the cards space, it’s mostly neobanks that have instant virtual card issuing although that’s starting to become a Core feature

Payments

Payments functionalities allow users to pay bills, send money to friends and family, and make purchases.

🍏 Core

P2P Payments: Peer-to-peer payment capabilities for sending money to friends and family

Bill Payments: Ability to pay utility bills, rent, and other recurring expenses

Scheduled Payments: Set up and manage future and recurring payments

International Transfers: Easy and cost-effective international money transfers

Payment History: Detailed history and receipts for past payments

🦸🏻♂️ Hero

QR Code Payments: Pay and receive money via QR codes

Payment Request: Request money from other users or non-users

Smart Payment Nudges: Suggestions on payments based on spending i.e. Request money from a friend because you were both in the same area and the payment to a restaurant exceeded £250

Account Management

Account Management features enable users to oversee and manage their banking details and preferences.

🍏 Core

Balance Overview: Real-time display of account balances across multiple accounts

Financial Insights: Tools for budgeting, spending analysis, and financial health tracking

Goal Setting: Features to set and track savings goals

Account Linking: Ability to link external accounts for consolidated financial management

🦸🏻♂️ Hero

Automated Savings: Options to round up transactions and save the difference

Profile

The Profile section allows users to manage their personal information and app settings.

🍏 Core

Personal Information Management: Update personal details such as address, contact info, and preferences

Security Settings: Manage login credentials, enable biometric authentication, and set up two-factor authentication

Notification Preferences: Customise notification settings for transactions, account activities, and promotions

Customer Support: Access to chatbots, FAQs, and direct support for customer service

🦸🏻♂️ Hero

Personalised Offers: Receive and manage tailored offers and rewards

This is just a taster of that expectation change, with some Hero features thrown in for good measure, and I use a much more extensive private feature database for digital bank consulting work but you get the picture.

The overview of Core and Hero features and the fun image is a great pulse check to really visualise the change that consumers have seen over the past decade and the new normal challengers created over the past decade, and neobanks continue to push.

It's also a retort to the argument I've heard over the past few years (which unsurprisingly is simmering down recently) that neobanks cannot and should not compete with 'high street' banks.

The reality is that neobanks will soon be economically close to some high street banks and are rapidly closing the gap in terms of customer numbers (Revolut's new licence will be an accelerant for their customer growth plans).

Economics aside, neobanks have not only competed but have set new benchmarks in customer experience, innovation, and financial inclusion, compelling traditional banks to rethink their strategies.

This has to be lauded because when the likes of Revolut, Atom, Tandem, Tide, Monzo, Starling (the list goes on), innovate and create Hero features to better serve their customers, they raise the standard that then becomes the new normal for everyone.

A rising tide lifts all boats.

And disruptive digital banks raise consumer expectations.

Pretty much every high street bank has the majority of the above Core features in their respective digital apps, which is only the case because challengers have shifted customer expectations of what a good digital banking product can look and feel like.

So let's not scold traditional banks for taking too long to innovate because the reality is that innovating in a brownfield (in some cases super brownfield) environment is tough. It's why many have resorted to creating products on clean slate, greenfield internal environments rather than use their existing stack.

At the same time, let's celebrate the challengers and disruptors that took up the gauntlet the FCA and PRA laid out and have, over the past decade, changed the way we interact with banking products for good.

Hope you enjoyed this one.

See you again in two weeks.

J.

P.S. Let me know what you thought of this shorter, punchier edition as I have a few more digital banking themed write ups in the pipeline that will follow the same format

P.P.S. I’d love to hear what your favourite digital banking feature of recent years is. Drop them in the comments or DM me :-)

Release Notes 📝 : Monzo’s Kids Account

Monzo tries to simultaneously capture two opposing ends of the customer journey by launching a Kids account and a Pensions product in pretty much the same week.

The pensions product does fit within the existing customer persona though so it’s the kids accounts I’ll take a quick look at.

Financial apps for kids, especially ones linked to cards are notoriously hard to get right and challenging economically.

Lending isn’t an option. Cards are costly and the transaction volumes and amounts barely justify the cost.

But what a kids account linked to an existing Monzo adult account does (which is what this will be) is allow for an additional card an account to be produced that’s still linked to a ‘money making’ adult account. Making the account more viable and also, effectively creating a full family app for those who want it.

Here are a couple of things I’d like to see from a Monzo Kids account:

Rewards based financial learning

Goal based saving

Forced 2FA on all transactions if the parent wishes to activate it

A nominated parent/guardian as the 2nd auth factor

Monzo definitely has the brand permission to make a kids account work and as Monzo itself gets older, so do some of their early advocates who have kids and want to better equip the next generation when it comes to financial learning.

(It’s also a great way to get a younger generation familiar with the brand and into the ecosystem at a low CAC, which is what big banks used to do)

Fintech Spotlight 🔦: Charlie

Charlie is a digital banking platform tailored specifically for individuals in the US aged 62 and older. Designed to address the unique financial needs and preferences of this demographic, Charlie offers a user-friendly experience with features that promote financial security, ease of use, and accessibility. The platform includes tools for managing retirement funds, budgeting, and simplifying everyday banking tasks. It also places a strong emphasis on customer support, with personalised assistance and resources aimed at helping users navigate their financial lives confidently. Through its specialised services, Charlie seeks to empower seniors to achieve financial well-being in their later years.

A great product solving vital challenges that also offers “frictionless, embarrassment free discounts just by using their debit cards”.

If you’re reading this and aware of a non-US version of Charlie then let me know.

Interesting News 🗞

Revolut FINALLY gets a UK banking licence (sort of): Revolut announced on its website that it has received its UK banking licence with restrictions from the Prudential Regulation Authority (PRA), the regulator responsible for overseeing the UK banking sector.

This 'authorisation with restrictions' is a common step on the road to a full banking licence and it now enters the ‘mobilisation’ stage for new banks in the UK being overseen by the City watchdog.

While it is in the mobilisation stage, Revolut can hold only £50,000 of total customer deposits. Customers will remain with its Financial Conduct Authority approved e-money entity until a full UK bank launches (which will likely be before Christmas)

The UK is about to get another behemoth neobank that will make the next couple of years very interesting. Let the battle commence.

Really interesting discussion of core vs hero. I'd love to see that framework in other fintech areas. It's a nice element in a newsletter: a deeper product dive vs industry news vs trends. (Also a nice showcase for your thought process.)