Fintech R&R ☕️🤖 - Everything’s gonna be AI right? | Part 2

A deep look at the benefits of AI to FS organisations and the four key horizontals everyone should focus on

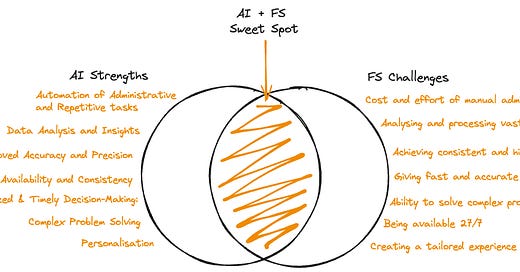

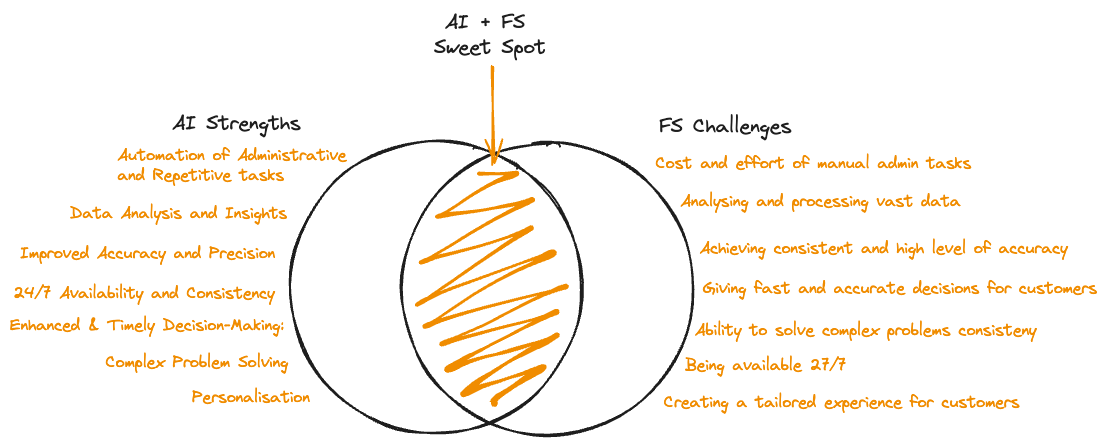

How do the big strengths of AI map to the challenges faced by FS?

What are the four big AI transformation horizontals?

Which tools are helping FS companies adopt AI?

Why do I think AI transformation in FS is a pincer move?

Why AI + Open Finance still has a way to go to solve the PFM problem?

What is the John Connor effect™️ in AI?

These questions and more will be answered in this week's edition of Fintech R&R.

Hey Fintechers and Fintech newbies 👋🏽

Another busy few weeks in fintech.

Events, announcements, and lots of product launches.

For me, though, the big news over the past few weeks was all AI-based.

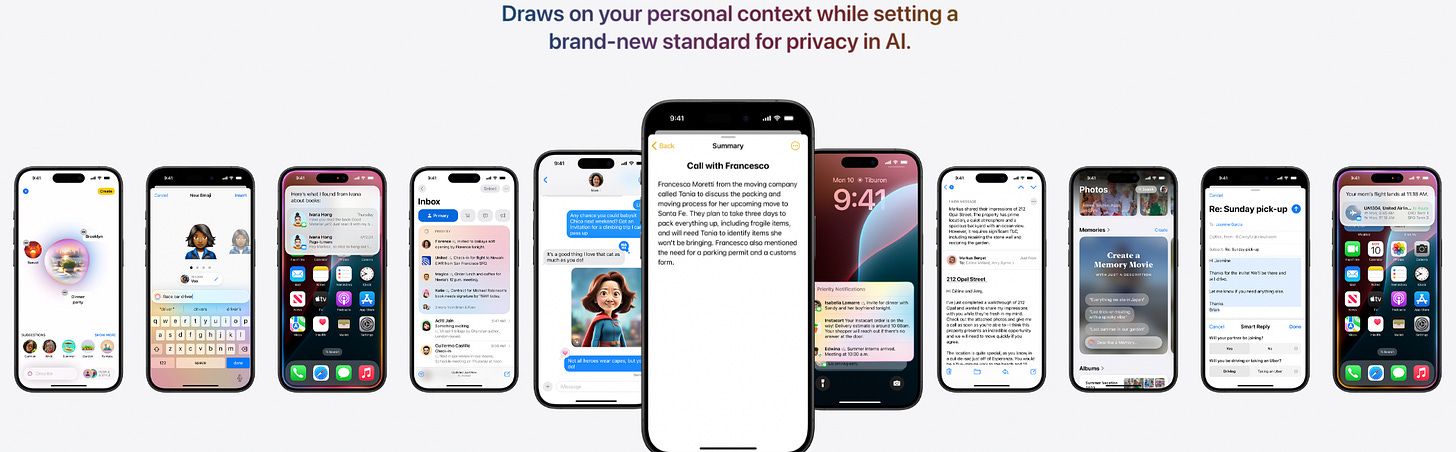

Apple announced Apple Intelligence. (It would be very ‘Apple’ of them to file the paperwork to try and trademark ‘AI’ as their own acronym).

AI baked into iPhones, iPads, Macs, and Macbooks that works seamlessly across apps, helping users write more effectively, communicate with ease, get creative, and more as it’s baked into Notes, Email, and iMessage, all under the watchful eye of Siri with all the security you expect from on-device processing.

They simultaneously announced a strategic partnership with OpenAI, which means Apple users can leverage ChatGPT for more complex processing without leaving their devices or switching apps.

Big and inevitable news of AI being baked into devices.

However, not long after they made the big announcement at their flagship dev conference WWDC, they stated that Apple Intelligence would not come to the EU this year due to “ Due to the regulatory uncertainties brought about by the Digital Markets Act”. A deep dive on that is in the schedule.

AI chip giant Nvidia became the biggest company in the world for a short period after Microsoft retook the crown. This temporary crowning and uncrowning isn’t that significant as Apple, Microsoft and others have been playing ‘top spot ping pong’ for the past few years but it is a sign that AI is approaching a full on heatwave.

Note: At the time of writing, Nvidia is back in 3rd place.

Although AI is one of THE main talking points at every conference, meetup and webinar, research from transformation consultancy Kin+Carta revealed that the “majority of financial services institutions are only now just starting to engage with generative artificial intelligence (Gen AI).”

Only one in seven (14%) of the FS organisations surveyed believe that AI is currently baked into their corporate strategy, although nearly half (43%) have a small number of proof-of-concept (POC) projects in development.

These big hits of AI news prompted me (get it, prompted) to write a follow up to last months ‘AI in FS’ primer and give my insights into the big opportunity areas for in FS, an informed and logical view on the biggest areas of AI disruption in FS from front to back.

As well as interesting news, puns + AI movie references, this edition includes the following:

A recap of the AI Primer edition

The biggest strengths of AI

Mapped against the challenges in FS

The four big horizontals of AI transformation across FS

Data Processing

Process Optimisation

Decision Making

Customer Experience

The prominent AI tools impacting each horizontal inc: Alteryx | Stratiphy | BluePrism | UiPath | Numerai

2 areas of AI impact to be excited about

The SME ecosystem

Personal Finance Management

Fintech Spotlight 🔦:Wonderful: Open Banking Payments for good

Now let’s get into it 💪🏽

NOTE: You know the drill. Your mail client might crop the end of this so click here to see the full, unclipped edition, drop a like and comment at the end, and don't forget to subscribeEverything's Gonna Be AI: Part 1 Recap

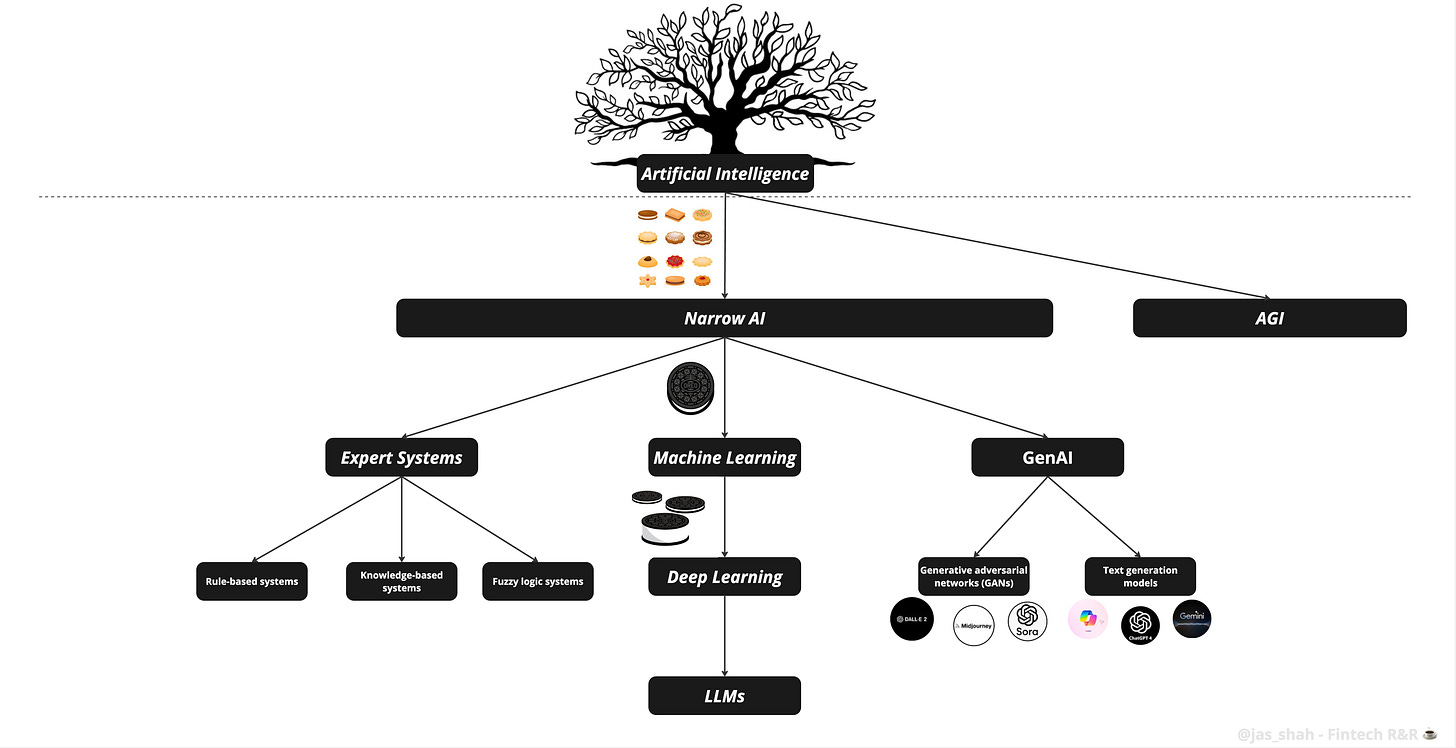

If you're yet to read Part 1, I recommend reading that before getting into this one. It has a brief history of AI, a clear definition, the different categories (Expert Systems to Deep Learning), and some recent examples of AI in Fintech.

Click the image below to read it first, then jump to the next section.

For those who did read it and want a quick reminder, here's a quick recap. If it's still fresh in your memory, skip to the next section.

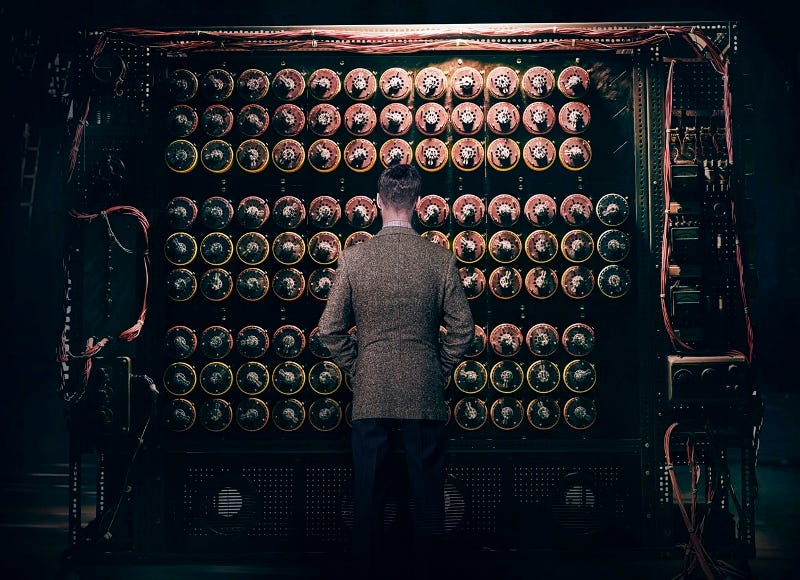

Origins of AI and Computing

The origins of modern-day computing and AI are often traced back to Alan Turing's team and their effort in building the enigma code-cracking machine known as The Bombe in the 40s. This machine systematically sped up the manual computation of the team of mathematicians and cryptographers to ensure codes could be broken in hours, not weeks, saving lives and contributing to the end of the war.

Most Expert Systems (a form of AI) used in organisations today are an advanced form of the original Bombe. A system built by qualified experts in their field who create rules for the system to follow and process that information at a much faster pace than a human.

Over the following few decades, the term Artificial Intelligence was coined by John McCarthy, one of the founding fathers and the first to coin it.

In the 1950s and 1960s, researchers developed early AI programs that demonstrated capabilities such as symbolic reasoning, problem-solving, and language translation. The 1970s and 1980s saw the rise of expert systems, AI programs designed to mimic the decision-making processes of human experts in specific domains. Expert systems were widely used in areas such as medicine, finance, and engineering.

The 80s and 90s saw a slow down in progress with AI known as the "AI winter" where funding for projects dried up and large organisations like IBM and GE pulled back on their plans for AI R&D centres.

This was naturally followed by a resurgence, which we have seen from the 2000s to today. We're on the upward curve of the AI hype cycle, or AI heatwave, as I like to call it.

What is AI?

There are a lot of varying definitions. If you ask ChatGPT, it gives a comprehensive but rather lengthy answer.

I prefer my simple definition.

"AI is a machine's ability to perform the cognitive functions we associate with human minds, such as perceiving, reasoning, learning, interacting with the environment, problem-solving, and even exercising creativity."

The keywords there are perceiving, reasoning, learning, and problem-solving, especially when we talk about it in the context of financial services, which is what I'll get into shortly.

When you first hear the term AI your subconscious might immediately jump to a robot with a built in supercomputer and the ability to evolve, learn and think for itself.

That's Artificial General Intelligence or AGI

A system that aims to replicate the broad cognitive abilities of human beings. AGI would possess the capacity to understand, learn, and apply knowledge across a wide range of domains, similar to human intelligence. Think Ex-Machina, Terminator and Sonny from I,Robot.

We're a few generations away from that.

99.99% of current AI is in fact Narrow or Weak AI. That's not a term used disparagingly, it's just the term to differentiate it from AGI.

Narrow AI, or Weak AI, are systems designed and trained for specific tasks or narrow domains, hence the name.

Here are the different forms of AI:

Machine Learning: A subset of AI that focuses on algorithms that allow computers to learn from data, identify patterns, and make predictions and recommendations by processing data and experiences with minimal human intervention. It encompasses techniques like supervised learning (learning from labelled data), unsupervised learning (finding patterns in unlabeled data), and reinforcement learning (learning through trial and error).

Example: Large-scale analysis of transactions, using that and merchant data to spot trends in fraud and identify likely points of fraud in the future.

Deep Learning: A deeper layer to Machine Learning, appropriately named Deep Learning. Deep Learning is more advanced than ML at processing a more comprehensive range of data resources (text, as well as unstructured data, including images), requires less human intervention, and can often produce more accurate results than traditional machine learning.

Deep Learning harnesses neural networks modelled after the intricate interactions of neurons in the human brain.

Example: The obvious general one is self-driving cars. In FS, a good future-looking example is algorithmic trading.

Large Language Models: These are advanced AI systems designed to comprehend and process massive amounts of unstructured text. They leverage deep learning techniques, particularly utilising architectures like transformers, to process vast amounts of text data. These models learn intricate patterns and relationships within language through training on massive datasets, enabling them to generate coherent and contextually relevant responses to queries.

Example: Backend of ChatGPT

GenerativeAI: This is the one that most will be accurately familiar with. The most basic description of GenAI is "an AI model capable of generating human-like content in response to a prompt including audio, code, images, text, simulations, and videos ."

Example: ChatGPT, Dall-E, Sora (in conjunction with OpenAIs LLM)

Expert Systems: An Expert System is an AI that emulates human expertise and decision-making in a specific domain. It consists of a knowledge base containing domain-specific information, rules, and heuristics and an inference engine that applies logical reasoning to interpret the knowledge and make decisions or provide recommendations.

Example: Many existing use cases across FS and beyond, including Lending & Insurance Underwriting, Fraud detection & Translation monitoring, decision-making platforms in asset/investment/wealth management and more.

That's the short summary. Now for the meat on the bones.

The Skeletal Strengths of AI

Before I outline what I see as the meaty horizontals where AI will have the biggest transformational impact over the next 5-10 years, I'm going to quickly look at the broad strengths of AI compared to traditional human expertise.

Firstly, the 'artificial' part of AI skews how most people think about it. As I hinted at earlier, movies like Ex-Machina, Spielberg's AI, and The Terminator have given the majority a perception of AI as this superintelligence that will soon match and mirror human thinking and behaviour.

That's very far off from the current reality.

Depending on the development and economics of relevant processing power, we'll likely get there, but by most conservative estimates, it will take at least 100 years.

For context, the future from which the terminators are sent back in the first two movies is 2029!

Just five years from now!

Yes, I know it's sci-fi but it's good to clarify that as much as they try to be predictive with dates they get it wrong. I imagine in five years there'll be articles with the header, "today is judgement day according to the Terminator series. What did they get wrong?". I'm just getting ahead of it.

So, rather than jumping 40 years into the future, when I think about AI and its benefits across a range of FS functions I first think logically about its strengths, challenges in FS, and then predict where it'll make the biggest impact.

Strength in Numbers 💪🏽

The strengths of AI, namely Machine and deep Learning, GenAI, LLMs, and Expert Systems, might be obvious to most, but I'll outline them here anyway with some direct FS use cases.

Automation of Administrative and Repetitive tasks

AI can automate mundane and repetitive tasks, freeing up human workers to focus on more complex and creative work. This leads to increased efficiency and productivity

Data Analysis and Insights:

AI 'excels' 😉 at analysing vast amounts of data quickly and accurately. It can identify patterns, trends, and correlations that might be missed by human analysts, providing valuable insights for decision-making

Improved Accuracy and Precision:

AI, specifically machine learning systems, can achieve high accuracy and precision in tasks such as image recognition, natural language processing, and predictive analytics

24/7 Availability and Consistency

AI systems can operate continuously without fatigue. This makes them ideal for tasks that require constant monitoring and quick responses, such as customer service chatbots and security surveillance

They also perform tasks consistently without variation, reducing the risk of errors that can occur with human workers due to fatigue, distraction, or bias

Enhanced & Timely Decision-Making:

AI helps in gathering reliable and valuable insights at a much faster pace. Along with important algorithms enables machines to bring consolidated data and predictions

AI systems are always available, thus helping with faster decision-making

AI can support and enhance human decision-making by providing data-driven recommendations and insights. This is particularly valuable in fields such as finance, healthcare, and logistics

Complex Problem Solving

AI can solve complex problems that are difficult or impossible for humans to tackle alone. This includes optimising supply chains, discovering new drugs, and predicting equipment failures in industrial settings

Personalisation

AI can tailor experiences and recommendations to individual users by analysing their behaviour, preferences, and past interactions. This capability is widely used in e-commerce, entertainment, and online advertising

Put simply, AI can analyse massive data sets, solve more complex problems, come to more accurate, unbiased, personalised decisions, and execute tasks at a speed, consistency and scale that equivalent human processing power cannot match.

Like the T-800 from Terminator, "It never eats, it never sleeps, it doesn't feel pity, or remorse, or fear. And it absolutely will not stop... ever".

Accuracy and availability are huge benefits applicable to FS btw.

The reason there's lots of talk about AI in financial services is that the big strengths of AI map quite neatly against the challenges many large FS firms, small fintechs and everyone in the industry faces.

Repetitive tasks

🏦 In FS, manual processing of transactions, compliance checks, and reporting can be time-consuming and prone to human error.

🧠 AI-powered Robotic Process Automation (RPA) tools can handle these tasks more efficiently and accurately, reducing operational costs and minimising errors.

Data Analysis and Insights

🏦 In FS, there are vast amounts of data to be analysed for trends, risk assessment, and customer insights that, in many cases, are too much for a team of humans to process, even with the aid of some computing power.

🧠 Machine Learning algorithms can process and analyse large datasets to identify patterns, trends, and anomalies, providing actionable insights for better decision-making in areas like credit risk assessment, investment strategies, and fraud detection.

Improved Accuracy and Precision

🏦 It's not just the ability to process data that's crucial. It's doing it with accuracy and precision to reduce poor financial decisions and risk to lead to better outcomes.

🧠 ML models can offer high precision in tasks such as credit scoring, fraud detection, and market forecasting, enhancing the accuracy of financial ops.

24/7 Availability

🏦 21st-century financial services need to be available round the clock to meet customer needs, handle transactions in real-time, and identify & respond to potential fraud. An account being blocked while you're on holiday or restricted access to a service because of timing or availability of staff is a major red flag nowadays.

🧠 AI-powered chatbots and virtual assistants fronted by GenAI can provide 24/7 customer service, addressing queries, processing transactions, and offer human-like, advice (getting closer by the day) without downtime.

Enhanced Decision Making

🏦 Fast and accurate decision-making is a core challenge for nearly all FS orgs. Whether that's onboarding a customer onto a current account based on risk, accepting them for a mortgage, making a major trading decision as part of an investment bank or an asset manager rebalancing a portfolio. These underlying systems take time, effort and resources to build and maintain.

🧠 AI provides data-driven insights and predictive analytics, supporting more informed and timely decision-making across all areas, including investment management, risk assessment, onboarding, credit decisions, and customer relationship management.

Problem-solving

🏦 Individual circumstances, financial markets, and regulatory environments are complex and constantly changing, requiring sophisticated problem-solving capabilities usually fulfilled by costly analysts, quants and customer behaviour experts.

🧠 AI can optimise trading strategies, simulate almost unlimited market scenarios, and ensure compliance with regulatory requirements, helping financial organisations navigate complex environments more effectively.

Personalisation

🏦 FS Customers expect personalised financial advice and services tailored to their individual needs. From PFM apps and wealth management products to SMEs seeking tools and services and individuals finding the best mortgage product, personalising experiences is key to winning customers but challenging to execute at scale.

🧠AI can analyse customer behaviour and preferences to offer personalised product recommendations, financial advice, and tailored marketing campaigns, improving customer satisfaction and engagement in a scalable way.

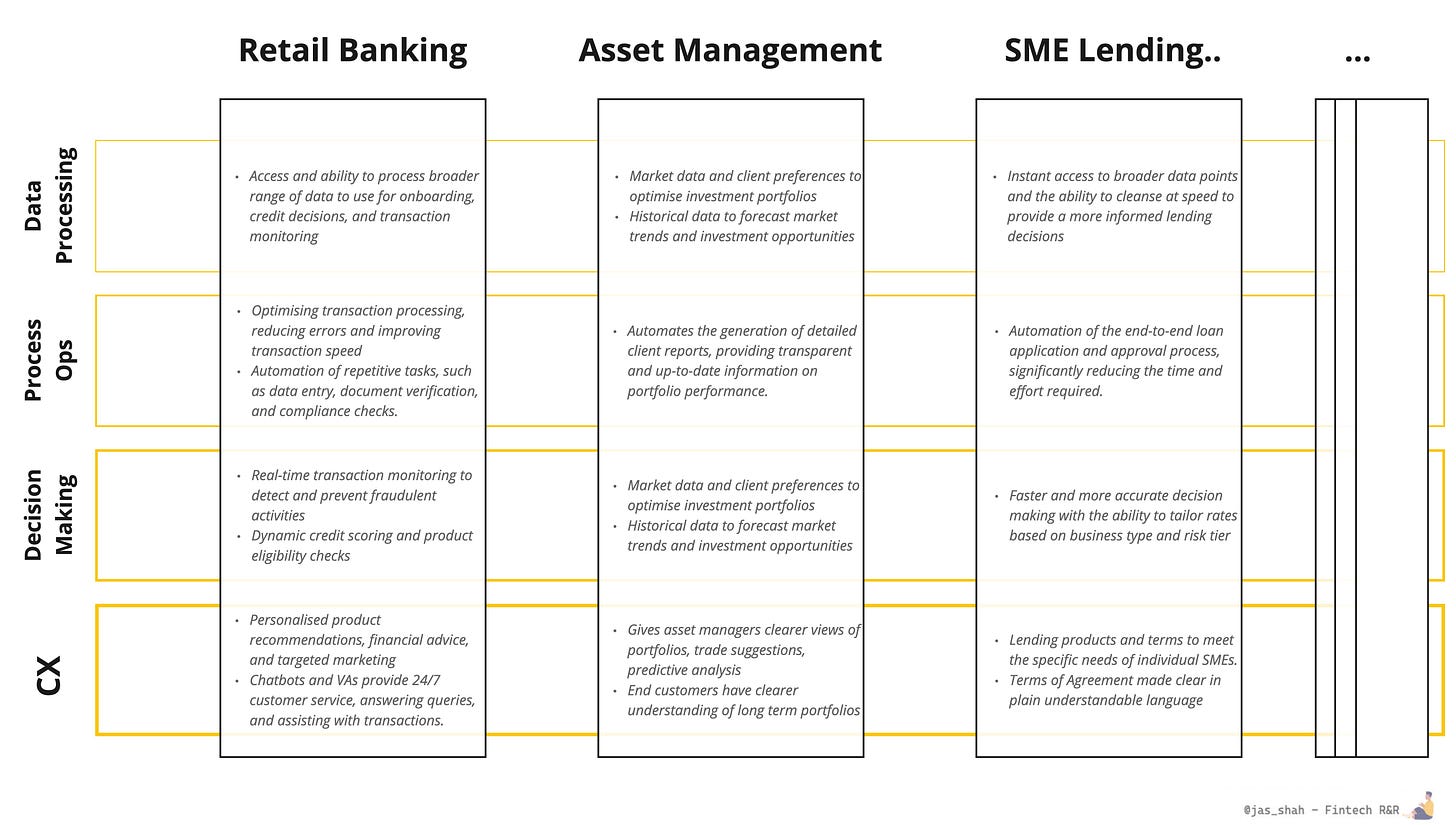

Transforming FS from Back to Front

Like death and taxes, AI baked into different facets of life, including one of the substantial parts, financial services, is inevitable.

When it comes to looking at the areas of change and where AI will have the most significant impact across varying parts of FS, rather than purely looking at the individual strengths and challenges, which can be pretty broad, I prefer to look at the areas of innovation as four front to back horizontals including the customer experience back to capturing and processing data. These are horizontals that can be applied to the majority of organisations, whether an asset manager, investment bank, retail bank, insurer, lender, or B2B.

1. Data Processing 💿

Data is the first crucial horizontal of all FS orgs and products. Financial services companies deal with vast amounts of data from transactions, customer interactions, market movements, and regulatory requirements. Efficient data processing is crucial for timely insights and better outcomes. Most companies need help with data processing. Pulling in the right data at the right time. Ensuring the data is of high quality, which often means building a data-cleansing framework around it. Keeping that data up to date and handling changes. Pulling and normalising data from multiple sources and creating a weighted hierarchy of which data points to trust from which vendors. Capturing data via different methods, i.e. Scanning documents, 1:1 conversations, pulling data from 3rd parties via Open Banking

It's not just about sourcing, capturing and storage.

Some organisations sit on vast amounts of data they don't know what to do with and often don't know if some of these data points are powering critical functions.

I call this data ignorance. It's one of the many areas AI will transform the critical first step in most journeys and for large organisations, unlock insights and opportunities that have sat dormant.

AI's impact:

Quickly identifying vendors with higher quality and coverage of data based on a sample set

Automating the capture of structured and unstructured data and processing it into a normalised format

Spotting data anomalies and suggesting corrections/cleansing steps

Surfacing data trends and patterns in existing structures

Refactoring data structures to make them more efficient for processing

Fast collection of data from alternate sources such as social media, smart web scraping, etc

Dynamic creation of APIs based on new trusted data formats

💡Example: That last one is interesting. A challenge many face is creating an API layer to capture and process data and be as normalised as possible. One way AI can speed up the data capture process is to be fed multiple data formats and points and be able to dynamically create a standardised API that processes those formats into an existing source. Embedded finance discussions get sped up, onboarding a new data source becomes seamless and speedy, and the lengthy and costly process of building a new or enhancing an existing API becomes obsolete.

🛠 Relevant AI Tools

IBM Watson, Google Cloud AI and Big Query, and Microsoft Azure Synapse Analytics all have machine learning data models for different industries, including financial services.

Alteryx - Data blending, advanced analytics, and machine learning capabilities

UiPath - Integrates AI with RPA to capture and process data from various sources, including documents and forms.

Data processing is the biggest and most important area for any grassroots AI transformation project.

2. Process Optimisation 🪜

Financial processes often involve repetitive tasks and manual interventions, which can be time-consuming and error-prone. Some of the manual interventions include initial lending application reviews, spot-checking transactions for fraud, multiple steps in the underwriting process, following up with internal teams on loan applications to adhere to SLAs, performance reports across systems, and many, many more.

There are numerous areas where things like RPA, in addition to the data processing layer, can accelerate growth, create efficiencies and allow an organisation to scale

AI's Impact

Generate financial and performance statements at a function and company level while adhering to accounting and org practices

Automate the chasing of additional documentation for financial product onboarding, e.g. Mortgages, Loans, SME finance, etc

Automation of reconciliation processes, reports, and summarised findings

Impact analysis of regulation and automated assessments on an ongoing basis

Standardisation of change reports and impact assessments across systems

💡 Example: One of the big challenges, especially in large financial organisations with many interconnected and dependent systems, is impact analysis. Build and test cycles are in the months because it takes time to understand the impact of one system's changes on several others. For example, changing the bond valuation method in a system has to be tested with all other interconnected analytics and reporting tools. Automating the test and impact process on a system change with AI can instantly look at the change being made, traverse all connected systems and highlight the impact, reducing time and resources and improving innovation.

🛠 Relevant AI Tools

Blue Prism - Enterprise-grade RPA tool that offers scalability and integration with AI and ML technologies

Automation Anywhere - RPA platform with cognitive automation capabilities, designed to handle complex financial processes

Trintech - Financial close management software designed to automate reconciliation, journal entry, and compliance processes.

3. Decision Making 🧠

Financial services require accurate and timely decision-making to manage risk, optimise investments, and service customers effectively. Almost every FS product has a decision making engine at its heart.

Investment Management platforms that optimise portfolios and suggest position changes.

Retail account onboarding processes that KYC customers assess risk and tier customers appropriately.

SME finance systems that process business accounting data, project sales, assess risk and disburse finance at bespoke interest rates.

At banks and large institutes, there are multiple decision-making systems. At smaller organisations, the decision-making system is the core IP.

These systems are complex to build, sit at the organisation's core and require constant evolution to remain relevant and accurate.

AI's Impact

Analysis of historical data and market conditions to assess credit risk, market risk, and operational risk, providing more accurate and data-driven risk assessments

AI fraud detection models can detect unusual patterns and behaviours in real-time, identifying potential fraud faster than traditional methods

AI algorithms can analyse market data to identify investment opportunities and optimise portfolios, enhancing returns and managing risk

AI can take more sources of data to provide a more accurate and informed underwriting decision, whilst providing a dynamic interest rate

Broadly, AI is better at the evolution of rules and processes, can take in external data, highlight trends and use them to makes changes to a decision making platform at a faster rate, and with a similar level of accuracy to a human

💡 Example: A wealth management platform that uses an expert system for decision making can use AI predictive models and a breadth of data to, for example, predict the impact of the election on the market and make adjustments to portfolio before prevailing prices increase.

🛠 Relevant AI Tools

Blackrock's Aladdin - Comprehensive investment management and risk analytics platform using AI for decision making in asset management.

Note: If this tool were an independent product, it would be valued at upwards of £10 billion. It is one of the most used but under-the-radar platforms, not really on the radar of folks outside of investment management.

DataRobot - Automated machine learning platform that helps financial institutions build and deploy predictive models.

Stratiphy.io - Standalone product providing investment management decisions using AI

Numerai - Crowdsourced AI hedge fund that leverages machine learning models from data scientists around the world

Turing - Machine learning models that have applications in investment management, asset allocation, and portfolio optimisation.

4. Customer Experience 📱

Customers expect fast, personalised, and seamless interactions with financial services providers. The challenge in FS is getting an accurate understanding of a broad customer base and their needs, providing personalised products, experiences and interactions at a large scale.

AI allows customer experiences to be tailored, easy execution of large scale customer analysis, and the ability to provide customers with bespoke products as and when they need them.

AI's Impact

AI powered chatbots and virtual assistants can provide round-the-clock support, handling queries, transactions, and troubleshooting without human intervention

It can analyse customer data to offer personalised product recommendations, financial advice, and marketing messages tailored to individual needs and preferences

AI models can predict customer needs and behaviours, enabling institutions to proactively engage with customers through timely offers, reminders, and alerts, improving overall satisfaction and retention

AI can enhance mobile and web applications with natural language processing and machine learning, providing intuitive and user-friendly experiences

In-app analytics can be review at scale by AI models to identify parts of products that customers are engaging with and those that can be scrapped

AI can be used to quickly read through KFIs and complex financial product documentation to give customers a simple overview of their rights when it comes to things like insurance and mortgage products

💡 Example: Retail bank customers who have expressed an interest in a mortgage product can have automated means testing and mortgage eligibility run on transactions, a mortgage in principle document produced and all complex KFI language expressed in simple terms before final agreement.

🛠 Relevant AI Tools

Salesforce Einstein -AI capabilities integrated into the Salesforce platform to provide personalised customer experiences

Zendesk Answer Bot - AI-powered chatbot that helps answer customer queries and provide support

Personetics - AI-driven personalisation and engagement platform that delivers real-time, proactive financial guidance

Mixpanel - Advanced analytics platform that provides insights into user behaviour, engagement, and retention

Pincer Move 🦀

Although I’ve outlined the above as a back-to-front exercise, from data capture and processing to customer-facing outcomes, from the outside, most AI transformation looks like front-to-back.

But what many outside of these organisations with complex products forget is that most of these firms have a trading arm, decision-making process, underwriting process, automated product selection, investment management solution, or another expert system. And some of these organisations have been using RPA and large-scale AI data transformation tools to refactor data inputs and improve processes. That process has just accelerated over the past five years, with those same tools now incorporating more advanced AI and passing those features and benefits onto clients.

So, although it looks like a front-to-back approach, with the advent of automated chatbots and incorporation of ChatGPT in several organisations, this AI transformation is more of a pincer move, embedding AI from front to back, AND back to front, meeting in the middle.

A couple of areas primed for AI Innovation 🚀

Transformation across all of FS in those horizontals is already happening. But if implemented correctly, AI will have an interesting impact in a couple of areas.

SMEs across their tech stack

SMEs have had a raw deal recently. COVID-19 impacted businesses everywhere, and I outlined a few other factors that specifically impacted UK SMEs in this early edition.

SMEs have a multitude of needs, including:

Obtaining Banking Solutions

Understanding Accounts

Getting Financed

Getting Paid Faster

Paying Taxes etc

Add to this the fact that businesses come in all sorts of shapes and sizes, you see why AI can have a transformative impact.

Providing more accurate predictive cashflow analytics, better accounting and transaction categorisation, dynamic budgets based on real-time data, analysis of supply chain and appropriate supply chain finance.

For me, the best place for all of this to sit is with accounting tech solutions which is why I was excited about the Sage Copilot, a GenAI layer sat atop one of the most popular accounting platforms out there. With embedded finance and analytics platforms part of Sage's ecosystem, an evolution of this Copilot could solve many problems for SMEs.

Open Finance + AI for Personal Finance Management

This is an area that long-time readers might recognise because I already outlined this as an area of innovation early last year.

Here's what i said then:

"One use case just over the horizon that combines Open Finance and OpenAI is hyper-personalised finance management using data from Open Finance and a 1:1 dedicated intelligent 'advisor' from OpenAI.

"With access to transactions and data across all accounts, the difficulty becomes solving problems for customers and helping them navigate through all this data. And what AI is good at is processing large data sets, spotting patterns, automating tedious tasks and providing a human-like intelligence layer between the consumer and their data.

So instead of starting the year with a budget hacked together using excel and its downloaded budget template, you'd connect your data to an app then ask it to set you a monthly budget.

If you want to ensure enough space in the budget for a holiday, then you'd be specific. "Budget for a week-long 5* resort holiday in the Maldives around May". The app using OpenAI would then estimate the cost for that holiday and adjust the budget accordingly, taking all the time and hassle out of maintaining a usable budget. It would also be able to:

Figure out tax implications and create the data required for a self-assessment tax return.

Adjust pension contributions to make the most of any salary changes.

Advise you on better, higher interest accounts for you to switch to

…and more….

💡 Read the full 'The future of finance is Open' hereI still believe this will happen and maybe Apple Intelligence will be the accelerator. It's impossible to predict whether they will make a big play in this space and it'd be fickle to make a hard prediction on it based on their track record of ditching fintech initiatives.

What I can say is that for it to truly work, account coverage needs to increase, the re-authentication process needs to improve and the OBIE roadmap needs progress.

And for any non-Apple product to work, it cannot be a pure referral based revenue model. The business model needs to be more robust.

The John Connor Effect 👨🏻🎤

So far I've mainly spoken about the upsides. It's not all upside. There are, of course, downsides.

There's the ongoing conversation about job losses resulting from AI. All talk at the moment and no real plan.

There's the cost and availability of AI hardware. We're already seeing bottlenecks and organisations buying up Nvidia chips to monopolise the market.

There's the question of plagiarism. I've been a victim of it, and OpenAI, in particular, isn't great about referencing source material. For example, there is nothing stopping a plucky GoCardless rival from taking all of their great educational resources, running them through a GPT with some rules to change clear IP and reposting them to improve SEO.

There is also the issue of nefarious AI. There are AI programs designed by fraudsters to systematically target and defraud customers and one of the factors in the rise of Authorised Push Payment fraud. There are of course many others designed to steal data, money and identity.

While there are some big challenges of AI, those might end up being a very big opportunity for some. As nefarious AIs grow in number, organisations will build products to combat nefarious AIs in what I call the John Connor effect.

These products will be designed to spot bad AIs posing as humans, outputs of AI models such as fake KYC documents and ultimately combat this rise.

Sophisticated AI combating products will be big business in the coming years as bad intentioned AIs grow.

However, right now the good outweighs the bad. Organisations have a lot to gain from implementing AI in the right places and for the right reasons.

Those hesitant about implementing it should also know that orgs don't have to be fully AI powered. They can be AI augmented. Hence the popular ‘Co-pilot’ phrase applied to many tools.

And the fact is, implementing GenAI as part of the Customer Experience horizontal is probably not the way to get the most out of the AI investment. There are many more pressing areas to focus on rather than just 'AI-ifying' the customer support team.

Implemented correctly, it has the power to give a better understanding of customers, more timely market insights, the ability to get more accurate data faster, and make more accurate and effective decisions to ultimately aid the growth and crucially, the scale of your product and org.

If you're not sure where to start, hopefully this edition has given you a good baseline of the areas to look at, and the possibilities. 👋🏽

J.

If you enjoyed this read, tell your colleagues and friends to subscribe by sharing using the button below, and remember to drop a like and comment. It makes the late Wednesday and Thursday evenings worth it :-)

Fintech Spotlight 🔦: Wonderful

I featured a number of AI companies in today's edition, so instead, I'm putting an Open Banking payments company in the Spotlight this week

Wonderful is a company specialising in instant bank payments at a highly competitive rate of just 1p per transaction. Their platform is designed to streamline financial transactions for businesses, offering a seamless, cost-effective solution for processing payments. Wonderful aims to simplify the payment process, making it faster and more affordable for businesses of all sizes.

As well as providing attractive and competitive rates for merchants taking payments online, they are an Open Banking Payments for good product as they offer a free subscription for charities.

They also have a useful tool that compares estimated costs against Stripe, GoCardless and PayPal.

Favourite Bits of News 🗞

Points win Prizes - ‘Lifestyle’ fintech Revolut is the latest fintech to launch a customer rewards program after they launched RevPoints. Customers on the Ultra plan can earn 1 point per £1 spent with points exchangeable for airline miles, and discounts at Revolut booked stays, experiences and checkout through Revolut Pay. A strategy that’s clearly targeted at increasing overall spend, brand loyalty and, specifically, engagement with the Revolut Stay & Experience platforms.

How I Can Help You 🫵🏼

Further to my last retro edition covering what I do and I help FS orgs and fintechs (see below) I’m adding a call to action at the end of each edition in case there are those reading this who want to work with me.

So reach out if you’re interested in my expertise in any of these areas:

Fintech, Product & Digital Strategy Consulting

Bespoke Digital Banking, PFM, SME Lending Strategy & Advisory

AI in FS panels, roundtables or other initiatives

AI in product development advice

Collaboration ideas for this newsletter

Reply to this email or drop me a message at jas@bitsul.co.uk