Fintech R&R☕️📮- Lessons Fintech can learn from the Post Office Scandal

A brief history of the PO, the big red flags that led to the scandal, lessons everyone in financial services can learn, and putting an interesting fintech in my Spotlight

Which King founded the Royal Mail in 1516 (a great quiz question)?

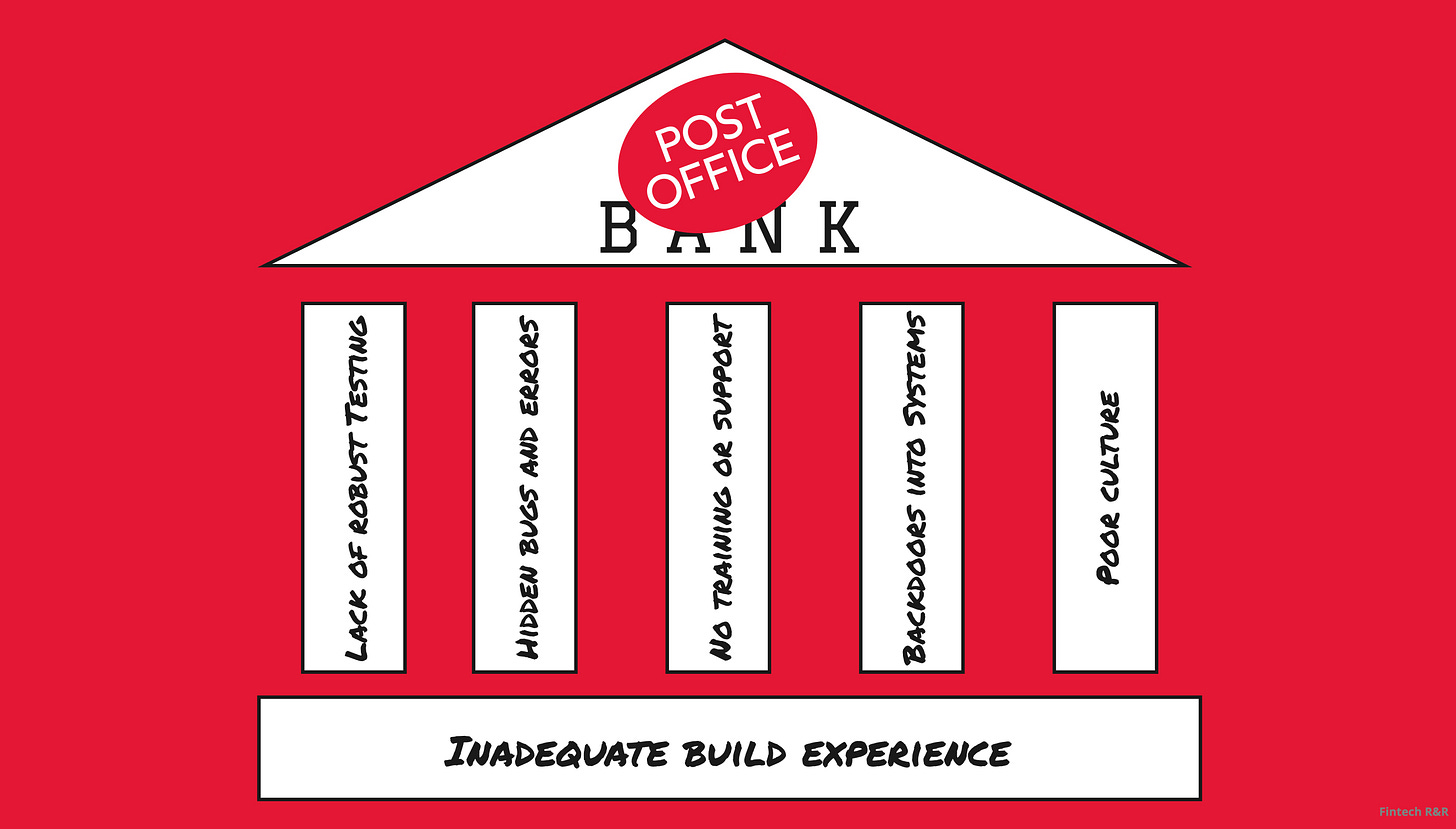

What were the biggest red flags of the Horizon implementation and rollout?

Why should dev houses and external agencies should be used with caution?

Why are operations just as important as the technology?

Which fintech is in my inaugural 'Spotlight' this week?

These questions and more will be answered in this week's edition of Fintech R&R

Hey Fintechers and Fintech newbies 👋🏽

Fintech News is in full flow and shows no signs of stopping.

Payment processor Adyen posted better than expected revenues, countering the "BaaS is Dead" many shout from the rooftops.

A week later, core banking solution Temenos decided to balance that argument after a damning report from Hindenburg Research (the most apt name) caused a 30% drop in their share price.

Temenos has refuted the allegations that caused the share price to plummet.

Then there's Monzo's mega milestone (intentional alliteration) of 9 Million personal account customers. It means they cement their position as the UK's seventh-biggest bank by customer numbers. I wrote a short post on why this is a genuinely big achievement from a product perspective.

And doing a final swing of the mini good news, bad news ping pong, we come to Paytm's woes.

Paytm is one of India's most popular digital wallets, making UPI-powered bill payments, retail payments, P2P and many other payment use cases easy and accessible for over 330 million customers. The trouble is, the Reserve Bank of India (RBI) suspects they've made it too easy to create an account and hundreds of thousands were created without proper IDV checks. They are also being investigated under the Foreign Exchange Management Act (FEMA) for potential violations of foreign exchange rules.

The concerns from the RBI led them to issue an order restricting Paytm Payments Bank from accepting new deposits or allowing credit transactions after March 15, 2024, causing Paytm's share price to plummet, wiping $2.5bn off the company's value.

NOTE: They recently partnered with Axis Bank to allow merchants to continue accepting payments through Paytm's QR code and terminals, settling through Axis as long as it's linked to other banks. That's some good news, at least.

This strong-handed and decisive action from the RBI made me think about the opposite slow march approach taken by execs during the UK's Post Office scandal because the Paytm news popped up as I was listening to a podcast detailing the intricacies of the disastrous implementation and rollout of the Horizon accounting system for the Post Office called The Great Post Office Trial.

The senior leadership and governing body approach wasn't the only parallel I saw between the fintech universe and the Post Office scandal.

As I listened to the story of this technological disaster, unfold, hearing accounts from sub-postmasters & mistresses of haphazard system changes, lack of user training, minimal testing, and limited stakeholder feedback reviews, I drew more comparisons with similar accounts from financial services, some of which I've heard from folks I trust, some I've heard second hand and some I've experienced directly in my 16 years in the industry.

So, as you've probably guessed, even if you didn't read the header, in this slightly broader scoped edition, I'm looking at…the lessons FS can learn from the Post Office scandal.

As well as interesting news, puns + movie references, this edition includes the following:

History of the Post Office

Key Services provided by the PO

1999-2024 Key events in the Horizon Scandal

The big red flags during the scandal

Limited Build Expertise

Inadequate Testing

No Transparency of Bugs and Errors

Lack of Training and Support

Hidden Backdoors

Lack of Accountability and Poor Culture

6 Lessons Fintech can learn from the Horizon scandal

The inaugural Fintech Spotlight

Now let’s get into it 💪🏽

NOTE: Click this link to read the web version or hit the ‘View entire message’ at the bottom of the mail as some email clients trim the emailsPost Office Scandal timeline 📮

It'd be remiss of me to do a write-up on the Post Office scandal without doing a brief background into the Post Office, the essential services it provides and how the scandal came about. There are many from outside the UK reading this that have never experienced the Post Office, know its position is most communities, and why this became (and is still) a huge issue for regular folks. So before we get into what happened and its relevance in building and transforming financial services, let's get everyone on the same starter block.

A brief history the Royal Mail and Post Office

The UK post office has a rich history dating back to ancient times, with formalised postal systems established by the Romans in 45AD and later by King Henry VIII, who founded the Royal Mail in 1516 and knighted the first Master of the Posts, Sir Brian Tuke to create a postal network primarily catered to the monarch and government officials.

However, one of the most significant milestones came in 1840 when Rowland Hill introduced the Uniform Penny Post, standardising postage rates and allowing letters to be sent anywhere in the UK for a penny.

This innovation revolutionised communication accessibility.

Throughout the 19th and 20th centuries, the post office expanded its services, introducing innovations such as postage stamps, postal orders, and parcel post. In 1969, the British government nationalised the General Post Office (GPO), forming the Post Office as a public corporation. Later, in the 1980s and 1990s, privatisation and restructuring efforts separated Royal Mail from the Post Office, with the latter retaining its role in providing postal and financial services as a public (government-run) organisation.

There are other respected regional postal service organisations like the United States Post Service, Japan Post and Australia Post. Still, the UK Post Office is recognised as one of the earliest postal systems.

In the 21st century, the Post Office continued to modernise and diversify, offering banking, currency exchange, and retail services. Despite declining letter volumes and increased competition, the Post Office remains a vital part of the UK's infrastructure, providing essential services to communities nationwide while adapting to technological advancements and facilitating communication, commerce, and social connections.

Part of the Post Office's vital services include:

Postal Services: This includes postage stamp sales, prepaid envelopes, and packaging materials for sending letters and parcels.

Financial Services: The Post Office offers a variety of financial services, including savings accounts, current accounts, mortgages, insurance products, and foreign currency exchange.

Government Services: Many government transactions can be completed at Post Office branches, such as paying bills, renewing vehicle licences, and applying for passports.

Retail Services: Post Office branches often serve as local retail outlets, offering a range of products such as stationery, cards, gifts, and mobile phone top-ups.

Identity Verification: Post Office branches provide services for verifying identities and issuing official documents such as driving licences and biometric residence permits.

Digital Services: The Post Office has adapted to the digital age by offering online services, including postage labels, bill payments, and parcel tracking.

The importance of the Post Office to individuals and communities is not only down to the services it provides but rather the combination of the services with the number and positioning of branches across the UK.

The latest figures put the number of Post Offices around the UK at 11,684, many of these in villages and areas where shops and access to services is limited.

For context, Lloyds, the UK's third largest bank, has the most physical branches of all the CMA9 with 1,195, according to analysis conducted by finder.com. That's 10,000 less than the Post Office.

This just highlights the breadth and value of services the Post Office provides. Not only that, but the number and spread of branches across the country, often the only local source of such services, including groceries, serves as an important reminder of the value of the Post Office as an institute for the millions of people and thousands of communities that still rely on it through necessity, convenience, or community connection.

Event Horizon 👩🏼🚀

Anyone who has worked for an FS institute founded before the 1980s has some experience with a technology transformation project. I've been at three big FSs when they were looking to bring their entire tech stack into the 21st century. Often, the needs and motivations for the project are sound–wanting to upgrade their entire technology stack so that products can be built faster and more robustly and data can be shared internally and across product lines rather than remain siloed. In my experience, it's not the overarching objectives but the upgrade plans, the execution, and decisions during the implementation that usually lead to failed transformation projects.

The Post Office is no different in this regard. The reasoning behind the upgrade was sound; however, the plan and the critical decisions during the build and the implementation led to disastrous results.

Background & Objective: Prior to the Horizon system, sub-postmasters–the self-employed business operators approved by Post Office Ltd to act as their agents in running Post Office branches–used physical tills and receipts to calculate their accounts and submit records to Post Office Ltd, which would tally how much cash would be at each branch based on sales.

Horizon was a multifaceted system with a physical electronic point of sale (EPOS) system, under-the-counter computing hardware, digital screens and a centralised accounting platform that would take the burden of paper accounting out of postmasters and subpostmasters hands, saving them time and effort, allowing them to manage accounts digitally often at the click of a button.

At the time of the announcement of the system and development of the platform by Fujitsu, it was welcomed by all (postmasters included) and during the rollout, Fujitsu lauded it as the "largest non-military IT system in Europe".

That's where the positivity starts and ends.

1999: Introduction of Horizon: The Post Office introduces Horizon, a new computerised accounting system developed by Fujitsu, intended to modernise operations and streamline financial processes. A senior developer on the project said to Computer Weekly recently that during the months leading up to the rollout, Horizon's problems were well known inside Fujitsu.

Early 2000: Reports of issues: Postmasters and mistresses, aka PM's (this is the only edition where PM doesn't refer to Product Manager) began reporting discrepancies and irregularities in their accounts, including unexplained losses and discrepancies that they could only attribute to the Horizon system. Alan Bates, who ran a post office in Craig-y-Don, Wales, was one of the PostM's who raised an issue with the system after £6,000 appeared on his books. Because he had technical expertise he was able to directly attribute this discrepancy to duplicate transactions in the system.

2000-2002: PostM's convicted by Post Office Ltd: PM's who reported discrepancies in their accounts due to multiple issues with the Horizon system, double counting transactions, not correctly capturing cash balance and numerous other issues, were told by the Post Office that it'd couldn't be the system as no other offices were reporting such issues. This was clearly not true. The Post Office chased PostM's accusing many of being directly responsible for the shortfall (gambling the money, stealing it and many other accusations). Many made up for accounting shortfalls by dipping into their own personal funds to make up the difference, taking money out of savings, using personal loans and remortgaging properties to pay the Post Office back for an incorrect accounting discrepancy of the systems making. Many who couldn't pay the Post Office were convicted and had criminal records. Some were sent to prison.

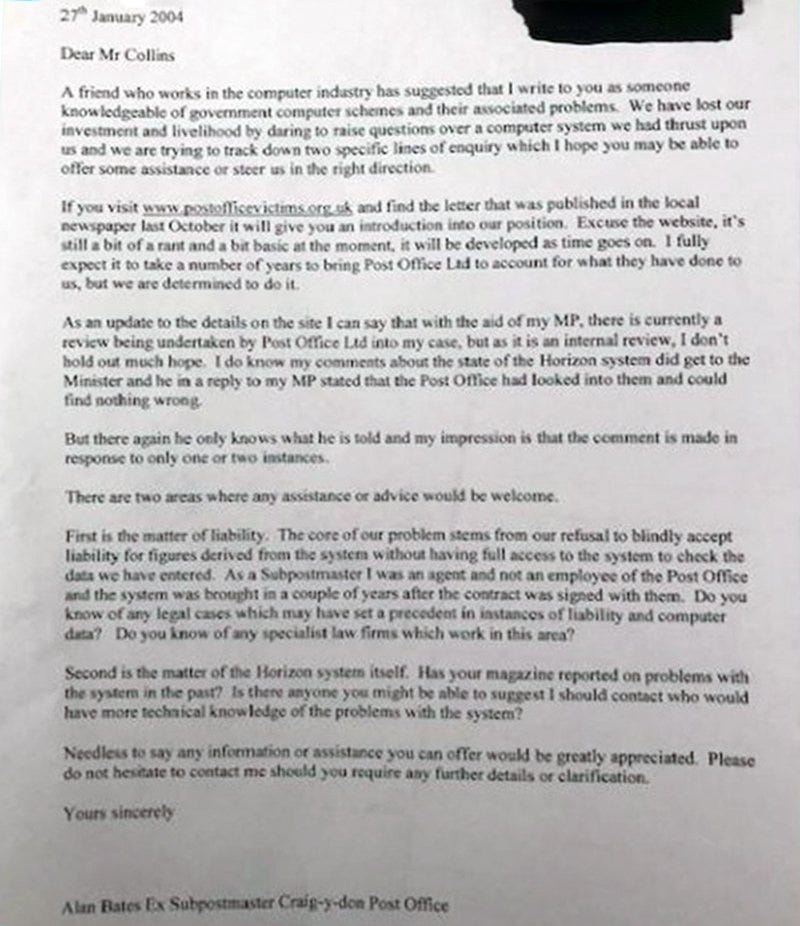

2003: Alan Bates' Contract Terminated: Alan, one of the central characters and heroes in this story, had his contract with the Post Office terminated after he refused to accept liability for alleged losses at his branch. Months later, he sent a letter to Computer Weekly explaining the ongoing issue and requesting exposure and expertise to do an in-depth analysis of the problems he and others faced.

2004-2009: Continue issues, prosecutions and denial: Many more face issues with the system and continue making up accounting shortfalls through personal funds (effectively paying the Post Office back for debts that have been erroneously created through the system), taking Post Office Ltd to court and ultimately failing or settling for smaller amounts, and all the while being told they are the only ones facing issues with the system.

2009: Computer Weekly Article Published: The first mainstream media article brings the issue to the public and, more importantly, to the eyes and ears of other Postmasters facing the same challenge but being told they were alone. Shortly after the article went mainstream, Alan and other victims of the Horizon scandal set up the Justice for Sub-postmasters Alliance (JFSA) to support postmasters affected by Horizon issues and to investigate and raise awareness of the problems faced by postmasters across the UK.

2012-2015: Second Sight Investigation: In 2012, the Post Office appointed Second Sight, an independent investigative firm, to conduct an inquiry into the system issues after pressure from MPs. Over the course of several months, Second Sight analysed data, reviewed documentation and assessed the functioning of the Horizon system. Their initial reports raised serious concerns about the reliability of the system, identifying potential software defects, system errors, and operational issues that could lead to financial discrepancies.

They published interim reports in 2013 detailing their findings and preliminary conclusions regarding the Horizon system and its impact on postmasters. These reports highlighted systemic problems with Horizon, including software bugs, lack of transparency, and inadequate support mechanisms for postmasters experiencing issues.

In 2014, after completing their investigation and issuing final reports, Second Sight concluded that Horizon was responsible for the financial discrepancies and inaccuracies in branch accounts. Their findings corroborated the claims of postmasters who had long maintained that they were unjustly blamed and prosecuted for accounting errors that were actually the result of Horizon system failures.

Although many of the reports were confidential and for Post Office Ltd only, a version was published online via a journalist in 2015 in which the system was described as 'not fit for purpose'.

2017: Group litigation: 555 claimants, led by Alan Bates, brought a group litigation against the Post Office at the High Court.

2019: High Court ruling: The High Court ruled that the Horizon system was responsible for errors leading to financial discrepancies. The court criticises the Post Office's handling of the issue and its treatment of postmasters. The Post Office did not accept liability, making it a cost settlement, not compensation.

2021: Exoneration of Postmasters: The Court of Appeal overturns the convictions of 39 postmasters who were wrongly accused of theft, fraud, or false accounting due to Horizon-related discrepancies. 39 out of 900 convicted…This led to a significant reassessment of the Post Office's actions and the impact on affected individuals.

2024: Mr Bates vs The Post Office Reignites Public Interest: Mr Bates vs the Post Office, a four-part drama depicting the events of the scandal, is broadcast on ITV. It is reported that 50 more victims came forward after its broadcast. This was just one of the positive outcomes of the show. It also gave clarity to the entire public on the issues and how PM's were treated during the rollout and subsequent years. The majority of the country was outraged. The Prime Minister, Rishi Sunak, talked about introducing legislation to exonerate sub-postmasters convicted in England and Wales. It also emerged that Post Office investigators, the team responsible for reclaiming the missing cash that was, in fact, due to system error, were offered cash bonuses for every sub-postmaster convicted during the Horizon scandal. Meaning they were incentivised to convict sub-postmasters rather than get to the root cause of any system error.

This isn't the end of the saga.

There are still 100s of sub-postmasters with wrongful convictions to their names. Many who went bankrupt and have that black mark following them around. And many who lost their lives during this mess.

Justice is yet to be fully served.

This timeline serves as an effective reminder of some of the key, largely pubic-facing events, but to really uncover the lessons Financial Services (Fintechs, Banks, Insurers, Lenders and everyone in between) can learn from this debacle, we need to highlight some of the major red flags that popped up during the implementation, rollout and running of Horizon that went unaddressed.

Ghosts in the Machine 👻

These are the major red flags I've identified from the knowledge in the public domain, whistleblower testimony and sub-postmaster accounts that should have been used to identify issues, stop/reverse the rollout and lead to an investigation.

🚩 #1 - Fujitsu team's inadequate build experience and expertise

It's clear from the accounts and testimony that the system wasn't built properly in the first place. The Second Sight report was pretty damning, where they summarised by describing the system as not fit for purpose. This is one of many testimonies pointing to a lack of expertise and understanding from the outset.

A Senior Developer contracted by Fujitsu in 1998, and at one point held the title Horizon Epos development manager, told Computer Weekly:

"To my knowledge, no one on the team had a computer science degree or any degree-level qualifications in the right field. They might have had lower-level qualifications or certifications, but none of them had any experience in big development projects, or knew how to do any of this stuff properly. They didn't know how to do it."

The biggest red flag and what ultimately led to an inadequate system being built and rolled out.

Imagine, for example, building a neobank where customers would use a card to spend at merchants, and some of these authorised transactions would erroneously double debit a customer's account?! This is just one of the systematic issues faced by PMs as transactions were frequently double-counted in the Post Office's central system, causing gaps in finances that PMs were responsible for.

🚩 #2 - Inadequate User Testing and Go-Live process

Standard procedure for large-scale system rollouts is to have a go/no-go call with relevant criteria preceded by a period of extensive testing. Any bankers here will know that's part of digital transformation projects 101.

At the very least, a parallel testing process, running both the old and new system side by side for a reasonable period of time (minimum three months to capture some month ends), allows the end users to get to grips with the system and run regular reconciliations. Any issues that arise during testing are reviewed, any relevant changes made, and a second round of testing ensues until all major bugs are ironed out.

This is nothing new. I've done it at all the large financial organisations I've worked for, and although it can sometimes feel like overkill, it mitigates A LOT of the new system implementation risk.

The go-live process then takes in findings from testing and is an assessment against a pre-set list of criteria (based on the initial system requirements), whether to go live or not based on functionality and severity of existing issues. In this case, Fujitsu knew there were several major issues in the system and went live anyway.

A Fujitsu developer, Richard Roll, who did go on the record, said this to the High Court:

"The issues with coding in the Horizon system were extensive. Furthermore, the coding issues impacted transaction data and caused financial discrepancies on the Horizon system at the branch level."

🚩 #3 - No Transparency of Bugs and Errors

In the early days of the rollout, when PMs complained of issues with the system, they were told that no other branches were facing the same issues and that they were unique. This was, of course, false.

One, named the "Dalmellington Bug", would see the screen freeze as the user was attempting to confirm receipt of cash. Each time the user pressed "enter" on the frozen screen, it would silently update the record. In Dalmellington, that bug created a £24,000 discrepancy, which the Post Office tried to hold the post office operator responsible for.

Another bug, called the "Callendar Square bug", created duplicate transactions due to an error in the database underpinning the system: despite being clear duplicates, the post office operator was again held responsible for the errors.

These bugs that were raised in the months and years after

🚩 #4 -Lack of Training and Support

Some postmasters expressed frustration over the lack of adequate training and support provided by the Post Office for using the Horizon system. Insufficient training materials, limited technical assistance, and a lack of understanding of the system's functionalities contributed to difficulties in operating the system effectively and resolving issues as they arose.

It was indefensible for a system as fundamental as this to so many branches to have a poor training and support process. This, coupled with the lite touch user testing and go-live process, meant that PMs were at the mercy of the system and had limited recourse or understanding when things went wrong.

🚩 #5 - Backdoors into Systems

One early point of contention was remote access to branch computers from the central Post Office by support staff and engineers. This was clearly an access control issue, as only in extreme cases should support staff or engineers have access to client systems because of the sensitivity of the platform, how it captures transactions and its importance to the dual-accounting process.

The Post Office denied that any backdoors existed, but evidence later proved that this was false again. Backdoors did exist and were used to amend branch system records to reflect incorrect positions logged by the central system.

There are occasions where backdoors into systems are needed, but these should be highly controlled and have a clear audit flow.

Using the customer transaction and neobanking example again, it'd be like going into and amending an individual's customer balance to make up for a discrepancy with the overall deposit number in a core banking platform.

🚩 #6 Poor Accountability and Company Culture

This one could have negated all the previous flags.

It was clear that there were issues with the system and the way it was built. As many, including the independent investigator, stated, 'it was not fit for purpose'.

But the way no one in the Post Office stood up and took accountability for the bad product they paid Fujitsu to build, the poor launch strategy, the lack of training on the system, the lack of transparency with issues and everything else in between is inexcusable.

The previous five flags can all be activated, and the financial & mental toll put on PMs could have still been avoided if the Post Office had simply acknowledged that there were issues, conducted a proper investigation, listened to PMs, reviewed the existing bugs and looked to rectify all issues.

There's an argument that senior management can use the excuse of ignorance to deny the gravity of the situation.

But that argument falls down when you find out that during this period of system issues and erroneous double counting leading to shortfalls that sub-postmasters had to make up, there was a bonus scheme in place for Post Office investigators, which meant they were compensated for every conviction postmasters received relating to the issue.

They were effectively incentivised to convict postmasters who couldn't make up the shortfall within a given timeframe. One of the individuals assigned to recover money from postmasters was Gary Thomas. He told the official inquiry into the scandal that there were "bonus objectives", including a 40 per cent "loss recovery objective", available to his team.

And when asked if it influenced his behaviour, he said: "I'd probably be lying if I said no because… it was part of the business, the culture of the business of recoveries or even under the terms of a postmaster's contract with the contracts manager."

Clearly a culture and accountability issue.

Look.

Of course, the fundamental issue was building a system without the right knowledge and understanding of dual accounting as well as the core principles required to build a robust, high-transaction distributed system, but it's all these red flags together that led to today and not just a poorly built, inadequate system.

Learning from a 1st Class Mess 🎓

So what are the learnings?

Well. There are a few.

I could take a simplistic approach and say, ‘Do the opposite of what they did,’ but I will add some nuance and give specific takeaways.

🎓 Lesson for…Anyone outsourcing development: Use external agencies and dev houses with caution

Firstly, you never know who will actually be building the product and how proficient they are. Secondly, the likelihood of the organisation you outsource to having domain knowledge is low, especially if you're outsourcing due to budgetary constraints. So ensure you build in a period of acceptance testing before anything is fully handed over and build contingencies into the contract in case the end result isn’t fit for purpose.

The exception, of course, is if you’re working directly with an individual specialist consultant 👀

🎓 Lesson for…Fintechs and FS building any product: Don’t underestimate the power of SMEs

Subject Matter Experts are your best friends when building any product but, especially in finance. They can help navigate through complicated technologies, help make sense of the standard practices within a domain, spot issues on the horizon (I intentionally left this obvious pun for the end), and be an initial tester for the suitability of a product. A product manager or strategist is often the source of this expertise but many engineers, commercial, operations experts and others can bring this knowledge.

Also, when they give you multiple warnings about something likely to go wrong, heed their warning. It’ll work out better for you in the long run.

🎓 Lesson for…Large internal FS system transformations: Big Bang launches are risky so avoid them (if possible)

Where possible, you shouldn’t launch a new system in a Big Bang fashion as part of a significant transformation. There are, of course, exceptions where systems are so intricately linked that launching for a small group of users or running systems in parallel just isn’t feasible. But other than those cases, the aim should be to launch it for a small group of users or for a small use case, allow the system to run stability in production, review performance and then make a decision on the broader rollout.

The other reason to prioritise a phased rollout is that you’re not likely to catch all the bugs and issues during testing. Some will arise when using the system in earnest. So it’s better to have these bugs appear in a small controlled group rather than for everyone, everywhere, all at once.

🎓 Lesson for…New product or system launches: Bake testing & feedback into the delivery plan

Beta testing is commonplace now. A great way to get some feedback from customers and to test if the product is working as expected. A common mistake, however, is to have a short beta testing phase and no time to review, assess and implement any feedback from customers. I don’t believe the old adage that “the customer is always right”. But customer feedback is vital at this stage in understanding whether the product is fit for purpose, how well it resonates, whether major bugs need to be addressed or whether a complete pivot is needed. Either way, ensuring that there’s enough time as part of the launch plan to listen to and incorporate any feedback is vital.

🎓 Lesson for…Fintechs looking to scale: Prioritise operations, not just technology

As I’ve outlined in some of those big red flags, it wasn’t just that the tech didn’t work. Some of the fundamental processes that should have been in place to protect against the inevitable contentious issues arising weren’t there. For scaling fintechs in particular, putting in place scalable processes for customer support, issue capture & resolution, standard operating procedures and training manuals for internal staff, ‘break glass’ processes for customer emergencies, along with audit processes where relevant, are just as important as the technology itself.

🎓 Lesson for…Founders, CEOs and all leaders in FS: Culture precipitates from the top, so lead by example

This is intentionally aimed at all of those in leadership positions, not just those at the top.

Another of the clear takeaways from the Horizon scandal is that decision-making, especially at challenging times, is critical and is often a signal to the culture of the organisation. While postmasters were dipping into their savings to cover shortfalls caused by a faulty system, Post Office enforcers were being incentivised to convict them. It is out of touch and a cultural issue that came from the top.

So, take culture seriously because it impacts how your team works with each other, talks to customers, behaves at events, works with other organisations, and much more. It’ll ultimately be reflected in the way your company is perceived.

Set a positive example and take people on the journey with you because it’s a surprisingly small industry despite the number of people in it. You might find yourself looking for new employees, investment, a partnership or big bang integration, but if your company culture stinks, people will smell it and steer clear.

As I said, these are just some of the lessons to take away from the scandal. Reading the history and big red flags, you might see some more. If so, let me know what your takeaways are.

I had an alternate ending for this edition with a deeper look at the post office network, the existing services it provides and its potential as a UK wide community bank but I’ll save that for another time as I think I’d do it a disservice by cramming it at the end.

Instead, I’ll just say that while we in the industry constantly talk about everything going digital and moving to a cashless society, it’s easy to forget about those who still rely on cash and the services the Post Office and postmasters provide to support this huge transition to the cashless future many laud.

I prefer to frame today as a ‘less-cash’ society, and through that frame, I see the value the Post Office brings to those in remote locations and communities not just as a way of depositing cash and supporting the transition but potentially being the long term physical banking hub that many will need over the coming years…

Don’t forget, if you enjoyed this edition, drop a like below, fire over your questions and share with a friend! Back again in two weeks!

Fintech Spotlight 🔦

This is Fintech Spotlight. Each week I’ll tag a fintech that I think is interesting, has a cool new feature, or is just hyper relevant to that edition.

In this inaugural edition, I’m highlighting Zeed.

It’s a UK app aimed at Gen-Z, providing investment content (not advice) and the ability to execute using your existing broker without leaving the app.

You might remember that in an earlier edition talking about PFM, I referenced the future of financial management as influence led.

This is what I meant.

Curated swipeable content

Informative reels

AI powered investment insights

Insightful Creators

A very cool, on base product with engaging features, making use of existing Gen-Z digital habits from TikTok to educate and bring a younger audience to the world of investments.

Check out their app whether you’re Gen-Z or a Boomer.

Interesting News

Mollie launching in the UK - Having led product for an SME Lender recently and done research into the UK SME landscape, I see the size of the market and the problems they continue to face. The competition is good for the market and therefore good for SMEs, so the Netherlands-based financial services provider expanding it’s offering to the UK can only be good news for all

And Finally…

I recently discovered an interesting newsletter relevant for embedded finance enthusiasts or fintech builders in the retail space called MarketMaze. It’s the #1 Marketplace & Ecommerce newsletter to keep professionals ahead. The newsletter keeps anyone building in the space up to date on what happens and matters in marketplaces & ecommerce designed by a former strategy consultant.👇🏽