My Alternate 5 Fintech Predictions for 2025

A quick look back to review 2024 predictions, 5 big fintech predictions for 2025, full results to the big fintech quiz and some interesting insights

What are my 5 very specific fintech predictions for 2025?

Why do I think Pay by Crypto will be the fintech phrase of this year?

What big EU regulation will trigger changes in fintech apps this year?

Who is the winner of the Big Fintech Quiz of 2024?

Which questions stumped most fintech enthusiasts?

These questions and more will be answered in this week's edition.

Hey Fintechers and Fintech Newbies 👋🏽

Happy New Year to all 🎉

I’m saying it even though saying HNY halfway through January always gives me flashbacks of this scene from Curb.

I’m starting with an apology to all those reading this who have “2025 Prediction Fatigue” because, guess what, in this edition, I’m outlining some of my fintech predictions for this year. However, these will be a little different to some of the broad, sweeping predictions I've seen flying around.

There's also a bit of accountability in this edition, as I'm going to take a brief look at my 2024 predictions to see which ones were accurate and which ones were way off.

For those of you who took the quiz last month, full answers are also included, the winner of the prize is revealed, theres a leaderboard, and some interesting overall insights.

As well as interesting news, puns + movie references, this edition includes the following:

A look back at my predictions for 2024

PFM Growth and consolidation

A2A Payment Growth

Apple and Open Banking for Pay Later

Digital Identity Enters the Mainstream

FinPropTech Innovation

My Alternative 2025 predictions

Accessibility as an agenda item

Save to Buy to go mainstream

Pay by Crypto having its Pay by Bank era

Open Banking Resurgence

Smarter Payments, not just Faster Payments

Full quiz questions and answers

Prize winner reveal

Fintech Spotlight: IFTTT

Release Notes: Monzo's 1p challenge

Let's get into it 💪🏽

Looking Back at My 2024 Predictions: How Did I Do? 🧐

Let's kick this off with some potentially humbling predictions I made for the fintech world this time last year. Here's a quick look at what I said in Jan 2024, what actually happened, and a short review.

1. PFM Consolidation and Increased Customer Numbers 📈

What I Said Then:

In 2024, I expected personal finance management (PFM) apps to go through a consolidation period, with feature-rich, revenue-diverse apps rising to the top. I also predicted smaller apps would either be acquired or exit the market while banks and other financial institutions would adopt some of these apps' features to attract users.

What Happened:

Although 2023 saw quite a bit of PFM consolidation, with one of the major consolidation moves being the purchase of Credit Karma by Intuit Mint, 2024 saw less than I thought. There was, however, quite a bit of sustained growth in those feature-rich PFMs like Rocket Money, Monarch Money and YNAB in the US, as well as the likes of MoneyBox, Plum and my personal favourite, Cleo, here in the UK.

Prediction Rating: 6/10 - Room for improvement

The ability to monetise effectively and deliver a broader range of features is critical for survival in the PFM space, and the ones who remain stagnant, like the unfortunate MoneyDashboard, which went under in 2023, will continue to struggle. Although there wasn't as much in the way of consolidation, there was stability, customer growth and an increase in broader brand awareness of some of these feature-rich, subscription-based PFMs.

2. A2A Payment Growth and Broader Consumer Understanding 💸

What I Said Then:

I predicted account-to-account (A2A) payments, particularly Pay by Bank, would grow in adoption and consumer understanding. I also noted the need for smoother in-person payment flows to unlock its full potential.

What Happened:

A2A payments made notable strides, with several fintechs introducing enhanced user flows for in-person and online transactions. Cards still dominated transactional spending, but 2024 was very much the year of Pay by Bank. As I detailed in some depth 18 months ago in a "how to increase Pay by Bank adoption" deep dive, big brands also played a huge part in driving adoption and customer awareness. Ryanair, Uber, and Booking.com are three big retailers adopting PBB at checkout, and I know of a few more in the works.

Prediction Rating: 8/10 - Solid Prediction

Most of what I had predicted came to fruition, but my explicit call out of in-person Pay by Bank use cases was not as prevalent as I had expected. I may have been a bit early on that one, so expect more in-person Pay by Bank this year.

3. Apple and Open Banking for Pay Later in the UK 📱

What I Said Then:

I predicted Apple would use its Open Banking integration to test Apple Pay Later in the UK, leveraging Credit Kudos and transaction data to tailor offerings. I also suggested this could lead to a broader Apple-branded personal finance manager.

What Happened:

Apple did launch Apple Pay Later in the UK late in 2024, with affordability checks powered by its Open Banking wallet feature, but it scrapped its native Pay Later product, opting for partnerships with Affirm and Klarna instead. While a full-fledged PFM didn't materialise, the groundwork appears to be laid, as the Apple Wallet continues to integrate more features and data insights.

Prediction Rating: 6/10 - Room for Improvement

Although I'm certain Apple will continue to use its Open Banking wallet connections for other financial products, it didn't launch a stand-alone Apple PFM app. I'm convinced this will come either this year or next as part of one of Apple's world-renowned developer conferences. I've learnt from Apple and its step into Financial Services that trying to predict their next move is often folly.

4. Digital Identity Enters the Mainstream 🪪

What I Said Then:

I forecasted that digital identity would gain traction in SME onboarding, with banks like Natwest and Lloyds leading the way by offering portable digital identity solutions.

What Happened:

Natwest's and Lloyds' initiatives made significant progress, with both banks expanding their digital identity solutions. While adoption is still growing, early users have seen faster onboarding and smoother KYC processes, validating its potential. Midway through 2024, Natwest announced an integration with Adobe Acrobat Sign in addition to its existing agreement with Digital Identity provider OneId to "streamline business processes while strengthening the security of signatories".

Prediction Rating: 9/10 - Near Bullseye

One thing I've learned is that although the implementation and adoption is slower than predicted, the groundwork being laid by these banks suggests this is a space poised for significant impact in the coming years. I'll be watching closely in 2025 to see if other players follow their lead. The only thing that made this fall short of a 10/10 was Lloyds not quite keeping up with Natwest's progress, but I'm sure that'll be rectified this year.

5. FinPropTech Innovation in a Challenging Market 🏠

What I Said Then:

I predicted innovation in FinPropTech, focusing on tools to help renters and homeowners navigate a challenging property market. Solutions for deposit building, rent reporting, and zero-deposit schemes were highlighted as areas of opportunity.

What Happened:

2024 saw growth in FinPropTech solutions, particularly in rent reporting and deposit-building apps. Startups addressing affordability and access challenges gained traction as consumers faced rising costs. There was also a large-scale initiative that kicked off early into 2024, which I covered in depth here. It was the coalition led by blockchain property innovator Coadjute and joined by some of the biggest players in the property market, including RightMove, Lloyds, and Nationwide, would band together to work on a UK Regulated Liability Network (RLN) experimentation phase "envisaged as a common 'platform for innovation' across multiple forms of money". There's no doubt this is the start of a property blockchain initiative designed to streamline the homebuying process significantly.

Prediction Rating: 10/10 - Spot on (and to end on a high)

There were some new FinPropTechs in 2024, but the main development was the rise in prominence of the existing innovators, including the growth of MoneyBox and its deposit saving scheme, brokers like MeetMargo and Habito becoming mainstream, and the big news that some of the biggest players in the UK property market were coming together to solve the disparate homebuying process.

You can read those predictions here and learn a bit more about why New Year's resolutions are so popular.

My alternative 5 predictions for 2025 🔮

I said these were alternate predictions, and they are. You won't hear "Fintech funding will be back", "The biggest year for anti-fraud tools", or "Stripe and Monzo will look to IPO" because I've seen these covered a few times already.

Instead, as I did at the start of 2024, I'm bringing a slightly alternative look at some of the specific things we'll see in 2025.

1. Accessibility as an agenda item rather than a footnote 🦻🏼

Monzo, Bunq and Caixabank launched accessibility features at the end of last year, which included digital services for people who use sign language to make communication with support teams way more inclusive. Monzo partnered with online interpreting service SignLive to deliver this, and Caixabank announced this via its pilot programme, SVisual.

With the advent of the 2025s EU Accessibility Rule, we'll see more fintechs and digital banks specifically get ahead of the long overdue regulation that's designed to ensure equal access to a range of products and services (including FS) for the 87 million Europeans who have some form of disability.

Before you ask, yes, I have written about this in depth, outlining the rule, impacts and what fintechs should be doing to get ahead of it long before this recent trifecta of neobanking accessibility releases (click below).

☕️🦻🏼EU Accessibility Act 2025: Paving the Way for Inclusive Banking Services

What is the EU Accessibility Act 2025 and what does it mean for new products?

In the summer deep dive, I wrote about "accessibility as a moat", not just an afterthought. I'm not a fan of this overuse of the 'moat' reference but in this case it's warranted because organisations who build with accessibility baked into product strategy can create fully accessible and inclusive digital products that not only serve a large demographic but also directly market their product to a group of 87 million traditionally underserved individuals.

I know this sounds rather capitalistic, but building products in financial services is not philanthropic for the most part. It has to be both a meaningful, valuable, useful product AND economically viable. The size of the market, lack of focus on the area, and incoming regulations are why I'm predicting more accessibility-focused product releases in 2025 and fintech and big banks putting it higher up their agenda.

That's my hope at least.

2. Save to Buy going mainstream 💰

I've pitched this as a new concept, but in reality, these savings schemes with specific retailers have been around for a while. Park in the UK, which is known as a Christmas Club, is a Save Now Buy Later scheme that has been around for over 50 years and helps families put money away each month for an increasingly expensive cyclical event each year. Notsure about you, but I spent around £1,000 on Christmas presents alone this year, and I was trying to be conservative with spending.

Although Park is an SNBL scheme that sits across a number of retailers, I can see more organisations setting up their own SNBL programs that encourage customers to ring-fence funds throughout the year to spend at that specific retailer and reward them for doing so by offering small discounts.

An example where this would work quite well is with Booking.com. My first port of call with hotel bookings is them, and if I could sweep £30 a month into a dedicated account in return for a discount or potential room upgrades, it would be well worth the consistent upfront cost, especially if they added a new loyalty tier for customers on the scheme. Genius Level 4

VRP under Open Banking also makes the implementation, or at least the MVP and testing of SNBL schemes, much more economically viable because you no longer need to own or 'lease' a bank account; you simply have to have visibility over an existing account and the ability to sweep payments into it.

It's also a great alternative to those groups of people who don't like the idea of credit cards and lines of credit (yes, they do exist).

There are a couple of retailers who I'm certain are close to beta testing with programs but I won't mention them yet as I may be speaking slightly too soon 👀

3. Pay by Crypto having its Pay by Bank era 🔐

This isn't quite the "2025 is the year of the stablecoin", but it's close.

Based on some of the signals I saw last year, including Visa's expansion of USDC on the Solana network to allow merchants to pay and be paid in the stablecoin, luxury brands like Gucci and Balenciaga experimenting with Crypto acceptance, and the biggest signal in my eyes, Stripes acquisition of Bridge.

Bridge, as the name indicates, has a core offering of an API that enables seamless conversion or 'bridge' between traditional fiat currencies and stablecoins.

Stripe already offers a Pay with Crypto feature to a limited set of merchants at present and also allows merchants to create Crypto supported invoices and subscriptions but I think 2025-2026 will have the same mainstream adoption that 2023-2024 saw with Pay by Bank.

Again, large retailers will be the key, and if the likes of Apple, Amazon, Walmart, et al start accepting Crypto as a payment method, many others will follow and create a new normal, just as Klarna did with BNPL.

4. Open Banking Resurgence 📈

September 2024 saw the official completion of the Open Banking roadmap in the UK but the two years prior saw a bit of stagnation. There was a change of leadership at the Open Banking Implementation Entity (now Open Banking Limited) and a sense of frustration as the roadmap completion took longer than anticipated, but now that leadership is stable and the original roadmap is complete, there are some green shoots of innovation in the UK Open Banking scene. It means that they can now look at the expansion of coverage, look at other innovative ways to use the rails, build an Open Finance roadmap and do dedicated research into areas that are the next phase of Open Data and spearhead innovation, which is exciting.

Outside of the UK though I see places like Saudi, UAE, Qatar, and Oman as places with Open Banking frameworks that will create a sea of cool new startups from the region and one of these frameworks will become the new gold standard for global frameworks.

NOTE: I have an 'Open Banking in KSA' deep dive coming soon.

5. Not just Faster Payments, but Smarter Payments 🧠

Payments are largely dumb. I mean that in the nicest possible way.

They're designed primarily for speed, security and efficiency rather than intelligence or adaptability. The UK's Real-Time payments network is literally called Faster Payments.

For 2025, I predict a shift toward "smarter payments," leveraging advanced rules, automation, and flexibility to make payments more intuitive and value-driven, and there are a few signals that support my prediction.

The launch last year of Visa's Flexible Credential, which allows a single card to toggle between payment methods, so customers can create rules on whether they use debit, credit, "pay-in-four" with Buy Now Pay Later or even pay using rewards points through the card product for different merchant or payments amounts. This is another area I've been meaning to do a deep dive on.

As previously touched on, the implementation of VRP that once mainstream, will allow for automatic sweeps between accounts based on personalised rules.

By far, the biggest shift from Faster Payments to Smarter Payments (trademark of that phrase pending) is Request to Pay.SEPA Request to Pay (SRTP) is a standardised framework introduced by the European Payments Council in November 2021, designed to facilitate secure, real-time payment requests within the Single Euro Payments Area (SEPA). It complements existing SEPA payment schemes by enabling businesses and individuals to send payment requests directly to payers, who can then approve and execute the payment in a streamlined, digital process..

As more organisations see the benefits of Request to Pay combined with a real-time payments network, more companies facilitating P2P transactions, B2B payments and e-commerce transactions will use SRTP to create smarter, rules-based payments.

NOTE: This is yet another area I'll dive into this year

Full answers to the Big Quiz of 2024 (including Winner reveal) 🎉

Now, let's move on to the part the keen quizzers from December have been waiting for.

At the end are the questions and answers to the quiz as well as a top 10 leaderboard and the ultimate winner, but before that, here are some quick stats from the quiz so far based on the 221 folks who completed it.

👉🏽 The easiest question was on the full meaning of SAR which 86.4% of respondents answered correctly with "Suspicious Activity Reports

👉🏽 The most split question was the question Plaid's original name. Answers were split between "Dasher" and "Rambler"(67 responses each, 30.3% correct). Folks who answered Dasher can go back and read my Plaid product and history overview to get the answer and in full context.

👉🏽 Less than 50% of quizzers knew what an AISP was

👉🏽 Lots of folks were up to speed with Visa's latest release, as 54.8% of people correctly answered that a Visa Polymorphic Card was not part of their major release in 2024

👉🏽 Only 33% of quizzers knew that Natwest was the bank who were the first to use bank-verified digital identity to enable people from different countries to prove their identity leveraging Adobe Acrobat Sign and OneId

👉🏽 A question that stumped many was the name of Mastercard's tokenization service. The answer was Mastercard Digital Enablement Service, which only 27.1% of people got right

👉🏽 The highest score out of the 36 questions, which only four people managed, was 35! No one managed a high score. It was a tricky one, after all.

👉🏽 The mean average score was 19, which proves it was a tough one.

1. HSBC, 2. 700, 3. $2 billion, 4. Marginal Investing, 5. >50, 6. Visa Polymorphic Card, 7. A Robotics Firm, 8. Trustly, 9. Financial Sanctions Screening, 10. NatWest, 11. Neo, 12. A16Z, 13. A bright blue unicorn, 14. Payment Card Industry Data Security Standard, 15. Embedded Finance, 16. Authorised Push Payments, 17. Rambler, 18. Mastercard Digital Enablement Service, 19. Suspicious Activity Reports, 20. Derivatives Trader, 21. Xoom, 22. Aadhaar, 23. /dev/payments, 24. AISP, 25. Payment Services Directive, 26. GoCardless, 27. Square, 28. SoFi, 29. Nik, 30. Choice 2, 31. Choice 1 (Visa), 32. LycheeLend, 33. FernFinance, 34. Ava, 35. Octagon Payments, 36. Bobbin.

Congrats to anyone who got above average, and to those who didn't, make sure you're subscribed and reading my newsletter this year.

As there were 4 top scorers, I put those names into a randomiser and out came…Drumroll please…Mridul Gupta also known as MG. Congrats. A cool bag courtesy of Plaid and a FunkoPop from FF News is on its way to you now.🎉🎉🎉

Here is the Top 10 Leaderboard just so those who made it can brag to friends and colleagues.

Right. That's it for the psychic predictions and gameshow host and edition. Further down, I've included a linked Fintech Spotlight and Release Notes edition, which will be back each fortnight going forward.

I'll be back to regular deep dives in two weeks, starting with an edition on Open Banking in Saudi Arabia, which will, of course, feature a diagram and informed insights from myself having worked in the region.

Until then

J.

Remember to like this edition and share it with a friend. Back again in two weeks 👋🏽

Fintech Spotlight 🔦: IFTTT

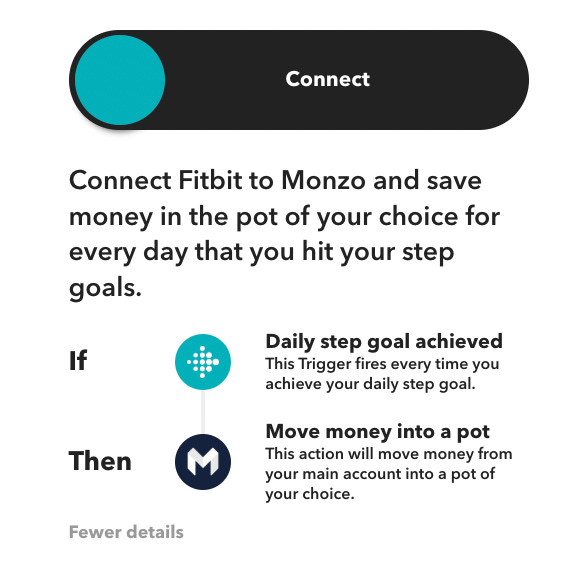

It might seem like a strange name for a company, and although they are not strictly a fintech, IFTTT is a platform that enables users to automate tasks and connect various apps, devices, and services through simple "if this, then that"statements, called applets. These applets allow users to trigger actions in one app or device based on events in another, creating seamless integrations for productivity, smart home control, social media management, and more. For example, you can automate posting to Twitter when you upload a photo to Instagram or turn on your smart lights when you arrive home. IFTTT simplifies creating custom workflows across an ecosystem of over 700 supported services.

The fintech link is that IFTTT has an applet with a Monzo connection. That means you can create a rule through IFTTT that sweeps money into a Monzo pot every time you hit a step goal in Fitbit. Or linking it to Google Maps and rewarding you every time you go to the gym (it's the New Year, after all).

There's a lot more really interesting fintech potential here as a way of linking different products together, creating an unofficial superapp by linking multiple workflows together.

Release Notes📝: Monzo’s 1p Challenge

The Monzo 1p Saving Challenge is a fun and simple way to build up savings over a year. It works by automatically setting aside an increasing amount of money each day, starting with just 1p on day one and adding an extra penny each day (e.g., 2p on day two, 3p on day three). By the end of the year, you'll have saved £667.95 effortlessly. Monzo makes this challenge easy by automating the process through its app, helping users build a savings habit with minimal effort. Monzonites who take part in the challenge also have the opportunity to win a £10,000 prize at the end of the year.

I so much enjoyed taking the quiz. I have forgotten my score. Can you pls remind me?

Steve who?