Fintech R&R☕️🎉 - Review and Big Fintech Quiz of the Year edition

A short look back at interesting news from Jan-Dec 2023 and a 25 question quiz to test your knowledge

Hey Fintechers and Fintech newbies 👋🏽

This is the last edition of the year, and to close things out, I'm doing a short, sharp summary of the news from 2023 that I've found particularly interesting. It's also early and dropping on Substack and LinkedIn simultaneously to fit in well before the Christmas break.

While things that happened in fintech are probably lower down the list of significant things that happened in 2023, it's always important to summarise key milestones and look back across recent history to better understand what will come in 2024. But I'll refrain from giving full-blown predictions here as I want to keep this edition a bit shorter and lighter so you can return to holiday preparations!

On keeping things light, I'm kicking this edition off with something a bit different to get an initial gauge of your knowledge of fintech news with…A Big Fintech Quiz of the Year!

No one else has a fintech quiz summarising key stories and a set of questions to truly separate the fintech nerds from the newbies, but a fun quiz is the perfect way to close out the year.

The only prerequisite for the quiz is to submit your email to sign up or confirm your subscription to this newsletter.

Other than that, I'd recommend taking the quiz before reading any more of this edition (as many of the answers are baked into this summary), then circling back once you have your score to confirm what you already know or to find out the answers to questions you struggled with. If you've been a Fintech R&R subscriber from the very beginning, all the way back in mid-February, then you'll have a bit of a head start as there are some callbacks to previous editions, ESPECIALLY when it comes to some of those tricky acronyms.

And if you're looking to do this as a fun Christmas period company activity and get a summary of your team's performance afterwards, make sure you all use your respective company emails; send me a request once you've completed it, and I'll gladly send over an extracted mini leaderboard from Typeform.

Now, off you go. Click the image below (or here)to get started! 25 questions and a maximum of 25 points available.

Summary of the Year

How did you get on with the quiz? Any questions you found particularly challenging? Some of the acronyms were tricky. The majority of the answers can be found in previous editions and in the summary below, but I'll also publish a full answer breakdown in the first edition of 2024, so keep an eye on your inboxes for that.

Now, on with the summary…

January

Neobanks lead the switching boom

Positive news for popular neobanks kicked off the year with Starling and Monzo being announced as the 3rd and 4th most popular banks to switch to, according to Q3 2022 data from the Current Account Switch service. This is a signal to indicate that fully digital banks are part of mainstream consumer thinking. However, the data doesn't clarify whether any of those switches were 'salary switch surfers', folks who move their salary into different accounts to make the most of bonus and cashback offers.

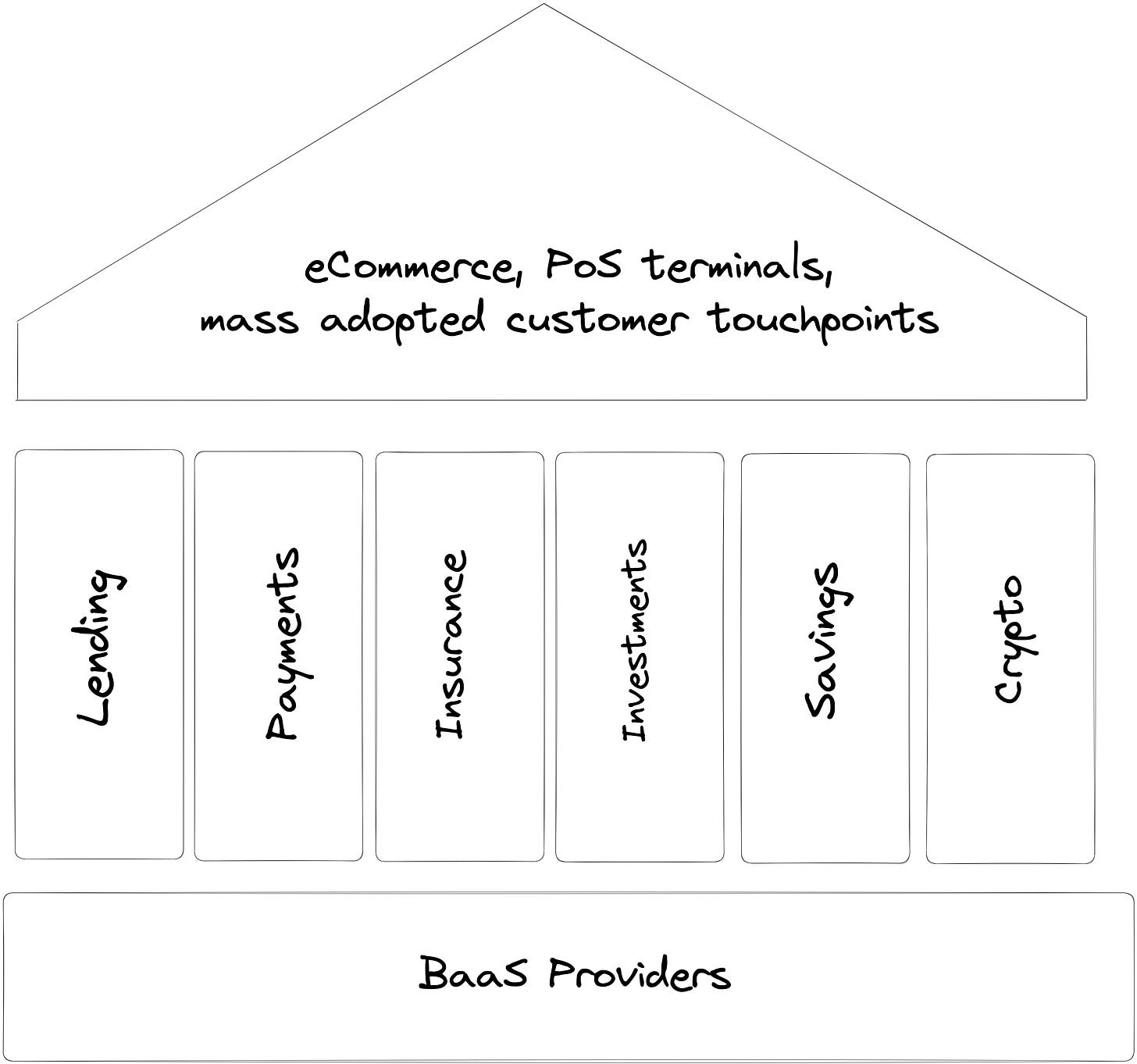

At the end of Jan, Marqeta, one of the more well-known BaaS providers, made their first-ever acquisition, Power, a credit card service provider. This allows them to provide their clients with more capabilities, allowing them to build and manage full-stack credit card programs from market research and card design to day-to-day card and risk management. But it also means they could provide this tech and service to established and up-and-coming e-commerce organisations to launch and manage their own branded credit cards, moving from embedded finance enabler to embedded finance provider. I wrote up a couple of interesting areas they could use the acquisition to really supercharge their offering in the embedded finance edition. The first but not the last acquisition for them.

February

Open Banking Limited (formerly known as OBIE) announced that the number of open banking users had finally hit the 7 million mark. A significant milestone, and as Henk Van Hulle, Chief Executive Officer of OBL, said at the time: "It is significant that 1.2 million of these are first-time users".

1.2 million first-time OB users is significant, but compared to the growth of many other global Open Banking networks (especially India's UPI), it's seen as stagnant progress.

March

Early in March, BaaS provider Griffin announced they'd been granted a banking licence from the FCA. The banking licence, which came with certain restrictions that limit the amount of deposits they can take and payment services it can provide, is still a huge step for them to become what they call "UK's API-first bank and full-stack Banking as a Service platform". Some positive BaaS news in what is otherwise a pretty bleak year.

April

The app-based children's education fintech that's the first name on everyone's lips when they think 'financial education' was acquired by US fintech Acorns this April. Although only a little has changed for customers, the potential to reach many more customers via the Acorns brand and to positively benefit future generations has undoubtedly increased. Broadly, there are not enough comprehensive financial education tools out there since many of us have made the transition over to mostly digital banking and I predict an increase in innovative child, teen and adult literacy applications over the next couple of years, not just in the UK but across the globe.

SEC charges Javice in JP Morgan vs Frank founder case

In April, the JPM v Charlie Javice drama started to unfold after Javice was charged with fraud by the SEC. This came after a long-running battle between the banking behemoth and the student finance application startup, where JPM claimed fraudulent and overinflated customer numbers and duped them into buying the supposedly successful and high-growth fintech.

They must have had Kevin from The Office running their data team…

May

2022 was a big year for the growth and awareness of AI spearheaded by OpenAI and ChatGPT. But 2023 was the year that fintech made use of this increase in customer understanding of AI, starting with Ramp. Ramp, the corporate card and finance automation fintech, announced a range of AI-powered tools called Ramp Intelligence to help businesses. This includes a software contract analyser that uses GPT-4 to analyse the contract and let the company know whether they are getting a good deal or not and can renegotiate the contract with vendors if not. And an advice centre where customers can ask questions about reducing costs like 'How can I cut operating costs?'. It'll then analyse the business's transactions and come up with suggestions. It was one of the first 'proper' implementations of AI that seems logical and brand-aligned and actually helps customers with real problems.

In May, Monzo announced it'd hit its first two consecutive months of profitability after a boost in revenue largely down to its lending products. Net interest income increased 382% to £164.2 million, contributing to its bottom line. Talking about the news, CEO TS Anil said: "Profitability was always a choice as we balance continuing to invest in growth with profitability. "

June

UPI nears the 10 billion monthly transaction mark

India's version of Open Banking rails, UPI, fast approached the 10 billion monthly transaction milestone. Unified Payments Interface (UPI) is India's mobile-first instant payments system that allows customers to make interbank peer-to-peer and peer-to-merchant payments using a virtual payment address, transforming digital payments nationwide. The milestone was just a small signal of the country's big shift towards fintech and its ambitions that, in some cases, exceed the UK's, US's, and Europe's.

Read more about UPI and India’s digital locomotive here

July

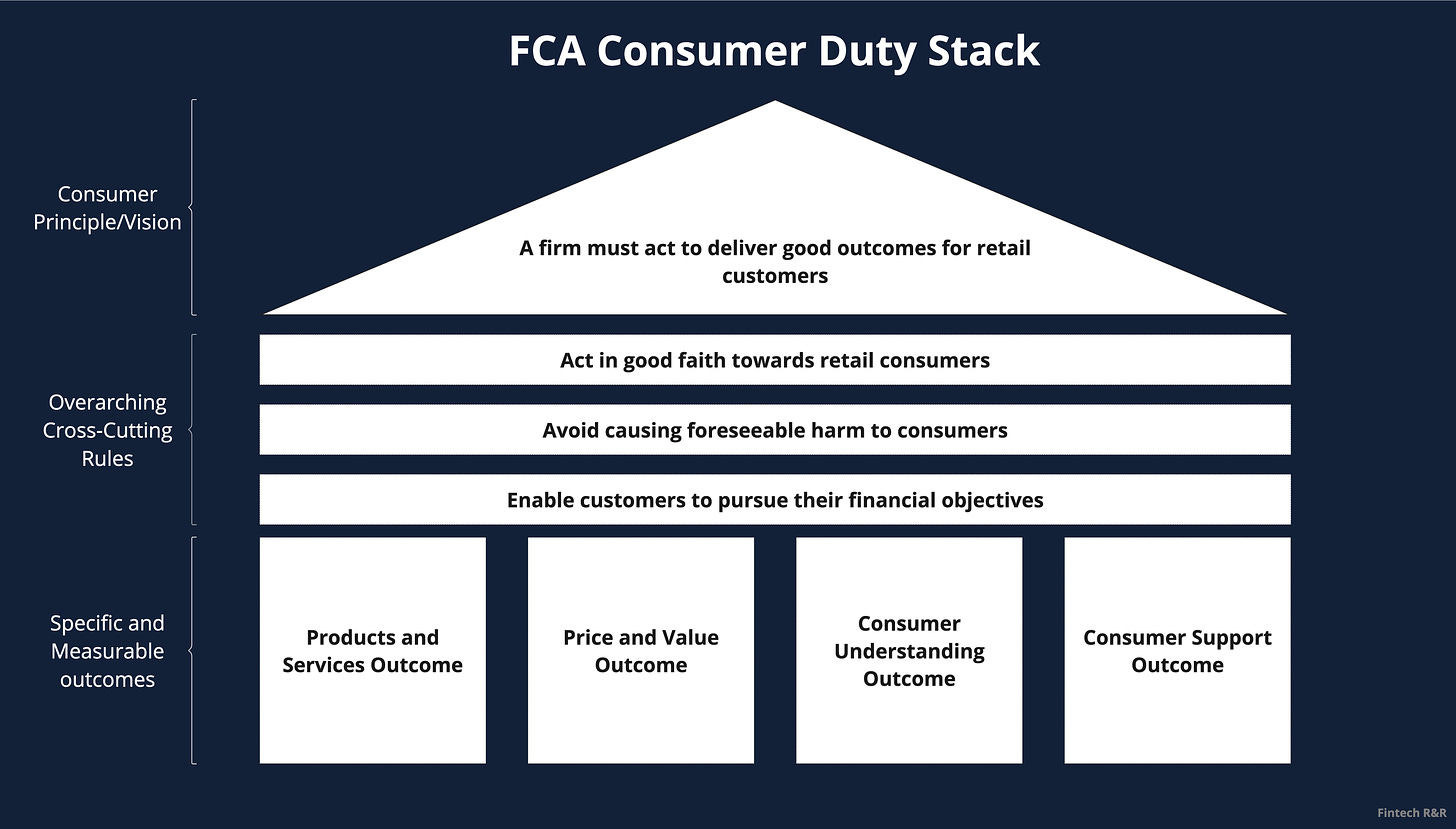

Consumer Duty Rolled out

On the 31st of July, the new duty, whose overarching objective is to "set higher expectations for the standard of care firms give consumers", came into force for all 'open' products (with a 2024 deadline for closed products). Although it's nothing new for many companies, once the FCA starts to outline repercussions for non-adherence, it could send a positive ripple through many firms in how they build products and serve consumers. More on consumer duty here.

A be-yond brilliant marketing Campaign

I've been to Wimbledon a few times, and the Wimbledon queue experience, from the people in it, the volunteers helping and the overall process, is probably one of the undisputed best times in a queue I've ever had. But Amex challenger Yonder tried to better it with their 'unofficial queue sponsor' campaign, setting a new bar for what a great out-of-home marketing campaign looks like and gaining loads of fitting customers in the process.

The long-anticipated instant payment rails developed by the Federal Reserve were launched to make everyday payments faster for Americans. Federal Reserve Chair Jerome H. Powell said, "Over time, as more banks choose to use this new tool, the benefits to individuals and businesses will include enabling a person to immediately receive a paycheck or a company to access funds when an invoice is paid instantly."

August

JP Morgan Taps to Pay with Sephora

In August, JP Morgan announced they were rolling out Tap to Pay for its US merchant clients, with Sephora, the first major store, signed up as part of the rollout. Stefan Jensen, Vice President, Treasurer at Sephora said this at the time, "Sephora operates with a customer-first mindset, and our goal is to provide an elevated shopping experience in all of the ways that our beauty community chooses to shop with us. Tap to Pay on iPhone allows our Beauty Advisors to complete contactless transactions easily with only an iPhone—anywhere in the store.". I also think Sephora as the first Tap to Pay client is a genius move, but I'm curious to see which other partners will take up the offer of TtP and whether they will use it to their advantage and trigger the beginning of the end of the fixed payment point for department stores.

September

FCA takes its first action under consumer duty

After the launch of the new consumer duty in July, the FCA swiftly got to work asking 9 banks and building societies to provide value assessments on its saving products after concerns that interest rate rises weren’t being passed onto consumers. The first clear demonstration of the new duty in action.

Mercedes driving embedded payments

Mercedes' payments initiative, Pay+, initially launched with 'Fuel and Pay' in Germany, allowing Mercedes drivers with Mastercard Credit or Debit cards to drive into gas stations, fuel their vehicles and pay using the in-car fingerprint scanner without having to use their card or leave the vicinity of their car. I did a deeper dive of the in-car use cases here.

October

Apple banking on Open connections

Strictly speaking, this was September news, but anyway. Apple announced they are making cross-account balances available in the Apple Wallet to UK customers that go through the standard Open Banking authorisation flow. This will mean customers can see their balances in their wallets without jumping into their banking apps.

I've always said Open Banking is an embedded finance on-ramp because of the ease with which it allows access to vital transaction data. Apple's foray into OB, as with everything else, is usually well thought out and has a longer-term plan attached. Balance visibility is a stealth feature designed to get customers to connect their accounts and allow for the processing of transaction data to surface lending opportunities. My ApplePay deep dive dropped a few weeks after this news.

Intuit announces the closure of PFM app Mint

At the end of October Intuit announced it was shutting down Mint, the popular PFM app loved by Minters all over the US and used to set budgets and understand finances.

Personal Finance Management takes a bashing, but the problem of budgeting still exists for consumers. The issue isn’t the package of features. It’s that many providers haven’t found an economic model that works. It’s clear from surveys and research that, generally, customers don’t want to pay for dedicated budgeting and PFM tools, so organisations should see vanilla PFM products (those with budgets and transaction categorisation) as loss leaders because of the extremely tight margins or as an acquisition tool that sits atop the customer acquisition funnel. In the case of Mint, I think it was a matter of picking the app to invest the time, money and resources on, and they picked Credit Karma (which they bought for $7.1 billion).

November

Apple proposes severing ties with Goldmans

In an announcement that shocked some but left a few smart cookies unsurprised, Apple approached Goldman Sachs about ending their relationship, which would see an end to a GS-powered credit card and savings account. The wind-down option would only come into effect once Apple finds an alternative partner, which they are likely on the hunt for right now, but it's not like there's an abundance of GS lookalikes waiting to bite their hand off. It'll be interesting to see if they find a partner and who that partner will be…

Capital G x Monzo investment rumours swirl

Rumours circulated recently of a potential investment by Capital G, Google's parent company investment vehicle, into Monzo Bank.

With this rumour that Capital G, a growth fund that has previously invested in the likes of Stripe & AirBnB, wants a piece of London fintech's poster child came out a couple of weeks ago I think it’s a case of ‘there's no smoke without fire’, especially when the specific investment range of "between £300-500m" is verified by multiple sources.

This will be the formal kick-starter for their IPO in my opinion.

December

I love what Curve does. The Lord of the Rings reference on their homepage (one card to rule them all) instantly gets me on side. And their recent wearables partnership is no different. They've partnered with a few different wearable firms to bring payments to people's fingertips and done it with an edgy tube, digital screen, and online campaign.

That's it for the last edition of the year. I told you it'd be short and sharp.

Did you manage at least over 70% correct answers in the quiz and find any missing answers?

Drop me a comment with any you struggled with, and if I get enough responses, I might do a bit of data analysis on the 'easiest' and 'hardest' questions.

I'll be back to regularly scheduled programming in 2024 with more Under the Hood explainers, Fintech Product deep dives, the latest fintech news, and practical insights into building fintech products.

Before then, I'd love to get your feedback. Whether you're one of the 100s of very early subscribers (you know who you are) or a recent follower, drop your feedback and any ideas for future editions you have at this link.

I'm also planning on adding a fixed section at the end of each newsletter describing some of the work I've done before, the services I offer, and the types of companies that would benefit from them, so watch out for that, and I'd love your help in getting the message to companies and early-stage founders who may need some extra fintech product support :-)

Thanks to everyone who subscribed this year, dropped comments, re-shared editions with their network and generally supported my work. It means a lot and keeps these arms powered through the late Thursday night writing sessions…

But that's it from me for this week and this year. I'm off to take three well-earned weeks of rest and relaxation and fully power down from all (well, most) work-related activities.

Happy holidays, happy new year, and see you in 2024!!

a somewhat cloudy & messy yr, yet with lots of silver linings, thanks for the insightful sharings in 2023, Jas.

2024, keep calm & cheer on:)