The Rise of FintechDevCons (and an Agentic Commerce update)

A deep look at a growing trend for big fintechs, the value of a well executed developer conference, Checkout.com's new releases, and my refreshed agentic commerce stack vision

Hey Fintechers and Fintech Newbies 👋🏽

A change of pace from the last two very deep dives on stablecoin.

I was recently at Checkout.com’s merchant community conference in Venice and it got me thinking about the rise of the developer conference in fintech.

These are events organised and hosted by mostly large/mature fintechs that are all about getting clients together, bringing global employees to a single location, connecting with the wider community, and getting everyone up to speed on new developments with their product.

There’s a reason we’re seeing more of these pop up in recent years.

Not only are they a great way to connect the fintech ecosystem, from employees and customers to prospective customers and partner vendors, but more classically, they are a great way to communicate the value and functionality of new products.

And selfishly, as a product person, I get to speak to the product people and engineers actually building products that you see get announced via PR releases, and really dive under the hood (yes, I said it 😎) of how these new products work and the strategy behind them.

So, as I’m fresh off an energising time at Checkout.com’s Thrive in Venice and have been to other great fintech developer conferences over the past few years, I thought I’d take this opportunity to dive into this growing trend, highlight the prominent ones, touch on the reasons we’ll see more of these, cover some of the exciting updates I saw from Checkout.com’s fifth conference, and add a few more insights on what I think are the prerequisites for agentic commerce, and the role PSPs have to play.

Here’s what to expect:

The Rise of Fintech Developer Conference

Reasons Fintech DevCons are on the rise

Help Strengthen the Community

Turn Prospects into Clients

Deepen Client Understanding of Products

Amplify Thought Leadership

Key ones to watch out for

Stripe Sessions

Plaid Effects

PayPal DevDays

Robinhood’s Hood Summit

Checkout.com’s Thrive Venice

Reasons I enjoyed Thrive

What’s new with Checkout.com since my last deep dive?

MALPB Charter Application

Flow Remember Me Global Rollout

Dashboard with Embedded AI assistant

The Future (and Prerequisites) of Agentic Commerce

Now let’s get into it 💪🏽

P.S. You know the deal by now. This is a very deep, deep dive, so click here to read the full version as your email client may clip the end, which you do not want to miss.

The Rise of the Fintech Developer Conference 🏟

Let’s start with what I believe will be a growing trend: more fintechs setting up their own developer conferences over the next few years.

What I mean when I say ‘developer conference’ is not a conference where developers get together and geek out about code, or even a hackathon.

Well, not exclusively that anyway.

It’s a company conference where leaders from that organisation present key milestones, future direction, highlight interesting things from the roadmap, have breakout areas where product and development get to demo new and existing functionality, and customers get to speak directly to the team about their existing integrations, ongoing challenges, and how the company can help.

As you probably already know, Apple is the pioneer of this type of conference that gathers customers, partners, and other interested parties to provide detailed demonstrations of new and upcoming products. The Apple Worldwide Developer Conference, or WWDC, started in 1982, but the buzz and popularity around the event really gained traction in the 90s and 00s in the Macintosh and iPhone eras.

For Apple, the WWDC serves as the perfect way to bring die-hard fans & partners in one place (while also broadcasting live across the world), build anticipation throughout the event, and is the perfect platform to launch and explain new products.

The appeal for fintechs to take inspiration from Apple’s famous conference is obvious. Still, the benefits of the Fintech Developer Conference go beyond creating a thunderclap moment around a new product launch.

Strengthening the Community

One of the most powerful outcomes of hosting a fintech developer conference is community building, especially in the new and sometimes isolating world of hybrid working.

These events create a shared space for customers, partners, developers, and even regulators to exchange ideas and collaborate. It reinforces a company’s positioning as a thought leader and central hub in its ecosystem, where innovation happens together. Internally, it helps unify different business units (product, engineering, marketing, operations and commercial) around a single narrative, strengthening the sense of shared purpose.

It also gives product and engineering the opportunity to see, firsthand, the impact of their work on real users. For attendees, it’s a chance to feel part of something bigger and connect more deeply with others in the ecosystem.

Turning prospects into clients

Nothing beats an in-person conversation to discuss an early-stage partnership or a larger vendor relationship. I’m no sales dev, but on the occasions that I’ve connected up a couple of folks, outlined how they could work together, and led to a fruitful commercial relationship, the core of that was done in person.

The same can be said for those clients who are invited to these developer conferences. No one wants to jump straight into sales talk. They want to be wined and dined, discuss some of their pain points, clearly convey their priorities, and then understand how you can help them.

It reminds me of the scene from The American Office where Michael Scott is trying to land a big client and rather than jumping straight into sales mode, he takes the client to a Chilli’s to get to know him a bit better before discussing business.

Note: There’s no Chilli’s in Venice, but I imagine a few deals got done over some mighty fine pasta and glasses of Barolo while overlooking the many canals

Deepening Client Understanding

Existing clients walk away with a deeper understanding of the company’s direction, upcoming releases, and integration potential. It’s an opportunity for clients to see new ways features can benefit their current use cases in real time, speak directly with the engineers behind the product, and provide feedback that shapes future iterations. This transparency often translates to stickier long-term relationships. It’s not only about clients seeing new products, though, but also seeing the depth and expertise of the broader team behind that powers the features they use daily, and that benefits them and their customers.

Amplifying Thought Leadership and Visibility

Lastly, these developer conferences are content engines.

Each keynote, product demo, and customer interview can be repurposed across blogs, press releases, social media, and thought leadership campaigns for months after. Many will take pictures during the event and share them with their audience, and some will take quotes from leaders.

The higher the production value of the event, the more Instagrammable the location and the more interesting the announcements, the greater the likelihood that people will organically share their thoughts with their audience.

Some may even take it upon themselves to do a longer write-up on fintech events more broadly and the interesting announcements that came from the event…👀

So, it might seem from the outside that setting up an event like this is a huge expense with minimal upside. However, the benefits are much longer lasting than the initial outlay, which is why many fintechs, including Checkout.com, are choosing to do them.

Key FintechDevCons to watch out for 👀

Here are just a few of the ones I’ve been to or heard good things about:

Stripe Sessions/Stripe Tour - Sessions is Stripe’s Annual Global Internet Economy conference, and the Stripe Tour is the regional edition of the conference held in London, Paris, New York, Singapore and Sydney. I’ve been to the last two London editions of the Stripe Tour, and they have lived up to the high expectations. Great insights and fun graphics from the keynotes, cool product demos, and high-grade production value across all parts of the conference.

P.S. Based on the success of the “Cheeky Pint” podcast, I wouldn’t be surprised to see a full reconstruction of an Irish pub at the next one. That’s what I’m expecting anyway…

Plaid Effects - This was a very well-put-together online DevCon I attended earlier this year, featuring a keynote from Plaid founder Zach, digital breakout rooms, numerous great networking sessions, and product deep dives with Q&As. I came away with some fascinating insights and had cool conversations with Plaid folks, customers, and other product leaders.

PayPal DevDays - I have not been to this one but I’ve heard great things from the annual conference held at PayPal HQ in San Jose covering the trends of the moment, showcasing products, and building hands-on demos of new features.

Robinhood’s HOOD Summit - This is another one I’m yet to experience firsthand, but I’ve heard good things about it. In September, they hosted their second annual HOOD Summit, a customer-focused conference geared towards active traders, in Las Vegas, following the first one, held the previous year in Miami. Alongside the broader customer-focused conference, they also held a special event this year on the French Riviera, focused on tokenized assets. This was more of a product launch event, but I’m sure there were breakout sessions and discussions after the initial keynote. There was a massive buzz surrounding the event (I watched it live), with one of the memorable snapshots being the scene below, which primed The Robinhood Chain.

And last but certainly not least…

Checkout.com’s Thrive.

Note: I’ve probably missed out a bunch, so if I’ve missed yours or you’ve been to a great one not on the list, let me know in the comments or DM me and I’ll add it to an edited version of this article in a few weeks

Thrive Venice 🚤

So a little about Thrive, and specifically Thrive Venice.

Thrive Venice is the fifth edition of Checkout.com’s merchant community conference.

The first one was in Lisbon.

The second was in Shaoxing.

The third was in Barcelona.

The fourth was in Abu Dhabi.

And the fifth and most recent edition was in Venice.

Presumably, these have been rotating to new global cities due to the global nature of the business and its customers as well as tied with product and growth plans. It’s also a cool way to bring groups from different regions together, rather than having it in the same place each year and creating a home city bias.

NB. Based on the recent news and growth plans, I predict that next year’s edition of Thrive will be somewhere in North America but you’ll see why I think that later.

At each of these conferences for enterprise and merchant payments professionals, there have been interesting announcements. At Lisbon, there was a significant announcement about card issuing, in Abu Dhabi, there was a focus on expansion in the region, and the announcements at Venice were also pretty significant, but more on that shortly.

However, I’ll start by addressing a question that may be on your mind right now.

“Why is it called Thrive”?

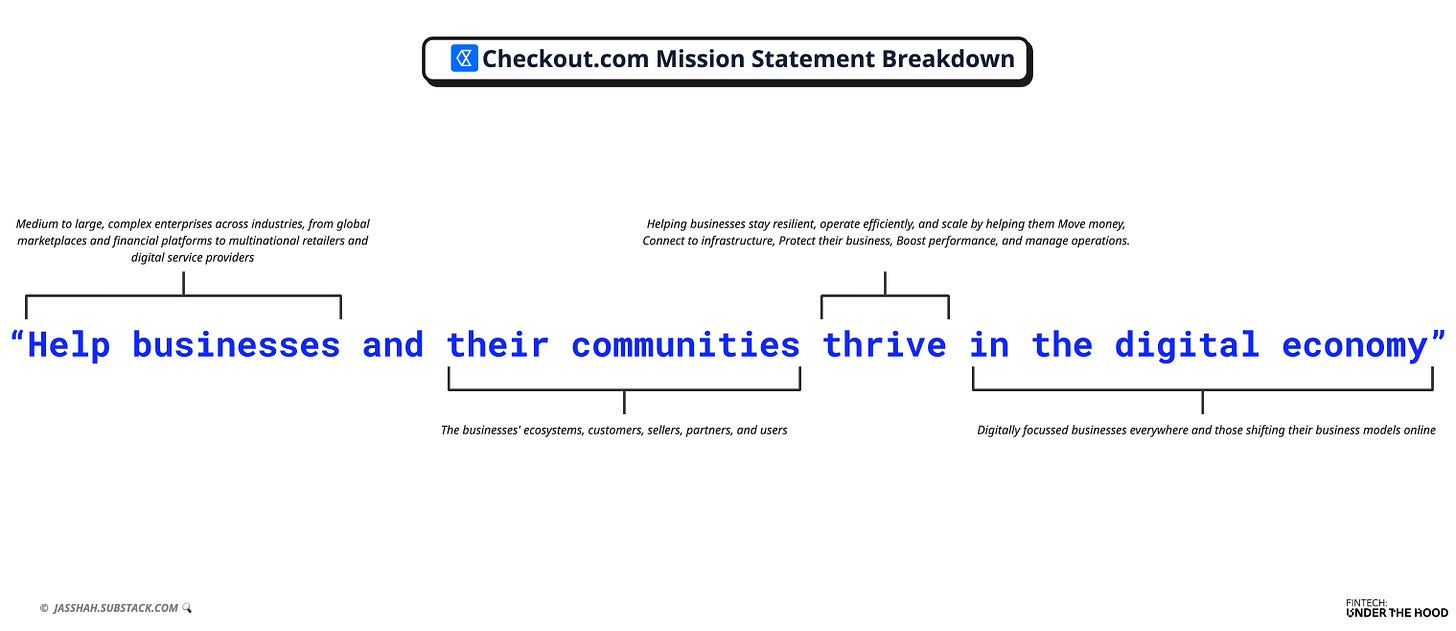

Well, if you read my pretty comprehensive Checkout.com deep dive from May, you’ll know that their mission statement is “Help businesses and their communities ‘Thrive’ in the digital economy.”

I even did a classic explainer image.

So it’s called Thrive because that’s what the conference is designed to do for merchants and their customers (as well as ecosystem partners).

The event itself was certainly thriving with activity.

The first ‘main day’ was kicked off by CEO Guillaume Pousaz with a keynote that talked about the history behind Venice, its relevance to Checkout.com and Thrive (see below), lots of fascinating growth numbers, including fraud prevention rates, payment volume, which ended with a talk about the future.

The poignant line explaining why Venice was selected ties back to its numerous islands and multiple bridges connecting them (much like a merchant with multiple payment methods, with Checkout.com seamlessly bridging all those islands for them).

The baton was then handed to Eminem.

No, not that one.

M & M.

Meron (CPO) and Mariano (CTO) walked through new releases and major tech, product, and regulatory announcements.

More on that in the next section.

(Credit to Ashley, VP of Commercial for the witty on stage Eminem intro).

After M&M, the main stage action continued with engaging panel discussions and keynotes from merchants and other partners. The rest of the building was a hive of activity, featuring a product demo area showcasing all the new features, breakout sessions in smaller rooms with interactive workshops on Stablecoins, AI, and other topics of interest to merchants, and each night concluded with a mixer. The first on the roof of the hotel overlooking San Marco, and the second at the Glass Cathedral on Murano.

As you can tell, I was quite impressed and absorbed by the event, and here are a few of the things I really loved that align with the benefits outlined earlier.

Production Value and Organisation

It’s an underrated factor in hosting a great event, from a fintech developer conference to a trade event, but the production value at Thrive was top-notch. It wasn’t just the quality of the assets, signage, stages and evening drinks but the seemingly little things. Like landing at the airport and being directed to a water taxi that took you straight to the hotel, where you could chat with other attendees. Or the Cicchetti and Gondola group tour, which explored the city and connected you with other participants. Or being assigned a table at lunch so you don’t look like that kid on their first day of school, desperately looking for a spare seat and not wanting to sit at a table by themselves.

This is the first thing that impressed me, because often when the production value is high, people aren’t distracted by the lack of food, not being able to see the stage, or struggling to get to the event from the airport. Instead, they end up fully engaged in the event and are much more comfortable networking with others, which ends up strengthening the community further.

Access and Community

The other thing Thrive nailed was access, both to people and to ideas. The event was big enough to feel significant, yet small enough to remain personal.

You could have a coffee with someone from the product team in the morning, chat to a founder or senior exec in the afternoon, speak to a partnerships lead from a major merchant, and swap notes with another fintech operator over dinner. It felt like a real community rather than a hierarchical or transactional event.

That accessibility matters. When people feel like they can ask questions, challenge assumptions, or even give direct feedback, they feel invested. It turns the event from a one-way broadcast into an ongoing conversation between the company, its clients, and its partners. Feedback was another point raised by Guillaume, and it really set the tone for the open and honest conversations throughout the event.

And ultimately, that’s what a great fintech developer conference achieves. It invites everyone in the room to become part of what it’s building next rather than just showcasing what the company has built.

Content and Understanding

This one feels obvious, but it’s worth emphasising.

The content at Thrive struck the perfect balance between storytelling and substance. Every keynote and breakout session felt purposeful, a mix of future vision, current capability, and clear takeaways, wrapped with punchy graphics. And the teams presenting weren’t just reading from slides, they were the ones building the products.

That proximity between the builders and the audience created genuine understanding, not the superficial kind where everyone nods along politely, but the kind where you can picture exactly how a new API or workflow could fit into your business. The demos were interactive, the roadmaps transparent, and the conversations felt honest.

It’s easy to underestimate how powerful that is.

When clients and partners truly understand a company’s direction and see where they fit within it, they have a clearer understanding of how they can leverage and build using those new and existing products. That clarity of understanding deepens trust and strengthens long-term relationships.

These are just some of the specific things I loved about Thrive’s fintech community event and aspects that all fintech developer conferences should strive to get right (some of which already do).

Checkout my even newer toys 🚂

So to some of the specific announcements I found particularly interesting.

But first, if you haven’t read my Checkout.com deep dive, I recommend you go read that before getting into these new announcements. It gives the origins, timeline of key events, deep dive into their product stack, some of my predictions at the time and is a great primer. 👇🏽

If it’s already fresh or you’re pretty familiar with their offering then you can jump straight in.

1. A Peachy MALPB Licence

Checkout.com’s application for a Merchant Acquirer Limited Purpose Bank (MALPB) charter was accepted by the Georgia Department of Banking and Finance, and once approved, it’ll provide Checkout.com direct access to US card networks, allowing it to act as its own acquirer.

MALPB is a specialised state banking charter issued by Georgia (the peach state) that allows companies to provide merchant payment processing services directly to card networks, without needing a traditional sponsoring bank. This means a company can underwrite merchants, clear and settle transactions, and connect directly to card schemes like Visa and Mastercard, all without relying on a bank intermediary. Importantly, the licence doesn’t allow for taking public deposits, which is what differentiates it from a full banking charter.

Checkout.com will be in a fairly exclusive MALPB group, as only Fiserv and Stripe have submitted official applications, both of which were submitted last year, and both have received conditional approval.

In addition to the successful acceptance of the charter application, they also announced the appointment of Jordan Reynolds as the new MALPB CEO and Head of North America Banking to run the new entity, manage compliance, and lock in direct access to US card networks, solidifying the company’s long-term commitment to the region.

🧠 My Thoughts: This is a considerable step toward vertical integration for Checkout.com. Today, most payment processors, even large ones, rely on third-party sponsor banks for acquiring access, which adds cost, friction, and dependencies. Becoming an MALPB effectively allows Checkout.com to bypass that middle layer in the US, giving it greater control over settlement timelines, risk management, and merchant onboarding.

Although this overlooked announcement seems like ‘just another bit of reg news’, it’s a clear statement of intent about going all in on US operations, and they clearly predict accelerated volume growth in the US, as a fully granted MALPB charter, which will mean more control over margins as well as the processing + acquiring for merchants.

2. Flow Remember Me

In the Checkout.com deep dive a few months back, I detailed the Flow product as part of the Connect vertical of their product stack. It’s a pre-built, customisable payment user interface that merchants can embed directly into their websites. At the time, I wrote about the announcement of the Remember Me product as part of Flow, their entry into consumer identity through one-click checkout, which allows shoppers to store and reuse their payment credentials across the entire Checkout.com merchant network. This creates a cross-merchant processing token for faster checkouts, improved conversion rates, and lower fraud risk.

At Thrive, they announced the global availability of Flow Remember Me, rolling the product out to 194 countries after a successful beta testing period in the Middle East.

The one-click consumer checkout method is already proving successful with merchants and consumers alike, with early adopters experiencing 22% fewer authentication challenges, 30% fewer timeouts, and a 70% reduction in checkout time and merchants who combine Flow and Remember Me seeing up to a 7% uplift in acceptance rates.

🧠 My Thoughts: Here’s what I said when this was first announced back in May.

“In the future, Remember Me could evolve into a broader identity layer, enabling loyalty integration, fraud profiling, and secure user verification across platforms. For now, it’s a part of Checkout.com’s strategy that is thinking beyond payment processing and toward becoming part of the consumer’s digital wallet infrastructure.” - Jas Shah

I stand by it, especially the last little nugget.

I think Remember Me will be crucial to continuing the improvement of two key metrics for merchants, and therefore Checkout.com.

Acceptance and Fraud rates.

The more customers who sign up for Remember Me, the more trusted identities there are in the Checkout.com merchant ecosystem, and the easier it becomes to spot whether an individual is a bad actor and should be removed from the trust pool, or they are a trusted individual and can have their details processed with fewer real-time checks.

And Remember Me is a network effect-powered product.

This means that the numbers I mentioned earlier (22% fewer authentication challenges, 30% fewer timeouts, and a 70% reduction in checkout time) improve even more as more merchants activate it and more customers sign up.

There was a signature ‘antibody’ analogy in the deep dive from May that described the power of the network effect in more detail.

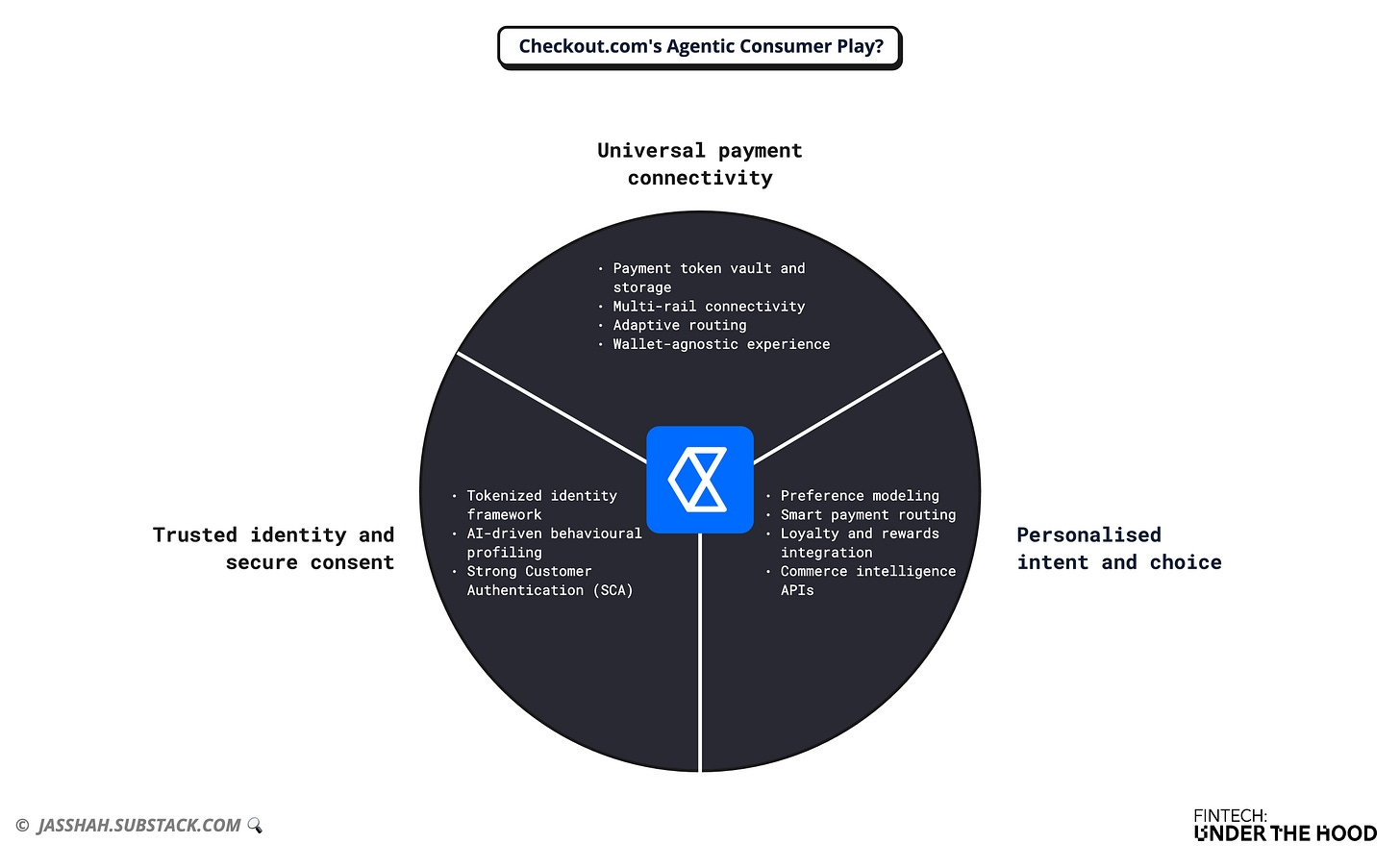

I also believe Remember Me is a foundational step for a larger Agentic Commerce play…

3. Dashboard with Embedded AI assistant

Dashboard is part of the Manage vertical and serves as a central interface for merchants to monitor transactions, performance, and fraud events. It’s effectively an operating system for back office teams. The improved version of the dashboard tracks the full lifecycle of a payment, enabling merchants to identify trends and make more informed decisions swiftly. In addition to extra insights, there is a significant upgrade. Large language model capabilities that allow users to ask natural language questions to get actionable insights faster.

🧠 My Thoughts: People often overlook the backend operational tools that facilitate payments, and Checkout.com’s dashboard is one of those essential tools. Payment analytics dashboards are what the heads of payments at some of the biggest companies on the planet use to keep track of payment performance and find those marginal (pun intended) gains.

However, the difference between a good dashboard and a great one isn’t just design; it’s speed to insight. The addition of a conversational layer is a meaningful leap forward in this regard. Instead of digging through multiple reports or exporting data to spreadsheets, a user can now ask questions in plain English, things like:

“Which region saw the highest decline rate last week?”

“How did fraud patterns change after we rolled out the new checkout flow?”

“Show me my top-performing markets by payment success rate.”

“Which acquirer setup is giving me the lowest transaction cost per dollar processed?”

Fintech innovation isn’t always about the flashy front-end experiences customers see. It’s often about the invisible systems that make those experiences possible. And in the world of global payments, where a few basis points can make or break margins, having an intelligent, data-driven dashboard might be one of Checkout.com’s most underrated competitive advantages.

The Future (and Prerequisites) of Agentic Commerce 🤖

These were three of the major announcements, but there were also other notable announcements, including recent partnerships with Uber, a collaboration with Microsoft for cloud expansion, and becoming a dual-network issuer in the UK and Europe, among others.

I want to conclude with a topic I’ve previously touched on, and one that was prevalent at Thrive.

No, it’s not ‘Growth’ as the new pillar.

Although I do still think a compelling addition to Checkout.com’s product stack would be a growth pillar that offers finance to businesses and their communities.

Take the recent Uber partnership. Imagine the collaboration extended beyond global acquiring and gateway services, and it also plugged into Uber’s Driver Portal. Using previously processed payment data, Checkout.com could project forward cashflow (combined with Uber’s own predictive model) and offer drivers finance for car maintenance, repairs, and to plug other much-needed financial gaps. Coupled with the Business Account they launched in 2024, it could be another way to “Help businesses and their communities Thrive in the digital economy”.

But no, it’s not a new Growth pillar. It’s a much more trendy topic.

Agentic Commerce.

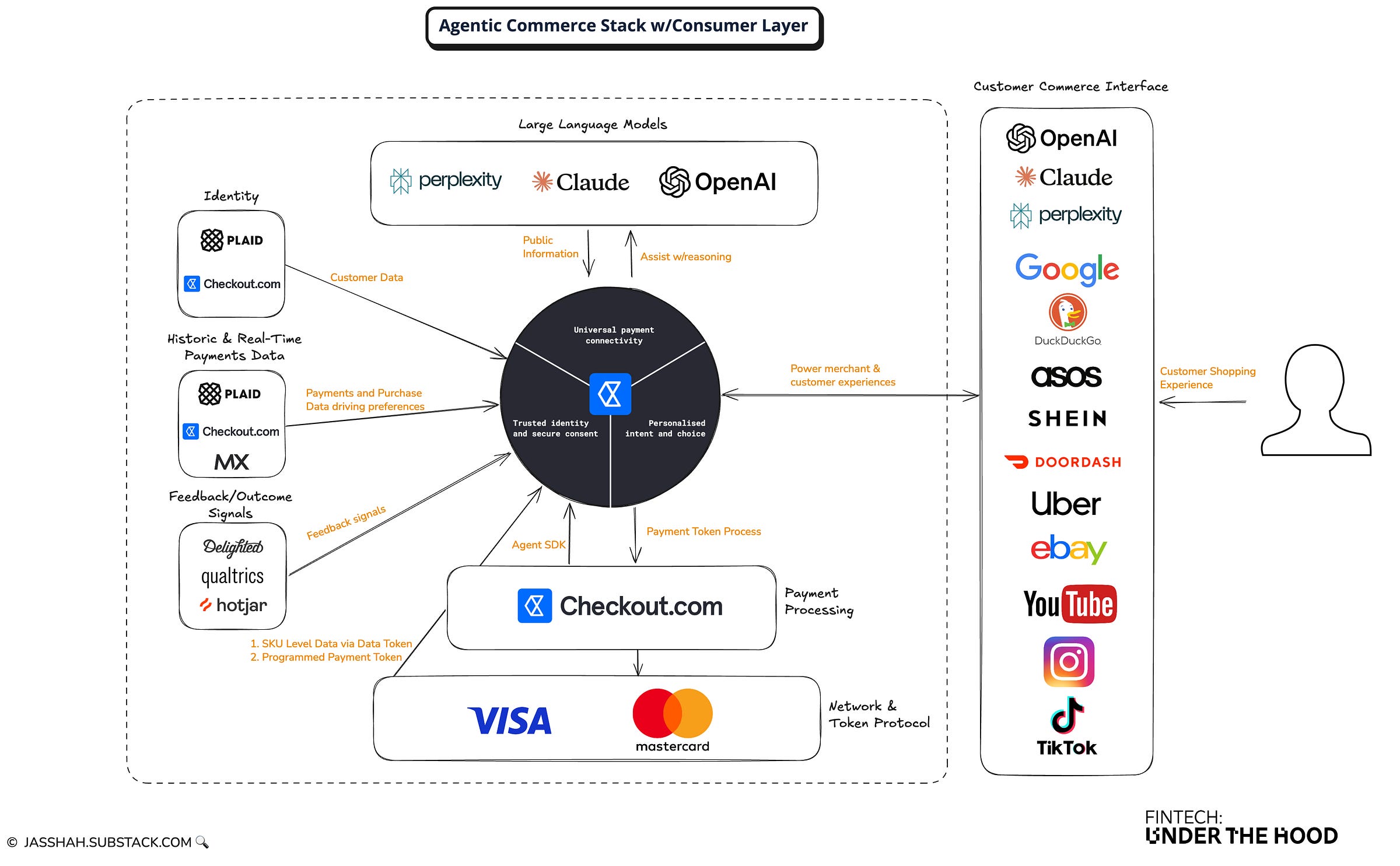

There’s been a lot of focus on agentic commerce over the past year and this was addressed head on at Thrive where leadership spoke about what they’re building for merchants to get ready for the agentic era and more discussion on the work they’re doing with Visa and Mastercard, as well as its involvement in specifying Google’s AP2 Protocol, a new set of rules defining how payments, authentication and authorisation work in agentic commerce.

I’m very bullish on the role of Checkout.com and other major PSPs in the agentic commerce era because agentic commerce relies on a few key components that I believe they, and others, are well-positioned to provide.

💳 Payment Method Access: AI agents will need to initiate and complete payments across multiple rails — cards, wallets, account-to-account, crypto, you name it. Checkout.com’s multi-rail architecture and global acquiring reach mean it can provide that “connective tissue” between agents and merchants, abstracting the complexity of different payment types into a single, reliable interface. In other words, PSPs like Checkout.com become the universal access layer for machine-driven commerce.

🪪 Identity and Authorisation: For agents to transact autonomously, identity, consent, and trust frameworks need to evolve. PSPs already sit at a critical junction of authentication and authorisation, verifying cardholders, merchants, and transaction intent. As AI agents begin to make purchases or negotiate subscriptions on behalf of users, companies like Checkout.com are well-positioned to manage this next layer of identity infrastructure, combining tokenization, biometrics, and behavioural signals to ensure every transaction is verified, secure, and compliant.

🛍 Customer Commerce Preferences: Perhaps the most underrated but most important component for adoption and growth is personalisation. Agents will need to understand and act on a consumer’s payment preferences, whether that means using the lowest-fee rail, a preferred card for rewards, or splitting payments between accounts. Not only that, but they also need to understand customers’ shopping preferences deeply. For example, when buying clothes, do they prefer high-end stores or budget-friendly options? What are their most frequented stores? What do they usually buy? PSPs that already process billions of transactions hold a uniquely rich dataset to model and manage these preferences responsibly. Checkout.com could serve as the “preference brain” or commerce agent layer, providing consumers with all the tools they need and allowing merchants (and agents) to route payments based on user intent, cost optimisation, or loyalty benefits in real-time.

This is why Remember Me is absolutely crucial to the agentic commerce era.

Over time, it’ll build a golden source record of a consumer, including their shopping behaviours, preferred payment methods, pricing sensitivities, and the initial identity verification journey.

Consumers could connect their data from a Remember Me wallet via an authentication flow (like the third party SSO authorisation that happens when you sign up to ChatGPT or Claude), and the agent in the respective interface can pull these preferences, including a conditional payment authorisation token, add items to a shopping basket based on the customers initial prompt or conditional statement e.g. “Buy the Stranger Things Blu-ray when it’s available”, and either push a final confirmation button to the customer for final purchasing power, OR, automatically transact on their behalf.

This is the type of scenario that is constantly discussed when we talk about agentic commerce, but most forget about the consumer preferences.

As I mentioned in a previous agentic commerce deep dive, someone will have to build out these components and give consumers a friendly way of viewing, editing the data as well as authorising access to third parties like ChatGPT, Claude, Gemini and others, and in my eyes, the PSPs are the ones who are positioned at the intersection of the consumer behaviour data, payment information, consumer identity and merchant connectivity to really win in this space.

That’s it from me. I hope you enjoyed this deep dive 👋🏽

Remember to hit the thumbs up below, drop a comment to let me know what you think (and whether there’s a FintechDevCon you love), and share it with a friend or colleague.

Jas.

P.S. If you want to partner with me on an edition of Fintech: Under the Hood or are interested in working with me in any of the below areas (what I call my day job), reply to this or send an email to jas@bitsul.co.uk 😊 :

👉🏽 Product Strategy/Development consulting

👉🏽 General Fintech advisory

👉🏽 Digital bank building and growth advice

👉🏽 VC/Family Office advisory & product due diligence

👉🏽 Mentorship or a ‘product therapist™️’ for your team

👉🏽 Content expertise (whitepapers/webinar hosting/roundtables)

Love this!