Fintech R&R☕️- A short Retrospective & Refinement of previous editions

A short highlights reel of previous editions, why they are still relevant, and who they are great for

Hey Fintechers and Fintech newbies 👋🏽

There is a slight change to the regularly scheduled programming as I am TECHNICALLY on holiday right now on a short road trip. I’m making my way from San Francisco to Seattle, stopping at Sonoma to taste some of the local grapes and Portland to get a feel for a city I’ve heard great things about.

So, I’ve taken a long overdue week off work with clients (or partners, as I prefer to call them) and the hobby that is this fledgling newsletter.

Why are you seeing this newsletter then?

As I was writing the ‘on hiatus this week’ message I realised this is the 18th Edition of Fintech R&R. Which means it’s of legal drinking age, can go into casinos and nightclubs, sign up for a credit card and all the other things that ‘Adults’ do.

An 18th birthday is the perfect time to take a short, sharp look at some of the previous editions, highlight the takeaways, give a short overview of why they remain relevant and point out my favourite movie reference or pun.

This short Retrospective and Refinement edition will take a look back at the following Fintech Product related subjects covered previously:

Embedded Finance

Open Banking Payments (Under the Hood)

Card Payment Process (Under the Hood)

Scaling Fintechs

Wise’s growth and the importance of Product + Marketing

SME Jobs-to-be-done and the Fintech’s who service them

Embedded Finance

Title: To Embed, or not to Embed. That is the question

1-liner Description: A brief primer on Embedded Services and Finance, the pros (and the cons) and some HUGE overlooked embedded opportunities on the horizon.

Date Posted: 10th-Feb-23

Key Sections:

👉🏽Embedded Services: What are embedded services, some examples and an embedded service that has been around for a while

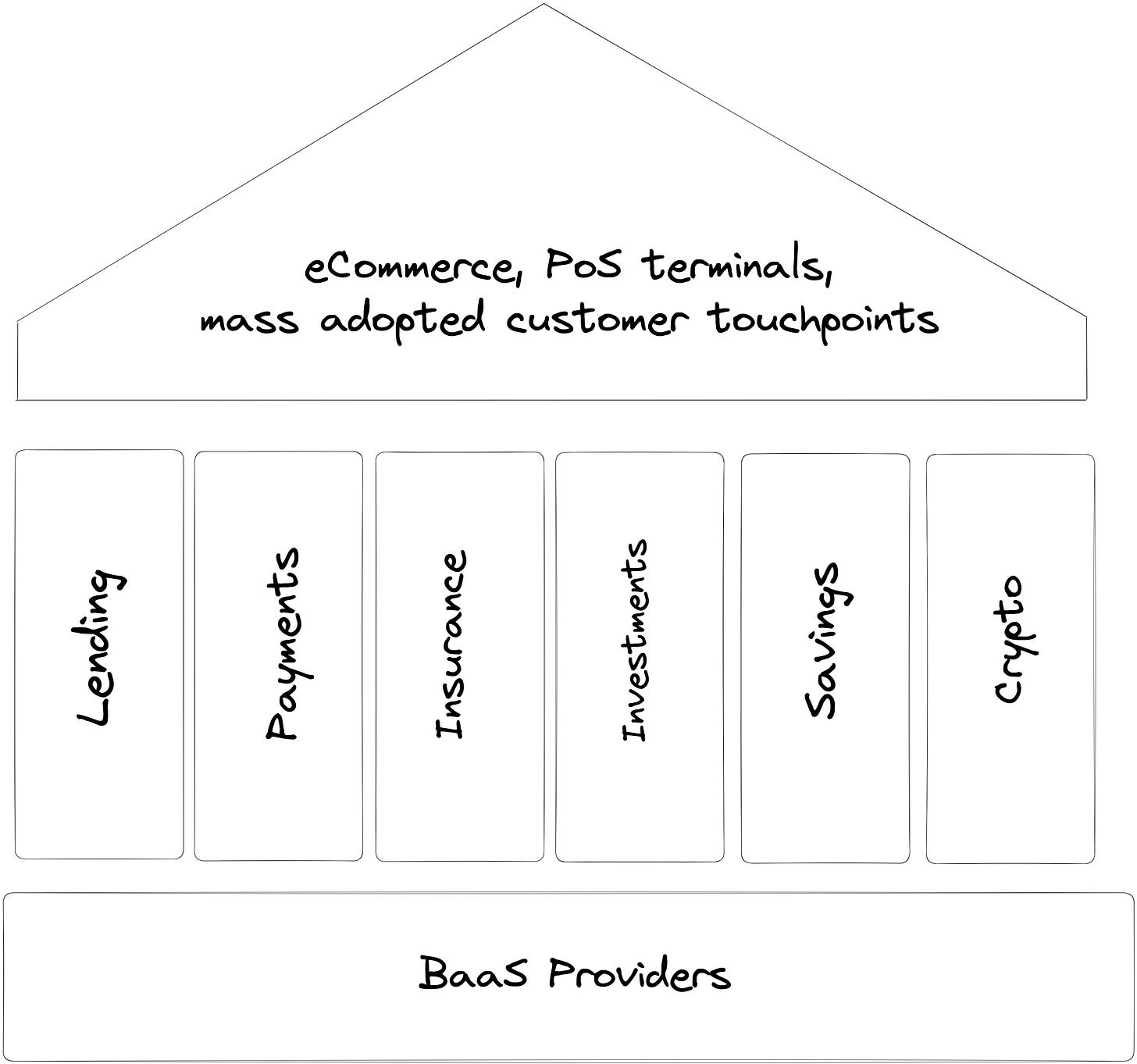

👉🏽Overview of Embedded Finance and clear and concise definitions: ‘A financial product or service that is attached to another product or service for the purpose of providing net gain to both the customer and enterprise”.

👉🏽Different forms of Embedded Finance from Lending, payments and insurance to the overlooked savings, investments, cards and crypto

👉🏽A quick note of BaaS and its role as an Embedded Finance enabler along with some puns related to Marqeta’s acquisition of Power

👉🏽Beneficiaries and the opportunities of Embedded Finance

👉🏽Downsides of EF for Fintechs

👉🏽Some of the big opportunities in my opinion including Property Finance + Airbnb, Car Finance + 2nd hand car dealerships, and SME finance for small businesses

Favourite Pun/Movie Reference: The title refers to the question that some fintechs should ask themselves before they throw themselves into an embedded finance initiative with a little Shakespeare/Hamlet reference.

Great for: Folks thinking about how their product could be used by others and embedded into banks, other fintech products or other industries.

Note: This is still a very relevant topic, especially the cross-industry opportunities and ways fintechs can use EF to grow their product and increase usage.

Open Banking Payments (Under the Hood)

Title: Open Banking Payments and how to accelerate ‘Pay by Bank’ adoption

1-liner Description: An Open Banking Payments Deep Dive, brief history of OB, major benefits of OB v Cards and big focus areas to drive mainstream pay by bank adoption

Date Posted: 11th-Aug-23

Key Sections:

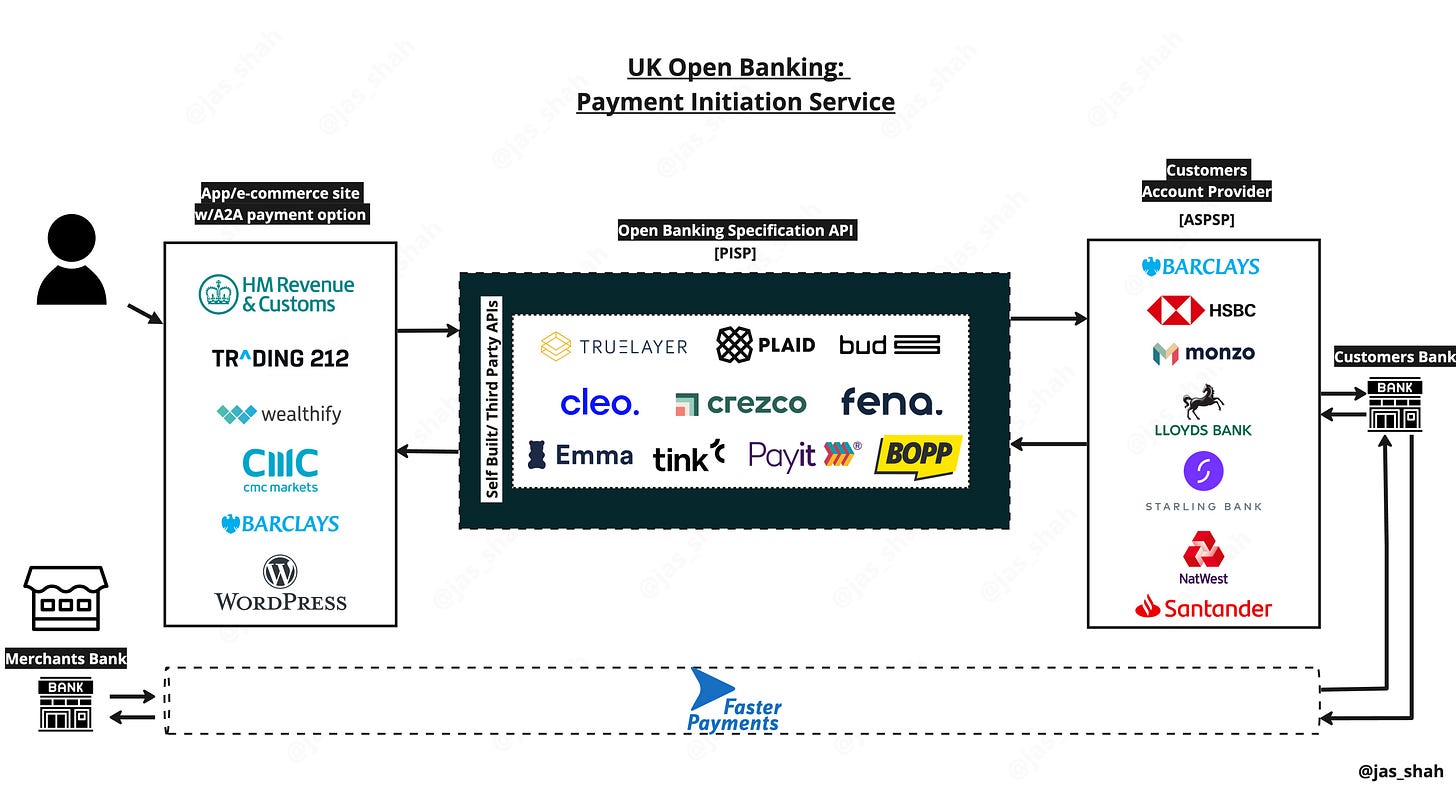

👉🏽Very Brief History of UK Open Banking

👉🏽Under the Hood of the OB payments flow

👉🏽Benefits of using Open Banking Payments vs Cards

👉🏽Suggestions to accelerate adoption and how they’d work

👉🏽Some interesting fintechs in the space

Favourite Pun/Movie Reference: Tinker and Tailor Chaps. A reference to a great spy thriller but also the ability to tinker and tailor the Open Banking Payments configuration to suit organisations’ needs

Great for: Folks looking to understand a bit more about the benefits and implementation of Open Banking as a payment method and accelerating adoption for Open Banking payment providers

Note: With UPI growth continuing and Mastercard and Visa announcing merchant fee increases in various regions, understanding OBP is vitally important to merchants and the fintechs that provide the OBP service

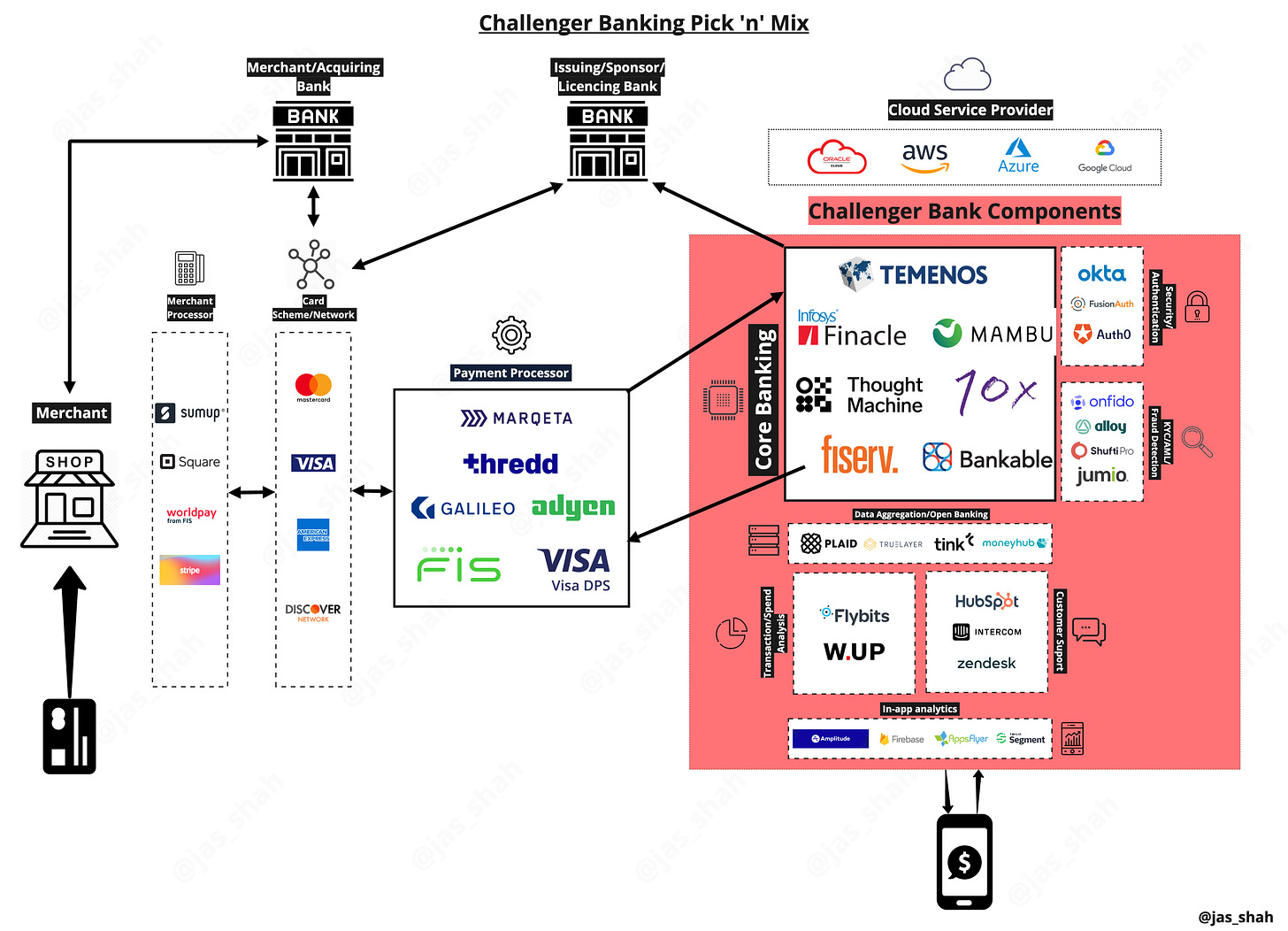

Card Payment Process (Under the Hood)

Title: The Merchant Payment Process, Revoloopholes and the Mandela Effect

1-liner Description: A Card Payments deep dive, why Revolut suffers from The Mandela Effect, education & resources for fintech builders, and the Product + Technical expertise debate

Date Posted: 14th-Jul-23

Key Sections:

👉🏽 The Merchant Payment Process: Step-by-step

👉🏽 The need for education in Fintech

👉🏽 Great fintech learning resources

👉🏽 How a better understanding might have mitigated the Revoloophole

👉🏽 The Mandela Effect and Revolut’s perceived reputation

Favourite Pun/Movie Reference: Office Space is one of the all-time classic movies, so being able to use that to refer to the Revolut theft was an easy one for me.

Great for: Anyone looking to learn more about payments and to get a great reading list for more payments education.

Note: Educational resources are important, especially in a fast-paced, ever-changing environment like fintech, and I regularly get comments from individuals saying thanks for visualising a complicated process. This will remain useful for as long as we have cards and networks.

Fintech Scaling

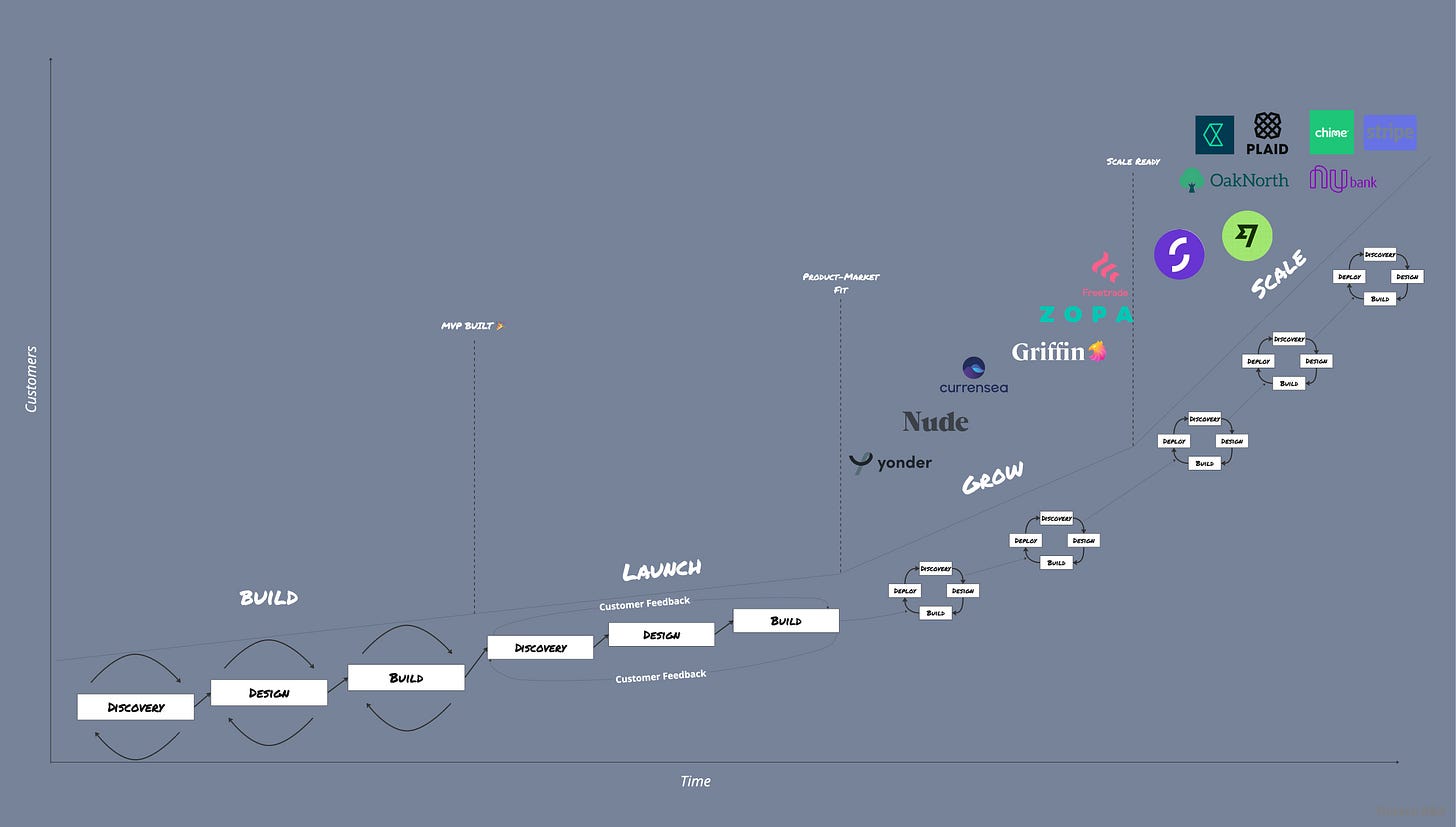

Title: Fail to Prepare, Prepare to not Scale

1-liner Description: The trials and tribulations of scaling a fintech, the product development lifecycle and why pirates are important to product roadmaps

Date Posted: 16th-Jun-23

Key Sections:

👉🏽 A deep dive of into the Product development lifecycle

👉🏽 Scaling and some of the misnomers

👉🏽 Scaling vs Growth

👉🏽 Three examples of fintech scaleups

👉🏽 Key Product Scaling considerations

👉🏽 Three levers used to Scaling

👉🏽 Some of the pitfalls of Fintech Product Scaling

Favourite Pun/Movie Reference: “Tipping the balance of scale”. A pun on organisational scaling vs weighing scales. This is a great one because scaling is a tricky balance.

Great for: Folks who have found product-market & product-customer fit, have a core customer base, have done some growing and are now looking at scale. It’s also great for those wanting some clarity over the difference between growth and scale.

Note: Fintech scaling is tricky and few crack the code. While there isn’t a hard and fast rule, in this edition, I outlined some of the important scaling levers and things to watch out for, which I can’t see losing relevance anytime soon.

Wise’s Evolution and the importance of Marketing in Product Development

Title: Growing older and Wise-r

1-liner Description: The importance of Product/Brand alignment, the evolution of Wise and figuring out when to rebrand

Date Posted: 10th-Mar-23

Key Sections:

👉🏽Who and what is Wise? - How the idea started and some of its growth over the past 12 years

👉🏽 Wise’s Product and Brand evolution - How the product and brand have evolved over time with handy visuals related to the amount of money that has been transferred through the platform over time

👉🏽Other Fintech Rebrands/Renames - Examples of other fintechs that have made timely updates

👉🏽 Reasons to Rebrand, including Product evolution - Key reasons organisations choose to rebrand (product evolution being an important one)

👉🏽Figuring out when to rebrand (if at all) - Important questions to determine whether a branding update should be on the cards for you or your organisations

Favourite Pun/Movie Reference:

Great for: Fintechs thinking about their product marketing and looking to rebrand because of product and customer growth or organisations looking to create a brand post MVP.

Note: One of the sections in this edition is ‘Product and Brand go hand-in-hand’. That will be forever relevant and this is even more important for fintechs looking to differentiate their product from others.

SME JTBD and the SME Fintech Landscape

Title: SMEs Got 99 Problems. But Fintech Ain’t One

1-liner Description: A dive into the SME landscape, the problems they face, Jobs-to-be-Done and Fintech’s positive impact on SMEs

Date Posted: 5th-May-23

Key Sections:

👉🏽 SMEs/SMBs definition and an overview

👉🏽 SMEs by the numbers

👉🏽 The ‘SME Super Squeeze’ (Copyright for that phrase in progress)

👉🏽 An overview of the benefits of Jobs-to-be-done for SMEs

👉🏽 The key Jobs-to-be-done for SMEs

👉🏽 Real SME focussed fintechs, the benefits they bring and the next steps

Favourite Pun/Movie Reference:

Great for: SME focussed fintechs, fintech innovators looking to solve problems for SMEs, folks looking to understand some of the core SME JTBD and anyone looking for a practical understanding of the Jobs-to-be-Done framework.

Note: SMEs make up 99.9% of business in most regions (UK, US and many others) so fintechs that solve problems for this sector are vitally important. Especially in the current climate where SMEs are being squeezed from multiple directions. That’s where SME lenders, cash flow analytic tools and others really come into play.

Outro

Hopefully, this has given a great flavour of things to come for new subscribers and for existing ones a great little reminder of some of the areas covered.

There are many more areas to cover and visual deep dives to create, all with my product perspective and unique position of having worked to build products in many of these areas, so I am talking from a position of authority rather than as a pure commentator.

I am always open to ideas, though, so if you think there is an area of fintech that doesn’t get any coverage or seems a little opaque, then drop me a DM, and I’ll add it to the list of topics to cover.

Thanks for joining me on this very brief trip down memory lane. We’re back to regular scheduled programming in the next edition when I’m hoping I’ll be over West to East jet lag (which is the worst)!