Fintech R&R ☕️ - Retrospective & Refinement of previous editions: Pt Deux

A look back at previous editions on Payments, Tokenisation, Open Banking, how to builder better fintech products and how others have done it successfully

How do Card payments actually work end-to-end?

How does ApplePay and Tokenization work?

How has UK Open Banking evolved since 2016?

What different pricing strategies are used in fintech?

How has Stripe scaled and stayed relevant over the past 13 years?

What psychological techniques can be baked into products to increase adoption?

These questions and more will be answered in this special edition of Fintech R&R.

Hey Fintechers and Fintech newbies 👋🏽

A special edition this week that acts as a retrospective highlights reel of all of my previous deep dives.

It highlights some of the popular previous editions with specific excerpts relevant for different folks across fintech, including people building Open Banking propositions, working on SME products, anyone thinking about product roadmaps, early-stage fintechs looking for lessons in growth, and much more.

But I'm kicking it off with a tailored call to action for subscribers with a couple of asks from this community.

So, for recent subscribers and early adopters, whether you're a Founder, Product Manager, intra/Entrepreneur, or VC here to learn more about fintech, someone working for a big corporate FS, a member of a three-person fintech, and everything in between, there's something in this edition for you!

NOTE: I’ve also been at a few fintech events this week and have been a bit busy during the evenings I usually allocate to write these lengthy deep dives, hence the shorter, sharper retro edition 🙂

This edition includes the following:

What I do and a quick ask

A retro of previous deep dives in several areas 👇🏽

Under the Hood: How fintech things work 🛠

ApplePay and Tokenization

Card Payments

Aadhar card and the basics of centralised Digital Identity

Product Thinking (in Fintech) 💡

User Experience

Pricing

Using Psychology in products

Importance of metrics in Fintech Products

Fintechs and how they’ve grown 🚀

Wise: Evolution of their product and brand

Monzo: How they’ve navigated issues throughout their journey

Stripe: How their product has grown and solved more problems over time

Open Banking 🏦

How Pay by Bank works and some growth strategies

The new US Open Banking proposals

Evolution of UK OB from 2016-present and beyond

Allow me to reintroduce myself…

This newsletter is very much a passion project to get clear fintech product insights out into the world and a way to educate and inform those working in and building financial services technology. I’m going to continue to write these newsletters for as long as I can stay up late on Wednesday and Thursday evenings every other week 🙂

First and foremost, I'm a Fintech Product specialist. I've spent the first 10 years of my career working at Citibank, Schroders, and Fidelity, shaping and building internal products and driving innovation. For the past 6 years, I've worked as a product consultant, helping ideate, design, build, launch, grow, and scale products as a solo expert.

In that time I’ve led two digital bank builds creating a product strategy, leading the early development, identifying and selecting appropriate partners, building out the customers journeys, navigating teams through challenges and ultimately, getting those products to market.

I continue to provide early advice to a couple of early-stage digital bank builds.

I also headed up product for an SME Lending fintech, building out a product team from scratch, defining ways of working, putting together a product strategy for a growth and scaling period and working on strategic embedded integrations with partners.

Other than these larger, longer engagements, I've worked directly with the founders and teams of Open Banking products, KYC/KYB fintechs, payment processors, Payments companies, and larger consultancies, providing strategic product advisory expertise, hands-on assistance in shaping & how to build propositions, market/competitor/customer analysis for early stage fintech ideas, ongoing advice to founders who don't have the funds to make their first product hire but still want ad hoc expertise etc.

That's why, when I write these deep dives, it's with some authority and in a lot of cases (Digital Banking, Card Programmes, OB products etc), I'm writing with that hands-on experience and perspective. Not as a pure commentator or speculator.

Broadly, when people ask me what I do as a Fintech Product Consultant, I say that I provide expertise across all stages of the Product Development Lifecycle, including:

Helping to conceptualise an idea fully

Shaping initial discovery

Creating a product strategy and roadmap to use during the build

Building out a product scaling strategy

Reviewing a product and giving 'health check' reports on areas of improvement/opportunity

Mentoring junior product folks and anyone new to fintech

Provide ongoing fintech expertise on how to build a digital bank, payments, OB

But I've made the cardinal sin as an independent consultant.

I've left a gap between finishing up some interesting strategy work and my next engagement (which has been delayed a little). Hence, this is the perfect opportunity for this reintroduction and call to action.

You don’t ask, you don’t get

So, I’m looking to explore and discuss opportunities in a couple of different areas and have outlined specific asks here which should resonate directly with readers in different areas.

Digital Banking and other early-stage fintech initiatives

I'm in some very early-stage conversations about leading some interesting digital banking propositions, but I'm really interested in talking to more organisations and individuals looking to develop a digital banking proposition, especially if it's in an interesting geography or for an underserved demographic.

👉🏽 If you or someone you know is at that early stage of a digital bank build and you’re looking for additional advisory expertise or a product leader who has been there and done it before, drop me a note.

Big Organisation Innovation

I’ve worked on some internal thought leadership and innovation work for a couple of bigger organisations but looking to do a bit more. From what I’ve seen, some of these larger financial institutes & consultancies can benefit from external expertise and sounding boards for their internal products, ideas and for their internal innovation labs.

👉🏽 If you or someone you know is working in a big firm building a new product, trying to solve problems for a new customer base, or are a consultancy with an FS project that could benefit from external product expertise, reach out to me.

Fintech Advisory Roles

Lots of fintechs have boards, advisors and other experts helping navigate founders and fintech teams through challenges, providing strategic advice along the way. One thing I’ve learned from the Post Office scandal is the value of a NED or advisor with actual experience and expertise in the domain they are operating and I haven’t seen a lot of fintech product folks as advisors on boards.

👉🏽 If you are such a fintech or know a fintech founder that would benefit from expertise they can tap into throughout their build, growth and scale journey then reach out.

VC/Fintech Investment Firms/Family Offices

This is an area I’ve done a little bit of work and provided analysis of a product for an investment/acquisition. An area that seems to be quite tough to break into but certainly an area that would benefit from an experienced fintech operator in the scouting, reviewing, and viability part of the fintech investment and acquisition process.

👉🏽 If you are a VC/Family Office or know one, then drop me a message directly or, if you can, set up an introduction as I’d like to dedicate some time to product due diligence work.

Mentoring & Coaching

I get a few requests a month from product folks in fintech for advice on how to navigate tricky issues, what to do next in their career, good organisations to work for etc. I’ve also formally mentored product folks and I’m doing some more founder mentoring soon but I’m always open to paid mentoring work that involves slightly larger teams or mentoring a solo PM at a fintech or FS who needs a bit of guidance making that step up internally.

👉🏽 If you’re a product person or founder looking for an external ear to help progress and navigate issues, or you want me to help be a ‘product therapist™️’ for your team, then drop me a note.

And finally, a slightly generic one.

If you like what I do, how I explain things, my experience building products, and you want to work with me but you’re not sure how, drop me a note.

And to get in contact on any of the above, reply to this email or drop me a note at jas@bitsul.co.uk and I’ll send you my calendly to schedule a chat 😊

Right.

Enough asks. Let's go through these interesting previous editions.

Under the Hood: How fintech things work 🛠

These are great for: People who work in FS and want to learn a bit more about how things work, folks building card programmes looking to get more detail on the complexity, and those interested in the detail of centralised Digital Identity.

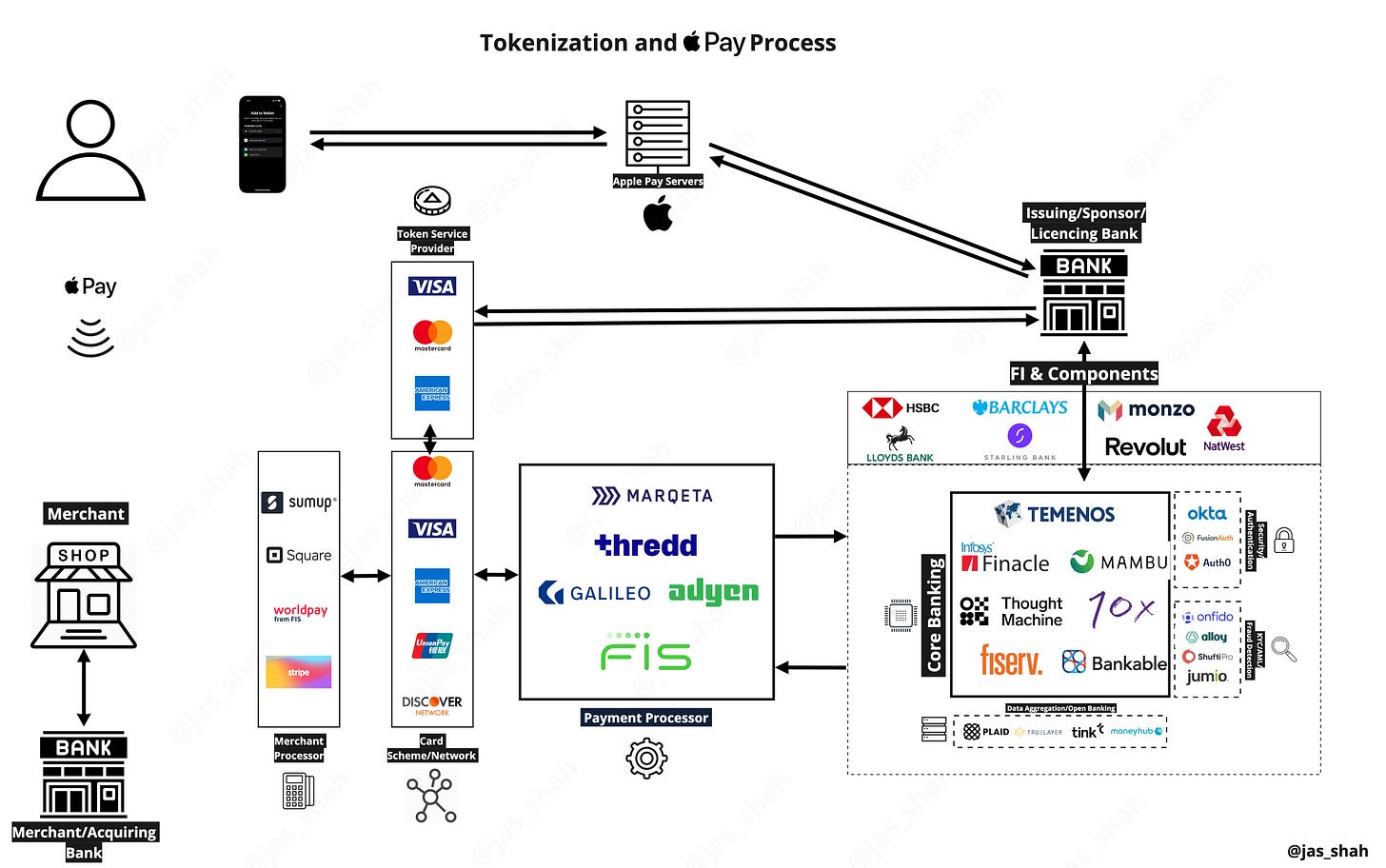

ApplePay and Card Tokenization

Title: Tokenisation, The ApplePay payment process, and mobile wallet growth

1-liner Description: A Tokenisation deep dive, step-by-step ApplePay process, benefits and frictions that come with tokenisation and global mobile wallets growth

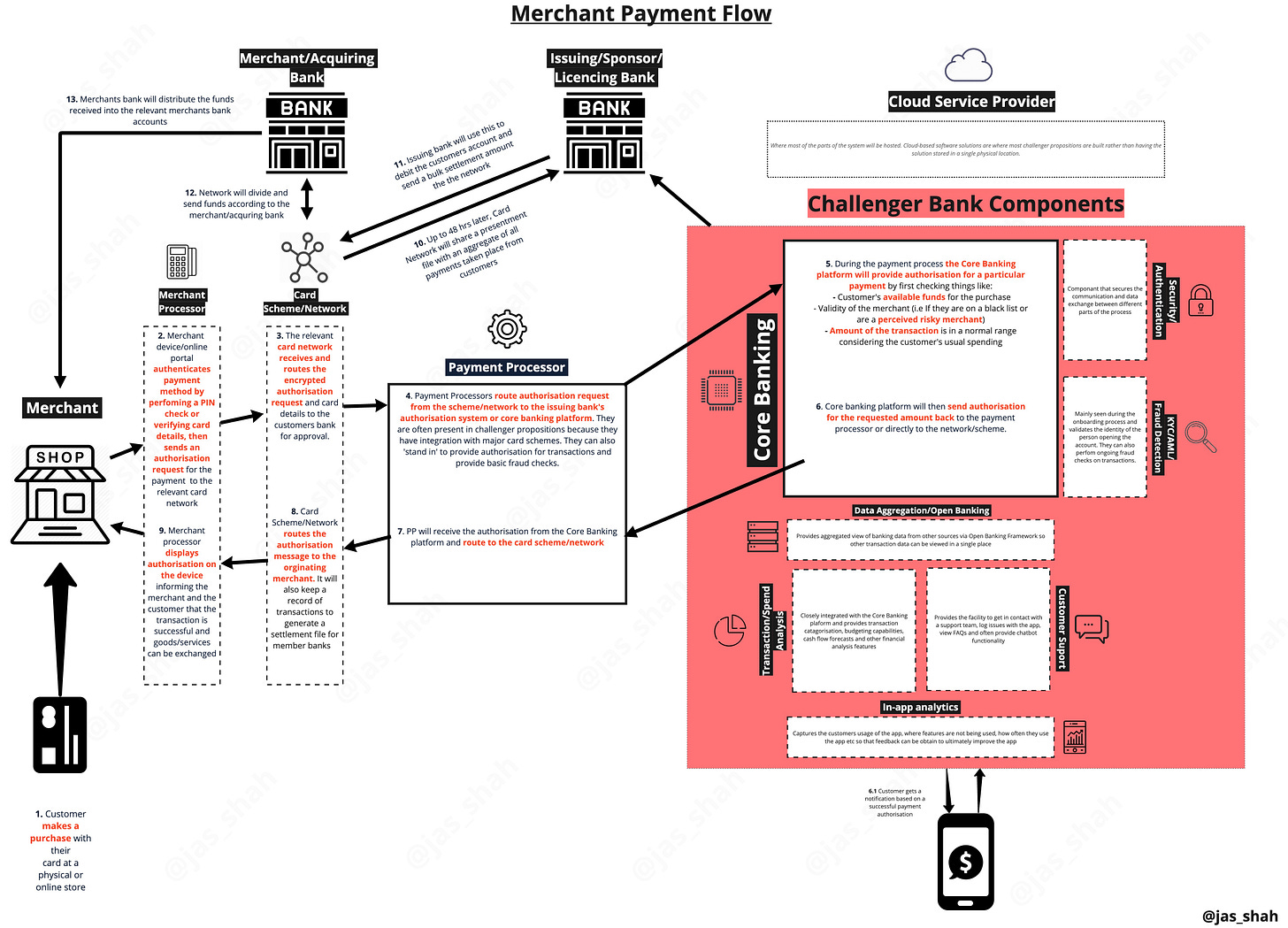

How Card Payments work

Title: The Merchant Payment Process, Revoloopholes and the Mandela Effect

1-liner Description: A Card Payments deep dive, why Revolut suffers from The Mandela Effect, education & resources for fintech builders, and the Product + Technical expertise debate

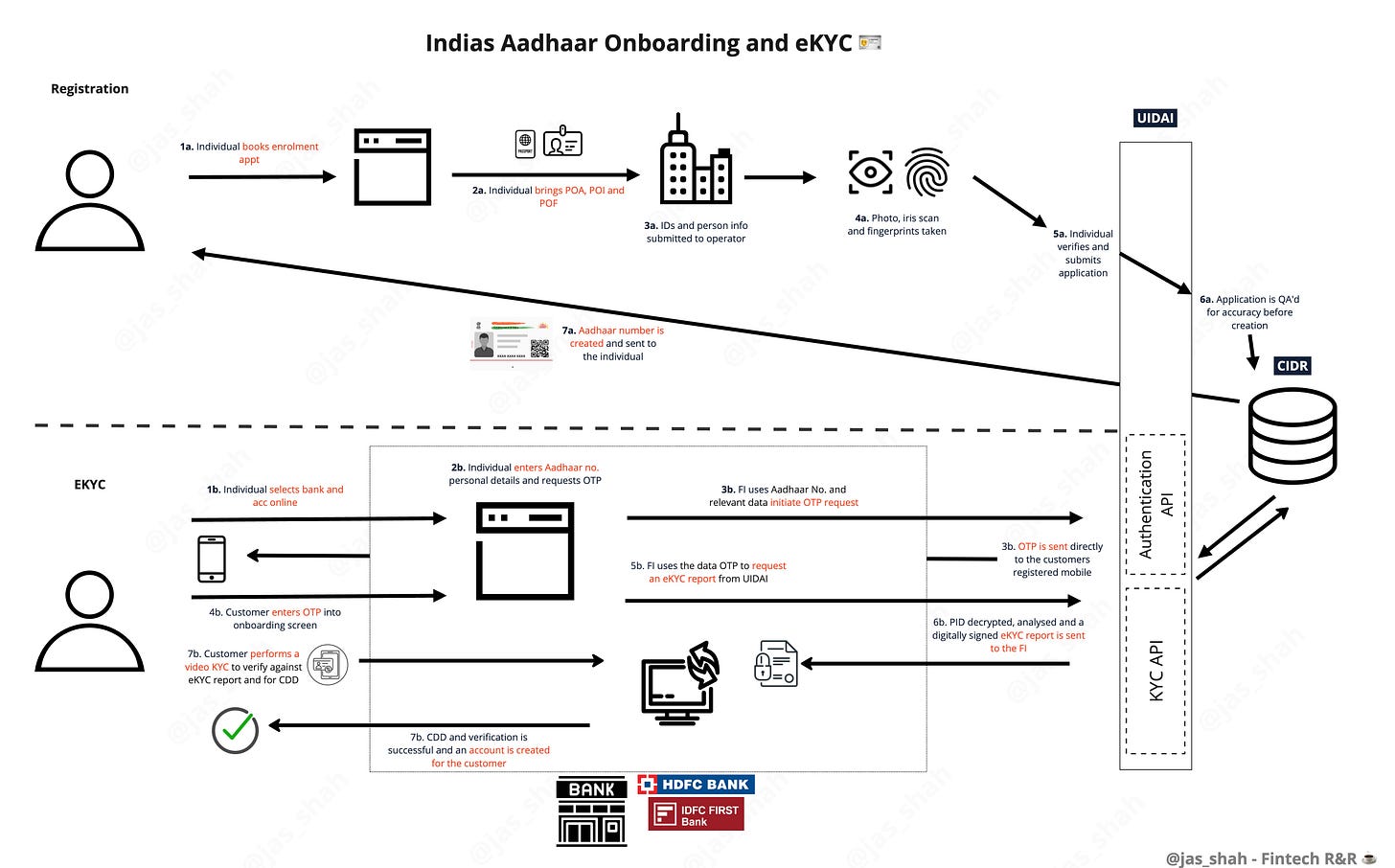

Aadhar card and the basics of centralised Digital Identity

Title: India’s Aadhaar Card in Bank IDV/eKYC

1-liner Description: A deep dive into India's National ID, other National ID programs, how it works in practice and the benefits for Financial Institutes

Product Thinking and Principles 💡

These are great for: Product folks new to fintech, juniors wanting to learn more about some of the product development techniques built into products, a commercial person looking at pricing and fintech founders curious about what to bake into their proposition.

User Experience

Title: Getting to the cr-UX of building great banking experiences

1-liner Description: A primer on Customer Experience, the challenges of building UX in banks, 3 pillars of great UX, I, Robot's relevance to UX, the evolution of fintech UX

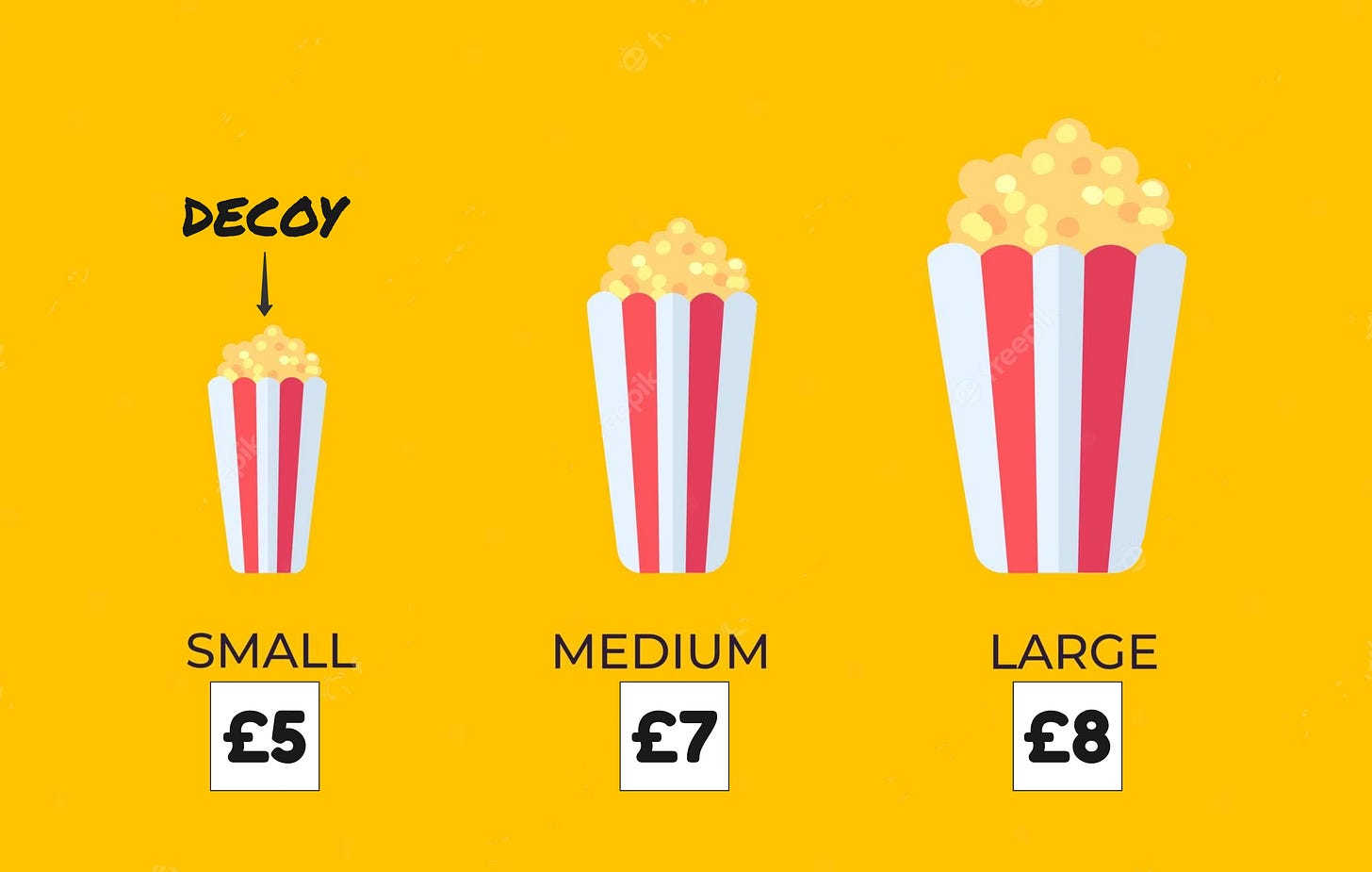

Pricing In Fintech Products

Title: The Price is Right. Or is it..?

1-liner Description: A frank discussion about product pricing, reasons discovery and research is vital, popular pricing models in fintech and some of the fun psychology 🧠 behind pricing pages

The Importance of Metrics in Fintech Products

Title: Enter the Fintech Metrics

1-liner Description: A dive into the rabbit hole of metrics and a preamble on Frank & Chase

Using Psychology to build better products

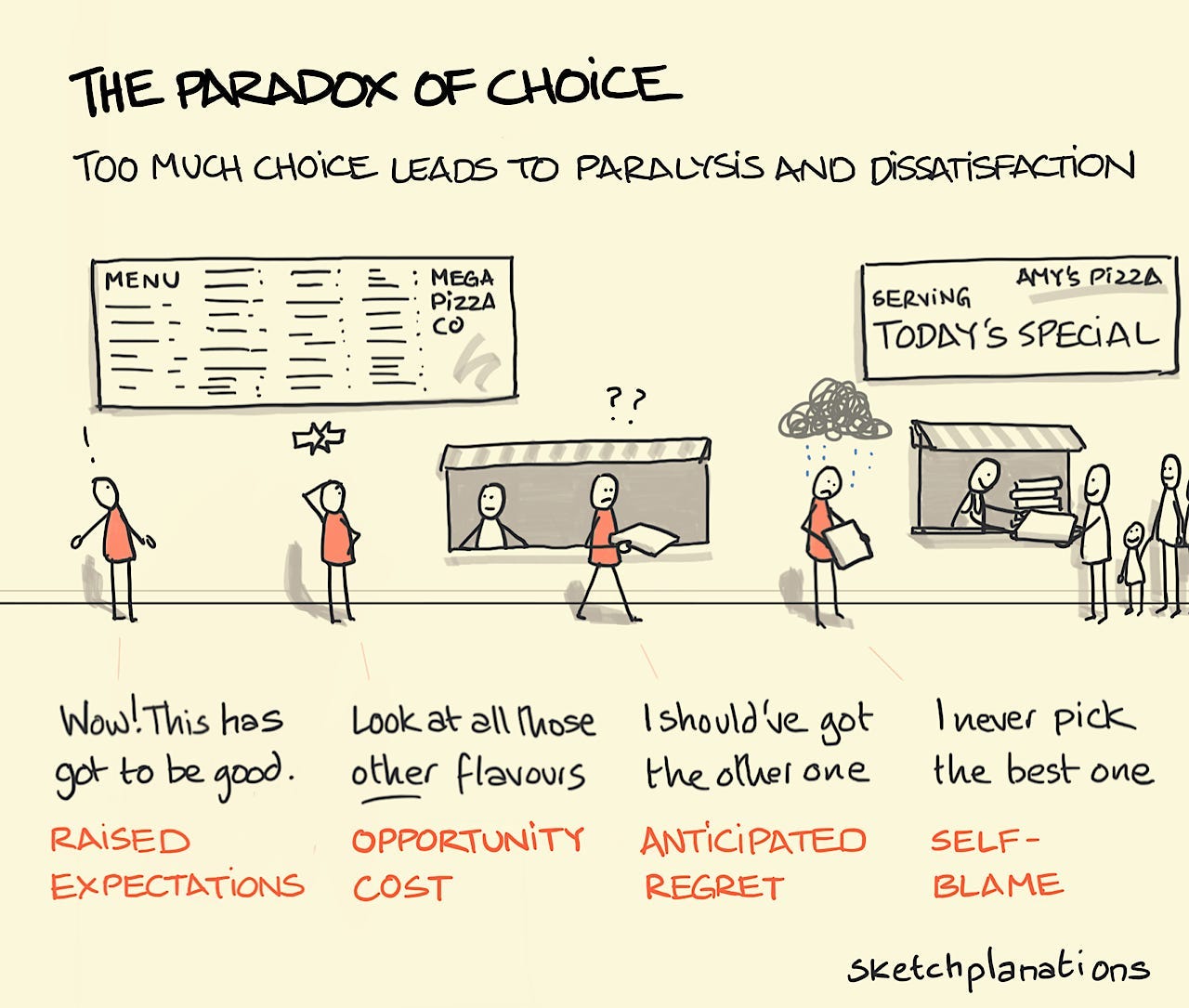

Title: The Paradox of Choice and the benefits of Scare-city in Fintech Products

1-liner Description: How you've been impacted by Miller's Law without realising it, the other psychological principles impacting choice, and mitigating choice friction in fintech products

Fintechs and how they’ve grown 🚀

These are great for: Fintechs who want tangible examples and strategies to point to and compare with. From those currently scaling a fintech, going through a rebrand, trying to find product market fit or about to launch. These are generally great for anyone interesting in different fintech products (FX, Challenger banks, PayFacs)

Wise: Evolution of their product and brand

Title: Growing older and Wise-r

1-liner Description: The importance of Product/Brand alignment, the evolution of Wise and figuring out when to rebrand

Monzo: How they’ve navigated issues throughout their journey to today

Title: Navigating the Transitions is How Fintechs Win

1-liner Description: A Monzo news double header, the reality of what a fintech product journey looks like, and why the transitions between stages is where the true test lies for fintechs

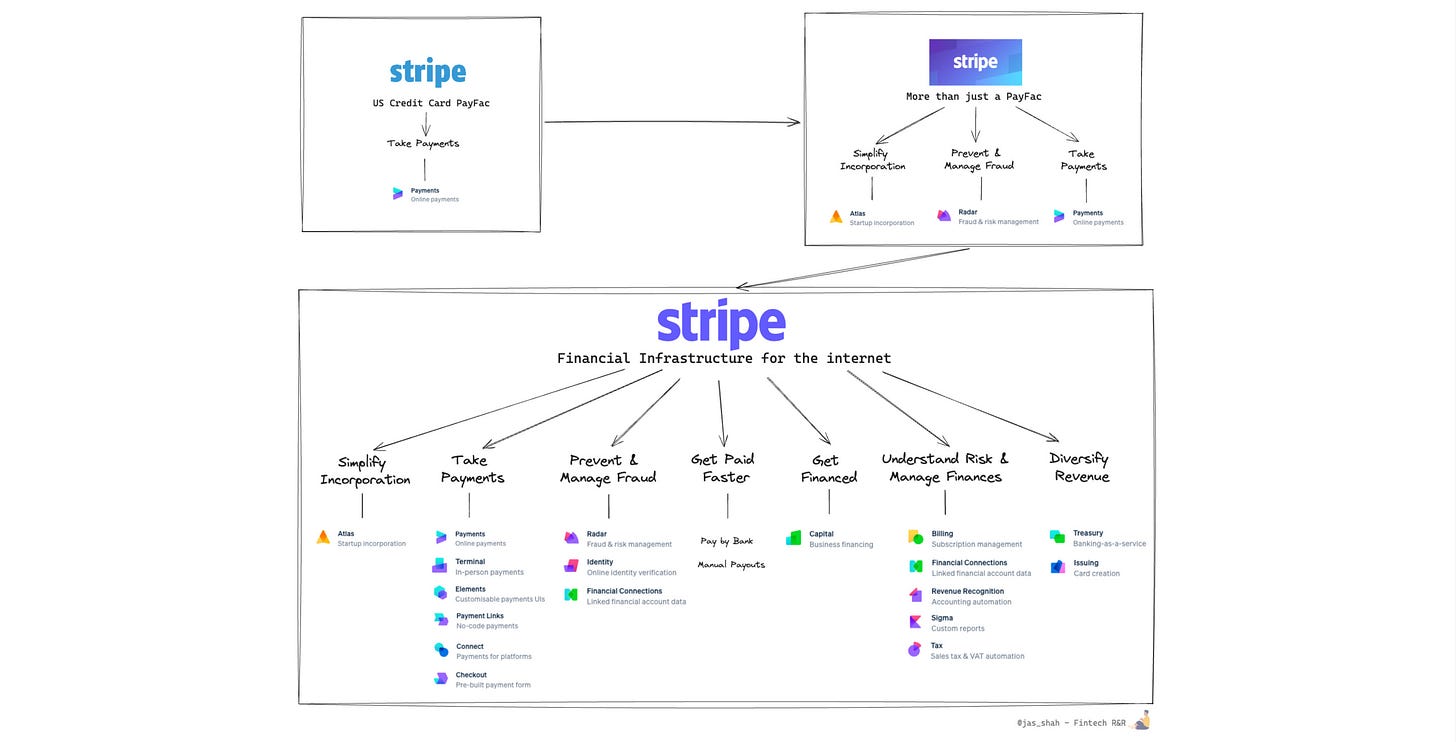

Stripe: How their product has grown and solved more problems over time

Title: Stripe, more than a PayFac

1-liner Description: A walkthrough of Stripe’s evolution, their early competitors, the Jobs that they solve for customers, an overview of their new products and the metrics they consider when driving growth & scale.

Open Banking 🏦

These are great for: Anyone looking to learn more about Open Banking, how OB Payments actually works Under the Hood, a look at what the US is doing and a deep dive on UK banking evolution over time.

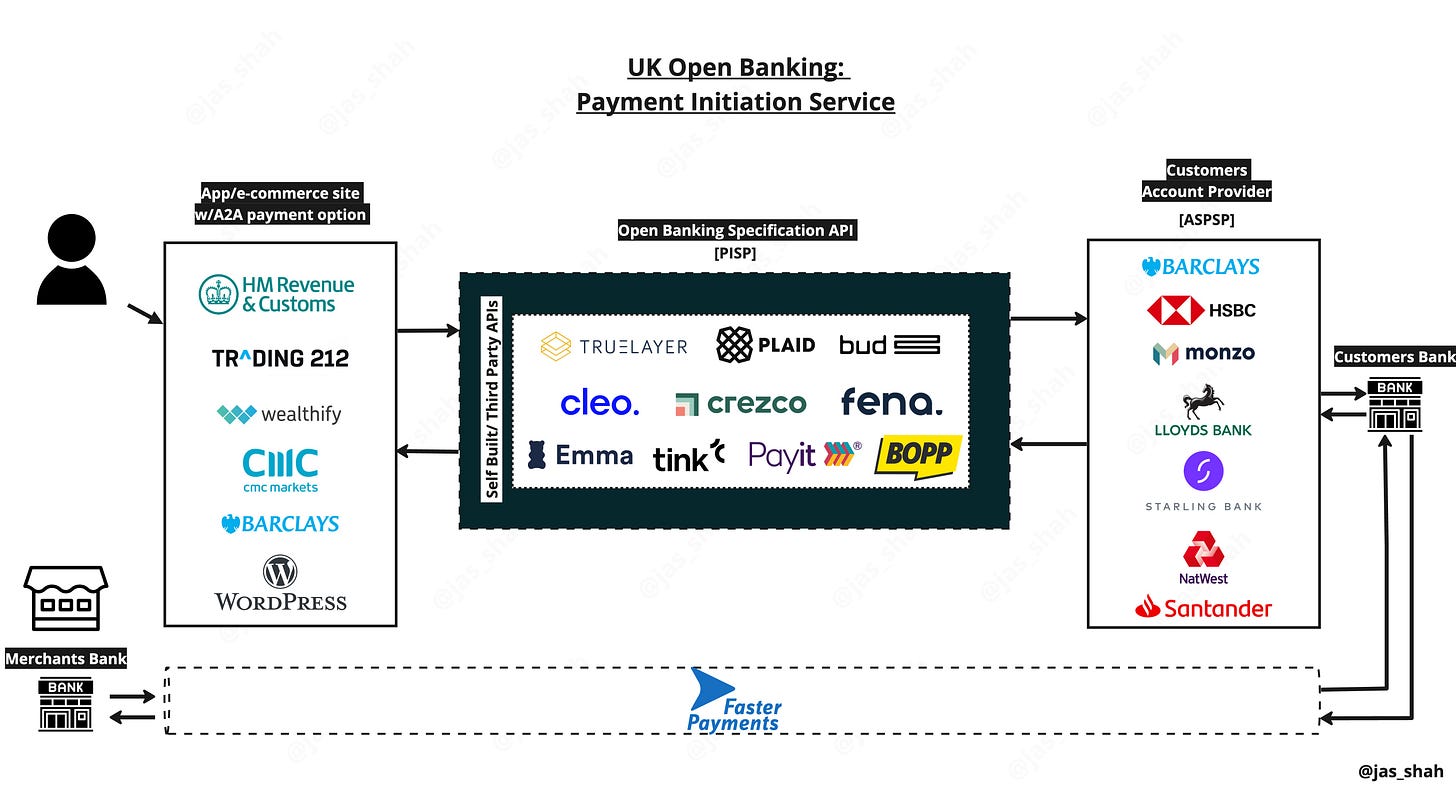

How Pay by Bank works and some growth & adoption strategies

Title: Open Banking Payments and how to accelerate ‘Pay by Bank’ adoption

1-liner Description: An Open Banking Payments Deep Dive, brief history of OB, major benefits of OB v Cards and big focus areas to drive mainstream pay by bank adoption

The new US Open Banking proposals

Title: The 411 on 1033. A US Open Banking standards deep dive

1-liner Description: The new US Open Banking proposal, what it might mean for consumers and what the US learned from the UK's Open Banking successes and failures

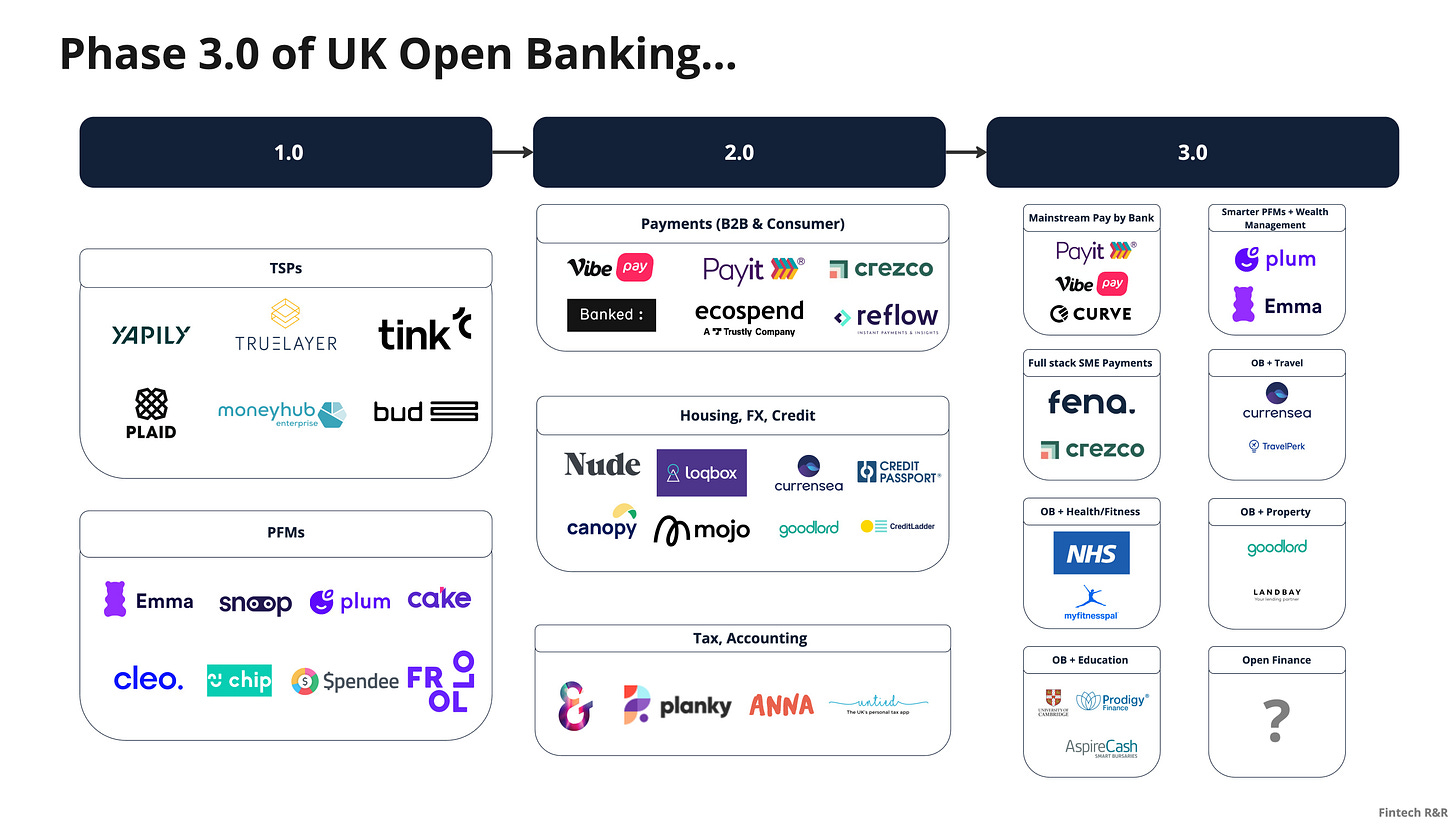

Evolution of UK OB from 2016-present and beyond

Title: Open Banking Phase 3.0

1-liner Description: A dive into UK Open Banking to date, what the next phase of UK Open Banking will bring, why other Open Banking implementations should read this, and much more...

I did say it was a shorter, sharper edition, and this week I meant it.

That was a quick highlights reel of previous editions and some of the more popular reads fintech folks value.

For folks new to this newsletter, I hope there are editions that resonate directly and help with your day to day, and for OGs who have read every edition from the beginning, this serves as a great refresher of some of the earlier and still relevant deep dives from early last year.

Look forward to hearing from some of you on the asks outlined at the beginning.

As always, don’t forget to like this edition and share it with a friend. See you in two weeks for another edition which will be back to the regular format with Interesting News and Fintech Spotlight 👋🏽

J.

Great read, Jas. It's good to understand a bit more about you and your background, as well as all the ground covered on the Fintech side of things.