Retrospective and Refinement of 2024 📺

A look back at the Top 5 editions of 2024, my favourites in different categories, what to expect next year, how I can help you in 2025, and a reminder about the Fintech Quiz coming very soon

Hey Fintechers and Fintech newbies 👋🏽

This is the last 'normal' edition of the newsletter for this year as I hang up my metamorphic pen for 2024 and enjoy a bit of a break.

It won't be the final edition of the year, though.

As many of you early subscribers will remember, last year, I created a fun fintech quiz to close out the year, be a little memory test for the abundance of interesting news, and act as a nice way to mark the start of the holiday period. Here's a little reminder for those who missed it:

The next and last edition of the year will be A Big Fintech Quiz of The Year 2024, so make sure you're up to speed with the fintech news of the year, and make sure your friends & colleagues are subscribed.

NB. If you want to sponsor a section of the quiz or get it before it goes out to the public for use in an internal team event and get a bespoke company-wide leaderboard, then drop me a message by replying to this or firing an email to jas@bitsul.co.ukBut before then, this edition looks back at the most popular write-ups of the year, my selection of the most interesting editions, and a tiny mention of some editions coming up in 2025.

As well as interesting news, puns + movie references, this edition includes the following:

A quick disclaimer for those who use republish/use my content

Top 5 Popular editions of 2024

Best editions in different categories

Most time spent creating a graphic

Longest to write

Passion Project Favourite

Favourite Product Centric Edition

Most complex and speculative workflow diagram

What to expect from this newsletter next year

How I can help you

A reminder about this years Fintech Quiz

A quick caveat to start this edition

Thanks to some very kind folks in my network, I’ve been made aware of some instances where my content has been copied and pasted into things like consulting proposal decks, whitepapers, and some other commercial uses without my consent, so I’m adding a little disclaimer to each newsletter.

If you’d like to use the bespoke images or content I’ve created for commercial use (a pitch deck, consulting proposal, strategy work, or put any of my content behind a paywall, etc), you can drop me a message to ask for my permission first, especially if its fintech product related.

Resharing content on LinkedIn, Twitter/X and other social platforms with the correct attribution i.e. The original source and my name at the top of the post, is still fine, but putting things I've created behind a paywall or directly using it for commercial gain is not.

Future editions will have an official disclosure blurb and images will have an embedded copyright notice, so if you do see any more instances of plagiarism then please let me know, and thanks again to those who made me aware :-).

Right. Enough admin. On with this retrospective edition!

Top 5 Popular editions of 2024

Let's start with the top 5 most popular editions of 2024. These are editions that were read and engaged with the most, but also ones where I received long and detailed positive feedback, as well as how much they were reshared. Starting with 5…

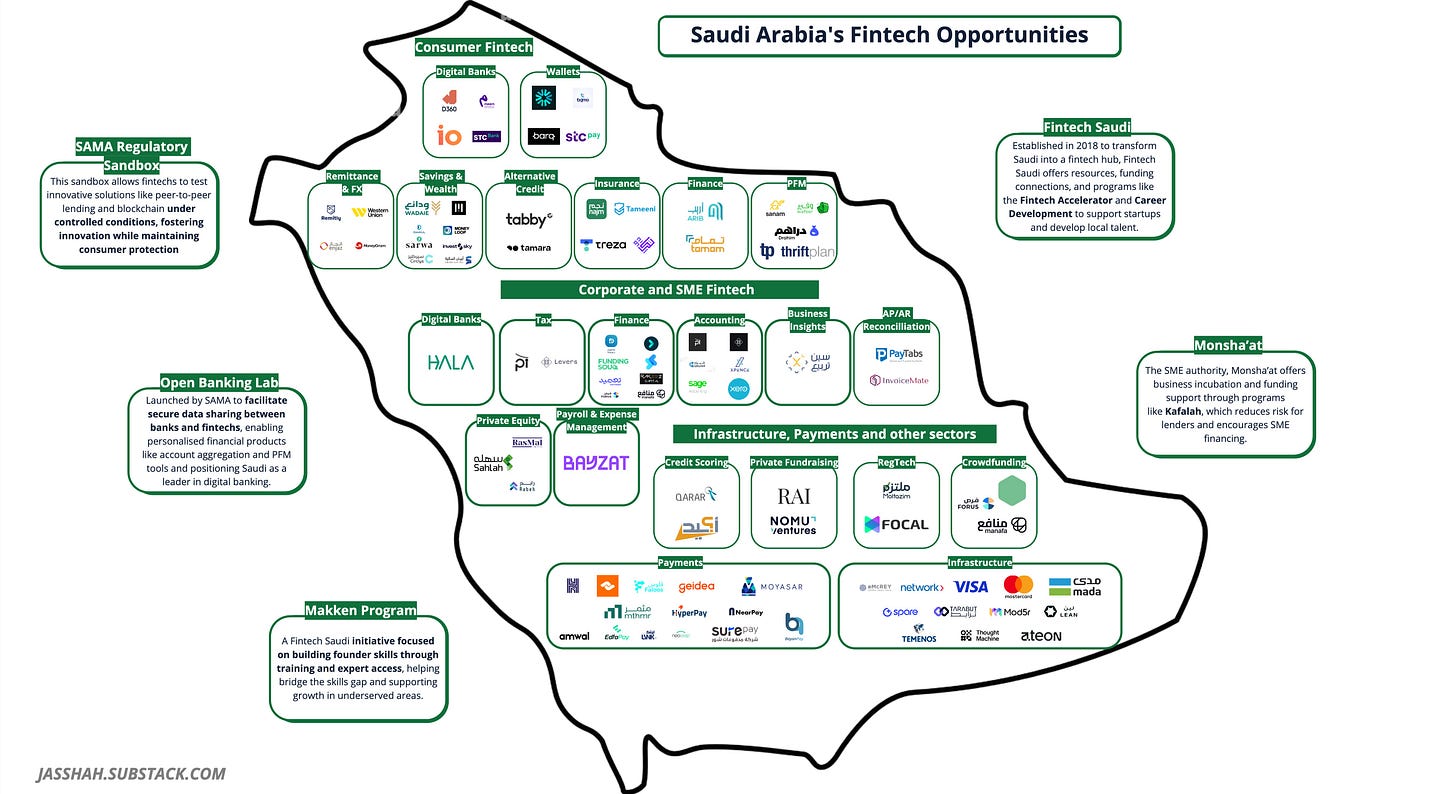

5. Saudi Arabia’s Fintech Oasis: A Market Flowing with Opportunity

👉🏽 A deep dive into the region, consumer trends, an overview of the fintech landscape, some 'Product White Space' analysis, and the biggest fintech opportunity areas

This is quite a recent one, but it clearly was eye-opening for many. It was inspired by some work I was doing out in the region, as well as my experience building a digital bank back there in 2020.

It was an interesting one to put together for a host of reasons, but namely, it showed a bit of the thinking required at the early stage of any startup in the discovery phase where you have to really take a deep look at the market, technology, regulatory environment, competitive landscape, product whitespace and more, to really assess the viability and size of the market for a product.

This is also a vital process for venture accelerators, banks looking at opportunities, fintechs looking to enter new markets and much more.

That's enough of a blurb from me.

Go read the edition if you haven't already, and reach out if you're looking for a bespoke version of the discovery work on a region, product whitespace analysis or other expertise applied in the post; drop me a message.

NB. My recent Plaid deep dive was close to breaking the top 5, but as it was only published 2 weeks ago, it doesn't have the same long-tail read rates as the others….yet.

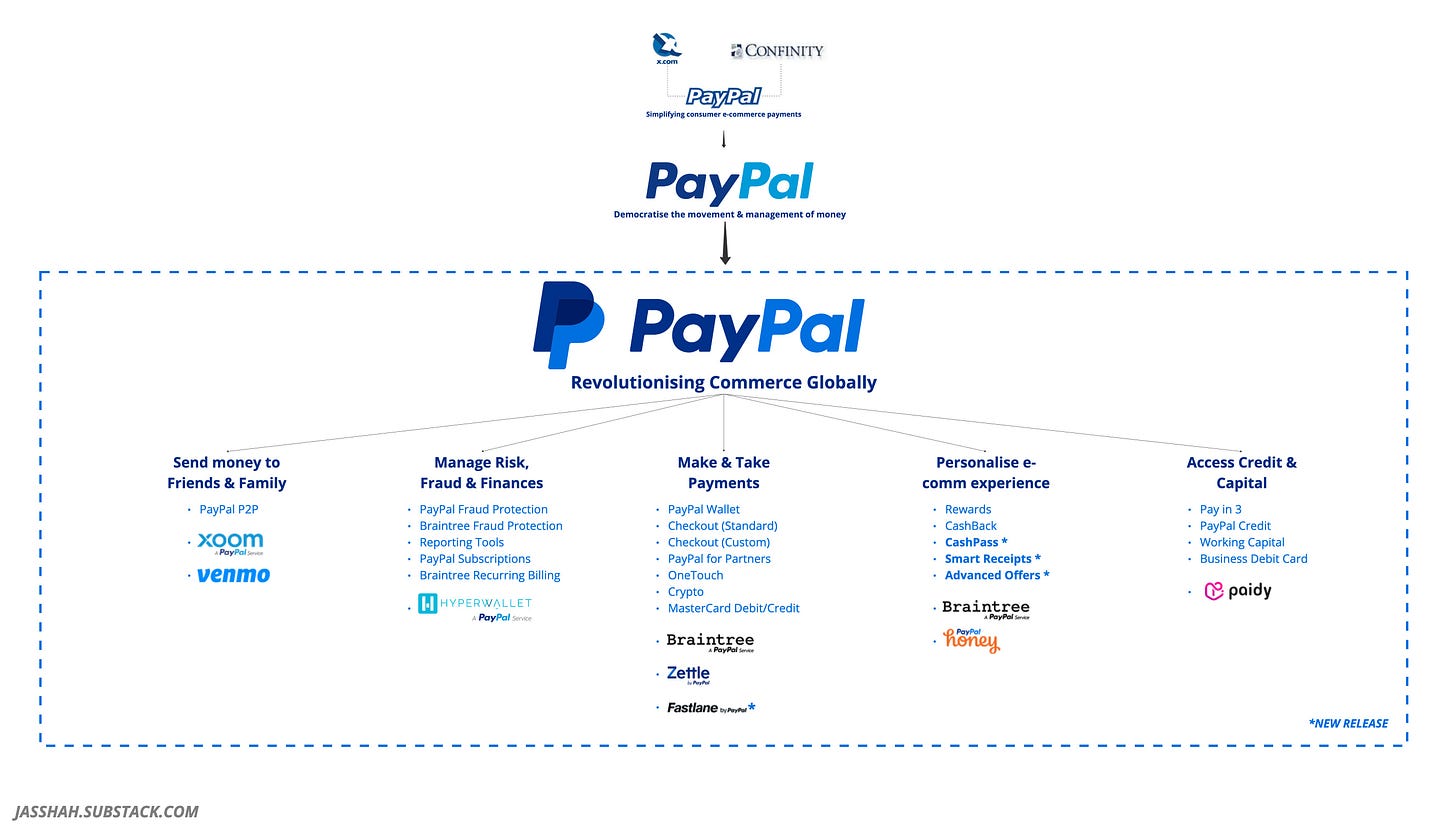

4. Paypal: A fintech OG rejoining the Fastlane

👉🏽 A detailed look at PayPal's origins, early success factors, current product stack, latest releases and reasons to be bullish

I published this simultaneously on the This Week in Fintech platform and in my newsletter. I put this together when there were many commentators with a very negative outlook on the Fintech OG, and the timing couldn't have been better. It was just after a few important product releases, including their 1-Click checkout product, Fastlane.

This one was a timely look at PayPal’s origins, the partnership crucial to their early growth, their crucial acquisitions, and how their broad product stack and brand position them well for future expansion.

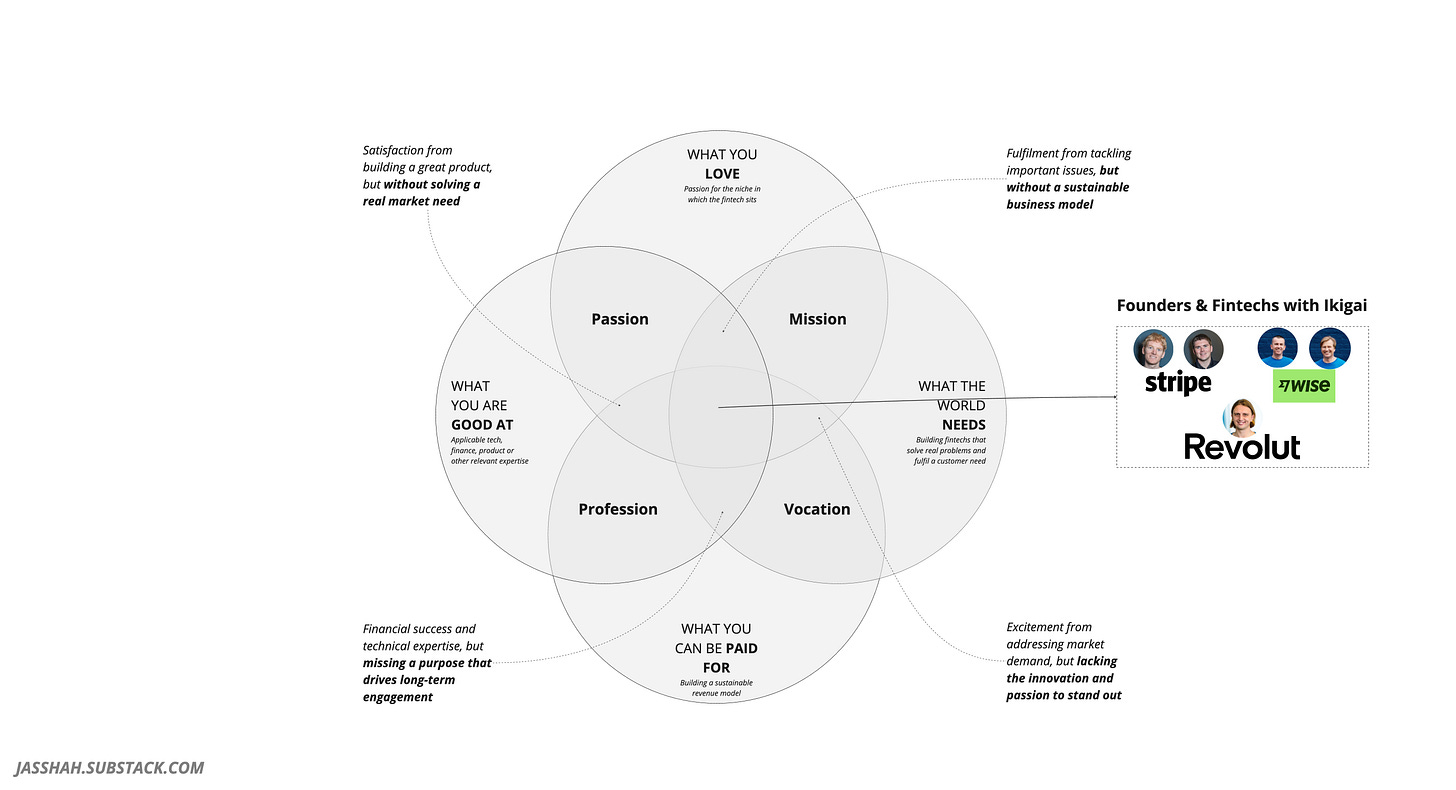

3. Ikigai in Fintech: Creating Products with Purpose, Passion, and Profit

👉🏽 Explaining Ikigai, its four pillars, and showing how striving for it can help build better products and more purposeful fintechers.

This was an edition where the concept hit me as I was reading a book on Ikigai. Ikigai, the Japanese concept of "a reason for being," revolves around four core pillars:

What you love.

What you are good at.

What the world needs,and

What you can be paid for.

When these pillars intersect, they create a sweet spot that brings fulfilment, both personally and professionally. This edition unpacked those pillars in detail, exploring how they can be applied to fintech product design, team culture, and the broader industry.

I outlined practical steps for founders, product managers, and fintech enthusiasts to incorporate Ikigai into their decision-making processes, from product ideation to execution. By aligning what we build with what truly matters, we can create fintech solutions that not only succeed in the marketplace but also make a lasting impact on the people who use them.

For me, this exploration was a reminder that while fintech is about innovation, scale, and growth, it can also be about meaning, purpose, and connection. Applying Ikigai to fintech isn't just a thought experiment—it's a pathway to building a better, more impactful future for the industry.

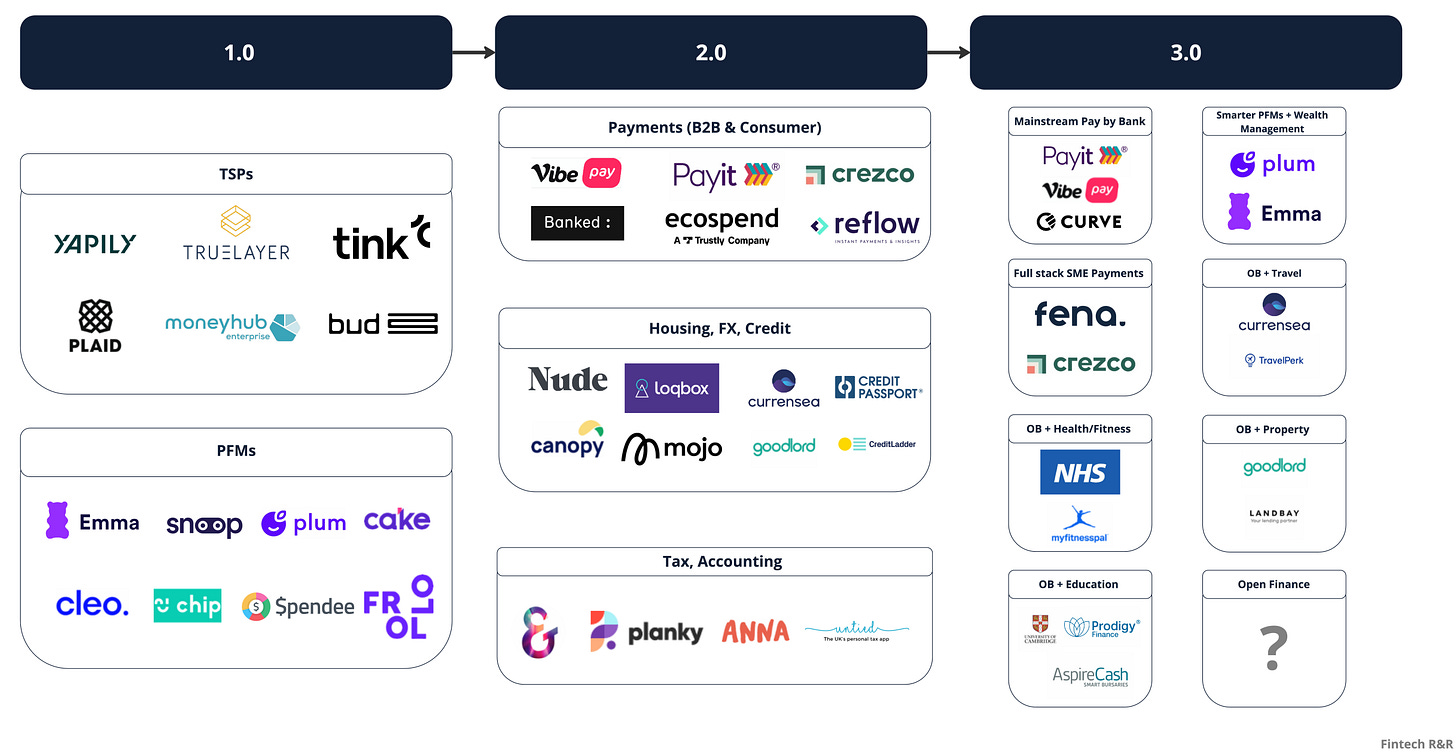

2. Open Banking Phase 3.0

👉🏽 A dive into UK Open Banking to date, what the next phase of UK Open Banking will bring, why other Open Banking implementations should read this, and much more...

This was a long time coming because since 2018 it felt like I'd had the same conversations with experts in the industry over and over again. Despite the initial excitement around Open Banking and its potential to transform financial services, the reality often fell short. Many industry players spoke of collaboration and innovation, but progress seemed stuck in Phase 1 or 2—focused more on compliance, and the basics of what Open Banking offered rather than on unlocking the true value for consumers and businesses.

In this edition, I explored what Phase 3 of Open Banking could look like—a phase where the promise of interoperability, seamless customer experiences, and meaningful partnerships might finally be realised. It was a call to move beyond inertia, with actionable insights on how banks, fintechs, and regulators could work together to bring Open Banking into its next chapter.

By breaking down real-world examples and dissecting the gaps still holding the ecosystem back, this edition remains one of my favorites (and yours apparently) for its mix of realism and optimism about the future of financial connectivity, and was clearly a great first edition to start 2024 and coincided with the 6 year anniversary of the launch of the UK Open Banking Framework.

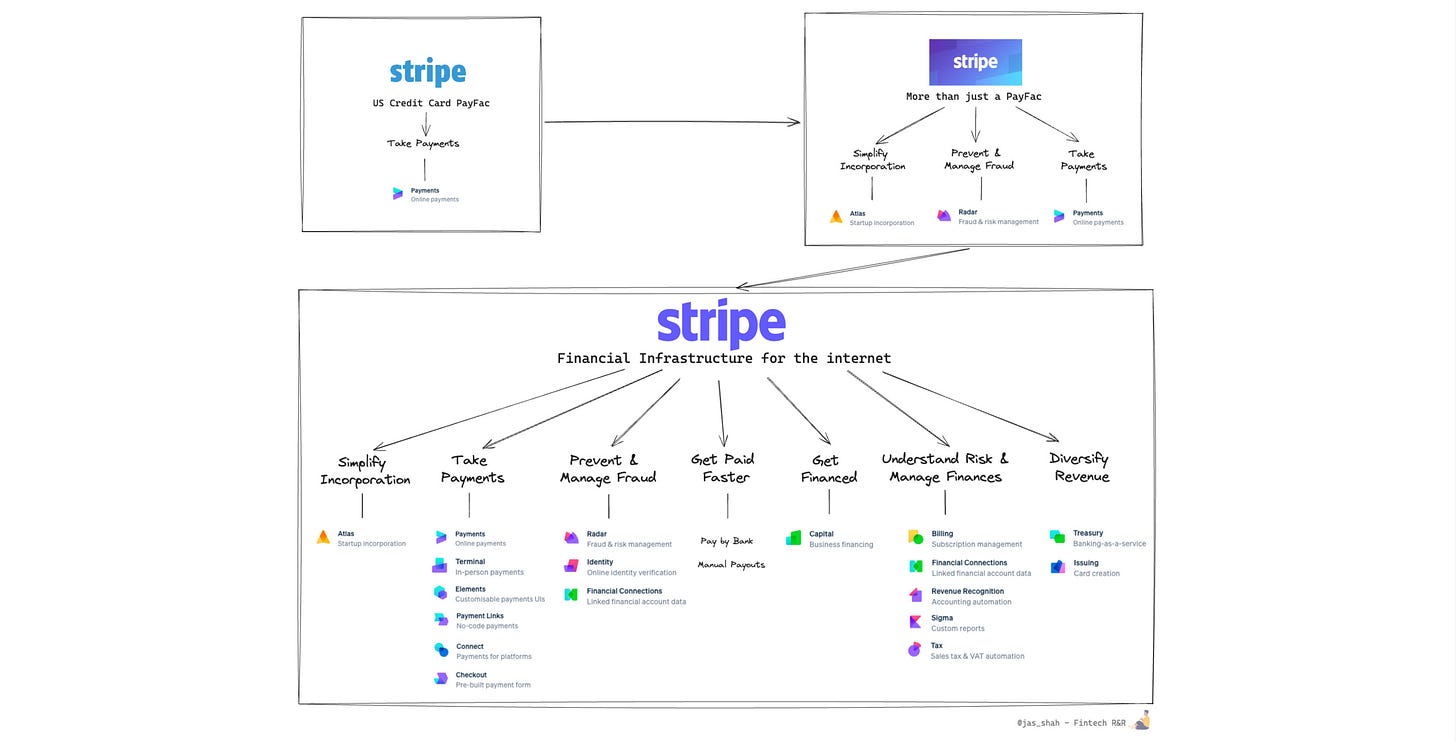

1. Stripe, more than a PayFac

A walkthrough of Stripe's evolution, their early competitors, the Jobs that they solve for customers, an overview of their new products and the metrics they consider when driving growth & scale.

This edition was an exciting dive into one of fintech's most fascinating growth stories: Stripe. Since its inception, Stripe has epitomised what it means to be a product-led organisation, delivering not just payment solutions but a comprehensive platform that developers and businesses alike have come to depend on.

Writing this felt like unpacking a masterclass in growth strategy—one that balances relentless focus on the customer with the ability to scale globally while keeping innovation at its core. I explored how Stripe has continually evolved from a developer-friendly payments API into a multifaceted ecosystem of financial tools and infrastructure. The edition also delved into what other fintechs could learn from Stripe's approach to growth, particularly its knack for addressing pain points with elegant simplicity, whether for startups or enterprises.

This was more than just a retrospective on Stripe; it was a reflection on how a singular focus on solving real problems, combined with an ability to anticipate future needs, can catapult a company into market leadership. For anyone building in fintech—or any industry, really—this one offers plenty of takeaways about the intersection of product, scale, and vision.

Top editions in other bespoke categories ⭐️

Top popular editions are a standard measure of the best editions. This additional set of categories creates a more complete picture of all of my favourite deep dives in various niche categories.

Most time spent creating a graphic

I had fun writing this one and let my creative juices flow with the entire piece, including the overview graphic. This graphic took me a while to put together because:

I had so many ideas of what this should look like & experimented with a few different options and

Once I finally decided on an outline, I still had a lot of tweaking and polishing to do.

You'll agree that it was worth it.

Longest time to write

A question I get asked, A LOT, is "how long does it take to write each edition".

The quick answer is "a while".

I often start them a couple of days before they go out, and end-to-end, with a bit of formatting; it's around 8-10 hrs of writing, editing and formatting for each edition which equates to about an hour for each section. This AI edition, however, took nearly 15 hrs in total, and it was so long (over 10,000 words) that I had to split it into two.

Passion Project Favourite

I'm a big football fan (soccer if you're reading this across the pond), and fintech has huge inroads to make in the sport and across others like Basketball, American Football and more.

In this deep dive, I look at the biggest opportunities for fintech in football and other sports, like the role of embedded finance in helping fans spread season ticket payments, the role of Open Banking, Save Now Buy Later, potential revenue from payments products and more.

Since the edition, I've seen several MyGuavaPay ads, so they are clearly making a push, and I think (speculation alert) Currensea, who recently partnered with Hilton, has a lot of potential to disrupt the space and create co-branded loyalty products linked to existing accounts to drive innovation.

As club owners become a lot more analytical, there's scope to start looking at closed-loop payment systems as a way to retain more profit from match-going fans. Watch this space. If you're working on a fintech football product, I would love to chat with you!

Favourite Product Centric Edition

I’ve done a bit of demystification of the role of product in fintech but not nearly enough. It’s something I will do more of in 2025. It’s mostly been peppered throughout editions such as the Saudi Arabia deep dive, or the Fintech profiles on Stripe, PayPal and Plaid, but this edition on roadmaps was a very direct dive into a key part of senior product leaders roles.

In this one I demystify some of the roadmap myths, detail why they are important, give some template examples, walk through different types of roadmap for different stages of organisations, and show examples of great public roadmaps from your favourite fintechs.

Most speculative workflow diagram

A bit of a random category but any excuse to bring out this very detailed speculative diagram I put together.

I have a fascination with the property market and part of that fascination is with the slow pace at which tech innovation happens whether that’s with the mortgage application process, the way to improve credit scores, the fact that up until recently rent reporting wasn’t part of a credit score and much more besides. The biggest area of interest for me is the recent adoption of tech, fintech specifically, and how I think this will transform the homebuying process entirely using blockchain tech like Coadjute as an underlying store and network layer to manage the exchanging of contracts and surveying process, fintechs like Habito and Mojo changing the mortgage search process, Tembo providing a better way to save for a deposit, and the role of digital identity to bring this all together.

The biggest transformation though, will be consumer facing platforms like RightMove embedding more and more of this functionality into their platform making them the first port of call for saving, eligibility, mortgage searching and the purchase process.

What to expect next year

I've had a lot of fun writing this year alongside some really rewarding and interesting product consulting work (my bread and butter). Next year, I'm hoping to add even more value to the fintech and have a few things already in the pipeline, including:

More 'Under the Hood' editions from Lending to BNPL, to Investing, Crypto and more

Open Banking in KSA and some other Saudi-specific deep dives

A Product Roles Overview

Potentially more recorded interviews like the one I did with Robinhood's UK CEO, Jordan Sinclair

A return of Interesting News, Release Notes, and Fintech Spotlight

If there's an area you think I should cover or feedback you want to give, then you can reply or send some feedback here…

Lastly…

Fintech friends keep telling me that I need to get better at promoting my expertise, who I help, and the valuable work I do with fintechs and FS orgs in addition to this newsletter, so if...

👉🏽 You or someone you know is at that early stage of a digital bank build and you’re looking for additional advisory expertise or a product leader who has been there and done it before, drop me a note.

👉🏽 You are such a fintech or know a fintech founder that would benefit from expertise they can tap into throughout their build, growth and scale journey then reach out.

👉🏽 You or someone you know is working in a big firm building a new product, trying to solve problems for a new customer base, or are a consultancy with an FS project that could benefit from external product expertise, reach out to me

👉🏽 You are a VC/Family Office or know one, then drop me a message directly or, if you can, set up an introduction as I’d like to dedicate some time to product due diligence work.

👉🏽 You’re a product person or founder looking for an external ear to help progress and navigate issues, or you want me to help be a ‘product therapist™️’ for your team, then drop me a note.

And, more broadly,. If you like what I do, how I explain things, my experience building products, and you want to work with an experienced fintech product leader, but you’re not sure how, reply to this email or drop me a note at jas@bitsul.co.uk and I’ll send you my calendly to schedule a chat 😊

That’s it for this edition.

As always, don’t forget to like this and share it with a friend. Brush up on your quiz skills and I look forward to seeing how much you remember from this busy year of fintech news in the final edition of the year👋🏽

J.