Fintech R&R ☕️💳 - Stripe, more than a PayFac

A walkthrough of Stripe’s evolution, their early competitors, the Jobs that they solve for customers, an overview of their new products and the metrics they consider when driving growth & scale.

What was Stripe’s original name?

Which tech company inspired Stripe to build a developer friendly payments integration?

How did Stripe get its first 20 customers?

What metrics are driving Stripe’s product development?

What’s THE most underrated announcement at Stripe’s recent launch events?

Why do I have high hopes for Stripe’s solo ‘Mixpanel for Payments’ optimisation tool?

Why should competitors be worried about Stripe’s product decoupling?

These questions and more will be answered in this week's edition of Fintech R&R.

Hey Fintechers and Fintech newbies 👋🏽

Yet another jam-packed fortnight in fintech, especially on the product launch side.

As I touched on in the last edition, Visa announced a magnificent seven new products to add to their already broad product stack, including enhanced AI protection mechanisms for A2A payments, expansion of Tap to Pay to include Tap to Add cards and Tap to Pay friends, and the Visa Flexible Credential allowing, amongst other things, a single card to toggle between payment methods, so customers can create rules on whether they use debit, credit, “pay-in-four” with Buy Now Pay Later or even pay using rewards points through the card product. I did a more detailed write-up on LinkedIn, and I’ll do an even deeper write-up here in the coming months.

GooglePay launched an exciting feature as part of their Chrome checkout process, which displays the benefits of stored cards as the customers select which card to use for payment. A reasonably innovative and beneficial feature, but it’s not clear if the card benefits are displayed based on the specific transactions the customer is carrying out, i.e. showing air rewards when booking a flight through a specific airline. It’s also not clear if it sorts the various cards by the biggest reward to smallest. Maybe that will come in a future release and be tied to Visa’s new payment-type agnostic, flexible tokens.

Plaid joined in on the act with an enhancement to their Beacon platform, its anti-fraud network tool that allows companies to report instances of fraud and allows all customers to access this database for use in onboarding, payments, and other activities. It’s now extending the Beacon platform to give companies 40+ additional attributes about connected accounts, such as:

Account age & status (closed/restricted)

Number of connected apps via Plaid

Account connection frequency and associated IPs

Identity changes to the account

Companies can then use this to determine the likelihood of downstream fraud. A very cool use of the network effect and one of the tools in the arsenal against fraud.

This use of the network effect is part of what led to today’s topic, another product launch that includes some network features.

That’s Stripe.

Stripe launched a bunch of new products and features as part of its London Stripe Tour event and prior Sessions event in the US. I was one of the lucky few to be invited to the London launch where they had a lot of their existing customers, partners, and other ecosystem participants.

In terms of products, their UK launch wasn’t too dissimilar to their US launch a couple of weeks earlier. A rare occasion where the UK launch of a US-originating product isn’t months or years apart.

There were A LOT of interesting UK-specific product announcements from the Stripe team, including things like Pay by Bank, a tool to give businesses fast access to capital, AI-powered fraud detection and many more, which I’ll dive into.

Most interesting of all was the sheer scale and breadth of products they have, which triggered my thinking about their evolution from simple US Credit Card payments facilitator to

“everything payments, for all business, everywhere™”.

So in this edition, I’m looking at Stripe’s jump from a PayFac + Processor in 2010 to ‘Financial Infrastructure for the internet’ today...and beyond.

I’m also taking a quick look at the technical nature of payments and why it’s essential to create more resources to help non-technical people, something I’m thinking about doing and would love to hear your thoughts on in a quick embedded poll further down the page.

As well as interesting news, puns + movie references, this edition includes the following:

Origins of Stripe and competitors at the time

A timeline from 2010-Present Day

The Jobs-to-be-Done for their customers and their product stack

Simplify Company Incorporation

Prevent & Manage Fraud

Take Payments (Online & In-person)

Understand Risk and Manage Finances

Get Paid Faster

Obtain Financing

A quick note on acronyms and technical terms in Fintech

Some of their new products

Pay by Bank and Faster Payouts

Stripe Capital

A/B Testing

Enhanced Radar

The big metrics indicating success for Stripe customers and the products that drive them

Acquisition | Revenue | Retention | Referral

Takeaways for fintechs from Stripe’s journey

Fintech Spotlight 🔦: Sunshine + Kittens - THE coolest kids banking app that will shake up financial education

NOTE: For the melomaniacs AKA music lovers among you, yes, the title is supposed to be voiced in the tune of More Than a Feeling by Boston

Now let’s get into it 💪🏽

NOTE: You know the drill. Your mail client might crop the end of this so click here to see the full, unclipped edition, drop a like and comment at the end, and don't forget to subscribe PayTech Bro’s 💁🏼💁🏻

Stripe, founded in 2010, was the brainchild of brothers Patrick and John Collison, born out of a need to simplify the process of accepting online payments.

NB: Using 'Fintech Bro's' in reference to the Collison brothers is probably the only time you can use that phrase without it sounding like an insult.

Although Stripe was not a trailblazer in the Payments Facilitation or PayFac domain, with the likes of PayPal and WePay already established players in the e-commerce payments vertical, it did see an opportunity to become a much friendlier way to take credit card payments online. The brothers had experienced first-hand the difficulties of integrating payment systems in their previous entrepreneurial endeavours, hence the focus on a more customer-friendly way of taking payments.

That's because traditional methods required businesses to navigate through a maze of banking relationships, payment gateways, and complex integrations, often taking weeks or even months to set up. They aimed to transform this process by providing a seamless, developer-centric solution for the growing e-commerce age.

The inspiration for creating a new, simple developer-centric solution came from a dev tool itself with Patrick citing Slicehost in an interview with StartupGrind when talking about Stripe's origins.

"We were taken with what was happening in other industries where there were these very developer-oriented services that were coming along building these really nice abstract layers over infrastructure making it really easy to go and do something…We sort of had this idea that maybe it would be interesting to go Slice Host for payments, and that's how we thought of it.

It was a SliceHost for payments.

SliceHost had this really nice slick GUI where you could start, click 'build server' and 60 seconds later you would have a server so we sort of wanted like that magical instantaneous experience for payments."

For context, SliceHost was a web hosting company that specialised in providing virtual private server (VPS) hosting services offering users, mostly developers, scalable and customisable virtual servers, which were referred to as "slices." giving them the flexibility and control associated with dedicated physical servers but at a lower cost.

So they essentially wanted to replicate the simplicity of a product like SliceHost that provided an easy to use interface, abstracting some of the super complicated functions and allowing users– in Stripe's case businesses that want to take card payments online–to get on with running their business.

This line from Patrick epitomises the vision:

"the fundamental idea is that it should be possible to launch a website and accept credit cards within 30 minutes."

That was Stripe's initial offering to US-based online businesses that wanted to take credit payments simply and effectively.

👉🏽 Seven simple lines of code any dev can use to embed payments.

👉🏽 Aggregation of multiple merchants under a single master merchant account streamlining the onboarding process for individual merchants, who no longer needed to go through the lengthy and often complex process of setting up their own merchant accounts.

👉🏽 Taking on the responsibility of underwriting, compliance, and fraud prevention.

This enabled businesses to start accepting payments almost immediately.

💡 One very cool thing about Stripe's early growth is that they took advantage of the fact they had previously gone through the Y Combinator programme and later took financing from YC. It meant they were part of the alumni and had the perfect set of early-stage startups as the product's first users and beta testers. This is what Patrick said about YC and the alum, "having all kinds of people who we knew were building startups, and being able to say to them, Oh, you guys should use Stripe instead of telling launch just to help us because we were a fellow YC company. I mean, that was just super valuable for us…Our first 10-20 users were YC companies."Reading the room, and the competition 💡

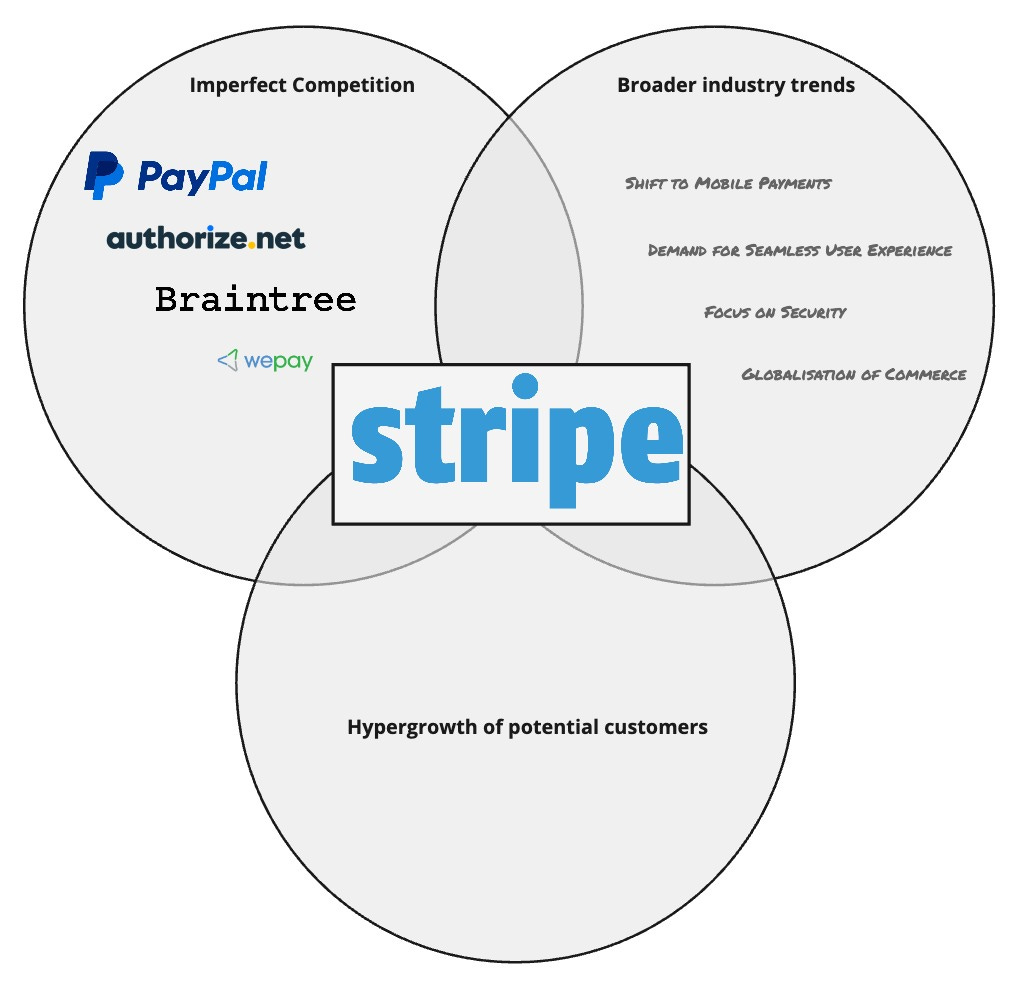

A quick jump back before we fast forward. As I said, Stripe was not a trailblazer in the Payment Facilitation space at the time. There were many Traditional PayFacs and gateways, such as WorldPay and Thales, that enabled businesses to take in-person card payments, and a few Online facilitators that were available to businesses. But as the Collison brothers had experienced first-hand, the PayFacs for online businesses, especially tech-savvy startups, weren't that customer or developer-friendly, slow to set up merchant accounts, and ultimately a clunky and frustrating experience, unlike other dev tools like SliceHost. So although there were existing players at the time, Stripe, or as they were initially called '/dev/payments' (yes, that was what they were called until they fortunately pivoted), saw deficiencies in the existing players and an opportunity to build a much better product for the digital-first businesses.

PayPal - A dominant force in online payments, and the most recognisable name on this list, PayPal offered a range of services including peer-to-peer payments, merchant accounts, and payment processing. While PayPal was widely used and trusted, at the time, it was criticised for its outdated user experience and complex integration processes.

Authorize.net - Established in 1996, Authorize.Net was one of the oldest payment gateways. It provided reliable payment processing solutions but was seen as cumbersome to integrate and manage, especially for small businesses and startups.

WePay - Launched in 2008, WePay provided payment processing services for platform businesses and marketplaces. WePay's focus on serving platforms that required split payments and marketplace solutions made it a direct competitor to Stripe in certain segments.

Braintree - Founded in 2007, Braintree offered API-based payment processing services that were very similar to Stripe's. Braintree was particularly popular among tech startups and provided features like mobile payments and recurring billing. They were, at the time, Stripe's biggest competition but even so, Stripe created what was considered a more elegant interface and simpler technical implementation for clients.

Worth noting that Authorize.net was later acquired by Visa, WePay by J.P.Morgan, and Braintree by PayPal. The acquisition of Braintree by PayPal was clearly an attempt to reclaim some of the ground it lost to Stripe in the early 2010s.

They didn't just look at the competition and improve on it.

That's one aspect of developing a valuable proposition.

They also understood broader industry trends. Notably, the transformation in the payments industry at the time was driven by tech advancements, like the ones experienced by the brothers themselves in DevOps tools, and changing consumer behaviours. The specific trends included:

Shift to Mobile Payments: The proliferation of smartphones led to an increase in mobile commerce, necessitating payment solutions that were optimised for mobile devices.

Demand for Seamless User Experience: Businesses and consumers increasingly demanded frictionless payment experiences, both online and in-store.

Focus on Security: With the rise in cyber threats, security became a paramount concern. Solutions offering robust fraud detection and secure payment methods gained traction.

Globalisation of Commerce: As businesses expanded globally, the need for payment processors that could handle multiple currencies and international transactions grew.

💡 In terms of product development, Patrick and John had a strong grasp of the trifecta of things critical to any early-stage fintech product. 1. Understanding the competitive landscape and competitors' respective deficiencies. 2. Having good knowledge of the current market and some of the trends that will facilitate growth & innovation. 3. Understanding the target customer and their pain points. Something they were acutely aware of, having experienced them first-hand.Using this trifecta of discovery insights, they created a product that was in the same overall vertical as the likes of PayPal, Braintree et al. but a 2.0 compared to those products with its own unique Stripe attributes.

Ease of Integration: Stripe's APIs were designed to be exceptionally user-friendly, enabling developers to add payment processing to their platforms with just a few lines of code. This significantly lowered the barrier to entry for businesses, especially startups, looking to accept payments online.

Developer-Centric Approach: Unlike many of its competitors, Stripe focused on the developer experience. The company provided extensive documentation, code libraries in multiple programming languages, and a sandbox environment for testing. This focus resonated deeply within the tech community, leading to widespread adoption among developers. One attribute that was regularly cited in developer chatrooms at the time was its robust and clear documentation.

Transparent Pricing: Stripe offered a straightforward pricing model with no hidden fees. Merchants were charged a flat rate per successful transaction, making it easier for businesses to predict costs and manage their finances. It was priced at the higher end in those early days at 5%+ 0.30 cents per transaction to filter out lower-end operators who were looking for cheap options and also to show the higher quality of the overall product

Full-Stack Solution: Stripe handled the entire payment process, from accepting payments to managing payouts to merchants' bank accounts. This full-stack approach meant that businesses did not need to deal with multiple vendors for different parts of the payment process.

After gaining learnings from some of the YC alumni to build this unique product and building a waitlist during this time, they launched to the public and slowly evolved over the course of the next 14 years…

2011: Early Development and Public Launch

Stripe launches its beta product, focusing on providing easy-to-integrate payment APIs for developers.

29th Sep 2011, Stripe officially launches to the public

2013: Product Enhancements

Stripe introduces Stripe Connect, enabling marketplace businesses to accept payments and manage payouts to third-party vendors.

2014: International Growth

Expands internationally, launching in Canada, the UK, and Ireland.

Raises $70 million in Series C funding at a $3.5 billion valuation, led by Thrive Capital and Sequoia Capital.

2015: Expanding Services

Stripe Atlas is introduced, a service to help entrepreneurs incorporate and set up businesses globally.

It announces partnerships with major tech companies like Twitter, Facebook, and Apple, integrating Stripe's payment solutions with their platforms.

Obtains strategic investment from Visa

2016: Continued Innovation

Launches Radar, a machine learning-based fraud prevention tool.

2017: Significant Growth

Raises $245 million in Series D funding at a $9.2 billion valuation, with investors including Tiger Global Management and DST Global.

2018: Strategic Investments

Launches in more countries, including Singapore, Australia, and New Zealand.

Raises $245 million in Series E funding, valuing the company at $20 billion.

2019: Market Expansion

Continues its international expansion, entering new markets in Asia and Europe.

Secures $250 million in funding at a $35 billion valuation.

2020: Response to Global Changes

Amid the COVID-19 pandemic, Stripe sees accelerated growth as more businesses move online.

Raises $600 million in Series G funding at a $36 billion valuation.

2021: Record-Breaking Valuation

Raises $600 million in Series H funding at a $95 billion valuation, making it one of the most valuable private fintech companies in the world.

2022: Further Expansion and Product Development

Stripe continues to expand its product offerings, including enhancements to Stripe Treasury and the introduction of Stripe Climate, a tool for funding carbon removal.

Stripe launches in the UAE, marking its first entry into the Middle East.

2023: New Ventures and Funding

Stripe introduces several new products and features, focusing on financial infrastructure, fraud prevention, and business optimization tools.

Stripe secures an additional $6.5 billion in Series I funding at a reduced valuation of $50 billion, aimed at providing liquidity to current and former employees and addressing primary needs.

2024: Present Day

That’s a whistle-stop tour of its evolution to today, and it’s clear that they do a lot more than just take credit card payments for US-based small businesses and startups.

They don’t just facilitate credit card payments.

They now support and facilitate more than 54 different payment methods, including multiple card brands, bank transfers, BNPL, and Wallets such as ApplePay, GooglePay, CashApp, and PayPal.

They don’t just operate in the US.

They now operate in 46 countries around the world with plans to expand further.

They don’t just serve startups and SMBs (from YC and beyond).

They power payments for nearly 3,000,000 businesses that still include SMBs but also the likes Apple, Etsy, Shopify, OpenAI and Amazon.

They’re not just a payment facilitator and processor.

They also facilitate company incorporation via Atlas, are a marketplace payments facilitator via Connect, and have a large vested interest in tackling fraud, which is executed via Radar.

I’ve laid this out semi poetically to drive the point home but they’ve come a long way since their launch in 2011 with what, in retrospect, now looks like a very small slice of their ever expanding offering with these latest product launches.

A quick note before talking about their product stack and latest releases.

There’s a lot of technicality in payments and fintech more broadly. So far in this article I’ve referenced around 10 different terms from APIs and DevOps to PayFacs and Payment Processors. But not everyone who works in a technical organisation is technical themselves.

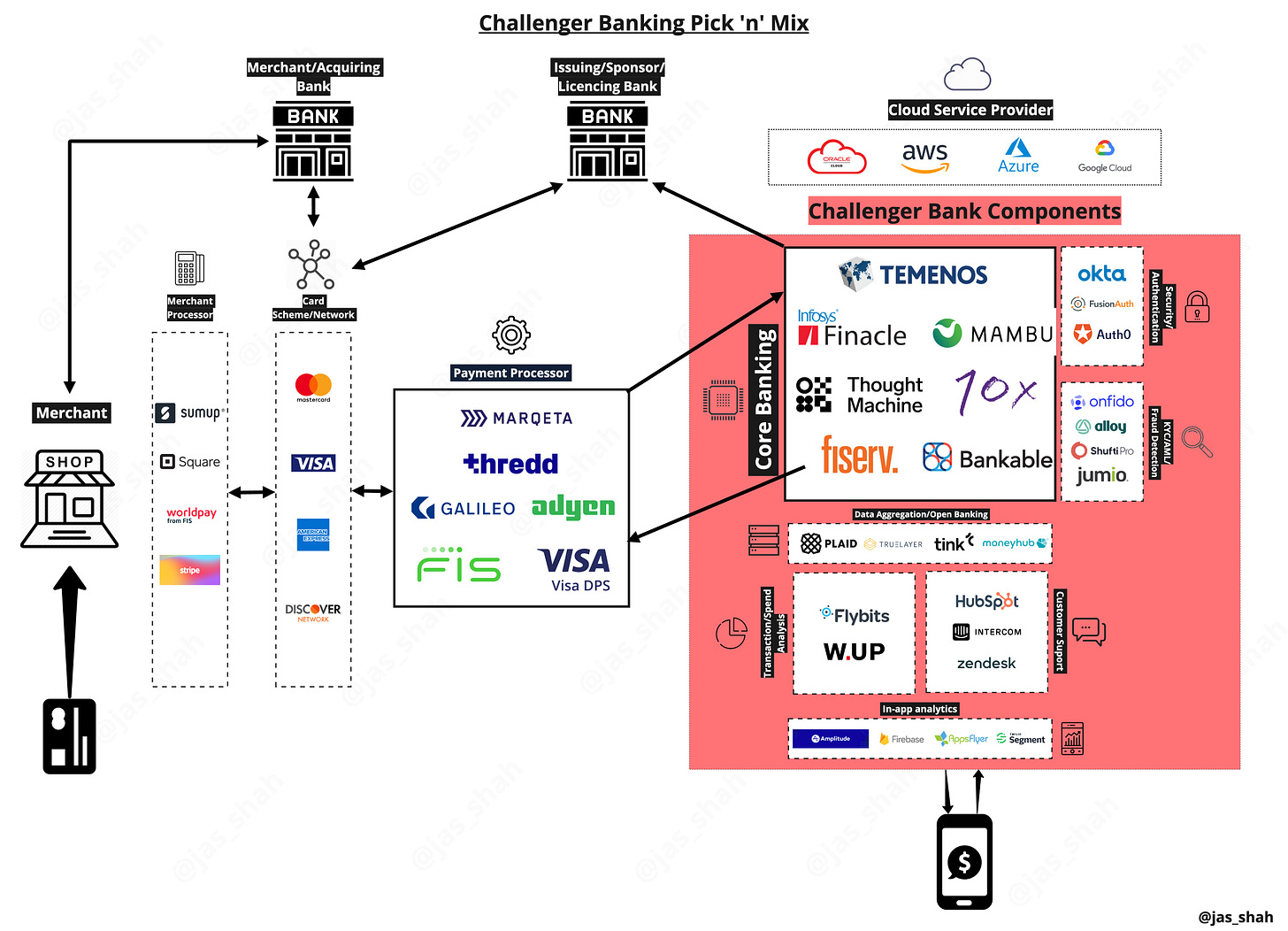

For example, I created this a few years back that many found super useful in explaining the merchant payment flow:

So I’ve been thinking about creating a doc that covers all the main technical areas of fintech, general technical concepts like APIs, SDKs, Decoupling, Microservices, etc, along with examples in Fintech, descriptions of as many of the technical fintech concepts, acronyms and technologies as possible including things like Tokenisation, Card Payments, KYC, Acquirer, Issuer, Programme Manager, and of course, using my experience as a former engineer and having built products in FS for nearly two decades to explain it in a simplified but relatable way. Is that something you or your colleagues would find useful? 👇🏽

Release the Kraken 🐙

The title will make more sense once you see the image further down the page…

I wrote an SME Jobs to be Done deep dive last year covering some of the basic jobs SMEs seek solutions for.

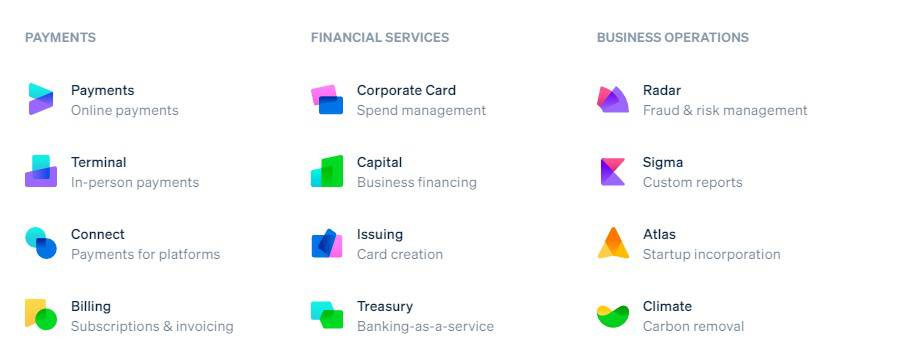

In terms of Stripe's product stack, the above is the web overview, but it's more relevant to think about their products and services in the context of what they do for businesses and the problems they solve rather than just listing them. There is also quite a bit of overlap with the JTBD I outlined last year and the ones that map across their stack.

Let's first use, as an example, the initial version of the product in 2010/11. The job was "Allow US startups and SMBs to take Credit Card payments via a simple and user-friendly interface."

The current set of jobs is of course, a lot broader in terms of problems solved for customers and geographies, which means they are shorter, snappier and include the following:

Simplify Company Incorporation: This is via their Atlas product, which was launched in 2015 and allows businesses across the globe to incorporate and operate.

👉🏽 Atlas

Prevent & Manage Fraud: They do this in several ways, but mainly through Radar, a sophisticated, machine learning-based fraud detection and prevention tool integrated into Stripe's payment platform. Launched in 2016, Radar leverages Stripe's extensive data network, analysing millions of transactions across the globe to identify and mitigate fraudulent activities in real-time.

👉🏽 Radar | Financial Connections | Identity

Take Payments (Online and In-person): Bread and butter of Stripe's business, which has recently expanded to in-person payments via their Terminal product and, in terms of Online, has grown across many more geos and payment methods.

👉🏽 Payments (Online) | Connect (Online Marketplaces) | Terminal (In-person)

Understand Risk & Manage Finances: Get a better understanding of all revenue, transactions, obligations and compliance reporting

👉🏽 Billing | Tax | Revenue Recognition | Sigma

Get Paid Faster: This is a relatively new job Stripe serves for customers with Manual Payouts and Pay by Bank, allowing customers to access their funds faster. More on that in the

👉🏽 Manual Payouts | Pay by Bank

Obtain Financing: Unlocking access to funding for the UK's small businesses and creating new revenue streams for platforms. This is another relatively new job for the UK market but a key one for UK businesses in the current climate.

👉🏽 Capital

Stripe's New Tools 🧰

As you can see from the jobs it covers and the solutions it provides for customers, Stripe continually increases the breadth of its offerings by creating solutions that solve all sorts of business problems, not just facilitating payments.

It helps businesses better understand and manage fraud through its Radar platform, allows companies to incorporate directly through Stripe using Atlas, understands risk and manages finances using a plethora of tools, and gets paid faster using manual payouts and PBB.

Although the latest set of product announcements from the US Sessions and UK Tour is not a full-blown revolution for Stripe, it's a big evolutionary step that, as seen above, adds key solutions and solves important problems for customers.

Here are the ones that particularly interested me:

Pay by Bank & Faster Payouts

Available in the UK first, Stripe's Open Banking-powered payment method and faster manual payouts provide businesses with quicker, cheaper ways to access their earnings. It allows merchants customers to pay using their bank account utilising the Open Banking framework and sending payments via Faster Payments, the UKs real-time payment infrastructure.

Online car marketplace Cinch and insurance brokerage AJ Gallagher are among the large companies that are already using Pay by Bank to reduce their payment costs and improve their cash flow.

This is an option UK businesses can enable on checkout and paired with Manual Payouts, the ability for businesses to manually access their earnings, it means organisations across the UK can get paid faster.

Read more about how Open Banking Payments works here.

Stripe Capital for the UK

This is their platform that gives small businesses access to flexible financing to invest in their own expansion. It uses a company's transaction and business history on Stripe to proactively qualify businesses for financing. Funds hit approved accounts the next business day, and businesses repay the amount as they earn. It allows businesses to take out finance against future revenue to invest in areas that ultimately lead to organisational growth.

"The payments tools and financing options we're launching today will help money move around the economy faster and make it easier for businesses to invest when they see an opportunity to grow," - John Collison .

There are also plans to launch Capital with Connect later in the year which will allow marketplace platforms like Shopify to offer financing through Capital to Shopify businesses.

💡 On the face of it, this offering with provider YouLend looks like a Revenue-based financing option. I predict Capital will expand to other types of financing, such as invoice/asset-based finance, to give businesses more cost-effective and tailored options over time. SME lenders in the UK should be concerned about this eating into their e-commerce market.

I've put this in the 'Obtain Finance' vertical but overall I think this will be one of the tools in the broader Grow your Business bucket with many more products to come…One to watch.

Radar Assistant

Stripe launched Radar, its machine-learning fraud platform, in 2016, utilising Stripe's extensive data network, analysing millions of transactions across the globe to identify and mitigate fraudulent activities in real time. A key part of the platform is its customisable rules engine, which gives merchants the ability to set custom rules tailored to their specific business needs, enhancing the flexibility and accuracy of fraud prevention.

Radar Assistant, their latest enhancement to the platform, allows businesses to use natural language prompts to describe new fraud rules they'd like to set. The assistant then drafts them accordingly and can test them against previous payments to see if they block fraud without increasing false positives and boost revenue.

A great way of making the fraud prevention process more bespoke to individual businesses whilst also being easy to use, reducing the need for a degree in money laundering regulations to reduce dispute rates and take payments securely.

The previous three product announcements were cool and impactful, but I thought the following two were the most underrated across both events.

A/B testing

I think A/B testing remains one of the underused tools in customer and feature discovery and testing but with good reason. It can be tricky to set up the control test, require a lot of technical skill to split the product and surface another view and set of functionality, and, depending on how the product is set up, quite costly to get those insights and understand the output of the testing.

Note: This is something an experienced product person makes easier

That's why Stripe's announcement of A/B testing of checkout options was very exciting. Not only does it provide a simple-to-use one-stop shop for A/B testing, but it also sits across the most important and ever-crowded space for sites taking payments.

Checkout.

We've all seen examples of mega-congested payment screens, and last year, I wrote about the fallacy of choice and confusion introduced when too many options are displayed. This can lead to friction, which ultimately reduces conversion and increases drop-off.

That's why A/B testing, as part of its broader optimised checkout suite, is very cool and impactful for businesses. Firstly, businesses can use the optimised checkout suite, which uses pre-built UIs, a wide range of payment methods, and controls that allow businesses and platforms to fine-tune the checkout experience for their customers quickly.

But crucially, they can use A/B testing to analyse the impact of adding, removing, repositioning payment options and modifying the experience on conversion and, ultimately, revenue without writing a single piece of code.

Interoperable, de-coupled Stripe products

Last but certainly not least, this is the most underrated announcement they made.

In the blog summary they called it "Allowing Stripe products to be used with other payment providers".

The gist is that some of the bigger products in Stripe's product stack will now be offered as standalone solutions to businesses that do not use Stripe as their payment provider. The initial de-coupled products offered are:

Stripe Radar

Stripe Billing

Optimised checkout suite including A/B testing

Here's a supporting statement from President of Product & Business, William Gaybrick on the release:

"Today, we're extending our modularity to the very core of Stripe: payments processing. Going forward, helping our users manage the complexity of running multiple processors will be a major investment area for us."

I think this is cool for a number of reasons.

Firstly, the de-coupled checkout optimisation suite that can be used by any site to create a first class checkout experience, improve conversion and ultimately increase revenue is a tool many will pay for and means Stripe will gain a whole new segment of customers not currently using Stripe Payments.

It's basically built 'Mixpanel for Payments' and can sell it as such.

Actually, it's better than Mixpanel because there's less dev work and, therefore, faster results.

The same goes for Radar.

Stripe Radar as a standalone product will end up being the biggest fraud management product on the planet based on the amount of data it uses as part of decisioning, its use of the network effect to become a better tool as it onboards more customers, and its configurability to suit different businesses.

Another reason this announcement is underrated is that it unblocks one of the biggest obstacles to its customer acquisition strategy.

As a payment processor/facilitator with those additional products, their core acquisition strategy was to continue to acquire new startups looking for payment services as well as bigger organisations looking to switch. Now they've broadened their prospective customer reach to include enterprise customers who already have a long-standing relationship with a processor, and any organisation looking to reduce fraud and improve checkout experience.

Long-term this is a great on ramp to onboard those Radar, Billing and Optimisation product customers onto Stripe Payments when the time comes.

And when thinking about Stripe's overall product stack and recent announcements, 'Acquisition' is not the only relevant metric.

Measuring Vertical Stripes 🦓

From a product point of view, there is a lot to admire about Stripe’s latest set of US & UK announcements. Not least, the alignment of these new features and overall product stack with some traditional product metrics.

Their mission and something that neatly aligns with what resembles a North Star, is “Grow the GDP of the Internet”.

I won’t focus too much on the North Star and mission but rather some of the general metrics used to measure product success in various areas and a taste of the initiatives they have to improve them that just make sense.

💡 Read more about metrics hierarchies in fintech products hereAcquisition: Increase acquisition of customers at different stages of the life cycle

Atlas: Using their business incorporation platform to acquire customers earlier in their payments journey

Product Interoperability: De-coupling key products that can be used to acquire customers who are not looking for a new payment provider

Revenue: Improve overall revenue and customer revenue

A/B testing & Checkout Optimisation: Improve conversion for customers and, therefore, increase basket sizes & transaction volumes and overall revenue for customers and Stripe

Stripe Capital: Provide capital to customers to invest in growth, increase revenue lines and increase overall revenue for Stripe

Radar: Proactively identity fraud to reduce dispute rates for businesses, increase overall payment volume and increase revenue for the business and Stripe

Retention: Creating on-ramps for customers not currently using Stripe

Improving crucial products like Radar and Payments for existing customers and adding products like Terminal to create more switching friction and increase retention

Referral: Using referral leverage to gain more customers

Connect: Onboarding marketplaces such as Shopify and Amazon that can then act as referrers of Stripe products

As you can tell, I’m a big fan of Stripe’s product and its evolution over time. For me, they are THE case study in how to build a fintech product using first principles, creating clear personas, understanding that customer base and growing & scaling a product. There are clear metrics they try to hit. They solve jobs for customers and constantly evolve with the North Star of “Increase the GDP of the Internet” in mind.

Just as Visa is more than a network, Stripe is more than a PayFac.

But before closing, I want to highlight some things folks building fintech products today can takeaway from their recent product launch and evolution over time.

👉🏽 Focus on a core problem and build a great product to solve it

👉🏽 Find the perfect core audience for your product, and it will pay dividends

👉🏽 Build for a core niche of customers (like startups) and slowly expand horizons

👉🏽 Building a tech-first platform and creating clear documentation makes it much easier to scale

👉🏽 Decoupling core products from the outset gives you much more flexibility

👉🏽 Continually keep a solid understanding of the market to make product evolution easier

👉🏽 Capture more of the market by looking at other problems your customer base faces and solving them

For more lessons, keep an eye on what Stripe does next. If you can’t wait till then, drop me a note for any specific product strategy requests.

Don’t forget to like this edition and share it with a friend and see you in two weeks for another edition 👋🏽

J.

Fintech Spotlight 🔦

I’ve spoken about the financial literacy issue in a few different editions. Financial education products are key to breaking a cycle that is currently in flow with Gen-Z becoming less confident with financial concepts and managing money. Kids are becoming more digitally savvy with each year that passes so engaging financial education and management apps are central to educating the children of the future.

That’s where Sunshine + Kittens comes in.

Sunshine + Kittens is building the kid's money management product of the future. A very different proposition to the likes of GoHenry, Rooster, or Starling Kite.

I’ve managed to take a look behind the curtain and they are building some very cool & relevant stuff that is genuinely the next-gen for kids money management.

I predict that S+K will become a household name in the next few years & the look and feel will be something that others will look to copy. Bookmark this statement.

They are also raising, so if you, or anyone you know, is looking to invest in products solving financial literacy and management problems for future generations, reply to this or email me at jas@bitsul.co.uk

Favourite bits of news 🗞

HSBC UK introduces Carbon Insights - This new feature enables HSBC Kinetic customers to view the estimated C02e values for their HSBC Kinetic Debit Card transactions on a user-friendly dashboard in their HSBC Kinetic app. Similar to Stripe’s Climate Product, it gives businesses a clearer view of their climate impact and also gives suggestions on how they might be able to manage their emissions.

One thing I love about Stripe is just how well versed their founders are, and can talk in such a wide range of subjects. Most fintech CEO's are just focused on their business area and dare to go outside of this, but the Collinsons are different. And in a really good way! This is a case in point:

https://www.noahpinion.blog/p/interview-patrick-collison-co-founder