Gearing up for a Payments Revvv-olution 🏎

A deep look into In-car Payment Systems (ICPSs), the size of the mobility payments markets, the companies already innovating in the space, and what the future holds for embedded vehicular finance tech

How big is the automotive payments market projected to be?

Where are the opportunities in automotive payments?

Can an in-car payment be better for the environment?

Why will Telematics transform automotive focussed fintechs from insurers to financiers?

Have I embedded a Back to the Future reference in this edition….?

These questions and more will be answered in this week's edition.

Hey Fintechers and Fintech Newbies 👋🏽

I'm back with a 'normal' edition that will have a certain throwback feeling to some of my earlier write-ups, with an abundance of on-topic puns and movie references.

It's in an area that has been somewhat in my blind spot (the puns start early), and it's inspired by a couple of things.

The main one was an event I was at last month hosted by Attenda, a payments company focused on fuel and mobility payments, with lots of industry folks at Visa HQ. The event started with a live podcast with Stuart Butler, Director of FordPay and Open Banking at Ford, Ben Boutcher-West, CTO at Connected Kerb, and Visa's Head of Fleet and Mobility Payments, Richard Campion, led expertly by Attenda’s Matt Oldham.

NB. I bet you didn't know Visa had an expert dedicated to vehicular payments, did you? Well, you do now.

I couldn't stay for the breakout sessions, but it was one of the more fun, interactive and insightful fintech evening events I've been to in a long time where the pod guests and we in the audience discussed a range of challenges with 'mobility payments' which refers to payments and all things fintech covering vehicular transport and includes things like electric cars, paying for fuel, car charging, and covering car and van fleet payments and expenses for businesses.

The second bit of inspiration came last week when I was driving back from Cornwall to London.

In the UK, the long Easter Weekend is an excuse to take a trip and make the most of the two additional public holidays. After making our way back to London and filling up at a petrol station (we call it petrol over here, but it's a gas station for you Americans), I went into the station to pay, and about 10 minutes later, we found ourselves at the very front of a jammed motorway. When I stepped out of the car on the jammed motorway/highway, I thought:

"Ahh, if only I could have filled up and then paid from my car. We would have saved about 4 minutes, missed the traffic, and been well on our way back home."

These two bits of inspiration triggered this week's re-ignition of the mobility payments topic (I did say it'd be a pun-packed edition).

I touched on mobility payments last year when I spoke about Mercedes Pay+, but as a Londoner and, therefore, an infrequent driver, it's a topic that's traditionally been in my blind spot, which today, I'm putting in full view.

Here’s what to expect in this shorter, sharper edition:

The projected car payments market

The difference between mobility & fleet payments, and everyday payments

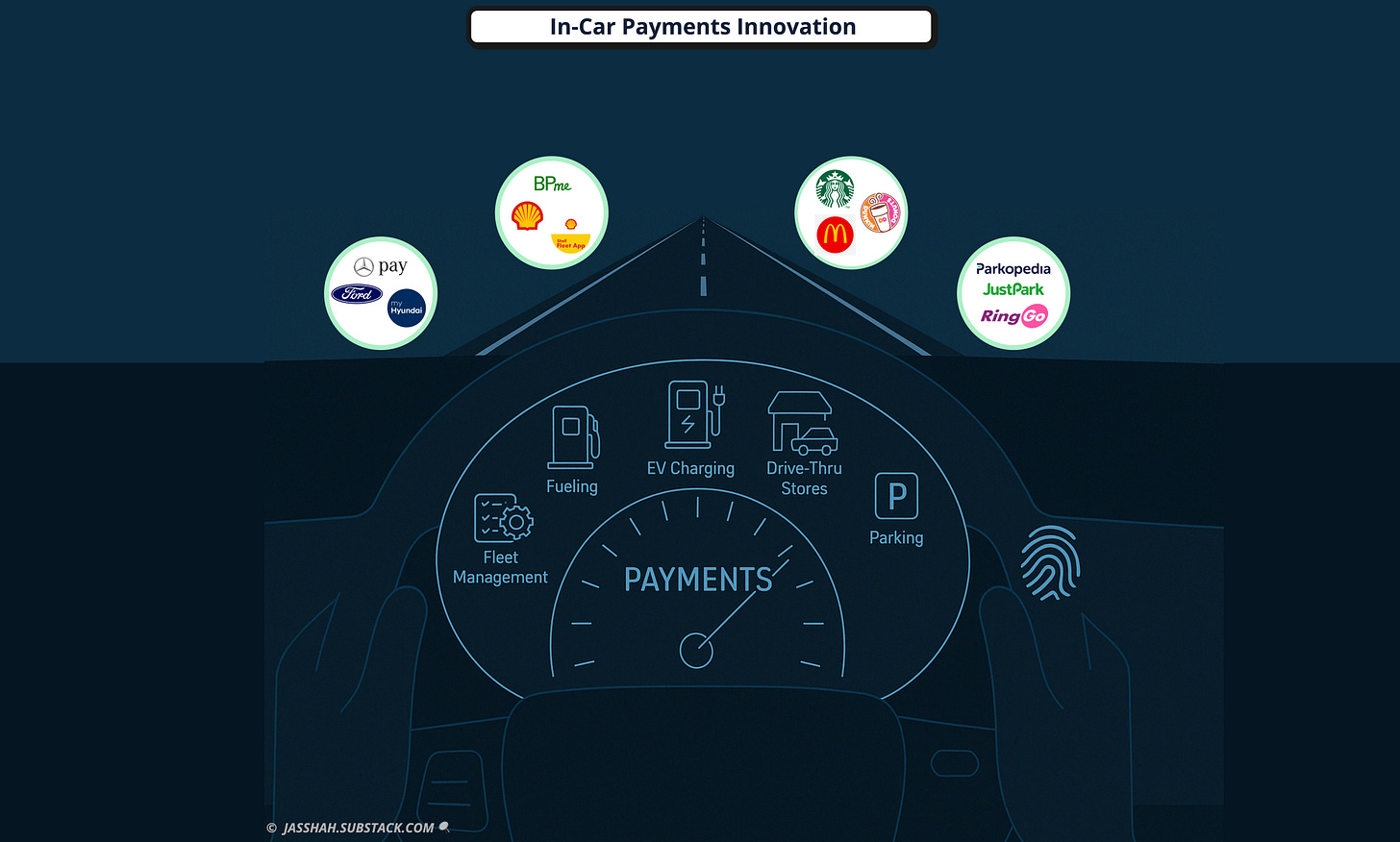

Use cases for CarPay or Pay by Car

Fuel

EV Charging

Tolls

Parking

Drive-Thru’s

Fleets

Examples of Mobility Payments in the wild

Mercedes Pay+

Hyundai + Parkopedia

BP Pay/BPMe

The Power of Telematics in Fintech

Interesting News🗞: Revolut’s Annual Letter

Fintech Spotlight🔦: Connected__Kerb

Lights out and away we go 🏎

Driving the Point Home 🛞

There are over 40 million vehicles on UK roads today (cars, buses, mopeds, trucks, vans, etc), with just under 33 million licensed cars as of 2024. That's a lot of windscreen wipers and a lot of potential payments being made every single day. Whether it's filling up at a forecourt, charging up an EV, paying for a parking spot, or hopping on the M6 toll road, the average driver in the UK is making multiple mobility-related payments a week.

And when it comes to fleet, the scale shifts into high gear.

There are around 4.7 million company cars and vans registered in the UK, with over half a million fleet-operating businesses relying on efficient, transparent payment systems for fuel, maintenance, charging, tolls, and more.

Mobility and fleet payments are, in many cases, mission-critical.

Globally, the automotive payments market, which includes in-car payments, fuel, EV charging, tolling, parking and more, is projected to reach $580 billion by 2030, powered by connected car technology, e-mobility trends, and the growing desire to make payments feel invisible.

So what about payments…?

The idea of car-based payments isn't new. Fuel cards have been around since the 1960s, originally introduced as simple charge cards for petrol purchases. Fleet managers loved them because they offered some control and visibility, though it was traditionally limited to end-of-month reporting and chasing down lost receipts.

Fast forward to the 2010s, and we start to see the early rumblings of in-dash payment systems. Companies like Visa and Mastercard began experimenting with connected car partnerships, working with automakers to embed payment modules into infotainment systems. Mercedes-Benz were one of the first to launch something close to a fully integrated experience with Mercedes Pay+, allowing users to pay for fuel and parking from their dashboards, no phone or wallet required.

But despite these innovations, most car payments today still happen outside the car, as demonstrated by my earlier frustrated refuelling incident.

Whether you're tapping a card at the pump or using an app to pay for a charge session, the industry is still navigating what a truly frictionless, mobility-native payments experience should look like.

The sector is now gearing up for big changes in automotive payments, and a few macro trends are contributing to this:

The rise of connected cars: Over 95% of new vehicles sold in the UK today come with embedded connectivity, creating a platform for embedded payments.

The boom in EV adoption: More than 1.1 million EVs now roam UK roads, creating new habits, use cases, and pain points around charging and paying.

A shift to 'on-the-go' commerce: Cars are increasingly being treated like a new retail channel, with companies like Hyundai and GM partnering with Starbucks, Shell, and others to enable in-vehicle payments.

(Nissan) Micro Trends 🚙

There are macro trends driving new innovation, but also some micro pains sparking change:

Fragmented systems: Whether you're a solo driver or managing a fleet, mobility payments are notoriously fragmented. Different apps for parking, EV charging, tolls, congestion zones, and fuel. It's app overload.

Fraud & misuse: Fleet managers are constantly chasing receipts and fighting fraud. Fuel card misuse alone costs UK businesses millions a year.

Poor UX: We've all had that moment at a petrol station pump. Insert card, enter PIN, wait, try again, pump not working. Or worse, the PIN pad has been removed, which many forecourts are now doing to push users into app-based or pre-authorised payment flows, especially for unmanned stations.

EV complexity: As EVs gain traction, drivers need to navigate a whole new layer of payment quirks. Variable pricing, dynamic charging speeds, location-based tariffs, and dozens of charging networks (with different apps, of course).

Fleet admin headaches: For businesses, reconciling who paid what, where, and why is often still stuck in the dark ages of paper receipts, spreadsheets, and monthly expense panic.

The Road Ahead 🛣

There’s a reason I think we’ll see big changes in automotive payments now.

We’re hitting an inflection point.

With embedded finance, vehicle telematics, and open banking/finance/data all converging, the industry is finally starting to reimagine how mobility payments could work.

Instead of reactive, clunky, and often manual processes, we’re seeing a future where payments are:

Proactive: Your car knows when you need fuel or a charge and suggests (and can book) the best spot nearby for a discounted rate.

Seamless: Authentication happens via biometrics, car ID, or even geolocation and the payment is triggered automatically.

Consolidated: One interface or provider manages all types of vehicle-related payments, with real-time visibility and smart controls.

Integrated with finance tools: From automated expense management to AI-powered vehicle budgeting for fleets.

All of this presents a juicy opportunity.

Bring modern, embedded payments into the driving experience where drivers can authenticate with a fingerprint, facial recognition or even voice while seated in their car, and pay seamlessly for whatever’s needed.

The reality though, is that this will be driven by industry players, not customer feedback, as most drivers are stuck in a jam and not able to see the potential of the road ahead (I'll admit, that one was a bit forced) 😆

The car manufacturers, fuel providers, retailers, and other industry experts will be the ones to drive the change, with folks like Visa, Ford, Connected Kerb, and Mercedes already stepping on the accelerator.

Fast and Furiously Innovative 🧠

Based on the event I went to last month, some of the experts I spoke to, and some of the areas I've looked into myself, there are some key areas in which automotive payments innovation will hit hard and fast.

Fuel ⛽️

This is the obvious one for non-EV drivers

Although 2024 saw battery electric vehicles (BEVs) account for nearly 20% of newly registered vehicles, most cars on the road today are still non-electric, so petrol stations are still vital to fleet and private vehicle refuelling.

Now, think about the majority of refuelling experiences you've had.

You check your fuel indicator (my usual baseline for a refuel is about a 5th of a tank remaining), figure out where the nearest station is, head to the pump, fill it up, go into the station, pay, and then jump back into the car and on the road.

As I mentioned in my example earlier, the process is inefficient.

Yes, in the UK, you still have to get out of your car to refuel, but there's no good reason why the customer can't get back into their car, give a fingerprint authentication on their dashboard, and have the relevant total debited from the car connected to their CarPay account. That's what the likes of Mercedes-Pay+ are looking to do.

But it shouldn't stop at basic payments.

What about a system that knows when you like to refuel (again, in my case, it's at the conservative 5th of tank level), maps all the available petrol stations within range, and selects the most cost-effective one or one where you already have a loyalty scheme?

There are many more 'smart loyalty and payment' use cases here, but the simplest one is embedded car payments for a better customer experience.

EV Charging 🪫

Yes, BEVs only accounted for around 20% of newly registered vehicles in the UK last year, but last year saw record annual EV volumes, and that number is only going one way.

EV charging is more ripe for innovation than fuel.

Why?

Because the pain points are bigger, charging sessions take longer, prices vary wildly depending on provider and location, and there's often no standardised way to pay. You might need a card, app, RFID fob, or even a subscription.

In some cases, all of the above.

Embedded EV payments, where your car recognises the charging station, authenticates your account and starts the session automatically, are already being tested. But smart systems could go further:

Pre-booked charging bays based on your route and battery level

Price transparency built into the car's dashboard UI

Dynamic pricing suggestions: "Charge now or wait 10 miles for a better rate."

Auto-pay with connected loyalty schemes (e.g. you get extra points if you charge off-peak)

Right now, drivers are juggling too many apps and networks. In the future, it could and should be as seamless as plugging in and driving off.

Tolls 🪙

Toll payments are one of the OGs of mobility payments, and yet, they still feel clunky in many parts of the world. While London's Congestion Charge and Dartford Crossing have moved to Automated Number Plate Recognition (ANPR), there's plenty of room to evolve in the UK and around the world. There are still many tolls where you drive up, have to stop the car, fumble around for a card, and, in some cases, coins, which can mean minutes lost to a journey, but also fossil fuel emitting vehicles sitting idle for extra unnecessary minutes.

Imagine a system that:

Automatically recognises toll points and charges without needing tags or manual payment

Offers in-car notifications when you're entering a toll zone

Shows real-time spending, receipts, and even company-specific toll breakdowns for fleet users

So, drive towards a barrier, and it scans your plate and sends a message to your vehicle about the toll required; you authenticate using a fingerprint scanner on the steering wheel and continue to drive at a similar speed as the barrier rises.

Imagine the savings to the environment if every toll payment worked like that and the two minutes of reduced idling time for every vehicle that went through the toll. Not forgetting, of course, the extra two minutes given back to the vehicle occupants.

Parking 🅿️

We've all experienced the eternal struggle of finding, paying for, and managing parking.

I experienced it on my recent trip away. Paying for a ticket, then having to rush back to the spot 4 hours later to renew after dinner ran over.

The problem?

There's no standardised system. Different councils, car parks, and street bays all use different apps or meters.

Fragmentation is the challenge, and integration is the unlock. What if your car could:

Detect when you've parked and automatically launch the correct local parking provider

Let you extend parking time directly from your car's dashboard or a linked app

Alert you to nearby spots based on location and availability

Find the cheapest parking available

Pay and reconcile parking costs seamlessly in your CarPay account (with receipts pushed to your expense system for fleets)

The likelihood is that apps like JustPark and RingGo will be the dominant intermediary here, as they have already built the integration and coverage across a range of parking spots around the country.

However, integrating these directly into the dashboard and being able to initiate and complete the experience, including the payment journey, is a step in the right direction for ideal CX.

Drive Thru Stores 🍔

We're in a culture where convenience is king. That's part of why drive-thru remains a staple in retail, Quick Service Restaurants (QSRs), and now pharmacies and grocery stores. Mcdonald's pioneered the method, and the likes of Starbucks and Subway have leveraged it in recent years, but the payment experience is still a little in the dark ages with multiple windows and a slow wait for the person in front trying to unplug their phone from the car charger to lean over and pay.

In-car payments could turn the whole experience into a tap-free, frictionless transaction:

Pre-order on the move → Pickup at the window

License plate recognition triggers the order

Payments are handled in-car, auto-checkout once the bag is handed over

Loyalty automatically applied without even scanning a barcode

Starbucks and Dunkin' Donuts are experimenting with these flows in the U.S. already, often with car manufacturers themselves like Hyundai, GM directly.

Think of it like turning your car into your wallet, rewards card, and checkout device all in one.

Fleet Management 🚚

Fleet managers have long used fuel cards and tracking systems, but the admin pain remains intense:

Paper receipts

Manual reconciliation

Lost or misused cards

Lack of visibility on individual vehicle spend

Embedded payments in fleet vehicles could automate expense reporting entirely. Each vehicle has a unique digital ID tied to a master account, and every transaction (fuel, charging, tolls, maintenance) is auto-tagged and logged.

You could even add:

Real-time controls (e.g. spending limits, fuel-only restrictions)

Automated alerts for unusual activity

Per-driver or per-vehicle breakdowns for cost allocation

AI-powered forecasting to predict and optimise future operating costs

At this point, it moves beyond just payments and becomes an embedded fleet financial management product.

Some of the Initiatives Driving Change 💡

I’ve already mentioned some examples in the automotive payments revolution and here are some of the explicit examples and use cases, starting with Mercedes.

Mercedes Pay+

Mercedes' payments initiative, Pay+, launched with 'Fuel and Pay' in Germany, allowing Mercedes drivers with Mastercard Credit or Debit cards to drive into gas stations (the US influence is clearly rubbing off on me), fuel their vehicles and pay using the in-car fingerprint scanner without having to use their card or leave the vicinity of their car.

The Fuel and Pay service activates once the driver arrives at a connected service station and shuts their engine, utilising the gas station's already active licence plate recognition software. The car's system then calculates the fuel left in the tank and estimates the maximum amount payable. The customer then fuels up, gets in their car, and reviews and completes payment using the fingerprint scanner on the MBUX display.

This uses the standard practice of 2-factor authentication (2FA) for payments, commonly 'Something you have', your mobile device, and 'Something you are' FaceID/Fingerprint. In the case of Pay+, the 'Something you have' is your vehicle, and the 'Something you are' is your fingerprint.

Pay+ can also be used to improve the experience in all the cases I mentioned earlier. Paying for a toll using a fingerprint, searching and paying for parking using the linked MasterCard, Drive-Thrus and much more.

True embedded Payments in action.

N.B. At least that’s one thing to shout about after their Formula 1 drop-off.

HyundaiPay + Parkopedia

HyundaiPay launched circa 2023 and one of its first services was a partnership with Parkopedia, to set up a new parking payment system.

Powered by Parkopedia’s comprehensive database, the system allows real-time access to space availability, pricing, and location info across thousands of car parks in North America. Once a space is found, payment is seamlessly handled through HyundaiPay, with confirmation displayed directly on the dashboard removing the stress of finding and paying for off-street garage parking, with on-street curbside services to be provided in a future update.

With HyundaiPay, Hyundai has hinted at expanding this embedded commerce experience into fueling, EV charging, tolling, and beyond, turning your car into a payment-enabled command centre.

BP Pay

BP's foray into mobility payments began with the BPme app (branded in some regions as BP Pay), which set the standard for digital-first refuelling. It allows drivers to pay for fuel directly from their phone, skipping the queue inside the station. Launched well before the embedded car payment craze took off, it paved the way for seamless pay-at-pump experiences across the UK, US, and other key markets.

Users simply pull up to a BP station, open the app, select the pump number, and authorise payment. The app then activates the pump and processes the transaction automatically — with the receipt stored digitally. For added utility, drivers can also track fuel spend, earn loyalty rewards (via BPme Rewards), and locate nearby stations with the best prices or amenities.

While still mobile-first rather than dashboard-embedded, BP has signalled interest in expanding into in-car payments, either through direct integrations with automakers or via platforms like Apple CarPlay and Android Auto. As one of the few energy companies with its own established payments app and loyalty program, BP is well-positioned to evolve BPme into a fully embedded fueling and convenience experience.

In short: Pay, Pump, Drive.

This is still a mobile app, though and phone use while driving is illegal in the UK, so it may not have actually saved me time if I'd used it as I would have still had to drive to the pump then use the app rather than pay while I'm driving up to the station in an integrated dashboard product.

These are just some of the examples of automotive payment innovation. I didn't even mention Ford's dedicated payments product, what Shell is doing, or the host of EV charging companies with embedded payments.

Needless to say, there's a lot happening in the space.

Back to the Future? ⚡️

In-car payments and In-Car payment systems (ICPSs) will become mainstream thing very soon.

My prediction. Within the next two years, 1 in 4 private car owners will use an ICPS to pay for fuel and tolls or charge for their car.

You can hold me to that, and I'll revisit this edition in two years.

I believe it's inevitable and how these things work is slowly, slowly...then all at once.

Look at sat navs.

One day, people were using physical maps, then for a brief period used external Sat Navs (Tom Tom/Garmin), then manufacturers caught on embedded navigation (of course, GoogleMaps and CarPlay integration is a factor here).

Aside from ICPSs and embedded car payments, there is one other area I think will supercharge automotive fintech innovation in the next couple of years.

That's Telematics.

Telematics might sound like something plucked straight out of Back to the Future, and it kinda does, but it'll soon become the norm for your average driver looking to get a better car insurance deal and more.

Telematics refers to the tech that enables real-time data sharing from your car, including speed, fuel usage, battery status, braking patterns, location, and even tyre pressure, to a central platform for every trip. Historically used fleet managers, it's now finding its way into consumer cars, unlocking a whole new frontier of personalised financial services. Basic Telematic data is as follows:

Position

Vehicle speed

Trip distance/time

RPM

Idling time

Harsh braking and driving

Seat belt use

Fuel consumption

Vehicle faults

Odometer value

Power voltage

Number of satellites

GPS Signal

GSM Signal

Event (eg. power disconnection)

Telematic data is based on a 'trip' from the time the vehicle is turned ON, to being turned OFF again with multiple records of the above data points contained in a single trip. That means you can recreate the common routes the driver takes, some of the ad hoc trips, how fast on average they drive, whether they are late on the brakes or more measured, how long they wait before they like to refuel (refer you back to my 5th of tank approach and happy to hear yours) and so on.

Telematic data gives a whole new insight into the car and driver and gives insurers, car financers and potentially even retailers insights to enable better deals and experiences to customers.

When we in fintech talk about the shift from Open Banking, to Open Finance and Open Data, this is what we're talking about.

For example, a customer can own their own telematic data, share it via an authentication process with an insurer, and get a better deal based on historical behaviours.

Or be able to share their historic telematic data with car repair shops, similar to the way a doctor would ask you questions about your lifestyle, to better diagnose any issues with the car and potentially avoid problems before they arise.

There are so many more use cases for telematic data in fintech, and the ability to share and own our telematic data would be a significant push beyond Open Banking to Open Finance + Open Data.

In this edition, I've mainly focused on what's happening at the pump or in the car park.

Telematics lets us zoom out and reimagine every financial touchpoint of car ownership.

For both Automative payments and the applications of telematic data, the future looks very interesting with innovation at every turn.

Very soon, your car will be your wallet, rewards card, verification method, and checkout device for on the road payments, and I for one am very excited about where this road takes us 🚘💳

That’s it from me.

I’ll see you in a few weeks (latest on the 16th May with a special sponsored edition on a really interesting Fintech that you DO NOT want to miss) 👋🏽

J.

P.S. Let me know your thoughts in the comments. Were the puns a bit much? 😂

Interesting News🗞: Revolut’s Annual Report

There’s a lot to unpack here and I will do a Revolut deep dive soon but what I found most interesting from the first few pages (click the link above to read the entire thing) was the dedicated section on “Becoming the Primary Bank for Our Customers”.

This is clearly, and some would say obviously, one of the primary ambitions for Revolut, but it’s notable to see it spelled out so directly in a formal investor document. They’re not just trying to be your travel card or your crypto off-ramp account, they want to be the place your salary lands, where your bills are paid from, where your savings grow, and where your credit lines live.

The language was pretty clear.

Daily engagement, multi-product usage, and trust-building are the key pillars. And with over 40 million customers globally and a banking license in the EU (still pending in the UK), Revolut is in the process of shedding the “just-an-app” perception and go full-stack.

Fintech Spotlight 🔦: Connected__Kerb

I touched on their attendance at the mobility payments event last month and although you may have heard the name in EV and sustainability circles, Connected Kerb is quietly becoming one of the most interesting fintech-ish plays in the mobility world.

UK-founded Connected Kerb is an EV charging infrastructure company with a focus on long-term, community-first deployment. Think less “fast charge at a motorway station” and more “slow charge overnight near your home, work, or school.” Their units are designed to blend into urban environments and support sustainable, inclusive access, especially for people without off-street parking.

Their model is underpinned by data, APIs, and flexible payment systems and their chargers support a wide range of payment methods, contactless, RFID, app-based, and potentially in-car.

They’re not just laying down chargers.

They’re building infrastructure for smart, scalable, embedded vehicle payments. And with partnerships across councils, developers, and EV fleet operators, they’re positioned to become part of the financial plumbing of the electric future.

Smart cities need smart payments. Connected Kerb is aiming to provide both.

I've never really understood the fuss of in car payments when more or less all drivers carry a smart phone on them in any case - is it really solving a problem? But this is a great summary of the various use cases and applications of in-car payments on the market to date.

Nissan Micro Trends?! Haha! Wasn't sure whether to laugh or facepalm at that one! All other puns were perfect!

Yes - I knew about the expert at Visa. I think I had them on a livestream, or at least I asked!

Another goodun, Jas. So much opportunity for a more enjoyable, less clunky, less faffy, less resource-intensive payment experiences across the board.

I used to have a Mercedes (it was awful and I got rid of it) but I still get the Mercedes Me emails, and what they are doing in the world of embedded finance is so impressive! (The build quality of my car was less so, but that is another story!) As ever, thank you for being the highlight of my Friday morning.