The "Whys" ways of building a Digital Bank

Looking at the key questions to answer before jumping into the digital banking journey, learning from failures and hacking the 5 Whys method to fit fintech

Why did Lanistar’s flashy marketing fail to deliver a successful banking product?

Who created the 5 Whys method and how can it be applied to Digital Bank builds?

What are the key questions you need to ask before building a digital bank to ensure long-term success?

What are the key factors driving digital banking success in emerging markets like Saudi Arabia?

These questions and more will be answered in this week's edition.

Hey Fintechers and Fintech newbies 👋🏽

Another 3-week gap between editions, unfortunately, so apologies to those expectantly waiting for the latest edition last week, but I’ve been a little busy.

I’m finishing up some initial work in Saudi Arabia (the next edition, which I promise will be two weeks, will cover more about the work I’m doing and the biggest opportunities I’ve seen in KSA). One part of my work is putting together a detailed pros and cons assessment of launching a new digital bank in the region. Highly relevant for this edition.

I’ve also been speaking at a couple of events recently including the inaugural FFS which obviously stands for Future of Financial Services where I was on a panel with some experts including Abdullo Kurbanov, Nadav Mordechai, and the brilliant Marie Walker talking about CX in FS.

We’re talking about fintech stuff, so of course, the acronyms come thick and fast. Keep up.

At the end of the final day, I co-hosted a 60-minute roundtable titled, “How to Build a Digital Bank”.

Although we didn’t manage to spec out the bank in the allocation time fully, we covered some valuable topics, including the importance of trust when building a new digital bank, the ease of building for future generations and the reasons many in the room still bank with a high street provider (as well as the Pandora’s box topic for some of ‘what is banking’).

I was going to cover this topic at some point, but the news that Lanistar hit with a winding-up order brought it forward. I was somewhat optimistic when I wrote about Lanistar’s troubles in my first newsletter over 40 editions ago, but sometimes optimism can be misplaced.

In the roundtable, I repeated and even had a whole slide saying ‘The Why to build a digital bank is as, if not more important, than the How’, and the news about Lanistar, who never really had a clear ‘Why’ further cements this point.

Although there is a lot of exciting news this week especially the finalisation of the US’s Open Banking Rule, it’s going to take me at least a week to read the full 500+ doc, so instead this short, sharp edition looks at…the things to think about before building a digital bank, and the “Whys” to answer.

As well as interesting news, puns + movie references, this edition includes the following:

Why building a digital bank still matters

A couple of digital banking failures

Lessons to learn from Lanistar and N26

The 5 Whys (and Hows) Method

Why should I build a digital bank?

Why will my target demographic sign up?

Why will they trust my product?

Why will they choose me over existing digital and traditional banks?

Why (and how) will my product be sustainable and generate revenue?

A short note on the use of Ikigai to build better digital banks

Some questions I use to filter the promising digital bank ideas from the not so good

Release Notes📝: Careem bringing Fintech to the beach

Let’s get into it 💪🏽

Setting the Banking Scene: Why Building a Digital Bank Still Matters 🧠

Let's start simple.

Despite what many think, there's still plenty of scope to create valuable, impactful, customer-centric digital banks across the globe.

When the banking regulations changed after PSD1 in 2007 (the EUs first Payment Services Directive), it was a game changer for financial services across Europe. It allowed new, non-traditional financial services providers to enter the market, opening the doors for innovation in payments and banking infrastructure. However, many underestimated the potential of fully digital banks, dismissing them as "challengers"—a term that implies they were unlikely to ever truly compete with established institutions. Yet, over time, banks like Monzo, Starling, Atom, and Revolut proved these assumptions wrong. They didn't just challenge traditional banks—they redefined the future of banking.

By prioritising customer experience, transparency, and convenience, these digital banks were able to create a value proposition that resonated deeply with consumers. They simplified the banking experience, reduced fees, and made managing money easier, often in real time. The impact of PSD1 and its successor, PSD2, was significant: they paved the way for open banking, encouraging further innovation in financial services and making it easier for digital banks to thrive.

Why Digital Banking Still Matters in 2024

Digital banking isn't just about convenience anymore—it's about giving customers more control over their financial lives. As consumers increasingly demand transparency and better access to their financial data, the role of digital banks has expanded beyond offering better user experiences. They now serve as vehicles for financial inclusion, helping underserved populations gain access to essential financial services. In regions like the Middle East, where digital banking is still in its growth phase, there is a significant opportunity to fill these gaps.

With traditional banking systems struggling to meet the expectations of younger, tech-savvy customers at a fast enough pace, the potential for building new digital banks that cater to specific needs is vast.

Saudi Arabia, in particular, presents enormous opportunities for digital banking. In Saudi, the ongoing regulatory shifts under Vision2030 & SAMA and consumer appetite for digital-first solutions make it an ideal region for new entrants. I've also got some specific numbers to highlight the opportunity:

36.84 million internet users, with 99% internet penetration and 90% of households owning at least one mobile device with internet access

63% of the Saudi population are under 30 years old, with an average monthly income of SAR 14,084 (per household)

Only 31% of Saudi adults are considered financially literate, which is much lower than South Africa (42%), Germany (66%) or UK (67%)

There are currently 4 digital-only banks in KSA (Vision Bank is live but in its infancy)

This translates to a high adoption rate for digital solutions by a growing youth population who take a digital-first approach to all things, including banking, and want better, richer financial solutions. Coupled with the fact that traditional banks struggle to launch fully digital products that appeal to much of the population and the limited number of digital, modern banking products means a big opportunity in the region.

The opportunities here are significant for those willing to establish a clear purpose ("Why") before diving into the technical ("How") of building a digital bank.

During those early days, not only did Monzo, Revout, etc distinguish on the How, using tech expertise and trends of the time to build modern UIs and backend stacks, but they also understood why they were building what they were building and who for.

In contrast, wannabe digital banking propositions like Lanistar failed because they lacked a clear vision from the outset. As I wrote in a previous newsletter, Lanistar's focus on flashy marketing and an unclear product offering led to its downfall. It never convincingly communicated why it existed or how it could offer real value to consumers beyond gimmicks. Without a well-articulated "Why," even the most technologically advanced solutions can fail to gain traction.

On the point of "Why", here's what my new friends from Elsewhen, Nadav & Yemi had to say:

"On having a clear "why": that famous Simon Sinek quote comes to mind!: "People don't buy what you do; they buy why you do it." This principle holds true in the banking sector, where consumers are increasingly looking for financial institutions that prioritise transparency, social responsibility, and customer-centricity."

Lessons from two Digital Banking Failures 👨🏼🏫

Not everyone should build a digital bank, or even attempt to. Lanistar is a great example of that. I wrote about when they tried to launch a wallet (with the logical plan to become a bank) back in 2022 in my first-ever edition. When they announced they were relaunching in the UK earlier this year after launching in Brazil (a country with a lower regulatory hurdle to get across), I was slightly optimistic that maybe they will go live in the UK.

My optimism was misplaced, and some of the product vision and customer demographic issues I raised in those early days were clearly not resolved.

Case Study 1: Lanistar – A Vision Lost in Translation

Lanistar burst onto the scene with bold claims of revolutionising the banking industry. With heavy social media promotion and celebrity endorsements, it painted itself as the next big thing in fintech. However, Lanistar's failure to establish a clear "Why" became evident early on. Instead of focusing on a solid value proposition, the company relied on flashy marketing that emphasised image over substance.

Lanistar's primary product, a multi-currency card, wasn't significantly different from existing offerings like Revolut or Monzo, but specifically Curve. While their marketing was innovative, their product wasn't differentiated enough to warrant the hype. They promised advanced features like dynamic CVV numbers for added security, but the launch was delayed, and regulatory issues, including concerns raised by the UK's Financial Conduct Authority, led to a winding-up order.

In essence, Lanistar failed because it never clearly communicated its purpose to potential customers—why they should choose it over established competitors. The focus on hype instead of value left both regulators and consumers sceptical. This failure to define a strong "Why" from the beginning was one of the primary reasons it couldn't deliver a meaningful banking experience. This was, of course, in addition to not having the understanding of the How and what was required from a regulatory and technical perspective.

Their sequel/2nd attempt at a UK launch was aiming to be like Godfather 2 but ended up more like Highlander 2.

Case Study 2: N26 in the UK – Miscalculating the Market

N26, a German-based digital bank, was highly successful across Europe, especially in Germany and France, where its focus on simplicity, real-time financial control, and zero fees resonated with users. However, its attempt to penetrate the UK market revealed a critical flaw: a lack of local market understanding.

N26 entered the UK market in 2018, but the landscape was already dominated by players like Monzo and Starling, who had gained a strong foothold with highly localised services. N26's product offering in the UK was essentially a replication of its European model, which failed to address the specific needs of UK customers, such as integrations with popular services like Open Banking or comprehensive overdraft solutions. The shadow of Brexit also loomed large, creating regulatory complexities and prompting the bank's eventual decision to pull out of the UK in 2020.

N26's retreat from the UK was a clear sign that simply transplanting a successful model from one market to another without adapting to local needs can lead to failure. They didn't ask, or dive deep enough into the topic of why UK consumers would choose their product over established digital banks. Had they focused more on understanding local demands and regulatory challenges, they might have tailored their product accordingly and avoided their withdrawal.

When the "Why" is clear, the "How" becomes more purposeful, and the bank can align its innovation, product design, and marketing around this core purpose. Without a well-defined purpose, even the most tech-first digital banks can lose their way, as these two examples demonstrate.

The 5 Whys Applied to Launching a Digital Bank 🤔

Let’s now apply the 5 Whys framework to the core questions that should be asked when building a digital bank. These “whys” are essential for founders and executives to identify the purpose and path for their venture.

1. Why should I build a digital bank?

Before starting any digital banking venture, this is the most fundamental question. Is there a clear gap in the market? Are there unmet customer needs that your digital bank can uniquely address?

For example, consider digital banks like Starling and Monzo, which recognized early on that traditional banking wasn’t catering to the needs of a younger, more tech-savvy audience. Their "why" was rooted in simplifying the user experience and offering transparency, which struck a chord with Millennials and Gen Z.

In emerging markets like Saudi Arabia, the “Why” could focus on financial inclusion, addressing the needs of unbanked or underserved populations. Understanding the specific market context and the demand for better financial products is the first crucial step.

2. Why will my target demographic sign up?

Once you’ve defined why you’re building a digital bank, the next question centres on your target market. What pain points are you solving that will make consumers choose your digital bank over existing competitors?

This "why" addresses the customer’s perspective: Why should they trust and switch to your product? Digital banks that thrive—like Nubank in Brazil—clearly understand their customers’ frustrations with traditional banking, from high fees to cumbersome processes. They offer solutions that are faster, cheaper, and more transparent. Your digital bank needs to define its customer base and their specific needs in order to stand out.

Ask yourself: Is your offering frictionless? Is it cost-effective? Does it provide services that customers can’t get from their current bank?

3. Why will they trust my product?

Trust is paramount, especially in the financial sector. Customers need to know that their money and data are safe. In an era of frequent data breaches and security concerns, how will your digital bank build and maintain trust?

Banks like Starling and Revolut have invested heavily in security, but trust goes beyond technology—it’s about communication, transparency, and reliability. Your digital bank must answer this "why" by showing how you’ll create and maintain trust through superior customer service, consistent uptime, and a security-first approach to both digital infrastructure and user experience.

Trust isn’t built overnight, but it can be severely damaged by a single misstep. So, it’s critical to plan how you’ll earn and sustain trust from day one.

4. Why will they choose me over existing digital and traditional banks?

In today’s crowded fintech space, customers have no shortage of options. This fourth "why" focuses on your unique selling proposition (USP). What makes your digital bank different, and why should consumers opt for your services instead of traditional banks or established challengers?

This might be about niche offerings, like catering specifically to freelancers (such as Lili in the U.S.) or focusing on sustainability and ethical banking, like Triodos Bank. It could also offer superior customer service or provide better integration with everyday financial services like budgeting tools, real-time notifications, or cryptocurrency.

Understanding your competitive landscape is key here, as is knowing how to carve out your niche. You need to answerwhy your bank will offer something others don’t—and how that difference will create lasting loyalty.

5. Why (and how) will my digital bank be sustainable?

The final "why" is about long-term viability. How will your digital bank generate revenue and scale over time? Thistouches on business model sustainability and ensuring that growth doesn’t come at the expense of profitability.

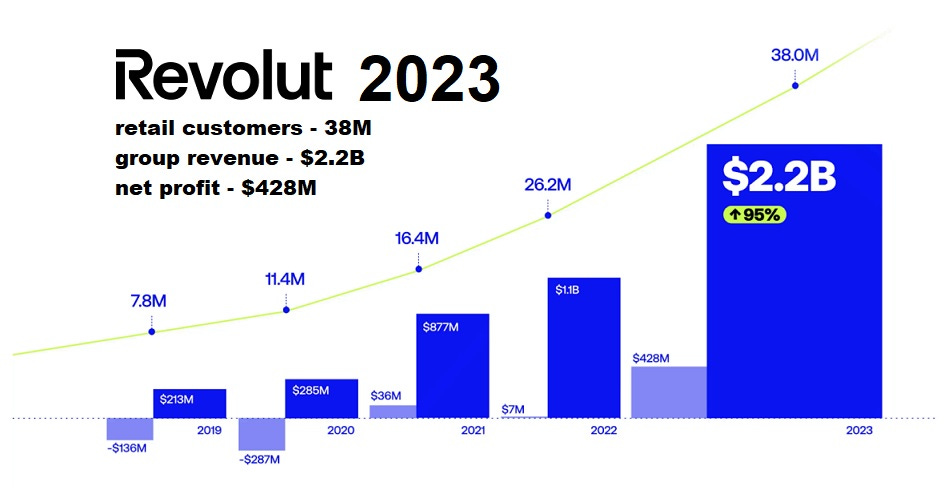

Many digital banks—such as Monzo—have struggled to become profitable despite their large user bases. This “why” forces you to consider the economics of digital banking. Can you scale without burning through cash too quickly? Are there opportunities for upselling services like premium accounts, insurance, or investment products?

It’s crucial to build a business model that can weather market changes and regulatory challenges, ensuring that your bank has longevity. This involves strategic partnerships, innovative revenue streams, and a keen eye on both customer acquisition and retention costs.

Using Ikigai instead of, or in addition to the 5 Whys

You regular readers who caught the last edition on Ikigai might be thinking that the Ikigai framework would also be a great framwork to use to assess whether a fintech product like a digital bank is ready and has solid enough foundations, and you’d be right.

The key areas to address before venturing into the digital bank-building process fit neatly into the four pillars of Ikigai.

Passion: Why should I build a digital bank?

Mission: How will my digital bank solve specific challenges in the market?

Profession: Have I or my team got the experience and capability of building a successful digital bank?

Vocation: How will my digital bank make money?

NOTE: For you regular friday readers, there is an image that was supposed to be here but formatting issues prevented me from uploading it. The cool ‘Why to build a digital bank decision tree’ will be in the LinkedIn version in a couple of days though

Fade Out

As said at the top, there’s still significant room to create valuable, impactful, and customer-centric banks—especially in regions like Saudi Arabia, where regulatory shifts and consumer demand are paving the way for new entrants. Monzo, Starling, Atom, Revolut and others led the way and showed that digital banks aren’t just challengers and can pave the way to become as popular as the incumbants.

However, these banks' success wasn’t just about building a digital product—it was about understanding and defining their "Why." They identified unmet customer needs, from transparency to user-friendly services, and delivered on those pain points. Lanistar and N26 underscore the importance of understanding the purpose and value of the proposition and the market before building or launching into a region.

Using frameworks like the 5 Whys or Ikigai and adapting as I have are great at driving to the right questions early in the process of building a digital bank. By iterating through the core questions—Why build this bank? Why will customers choose you? Why will they trust you?—founders can get to the root of their motivations and build a proposition that’s both relevant and sustainable.

As the digital banking space continues to evolve, it’s critical to not only execute technically but also to ground innovation in purpose. By asking the right questions from the outset, digital banks can align their vision, strategy, and execution to create long-term success in a highly competitive market.

Questions such as:

What unmet need or problem in the market are you solving? Is there a clear gap in the market that your digital bank addresses? Or are you replicating services that already exist without offering real value?

Who is your target audience, and why will they choose your bank over existing options? Have you identified your target demographic, and are you solving their specific pain points? Are you offering something that makes your digital bank stand out from both traditional and existing digital competitors?

How will you build and maintain trust with your customers? Trust is crucial in banking. What steps are you taking to ensure security, transparency, and excellent customer service from the start?

How will your digital bank be financially sustainable in the long run? What’s your revenue model? Are you relying on scale to become profitable, or do you have other streams like premium services, lending, or partnerships?

How are you planning to differentiate from other digital and traditional banks? What’s your unique value proposition (USP)? How are you innovating beyond the basics of digital banking?

What is your strategy for regulatory compliance and adapting to market-specific requirements? Are you ready to navigate complex regulations in different regions? How adaptable is your banking model for global expansion or local market entry?

Do you have the right team and expertise to execute your vision? Does your team have the necessary experience in fintech, banking, technology, and regulation to bring your digital bank to life?

What’s your customer acquisition and retention strategy? How will you attract your first customers, and what strategies do you have in place to keep them engaged and loyal?

How scalable is your digital bank’s infrastructure and business model? Can your technology handle growth, and does your business model allow for sustainable scaling without burning through cash?

Why should customers trust you with their money? Beyond security, what are you doing to show your reliability and commitment to providing long-term value to customers?

The pursuit of solid answers to these questions builds a much more solid foundation and ensures that future digital banks don’t fade out into obscurity as Lanistar is destined to do.

Remember to like this edition and share it with a friend. I hope to be back in two weeks, but it might be three, depending on my work travels. So if you don't see an email in your inbox in two weeks, it should be there the following week 👋🏽

J.

P.S. No Spotlight this week, but if you know of any cool fintechs doing something new and interesting, drop me a message so I can feature them in future editions.

P.S.S. The next edition will be a deep dive on Saudi fintech and the big opportunities and I see in the region so if you or anyone you know is interested in that, make sure they’re fully signed up members of the Fintech R&R fanclub

Release Notes 📝 : Careem bringing fintech to the beach

Careem, the Middle Eastern super app offering rides, food delivery, bill payment and more is now going one step further with an interesting offering.

Beach umbrellas.

The aptly named ‘Careem Beach’ acts similarly to Carmeem Bikes and are GPS-tracked umbrellas which will be stored in stations at the beach entrance, which beachgoers can easily unlock with a quick scan. In addition, with Careem Beach, customers no longer have to worry about finding a shaded area or dragging an umbrella around. When they’re finished, they simply return the umbrella to the station for the next person to use. Umbrella users can also order Careem food and drink on the beach and riders can find the recipients by using the GPS in the umbrella.

It might be because I use Careem pretty much twice a day when I’m out in the Middle East but this is cool. Something similar for the UK might be GPS park blankets for those 2 weeks of the year when it’s hot 🤣

Interesting News 🗞

US Open Banking becomes official - The biggest news for me was the official finalisation of the US’s Open Banking rule, codenamed 1033. You can read my deep (very deep) dive about that below.

Fintech R&R ☕️ 📜 - The 411 on 1033. A US Open Banking standards deep dive

Hey Fintechers and Fintech newbies 👋🏽

Here’s what CFPB Director Rohit Chopra said about it.

“Too many Americans are stuck in financial products with lousy rates and service. Today’s action will give people more power to get better rates and service on bank accounts, credit cards, and more.”

That’s the hope but if it’s anything like the UK’s it’s going to need specific use cases, accountability for those not building interoperable rails, a proper long term funding model and a lot more than just good intentions. More on that soon

Thanks for the mention Jas 😘 Such an interesting and useful read - as always!