☕️😌 Ikigai in Fintech: Creating Products with Purpose, Passion, and Profit

Explaining Ikigai, it's four pillars, and showing how striving for it can help build better products and more purposeful fintechers

What is Ikigai and how does work in day to day life?

How does it apply to building fintech products?

What are the risks of building a fintech without purpose or sustainability?

Why do successful fintech founders need more than just technical expertise?

How can a BaaS provider or other vendor use Ikigai to assess founders?

Why am I excited about new fintech BabyReady?

These questions and more will be answered in this week's edition.

Hey Fintechers and Fintech newbies 👋🏽

A conversation with a good friend triggered this week's edition on top of a few very timely bits of news and its connection to some of the work I’m currently doing in KSA.

So, let's jump straight in with those snippets of interesting, timely stories.

Revolut's new UAE CEO: On Wednesday, Revolut further hammered home their MENA expansion plans by announcing Ambareen Musa as their UAE CEO. Ambareen, has a solid career in FS and spent 10 years as an entrepreneur in Dubai, founding financial comparison site Souqalmal in 2012 (MoneySupermarket for the Middle East) before it was acquired and pivoted into financial education product Yabi in 2022, where she stayed on as CEO until now. Earlier in her career, she led projects for Bain and was a senior consultant for Mastercard.

Here’s what she said about MENA region trends when she spoke with The Fintech Times back in 2020 when she was CEO of Souqalmal:

“The opportunity for fintech in the region is enormous. Pick any statistic – Internet penetration, mobile adoption, customer adoption of online financial services – All signs point towards the massive potential of fintech and how digitization is transforming the future of finance.”

She clearly has a passion for fintech innovation, specific expertise in the space, and a desire to empower people in the region through digital innovation.

Former Starling CEO’s next steps: Then there were the comments from former Starling CEO Anne Boden at Sifted Summit in London about her next venture. The headline quote from her fireside chat with Sifted reporter Amy Lewin was “I wouldn’t be a CEO founder again”. In the chat she talks about what she wants to do next which is ‘not launch a Starling 2.0’ but rather focus on ventures that have a positive impact on the world.

“I’m going to try to find five companies over the next five years and hope that at least one of them can turn into a £10bn company. And I’m going to try to find those businesses that I have a huge commitment to and feel that they can actually do something about changing the world.”

Now back to the conversation with my good friend. In short, we were talking about life, career choices and finding what’s next for each of us. During the conversation I started asking him about what he’d love to do and why. Lots of the themes of the discussion revolved around purpose, impact, and making a difference to people.

Finding something you love to do, that has purpose and fits with your expertise is the holy grail. Many will tick a couple of those boxes but not all.

And finally, the third thing that led to today’s topic.

Some of the work I’m doing out in Saudi.

I still can’t get into specifics but one small part of what I’m doing is thinking about the attributes that make a good entrepreneur/founder of fintech ventures. So far I’ve been thinking about some of the attributes of great founders gone by, most of whom have expertise in the area they built, really felt the problems they’ve tried to solve, and want to make a positive impact on the world.

This trifecta of things got me thinking about purpose, meaning and happiness, especially when building fintech ventures (yes, founding and building a fintech isn't just creating some infrastructure and then launching), which led to today's topic. Ikigai and its application in building great fintechs.

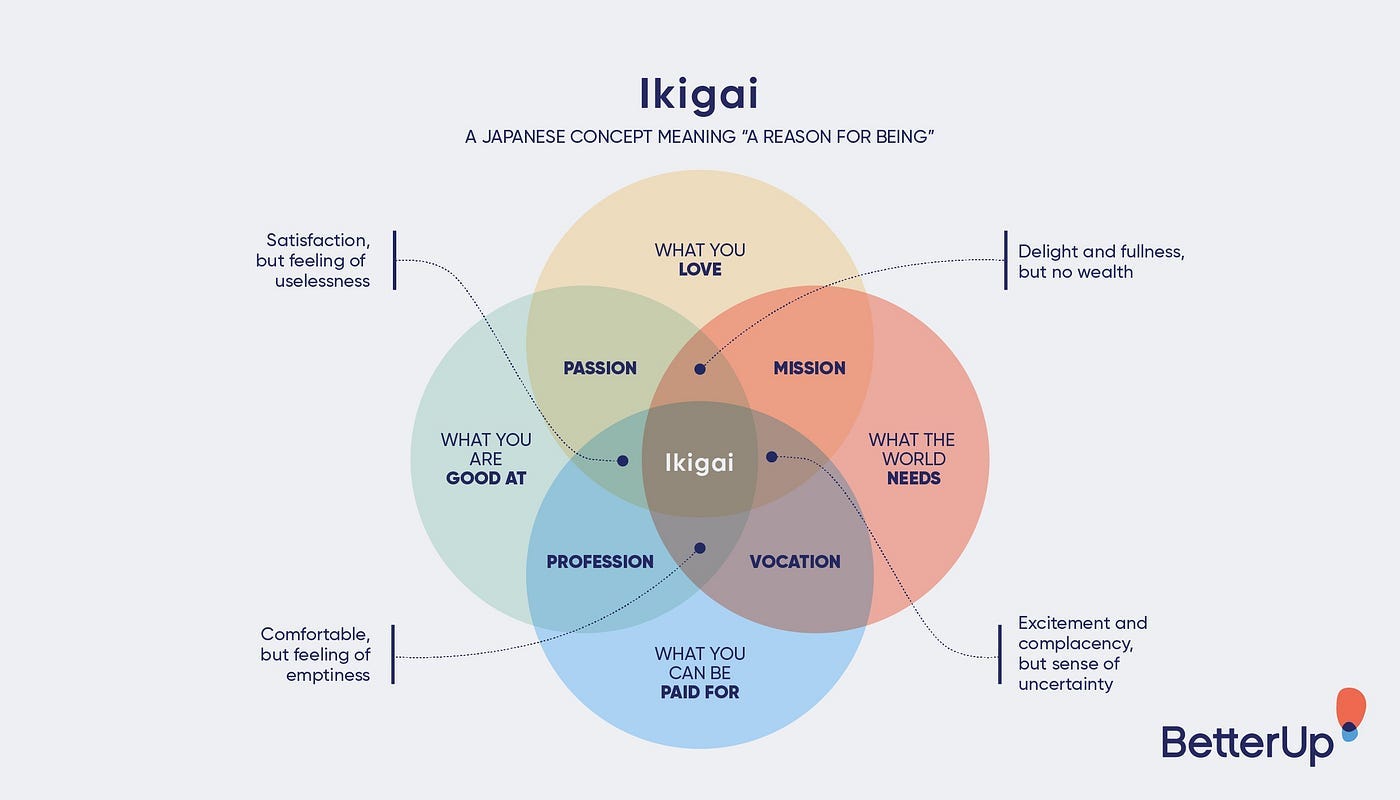

There's a lot to learn from Ikigai, the Japanese concept of aligning passion, skill, need, and value. It's super relevant in fintech so that's what I'm covering in this special, shorter, sharper edition on how it applies to building meaningful fintech ventures.

As well as interesting news, Fintech Spotlight, and the occasional pun, this includes the following:

What is Ikigai?

What are the four pillars of Ikigai?

What you love (Passion)

What the world needs (Profession)

What your good at (Mission)

What you can get paid for (Vocation)

Applying the four key pillars to fintech

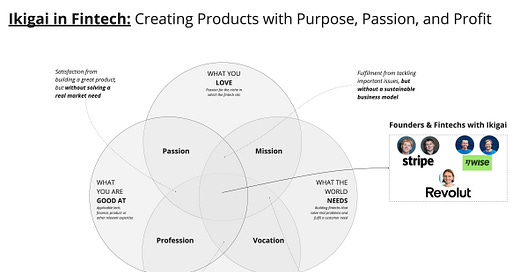

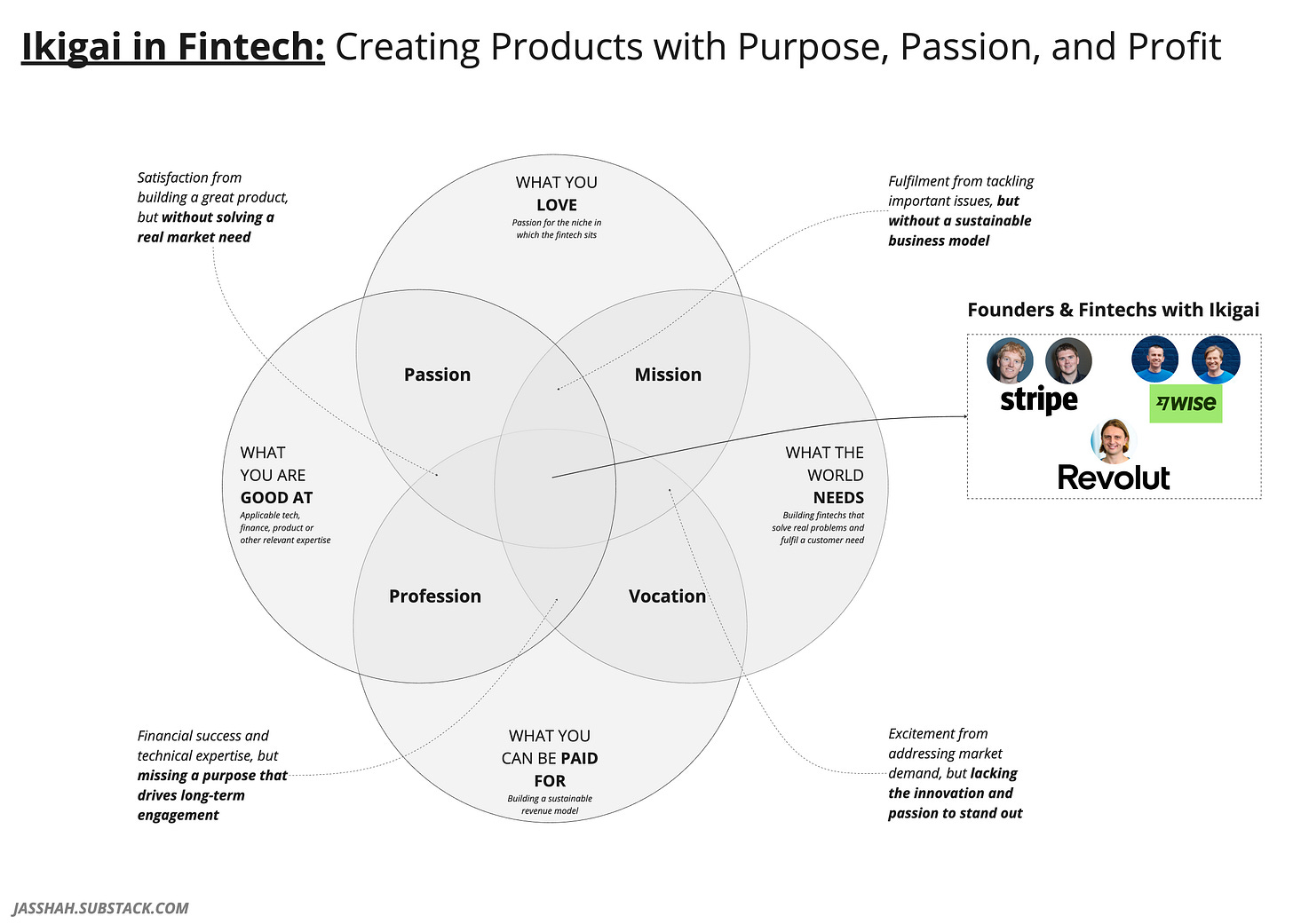

A fun visual to bring it all together

Examples of Fintechs and Founders that have found Ikigai

Stripe: The Collison Brothers

Wise: Kristo Käärmann & Taavet Hinrikus

Revolut: Nik Storonsky

Release Notes: Currensea + Hilton Rewards

Fintech Spotlight 🔦: BabyReady

Interesting News: Starling gets a fine

Now let’s get into it 💪🏽

NOTE: You know the drill. Your mail client might crop the end of this so click here to see the full, unclipped, perfectly formatted edition, drop a like and comment at the end, and don't forget to subscribe below. What is Ikigai?

In Fintech it’s often easy to focus solely on technological innovation, regulatory compliance, or market demand. But at the heart of successful ventures lies something deeper: Purpose.

While many fintech founders start with a burning desire to solve real problems in finance, they often face burnout or lose direction if their work doesn’t connect with a deeper sense of meaning (Anne’s messages from earlier and to a lesser degree some previous comments from Monzo’s Tom Blomfield about being the CEO and running one company supports this). This is where Ikigai comes in—a Japanese concept that offers a powerful framework for aligning passion with purpose, skill, and value creation.

So let’s start with a nice simple definition as not everyone has heard of Ikigai, and may not be familiar with the concept at all.

Ikigai (生き甲斐) is pronounced ee-kee-guy. The word is composed of two Japanese characters:

"Iki" (生き) – meaning “life” or “to live.”

"Gai" (甲斐) – meaning “worth” or “value.”

When combined, the word can be understood as “the value or worth of living” or “reason for being.” In essence, it’s about finding purpose in life, giving us motivation to get out of bed each day. But it’s more than just a career path or a passion project.

Ikigai has cultural roots in Japan, where the idea of finding purpose in life is deeply connected to broader Japanese values like community, selflessness, and perseverance. The concept of Ikigai is often tied to the small island of Okinawa, which has one of the highest concentrations of centenarians (people who live past 100 years old) in the world. Many attribute their longevity to living in alignment with Ikigai, maintaining an active lifestyle, strong social connections, and having a deep sense of purpose that keeps them going day by day.

In Japan, it’s a deeply ingrained philosophy of life, guiding individuals to find the intersection between what they love, what they’re good at, what the world needs, and what they can be paid for. By balancing these elements, people can live a more fulfilling and meaningful life, both personally and professionally.

But what does Ikigai have to do with fintech?

In building successful fintech ventures, founders must navigate complex challenges: finding a real market need, developing innovative solutions, assembling the right team, and building a sustainable business model. These tasks require more than just technical expertise or business acumen—they require a clear sense of purpose and alignment between the founder’s vision and the needs of the market. This is where the principles of Ikigai become especially relevant.

Consider the great fintech founders. They typically don’t just stumble upon success. Instead, they feel a deep connection to the problem they’re solving. They love what they’re doing, they possess the skills and expertise to solve complex issues, they see a genuine need in the market, and they build businesses that are financially viable. These founders embody the principles of Ikigai, even if they’ve never heard the term.

As the concept of Ikigai gains traction worldwide, more entrepreneurs are using it to guide their personal and professional lives. For fintech founders, applying Ikigai can help ensure that they’re not just creating technology for the sake of innovation but that they’re building ventures that address real problems and have a lasting, positive impact.

The four pillars of Ikigai—what you love, what you’re good at, what the world needs, and what you can be paid for—are the foundation of this concept. Let’s take a closer look at these pillars and then how they can shape the building of meaningful fintech ventures.

NOTE: If you’re already intrigued by this Japanese concept inspired edition, you’ll love the edition below from last year on Kintsugi (the art of repairing broken pottery with lacquer and gold) and how it relates to Revolut and superapps more broadly.The Four pillars of Ikigai?

When the previously outlined four elements come together, they form the foundation of a life—and work—that is deeply fulfilling and sustainable. However, when one or more of these pillars are missing, it can lead to imbalance, dissatisfaction, or even burnout.

1. What You Love (Passion) ❤️

This first pillar emphasises doing what excites and motivates you. It's about following your passion—the activities or pursuits that make you feel most alive. This isn’t just about hobbies or fleeting interests, but about a deeper connection to the work or purpose that brings joy and fulfilment.

People who are aligned with what they love often experience a sense of flow in their work, losing track of time because they’re so immersed in the task. Whether it’s in creative fields, social causes, or entrepreneurial ventures, this love for the work is what fuels energy, innovation, and persistence, even in the face of challenges.

2. What the World Needs (Mission) 🎯

The second pillar is about fulfilling a broader purpose—identifying and addressing what the world truly needs. It’s not enough to simply love what you do; there must be a meaningful impact that addresses real-world problems. This pillar connects an individual’s work to a larger mission, creating a sense of responsibility and contribution to society.

Whether it’s solving social, environmental, or economic issues, this pillar gives people a sense of purpose and drives them to make a difference. When you align your work with what the world needs, your actions become part of something larger than yourself, creating a sense of fulfilment that goes beyond personal success.

Any mention of mission gives me an excuse to bring out this classic ‘arm reload’ scene from Mission Impossible

3. What You’re Good At (Profession) 🕵🏼♀️

The third pillar is about aligning your work with your skills and expertise. Even if you’re passionate about something and the world needs it, you need to have the ability to execute. This pillar focuses on what you’re capable of doing, what you excel at, and how you can use your talents to contribute effectively.

It involves not only existing skills but also the willingness to develop and hone new ones. Success in any field often requires a high level of competence, which is built over time through experience, education, and practice. Aligning your work with your strengths ensures that you’re not only doing what you love, but that you’re also capable of making a meaningful impact.

4. What You Can Be Paid For (Vocation) 💰

The final pillar emphasises the importance of financial sustainability. It’s about finding work that not only fulfils your passion and addresses a societal need but can also provide financial support. This pillar ensures that your efforts are economically viable and that your work can support you, your family, or your business in the long run.

Even the most meaningful and passionate work can lead to frustration or burnout if it doesn’t provide financial stability. This pillar is about understanding the market value of your skills, ideas, or products, and ensuring there is a sustainable business model behind them. When aligned properly, it allows you to create long-term value, both personally and financially.

As you can see from the image below, combinations of these elements give some positive outcomes but can still lead to frustration. True Ikigai is achieved at the intersection of all four.

So, how can these four elements be applied to fintech?

There are a few ways Ikigai can be applied to fintech. The main one which I alluded to at the top, is for early stage founders and entrepreneurs developing an idea OR selecting a venture to head up.

Here, there are slightly modified elements for founders and others building and running fintechs.

1. What You Love (Passion for the niche in which the fintech sits)

In fintech, this often means founders who are truly passionate about solving a particular financial problem. Whether it's bringing financial literacy to underserved communities, improving access to credit, or creating more intuitive personal finance tools, successful fintech founders are those who feel deeply connected to the mission.

Example: Think of founders who created apps like Mint or Wafeer. And the folks who created Sibstart. They didn’t just see an opportunity for profit—they were passionate about making personal finance management easier for everyday people. Or in the case of Sibstar, building a problem the founders faced themselves when it came to money management and dementia. This passion drives them to build products that they care about, and that enthusiasm often resonates with users.

2. What the World Needs (Building fintechs that solve real problems and fulfil a customer need)

Fintech, by its very nature, aims to solve real-world financial problems. Whether it’s addressing gaps in financial inclusion, reducing friction in payments, or improving access to capital, the mission of a fintech venture must align with a genuine market need. Founders who tap into a problem that is both pressing and underserved are more likely to create something that endures.

Example: In Saudi Arabia, fintech solutions that cater to financial inclusion, particularly for women and SMEs, have gained traction. These ventures aren’t just driven by profit—they fulfil a societal need by empowering underserved groups, which is a core aspect of Ikigai’s mission pillar.

3. What You’re Good At (Applicable tech, finance, product or other relevant expertise)

Having passion and a mission is critical, but without expertise, it’s difficult to turn an idea into a viable product. Founders with deep domain knowledge or specialised skills are more likely to succeed because they understand the intricacies of the financial landscape. Whether it's regulatory know-how, technical skills in blockchain, or experience in consumer banking, expertise enables founders to build robust solutions.

Example: The founders of successful fintechs often have backgrounds in finance, economics, or technology, equipping them with the professional skills needed to navigate the complexities of the industry. For instance, Wealthfront's success is tied to its founders' expertise in both finance and software development, helping them to create a trusted platform for wealth management.

4. What You Can Be Paid For (Building a sustainable revenue model)

The fourth pillar highlights the need for financial viability. In fintech, as in any other sector, it’s essential to have a clear path to revenue, ensuring that the product or service you build not only solves real problems but also generates income to sustain the business. This pillar ties into developing a strong value proposition that customers are willing to pay for, whether through fees, subscriptions, or embedded services.

Example: Look at Revolut, a digital bank that started with a mission to simplify cross-border payments and make them cheaper. While Revolut addresses a clear need (international money transfers), it also offers premium account options, cryptocurrency trading, and other paid features that users are willing to pay for. This combination of solving a real financial need while ensuring the company has multiple revenue streams demonstrates how the vocation pillar works in fintech—balancing purpose with a sustainable, monetised model.

The Downsides of Missing Pillars in Fintech Ventures

Ikigai provides a comprehensive framework, but if a fintech founder only focuses on two out of the four pillars, the venture may face serious challenges. Let's break down the pros and cons when two pillars are present but the other two are missing, and how that could affect a fintech business.

1. Passion + Profession (What You Love + What You Are Good At)

Pros:You have enthusiasm and expertise on your side. You love what you're doing and are skilled at it, which can lead to high-quality work and satisfaction.

Cons:While this combination can bring personal satisfaction, it may lack a sense of greater purpose or market relevance. In fintech, this could happen if you're building a product that doesn't address a real market need (missing the mission) or isn’t financially viable (missing vocation). Without solving a real problem in the financial world, or having customers who are willing to pay for it, the fintech might struggle to find its market fit and scale successfully. You could be building something excellent but irrelevant.

Summary: “Satisfaction from building a great product, but without solving a real market need.”

2. Passion + Mission (What You Love + What the World Needs)

Pros: You’re doing something you’re passionate about that genuinely solves a societal or financial need. This could result in a strong sense of purpose and drive, especially in fintech sectors like financial inclusion, education, or sustainable finance.

Cons: While this combination may bring personal fulfilment and a sense of making a difference, it often lacks financial sustainability. In fintech, while you may be driven by purpose and passion, without the profession and vocation pillars, your business may lack expertise or a clear monetization strategy. You might be solving a great problem but don’t have the technical know-how or the business model to sustain the fintech in the long term. This often leads to early-stage enthusiasm but eventual financial struggles or operational inefficiencies.

Summary: “Fulfilment from tackling important issues, but without a sustainable business model.”

3. Mission + Vocation (What the World Needs + What You Can Be Paid For)

Pros: This combination ensures you’re solving a real problem in the world and people are willing to pay for it. In fintech, this can translate into strong market demand, especially in areas like payments, lending, or InsurTech. Your solution is addressing a gap, and there’s a clear path to revenue generation.

Cons: While this combination may offer excitement and financial security, it often lacks personal fulfilment and passion. In fintech, if you're missing the passion and profession pillars, you may feel disconnected from the work. You may be running a financially viable business, but without passion or deep expertise, innovation and creativity may suffer. In the long run, founders and teams may lose motivation, and the fintech may stagnate or become overtaken by more passionate competitors.

Summary: “Excitement from addressing market demand, but lacking the innovation and passion to stand out.”

4. Profession + Vocation (What You Are Good At + What You Can Be Paid For)

Pros: In this case, you are skilled in what you do and have a business model that generates income. In fintech, this could look like a technically competent solution that operates smoothly and has a clear customer base willing to pay for it, such as a successful B2B SaaS product.

Cons: While this combination can lead to financial success and technical proficiency, it can leave you feeling disconnected or uninspired over time. Without the passion and mission pillars, the fintech may feel transactional rather than transformative. You might have created something profitable but uninspiring. Over time, this can lead to disengagement from the founder or the team, and even customers may feel the lack of innovation and purpose. In a field like fintech, which thrives on solving real problems with passion, this can make the venture vulnerable to disruption by competitors with a stronger sense of purpose.

Summary: “Financial success and technical expertise, but missing a purpose that drives long-term engagement.”

Ikigai: A great way for folks in fintech to find their purpose

Using the Ikigai pillars is a great way to find the perfect fintech idea to build or organization to lead because it creates alignment between passion, purpose, expertise, and profitability. By aligning passion, mission, profession, and vocation, fintech founders create ventures that are both meaningful and financially viable.

Ikigai helps founders, and others, stay connected to the bigger picture—solving real financial problems—while maintaining personal fulfilment and ensuring long-term business growth. Without this alignment, fintech ventures risk becoming disconnected from market needs, losing motivation, or failing to sustain themselves financially. It brings purpose-driven innovation to the heart of the fintech build process, driving solutions that resonate with both customers and founders, leading to more resilient, impactful businesses.

Three great examples of Ikigai in Fintech

Stripe: John and Patrick Collison

Passion: John and Patrick Collison were deeply passionate about making online payments simpler and more accessible for developers and businesses. As John Collison said to TechCrunch in 2017, "We were frustrated with how hard it was to start and scale a business on the internet, so we set out to fix the infrastructure problem."

Mission: Their mission was to solve the frustratingly complex and fragmented payments infrastructure that hindered online commerce, especially for startups and small businesses.

Profession: With backgrounds in software engineering and a deep understanding of coding, they leveraged their technical expertise to build a seamless, developer-friendly payments platform.

Vocation: Stripe quickly monetized by charging transaction fees, creating a scalable, profitable business model that allowed them to grow into a multi-billion-dollar global payments giant.

Read more about Stripe and it’s journey here 👇🏽

Wise: Kristo Käärmann and Taavet Hinrikus

Passion: Kristo Käärmann and Taavet Hinrikus were passionate about making international money transfers cheaper and more transparent. As Käärmann once said, "We built Wise because we were tired of banks ripping us off with hidden fees on currency exchange."

Mission: Their mission was to tackle the hidden fees and high costs that banks charged for cross-border payments, making financial services fairer for people around the world.

Profession: Hinrikus, Skype’s first employee, and Käärmann, a former financial consultant, used their combined expertise in technology and finance to build an efficient, transparent platform for international transfers.

Vocation: Wise monetized by charging a small, upfront fee per transfer, offering customers a better deal than traditional banks and creating a profitable, scalable business that now serves millions worldwide.

Revolut: Nik Storonsky

Passion: Nik Storonsky was passionate about creating a more convenient and cost-effective way to manage money globally. He stated in a Forbes interview in 2018, "I was frustrated by the inefficiency of traditional banking, especially the high costs of currency exchange and transfers."

Mission: His mission was to disrupt the traditional banking sector by offering a digital alternative that made international money transfers, currency exchange, and banking services faster, cheaper, and more accessible.

Profession: With a background in financial trading and a strong understanding of global markets, Storonsky leveraged his financial expertise to develop a platform that streamlined banking services for a tech-savvy generation.

Vocation: Revolut monetized through premium account subscriptions, interchange fees, and additional services such as cryptocurrency trading, turning the platform into a high-growth, scalable business while offering free or low-cost core services.

How can we end what was supposed to be a short sharp edition that ended up being as lengthy and deep as the previous ones?

Well, first, it's important to note that if you're thinking about an idea that you are passionate about and have a clear mission for but don't necessarily have the expertise, then don't despair. That's why co-founders exist. To balance and complement the founding team and cover all those pillars.

And second. Ikigai doesn't just apply to founders and those with ideas. It can be applied and used by many different people and for a range of different purposes.

👉🏽 For vendors or BaaS providers, Ikigai can be used as a tool to evaluate whether a fintech founder and their venture are worth the investment by checking if they align with all four pillars: passion, mission, expertise, and profitability.

👉🏽 For potential employees, Ikigai can help determine whether joining a fintech startup is the right move by assessing if the company's mission and vision align with your own passion, skills, and long-term goals.

👉🏽 For investors, Ikigai can be a framework for evaluating whether a fintech startup has long-term potential by assessing if it aligns with all four pillars: passion, mission, expertise, and financial viability.

👉🏽 For fintech product teams, Ikigai can help align product development with both user needs and the company's broader mission, ensuring that every feature or service provides real value.

👉🏽 For mentors and advisors, Ikigai can be a tool to coach founders, helping them balance their passion with market opportunities and business sustainability.

Now that you've read this edition, you know that while the saying, 'Find something you love to do and you'll never work a day in your life.' is true, you know passion is just one of four areas to consider before you find your true Ikigai. 😊

Remember to like this edition and share it with a friend. I hope to be back in two weeks, but it might be three, depending on my work travels. So if you don't see an email in your inbox in two weeks, it should be there the following week 👋🏽

J.

Release Notes 📝 : Currensea launching with Hilton 👀

An interesting release that caught my eye was Currensea’s collab with Hilton to launch two new rewards debit cards.

In their own words, here’s what makes the cards special

Earn Hilton Honors Points with every eligible transaction.

Enjoy low FX fee or 0% FX fee with the Plus card when spending abroad, powered by Currensea’s competitive exchange rates.

Keep things simple – it links directly to your existing UK bank account.

Save on overseas transaction fees and exchange rate markups, making your money go further wherever you are.

And some other key details:

Both cards have annual fees (£60 or £150) and no free option.

They offer Hilton elite status (Silver and Gold) with perks like free breakfast.

The only UK travel rewards cards with 0% or 0.5% foreign exchange fees globally.

Weak points earn rate on UK spending but strong on foreign transactions.

These co-branded cards allow Hilton customers to earn points on everyday spend while using their existing bank account. It offers a low-friction way to earn points as customers simply connect their existing bank account to the card in the app using an Open Banking connection.

A very cool co-branded proposition with loyalty and rewards at its heart (something I think will ramp up over the next 12 months), and I’m curious to see what comes next.

Fintech Spotlight 🔦: BabyReady

Today’s edition talks about Ikigai and in this week’s spotlight I think Ihave found the perfect product to feature.

BabyReady is a fintech product that does exactly what it says on the tin. It helps existing and expectant parents get financially ready for a baby. The platform provides a suite of tools aimed at making prenatal and childcare costs more transparent. It offers features like budgeting tools, savings accounts, government benefits checkers, and cashback on baby-related purchases. Parents can open savings or investment accounts, track expenses, and plan for their child’s future education or housing costs. BabyReady also connects users with community support and expert workshops, making it a comprehensive tool for financial preparedness during parenthood.

It’s certainly a product that solves a real-world problem, has the potential for great sources of revenue (whether through ads, a subscription service or creating an attached savings account), and the founder is very passionate about the space. Here’s what she said in an interview while on the Barclays Eagle Labs programme about why she started the business:

“I wanted to invest my time and energy into something I love and see my creation grow from an idea into an empire”

I personally think there is a lot of growth in fintech for prepartum, postpartum and childcare products and this could be the product that encompasses a whole range of uses cases across that journey.

I’m so bullish and excited about this niche fintech product and the problems it solves for expectant parents that I’m planning on giving free, no-strings-attached product & fintech advice.

If you can help with expertise, funding or a partnership drop me a note and I can connect you directly with the founder.

Interesting News 🗞

Starling gets fined: Starling Bank has been fined £29 million by UK regulators for significant failures in its financial controls, which were described as “shockingly lax.” The bank was found to have inadequate systems to detect and prevent financial crime, leaving it vulnerable to risks like money laundering. The Financial Conduct Authority (FCA) highlighted major shortcomings in Starling's transaction monitoring and risk assessment processes. Despite rapid growth, the bank neglected to properly address these issues.

Positioning is so important, this process definitely helps with that. Great write-up!

This was great fun to read! Love the photo of the Japanese centenarians! Utterly inspiring.

Looking forward to finding out more about your work in Saudi when you can reveal more!