Saudi Arabia’s Fintech Oasis: A Market Flowing with Opportunity

A deep dive into the region, consumer trends, an overview of the fintech landscape, some 'Product White Space' analysis, and the biggest fintech opportunity areas

What are some consumer trends and challenges in KSA that fintech could address?

How can fintechs help close Saudi Arabia’s SAR 55 billion household savings gap?

Where are the biggest white spaces in Saudi Arabia’s fintech landscape—and which areas are approaching saturation?

Could Saudi’s booming investment landscape make it the next frontier for digital wealth management and robo-advisors?

These questions and more will be answered in this week's edition.

Hey Fintechers and Fintech newbies 👋🏽

This week, I’m finally diving into KSA, and although I start each newsletter with a list of questions that’ll be answered, there’s one broader question that really kicks this week’s primer off.

How much do you really know about the fintech scene in the Kingdom of Saudi Arabia and the biggest problems to be solved?

Chances are you know there’s a lot happening, you probably know a few fintechs, and you might even know some folks working on fintech in the region (including me). I’m here to set the scene for some future editions and give some deep insights on the market & consumer behaviour, the popular products in the region, and what the current fintech scene looks like to bring everyone to baseline level of knowledge.

To start, here’s a quick roundup of what’s been happening lately in Saudi’s fintech space:

Mastercard & Geidea: Mastercard recently partnered with Saudi payments fintech Geidea to expand payment solutions for SMEs aimed at bringing affordable and advanced payment solutions to over 100,000 merchants across the Kingdom

Visa & STC Pay: Visa and STC Pay announced a collaboration to enhance digital payment solutions, enabling STC Pay users to benefit from Visa’s extensive network for both domestic and international transactions, enhancing digital wallet functionality and accessibility, particularly for Saudi’s expat population.

SAMA’s Open Banking Release: The Saudi Central Bank (SAMA) recently launched the second phase of its Open Banking Framework, a significant step toward fostering a more integrated and competitive financial ecosystem. This release provides detailed technical standards for the facilitation of Open Banking Payments (aka PIS in the UK/EU) for fintechs to use to create innovative and customer-centric solutions.

KSA’s fintech landscape isn’t just vibrant; it’s evolving rapidly, driven by strong regulatory and government support, increasing venture capital flows, and leadership that’s focused on building a cashless, tech-driven society. But beyond the headlines, the real story is in how Saudis embrace digital financial products.

From BNPL and remittance platforms to PFM apps and alternative credit solutions tailored for SMEs, the ecosystem is packed with opportunities to improve financial accessibility and drive innovation.

So, whether you’re already familiar with KSA’s fintech scene or just getting started, this edition is here to give you a deeper look into the products, consumer behaviour, and trends shaping the Middle East’s most dynamic fintech market and act as a primer for future editions on Open Banking, Digital Banking and fintech product innovation in the region.

As well as interesting news, puns + movie references, this edition includes the following:

An overview of the Saudi market

Youth Population

Gender Inclusion Rising

Metropolitan elites

The big initiatives driving change

Vision 2030 | Monsha’at | Makaan | Open Banking Lab

Customer Trends

Saving, Spending and Financial Literacy

Wealth & Investing

SMEs

Product Market Map and White Space Analysis

Big Opportunity Areas

Consumer Credit, Savings and Literacy

Wealth and & InvestTech B2C and B2B

SME and Corporate Fintech

RegTech, InsureTech and BaaS

Fintech Spotlight: Vision Bank - The latest neobank to hit Saudi Arabia

Let’s get into it 💪🏽

A quick note on my recent work in Saudi

For those of you wondering what I’ve been working on in KSA for the past couple of months I was there to analyse the market deeply, understand customers, review the existing fintech scene, overlay global trends, and use my own fintech expertise to uncover the most significant, beneficial and revenue-generating opportunities the organisation should pursue.

Discovery is a common exercise, especially for early-stage startups, and it forms the foundations of pitch decks, product strategy, marketing campaigns, customer acquisition and much more. It’s also extremely valuable for big banks looking to incubate products, venture funds looking to build out a collection of successful fintechs and even VCs looking to invest in a fintech company to get a better understanding of the opportunity, competitors and the long-term growth prospects.

This edition is just a small slice of my process that also pulls in some of the work I did back in 2020 when I worked with a big Saudi bank to build a neobank for Gen-Z.

Riyadh-ing the Wave🌊: A Snapshot of Saudi and its Fintech Surge

You might already know there’s serious momentum building in KSA’s fintech space, but to really get why it’s happening, we need to zoom out and understand the country itself – because, like in any market, the numbers, demographics, and industries lay the groundwork for how fintech is unfolding.

First, the Basics

👉🏽 A Vast Opportunity: Saudi Arabia, the largest country in the Middle East by size, is home to 37.5 million people. In terms of population, it’s nearly 4x bigger than the UAE (approx 9m ppl) despite the perception of the UAE, specifically Dubai, as a super dense populous city.

👉🏽 The Youth Factor: Nearly 70% of the population is under the age of 35, which means there’s a huge audience of digitally native, tech-savvy young people who are open to new digital financial tools. And, in a country where 99% of the population has internet access, there’s a high level of connectivity, with almost everyone online and over 90% smartphone penetration – ideal for mobile-first fintech solutions. With 3 out of 4 young Saudis actively seeking more financial education and digital tools, fintech solutions targeting financial literacy, mobile payments, and credit options are in high demand.

👉🏽 Metropolitan Elites: Over 84% of Saudi Arabia’s population lives in urban areas, with major hubs in Riyadh, Jeddah, and Dammam. This urban concentration makes it easier for digital services to reach a large portion of the population quickly, as urban residents are generally more connected and receptive to digital finance.

👉🏽 A Nation Connected: Saudi Arabia is among the most connected countries globally, with 99% internet penetration and 90% smartphone usage. This high connectivity level supports a thriving mobile ecosystem, ideal for mobile-first financial services like digital wallets, BNPL, and personal finance apps. A recent study found that 91% of Saudis access the internet via smartphones, making mobile their primary gateway to financial services.

👉🏽 SME Surge: Saudi Arabia’s Vision 2030 prioritises the growth of small and medium enterprises, aiming for SMEs to contribute 35% to GDP. SMEs account for 99% of all businesses in Saudi Arabia, yet they still face significant financing gaps. The government’s push to close this gap has created a large market for fintech solutions in lending, digital banking, and financial management tailored for SMEs.

👉🏽 Gender Inclusion Rising: In recent years, female participation in the workforce has surged, from 20% to over 36%. This shift brings more women into the financial system, increasing demand for gender-inclusive financial products like micro-loans, savings tools, and investment platforms. Women’s financial independence is rising, with an estimated 40% target by 2030, representing a significant new demographic for fintechs to engage.

👉🏽 Going Beyond Oil: For decades, Saudi Arabia’s economy has been synonymous with oil. But the Kingdom has been aggressively diversifying, and today, sectors like tourism, entertainment, real estate, and financial services are taking centre stage. Vision 2030 aims to shift the Kingdom’s economic reliance, with non-oil GDP expected to grow by over 7% annually.

👉🏽 The Financial Landscape: KSA is also unique in that it’s a largely banked population, but with a growing appetite for digital financial services. Traditional banks have dominated, but the fintech wave is pushing people toward more mobile and digital-first options. Consumer finance, credit, and micro-lending products are picking up, especially with young people seeking alternatives to traditional banking products. And with the unbanked rate shrinking rapidly, financial inclusion is progressing, with fintechs playing a key role in reaching the last mile.

👉🏽 The Investment Boom: There’s no ignoring the capital influx. In the first half of 2024 alone, Saudi fintechs secured $412 million in funding, leading the MENA region. Venture capital and private equity firms are now actively investing in KSA fintechs, seeing it as a high-growth market with less saturation than some other regions. Key sectors attracting investment include BNPL, payments, digital banking, and SME finance.

These are some overarching areas that give an overview of the size and some specifics of the broader fintech opportunity, and the direction of travel. Much of this, however, has been supported and driven by Vision2030 and other strategic programmes.

The Role of Vision 2030 and Key Programs

Vision 2030 isn’t just a buzzword, although it does sound a little ‘pie in the sky’; it’s the driving force behind Saudi Arabia’s ambitious transformation into a diversified, tech-driven economy. In short, it’s a comprehensive roadmap to shift the Kingdom’s economy away from oil dependence, foster private sector growth, and ensure long-term sustainability through innovation and inclusivity. For fintech, Vision 2030 represents a mandate to drive financial inclusion, innovation, and consumer trust by establishing a cashless society and expanding access to financial services across all population segments.

This initiative has set goals to:

Increase the SME sector’s GDP contribution to 35%: SMEs play a crucial role in Saudi’s economic diversification. Vision 2030 seeks to make the SME sector more robust by increasing access to financing and business development resources, presenting a vast opportunity for fintechs in areas like lending, digital banking, and payments.

Raise household savings from 6% to 10%: With financial literacy and access to savings products as top priorities, Vision 2030’s focus on household savings opens the door for fintech solutions that promote smart spending, micro-savings, and investment tools tailored to diverse segments of the population.

Build a cashless society with over 70% digital payments by 2025: A key goal of Vision 2030 is to reduce reliance on cash, with the Kingdom aiming for digital payments to represent over 70% of transactions. Fintechs have a pivotal role in this shift, providing digital wallets, mobile payment options, and payment infrastructure for consumers and businesses.

Key Programs Supporting Vision 2030

Vision 2030 is underpinned by several government-backed programs and regulatory initiatives that create an enabling environment for fintech growth:

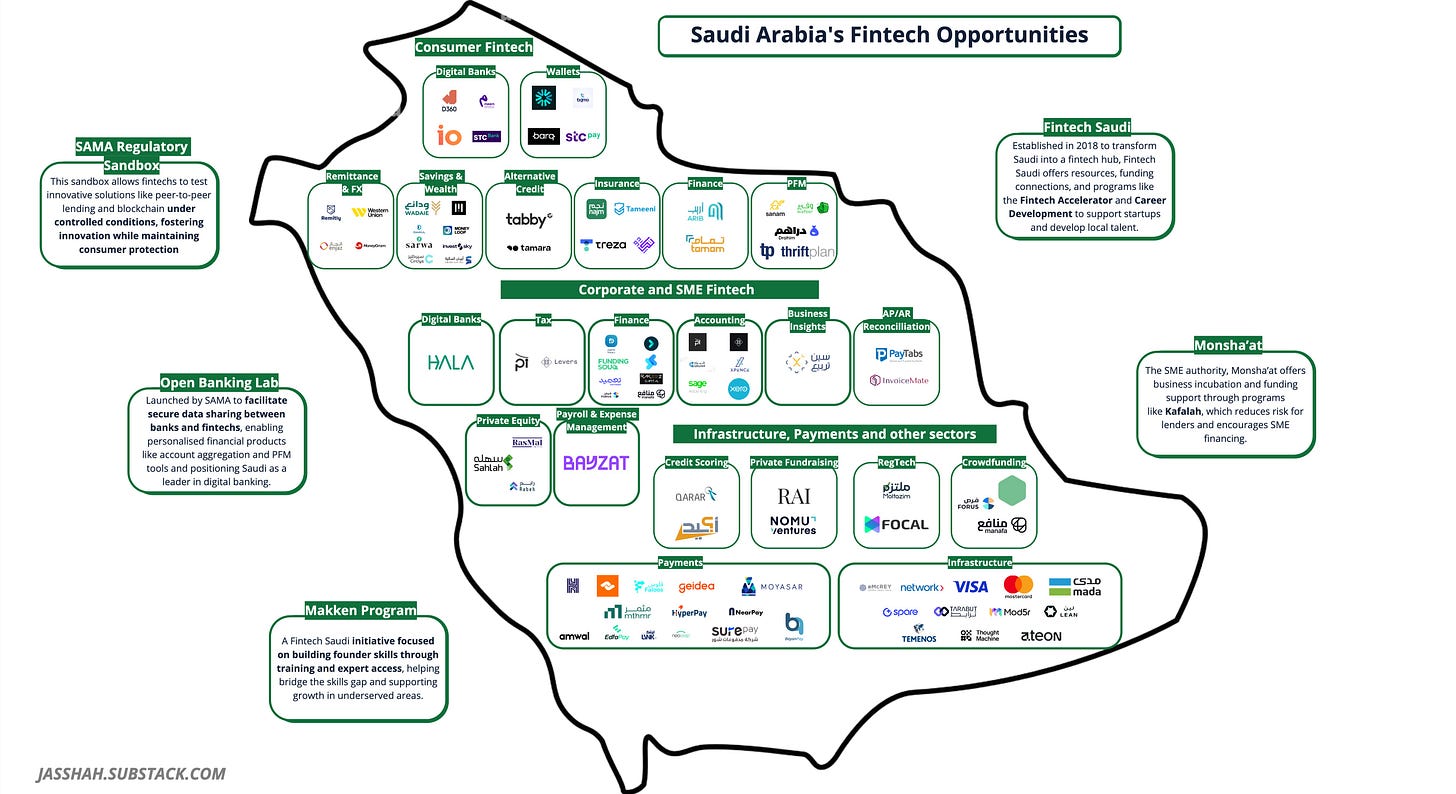

Fintech Saudi: Established in 2018 to transform Saudi into a fintech hub, Fintech Saudi offers resources, funding connections, and programs like the Fintech Accelerator and Career Development to support startups and develop local talent.

SAMA and CMA Regulatory Sandbox: This sandbox allows fintechs to test innovative solutions like peer-to-peer lending and blockchain under controlled conditions, fostering innovation while maintaining consumer protection.

Open Banking Lab: Launched by SAMA to facilitate secure data sharing between banks and fintechs, enabling personalised financial products like account aggregation and PFM tools and positioning Saudi as a leader in digital banking.

Makken Program: A Fintech Saudi initiative focused on building founder skills through training and expert access, helping bridge the skills gap and supporting growth in underserved areas.

Monsha’at: The SME authority, Monsha’at offers business incubation and funding support through programs like Kafalah, which reduces risk for lenders and encourages SME financing.

I can summarise most of this entire section, setting the scene and highlighting the existence of the broad fintech opportunity in the following encapsulating line:

“Saudi Arabia has ambitious targets to shift its economic dependency away from oil, have government-backed funds to help with this shift, a focus on a cashless society, aims to increase household savings, as well as highlighting SMEs as a key part of this transition, and a huge young, ever diverse and digitally savvy population primed for digital transformation across industries, especially in fintech.“ - Jas Shah 😂

It’s a lengthy one-liner, but it nails the broad opportunity, and in essence, I’m saying that the market, economic environment, a primed demographic and motivation at the government level all exist to drive fintech innovation.

Ticking these boxes is the first layer in the funnelling towards viable ventures with a reasonable likelihood of success. Some of the other deeper filtration layers include:

⬇️ Investment inflows into specific areas (what’s likely to get funded)

⬇️ Investment blindspot analysis (what areas have investors missed)

⬇️ Global Trend Analysis (are there global trends that can spark innovation, such as Embedded Finance/Payments)

⬇️ Technology Analysis (what regional and global tech can bring a competitive advantage and speed up innovation in certain areas)

I’m trying to keep this edition leaner, though, so I’m just going to look at two opportunity filtration layers:

👉🏽 Customer Trends: Deeper look at the challenges consumers and SMEs face and

👉🏽 Product Saturation & White Space analysis: Looking at existing products, competitive landscape and identifying any areas with limited products or innovation

Customer Trends

For the KSA organisation I was working with, I put together an all-encompassing 50+ page document, but in the interests of time (mine and yours), I’m examining the three areas with the most compelling customer trends and statistics that indicate opportunities.

Saving, Spending and Financial Literacy 🧮

In Saudi, financial habits are shaped by a strong preference for savings over debt, reflecting cultural values around fiscal responsibility. Although credit card usage is on the rise, Saudis typically reserve credit for larger, planned purchases rather than everyday spending, leading to a relatively low credit card penetration rate of 17%—well below global averages, indicating a trend toward traditional savings rather than consumption.

The push towards a cashless economy is also evident, with 57% of consumer transactions now cashless, fueled by e-commerce growth and widespread adoption of digital payments. Vision 2030’s cashless target opens the door for fintechs to develop digital tools that further reduce reliance on cash.

Compelling Points

Household Savings Gap: Despite Vision 2030’s savings target, projections reveal a 55bn SAR gap between household disposable income and actual savings levels, underscoring the need for tools that encourage and simplify savings.

💡Opportunities: Fintechs can seize these trends by introducing micro-savings apps, automated budgeting tools, and goal-oriented savings platforms that encourage disciplined saving. Financial literacy-focused features within these apps could foster smarter spending and saving habits among young Saudis. Moreover, with the goal of a cashless society in mind, digital wallets and BNPL solutions hold significant potential to become everyday spending tools, enhancing financial inclusion and supporting Saudi Arabia’s broader digital transformation.

Fintechs can introduce PFM (Personal Finance Management) apps with integrated educational content, gamified learning modules, and interactive budgeting tools that appeal to a younger audience. Apps that promote hands-on learning in budgeting, credit management, and investing can address the literacy gap while building long-term financial habits.

Wealth and Investing 💰💰💰

Investment habits are shifting in Saudi Arabia, with a growing interest in diversified assets. Slide 17 shows that younger Saudis are increasingly investing in stocks, real estate, and Shariah-compliant products, such as Sukuk. Demand for wealth management tools is on the rise, with many Saudis open to robo-advisors and low-cost investment apps.

Compelling points

With only 20% of retail investors engaged in the stock market—compared to 60% in other regions—yet over half showing a high interest, the Saudi investment landscape holds substantial room for expansion

💡Opportunities: Wealthtech solutions that offer easy access to stocks, ETFs, and goal-based portfolios have a strong potential in this market. There’s also room for Shariah-compliant robo-advisors and educational investment tools that appeal to younger investors who seek transparency, personalisation, and low fees.

SMEs 🧾

SMEs account for 99% of Saudi’s businesses and are expected to contribute 35% to GDP by 2030. Yet, they face a SAR 117 billion financing gap, with limited access to traditional lending. Many SMEs are also in the early stages of digital transformation, with a growing demand for tools that support cash flow management, invoicing, and digital payments. To address these needs, government initiatives like Monsha’at and the Kafalah Program are working to improve access to credit and provide financial guarantees that reduce the risk for lenders. However, there remains a huge opportunity for fintechs to provide tailored solutions that support SMEs’ digital and financial growth.

Compelling points

Underbanked SMEs, representing 33% of fintech opportunities, are driving demand for Shariah-compliant and digital solutions.

SMEs currently contribute 28.7% to Saudi Arabia’s GDP, falling short of the Vision 2030 target of 35%, despite the number of SMEs more than doubling since the program’s inception, reaching 1.27 million in 2023

Major SME challenges: High-interest rates, liquidity management, and regulatory compliance.

💡Opportunities: Fintechs focusing on SME financing, digital accounting, and cash flow management have significant growth potential. Solutions like embedded finance, digital lending platforms, and CFO-as-a-Service products that help SMEs optimise cash flow, access credit, and streamline financial processes are well-positioned to meet these needs, especially in high-growth sectors like e-commerce and logistics.

Product Saturation and White Space Analysis

Here’s where I’m in my element. As part of discovery, most will do some light touch competitor analysis, but analysing the existing landscape goes deeper than just looking at potential competitors. Mapping out products and the sub-sectors in fintech in which they sit is a great way to look at product saturation--where there’s already an abundance of products and any new venture would need to be significantly different--and white space analysis --identifying sectors where there’s little to no fintech presence and assessing the reasons for that and whether being a first mover is a genuine opportunity.

I split this product map into four broader groups that have some alignment with the customer trends section.

Consumer Fintech

🧠 Gaps

Personal Finance Management (PFM): Despite a few existing PFM apps, there’s still space for growth in advanced financial tools like AI-driven budgeting, retirement planning, and savings trackers.

InsurTech: The InsurTech sector remains limited, with few available options targeting niche markets such as health, auto, and property insurance for individuals.

Credit & Savings Products: There’s a lack of credit products aimed at consumers with limited financial histories. There’s also a whitespace in savings products that incentivise long-term financial planning.

Digital Banking: There are four digital banks in the region, but still space for niche digital banking products to serve the entire population

⚠️ Saturation

Payments: The payments space, particularly in mobile wallets and digital payments, is approaching saturation with dominant players like STC Pay, Geidea, and PayTabs. While further growth is expected, new entrants will need innovative propositions to differentiate in this competitive market.

Corporate and SME Fintechs

🧠 Gaps

Digital Banking for SMEs: Digital banking options for SMEs are still underdeveloped. Most offerings are either partial solutions or tailored toward large corporations. There is space for BaaS-powered SME banking solutions that integrate invoicing, payroll, and digital banking in one place.

Full-Stack CFO Suite for SMEs: There’s a clear lack of full-stack CFO suites that cater to SME needs across a variety of financial operations, from accounting to tax management and cash flow forecasting.

Disbursement Challenges: While financing options for SMEs are available, seamless disbursement and easy access to funds remain a significant gap. Current providers don’t offer fully digital end-to-end solutions for SMEs to manage loans and payments.

⚠️ Saturation

SME Lending: The alternative lending space is becoming saturated, especially with platforms offering Shariah-compliant lending and crowdfunding. Players like Emkan, Lendo, Manafa, and Forus dominate the SME lending landscape, leaving limited space for new entrants.

Accounting Software: Several solutions exist for basic accounting functions, including Qoyod and Odoo, making this space relatively competitive for new accounting-only products.

Infrastructure & Payments

🧠 Gaps

Infrastructure for SME Tools & Solutions: The SME product stack highlights significant gaps in the availability of comprehensive financial tools for SMEs. These include gaps in cash flow forecasting, payment reconciliation, and a full-stack CFO suite that integrates across accounting, payroll, and tax services.

Banking as a Service (BaaS) Providers: Unlike markets in the West, there is a lack of modular BaaS providers like Marqeta, Galileo, and Thredd that offer easy-to-use banking infrastructure for fintechs, which could significantly lower barriers to entry for new digital banking or financial services.

Digital Banking for SMEs & Corporates: There’s limited infrastructure that facilitates modular banking solutions specifically aimed at SMEs and corporates. A white-labelled, end-to-end banking infrastructure could encourage greater innovation and adoption of digital banking for businesses.

⚠️ Saturation

Payments Sector: The payment gateway and processing infrastructure space is already crowded. Major players like Geidea, PayTabs, and BayanPay dominate both the online and physical payments landscapes, and new entrants face steep competition. While the market is expected to grow, newcomers will struggle without significant innovation.

Online Payment Acceptance: Both online payment gateways and physical card processing solutions are becoming highly competitive, with a handful of providers holding most of the market share, making it a difficult space for new fintechs to penetrate.

Broad Overview (everything else)

🧠 Gaps

RegTech Solutions: There are limited RegTech offerings in the Saudi fintech market, especially considering the growing need for compliance, fraud detection, and reporting solutions in an increasingly cashless society.

Digital Banking for Consumers & SMEs: Fully digital banking services for both consumers and SMEs are underdeveloped. Particularly for SMEs, a comprehensive banking solution that includes loans, accounts, and payments is missing.

InsurTech and WealthTech: As highlighted earlier, InsurTech offerings remain limited, and WealthTech platforms focused on SME employee benefits or personalised investment tools are yet to gain traction.

⚠️ Saturation

Payments: Both the digital payment and mobile payment gateway sectors are nearing saturation, with dominant players like Geidea and PayTabs. The payments landscape has seen significant investment, and most startups entering the space will find it hard to gain market share without significant differentiation.

Crowdfunding: The crowdfunding space, particularly for early-stage companies, is becoming saturated with multiple platforms. Further expansion into SME-focused crowdfunding is required to diversify offerings.

Product and Customer Trends Overview

The combined product and customer analysis shows a few things:

1️⃣ There’s a big market for Consumer Savings and Credit Solutions: There are some PFM tools and micro-savings apps that encourage better financial habits, as you can see from the product map. But based on the emerging savings gap and the retail spending culture (just look at the hyper-growth of platforms like Tabby and Tamara in the region), there are opportunities to create feature-rich rewards credit card programmes. There’s also huge scope to create digital savings tools and leverage the new Open Banking Payments release in the region, as well as Save Now, Buy Later products to encourage responsible spending and improve financial literacy.

2️⃣ Wealth & InvestTech platforms are limited: Robo-advisors, full stack investment platforms, fractional investment options, and backend investment management tools are quite limited. There are tools like InvestSky and MoneyLoop that provide investment and wealth creation tools but there’s much more scope to create solutions specifically for the growing number of Gen-Z’ers with savings to invest. An area with huge potential, connected to point 4 further down, is building backend Wealth and InvestTech infrastructure that connects brokers and allows innovators to create frontend applications on ready-made rails.

3️⃣ Digital Lending, Analytics, CFO and broader solutions for SMEs is a challenge in KSA as it is in most regions: This is one area where KSA is similar to many other markets. Although there are many programmes and lots of funding for SMEs, getting access to the capital in a timely fashion is always a challenge. Not only that but as many more SME owners expect digital-first finance platforms, lenders are struggling to keep up. Embedded Finance platforms linked to traditional lenders, business analytics & insights tools, and other process digitisation products are primed for success.

4️⃣ RegTech, Insurtech and BaaS Infrastructure Providers have potential: Compliance, modular banking infrastructure, and fraud detection solutions support the broader fintech ecosystem. Through the product white space analysis, there are clear gaps in all these areas. RegTech, in particular, is an area in which the regulator is looking to invest more time and resources, and as the fintech ecosystem grows, so does the requirement for tools that not only detect risk and fraud but also tools that support the regulator in doing their work. On the BaaS side, it’s apparent that building 100s of fintechs in the next 5 years means there needs to be the infrastructure available to build, and in my firsthand experience of building a digital bank in the region, the lack of BaaS players in the region makes it difficult to build compliant fintech products quickly.

There are many more areas of Saudi Fintech to cover:

👉🏽 The specific opportunities and the broader challenges in the region

👉🏽 Saudi tech that accelerates innovation, including Sarie, Absher and SADAD

👉🏽 The best way to build and grow a digital proposition in the region

👉🏽 And of course Saudi’s Open Banking Strategy

I will cover some of these in a future edition, specifically the Open Banking strategy, as it provides a really interesting contrast with the UK implementation.

But as this has been quite a ‘stats and facts’ heavy edition, it seems like a logical stopping point. Before I go, though, it should now be clear that there’s a reason you’re seeing so many posts on LinkedIn about people moving to the Middle East and picking up projects in Saudi specifically.

It’s the same reason Revolut and Nubank are entering the area and it’s not only because it’s a market that loves superapps.

A vast digitally savvy population, clear challenges, an ambitious vision from the government, and an abundance of funding make it an exciting place to innovate.

Now that you’ve read this primer, you have a slightly better idea of the opportunity areas most in need of innovation. In follow-up KSA editions, I’ll pick some of these areas (maybe consumer and SME digital banking) and demonstrate what innovation and solving some of these challenges with fintech ventures really looks like.

Until then.

J.

Remember to like this edition and share it with a friend. Back again in two weeks 👋🏽

Fintech Spotlight 🔦: VisionBank

A full house of Saudi content in this edition as Vision Bank is in the Spotlight this week.

Vision Bank is a digital bank regulated by (SAMA). It aims to reimagine banking in KSA by offering an experience tailored to customers' dynamic lifestyles, emphasising simplicity, personalisation, convenience, and control over financial lives.

In terms of neobank features it offers the bread and butter stuff at present from fully Digital Banking services, Account Management, Card Services, 2FA, and customers support, but also region specific needs such as microfinancing.

Vision Bank is very much the new kid on the block and has a long way to go before it gets to STC Bank’s popularity but what will be interesting is how it stays agile and evolves with the needs of customers.

This is one to watch (Pun intended)

Interesting News 🗞

A-Jeel development 😉 - In the week I mention a lack of digital banking infrastructure, Jeel, Riyadh Bank’s digital development arm, and Audax, a provider of digital banking technology solutions backed by Standard Chartered, partner to transform the digital banking ecosystem in KSA.

The partnership enables Saudi financial institutions to quickly migrate from outdated systems, unlocking access to new digital capabilities and flexible business models.

Essentially providing one solution to the lack of available BaaS providers in the space. I’m excited to see how this will accelerate development and fintech startup growth in the region.

DISCLAIMER: The bespoke images created in this article are not for commercial or use in commercial pitch decks and they, and the insights and conclusions in this article, have been created independently of any consulting work

Insightful read by Jas Shah on Saudi Arabia’s booming fintech landscape. A must-read for anyone interested in the future of finance in the region.

Wow Jas, this is very in-depth and looks very on the money! I will need to allocate time to read this properly, the main takeaways are fire! 🔥🔥