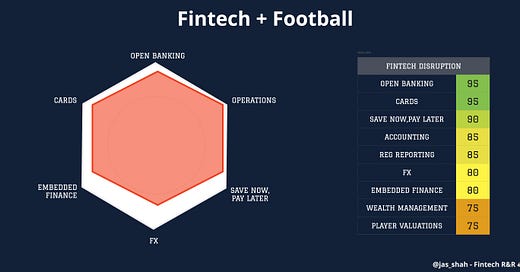

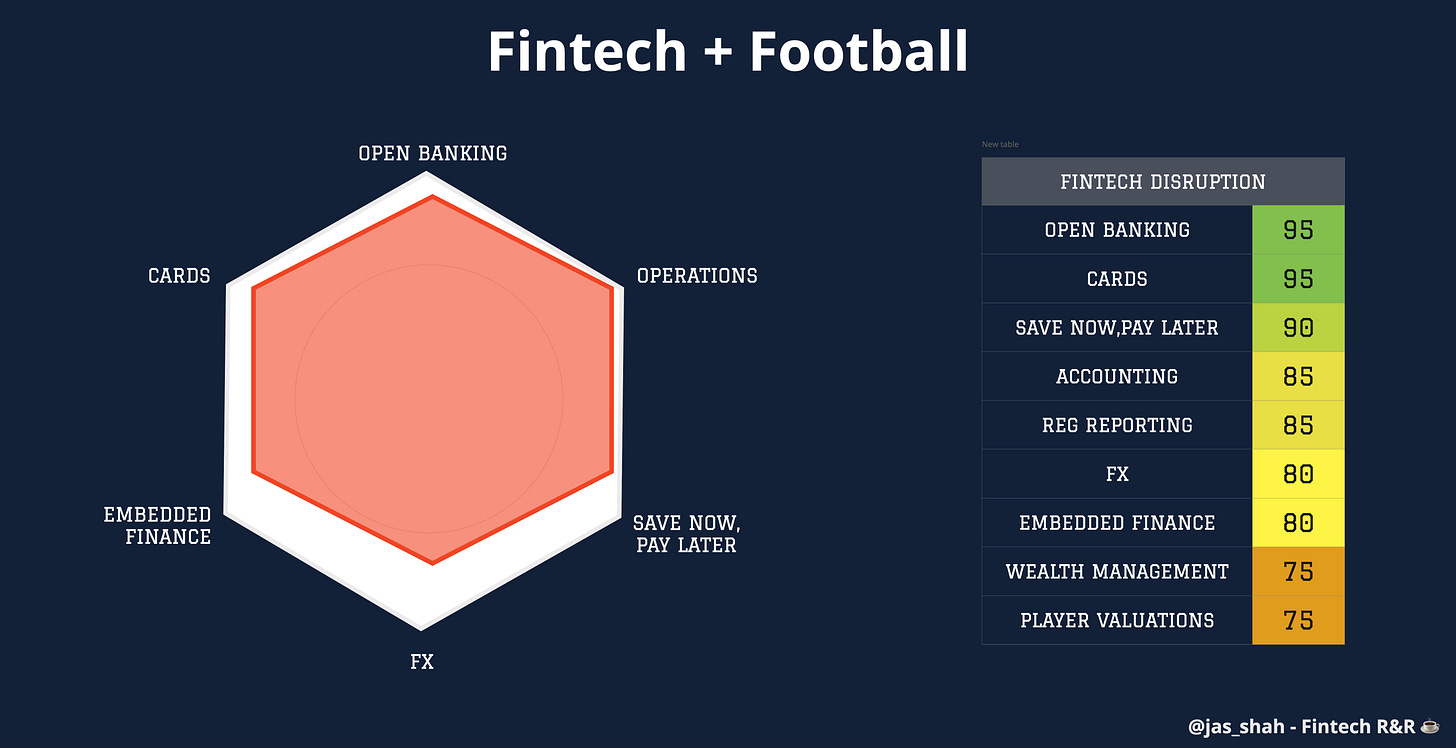

⚽️ Fintech + Football: A £100bn+ Open Goal

A deep dive into the big benefits of fintech to the beautiful game, from Open Banking and card programmes, to SNBL and embedded finance. For Fans, Clubs, FinOps and more.

How can Open Banking benefit football clubs and fans?

What role does embedded finance have in helping football fans?

Which Batman gif evokes memories of me and other early Monzo users pulling out our Hot Coral cards?

Why is community central to the Product-Market fit equation and building a sustainable fintech product?

What 3 things would I do as ‘Head of Fintech’ at a major football club?

How much revenue would a club make from match going fans through payments alone?

How is fintech + football a £100 billion+ opportunity?

These questions and more will be answered in this week's edition of Fintech R&R.

Hey Fintechers and Fintech newbies 👋🏽

Since the last edition two weeks ago we’ve seen exciting news from the world of fintech across Open Banking, Fraud, and Digital Banking. Here are my picks.

The Financial Consumer Agency of Canada (FCAC) officially assumed the responsibility of overseeing, administering and enforcing Canada’s Consumer-Driven Banking Framework, the name of their Open Banking framework. In the lead-up to this official announcement, they also posted a short but handy consumer-facing guide to the new framework and what it’ll mean for consumers.

As an Open Banking aficionado, there are lots more questions than answers for me at this stage like:

"Will the framework be truly open, and can innovators build directly with APIs?"

"How interoperable will the framework be?"

"Will a robust and complete implementation remove the need for TSPs and aggregators like Finicity, MX and Akoya?"

"Will there be some collaboration with the US as they build their technical framework off the back of the 1033 ruling?"

Despite some of the outstanding questions, it's still a positive announcement that will, in the long run, mean better outcomes and data ownership for consumers and greater fintech innovation. I'll do a deep dive once I have more information.

Monzo released three new fraud-fighting features to curb the continual rise of financial fraud. I've given a more detailed overview of those changes in a new section at the end of the edition called 'Release Notes'.

Revolut released their impressive annual statement, including some huge headline numbers from 2023. You can read the full 192-page report here, but here are some highlights:

Revenues increased by 95% to £1.8bn from £0.92bn in 2022

£438m pre-tax profit with a net profit margin of 19%

53% growth in subscriptions to £244m, from £159m

And as of June 2024, they reached 45 Million global retail customers

Revolut CEO Nik Storonsky said, "Even as we reached 45 million global retail customers six months into 2024, Revolut remains poised for exponential growth in 2024 and beyond, continuing to redefine the financial services landscape as we've known it."

Redefining the FS landscape is a great way to put it, and fintech innovation isn't limited to Neobanking.

Fintech-driven disruption has touched many areas, including banking, personal finance management, investment, lending, and payments, across many verticals, including e-commerce, travel, real estate education, and more.

However, one area that has yet to see much fintech disruption is sports, specifically the biggest sport on the planet.

So, with the Copa America and Euros coming to a close and fan excitement about the new club season starting in a few weeks ramping up, I thought this would be the perfect time to talk about an area that is ripe for wholesale fintech disruption: Football.

At the time of publishing England are in the Euros final. I’m not going to say “It’s Coming Home!” because that’ll jynx it

👆🏽That doesn’t count btw.

Edits will follow depending on the result 🏴Football is one of my great passions, and in many areas, the beautiful game is ripe for fintech disruption.

There are several areas where fintech can help fans, the club and even players. As a Man United fan, I've been thinking about these benefits to all parties for my club to improve the fan experience and, at the same time, improve club finances while we're in this…let's call it…transition period.

So, as well as interesting news, a new section called 'Release Notes', puns + sports references, this edition includes the following:

The Beautiful Game in numbers: Size of the opportunity

The value of a ready made community in product development

Challenges for Matchgoing fans and Armchair fans

Paying for a season ticket

Getting to games

Spending Abroad

Getting rewards for buying club merch

There areas of fintech that will transform football clubs

Payments

Open Banking

Digital Wallets

Save Now, Buy Later & Embedded Finance

My step-by-step guide to transforming a club with fintech

Fintech’s role in backend operations

Accounting

Player Valuations

Real-time reg reporting

Wealth Management

The global cross-sport opportunity

Release Notes📝: Monzo’s F3 + Ramp

Fintech Spotlight 🔦:VibePay: Pay by Bank for P2P and businesses

A quick bit of admin

Regular email recipients might have noticed that, in a move similar to Facebook's early name change, I've dropped the 'Fintech R&R' from the start of the header. This isn't an error. It's part of a tidying up of the archive editions and a renaming of the newsletter 👀.

Make sure this and future emails don't land in spam by adding my name to your address book.

NOTE: You know the drill. Your mail client might crop the end of this so click here to see the full, unclipped edition, drop a like and comment at the end, and don't forget to subscribe Now let’s get into it 💪🏽

Stats behind The Beautiful Game

Let's start with some context to outline the size of the opportunity.

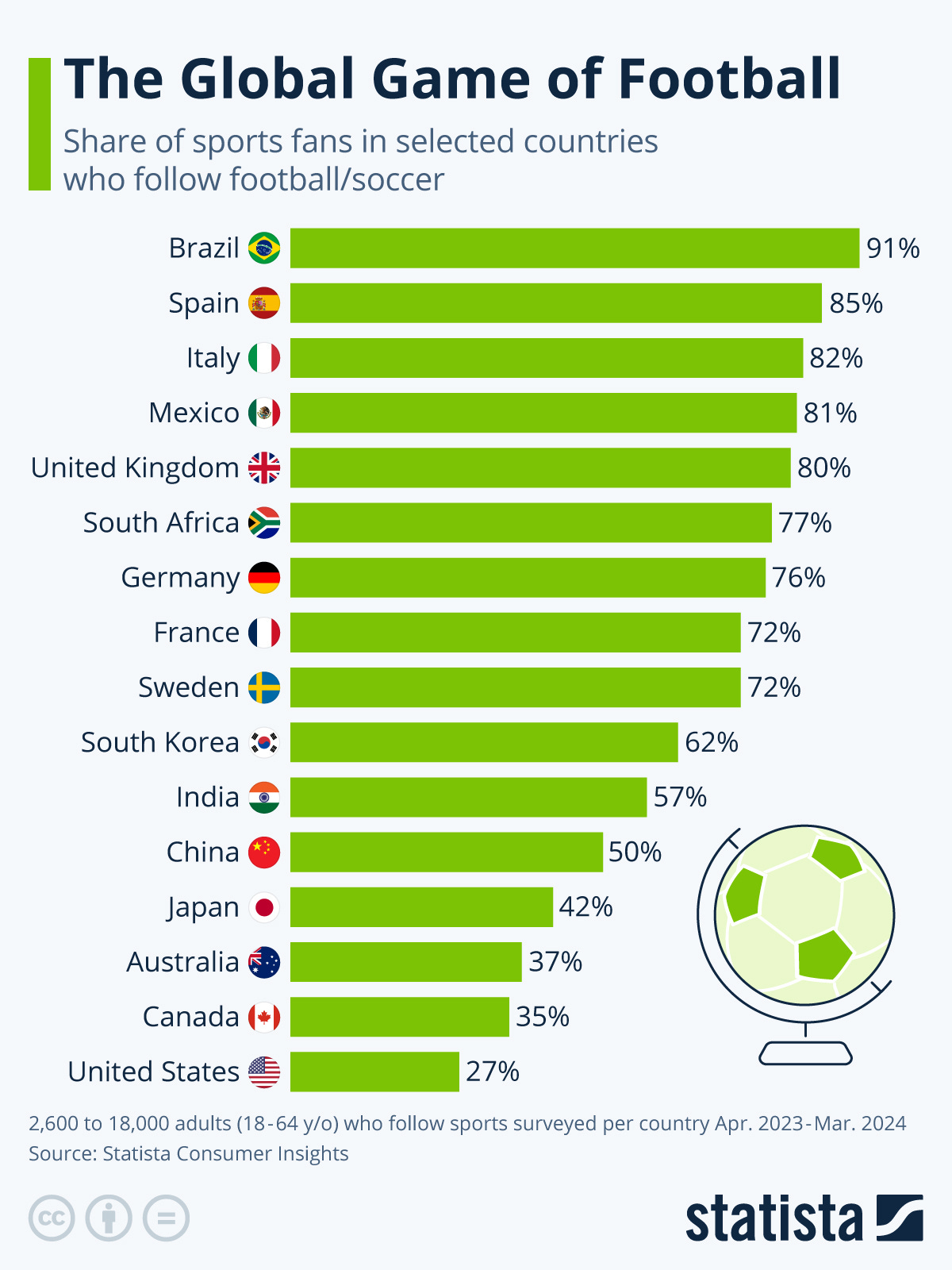

By the numbers, football, or soccer, as some like to say, is the biggest sport in the world.

Over 3.5 billion fans watch the sport, and around 250 million play it regularly, including me.

💡 For you keen quizzers, what is the world's 2nd most popular sport? Have a think. I'll put the answer a bit further down, and it might surprise you. Hint: Think logically about largely populated countries.To put the viewership into context, the 2022 Fifa World Cup in Qatar reached a global viewership of 1.5 billion, and last year's UEFA Champions League final reached an estimated 450 million people across the globe.

Note: Visa and Mastercard are the two major FS sponsors of the World Cup and Champions League

By comparison, the Super Bowl only managed a measly estimated global audience of around 200 million viewers. Although I'm sure the ads and the halftime show had a significant residual audience.

In terms of viewership as a percentage of population Brazil is the country most loyal to football with 91% of the country's population stating they follow the sport, with Spain in second, Italy third, Mexico fourth and the UK in fifth.

Europe, the birthplace of modern football, boasts 40 professional divisions representing over 1000 clubs in 34 countries. The Union of European Football Associations (UEFA) governs European football, with 55 national association members.

The FA is the association that has a level of governance over most professional and grassroots leagues in England with the professional leagues containing 92 teams from League 2, League 1, the Championship, all the way to the pinnacle of English football–the top of the football pyramid–the Premier League.

The PL is considered one of the greatest leagues in the world because of the history and popularity of the teams that play in it, the profile of the players, the quality and competitiveness of the competition, global reach, and financial power.

PL games have, on average, 40,000 attendees per match, which means that 400,000 people visit stadiums across England each weekend (10 games for the 20 PL teams).

Millions more watch live games on TV each week via platforms like Sky, TNT Sports, and other global broadcasters. A press release from Sky, the main UK broadcast rights holder, stated that the first five games of the 23/24 Premier League season brought in 8,000,000 viewers.

With the number of people who watch on TV and physically attend games in the UK alone, the market size for a broader fintech proposition is in the 10s of millions.

Size isn't everything though…

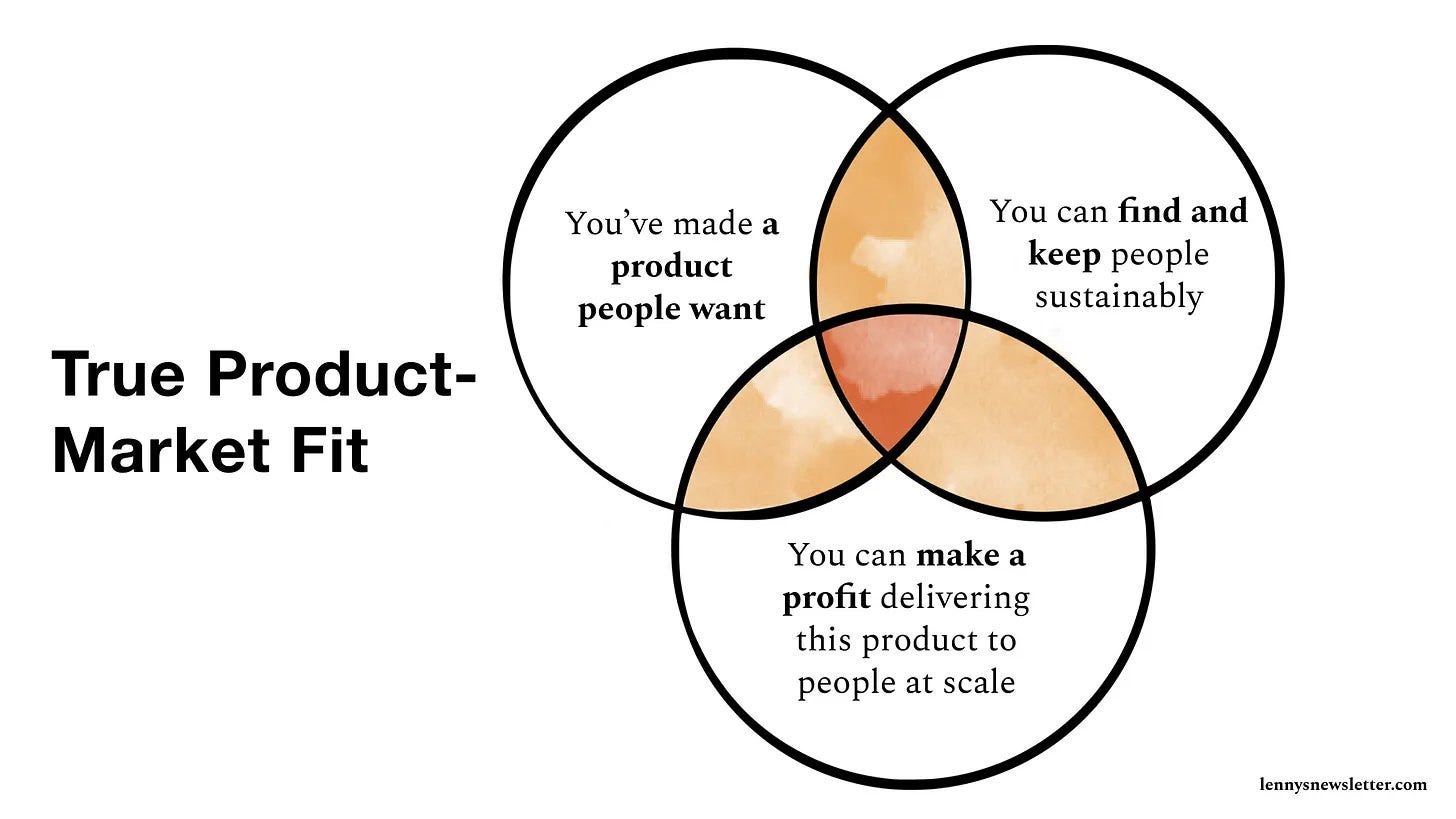

It's more than the size of the market that makes any fintech + football proposition attractive. It's that each club has a ready made community in their fan base and football fans are one of the most loyal consumer segments. This mitigates two of the biggest challenges most face when building a product.

Building a community for and around your product

Creating brand loyalty to retain customers for a sustained period

Loyalty, Loyalty, Loyalty 🎁

Building a community for and around a product is a huge undertaking.

Revolut's 45 million customer milestone must be congratulated, despite what you might think of their fraud management measures.

If you don't believe me, go ask the founding Monzo team, the Wise community team, which had many resource-intensive out-of-home brand-building campaigns, the Yonder team, which is growing a community for the disruptive rewards credit card, and thousands of other fintech companies currently building a community and product for a specific problem area.

Community in these early stages ranges from a group of people who have access to the live app and have crucial product feedback to the fledgling startup stage of a group of people, maybe on a waitlist, who could all be potential users of your currently unfinished MLP but whom you still want to engage and learn from as you build.

There are challenges in building a community, especially in those early stages, which include:

👉🏽 Engagement and Participation - Getting people to join the community and encouraging members to actively participate and engage regularly can be challenging

👉🏽 Retention - Maintaining long-term interest among community members requires continuous effort and innovation

👉🏽 Balancing Online and Offline Interaction - Ensuring members are equally engaged in both online and offline activities requires careful planning and execution

👉🏽 Sustaining Momentum - Keeping the community dynamic and engaging requires continuous innovation and the introduction of new ideas and activities

Although the community-building process can be time- and resource-intensive, the benefits of a dedicated group of loyal supporters are priceless when it comes to launch. The most successful fintech products over the last 10 years (at least the B2C ones) have put a community-building strategy at the heart of their work.

It's also crucial to the product-market fit equation, and as Lenny neatly outlines in this diagram, finding and keeping customers sustainably is one of the three prongs in the PMF trifecta.

Football DEFINITELY does not have a community problem.

This recent shot of the Dutch fans before a game should be all the evidence you need of that.

This is a massive plus for anyone building a product for a fanbase or across the sport.

When you move down to club level, there is an even deeper sense of community to tap into.

💡 Read more about how Stripe tapped into a ready-made community hereResearch also shows that fans are not only fiercely loyal to their clubs, which has a reasonably high level of transfer from generation to generation, but that trait also extends beyond their clubs to other brands.

A Nielsen study found that around 60% of football fans follow the same club their parents supported, and a whopping 82% of football fans remain loyal to their club throughout their entire lives, regardless of the team's performance or changes in personal circumstances. That level of loyalty is not seen in any other area.

Not the Automotive Industry.

Not in Retail.

Not in Hospitality.

Not in Politics (especially in the last election).

Not in Financial Services.

Not even in relationships.

Football fan loyalty has also been proven to have a halo effect with other brands.

Research from SAP Emarsys shows football fan loyalty extends beyond the pitch, with supporters typically 11% more loyal to brands and retailers than non-football fans. The data also indicates that football fans are not only more faithful but also stay loyal for longer, with 55% continuing to support retailers after sales end, compared to just 39% of non-fans.

The final key insight. Half of football fans (54%) spend more with brands if they have a loyalty card, while 47% want to see more personalised offers in exchange for their support.

This shows that football fan loyalty extends beyond chanting your team's name while perched in the stands. In club fans specifically, there's a ready-made community of lifetime loyal fans who are "incentivised less by discounts and more by heritage, ethics, and history," increasing the success of any club-led, fan-beneficial innovation.

A demographic of two halves 👬

An ample and ripe market isn't the only factor in innovating and creating a successful proposition. There have to be core problems to solve or large improvements in experience to be made.

When it comes to highlighting innovation areas, this is made clearer when you look at the regular activities performed by the two key football fan personas.

The 'Regular Match Going Fans, and the 'Armchair fans'.

Note: This is where you'll start to see the impactful areas of fintech innovation, so at each of these bullets, think about fintech's positive impact on the customer journey.Regular Match going fans 🏟

These are fans who regularly go to the games, have a season ticket (or at least access to a regular seat), and have the complete matchday experience from a drink or two at a pub near the stadium, a snack, watching the game in person, then either celebrate or go home and commiserate. They'll often travel to away games each week, and often, cup and European games.

Common Activities

Purchase a season ticket to get a regular seat at all home games in that season. The average for the cheapest ticket across Premier League clubs is around £500

Meetup with friends pre-match to grab a drink and talk about the game

Purchase food and sometimes a matchday programme

Race to grab a drink at half-time

Purchase tickets to league away games depending on schedules

Travel to and from league-away games

Purchase tickets and travel to and from European away games (inc spend when in the country, flights, accommodation etc)

Periodically buy merchandise like shirts and other memorabilia for them and children

Armchair Fans 📺

These are fans that, as you've probably guessed, go to fewer games and watch more games at home via a subscription to a sports package, or at the pub with friends.

Common Activities

Purchase a sports viewing subscription that covers all or most of the team's televised games

Getting a takeaway delivered ready for kickoff. Food delivery services report increased activity during big games, with Deliveroo reporting a 25% increase in activity in the build-up to each of England's Euro games

Placing a bet on a game. 23% of football fans regularly gamble.

Watching a game at a pub with friends and buying food and drink on premises

Listening to a fan channel pre/post-game

Occasionally going to games in person and ticking off many of the activities of 'Regular Match Going Fans'

The Cornerstones of Finnovation in Football ⛳️

From that outline of common activities, it's easy to spot some of the biggest transformation areas for fans and clubs, most of which have a significant fintech component. Many fintechers who read the title would have instantaneously thought of fintechs, frameworks and the latest trends that would benefit the overall fan experience.

There are a whole host of them, but here are the ones that will most impact clubs and their fans.

Payments 💸

This is a broad one to start with, and I've outlined specific payment innovations in FX and Open Banking further down.

Generally, clubs have welcomed some change in payments, with food, drink, and merchandising kiosks adopting contactless terminals, moving to cashless, and allowing for mobile wallet payments. However, you could argue that this has been part of a region-wide trend.

Online stores have seen more innovation with club stores accepting a variety of payment methods beyond classic Visa and Mastercard debit payments.

We now see BNPL options at online club merchandise checkout pages, as well as options for GooglePay and ApplePay and payments via digital wallets like Paypal.

It's incremental progress but more can be done here.

Dynamic checkout displaying relevant options based on basket size, discounts to customers based on the payment method (more on that in the Open Banking section), and more financing options around seasons, like Christmas, where basket sizes are likely to be higher, are just some of the options to increase conversion and improve CX.

FX 🇪🇺

This is an area that has seen little to no innovation from clubs

Cross-border spending impacts travelling fans, of which there are around 50,000 who go to watch games abroad each season, with thousands more travelling to be part of the atmosphere.

Regarding travel planning, accommodation, and taking out relevant currency, fans are left to fend for themselves. Many fans still take out cash at cashier rates using outlets like Travelex, which can be costly, inconvenient, and increasingly less attractive because most destinations have become cashless. Fans who don't use cash have started to use fintechs like Monzo, Wise, and Currensea to get close to market FX rates while spending on European away days.

A partner or direct to consumer product, backed by CurrencyCloud or similar, that gives fans preferential rates, especially to locations they are travelling to as part of away fixtures would benefit fans and would generate interchange income for the club.

Embedded Finance & Save Now, Buy Later 💰

Season ticket prices for teams in the top leagues continue to rise.

10 years ago, the average season ticket, which guaranteed access to all of a team's home games, was around £500-£600. Now it's around £700-£800. Although it seems like only a 20-30% increase, the reality is that for some clubs, the increase is far greater.

Getting on the list for a season ticket can be a lengthy process, so for many, renewing their season ticket is keeping a seat that they've had for years in a section of a stadium where all their friends sit so with costs of everything rising, available cash might not be on hand to pay the sometimes thousands of pounds required to renew.

That's why finance options at point of renewal and having that option available for other high ticket products is key to giving customers flexibility.

V12 Season Ticket Finance is one such organisation that powers finance options for West Ham, Arsenal, Dundee and others. A great option but more competition in the space would improve the end-to-end journey for customers.

Another growing option for funding high-ticket items is Save Now, Buy Later. In contrast to BNPL, the SNBL financial product is designed to encourage consumers to save money towards a specific purchase or goal before completing the transaction. SNBL promotes regular savings, encourages financial discipline, avoids debt, and can often come with savings bonuses attached.

Club-led Save Now, Buy Later schemes not only encourage keeping funds within the ecosystem and give more transparency on customer spending power for season ticket renewals but also give customers better budgeting tools, leading to greater satisfaction and more funds for merchandise such as the latest shirt without hard credit checks.

Digital Wallet, w/Loyalty & Rewards 💳

Standing up a club-backed card programme with a digital wallet that allows customers to spend, earn points (and bonuses for spending on merch and tickets), and get rewards from the club is a no-brainer.

Paired with an FX payments solution like CurrencyCloud, it can also offer better rates for travelling fans and allow for discounts on partner flights and accommodation providers while providing revenue for the club.

The costs of standing up a programme would be repaid in no time and the benefits for clubs and fans aren't just limited to the above. More on the costs, revenue and additional benefits shortly.

Open Banking + Open Finance 🏦

The biggest opportunity that most clubs aren't taking advantage of.

Earlier in the year, I wrote about the evolution of Open Banking over the past 6+ years, in which I predicted more mainstream adoption. Click below to read that edition.

After posting, there was a wave of announcements about partnerships, including Uber's implementation of Pay by Bank with an associated incentive scheme.

But none with football clubs.

Open Banking brings a range of benefits for clubs and fans.

At the point of sale, as other big brands have shown, implementing Pay by Bank as an option at clubs' online stores for merchandise, tickets, and experiences is financially smart for clubs paying high merchant fees and, with the right incentives, can also be beneficial for customers.

For a £100 transaction, a credit card fee at 2.5% would cost £2.50, whereas a bank transfer fee at 1% would cost £1.00, saving £1.50 per transaction

An Open Banking payments provider can also be leveraged to build a P2P payments stream to help football fans and friends pay each other.

Open Banking APIs' Variable Recurring Payment functionality can create a more cost-effective Pay-in-3 service for clubs rather than Klarna for season ticket renewal without the potential backend fees for customers.

Open Banking can be used to power a lo-fi Save Now, Buy Later strategy by connecting to existing accounts, allocating one account to act as the pot for future purchases, and regularly sweeping funds into it.

Open Finance can be leveraged to get a single view of accounts, which can power truly responsible betting by having a 360-degree view of income, betting ranges, and other gambling activity and allow for sustainable partnerships with gambling providers where relevant.

Note: BetBudget already has a product that does what I've described but clubs who have betting partners should also do it

Focus on Man United: Tactics for a Fintech Transformation 🏟

There is a lingering question here about why there has been little to no modern fintech innovation at a club and even country level (other than the random appearance of Klarna or ClearPay in club stores).

I think it's because there haven't been fintech folks embedded in clubs.

There have been some great digital transformation projects focussed on content, ticket purchasing, and e-commerce transformation, but deep knowledge and understanding of the applications and benefits of fintech across the club hasn't been available.

Which led me to think about my top 3 priorities if I was 'Head of Fintech' for a club like Man United. Allow me to dream for a minute…

NB. I've been specific with the club, but in reality, these would be the same for most clubs at the top and, to slightly lesser degrees, those further down the pyramid. So please take fan rivalry out of this read

1. Find a strategic Open Banking PIS & AIS partner

As highlighted by the benefits of Open Banking for payments and gambling, the extended possibilities of a BNPL replacement, and its application in a Save Now, Buy Later product, this is an obvious first step.

Firstly, find a provider with experience in all of the broad applications of OB and who specialises in payments and account data.

Then, implement them in the high-ticket, low-refund products payment journey. Things like season ticket renewal

United's most expensive season ticket is £950. Implementing a Pay by Bank option would save the club £14.25 in merchant fees per transaction compared to a credit card payment. Small fries, yes, but a 1.5% saving on each transaction once scaled up to several different payment journeys, such as purchasing hospitality packages with dinner and drinks, start to add up and make a real difference.

There are currently around 330,000 worldwide fans enrolled as Man United members. Memberships start at £20 per season. Implementing Pay by Bank as an option, and if all members renewing use that option (encouraged by a small incentive), the cost savings vs cards would be around £99k. Once you scale that up to the different tiered subscriptions the number is a lot higher.

Access to account information would also be incredibly powerful for doing means based betting tests, help speed up income verification checks and ensure UTD fans betting are doing so sustainably and safely.

This is a straightforward step 1 that would yield instant cost savings and consumer benefits, as well as provide a perfect proof of concept to quickly demonstrate the value of the tech and create an on-ramp for other use cases across the club

2. Create a Save Now, Buy Later Scheme (+ an embedded finance partnership)

This is slightly trickier, probably less lucrative for the club, and would require a strategic fintech partner to execute it, but the benefits to fans would be immense.

As mentioned, ticket prices go up each year, the cost of travel continues to rise and even for armchair fans, subscriptions, shirts and costs of other merchandise trends upwards.

For current fans looking to renew their season tickets, an embedded finance partner is logical, similar to one used by other clubs. Loyal fans who want to keep their seat but don't want the upfront outlay of £600-£700 are offered low to zero-interest finance agreements that spread the cost throughout the season. Through a strategic partnership where customer data can be shared with the lender, onboarding can be more streamlined, and in the long term, it may make economic sense to bring the programme fully in-house.

For fans planning for next year's season tickets and those looking to create a spending pot for merchandise, experiences and other gifts, a Save Now, Buy Later scheme would be an ideal solution for customers and a great PR move.

Giving goals-based savings functionality with the goal being a season ticket, an experience, or merchandise, with bonuses for consistent savings, is not only great from a club PR perspective but is also a tactic to instil better financial planning with an account connected to provide a suggestion of how much to save each month depending on the goal and sweeping that amount into an easy access account with a non-withdrawal bonus.

Partnering with someone like Oaknorth to provide the underlying savings account would remove much of the initial workload and allow the programme to be proven with a subset of eligible match-goers and armchair fans.

3. Stand up a branded account & card programme

The third major step is to set up a card programme that sits on top of an e-money account that allows fans to transact, connect existing bank accounts, view SNBL progress, manage rewards, and more.

Hear me out.

Yes, standing up a card programme can be challenging.

I know because I've worked on a few as part of broader digital bank projects.

However, the long-term benefits outweigh the cost and effort.

I did some quick maths on this.

Once relevant providers, including a KYC service, licenced e-money account provider, core banking platform, payment processor, card issuer, compliance engine, and all other peripheral services, have been factored in, we're talking around £500k. Just for the first year.

Then there is the cost of the integrations, and the app build itself. Very conservatively, it would take another £500k to get a fully-fledged, high-quality app built and tested with a card performing live transactions, which would take at least 9 months timeline-wise.

Firstly, big clubs would have Visa and Mastercard knocking at the door with a very lucrative incentive program for the club that means costs get recouped quickly. The schemes are always looking for interesting programmes where they see long term growth and a mass of customers transacting.

Secondly, based on the 50,000 season ticket holders in Old Trafford and the average of £3k per season that holders spend on tickets, travel etc, fans using the programme would generate £150,000,000 of annual transaction volume on club spend alone, and using the current interchange cap of 0.2%, clubs would generate £300,000 from transactions and take 3 years to recoup initial outlay.

That's if there is no paid subscription model, assuming spending only occurs on club-related goods and services and only season ticket holders use the product.

There are big upsides to clubs creating a closed-loop model rather than losing transaction revenue to external institutes.

It's more than revenue being lost, though.

It's valuable insights into where fans are spending their money on matchday, how popular certain food and drink outlets are with key demographics, what fans spend their money on when they're not at a game or watching at home, and the distribution of fans across the country.

There is a huge opportunity to house some of the other fintech offerings, learn more about fans' habits, and create personalised experiences and offers.

Put simply, clubs are losing money by not running even a lo-fi card programme and closing the loop on club payments and data.

Let's also remember the community aspect.

Imagine you see a fan at a supermarket checkout pull their player-personalised but club-coloured debit card, and you then do the same. It evokes the same look of approval and sense of community exclusivity that I and other early Monzo users felt when we saw someone else pull out their Hot Coral card.

This is the look…

Creating personalised offers. Providing bespoke finance options. Learning more about fan habits. Embedding rewards and discounts for club spend. Promoting better financial habits.

These are all benefits fintech gives to fans that a branded card and wallet offering would tie together neatly.

Backroom staff

Lots of great potential and avenues to benefit clubs and fans.

However, the 'fintech in football' play isn't limited to consumer-facing products. As with the general fintech product landscape, clubs have many backend problems to solve. Fintech solutions and experts could solve many of these problems more quickly and on a broader scale.

🧠 Club accounting & Financial Ops

Accounting is a challenge for most large organisations, but in football, there are additional complexities. A football accounting and finance ops platform, or at least a football module as part of a broader platform, can connect to payment solutions to bring in real-time transactions, ticket sales, merch, manage payroll, and also provide bespoke budgeting and financial planning dashboards that make the overarching management of club finances simpler.

🧠 Player Valuations

To a degree, a player is worth whatever someone is willing to pay for them. However, there should be a difference between the transfer fee—what a club pays for a player- and their market value.

I think there's an opportunity to create a player valuation standard similar to bond valuation models, that use future cash flows, discount them back and factor in things like age, likely strike rate, defensive action projections etc. This would at least create a level playing field with clubs then able to pay over or under the odds depending on their desire to get the player.

🧠 Real-time Reg Reporting

Reporting is a surprisingly important part of club operations, especially given Financial Fair Play rules and league rules on Profit and Sustainability. A standardised real-time reporting platform connected to an accounting and FinOps backend could take much of the heavy lifting of reporting audited accounts, interim financial statements, budget forecasts, wage reports, commercial revenue, profit and sustainability calculations and FFP to the league governing bodies and UEFA.

🧠 Wealth Management for players

The perception is that football players are rich beyond their wildest dreams. But with a massive amount of income in a short space of time, often at a very young age, comes challenges with understanding investments, being tax efficient, creating trusts and generally ensuring that vast sums of money are invested wisely so they last a lifetime. Specialised football wealth managers who understand the complexities, can use tech tools to give players transparency over their finances and invest wisely so players have income that lasts well beyond their playing career are extremely valuable. Fintech facilitates a lot of this.

👉🏽 David James, Paul Gascoigne, Brad Friedel and even Maradona have all faced bankruptcy due to bad investments and financial planning.

Extra-Time 📢

Before closing I want to highlight a few things.

I've zoomed in on the Premier League and the opportunities there.

The opportunities, in fact, are much wider. Countries in the Middle East have created and grown leagues in recent years. This is an opportunity that goes global.

I've referenced stats that are mostly taken from the mens game.

The women's game is growing FAST.

The main focus of this edition is football.

But there's a lot in the 'finnovation' and 'tactics' sections that can be logically applied to other sports and teams like basketball, NFL and maybe even the second most popular sport on the planet…Cricket.

That's what makes it an opportunity in the 100s of billions.

I've outlined some of the innovation areas in which clubs and other sports can invest. It's just the tip of the iceberg.

There’s crypto and NFTs, where there's been some adoption. Diving deeper into loyalty programs. Covering what a partner rewards programme as part of a card would look like.

There'll be much more to cover in a follow-up edition once the fintech + football needle moves.

But before then I'd like to hear from you.

👉🏽 Which fintech innovations would you like to see at your football club or sport you love?

👉🏽 Is your team already doing something interesting in fintech?

👉🏽 Does your fintech do something that would benefit clubs?

👉🏽 Are you in football and thinking about some of the benefits I've outlined?

DM me or drop your thoughts in the comments.

Thanks for reading this bumper and very timely edition. Check out the new 'Release notes' section below, and see you again in two weeks 🙂👋🏽

J.

Release Notes 📝 : Monzo + Ramp

Monzo's Fraud Fighting Features

Monzo released three innovative app features to combat rising fraud.

1. Known Locations: Choose a trusted location, such as your home or workplace, for bank transfers or savings withdrawals exceeding your daily limit.

2. Trusted Contacts: Send a transaction verification request to a trusted friend or family member who is also a Monzo user, ensuring the transaction is safe.

3. Secret QR Codes: Use a QR code stored on a separate device or printed out. You'll need to scan this code along with using your phone to approve payments or withdrawals.

These are additional security factors that help secure large transfers from Monzo accounts and savings pots, combating rising APP fraud, fraud committed on stolen phones, and 'shoulder surfing' thieves.

Great feature innovations, of course, but I see this as the beginning. Monzo has had ample time, product delivery velocity, and creative minds to launch this. So why now?

When it had 500,000 customers, the fraud issue wasn't as big and monetarily harmful. Now, it has 9 million customers and a larger number of deposits, and it's going through its scale era.

With 9 million customers, it can build network effect features like 'trusted contacts' that become richer and more effective the larger the group of customers who use them. I anticipate more features like this now that there's a mass of loyal customers and because Monzo, like many other fintechs, are able to innovate and deliver at speed.

Ramp

A new change from Ramp, the expense management fintech, requested by a customer via a Tweet, has further proven that receipt management is a feature, NOT a product.

They demonstrated a masterclass in how to ship features fast when they responded to the tweet, which requested a quick integration between mobile receipts and the Ramp platform, and the engineering team sent back this:

Mobile receipt that the recipient just forwards to a Ramp mobile no. and is automatically attached to the relevant transaction.

Receipt management has long been a feature not a standalone product. Ramp’s quick feature change and smooth integration proved why.

Accounting platforms should take note.

Fintech Spotlight 🔦: VibePay

The fintech, football and Open Banking combination has been featured heavily in this edition, which is the perfect opportunity to feature a fintech that has a significant overlap with those themes.

Hence, the feature of VibePay this week.

VibePay is an Open Banking Payments platform that uses A2A payments to allow individuals and businesses to pay and get paid quickly and with low fees.

They are bringing Pay by Bank to the mainstream in the UK.

In addition to solving fundamental problems, they've grown a large community on Twitter and regularly posts football-related promotions as a way of growing brand awareness and increasing sign-ups:

They're also continually innovating. Their latest release, Guest Payments, allows non-VibePay customers to receive payment requests and make P2P payments without signing up to the app, opening up Pay by Bank for all.

I'm very bullish on these guys taking Pay by Bank and P2P payments in the UK mainstream, so check them out and let me know if you agree.

Interesting News 🗞

Monzo Sponsor Coventry City - I wasn't going to include news as part of this bumper edition, but it seemed like fate that while writing this, Monzo unveils that it'll be the front-of-shirt sponsor of Coventry City. Sponsorship is the biggestarea fintech has entered football over the last decade, and this is a smart bet from Monzo, with the deal likely structured to include an extension if the team gets into the Premier League, where millions more eyes will be on their brand each week.

Coventry fans on Twitter immediately asked for Sky Blue Monzo cards.